Data Science and ML (Part 33): Pandas Dataframe in MQL5, Data Collection for ML Usage made easier

Contents

- Introduction

- Basic Data Structures in Pandas

- A Pandas Dataframe

- Adding Data Into the Dataframe Class

- Assigning a CSV file to the Dataframe

- Visualizing What's in the Dataframe

- Exporting the Dataframe To a CSV file

- Dataframe Selection and Indexing

- Exploring and Inspecting Pandas Dataframe

- Time Series and Data Transformation Methods

- Collecting Data for Machine Learning

- Training a Machine Learning Model

- Deploying a Machine Learning Model in MQL5

- Conclusion

Introduction

When it comes to working with machine learning models, it is essential that we have the same data structure if not the same values for all the environments; Training, validation, and testing. With Open Neural Network Exchange (ONNX) models being supported in MQL5 and MetaTrader 5, nowadays we have an opportunity to import models trained outside into the MQL5 language and use them for trading purposes.

Since most users use Python for training these Artificial Intelligence (AI) models which are then being deployed in MetaTrader 5 through MQL5 code, there could be a huge difference in how the data is organized, and often times even the values within the same data structure can be slightly different, this is due to the difference in the two technologies.

In this article, we are going to mimic the Pandas library available in Python language. It is one of the most popular libraries, useful particularly when it comes to working with vast amounts of data.

Since this library is used by data scientists to prepare and manipulate data used in training ML models, by harnessing its ability, we aim to have the same data playground in MQL5 as in Python.

Basic Data Structures in Pandas

The Pandas library provides two types of classes for handling data.

- Series: a one-dimensional labeled array for holding data of any type such as integers, strings, Objects, etc.

s = pd.Series([1, 3, 5, np.nan, 6, 8])

- Dataframe: a two-dimensional data structure that holds data like a two-dimensional array or a table with rows and columns.

Since a series pandas data class is one-dimensional, It is more like an Array or a vector in MQL5, we are not going to work on it. Our focus is on the two-dimensional "Dataframe".

A Pandas DataFrame

Again, this data structure holds data like a two-dimensional array or a table with rows and columns, in MQL5 we can have a two-dimensional array but, the most practical two-dimensional object we can use for this task is a matrix.

Since we now know that at the core of the Pandas Dataframe lies a two-dimensional array, we can implement this similar foundation in our Pandas class in MQL5.

File: pandas.mqh

class CDataFrame { public: string m_columns[]; //An array of string values for keeping track of the column names matrix m_values; // A 2D matrix CDataFrame(); ~CDataFrame(void); }

We need to have an array named "m_columns" for storing the column names for every column in the Dataframe, unlike other libraries for working with data like Numpy, Pandas ensures the data stored is human-friendly by keeping track of the column names.

Pandas Datafrme in Python supports different data types such as Integers, strings, objects, etc.

import pandas as pd df = pd.DataFrame({ "Integers": [1,2,3,4,5], "Doubles": [0.1,0.2,0.3,0.4,0.5], "Strings": ["one","two","three","four","five"] })

We are not going to implement this same flexibility in our MQL5 library because the goal of this library is to aid us when working with machine learning models where variables of float and double data type are the most useful.

So, make sure you cast (integers, long, ulong etc) into values of double data type and encode all (string) variables you have before plugging them into the Dataframe class because all variables will be forced to become of double data type.

Adding Data Into the Dataframe Class

Now that we know that a matrix at the core of a Dataframe object is the one responsible for storing all the data, Let us implement ways to add information to it.

In Python, you can simply create a new Dataframe and add objects to it by calling the method;

df = pd.DataFrame({

"first column": [1,2,3,4,5],

"second column": [10,20,30,40,50]

})

Due to the MQL5 language syntax, we can't have a class or method behave like this, Let's implement a method known as Insert.

File: pandas.mqh

void CDataFrame::Insert(string name, const vector &values) { //--- Check if the column exists in the m_columns array if it does exists, instead of creating a new column we modify an existing one int col_index = -1; for (int i=0; i<(int)m_columns.Size(); i++) if (name == m_columns[i]) { col_index = i; break; } //--- We check if the dimensiona are Ok if (m_values.Rows()==0) m_values.Resize(values.Size(), m_values.Cols()); if (values.Size() > m_values.Rows() && m_values.Rows()>0) //Check if the new column has a bigger size than the number of rows present in the matrix { printf("%s new column '%s' size is bigger than the dataframe",__FUNCTION__,name); return; } //--- if (col_index != -1) { m_values.Col(values, col_index); if (MQLInfoInteger(MQL_DEBUG)) printf("%s column '%s' exists, It will be modified",__FUNCTION__,name); return; } //--- If a given vector to be added to the dataframe is smaller than the number of rows present in the matrix, we fill the remaining values with Not a Number (NaN) vector temp_vals = vector::Zeros(m_values.Rows()); temp_vals.Fill(NaN); //to create NaN values when there was a dimensional mismatch for (ulong i=0; i<values.Size(); i++) temp_vals[i] = values[i]; //--- m_values.Resize(m_values.Rows(), m_values.Cols()+1); //We resize the m_values matrix to accomodate the new column m_values.Col(temp_vals, m_values.Cols()-1); //We insert the new column after the last column ArrayResize(m_columns, m_columns.Size()+1); //We increase the sice of the column names to accomodate the new column name m_columns[m_columns.Size()-1] = name; //we assign the new column to the last place in the array }

We can parse new information to the Dataframe as follows;

#include <MALE5\pandas.mqh> //+------------------------------------------------------------------+ //| Script program start function | //+------------------------------------------------------------------+ void OnStart() { //--- CDataFrame df; vector v1= {1,2,3,4,5}; vector v2= {10,20,30,40,50}; df.Insert("first column", v1); df.Insert("second column", v2); }

Alternatively, we can give the class constructur the ability to receive a matrix and its column names.

CDataFrame::CDataFrame(const string &columns, const matrix &values) { string columns_names[]; //A temporary array for obtaining column names from a string ushort sep = StringGetCharacter(",", 0); if (StringSplit(columns, sep, columns_names)<0) { printf("%s failed to obtain column names",__FUNCTION__); return; } if (columns_names.Size() != values.Cols()) //Check if the given number of column names is equal to the number of columns present in a given matrix { printf("%s dataframe's columns != columns present in the values matrix",__FUNCTION__); return; } ArrayCopy(m_columns, columns_names); //We assign the columns to the m_columns array m_values = values; //We assing the given matrix to the m_values matrix }

We can also add new information to the Dataframe class as follows;

void OnStart() { //--- matrix data = { {1,10}, {2,20}, {3,30}, {4,40}, {5,50}, }; CDataFrame df("first column,second column",data); }

I suggest you use the Insert method for adding data to the Dataframe class that any other method for the task.

The prior two discussed methods are useful when you are preparing datasets, we also need a function for loading the data present in a dataset.

Assigning a CSV file to the Dataframe

The method for reading a CSV file and assigning the values to a Dataframe is among the most useful functions in Pandas when you are working with the library in Python.

df = pd.read_csv("EURUSD.PERIOD_D1.csv")

Let us implement this method in our MQL5 class;

bool CDataFrame::ReadCSV(string file_name,string delimiter=",",bool is_common=false, bool verbosity=false) { matrix mat_ = {}; int rows_total=0; int handle = FileOpen(file_name,FILE_READ|FILE_CSV|FILE_ANSI|(is_common?FILE_IS_COMMON:FILE_ANSI),delimiter); //Open a csv file ResetLastError(); if(handle == INVALID_HANDLE) //Check if the file handle is ok if not return false { printf("Invalid %s handle Error %d ",file_name,GetLastError()); Print(GetLastError()==0?" TIP | File Might be in use Somewhere else or in another Directory":""); return false; } else { int column = 0, rows=0; while(!FileIsEnding(handle)) { string data = FileReadString(handle); //--- if(rows ==0) { ArrayResize(m_columns,column+1); m_columns[column] = data; } if(rows>0) //Avoid the first column which contains the column's header mat_[rows-1,column] = (double(data)); //add a value to the matrix column++; //--- if(FileIsLineEnding(handle)) //At the end of the each line { rows++; mat_.Resize(rows,column); //Resize the matrix to accomodate new values column = 0; } } if (verbosity) //if verbosity is set to true, we print the information to let the user know the progress, Useful for debugging purposes printf("Reading a CSV file... record [%d]",rows); rows_total = rows; FileClose(handle); //Close the file after reading it } mat_.Resize(rows_total-1,mat_.Cols()); m_values = mat_; return true; }

Below is how you can read a CSV file and assign it to the Dataframe directly.

void OnStart() { //--- CDataFrame df; df.ReadCSV("EURUSD.PERIOD_D1.csv"); df.Head(); }

Visualizing What's in the Dataframe

We have seen how you can add information into a Dataframe but, it is very crucial to be able to briefly look into the Dataframe to see what is it all about. In most cases, you will be working with big Dataframes that often require looking back into the Dataframe for exploration and recalling purposes.

Pandas has a method known as "head" which returns the first n rows for the Dataframe object based on position. This method is useful for quickly testing if your object has the right type of data in it.

When the method "head" is called in a Jupyter Notebook cell with its default value(s), five first rows of the Dataframe are displayed in the cell output.

