Neural Network

Neural Network: discussion/development threads

- Better NN EA development thread with indicators, pdf files and so on.

- Better NN EA final thread

- taking NEURAL NETWORKS to the NEXT LEVEL - very interesting thread

- Neural Networks thread (good public discussion)

- How to build a NN-EA in MT4: usefull thread for developers.

- Radial Basis Network (RBN) - As Fit Filter For Price: the thread

Neural Network: Indicators and systems development

- Self-trained MA cross!: development thread for new generation of the indicators

- Levenberg-Marquardt algorithm: development thread

Neural Network: EAs

- CyberiaTrader EA: discussion thread and EAs' thread.

- Self learning expert thread with EAs' files here.

- Artificial Intelligence EAs threads: How to "teach" and to use the AI ("neuron") EA thread and Artificial Intelligence thread

- Forex_NN_Expert EA and indicator thread.

- SpiNNaker - A Neural Network EA thread.

Neural Network: The Books

- What to read and where to learn about Machine Learning (10 free books) - the post.

The article

- Neural Networks Made Easy - MT5

- Neural Network in Practice: Least Squares - MT5

- Neural Network in Practice: Straight Line Function - MT5

- Neural Network in Practice: Pseudoinverse (II) - MT5

- Neural Network in Practice: The First Neuron - MT5

- ALGLIB numerical analysis library in MQL5 - MT5

- Data Science and Machine Learning — Neural Network (Part 01): Feed Forward Neural Network demystified - MT5

- Data Science and Machine Learning — Neural Network (Part 02): Feed forward NN Architectures Design - MT5

- Data Science and Machine Learning (Part 03): Matrix Regressions - MT5

- Data Science and Machine Learning (Part 04): Predicting Current Stock Market Crash - MT5

- Data Science and Machine Learning (Part 05): Decision Trees - MT5

- Data Science and Machine Learning (Part 06): Gradient Descent - MT5

- Data Science and Machine Learning (Part 07): Polynomial Regression - MT5

- Data Science and Machine Learning (Part 08): K-Means Clustering in plain MQL5 - MT5

- Data Science and Machine Learning (Part 09) : The K-Nearest Neighbors Algorithm (KNN) - MT5

- Data Science and Machine Learning (Part 10): Ridge Regression - MT5

- Data Science and Machine Learning (Part 11): Naïve Bayes, Probability theory in Trading - MT5

- Data Science and Machine Learning (Part 12): Can Self-Training Neural Networks Help You Outsmart the Stock Market? - MT5

- Data Science and Machine Learning (Part 13): Improve your financial market analysis with Principal Component Analysis (PCA) - MT5

- Data Science and Machine Learning (Part 14): Finding Your Way in the Markets with Kohonen Maps - MT5

- Data Science and Machine Learning (Part 15): SVM, A Must-Have Tool in Every Trader's Toolbox - MT5

- Data Science and Machine Learning (Part 16): A Refreshing Look at Decision Trees - MT5

- Data Science and Machine Learning (Part 17): Money in the Trees? The Art and Science of Random Forests in Forex Trading - MT5

- Data Science and Machine Learning (Part 18): The battle of Mastering Market Complexity, Truncated SVD Versus NMF - MT5

- Data Science and Machine Learning (Part 19): Supercharge Your AI models with AdaBoost - MT5

- Data Science and Machine Learning (Part 20) : Algorithmic Trading Insights, A Faceoff Between LDA and PCA in MQL5 - MT5

- Data Science and Machine Learning(Part 21): Unlocking Neural Networks, Optimization algorithms demystified - MT5

- Data Science and ML (Part 22): Leveraging Autoencoders Neural Networks for Smarter Trades by Moving from Noise to Signal - MT5

- Data Science and ML (Part 23): Why LightGBM and XGBoost outperform a lot of AI models? - MT5

- Data Science and Machine Learning (Part 24): Forex Time series Forecasting Using Regular AI Models - MT5

