Abiroid Range Filtered Trend Signals

- Indicators

- Abir Pathak

- Version: 2.3

- Updated: 30 September 2025

- Activations: 20

Read detailed blogpost with screenshots here:

https://www.mql5.com/en/blogs/post/764306

Note: This is the MT4 only version.

Get the MT5 version here:

https://www.mql5.com/en/market/product/150789/

Features

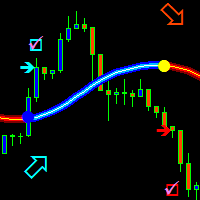

- Kalman smoothing to reduce market noise.

- Supertrend bands for trend direction.

- Color-coded dots and arrows for quick reading.

- Arrow signals for trend continuation.

- Custom Timeframe for drawing bands

- Alerts for trend changes.

- Adjustable inputs for different styles.

How to Use

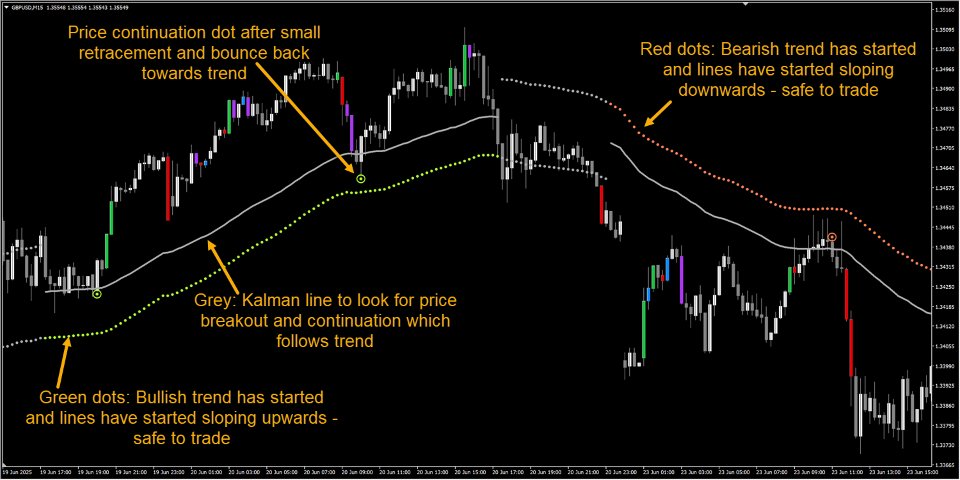

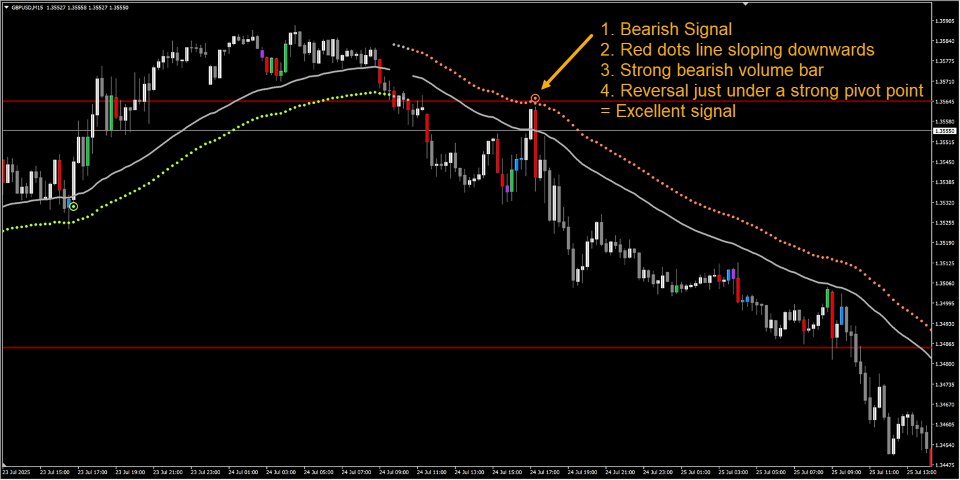

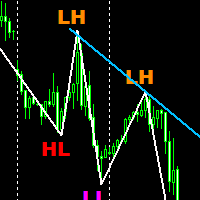

Green dots = bullish bias. Red dots = bearish bias. Gray dots = ranging (do not trade).For Bullish, make sure that the dots are in a slight upwards slope to confirm up trend and for Bearish dots should be slightly sloping downwards

Note that after trend slope has started, when a retracement happens back to center gray Kalman line, it will flatten a little. That's expected. But overall channel should have already started a slope after trend change.

Do not trade signals, when the lines are flat like this:

This indicates a ranging market. This indicator works best during a trending market.

Best timeframes:

- Scalping: M1–M15 (faster Kalman, shorter ATR).