File: main.ipynb

df = pd.read_csv("EURUSD.PERIOD_D1.csv") df.head()

Output

| Open | High | Low | Close | |

|---|---|---|---|---|

| 0 | 1.09381 | 1.09548 | 1.09003 | 1.09373 |

| 1 | 1.09678 | 1.09810 | 1.09361 | 1.09399 |

| 2 | 1.09701 | 1.09973 | 1.09606 | 1.09805 |

| 3 | 1.09639 | 1.09869 | 1.09542 | 1.09742 |

| 4 | 1.10302 | 1.10396 | 1.09513 | 1.09757 |

We can make a similar function for the task in MQL5.

void CDataFrame::Head(const uint count=5) { // Calculate maximum width needed for each column uint num_cols = m_columns.Size(); uint col_widths[]; ArrayResize(col_widths, num_cols); for (uint col = 0; col < num_cols; col++) //Determining column width for visualizing a simple table { uint max_width = StringLen(m_columns[col]); for (uint row = 0; row < count && row < m_values.Rows(); row++) { string num_str = StringFormat("%.8f", m_values[row][col]); max_width = MathMax(max_width, StringLen(num_str)); } col_widths[col] = max_width + 4; // Extra padding for readability } // Print column headers with calculated padding string header = ""; for (uint col = 0; col < num_cols; col++) { header += StringFormat("| %-*s ", col_widths[col], m_columns[col]); } header += "|"; Print(header); // Print rows with padding for each column for (uint row = 0; row < count && row < m_values.Rows(); row++) { string row_str = ""; for (uint col = 0; col < num_cols; col++) { row_str += StringFormat("| %-*.*f ", col_widths[col], 8, m_values[row][col]); } row_str += "|"; Print(row_str); } // Print dimensions printf("(%dx%d)", m_values.Rows(), m_values.Cols()); }

By default, this function displays five first rows in our Dataframe.

void OnStart() { //--- CDataFrame df; df.ReadCSV("EURUSD.PERIOD_D1.csv"); df.Head(); }

Outputs

GI 0 12:37:02.983 pandas test (Volatility 75 Index,H1) | Open | High | Low | Close | RH 0 12:37:02.983 pandas test (Volatility 75 Index,H1) | 1.09381000 | 1.09548000 | 1.09003000 | 1.09373000 | GI 0 12:37:02.984 pandas test (Volatility 75 Index,H1) | 1.09678000 | 1.09810000 | 1.09361000 | 1.09399000 | DI 0 12:37:02.984 pandas test (Volatility 75 Index,H1) | 1.09701000 | 1.09973000 | 1.09606000 | 1.09805000 | EI 0 12:37:02.984 pandas test (Volatility 75 Index,H1) | 1.09639000 | 1.09869000 | 1.09542000 | 1.09742000 | CI 0 12:37:02.984 pandas test (Volatility 75 Index,H1) | 1.10302000 | 1.10396000 | 1.09513000 | 1.09757000 | FE 0 12:37:02.984 pandas test (Volatility 75 Index,H1) (1000x4)

Exporting the Dataframe To a CSV file

After collecting all different kinds of data into the Dataframe, we need to export it outside MetaTrader 5 where all the machine learning procedures occur.

A CSV file is handy when it comes to exporting data, especially since we will then use the Pandas library to import the CSV file in Python language.

Let us save the Dataframe we extracted from a CSV file back to the CSV file.

In Python.

df.to_csv("EURUSDcopy.csv", index=False) The outcome is a csv file named EURUSDcopy.csv.

Below is an implementation of this method in MQL5.

bool CDataFrame::ToCSV(string csv_name, bool common=false, int digits=5, bool verbosity=false) { FileDelete(csv_name); int handle = FileOpen(csv_name,FILE_WRITE|FILE_SHARE_WRITE|FILE_CSV|FILE_ANSI|(common?FILE_COMMON:FILE_ANSI),",",CP_UTF8); //open a csv file if(handle == INVALID_HANDLE) //Check if the handle is OK { printf("Invalid %s handle Error %d ",csv_name,GetLastError()); return (false); } //--- string concstring; vector row = {}; vector colsinrows = m_values.Row(0); if (ArraySize(m_columns) != (int)colsinrows.Size()) { printf("headers=%d and columns=%d from the matrix vary is size ",ArraySize(m_columns),colsinrows.Size()); DebugBreak(); return false; } //--- string header_str = ""; for (int i=0; i<ArraySize(m_columns); i++) //We concatenate the header only separating it with a comma delimeter header_str += m_columns[i] + (i+1 == colsinrows.Size() ? "" : ","); FileWrite(handle,header_str); FileSeek(handle,0, SEEK_SET); for(ulong i=0; i<m_values.Rows() && !IsStopped(); i++) { ZeroMemory(concstring); row = m_values.Row(i); for(ulong j=0, cols =1; j<row.Size() && !IsStopped(); j++, cols++) { concstring += (string)NormalizeDouble(row[j],digits) + (cols == m_values.Cols() ? "" : ","); } if (verbosity) //if verbosity is set to true, we print the information to let the user know the progress, Useful for debugging purposes printf("Writing a CSV file... record [%d/%d]",i+1,m_values.Rows()); FileSeek(handle,0,SEEK_END); FileWrite(handle,concstring); } FileClose(handle); return (true); }

Below is how to use this method.

void OnStart() { CDataFrame df; df.ReadCSV("EURUSD.PERIOD_D1.csv"); //Assign a csv file into the dataframe df.ToCSV("EURUSDcopy.csv"); //Save the dataframe back into a CSV file as a copy }

The outcome is the creation of the CSV file with the name EURUSDcopy.csv.

Now that we have discussed about creating a Dataframe, inserting the values into it, importing, and exporting the data, let's see data selection and indexing techniques.

Dataframe Selection and Indexing

It is very crucial to have the ability to slice, select, or access some specific parts of the Dataframe at times. For instance; while using a model to make predictions you might want to access only the latest values (the last row) in the dataframe meanwhile, during training, you may want to access some rows located at the beginning of the Dataframe.

Accessing a Column

To access a column, we can implement an index operator that takes a string values in our class.

vector operator[] (const string index) {return GetColumn(index); } //Access a column by its name

The function "GetColumn" when given a column name, it returns a vector of its values when it is found.

Usage

Print("Close column: ",df["Close"]);

Outputs

2025.01.27 16:16:19.726 pandas test (EURUSD,H1) Close column: [1.09373,1.09399,1.09805,1.09742,1.09757,1.10297,1.10453,1.10678,1.1135,1.11594,1.11765,1.11327,1.11797,1.11107,1.1163,1.11616,1.11177,1.11141,1.11326,1.10745,1.10747,1.10111,1.10192,1.10351,1.10861,1.11106,1.1083,1.10435,1.10723,1.10483,1.1078,1.11199,1.11843,1.1161,1.11932,1.11113,1.11499,1.113,1.10852,1.10267,1.09712,1.10124,1.09928,1.09321,1.09156,1.09188,1.09236,1.09315,1.09511,1.09107,1.07913,1.08258,1.08142,1.08211,1.08551,1.0845,1.08392,1.08529,1.08905,1.08818,1.08959,1.09396,1.08986,

The "loc" Indexing

This indexing helps to access a group or rows and columns by labels(s) or a boolean array.

In Pandas Python.

df.loc[0] Outputs.

Open 1.09381 High 1.09548 Low 1.09003 Close 1.09373 Name: 0, dtype: float64

In MQL5, we can implement this as a regular function.

vector CDataFrame::Loc(int index, uint axis=0) { if(axis == 0) { vector row = {}; //--- Convert negative index to positive if(index < 0) index = (int)m_values.Rows() + index; if(index < 0 || index >= (int)m_values.Rows()) { printf("%s Error: Row index out of bounds. Given index: %d", __FUNCTION__, index); return row; } return m_values.Row(index); } else if(axis == 1) { vector column = {}; //--- Convert negative index to positive if(index < 0) index = (int)m_values.Cols() + index; //--- Check bounds if(index < 0 || index >= (int)m_values.Cols()) { printf("%s Error: Column index out of bounds. Given index: %d", __FUNCTION__, index); return column; } return m_values.Col(index); } else printf("%s Failed, Unknown axis ",__FUNCTION__); return vector::Zeros(0); }

I added the argument named axis to gain the ability to choose between obtaining a row (along axis 0) and a column (along axis 1).

When this function receives a negative value it accesses items in reverse, an index value of -1 is the last element in the Dataframe (last row when axis=0, last column when axis=1).