- Data Science and Machine Learning (Part 25): Forex Timeseries Forecasting Using a Recurrent Neural Network (RNN) - MT5

- Data Science and ML (Part 26): The Ultimate Battle in Time Series Forecasting — LSTM vs GRU Neural Networks - MT5

- Data Science and ML (Part 27): Convolutional Neural Networks (CNNs) in MetaTrader 5 Trading Bots — Are They Worth It? - MT5

- Data Science and ML (Part 28): Predicting Multiple Futures for EURUSD, Using AI - MT5

- Data Science and ML (Part 29): Essential Tips for Selecting the Best Forex Data for AI Training Purposes - MT5

- Data Science and ML(Part 30): The Power Couple for Predicting the Stock Market, Convolutional Neural Networks(CNNs) and Recurrent Neural Networks(RNNs) - MT5

- Data Science and ML (Part 31): Using CatBoost AI Models for Trading - MT5

- Data Science and ML (Part 32): Keeping your AI models updated, Online Learning - MT5

- Data Science and ML (Part 33): Pandas Dataframe in MQL5, Data Collection for ML Usage made easier - MT5

- Data Science and ML (Part 34): Time series decomposition, Breaking the stock market down to the core - MT5

- Data Science and ML (Part 35): NumPy in MQL5 – The Art of Making Complex Algorithms with Less Code - MT5

- Data Science and ML (Part 36): Dealing with Biased Financial Markets - MT5

- Data Science and ML (Part 37): Using Candlestick patterns and AI to beat the market - MT5

- Data Science and ML (Part 38): AI Transfer Learning in Forex Markets - MT5

- Data Science and ML (Part 39): News + Artificial Intelligence, Would You Bet on it? - MT5

- Data Science and ML (Part 40): Using Fibonacci Retracements in Machine Learning data - MT5

- Data Science and ML (Part 41): Forex and Stock Markets Pattern Detection using YOLOv8 - MT5

- Data Science and ML (Part 42): Forex Time series Forecasting using ARIMA in Python, Everything you need to Know - MT5

- Data Science and ML (Part 43): Hidden Patterns Detection in Indicators Data Using Latent Gaussian Mixture Models (LGMM) - MT5

- Data Science and ML (Part 44): Forex OHLC Time series Forecasting using Vector Autoregression (VAR) - MT5

- Data Science and ML (Part 45): Forex Time series forecasting using PROPHET by Facebook Model - MT5

- Data Science and ML (Part 46): Stock Markets Forecasting Using N-BEATS in Python - MT5

- Experiments with neural networks (Part 1): Revisiting geometry - MT5

- Experiments with neural networks (Part 2): Smart neural network optimization - MT5

- Experiments with neural networks (Part 3): Practical application - MT5

- Experiments with neural networks (Part 4): Templates - MT5

- Experiments with neural networks (Part 5): Normalizing inputs for passing to a neural network - MT5

- Experiments with neural networks (Part 6): Perceptron as a self-sufficient tool for price forecast - MT5

- Experiments with neural networks (Part 7): Passing indicators - MT5

- Programming a Deep Neural Network from Scratch using MQL Language - MT5

- Neural networks made easy (Part 2): Network training and testing - MT5

- Machine learning in Grid and Martingale trading systems. Would you bet on it? - MT5

- Neural networks made easy (Part 3): Convolutional networks - MT5

- Neural networks made easy (Part 4): Recurrent networks - MT5

- Neural networks made easy (Part 5): Multithreaded calculations in OpenCL - MT5

- Neural networks made easy (Part 6): Experimenting with the neural network learning rate - MT5