- Day trading: M15–H1 (default settings work well).

- Swing: H4–D1 (smoother Kalman - higher kalman alpha like 0.05, higher ATR factor).

Market type:Trending pairs depending on market timings: EUR/USD, GBP/USD, AUD/USD.

Avoid very thin/low-liquidity pairs during off-hours.

Quick tip: Check higher timeframe trend first (e.g., H4) then use M15 for entries.

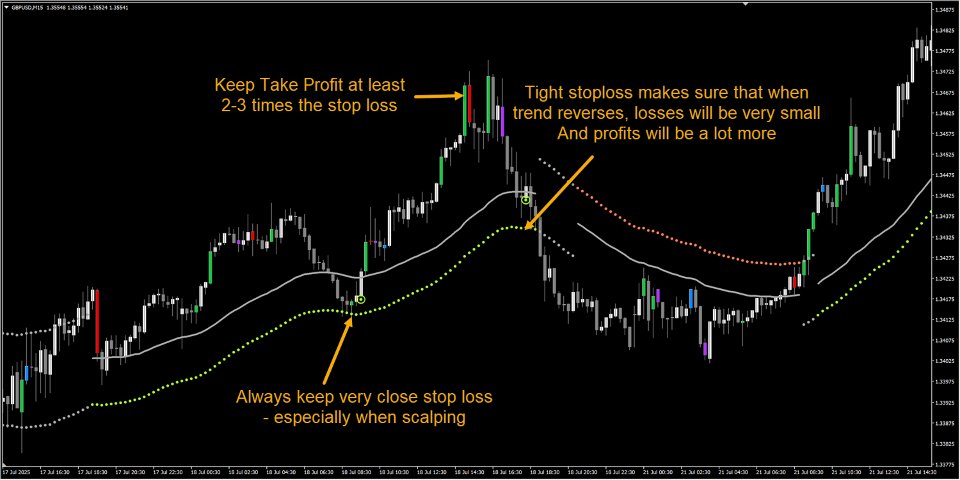

Stops:

If you get a signal when a trend is ending and price is about reverse, it will hit your stop loss despite a good trend slope:

So, keep very close stop loss, just under the green dotted line, or above the red dotted line. And keep Take Profit at least 2-3 times the SL.

If you are quick scalping, the ratio can be 1:1. But still higher TP is recommended.

If you get a signal where price looks like it's already gone too far. So might not get the 1:3 SL:TP ratio, avoid such signals:

So be careful around those.

All Settings Explained

Kalman settings

Kalman Alpha: responsiveness. Lower = smoother. Higher = more reactive.

Kalman Beta: adapts to volatility. Increase in choppy markets.

Kalman Period: lookback for filter. Longer = smoother.

Deviation: multiplier for trend bands from Kalman line. Higher = wider distance.

Supertrend settings

Supertrend Factor: controls band width. Bigger = fewer signals.

ATR Period: sensitivity of ATR. Lower = quicker changes.

Visual & alerts

Neutral/Bull/Bear colors: change for visibility.

Show Arrows: toggle buy/sell arrows.

Alerts: enable trend or arrow alerts.

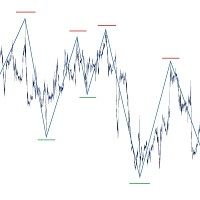

Trades to Avoid

- Tight sideways ranges with many gray dots.

- Flat slope even though red/green dots are there

- Trading right after major news spikes.

- Low-volume times (weekends, off-session).

- Going against the trend on higher timeframes (be careful)

Conclusion

Use the indicator to spot trend vs range and to time entries with confluence (volume, SR, pivots). Start with defaults. Test on demo. Adjust Kalman and Supertrend to match your timeframe and pair. Combine signals with volume and support/resistance for better results.

Cheat sheet:

Settings will really depend on your style of trading and the symbol/timeframe you are trading with.

But here is a quick cheat sheet of example settings which will be useful to you:

Scalping (fast)Timeframe: M1–M15

Kalman Alpha: 0.01

Kalman Beta: 0.08

Kalman Period: 50

Supertrend Factor: 0.6

ATR Period: 5

Deviation: 1.0

Use: quick entries, tight stops

Day Trading (balanced)

Timeframe: M15–H1

Kalman Alpha: 0.02 (default 0.01 ok)

Kalman Beta: 0.10

Kalman Period: 77

Supertrend Factor: 0.7

ATR Period: 7

Deviation: 1.2

Use: main preset for most pairs

Swing Trading (smooth)

Timeframe: H4–D1

Kalman Alpha: 0.05

Kalman Beta: 0.12

Kalman Period: 100

Supertrend Factor: 0.9

ATR Period: 10

Deviation: 1.5

Use: focus on trend strength, wider stops