Usage

void OnStart() { //--- CDataFrame df; df.ReadCSV("EURUSD.PERIOD_D1.csv"); df.Head(); Print("First row",df.Loc(0)); //--- Print("Last 5 items in df\n",df.Tail()); Print("Last row: ",df.Loc(-1)); Print("Last Column: ",df.Loc(-1, 1)); }

Outputs

RM 0 09:04:21.355 pandas test (EURUSD,H1) | Open | High | Low | Close | IN 0 09:04:21.355 pandas test (EURUSD,H1) | 1.09381000 | 1.09548000 | 1.09003000 | 1.09373000 | GP 0 09:04:21.355 pandas test (EURUSD,H1) | 1.09678000 | 1.09810000 | 1.09361000 | 1.09399000 | NS 0 09:04:21.355 pandas test (EURUSD,H1) | 1.09701000 | 1.09973000 | 1.09606000 | 1.09805000 | IE 0 09:04:21.355 pandas test (EURUSD,H1) | 1.09639000 | 1.09869000 | 1.09542000 | 1.09742000 | IG 0 09:04:21.355 pandas test (EURUSD,H1) | 1.10302000 | 1.10396000 | 1.09513000 | 1.09757000 | NJ 0 09:04:21.355 pandas test (EURUSD,H1) (1000x4) EO 0 09:04:21.355 pandas test (EURUSD,H1) First row[1.09381,1.09548,1.09003,1.09373] JF 0 09:04:21.355 pandas test (EURUSD,H1) Last 5 items in df DN 0 09:04:21.355 pandas test (EURUSD,H1) [[1.20796,1.21591,1.20742,1.21416] JK 0 09:04:21.355 pandas test (EURUSD,H1) [1.21023,1.21474,1.20588,1.20814] PR 0 09:04:21.355 pandas test (EURUSD,H1) [1.21089,1.21342,1.20953,1.21046] OO 0 09:04:21.355 pandas test (EURUSD,H1) [1.21281,1.21664,1.20785,1.2109] FK 0 09:04:21.355 pandas test (EURUSD,H1) [1.21444,1.21774,1.21101,1.21203]] EM 0 09:04:21.355 pandas test (EURUSD,H1) Last row: [1.21444,1.21774,1.21101,1.21203] QM 0 09:04:21.355 pandas test (EURUSD,H1) Last Column: [1.09373,1.09399,1.09805,1.09742,1.09757,1.10297,1.10453,1.10678,1.1135,1.11594,1.11765,1.11327,1.11797,1.11107,1.1163,1.11616,1.11177,1.11141,1.11326,1.10745,1.10747,1.10111,1.10192,1.10351,1.10861,1.11106,1.1083,1.10435,1.10723,1.10483,1.1078,1.11199,1.11843,1.1161,1.11932,1.11113,1.11499,1.113,1.10852,1.10267,1.09712,1.10124,1.09928,1.00063,…]

The "iloc" method

The Iloc function in introduced in our class selects rows and columns of a Dataframe by integer positions similar to the iloc method offered by Pandas in Python.

This method returns a new Dataframe which is a result of the sliced operation.

MQL implementation.

CDataFrame Iloc(ulong start_row, ulong end_row, ulong start_col, ulong end_col);

Usage

df = df.Iloc(0,100,0,3); //Slice from the first row to the 99th from the first column to the 2nd df.Head();

Outputs

DJ 0 16:40:19.699 pandas test (EURUSD,H1) | Open | High | Low | LQ 0 16:40:19.699 pandas test (EURUSD,H1) | 1.09381000 | 1.09548000 | 1.09003000 | PM 0 16:40:19.699 pandas test (EURUSD,H1) | 1.09678000 | 1.09810000 | 1.09361000 | EI 0 16:40:19.699 pandas test (EURUSD,H1) | 1.09701000 | 1.09973000 | 1.09606000 | DE 0 16:40:19.699 pandas test (EURUSD,H1) | 1.09639000 | 1.09869000 | 1.09542000 | FQ 0 16:40:19.699 pandas test (EURUSD,H1) | 1.10302000 | 1.10396000 | 1.09513000 | GS 0 16:40:19.699 pandas test (EURUSD,H1) (100x3)

The "at" method

This method returns a single value from the Dataframe.

MQL implementation.

double CDataFrame::At(ulong row, string col_name) { ulong col_number = (ulong)ColNameToIndex(col_name, m_columns); return m_values[row][col_number]; }

Usage.

void OnStart() { //--- CDataFrame df; df.ReadCSV("EURUSD.PERIOD_D1.csv"); Print(df.At(0,"Close")); //Returns the first value within the Close column }

Outputs.

2025.01.27 16:47:16.701 pandas test (EURUSD,H1) 1.09373

The "iat" method

This enables us to access a single value in the Dataframe by position.

MQL implementation.

double CDataFrame::Iat(ulong row,ulong col) { return m_values[row][col]; }

Usage

Print(df.Iat(0,0)); //Returns the value at first row and first colum

Output.

2025.01.27 16:53:32.627 pandas test (EURUSD,H1) 1.09381

Dropping columns from the Dataframe using the "drop" method

It sometimes happens that we have unwanted columns in our dataframe, or we want to remove some variables for training purposes. The drop function can help with this task.

MQL implementation.

CDataFrame CDataFrame::Drop(const string cols) { CDataFrame df; string column_names[]; ushort sep = StringGetCharacter(",",0); if(StringSplit(cols, sep, column_names) < 0) { printf("%s Failed to get the columns, ensure they are separated by a comma. Error = %d", __FUNCTION__, GetLastError()); return df; } int columns_index[]; uint size = column_names.Size(); ArrayResize(columns_index, size); if(size > m_values.Cols()) { printf("%s failed, The number of columns > columns present in the dataframe", __FUNCTION__); return df; } // Fill columns_index with column indices to drop for(uint i = 0; i < size; i++) { columns_index[i] = ColNameToIndex(column_names[i], m_columns); if(columns_index[i] == -1) { printf("%s Column '%s' not found in this DataFrame", __FUNCTION__, column_names[i]); //ArrayRemove(column_names, i, 1); continue; } } matrix new_data(m_values.Rows(), m_values.Cols() - size); string new_columns[]; ArrayResize(new_columns, (int)m_values.Cols() - size); // Populate new_data with columns not in columns_index for(uint i = 0, count = 0; i < m_values.Cols(); i++) { bool to_drop = false; for(uint j = 0; j < size; j++) { if(i == columns_index[j]) { to_drop = true; break; } } if(!to_drop) { new_data.Col(m_values.Col(i), count); new_columns[count] = m_columns[i]; count++; } } // Replace original data with the updated matrix and columns df.m_values = new_data; ArrayResize(df.m_columns, new_columns.Size()); ArrayCopy(df.m_columns, new_columns); return df; }

Usage

void OnStart() { //--- CDataFrame df; df.ReadCSV("EURUSD.PERIOD_D1.csv"); CDataFrame new_df = df.Drop("Open,Close"); //drop the columns and assign the dataframe to a new object new_df.Head(); }

Outputs

II 0 19:18:22.997 pandas test (EURUSD,H1) | High | Low | GJ 0 19:18:22.997 pandas test (EURUSD,H1) | 1.09548000 | 1.09003000 | EP 0 19:18:22.998 pandas test (EURUSD,H1) | 1.09810000 | 1.09361000 | CF 0 19:18:22.998 pandas test (EURUSD,H1) | 1.09973000 | 1.09606000 | RL 0 19:18:22.998 pandas test (EURUSD,H1) | 1.09869000 | 1.09542000 | MR 0 19:18:22.998 pandas test (EURUSD,H1) | 1.10396000 | 1.09513000 | DH 0 19:18:22.998 pandas test (EURUSD,H1) (1000x2)

Now that we have functions for indexing and selecting some parts of the Dataframe, let's implement several Pandas functions to help us with data exploration and inspection.

Exploring and Inspecting Pandas Dataframe

The "tail" function

This method displays the last few rows of the Dataframe.

MQL5 implementation.

matrix CDataFrame::Tail(uint count=5) { ulong rows = m_values.Rows(); if(count>=rows) { printf("%s count[%d] >= number of rows in the df[%d]",__FUNCTION__,count,rows); return matrix::Zeros(0,0); } ulong start = rows-count; matrix res = matrix::Zeros(count, m_values.Cols()); for(ulong i=start, row_count=0; i<rows; i++, row_count++) res.Row(m_values.Row(i), row_count); return res; }

Usage.

void OnStart() { //--- CDataFrame df; df.ReadCSV("EURUSD.PERIOD_D1.csv"); Print(df.Tail()); }By default, the function returns 5 last rows of the Dataframe.

GR 0 17:06:42.044 pandas test (EURUSD,H1) [[1.20796,1.21591,1.20742,1.21416] MG 0 17:06:42.044 pandas test (EURUSD,H1) [1.21023,1.21474,1.20588,1.20814] KQ 0 17:06:42.044 pandas test (EURUSD,H1) [1.21089,1.21342,1.20953,1.21046] DK 0 17:06:42.044 pandas test (EURUSD,H1) [1.21281,1.21664,1.20785,1.2109] MO 0 17:06:42.044 pandas test (EURUSD,H1) [1.21444,1.21774,1.21101,1.21203]]

The "info" Function

This function is very useful in understanding the structure of the Dataframe, data types, memory usage, and the presence of not-null values.

Below is its MQL5 implementation.

void CDataFrame::Info(void)

Outputs.

ES 0 17:34:04.968 pandas test (EURUSD,H1) <class 'CDataFrame'> IH 0 17:34:04.968 pandas test (EURUSD,H1) RangeIndex: 1000 entries, 0 to 999 LR 0 17:34:04.968 pandas test (EURUSD,H1) Data columns (total 4 columns): PD 0 17:34:04.968 pandas test (EURUSD,H1) # Column Non-Null Count Dtype OQ 0 17:34:04.968 pandas test (EURUSD,H1) --- ------ -------------- ----- FS 0 17:34:04.968 pandas test (EURUSD,H1) 0 Open 1000 non-null double GH 0 17:34:04.968 pandas test (EURUSD,H1) 1 High 1000 non-null double LS 0 17:34:04.968 pandas test (EURUSD,H1) 2 Low 1000 non-null double IH 0 17:34:04.968 pandas test (EURUSD,H1) 3 Close 1000 non-null double FJ 0 17:34:04.968 pandas test (EURUSD,H1) memory usage: 31.2 KB

The "describe" Function

This function provides descriptive statistics for all the numeric columns in a Dataframe. The information it provides includes, the Mean, Standard deviation, the count, minimum value, and maximum value of the columns not to menthion the 25%, 50%, and 75% percentile values of each column.

Below is the overview of how the function was implemented in MQL5.

void CDataFrame::Describe(void)

Usage

void OnStart() { //--- CDataFrame df; df.ReadCSV("EURUSD.PERIOD_D1.csv"); //Print(df.Tail()); df.Describe(); }

Outputs.

