Dear traders! For the first time in the history of trading, I have managed to prove 100% theoretically one of Dow's 6 axioms, namely his first and main axiom"The market takes into account everything! and raise it from the rank of an axiom to the rank of a theorem, i.e. a proven axiom.

Within this topic I will try to prove the other 5 axioms of the Doe. I need your moral support in this matter.

why do you need all this? there will be no money anyway, and all his postulates will work regardless of whether they are proven by anyone or not, better go back to the original source of everything, the extraction of material values

Why do you need all this? There will be no money anyway, and all his postulates will work regardless of whether they are confirmed by anyone or not, better go back to the source of everything, the extraction of material values

To me moral values are more important than material values. Showed the greatness of Dow and his assistant William Hamilton, uncovered by me, way back in 2011https://www.mql5.com/ru/articles/250 Note, the new list of 14 trading laws includes only the Dow's axiom, even the word "flat" and the combination of words or the concept "Market stands" from the lexicon of traders were excluded by the Law № 4! You cannot live on axioms for long, you must either turn them into theorems or point out their fallacy, Sergey!

- www.mql5.com

Take the higher. The man wants to get into the story. I believe and have believed that there is an algorithm in price movements, and everything else is just a pretty wrapper for candy.

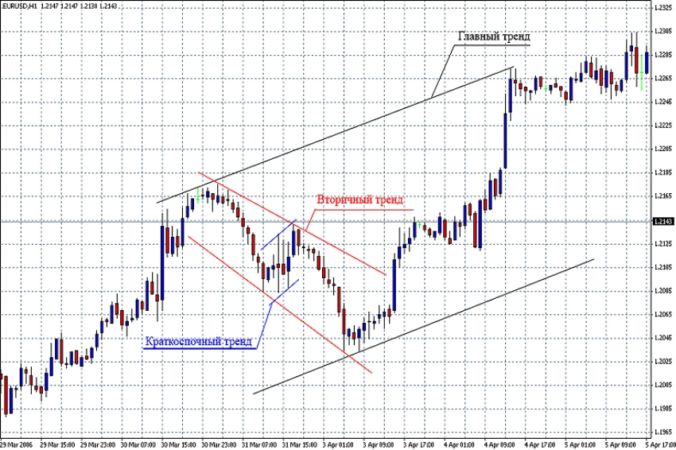

3 trends and 3 trend phases

The second and third postulate of Dow theory is related to market trends.

The market includes three types of trend. There is a concept of market trend in the method. The authors explain the concept as follows: a trend line is a price movement in which each new high is higher than the previous high or a new low will have a location lower than the previous lowhttps://news-hunter.pro/forex/aksiomy-tehnicheskogo-analiza-teoriya-dou-i-klyuchevye-postulaty-rynka.pro.

- 2018.05.27

- Olga R

- news-hunter.pro

To me, moral values are more important than material ones. Showed the greatness of Doe and his assistant William Hamilton, uncovered by me, way back in 2011https://www.mql5.com/ru/articles/250.

As far as I'm concerned, moral values are generally not inferior to material values. But what I see in the first post is a real tin can... =((

The link shows verbiage, lack of substance, general phrases, obvious statements, lack of coherence... This is usually classified as pseudoscience

Give concrete arguments, no hot air! Which link did you see as a hollow argument?

For me, moral values are generally as good as material values. But what I see in the first post is a real tantrum... =((

Thanks for your support in such a difficult question that could not be solved for 2 centuries and could not be solved for another 2 thousand years if I had not interfered!

is there anyone who can give a precise definition to this? simple common words are not understood by man

Dow himself gave it: "The market takes into account everything!" and has actually used this statement in trading. It couldn't be simpler, nor can it be expressed!

Where it all started

The principle itself appeared in the nineteenth century. As you may have seen earlier, the founder of the theory is Charles Dow - a journalist and researcher from America, and co-founder of the company called Dow Jones and Co. He is best known as the founder of the popular Dow Jones index. Even today, this index is one of the most important instruments with which the entire world economy deals.

What is surprising is that his principle for forex trading came into use after his death, and after some adaptations. The method was refined by people such as Hamilton, Nelson, Schaefer and others. Already after that, the method was called the Dow Theory, while during the creator's lifetime there was no such name.