- Neural networks made easy (Part 7): Adaptive optimization methods - MT5

- Neural networks made easy (Part 8): Attention mechanisms - MT5

- Neural networks made easy (Part 9): Documenting the work - MT5

- Neural networks made easy (Part 10): Multi-Head Attention - MT5

- Neural networks made easy (Part 11): A take on GPT - MT5

- Neural networks made easy (Part 12): Dropout - MT5

- Neural networks made easy (Part 13): Batch Normalization - MT5

- Neural networks made easy (Part 14): Data clustering - MT5

- Neural networks made easy (Part 15): Data clustering using MQL5 - MT5

- Neural networks made easy (Part 16): Practical use of clustering - MT5

- Neural networks made easy (Part 17): Dimensionality reduction - MT5

- Neural networks made easy (Part 18): Association rules - MT5

- Neural networks made easy (Part 19): Association rules using MQL5 - MT5

- Neural networks made easy (Part 20): Autoencoders - MT5

- Neural networks made easy (Part 21): Variational autoencoders (VAE) - MT5

- Neural networks made easy (Part 22): Unsupervised learning of recurrent models - MT5

- Neural networks made easy (Part 23): Building a tool for Transfer Learning - MT5

- Neural networks made easy (Part 24): Improving the tool for Transfer Learning - MT5

- Neural networks made easy (Part 25): Practicing Transfer Learning - MT5

- Neural networks made easy (Part 26): Reinforcement Learning - MT5

- Neural networks made easy (Part 27): Deep Q-Learning (DQN) - MT5

- Neural networks made easy (Part 28): Policy gradient algorithm - MT5

- Neural networks made easy (Part 29): Advantage Actor-Critic algorithm - MT5

- Neural networks made easy (Part 30): Genetic algorithms - MT5

- Neural networks made easy (Part 31): Evolutionary algorithms - MT5

- Neural networks made easy (Part 32): Distributed Q-Learning - MT5

- Neural networks made easy (Part 33): Quantile regression in distributed Q-learning - MT5

- Neural networks made easy (Part 34): Fully Parameterized Quantile Function - MT5

- Neural networks made easy (Part 35): Intrinsic Curiosity Module - MT5

- Neural networks made easy (Part 36): Relational Reinforcement Learning - MT5

- Neural networks made easy (Part 37): Sparse Attention - MT5

- Neural networks made easy (Part 38): Self-Supervised Exploration via Disagreement - MT5

- Neural networks made easy (Part 39): Go-Explore, a different approach to exploration - MT5

- Neural networks made easy (Part 40): Using Go-Explore on large amounts of data - MT5

- Neural networks made easy (Part 41): Hierarchical models - MT5

- Neural networks made easy (Part 42): Model procrastination, reasons and solutions - MT5

- Neural networks made easy (Part 43): Mastering skills without the reward function - MT5

- Neural networks made easy (Part 44): Learning skills with dynamics in mind - MT5

- Neural networks made easy (Part 45): Training state exploration skills - MT5

- Neural networks made easy (Part 46): Goal-conditioned reinforcement learning (GCRL) - MT5

- Neural networks made easy (Part 47): Continuous action space - MT5

- Neural networks made easy (Part 48): Methods for reducing overestimation of Q-function values - MT5

- Neural networks made easy (Part 49): Soft Actor-Critic - MT5

- Neural networks made easy (Part 50): Soft Actor-Critic (model optimization) - MT5

- Neural networks made easy (Part 51): Behavior-Guided Actor-Critic (BAC) - MT5

- Neural networks made easy (Part 52): Research with optimism and distribution correction - MT5

- Neural networks made easy (Part 53): Reward decomposition - MT5

- Neural networks made easy (Part 54): Using random encoder for efficient research (RE3) - MT5

- Neural networks made easy (Part 55): Contrastive intrinsic control (CIC) - MT5

- Neural networks made easy (Part 56): Using nuclear norm to drive research - MT5

- Neural networks made easy (Part 57): Stochastic Marginal Actor-Critic (SMAC) - MT5

- Neural networks made easy (Part 58): Decision Transformer (DT) - MT5

- Neural networks are easy (Part 59): Dichotomy of Control (DoC) - MT5

- Neural networks made easy (Part 60): Online Decision Transformer (ODT) - MT5

- Neural networks made easy (Part 61): Optimism issue in offline reinforcement learning - MT5