MM 0 18:10:42.459 pandas test (EURUSD,H1) Open High Low Close JD 0 18:10:42.460 pandas test (EURUSD,H1) count 1000 1000 1000 1000 HD 0 18:10:42.460 pandas test (EURUSD,H1) mean 1.104156 1.108184 1.100572 1.104306 HM 0 18:10:42.460 pandas test (EURUSD,H1) std 0.060646 0.059900 0.061097 0.060507 NQ 0 18:10:42.460 pandas test (EURUSD,H1) min 0.959290 0.967090 0.953580 0.959320 DI 0 18:10:42.460 pandas test (EURUSD,H1) 25% 1.069692 1.073520 1.066225 1.069950 DE 0 18:10:42.460 pandas test (EURUSD,H1) 50% 1.090090 1.093640 1.087100 1.090385 FN 0 18:10:42.460 pandas test (EURUSD,H1) 75% 1.142937 1.145505 1.139295 1.142365 CG 0 18:10:42.460 pandas test (EURUSD,H1) max 1.232510 1.234950 1.226560 1.232620

Getting the Dataframe Shape and Columns Present in the Dataframe

Pandas in Python have methods such as pandas.DataFrame.shape which returns the shape of the Dataframe, and pandas.DataFrame.columns which return the columns present in the Dataframe.

In our class, we can access these values from a globally defined matrix named m_values as follows.

printf("df shape = (%dx%d)",df.m_values.Rows(),df.m_values.Cols());

Outputs.

2025.01.27 18:24:14.436 pandas test (EURUSD,H1) df shape = (1000x4)

Time Series and Data Transformation Methods

In this section, we are going to implement some of the methods often used to transform the data and analyze changes over some time between rows of the Dataframe.

Methods discussed in this section are used the most when it comes to feature engineering.

The shift() Method

It shifts the index by a specified number of periods, it is often used in a time-series data to compare a value with its previous or future one.

MQL5 implementation.

vector CDataFrame::Shift(const vector &v, const int shift) { // Initialize a result vector filled with NaN vector result(v.Size()); result.Fill(NaN); if(shift > 0) { // Positive shift: Move elements forward for(ulong i = 0; i < v.Size() - shift; i++) result[i + shift] = v[i]; } else if(shift < 0) { // Negative shift: Move elements backward for(ulong i = -shift; i < v.Size(); i++) result[i + shift] = v[i]; } else { // Zero shift: Return the vector unchanged result = v; } return result; }

vector CDataFrame::Shift(const string index, const int shift) { vector v = this.GetColumn(index); // Initialize a result vector filled with NaN return Shift(v, shift); }

When this function is given a positive index value, it moves elements forward effectively creating a lagged varsion of a given vector or column.

void OnStart() { //--- CDataFrame df; df.ReadCSV("EURUSD.PERIOD_D1.csv"); vector close_lag_1 = df.Shift("Close", 1); //Create a previous 1 lag on the close price df.Insert("Close lag 1",close_lag_1); //Insert this new column into a dataframe df.Head(); }

Outputs

EP 0 19:40:14.257 pandas test (EURUSD,H1) | Open | High | Low | Close | Close lag 1 | NO 0 19:40:14.257 pandas test (EURUSD,H1) | 1.09381000 | 1.09548000 | 1.09003000 | 1.09373000 | nan | PR 0 19:40:14.257 pandas test (EURUSD,H1) | 1.09678000 | 1.09810000 | 1.09361000 | 1.09399000 | 1.09373000 | ES 0 19:40:14.257 pandas test (EURUSD,H1) | 1.09701000 | 1.09973000 | 1.09606000 | 1.09805000 | 1.09399000 | PS 0 19:40:14.257 pandas test (EURUSD,H1) | 1.09639000 | 1.09869000 | 1.09542000 | 1.09742000 | 1.09805000 | PP 0 19:40:14.257 pandas test (EURUSD,H1) | 1.10302000 | 1.10396000 | 1.09513000 | 1.09757000 | 1.09742000 | QO 0 19:40:14.257 pandas test (EURUSD,H1) (1000x5)

However, when a negative function is received, the function creates a future variable for a given column. This is very useful for creating the target variables.

vector future_close_1 = df.Shift("Close", -1); //Create a future 1 variable df.Insert("Future 1 close",future_close_1); //Insert this new column into a dataframe df.Head();

Outputs

CI 0 19:43:08.482 pandas test (EURUSD,H1) | Open | High | Low | Close | Close lag 1 | Future 1 close | GJ 0 19:43:08.482 pandas test (EURUSD,H1) | 1.09381000 | 1.09548000 | 1.09003000 | 1.09373000 | nan | 1.09399000 | MR 0 19:43:08.482 pandas test (EURUSD,H1) | 1.09678000 | 1.09810000 | 1.09361000 | 1.09399000 | 1.09373000 | 1.09805000 | FM 0 19:43:08.482 pandas test (EURUSD,H1) | 1.09701000 | 1.09973000 | 1.09606000 | 1.09805000 | 1.09399000 | 1.09742000 | IH 0 19:43:08.482 pandas test (EURUSD,H1) | 1.09639000 | 1.09869000 | 1.09542000 | 1.09742000 | 1.09805000 | 1.09757000 | OK 0 19:43:08.483 pandas test (EURUSD,H1) | 1.10302000 | 1.10396000 | 1.09513000 | 1.09757000 | 1.09742000 | 1.10297000 | GG 0 19:43:08.483 pandas test (EURUSD,H1) (1000x6)

The pct_change() Method

This function computes the percentage change between the current and prior element, It is commonly used in financial data to calculate returns.

Below is how it is implemented in the DataFrame class.

vector CDataFrame::Pct_change(const string index) { vector col = GetColumn(index); return Pct_change(col); } //+------------------------------------------------------------------+ //| | //+------------------------------------------------------------------+ vector CDataFrame::Pct_change(const vector &v) { vector col = v; ulong size = col.Size(); vector results(size); results.Fill(NaN); for(ulong i=1; i<size; i++) { double prev_value = col[i - 1]; double curr_value = col[i]; // Calculate percentage change and handle division by zero if(prev_value != 0.0) { results[i] = ((curr_value - prev_value) / prev_value) * 100.0; } else { results[i] = 0.0; // Handle division by zero case } } return results; }

Usage.

void OnStart() { //--- CDataFrame df; df.ReadCSV("EURUSD.PERIOD_D1.csv"); vector close_pct_change = df.Pct_change("Close"); df.Insert("Close pct_change", close_pct_change); df.Head(); }

Outputs.

IM 0 19:49:59.858 pandas test (EURUSD,H1) | Open | High | Low | Close | Close pct_change | CO 0 19:49:59.858 pandas test (EURUSD,H1) | 1.09381000 | 1.09548000 | 1.09003000 | 1.09373000 | nan | DS 0 19:49:59.858 pandas test (EURUSD,H1) | 1.09678000 | 1.09810000 | 1.09361000 | 1.09399000 | 0.02377186 | DD 0 19:49:59.858 pandas test (EURUSD,H1) | 1.09701000 | 1.09973000 | 1.09606000 | 1.09805000 | 0.37111857 | QE 0 19:49:59.858 pandas test (EURUSD,H1) | 1.09639000 | 1.09869000 | 1.09542000 | 1.09742000 | -0.05737444 | NF 0 19:49:59.858 pandas test (EURUSD,H1) | 1.10302000 | 1.10396000 | 1.09513000 | 1.09757000 | 0.01366842 | NJ 0 19:49:59.858 pandas test (EURUSD,H1) (1000x5)

The diff() Method

This function calculates the difference between the current and its prior element in a sequence, it is often used to find changes over time.

vector CDataFrame::Diff(const vector &v, int period=1) { vector res(v.Size()); res.Fill(NaN); for(ulong i=period; i<v.Size(); i++) res[i] = v[i] - v[i-period]; //Calculate the difference between the current value and the previous one return res; } //+------------------------------------------------------------------+ //| | //+------------------------------------------------------------------+ vector CDataFrame::Diff(const string index, int period=1) { vector v = this.GetColumn(index); // Initialize a result vector filled with NaN return Diff(v, period); }

Usage

void OnStart() { //--- CDataFrame df; df.ReadCSV("EURUSD.PERIOD_D1.csv"); vector diff_open = df.Diff("Open"); df.Insert("Open diff", diff_open); df.Head(); }

Outputs

GS 0 19:54:10.283 pandas test (EURUSD,H1) | Open | High | Low | Close | Open diff | HM 0 19:54:10.283 pandas test (EURUSD,H1) | 1.09381000 | 1.09548000 | 1.09003000 | 1.09373000 | nan | OQ 0 19:54:10.283 pandas test (EURUSD,H1) | 1.09678000 | 1.09810000 | 1.09361000 | 1.09399000 | 0.00297000 | QQ 0 19:54:10.283 pandas test (EURUSD,H1) | 1.09701000 | 1.09973000 | 1.09606000 | 1.09805000 | 0.00023000 | FF 0 19:54:10.283 pandas test (EURUSD,H1) | 1.09639000 | 1.09869000 | 1.09542000 | 1.09742000 | -0.00062000 | LF 0 19:54:10.283 pandas test (EURUSD,H1) | 1.10302000 | 1.10396000 | 1.09513000 | 1.09757000 | 0.00663000 | OI 0 19:54:10.283 pandas test (EURUSD,H1) (1000x5)

The rolling() Method

This method provides a convenient way for rolling window calculations, it is handy for those wanting to calculate the values within a given time (period) for example; calculating the moving averages of variables in a Dataframe.

