Candle Power Pro

- Indicators

- Thushara Dissanayake

- Version: 1.7

- Updated: 2 June 2025

- Activations: 5

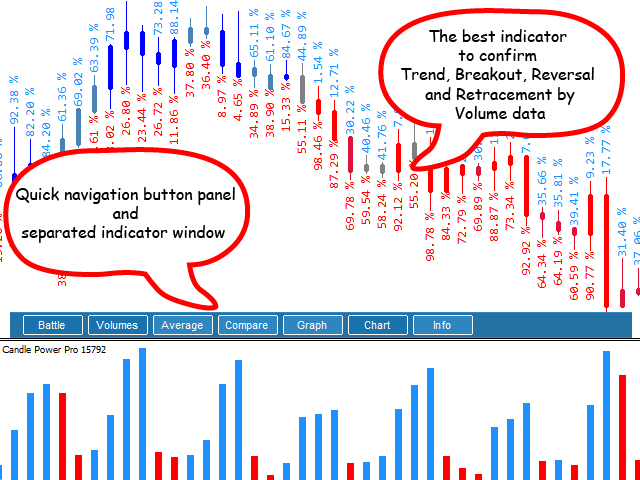

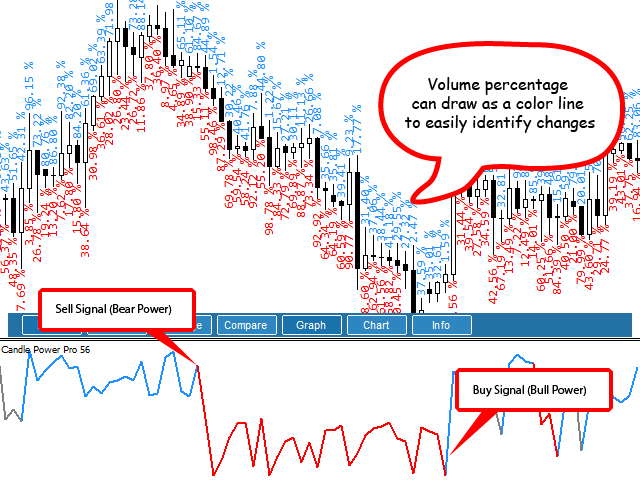

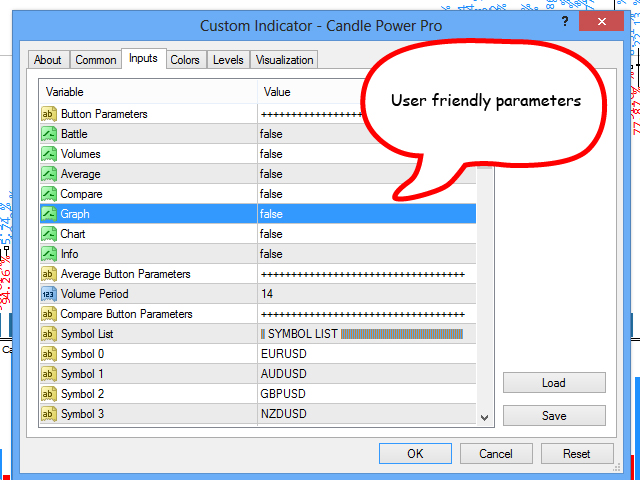

The Candle Power Pro is a sophisticated trading tool designed to decode real volume pressure, tick data imbalances, and institutional order flow dynamics by measuring the battle between bull ticks and bear ticks in real time. This indicator transforms raw volume data into actionable insights, helping traders identify Smart Money movements, liquidity hunts, and hidden market psychology behind each price candle. By analyzing buyer/seller volume percentages, divergence patterns, and volume based confirmations, it bridges the gap between price action and volume analysis, making it invaluable for traders following ICT, SMC, and institutional trading methodologies.