A large part of his time was spent on the analysis of the American stock market. Using the data he received during the analysis as a base, he developed a basis for creating his method. Charles's goal was to find some mathematical regularities in the change of stock quotes. To do this, he took a long time to look at and analyze the charts reflecting the movement's quotes. All his analyses and observations are reflected in the modern Dow Theory.

Charles' followers have managed to take out of context and form six postulates according to which his approach functions. Let's talk about each statement separately.

The market takes everything into account.

This is the first and key postulate. This statement is still one of the most important rules of price formation in the market. It means that everything from technical reasons to players' psychology influences the price. The market environment takes into account all of the numerous factors and traders should always keep this in mind.

3 trends and 3 trend phases

The second and third postulate of Dow theory is related to market trends.

The market includes three types of trends. There is a concept of market trend in the method. The authors explain the concept as follows: a trend line is a price movement in which every new high is higher than the previous one or a new low will have a location lower than the previous low.

- A primary (long-term) trend is one that is formed over a long period of time (several years).

- A secondary (medium term) trend is a trend that develops over a few months.

- A small (short-term) trend is a trend that will form in a short time: a few weeks, days, or hours.

-

Each long-term trend can be divided into certain phases which have their own development stages. Like any cyclical system a trend has a kind of a starting point, a climax and a conclusion.

- The first phase is the accumulation. In this time period very few players are aware of the new trend. At this point they create transactions with a small volume compared to the market volume. During this period, the price is almost unchanged, the players can not act as a significant price driver.

- The second phase is participation. During this phase the trend begins to form. At this moment deals are opened in large quantities. This is done by market players as soon as they understand that a trend has formed. Opening a large number of transactions leads to an increase in the trend, which in turn affects the price, which begins to change rapidly.

- The third phase is the realization phase. This is the final part of the trend, which implies reaching a maximum or minimum price value. During this period, a large number of assets are sold and large price spikes are recorded. Investors who have a lot of experience in this period close their positions that were opened during the previous phases. They do so because they have an understanding of the oversold and overbought areas of the market. Usually, after that there is a pullback in the opposite direction.

Indices are obliged to agree.

The fourth postulate of the theory states that all stock market signals, indices must be confirmed. At the moment of making any decision, Forex traders take into account some signals. The signals give different indicators or show the dynamics of a particular market segment. These signals are also mentioned in Charles' theory. It says that these signals should be compared with each other, and that they can only be used when the changes in the indicators are not contradictory.

Trading volume supports the trend

According to Mr. Charles's fifth postulate, any trend should be supported by the trading volume. To be sure of the formation of a trend, you should compare the dynamics of trading volume in Forex and the price dynamics. A change in the same direction will tell the trader that this is a real trend. If the price changes and the trading volume does not change, we can conclude that we are witnessing an ordinary trend with unknown reasons. And this will not herald any change in the global trend.

Signal of a trend reversal

The sixth postulate of Dow says that no trend is complete until there is a reversal signal. This postulate is considered to be the most accurate of all the statements described in Senor Charles' approach. However, few people know how to use it correctly. In the technical analysis by this method, you should not make deals against the current trend and try to predict the moment of its reversal. Such transactions do not promise anything good. The market will signal to you itself about the reversal, you just have to watch it carefully. It is better to lose only a part of your profit in the beginning of trading, than to incur continuous losses due to ignorance and baseless trades. Stick to the Dow method and open trades in the current trend, not against it. You should always do this, even if you see prices changing in a different direction. Such moments should be seen as a correction, not a trend change.

- www.mql5.com

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Dear traders! For the first time in the history of trading, I managed to prove 100% theoretically one of the 6 axioms of Dow, namely his first and main axiom"The market takes into account everything" and raise it from the rank of an axiom to the rank of a theorem, i.e. a proven axiom, which gives a huge honor to our forum and this news will fly around the world in an instant. Currency quotes and all that, may change from that, now traders will be more confident in using this powerful TA method not on the level of an axiom, but on the level of a theorem or on legal grounds within the limits of laws #7 and #14 in the list of trading lawshttps://www.mql5.com/ru/forum/358795/page12#comment_19949258! A new era in trading has begun, Gentlemen!

The market takes everything into account.

This is the first and key tenet. To this day, this statement is one of the most important rules of price formation on the market. It means that everything from technical reasons to players' psychology influences the price. The market environment takes into account many factors and traders should always keep this in mind.

Within this topic I will try to prove the other 5 axioms of the Dow. In this matter I need your moral support.