File: main.ipynb Language: Python

df["Close sma_5"] = df["Close"].rolling(window=5).mean() df

Unlike other methods, the rolling method requires creating a two-dimensional matrix full of split windows along the rows. Since we then need to apply the resulting 2D matrix to some mathematical functions of our choices we might need to create a separate structure for this task only.

struct rolling_struct { public: matrix matrix__; vector Mean() { vector res(matrix__.Rows()); res.Fill(NaN); for(ulong i=0; i<res.Size(); i++) res[i] = matrix__.Row(i).Mean(); return res; } };

We can create the functions for populating the matrix variable named matrix__.

rolling_struct CDataFrame::Rolling(const vector &v, const uint window) { rolling_struct roll_res; roll_res.matrix__.Resize(v.Size(), window); roll_res.matrix__.Fill(NaN); for(ulong i = 0; i < v.Size(); i++) { for(ulong j = 0; j < window; j++) { // Calculate the index in the vector for the Rolling window ulong index = i - (window - 1) + j; if(index >= 0 && index < v.Size()) roll_res.matrix__[i][j] = v[index]; } } return roll_res; } //+------------------------------------------------------------------+ //| | //+------------------------------------------------------------------+ rolling_struct CDataFrame::Rolling(const string index, const uint window) { vector v = GetColumn(index); return Rolling(v, window); }

We can now use this function to calculate the mean of a window and many more mathematical functions as it pleases us.

void OnStart() { //--- CDataFrame df; df.ReadCSV("EURUSD.PERIOD_D1.csv"); vector close_sma_5 = df.Rolling("Close", 5).Mean(); df.Insert("Close sma_5", close_sma_5); df.Head(10); }

Outputs.

RP 0 20:15:23.126 pandas test (EURUSD,H1) | Open | High | Low | Close | Close sma_5 | KP 0 20:15:23.126 pandas test (EURUSD,H1) | 1.09381000 | 1.09548000 | 1.09003000 | 1.09373000 | nan | QP 0 20:15:23.126 pandas test (EURUSD,H1) | 1.09678000 | 1.09810000 | 1.09361000 | 1.09399000 | nan | HP 0 20:15:23.126 pandas test (EURUSD,H1) | 1.09701000 | 1.09973000 | 1.09606000 | 1.09805000 | nan | GO 0 20:15:23.126 pandas test (EURUSD,H1) | 1.09639000 | 1.09869000 | 1.09542000 | 1.09742000 | nan | RR 0 20:15:23.126 pandas test (EURUSD,H1) | 1.10302000 | 1.10396000 | 1.09513000 | 1.09757000 | 1.09615200 | CR 0 20:15:23.126 pandas test (EURUSD,H1) | 1.10431000 | 1.10495000 | 1.10084000 | 1.10297000 | 1.09800000 | NS 0 20:15:23.126 pandas test (EURUSD,H1) | 1.10616000 | 1.10828000 | 1.10326000 | 1.10453000 | 1.10010800 | JS 0 20:15:23.126 pandas test (EURUSD,H1) | 1.11262000 | 1.11442000 | 1.10459000 | 1.10678000 | 1.10185400 | EP 0 20:15:23.126 pandas test (EURUSD,H1) | 1.11529000 | 1.12088000 | 1.11139000 | 1.11350000 | 1.10507000 | EP 0 20:15:23.126 pandas test (EURUSD,H1) | 1.11765000 | 1.12029000 | 1.11249000 | 1.11594000 | 1.10874400 | RO 0 20:15:23.126 pandas test (EURUSD,H1) (1000x5)

You can do much more with the rolling structure and add more formulas for all the maths you want to apply to the rolling window, more mathematical functions for matrices and vectors can be found here.

As it stands I have implemented several functions that you can apply to the rolling matrix;

- Std() for calculating the standard deviation of data in a particular window.

- Var() for calculating the variance of the window.

- Skew() for calculating the skewness of all data in a particular window.

- Kurtosis() for calculating the kurtosis of all the data in a particular window.

- Median() for calculating the median of all the data in a particular window.

These are just a few useful functions mimicked from the Pandas library in Python, Now let's see how we can use this library to prepare data for machine learning.

We are going to collect the data in MQL5, export it into a CSV file that will be imported in a Python script, a trained model will be saved in ONNX format, the ONNX model will be imported and deployed in MQL5 with the same data collection, storing approach.

Collecting Data for Machine Learning

Let us collect around 20 variables and add them to a Dataframe class.

- Open, High, Low, and Close (OHLC) values.

CDataFrame df; int size = 10000; //We collect this amount of bars for training purposes vector open, high, low, close; open.CopyRates(Symbol(), PERIOD_D1, COPY_RATES_OPEN,1, size); high.CopyRates(Symbol(), PERIOD_D1, COPY_RATES_HIGH,1, size); low.CopyRates(Symbol(), PERIOD_D1, COPY_RATES_LOW,1, size); close.CopyRates(Symbol(), PERIOD_D1, COPY_RATES_CLOSE,1, size); df.Insert("open",open); df.Insert("high",high); df.Insert("low",low); df.Insert("close",close);

These features are essential as they help derive more features, they are simply the foundation of all the patterns we see on the market.

- Since the forex market is open for 5 days, let's add the Close values for the prior 5 days (lagged close values). This data can help AI models understand patterns over the course of time.

int lags = 5; for (int i=1; i<=lags; i++) { vector lag = df.Shift("close", i); df.Insert("close lag_"+string(i), lag); }

This now makes it to 9 variables total in the Dataframe.

- Daily percentage change on the closing price (for detecting the daily closing price changes).

vector pct_change = df.Pct_change("close"); df.Insert("close pct_change", pct_change);

- Since we are working on a daily timeframe, let's add the variance of the 5 days to capture the variability patterns within a rolling 5-day period.

vector var_5 = df.Rolling("close", 5).Var(); df.Insert("var close 5 days", var_5);

- We can add the differenced features to help capture the volatility and price movements between OHLC values.

df.Insert("open_close",open-close); df.Insert("high_low",high-low);

- We can add the average price, hoping it will help models capture the patterns within OHLC values themselves.

df.Insert("Avg price",(open+high+low+close)/4);

- Finally, we can add some indicators to the mix. I'm going to use the indicators data collection approach discussed in this article. Please don't hesitate to use any approach in collecting indicator data if this one doesn't suit you.

BB_res_struct bb = CTrendIndicators::BollingerBands(close,20,0,2.000000); //Calculating the bollinger band indicator df.Insert("bb_lower",bb.lower_band); //Inserting lower band values df.Insert("bb_middle",bb.middle_band); //Inserting the middle band values df.Insert("bb_upper",bb.upper_band); //Inserting the upper band values vector atr = COscillatorIndicators::ATR(high,low,close,14); //Calculating the ATR Indicator df.Insert("ATR 14",atr); //Inserting the ATR indicator values MACD_res_struct macd = COscillatorIndicators::MACD(close,12,26,9); //MACD indicator applied to the closing price df.Insert("macd histogram", macd.histogram); //Inserting the MAC historgram values df.Insert("macd main", macd.main); //Inserting the macd main line values df.Insert("macd signal", macd.signal); //Inserting the macd signal line values

We have 21 variables in total.

df.Head();

Outputs.

PG 0 11:32:21.371 pandas test (EURUSD,H1) | open | high | low | close | close lag_1 | close lag_2 | close lag_3 | close lag_4 | close lag_5 | close pct_change | var close 5 days | open_close | high_low | Avg price | bb_lower | bb_middle | bb_upper | ATR 14 | macd histogram | macd main | macd signal | DD 0 11:32:21.371 pandas test (EURUSD,H1) | 1.15620000 | 1.15660000 | 1.15030000 | 1.15080000 | nan | nan | nan | nan | nan | nan | nan | 0.00540000 | 0.00630000 | 1.15347500 | nan | nan | nan | nan | nan | nan | nan | JN 0 11:32:21.371 pandas test (EURUSD,H1) | 1.15100000 | 1.15130000 | 1.14220000 | 1.14280000 | 1.15080000 | nan | nan | nan | nan | -0.69516858 | nan | 0.00820000 | 0.00910000 | 1.14682500 | nan | nan | nan | nan | nan | nan | nan | ID 0 11:32:21.371 pandas test (EURUSD,H1) | 1.14300000 | 1.15360000 | 1.14230000 | 1.15110000 | 1.14280000 | 1.15080000 | nan | nan | nan | 0.72628631 | nan | -0.00810000 | 0.01130000 | 1.14750000 | nan | nan | nan | nan | nan | nan | nan | ES 0 11:32:21.371 pandas test (EURUSD,H1) | 1.15070000 | 1.15490000 | 1.14890000 | 1.15050000 | 1.15110000 | 1.14280000 | 1.15080000 | nan | nan | -0.05212406 | nan | 0.00020000 | 0.00600000 | 1.15125000 | nan | nan | nan | nan | nan | nan | nan | LJ 0 11:32:21.371 pandas test (EURUSD,H1) | 1.14820000 | 1.14900000 | 1.13560000 | 1.13870000 | 1.15050000 | 1.15110000 | 1.14280000 | 1.15080000 | nan | -1.02564103 | 0.00002596 | 0.00950000 | 0.01340000 | 1.14287500 | nan | nan | nan | nan | nan | nan | nan | HG 0 11:32:21.371 pandas test (EURUSD,H1) (10000x22)

Let us glance into the dataset for a second.

df.Info();

