Join our fan page

- Published by:

- MetaQuotes

- Views:

- 50867

- Rating:

- Published:

- Updated:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

Real author:

Sergey Bochkanov. ALGLIB project website - http://www.alglib.net/. The library dates back to 1999.

ALGLIB is one of the largest and most complete mathematical libraries

Do you need to make a fast Fourier transform or to solve a differential equation system? Do you perform a complex data analysis trying to gather all methods in one place as a source code? Then ALGLIB library of numerical methods is for you!

ALGLIB is currently one of the best libraries of the multi-language algorithms. Below are ALGLIB features mentioned on the official website:

ALGLIB is a cross-platform numerical analysis and data processing library. It supports several programming languages (C++, C#, Pascal, VBA) and several operating systems (Windows, Linux, Solaris). ALGLIB features include:

- Linear algebra (direct algorithms, EVD/SVD)

- Solvers (linear and nonlinear)

- Interpolation

- Optimization

- Fast Fourier transforms

- Numerical integration

- Linear and nonlinear least-squares fitting

- Ordinary differential equations

- Special functions

- Statistics (descriptive statistics, hypothesis testing)

- Data analysis (classification/regression, including neural networks)

- Multiple precision versions of linear algebra, interpolation optimization and others algorithms (using MPFR for floating point computations)

Why to choose ALGLIB? Because it is:

- portable. It can be compiled almost anywhere using almost any compiler (see compatibility matrix for more info).

- easy to use. It supports many programming languages. If you use one language, you don't need to study another (FORTRAN, for example) to compile and link an external library.

- open source. It can be used for free under GPL 2+.

- suited for commercial users too. Those who want to use ALGLIB in commercial applications can buy commercial license without copyleft requirement.

ALGLIB library is being constantly enhanced, new functions and improvements according to users' comments are implemented regularly. The latest version is 4.0.

Besides, the library contains the large collection of test cases covering the major part of the proposed methods' functionality. That will allow you to carry the tests and report detected errors to the project's authors.

CAlglib class static functions should be used to work with the library - all library functions are moved to CAlglib system class as static functions.

testclasses.mq5 and testinterfaces.mq5 test cases scripts are attached together with a simple usealglib.mq5 demo script. Include files of the same name (testclasses.mqh and testinterfaces.mqh) are used to launch test cases. They should be placed to \MQL5\Scripts\Alglib\Testcases\.

Note: testclasses.mq5 script execution takes quite a long time (about 8 minutes).

Below is more detailed information about ALGLIB MQL5 ported library packages:

| Packages | Description |

|---|---|

| alglib.mqh | The main library package includes custom functions. These functions should be called for working with the library. |

| alglibinternal.mqh | Additional classes for the operation of other library packages. |

| alglibmisc.mqh | The package contains the following classes:

|

| ap.mqh | The package also contains additional classes necessary for other packages. |

| bitconvert.mqh | С++ basic classes and functions that are absent in MQL5 as built-in:

|

| dataanalysis.mqh | Classes of data analysis:

|

| delegatefunctions.mqh | The package contains the classes created as replacement for the delegates. The objects of these classes are the functions optimized in several library methods. |

| diffequations.mqh | The class for solving ordinary differential equations:

|

| fasttransforms.mqh | Fast transformation classes:

|

| integration.mqh | Classes for numerical integration:

|

| interpolation.mqh | Interpolation, approximation and numerical differentiation classes:

|

| linalg.mqh | Classes for calculation of some linear algebra operations:

|

| matrix.mqh | Classes of matrices: integer, continuous and complex. |

| optimization.mqh | Dimensional and multidimensional optimization classes:

|

| solvers.mqh | Classes for solving linear and non-linear equation systems:

|

| specialfunctions.mqh | Classes of distribution functions, integrals and polynomials:

|

| statistics.mqh | Classes of statistical data analysis:

|

Code:

Library functions have detailed comments on their usage.