- Neural networks made easy (Part 62): Using Decision Transformer in hierarchical models - MT5

- Neural networks made easy (Part 63): Unsupervised Pretraining for Decision Transformer (PDT) - MT5

- Neural networks made easy (Part 64): ConserWeightive Behavioral Cloning (CWBC) method - MT5

- Neural networks made easy (Part 65): Distance Weighted Supervised Learning (DWSL) - MT5

- Neural networks made easy (Part 66): Exploration problems in offline learning - MT5

- Neural networks made easy (Part 67): Using past experience to solve new tasks - MT5

- Neural networks made easy (Part 68): Offline Preference-guided Policy Optimization - MT5

- Neural networks made easy (Part 69): Density-based support constraint for the behavioral policy (SPOT) - MT5

- Neural networks made easy (Part 70): Closed-Form Policy Improvement Operators (CFPI) - MT5

- Neural networks made easy (Part 71): Goal-Conditioned Predictive Coding GCPC) - MT5

- Neural networks made easy (Part 72): Trajectory prediction in noisy environments - MT5

- Neural networks made easy (Part 73): AutoBots for predicting price movements - MT5

- Neural networks made easy (Part 74): Trajectory prediction with adaptation - MT5

- Neural networks made easy (Part 75): Improving the performance of trajectory prediction models - MT5

- Neural networks made easy (Part 76): Exploring diverse interaction patterns with Multi-future Transformer - MT5

- Neural networks made easy (Part 77): Cross-Covariance Transformer (XCiT) - MT5

- Neural networks made easy (Part 78): Decoder-free Object Detector with Transformer (DFFT) - MT5

- Neural networks made easy (Part 79): Feature Aggregated Queries (FAQ) in the context of state - MT5

- Neural networks made easy (Part 80): Graph Transformer Generative Adversarial Model (GTGAN) - MT5

- Neural Networks Made Easy (Part 81): Context-Guided Motion Analysis (CCMR) - MT5

- Neural networks made easy (Part 82): Ordinary Differential Equation models (NeuralODE) - MT5

- Neural Networks Made Easy (Part 83): The "Conformer" Spatio-Temporal Continuous Attention Transformer Algorithm - MT5

- Neural Networks Made Easy (Part 84): Reversible Normalization (RevIN) - MT5

- Neural Networks Made Easy (Part 85): Multivariate Time Series Forecasting - MT5

- Neural Networks Made Easy (Part 86): U-Shaped Transformer - MT5

- Neural Networks Made Easy (Part 87): Time Series Patching - MT5

- Neural Networks Made Easy (Part 88): Time-Series Dense Encoder (TiDE) - MT5

- Neural networks made easy (Part 89): Frequency Enhanced Decomposition Transformer (FEDformer) - MT5

- Neural Networks Made Easy (Part 90): Frequency Interpolation of Time Series (FITS) - MT5

- Neural Networks Made Easy (Part 91): Frequency Domain Forecasting (FreDF) - MT5

- Neural Networks Made Easy (Part 92): Adaptive Forecasting in Frequency and Time Domains - MT5

- Neural Networks Made Easy (Part 93): Adaptive Forecasting in Frequency and Time Domains (Final Part) - MT5

- Neural Networks Made Easy (Part 94): Optimizing the Input Sequence - MT5

- Neural Networks Made Easy (Part 95): Reducing Memory Consumption in Transformer Models - MT5

- Neural Networks Made Easy (Part 96): Multi-Scale Feature Extraction (MSFformer) - MT5

- Neural Networks Made Easy (Part 97): Training Models With MSFformer - MT5

- Developing a self-adapting algorithm (Part I): Finding a basic pattern - MT5

- Developing a self-adapting algorithm (Part II): Improving efficiency - MT5

- Self-adapting algorithm (Part III): Abandoning optimization - MT5

- Deep neural network with Stacked RBM. Self-training, self-control - MT4

- Practical application of neural networks in trading - MT5

- Practical application of neural networks in trading. Python (Part I) - MT5

- Practical application of neural networks in trading (Part 2). Computer vision - MT5

