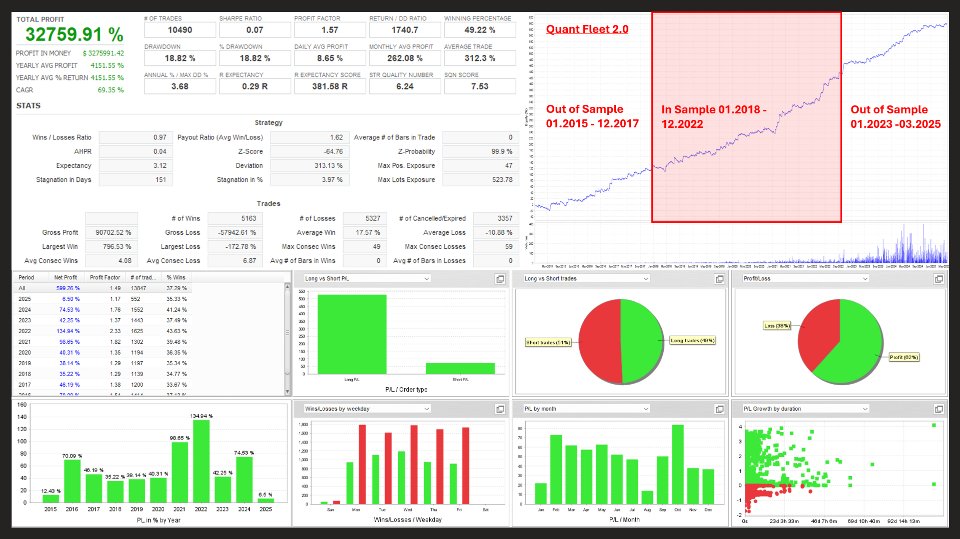

Quant Fleet MT5

Introducing: Quant Fleet MT5 2.0!

The Quant Fleet operates on the USDJPY using five independent strategies for a broad diversification. The difference to Quant Fleet MT5 1.0 is, that there are six sub-strategies supporting the performance.Launch Promo:

Documentation and presets: click here Signal: click here |

Key Features:

- Easy Installation: Ready in just a few steps—drag the EA onto the USDJPY chart and load the setfiles.

- Safe Risk Management: No martingale, grid, or other risky money management methods. Fixed risk per trade as percentage of balance.

- Stable Growth: Designed for long-term stability, suitable as additional EA in you portfolio.

- Prop Firm friendly: Low daily drawdown and historically low max drawdowns.

- Customizable Parameters: Flexible configuration for individual trading preferences.

The goal was, and still is, to develop a transparent trading algorithm without false promises. All the testing and optimization was done as close to real market environment as possible. To mitigate any threat to the balance, a lot of protection measures were taken: spread and slippage filters, as well as protection against short connection losses. — which happens fairly often in MetaTrader —

With factors like these, in combination with tick data and backtested slippage and spread, I can confidently say that the backtest results are very close to the real market environment.

The signal provided runs on Swissquote, a broker located in Switzerland. Swissquote is not the best broker when it comes to spread and slippage. I chose to run it on Swissquote anyway because I want to have a worst-case scenario as signal. If it runs there, it will run almost everywhere.

Important Notes:

- Remember to load the setfiles after installation.

- If you have any questions regarding the product, feel free to DM, use the group or comments-section.

Why this Expert Advisor?

With years of experience in algorithmic trading, this EA was developed to systematically and precisely capture trading opportunities. The parameters ensure a flexible behavior of the EA, making it a valuable tool for both private and professional traders. The risk management is up to date and prop firm friendly.

Another reason is the already implied diversification. All traded strategies are independent from each other. This ensures a less clustered risk.

About the Developer:

I have been active in the financial markets for 6 years, specializing in the development of Expert Advisors for 4 years. Last year I founded my own asset management company in Switzerland.

My focus is on stable, transparent, and secure trading strategies suitable for both private investors and institutional environments.

User didn't leave any comment to the rating