Outputs

FN 0 12:18:01.745 pandas test (EURUSD,H1) <class 'CDataFrame'> QE 0 12:18:01.745 pandas test (EURUSD,H1) RangeIndex: 10000 entries, 0 to 9999 NL 0 12:18:01.745 pandas test (EURUSD,H1) Data columns (total 21 columns): MR 0 12:18:01.745 pandas test (EURUSD,H1) # Column Non-Null Count Dtype DI 0 12:18:01.745 pandas test (EURUSD,H1) --- ------ -------------- ----- CO 0 12:18:01.745 pandas test (EURUSD,H1) 0 open 10000 non-null double GR 0 12:18:01.746 pandas test (EURUSD,H1) 1 high 10000 non-null double LK 0 12:18:01.746 pandas test (EURUSD,H1) 2 low 10000 non-null double JF 0 12:18:01.747 pandas test (EURUSD,H1) 3 close 10000 non-null double QS 0 12:18:01.748 pandas test (EURUSD,H1) 4 close lag_1 9999 non-null double JO 0 12:18:01.748 pandas test (EURUSD,H1) 5 close lag_2 9998 non-null double GH 0 12:18:01.748 pandas test (EURUSD,H1) 6 close lag_3 9997 non-null double KD 0 12:18:01.749 pandas test (EURUSD,H1) 7 close lag_4 9996 non-null double FP 0 12:18:01.749 pandas test (EURUSD,H1) 8 close lag_5 9995 non-null double EL 0 12:18:01.750 pandas test (EURUSD,H1) 9 close pct_change 9999 non-null double ME 0 12:18:01.750 pandas test (EURUSD,H1) 10 var close 5 days 9996 non-null double GI 0 12:18:01.751 pandas test (EURUSD,H1) 11 open_close 10000 non-null double ES 0 12:18:01.752 pandas test (EURUSD,H1) 12 high_low 10000 non-null double LF 0 12:18:01.752 pandas test (EURUSD,H1) 13 Avg price 10000 non-null double DI 0 12:18:01.752 pandas test (EURUSD,H1) 14 bb_lower 9981 non-null double FQ 0 12:18:01.753 pandas test (EURUSD,H1) 15 bb_middle 9981 non-null double NQ 0 12:18:01.753 pandas test (EURUSD,H1) 16 bb_upper 9981 non-null double QI 0 12:18:01.753 pandas test (EURUSD,H1) 17 ATR 14 9986 non-null double CF 0 12:18:01.753 pandas test (EURUSD,H1) 18 macd histogram 9975 non-null double DO 0 12:18:01.754 pandas test (EURUSD,H1) 19 macd main 9975 non-null double FR 0 12:18:01.754 pandas test (EURUSD,H1) 20 macd signal 9992 non-null double FF 0 12:18:01.754 pandas test (EURUSD,H1) memory usage: 1640.6 KB

Our data uses around 1.6 MB in memory, there are plenty of null (nan) values that we have to drop.

CDataFrame new_df = df.Dropnan(); new_df.Head();

Outputs

JO 0 12:18:01.762 pandas test (EURUSD,H1) CDataFrame::Dropnan completed. Rows dropped: 25/10000 JR 0 12:18:01.766 pandas test (EURUSD,H1) | open | high | low | close | close lag_1 | close lag_2 | close lag_3 | close lag_4 | close lag_5 | close pct_change | var close 5 days | open_close | high_low | Avg price | bb_lower | bb_middle | bb_upper | ATR 14 | macd histogram | macd main | macd signal | FQ 0 12:18:01.766 pandas test (EURUSD,H1) | 1.23060000 | 1.23900000 | 1.20370000 | 1.21470000 | 1.23100000 | 1.23450000 | 1.21980000 | 1.22330000 | 1.22350000 | -1.32412673 | 0.00005234 | 0.01590000 | 0.03530000 | 1.22200000 | 1.16702297 | 1.20237000 | 1.23771703 | 0.01279286 | -1.19628486 | 0.02253736 | 1.21882222 | OJ 0 12:18:01.766 pandas test (EURUSD,H1) | 1.21540000 | 1.22120000 | 1.20930000 | 1.21130000 | 1.21470000 | 1.23100000 | 1.23450000 | 1.21980000 | 1.22330000 | -0.27990450 | 0.00008191 | 0.00410000 | 0.01190000 | 1.21430000 | 1.17236514 | 1.20446500 | 1.23656486 | 0.01265000 | -1.19925638 | 0.02076585 | 1.22002222 | IO 0 12:18:01.766 pandas test (EURUSD,H1) | 1.21040000 | 1.21390000 | 1.20730000 | 1.20930000 | 1.21130000 | 1.21470000 | 1.23100000 | 1.23450000 | 1.21980000 | -0.16511186 | 0.00010988 | 0.00110000 | 0.00660000 | 1.21022500 | 1.17774730 | 1.20631000 | 1.23487270 | 0.01253571 | -1.20115162 | 0.01898171 | 1.22013333 | QP 0 12:18:01.766 pandas test (EURUSD,H1) | 1.20840000 | 1.20840000 | 1.19490000 | 1.20340000 | 1.20930000 | 1.21130000 | 1.21470000 | 1.23100000 | 1.23450000 | -0.48788555 | 0.00008624 | 0.00500000 | 0.01350000 | 1.20377500 | 1.17941845 | 1.20699500 | 1.23457155 | 0.01292857 | -1.20208086 | 0.01689692 | 1.21897778 | DJ 0 12:18:01.766 pandas test (EURUSD,H1) | 1.21000000 | 1.21930000 | 1.20900000 | 1.21330000 | 1.20340000 | 1.20930000 | 1.21130000 | 1.21470000 | 1.23100000 | 0.82266910 | 0.00001558 | -0.00330000 | 0.01030000 | 1.21290000 | 1.18119695 | 1.20804500 | 1.23489305 | 0.01360714 | -1.20198373 | 0.01586072 | 1.21784444 | MS 0 12:18:01.766 pandas test (EURUSD,H1) (9975x21)

We can save this Dataframe into a CSV file.

string csv_name = Symbol()+".dailytf.data.csv"; new_df.ToCSV(csv_name, false, 8);

Training a Machine Learning Model

We start by importing the libraries we might need in a Python Jupyter Notebook.

File: main.ipynb

import pandas as pd import matplotlib.pyplot as plt import seaborn as sns from sklearn.linear_model import LinearRegression from sklearn.pipeline import Pipeline from sklearn.preprocessing import RobustScaler from sklearn.model_selection import train_test_split import skl2onnx from sklearn.metrics import r2_score sns.set_style("darkgrid")

We import the data and assign it to a Pandas Dataframe.

df = pd.read_csv("EURUSD.dailytf.data.csv")

Let's create the target variable.

df["future_close"] = df["close"].shift(-1) # Shift the close price by one to get df = df.dropna() # drop nan values caused by the shift operation

Now that we have the target variable for a regression problem, let us split the data into training and testing samples.

X = df.drop(columns=[ "future_close" # drop the target veriable from the independent variables matrix ]) y = df["future_close"] # Train test split X_train, X_test, y_train, y_test = train_test_split(X, y, shuffle=False)

We set the shuffle value to false so that we can work this as a time series problem.

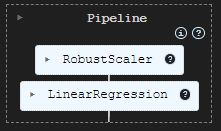

We then wrap a Linear Regression model in a Pipeline and train it.

pipe_model = Pipeline([ ("scaler", RobustScaler()), ("LR", LinearRegression()) ]) pipe_model.fit(X_train, y_train) # Training a Linear regression model

Outputs

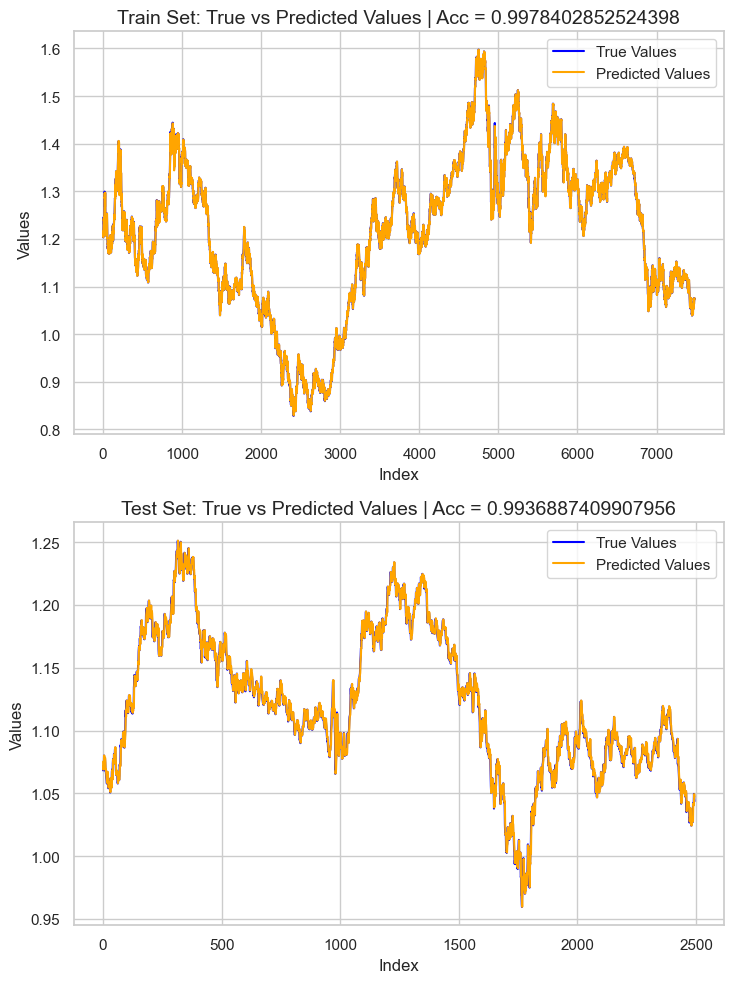

To evaluate the model we have, I decided to predict the target based on the training and testing data, added this information into a Pandas Dataframe, and then plotted the outcome using Seaborn and Matplotlib.