//+------------------------------------------------------------------+ //| Calculation of the distribution moments: mean, variance, | //| skewness, kurtosis. | //| INPUT PARAMETERS: | //| X - sample | //| N - N>=0, sample size: | //| * if given, only leading N elements of X are | //| processed | //| * if not given, automatically determined from | //| size of X | //| OUTPUT PARAMETERS | //| Mean - mean. | //| Variance- variance. | //| Skewness- skewness (if variance<>0; zero otherwise). | //| Kurtosis- kurtosis (if variance<>0; zero otherwise). | //+------------------------------------------------------------------+ static bool CBaseStat::SampleMoments(const double &cx[],const int n,double &mean, double &variance,double &skewness,double &kurtosis) { //--- check if(!CAp::Assert(n>=0,__FUNCTION__+": the error variable")) return(false); //--- check if(!CAp::Assert(CAp::Len(cx)>=n,__FUNCTION__+": length(x)<n")) return(false); //--- check if(!CAp::Assert(CApServ::IsFiniteVector(cx,n),__FUNCTION__+": x is not finite vector")) return(false); //--- create variables double v=0; double v1=0; double v2=0; double stddev=0; //--- Init, special case 'N=0' mean=0; variance=0; skewness=0; kurtosis=0; //--- check if(n<=0) return(true); //--- Mean for(int i=0;i<n;i++) mean+=cx[i]; mean/=n; //--- Variance (using corrected two-pass algorithm) if(n!=1) { //--- calculation for(int i=0;i<n;i++) v1+=CMath::Sqr(cx[i]-mean); for(int i=0;i<n;i++) v2+=cx[i]-mean; v2=CMath::Sqr(v2)/n; variance=(v1-v2)/(n-1); //--- calculation stddev=MathSqrt(variance); } else variance=EMPTY_VALUE; //--- Skewness and kurtosis if(stddev!=0) { //--- calculation for(int i=0;i<n;i++) { v=(cx[i]-mean)/stddev; v2=CMath::Sqr(v); skewness+=v2*v; kurtosis+=CMath::Sqr(v2); } //--- change values skewness=skewness/n; kurtosis=kurtosis/n-3; } //--- successful execution return(true); }

CAlglib class static functions should be used to work with the library. Below is usealglib.mq5 function script's source code for calculation of some statistical trading parameters:

//+------------------------------------------------------------------+ //| UseAlglib.mq5 | //| Copyright 2012, MetaQuotes Software Corp. | //| https://www.mql5.com | //+------------------------------------------------------------------+ #property copyright "Copyright 2012, MetaQuotes Software Corp." #property link "https://www.mql5.com" #property version "1.00" //+------------------------------------------------------------------+ //| Connecting the libraries | //+------------------------------------------------------------------+ #include <Math\Alglib\alglib.mqh> #include <Trade\DealInfo.mqh> #include <Arrays\ArrayDouble.mqh> //+------------------------------------------------------------------+ //| Script program start function | //+------------------------------------------------------------------+ void OnStart() { //--- object to access data on deals CDealInfo deal; //--- object for storing profit/loss of each deal CArrayDouble *profit=new CArrayDouble; //--- objects for storing the balance CArrayDouble *balance_total=new CArrayDouble; //--- initial balance double balance=0; //--- receive history HistorySelect(0,TimeCurrent()); //--- total amount of deals int deals_total=HistoryDealsTotal(); //--- receive data on deals' profit and balance for(int i=0;i<deals_total;i++) { //--- move to the deal having i index deal.SelectByIndex(i); //--- receive initial balance if(deal.DealType()==DEAL_TYPE_BALANCE) { if(NormalizeDouble(deal.Profit()+deal.Swap(),2)>=0.0) if(balance==0.0) balance=deal.Profit(); } //--- receive profit and balance if(deal.DealType()==DEAL_TYPE_BUY || deal.DealType()==DEAL_TYPE_SELL) if(deal.Entry()==DEAL_ENTRY_OUT || deal.Entry()==DEAL_ENTRY_INOUT) { profit.Add(NormalizeDouble(deal.Profit()+deal.Swap()+deal.Commission(),2)); balance_total.Add(balance); balance=balance+NormalizeDouble(deal.Profit()+deal.Swap()+deal.Commission(),2); } } balance_total.Add(balance_total.At(balance_total.Total()-1)+profit.At(balance_total.Total()-1)); //--- copy data on the balance to double type array double arr_balance[]; ArrayResize(arr_balance,balance_total.Total()); for(int i=0;i<balance_total.Total();i++) arr_balance[i]=balance_total.At(i); //--- copy data on profit to double type array double arr_profit[]; ArrayResize(arr_profit,profit.Total()); for(int i=0;i<profit.Total();i++) arr_profit[i]=profit.At(i); //--- linear regression //--- number of independent variables int nvars=1; //--- sample volume int npoints=balance_total.Total(); //--- create the matrix of parameters for the linear regression CMatrixDouble xy(npoints,nvars+1); for(int i=0;i<npoints;i++) { xy[i].Set(0,i); xy[i].Set(1,arr_balance[i]); } //--- variable for detecting calculations result (successful, unsuccessful) int info; //--- class objects necessary for storing data on calculations CLinearModelShell lm; CLRReportShell ar; //--- arrays for storing regression results double lr_coeff[]; double lr_values[]; ArrayResize(lr_values,npoints); //--- calculate linear regression ratios CAlglib::LRBuild(xy,npoints,nvars,info,lm,ar); //--- receive linear regression ratios CAlglib::LRUnpack(lm,lr_coeff,nvars); //--- receive recovered linear regression values for(int i=0;i<npoints;i++) lr_values[i]=lr_coeff[0]*i+lr_coeff[1]; //--- calculate Expected Payoff double exp_payoff,tmp1,tmp2,tmp3; CAlglib::SampleMoments(arr_profit,exp_payoff,tmp1,tmp2,tmp3); //--- calculate HPR array double HPR[]; ArrayResize(HPR,balance_total.Total()-1); for(int i=0;i<balance_total.Total()-1;i++) HPR[i]=balance_total.At(i+1)/balance_total.At(i); //--- calculate standard deviation and math expectation from HPR double AHPR,SD; CAlglib::SampleMoments(HPR,AHPR,SD,tmp2,tmp3); SD=MathSqrt(SD); //--- calculate LR Correlation double lr_corr=CAlglib::PearsonCorr2(arr_balance,lr_values); //--- receive LR Standard Error double lr_stand_err=0; for(int i=0;i<npoints;i++) { double delta=MathAbs(arr_balance[i]-lr_values[i]); lr_stand_err=lr_stand_err+delta*delta; } lr_stand_err=MathSqrt(lr_stand_err/(npoints-2)); //--- calculate Sharpe Ratio double sharpe_ratio=(AHPR-1)/SD; //--- print PrintFormat("-----------------------------------------------"); PrintFormat("Correlation function: y = %.2fx + %.2f",lr_coeff[0],lr_coeff[1]); //--- parameters PrintFormat("Expected Payoff = %.2f",exp_payoff); PrintFormat("AHPR = %.4f",AHPR); PrintFormat("Sharpe Ratio = %.2f",sharpe_ratio); PrintFormat("LR Correlation = %.2f",lr_corr); PrintFormat("LR Standard Error = %.2f",lr_stand_err); PrintFormat("-----------------------------------------------"); //--- delete objects delete profit; delete balance_total; } //+------------------------------------------------------------------+

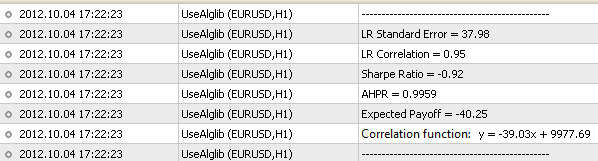

We receive the following result:

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/1146

Ask Bid Ticks

Ask Bid Ticks

Ask Bid Ticks is a high-precision, real-time tick data solution for microstructure analysis (a tick data collector). It works with local computer time.

Daily Range

Daily Range

This indicator calculates and shows daily highest and lowest prices, display them as two set of lines.

AML Adaptive Market Level

AML Adaptive Market Level

Adaptive Market Level shows the current reference level of the market price. The level is shifted only in case of the price trend movement.

BubblesAndDrops

BubblesAndDrops

The indicator shows possible price movement direction.