MA Distance Histogram

- Indicators

- Pablo Filipe Soares De Almeida

- Version: 1.0

- Activations: 10

MA Distance Histogram

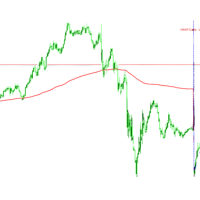

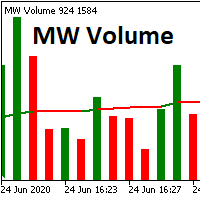

The MA Distance Histogram is an indicator that shows, in histogram form, the distance between the closing price (Close) and a Moving Average, allowing a clear visualization of buying and selling strength in the market.

Positive values (green bars) indicate that the price is above the moving average, representing buying pressure (bulls).

Negative values (red bars) indicate that the price is below the moving average, representing selling pressure (bears).

The indicator uses ATR (Average True Range) to normalize this distance, making the reading more accurate under different volatility conditions and on any asset or timeframe. In this way, strong and weak movements can be compared proportionally.

Advantages of using the Moving Average as a histogram

Facilitates the identification of trend strength.

Allows clear and objective visualization of the price distance from the moving average.

Helps detect possible overbought and oversold zones.

Shows momentum changes when the histogram crosses the zero level.

Works as both a trend and strength oscillator at the same time.

Additional features

Configuration of the Moving Average period and type (SMA, EMA, SMMA, LWMA).

Option to display ATR-based levels for visual reference.

Possibility to show or hide the zero level.

Compatible with any asset and timeframe.

Recommended for

Identifying trend and its strength.

Confirming entries together with price action or other indicators.

Analyzing moments of movement exhaustion.

Use in trend following and reversal strategies.