# Preparing the data for plotting train_pred = pipe_model.predict(X_train) test_pred = pipe_model.predict(X_test) train_data = pd.DataFrame({ 'Index': range(len(y_train)), 'True Values': y_train, 'Predicted Values': train_pred, 'Set': 'Train' }) test_data = pd.DataFrame({ 'Index': range(len(y_test)), 'True Values': y_test, 'Predicted Values': test_pred, 'Set': 'Test' }) # figure size 750x1000 pixels fig, axes = plt.subplots(2, 1, figsize=(7.5, 10), sharex=False) # Plot Train Data sns.lineplot(ax=axes[0], data=train_data, x='Index', y='True Values', label='True Values', color='blue') sns.lineplot(ax=axes[0], data=train_data, x='Index', y='Predicted Values', label='Predicted Values', color='orange') axes[0].set_title(f'Train Set: True vs Predicted Values | Acc = {r2_score(y_train, train_pred)}', fontsize=14) axes[0].set_ylabel('Values', fontsize=12) axes[0].legend() # Plot Test Data sns.lineplot(ax=axes[1], data=test_data, x='Index', y='True Values', label='True Values', color='blue') sns.lineplot(ax=axes[1], data=test_data, x='Index', y='Predicted Values', label='Predicted Values', color='orange') axes[1].set_title(f'Test Set: True vs Predicted Values | Acc = {r2_score(y_test, test_pred)}', fontsize=14) axes[1].set_xlabel('Index', fontsize=12) axes[1].set_ylabel('Values', fontsize=12) axes[1].legend() # Final adjustments plt.tight_layout() plt.show()

Outputs

The result is an overfit model with approximately 0.99 r2 score. This is not a good sign of the well-being of the model. Let's inspect the feature importance to observe which features were affecting the model in a positively, those with a bad influence on the model will be removed when detected.

# Extract the linear regression model from the pipeline lr_model = pipe_model.named_steps['LR'] # Get feature importance (coefficients) feature_importance = pd.Series(lr_model.coef_, index=X_train.columns) # Sort feature importance feature_importance = feature_importance.sort_values(ascending=False) print(feature_importance)

Outputs

macd main 266.706747 close 0.093652 open 0.093435 Avg price 0.042505 close lag_1 0.006972 close lag_3 0.003645 bb_upper 0.001423 close lag_5 0.001415 bb_middle 0.000766 high_low 0.000201 bb_lower 0.000087 var close 5 days -0.000179 ATR 14 -0.000185 close pct_change -0.001046 close lag_4 -0.002636 close lag_2 -0.003881 open_close -0.004705 high -0.008575 low -0.008663 macd histogram -5504.010453 macd signal -5518.035201 dtype: float64

The most informative feature was the macd main, while the macd histogram and macd signal were the least informative variables to the model. Let us drop all the values with negative feature importance, re-train the model then observe the accuracy again.

X = df.drop(columns=[ "future_close", # drop the target veriable from the independent variables matrix "var close 5 days", "ATR 14", "close pct_change", "close lag_4", "close lag_2", "open_close", "high", "low", "macd histogram", "macd signal" ])

pipe_model = Pipeline([ ("scaler", MinMaxScaler()), ("LR", LinearRegression()) ]) pipe_model.fit(X_train, y_train)

The accuracy of the re-trained model was very similar to the prior model, The model was still an overfit one. That's fine for now, let's proceed to export the model into ONNX format.

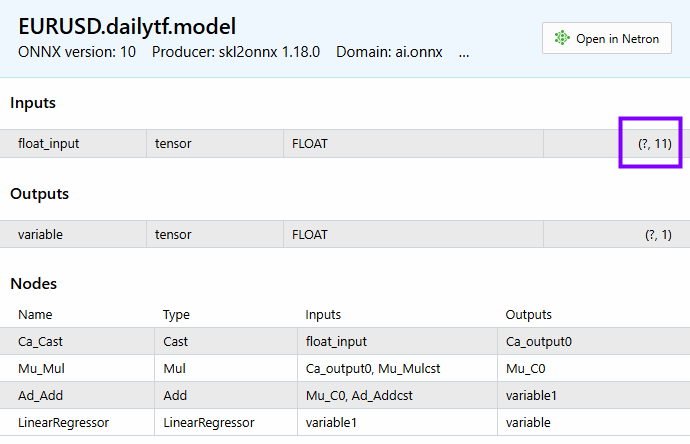

Deploying a Machine Learning Model in MQL5

Inside our Expert Advisor (EA), we start by adding the model as a resource so that it can be compiled with the program.

File: LR model Test.mq5

#resource "\\Files\\EURUSD.dailytf.model.onnx" as uchar lr_onnx[]

We import all the necessary libraries, The Pandas library, ta-lib (for indicators), and Linear Regression (for loading the model).

#include <Linear Regression.mqh> #include <MALE5\pandas.mqh> #include <ta-lib.mqh> CLinearRegression lr;

We initialize the linear regression model in the OnInit function.

int OnInit() { //--- if (!lr.Init(lr_onnx)) return INIT_FAILED; //--- return(INIT_SUCCEEDED); }

The good thing about using this custom Pandas library we have is that, you don't have to start writing code from scratch to collect the data again, we just have to copy the code we used and paste it into the main expert advisor and make tiny modifications to it.

void OnTick() { //--- CDataFrame df; int size = 10000; //We collect this amount of bars for training purposes vector open, high, low, close; open.CopyRates(Symbol(), PERIOD_D1, COPY_RATES_OPEN,1, size); high.CopyRates(Symbol(), PERIOD_D1, COPY_RATES_HIGH,1, size); low.CopyRates(Symbol(), PERIOD_D1, COPY_RATES_LOW,1, size); close.CopyRates(Symbol(), PERIOD_D1, COPY_RATES_CLOSE,1, size); df.Insert("open",open); df.Insert("high",high); df.Insert("low",low); df.Insert("close",close); int lags = 5; for (int i=1; i<=lags; i++) { vector lag = df.Shift("close", i); df.Insert("close lag_"+string(i), lag); } vector pct_change = df.Pct_change("close"); df.Insert("close pct_change", pct_change); vector var_5 = df.Rolling("close", 5).Var(); df.Insert("var close 5 days", var_5); df.Insert("open_close",open-close); df.Insert("high_low",high-low); df.Insert("Avg price",(open+high+low+close)/4); //--- BB_res_struct bb = CTrendIndicators::BollingerBands(close,20,0,2.000000); //Calculating the bollinger band indicator df.Insert("bb_lower",bb.lower_band); //Inserting lower band values df.Insert("bb_middle",bb.middle_band); //Inserting the middle band values df.Insert("bb_upper",bb.upper_band); //Inserting the upper band values vector atr = COscillatorIndicators::ATR(high,low,close,14); //Calculating the ATR Indicator df.Insert("ATR 14",atr); //Inserting the ATR indicator values MACD_res_struct macd = COscillatorIndicators::MACD(close,12,26,9); //MACD indicator applied to the closing price df.Insert("macd histogram", macd.histogram); //Inserting the MAC historgram values df.Insert("macd main", macd.main); //Inserting the macd main line values df.Insert("macd signal", macd.signal); //Inserting the macd signal line values df.Info(); CDataFrame new_df = df.Dropnan(); new_df.Head(); string csv_name = Symbol()+".dailytf.data.csv"; new_df.ToCSV(csv_name, false, 8); }

The modifications include;

Modifying the size of data we want. We no longer need 10000 bars, we just need about 30 bars because the MACD indicator has a period of 26, the Bollinger bands have a period of 20, and the ATR has a period of 14. By giving this a value of 30 we effectively leave some room for calculations.

The OnTick function can be very fluent and explosive sometimes, we don't need to redefine the variables every time a new tick is received.

We don't need to save the data into a CSV file we just need the last row of the Dataframe to be assigned into a vector for plugging into the model.

We can wrap these lines of code into a standalone function to make it easier to work with.

vector GetData(int start_bar=1, int size=30) { open_.CopyRates(Symbol(), PERIOD_D1, COPY_RATES_OPEN,start_bar, size); high_.CopyRates(Symbol(), PERIOD_D1, COPY_RATES_HIGH,start_bar, size); low_.CopyRates(Symbol(), PERIOD_D1, COPY_RATES_LOW,start_bar, size); close_.CopyRates(Symbol(), PERIOD_D1, COPY_RATES_CLOSE,start_bar, size); df_.Insert("open",open_); df_.Insert("high",high_); df_.Insert("low",low_); df_.Insert("close",close_); int lags = 5; vector lag = {}; for (int i=1; i<=lags; i++) { lag = df_.Shift("close", i); df_.Insert("close lag_"+string(i), lag); } pct_change = df_.Pct_change("close"); df_.Insert("close pct_change", pct_change); var_5 = df_.Rolling("close", 5).Var(); df_.Insert("var close 5 days", var_5); df_.Insert("open_close",open_-close_); df_.Insert("high_low",high_-low_); df_.Insert("Avg price",(open_+high_+low_+close_)/4); //--- BB_res_struct bb = CTrendIndicators::BollingerBands(close_,20,0,2.000000); //Calculating the bollinger band indicator df_.Insert("bb_lower",bb.lower_band); //Inserting lower band values df_.Insert("bb_middle",bb.middle_band); //Inserting the middle band values df_.Insert("bb_upper",bb.upper_band); //Inserting the upper band values atr = COscillatorIndicators::ATR(high_,low_,close_,14); //Calculating the ATR Indicator df_.Insert("ATR 14",atr); //Inserting the ATR indicator values MACD_res_struct macd = COscillatorIndicators::MACD(close_,12,26,9); //MACD indicator applied to the closing price df_.Insert("macd histogram", macd.histogram); //Inserting the MAC historgram values df_.Insert("macd main", macd.main); //Inserting the macd main line values df_.Insert("macd signal", macd.signal); //Inserting the macd signal line values CDataFrame new_df = df_.Dropnan(); //Drop NaN values return new_df.Loc(-1); //return the latest row }