- Neural Networks in Trading: Piecewise Linear Representation of Time Series - MT5

- Neural Networks in Trading: Dual-Attention-Based Trend Prediction Model - MT5

- Neural Networks in Trading: Lightweight Models for Time Series Forecasting - MT5

- Neural Networks in Trading: Using Language Models for Time Series Forecasting - MT5

- Neural Networks in Trading: Practical Results of the TEMPO Method - MT5

- Neural Networks in Trading: A Complex Trajectory Prediction Method (Traj-LLM) - MT5

- Neural Networks in Trading: Unified Trajectory Generation Model (UniTraj) - MT5

- Neural Networks in Trading: Hierarchical Vector Transformer (HiVT) - MT5

- Neural Networks in Trading: Hierarchical Vector Transformer (Final Part) - MT5

- Neural Networks in Trading: Hierarchical Feature Learning for Point Clouds - MT5

- Neural Networks in Trading: Point Cloud Analysis (PointNet) - MT5

- Neural Networks in Trading: Transformer for the Point Cloud (Pointformer) - MT5

- Neural Networks in Trading: Transformer with Relative Encoding - MT5

- Neural Networks in Trading: Scene-Aware Object Detection (HyperDet3D) - MT5

- Neural Networks in Trading: Exploring the Local Structure of Data - MT5

- Neural Networks in Trading: Superpoint Transformer (SPFormer) - MT5

- Neural Networks in Trading: Mask-Attention-Free Approach to Price Movement Forecasting - MT5

- Neural Networks in Trading: Generalized 3D Referring Expression Segmentation - MT5

- Neural Networks in Trading: Controlled Segmentation - MT5

- Neural Networks in Trading: Controlled Segmentation (Final Part) - MT5

- Neural Networks in Trading: Market Analysis Using a Pattern Transformer - MT5

- Neural Networks in Trading: Contrastive Pattern Transformer - MT5

- Neural Networks in Trading: Contrastive Pattern Transformer (Final Part) - MT5

- Neural Networks in Trading: Node-Adaptive Graph Representation with NAFS - MT5

- Neural Networks in Trading: Directional Diffusion Models (DDM) - MT5

- Neural Networks in Trading: Hyperbolic Latent Diffusion Model (HypDiff) - MT5

- Neural Networks in Trading: Hyperbolic Latent Diffusion Model (Final Part) - MT5

- Neural Networks in Trading: Optimizing the Transformer for Time Series Forecasting (LSEAttention) - MT5

- Neural Networks in Trading: Enhancing Transformer Efficiency by Reducing Sharpness (Final Part) - MT5

- Neural Networks in Trading: A Parameter-Efficient Transformer with Segmented Attention (PSformer) - MT5

- Neural Networks in Trading: A Multi-Agent Self-Adaptive Model (MASA) - MT5

- Neural Networks in Trading: A Multi-Agent Self-Adaptive Model (Final Part) - MT5

- Neural Networks in Trading: An Ensemble of Agents with Attention Mechanisms (MASAAT) - MT5

- Neural Networks in Trading: A Hybrid Trading Framework with Predictive Coding (StockFormer) - MT5

- Neural Networks in Trading: An Ensemble of Agents with Attention Mechanisms (Final Part) - MT5

- Neural Networks in Trading: A Hybrid Trading Framework with Predictive Coding (Final Part) - MT5

- Neural Networks in Trading: Models Using Wavelet Transform and Multi-Task Attention - MT5

- Connecting NeuroSolutions Neuronets - MT5

- Using Neural Networks In MetaTrader - MT4

- Price Forecasting Using Neural Networks - MT4

- Recipes for Neuronets - MT4

- Third Generation Neural Networks: Deep Networks - MT5

- Neural Networks Cheap and Cheerful - Link NeuroPro with MetaTrader 5 - MT5

- Creating Neural Network EAs Using MQL5 Wizard and Hlaiman EA Generator - MT5

- Neural network: Self-optimizing Expert Advisor - MT5

- Neural Networks: From Theory to Practice - MT5

- Using MetaTrader 5 Indicators with ENCOG Machine Learning Framework for Timeseries Prediction - MT5

- Using Self-Organizing Feature Maps (Kohonen Maps) in MetaTrader 5 - MT5

- Deep Neural Networks (Part I). Preparing Data - MT5

- Deep Neural Networks (Part II). Working out and selecting predictors - MT5

- Mastering Model Interpretation: Gaining Deeper Insight From Your Machine Learning Models - MT5

CodeBase

- Next price predictor using Neural Network - indicator for MetaTrader 4

- Easy Neural Network - library for MetaTrader 5

- LGLIB - Numerical Analysis Library - library for MetaTrader 4

- ALGLIB - Numerical Analysis Library - library for MetaTrader 5

- MTS Neural network plus MACD - expert for MetaTrader 4

- ArtificialIntelligence_Right - expert for MetaTrader 4

- NeuroNirvamanEA - expert for MetaTrader 4

- Create your own neural network predictor easily (example: MA and RSI Predictors) - indicator for MetaTrader 4

- Automated Trading System "Сombo" - expert for MetaTrader 4

- MTC Neural network plus MACD - expert for MetaTrader 5

- Bollinger Band Width calculation with Neural Network using - expert for MetaTrader 5

- PNN Neural Network Class - library for MetaTrader 5

- GRNN Neural Network Class - library for MetaTrader 5

- RBF Neural Network Class - library for MetaTrader 5

- MLP Neural Network Class - library for MetaTrader 5

- Artificial Intelligence - expert for MetaTrader 5

- www.mql5.com

hi friend!

thanks so much! but I mean your personal experience with AI. do you get real profit by using this method? do you think it will be a good method instead of using Technical methods?

hi friend!

thanks so much! but I mean your personal experience with AI. do you get real profit by using this method? do you think it will be a good method instead of using Technical methods?

No, I do not have practical experience sorry.

But there is one thread in Russian forum where the users are talking about it, and it is 2,739 pages on the thread for now (yes, the thread is very popular one).

I am not fully understand about what they are talking about ... something related to this page:

https://cs.stanford.edu/people/karpathy/convnetjs/demo/rldemo.html

..and something about the following ("machine translation" from Russian):