This is how we initially collected data for training, some of the features present in this function did not make it to the final model due to various reasons, We had to drop them, similarly to how we dropped them inside the Python script.

vector GetData(int start_bar=1, int size=30) { open_.CopyRates(Symbol(), PERIOD_D1, COPY_RATES_OPEN,start_bar, size); high_.CopyRates(Symbol(), PERIOD_D1, COPY_RATES_HIGH,start_bar, size); low_.CopyRates(Symbol(), PERIOD_D1, COPY_RATES_LOW,start_bar, size); close_.CopyRates(Symbol(), PERIOD_D1, COPY_RATES_CLOSE,start_bar, size); df_.Insert("open",open_); df_.Insert("high",high_); df_.Insert("low",low_); df_.Insert("close",close_); int lags = 5; vector lag = {}; for (int i=1; i<=lags; i++) { lag = df_.Shift("close", i); df_.Insert("close lag_"+string(i), lag); } pct_change = df_.Pct_change("close"); df_.Insert("close pct_change", pct_change); var_5 = df_.Rolling("close", 5).Var(); df_.Insert("var close 5 days", var_5); df_.Insert("open_close",open_-close_); df_.Insert("high_low",high_-low_); df_.Insert("Avg price",(open_+high_+low_+close_)/4); //--- BB_res_struct bb = CTrendIndicators::BollingerBands(close_,20,0,2.000000); //Calculating the bollinger band indicator df_.Insert("bb_lower",bb.lower_band); //Inserting lower band values df_.Insert("bb_middle",bb.middle_band); //Inserting the middle band values df_.Insert("bb_upper",bb.upper_band); //Inserting the upper band values atr = COscillatorIndicators::ATR(high_,low_,close_,14); //Calculating the ATR Indicator df_.Insert("ATR 14",atr); //Inserting the ATR indicator values MACD_res_struct macd = COscillatorIndicators::MACD(close_,12,26,9); //MACD indicator applied to the closing price df_.Insert("macd histogram", macd.histogram); //Inserting the MAC historgram values df_.Insert("macd main", macd.main); //Inserting the macd main line values df_.Insert("macd signal", macd.signal); //Inserting the macd signal line values df_ = df_.Drop( //"future_close", "var close 5 days,"+ "ATR 14,"+ "close pct_change,"+ "close lag_4,"+ "close lag_2,"+ "open_close,"+ "high,"+ "low,"+ "macd histogram,"+ "macd signal" ); CDataFrame new_df = df_.Dropnan(); return new_df.Loc(-1); //return the latest row }

Instead of dropping the columns like in the above function, It is wise to remove the code used to produce them in the first place, this could reduce unnecessary computations which may slow the program when there are a lot of features to calculate just so they can be dropped shortly.

We are going to stick with the Drop method for now.

After calling the Head() method to see what's on the Dataframe, below was the outcome:

PM 0 15:45:36.543 LR model Test (EURUSD,H1) CDataFrame::Dropnan completed. Rows dropped: 25/30 HI 0 15:45:36.543 LR model Test (EURUSD,H1) | open | close | close lag_1 | close lag_3 | close lag_5 | high_low | Avg price | bb_lower | bb_middle | bb_upper | macd main | GK 0 15:45:36.543 LR model Test (EURUSD,H1) | 1.04057000 | 1.04079000 | 1.04057000 | 1.02806000 | 1.03015000 | 0.00575000 | 1.04176750 | 1.02125891 | 1.03177350 | 1.04228809 | 0.00028705 | QI 0 15:45:36.543 LR model Test (EURUSD,H1) | 1.04079000 | 1.04159000 | 1.04079000 | 1.04211000 | 1.02696000 | 0.00661000 | 1.04084750 | 1.02081967 | 1.03210400 | 1.04338833 | 0.00085370 | PL 0 15:45:36.543 LR model Test (EURUSD,H1) | 1.04158000 | 1.04956000 | 1.04159000 | 1.04057000 | 1.02806000 | 0.01099000 | 1.04611250 | 1.01924805 | 1.03282750 | 1.04640695 | 0.00192371 | JR 0 15:45:36.543 LR model Test (EURUSD,H1) | 1.04795000 | 1.04675000 | 1.04956000 | 1.04079000 | 1.04211000 | 0.00204000 | 1.04743000 | 1.01927184 | 1.03382650 | 1.04838116 | 0.00251595 | CP 0 15:45:36.543 LR model Test (EURUSD,H1) | 1.04675000 | 1.04370000 | 1.04675000 | 1.04159000 | 1.04057000 | 0.01049000 | 1.04664500 | 1.01938012 | 1.03447300 | 1.04956588 | 0.00270798 | CH 0 15:45:36.543 LR model Test (EURUSD,H1) (5x11)

We have 11 features, The same number of features can be seen on the model.

Below is how we can get the final model's predictions.

void OnTick() { vector x = GetData(); Comment("Predicted close: ", lr.predict(x)); }

It is not smart to perform all the data collection and model calculations on every tick, we need to calculate them at the opening of a new bar on the chart.

void OnTick() { if (isNewBar()) { vector x = GetData(); Comment("Predicted close: ", lr.predict(x)); } }

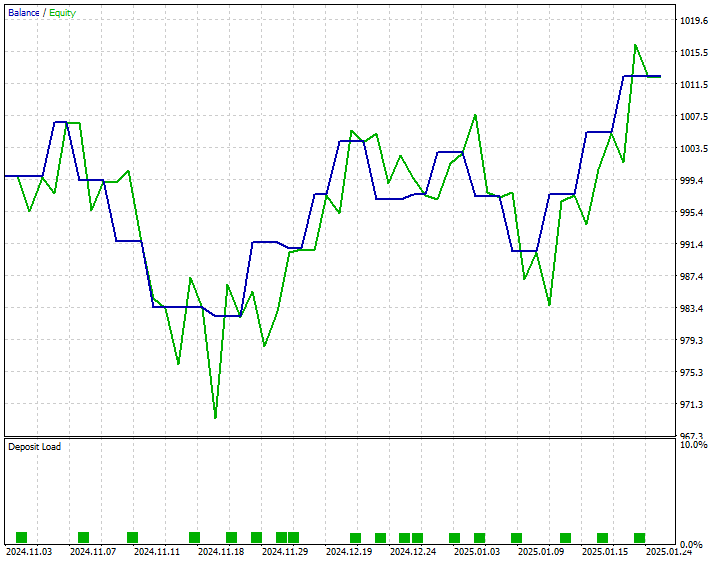

I developed a simple strategy to place a buy trade whenever the predicted closing price is above the current bid price and place a sell trade whenever the predicted closing price is below the current ask price.

Below is the strategy tester outcome from 01 November 2024 to January 25, 2025.

Conclusion

It is now easy to import sophisticated AI models into MQL5 and use them in MetaTrader 5 like nothing, It is still not easy to keep your model in sync with the data structure similar to the one used for training. In this article, I introduced a custom class named CDataframe to aid us when dealing with two-dimensional data in an environment that feels like the one in Pandas library which is very familiar to the machine learning community and data scientists coming from a Python background.

It is my hope the Pandas library in MQL5 will be of good use and make our lives much easier when dealing with complex AI data in MQL5.

Best regards.

Stay tuned and contribute to machine learning algorithms development for MQL5 language in this GitHub repository.

Attachments Table

| Filename | Description/Usage |

|---|---|

| Experts\LR model Test.mq5 | An Expert advisor for deploying the final linear regression model. |

| Include\Linear Regression.mqh | A library containing all the code for loading a Linear regression model in ONNX format. |

| Include\pandas.mqh | Consists all the custom Pandas methods for working with data in a Dataframe class. |

| Scripts\pandas test.mq5 | A script responsible for collecting the data for ML training purposes. |

| Python\main.ipynb | A jupyter notebook file with all the code for training a linear regression model used in this article. |

| Files\ | This folder consists of a linear regression model in ONNX models and CSV files for AI models training purposes. |

Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

This article was written by a user of the site and reflects their personal views. MetaQuotes Ltd is not responsible for the accuracy of the information presented, nor for any consequences resulting from the use of the solutions, strategies or recommendations described.

MQL5 Wizard Techniques you should know (Part 53): Market Facilitation Index

MQL5 Wizard Techniques you should know (Part 53): Market Facilitation Index

Price Action Analysis Toolkit Development (Part 10): External Flow (II) VWAP

Price Action Analysis Toolkit Development (Part 10): External Flow (II) VWAP

Generative Adversarial Networks (GANs) for Synthetic Data in Financial Modeling (Part 2): Creating Synthetic Symbol for Testing

Generative Adversarial Networks (GANs) for Synthetic Data in Financial Modeling (Part 2): Creating Synthetic Symbol for Testing

Developing a multi-currency Expert Advisor (Part 16): Impact of different quote histories on test results

Developing a multi-currency Expert Advisor (Part 16): Impact of different quote histories on test results

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use