Forum on trading, automated trading systems and testing trading strategies

Machine learning in trading: theory, models, practice and algorithmic trading

mytarmailS , 2022.09.07 07:24

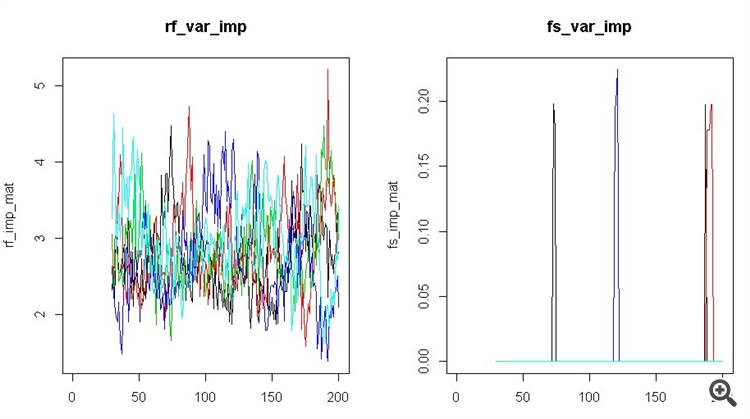

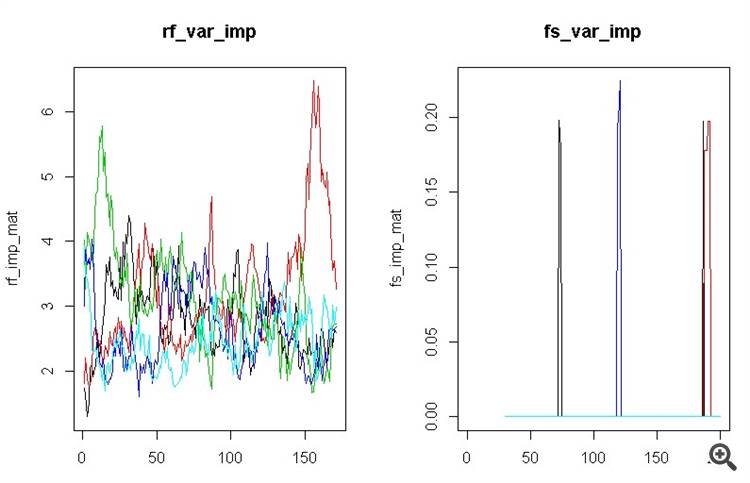

It makes no sense to look at the old model, it does not capture market changes.Here is an example on a randomly generated sample of 5 features and 1 binary target

for forest and feature selector

X <- matrix (rnorm( 1000 ),ncol = 5 ) Y <- as .factor(sample( 0 : 1 ,nrow(X),replace = T)) head(X) head(Y) #install.packages( "randomForest" ) library (randomForest) rf_imp_mat <- matrix (ncol = ncol(X),nrow = nrow(X)) for (i in 30 :nrow(X)){ ii <- (i- 29 ):i rf <- randomForest(Y[ii]~.,X[ii,],ntree= 100 ) rf_imp_mat[i,] <- importance(rf)[, 1 ] } #install.packages( "FSelectorRcpp" ) library (FSelectorRcpp) fs_imp_mat <- matrix (ncol = ncol(X),nrow = nrow(X)) for (i in 30 :nrow(X)){ ii <- (i- 29 ):i infg <- information_gain(y = Y[ii],x = as .data.frame(X[ii,])) fs_imp_mat[i,] <- infg$importance } par(mfrow=c( 1 , 2 )) matplot(rf_imp_mat , t= "l" ,lty= 1 ,main= "rf_var_imp" ) matplot(fs_imp_mat , t= "l" ,lty= 1 ,main= "fs_var_imp" )

In R, of course, it is not customary to write in cycles if it is not necessary, but this style confuses beginners, and middle peasants, like me, also confuses ..

but you can write short and so, the code is 3 times less, the result is the same

X <- matrix (rnorm( 1000 ),ncol = 5 ) Y <- as .factor(sample( 0 : 1 ,nrow(X),replace = T)) idx <- embed( 1 :nrow(X),dimension = 30 )[, 30 : 1 ] library (randomForest) rf_imp_mat <- t(apply(idx, 1 ,function(i) importance(randomForest(Y[i]~.,X[i,]))[, 1 ])) library (FSelectorRcpp) fs_imp_mat <- t(apply(idx,1,function(i) information_gain(y=Y[i],x=as.data.frame(X[i,]))$importance)) par(mfrow=c( 1 , 2 )) matplot(rf_imp_mat , t= "l" ,lty= 1 ,main= "rf_var_imp" ) matplot(fs_imp_mat , t= "l" ,lty= 1 ,main= "fs_var_imp" )

Also , different feature selectors for every taste, probably 5% of what is in R-ke

hi friend!

thanks so much! but I mean your personal experience with AI. do you get real profit by using this method? do you think it will be a good method instead of using Technical methods?

The AI of any trading robot uses technical methods as a starting point to make trades since it is easiest to work with. It bases its trades on the information that the chart provides and some really sophisticated ones also integrate fundamental aspects. Implementing genetic algorithms into an EA further enhances its intelligence, as it uses the selection, crossover and mutation that we see in nature to optimize whatever strategy it uses. It's actually one of the fields that I'm currently studying in my free time and the results look really promising. So the question shouldn't be about AI vs. technical trading, and instead should revolve around "does a trading AI enhance technical analysis?" and the answer to that is a very clear YES!

The AI of any trading robot uses technical methods as a starting point to make trades since it is easiest to work with. It bases its trades on the information that the chart provides and some really sophisticated ones also integrate fundamental aspects. Implementing genetic algorithms into an EA further enhances its intelligence, as it uses the selection, crossover and mutation that we see in nature to optimize whatever strategy it uses. It's actually one of the fields that I'm currently studying in my free time and the results look really promising. So the question shouldn't be about AI vs. technical trading, and instead should revolve around "does a trading AI enhance technical analysis?" and the answer to that is a very clear YES!

hi friend!

really answer this question needs to have a deep acknowledge of the market. as you know the market is semi random and the news also affects it's trends. so I think there is many obstacles in this field. you should determine how much percent of the market is predictable and how you can extract this part from the data!

hi friend!

really answer this question needs to have a deep acknowledge of the market. as you know the market is semi random and the news also affects it's trends. so I think there is many obstacles in this field. you should determine how much percent of the market is predictable and how you can extract this part from the data!

Future price uncertainty is part of the market, but that doesn't mean it's random. What many call "random" is simply a pattern they don't yet understand and thus erroneously classify it as such. The markets always rely on a set of repeating patterns that express themselves in different ways at different times. If that wasn't true, hedge funds and investment banks wouldn't bother trading the markets at all. Now, without AI you'd have to figure out the changes of those patterns yourself, which is time consuming. Not to mention that by the time you have figured out what that pattern is, the pattern itself might have already morphed into a new one. The use of AI gets rid of all this human fallibility and recognizes, adapts, memorizes and calculates those changing patterns and integrates all that into its trading strategy. It's a much more efficient use of technical, as well as fundamental analysis.

Future price uncertainty is part of the market, but that doesn't mean it's random. What many call "random" is simply a pattern they don't yet understand and thus erroneously classify it as such. The markets always rely on a set of repeating patterns that express themselves in different ways at different times. If that wasn't true, hedge funds and investment banks wouldn't bother trading the markets at all. Now, without AI you'd have to figure out the changes of those patterns yourself, which is time consuming. Not to mention that by the time you have figured out what that pattern is, the pattern itself might have already morphed into a new one. The use of AI gets rid of all this human fallibility and recognizes, adapts, memorizes and calculates those changing patterns and integrates all that into its trading strategy. It's a much more efficient use of technical, as well as fundamental analysis.

hi friend!

I'm not agree with you! we have a normal distribution in mathematics which is made by random data. however it's not completely Gaussian but you can claim it's a semi random data. what you say is the patterns which made by predictable data section.

hi friend!

I'm not agree with you! we have a normal distribution in mathematics which is made by random data. however it's not completely Gaussian but you can claim it's a semi random data. what you say is the patterns which made by predictable data section.

Semi-random is kind of an oxymoron. Oxford defines the word random as follows: "made, done, or happening without method or conscious decision". So randomness is a term people use to describe processes they perceive to be chaotic, but that doesn't make it so. Furthermore, when you attach the word "semi" to it, you are actually disproving that notion. If there is no method to the markets, then trading the markets would be absolutely pointless and big money wouldn't waste their precious time and resources on it. This isn't just something I'm saying off the bat, as I work in this industry and know what I'm talking about. Investment banks and hedge funds spend hundreds of millions of dollars on R&D to get the brightest mathematicians from elite universities such as Yale, Harvard and Oxford to work for them and find market patterns which they can exploit to their advantage. If the markets were random, they wouldn't spend a dime on this research. The foreign exchange department of my former employer was literally hoarding all the quant algorithms that have proven to be profitable over the years, made high-frequency trading bots out of them and recorded those profits in the "other assets" part of the balance sheet (which is quite a significant sum if you look at the balance sheets of investment banks).

I suggest you look a bit more into quantum physics. Science is finding more and more evidence that such a thing as "randomness" doesn't really exist. Everything is interconnected, it's just a matter of filtering out the noise to see the clear picture.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use