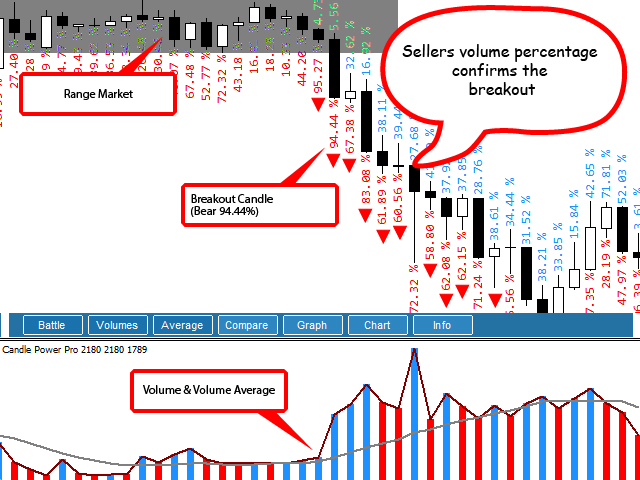

Unlike conventional volume indicators, Candle Power Pro focuses on tick data granularity, revealing whether each candle’s movement aligns with underlying bull/bear strength or signals potential market maker traps, reversals, or breakout continuations. It integrates seamlessly with session based strategies (London/New York Killzones), Fair Value Gaps (FVGs), and range breakouts, providing a holistic view of market liquidity and participant intent.

How It Works:

The indicator processes real time tick volume data, calculating the percentage of bullish vs. bearish transactions within each candle. This reveals:

-

Buyer/Seller Imbalances: High bull tick percentages on bearish candles warn of potential reversals or liquidity sweeps.

-

Volume - Price Divergences: Mismatches between candle direction and tick data expose institutional manipulation or exhaustion.

-

Trend Confirmation: When price and volume ticks align, it validates breakouts or trend continuations.

Traders can visualize these dynamics through:

-

Colored Candles: Customizable hues reflect bull/bear volume dominance (e.g., blue for strong bullish pressure, red for bearish).

-

Divergence Arrows: Highlights early reversal signals when tick data contradicts price.

-

Multi-Symbol Dashboard: Compares volume trends across 19 pairs to confirm relative strength or weakness.

Trading Strategy – Integrating Volume with Multiple Trading Approaches

This indicator enhances various trading methodologies by incorporating real volume tick data, helping traders confirm signals, avoid traps, and refine entries. Below are ways to integrate it with common strategies:

1. Price Action Trading

-

Breakout Confirmation: Validate breakouts when price exits a consolidation zone with aligned volume ticks (e.g., bullish breakout + >70% bull ticks).

-

False Breakout Filter: Avoid fakeouts when price breaks a level but volume ticks contradict (e.g., bearish breakout with high bull ticks).

-

Support/Resistance Strength: Gauge if key levels hold by checking volume absorption (high bear ticks at resistance = potential reversal).

2. Trend Following

-

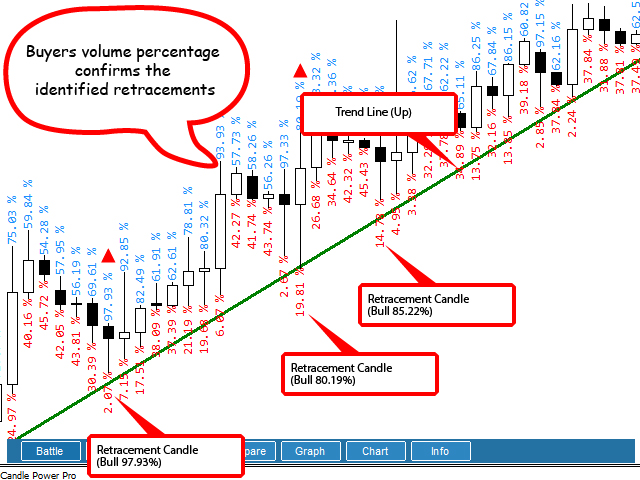

Trend Continuation: Stay in trades when price and volume ticks align (e.g., uptrend with consistent >60% bull ticks).

-

Trend Exhaustion: Watch for declining volume in trend direction, signaling weakening momentum.

-

Pullback Entries: Use volume spikes during retracements to confirm trend resumption.

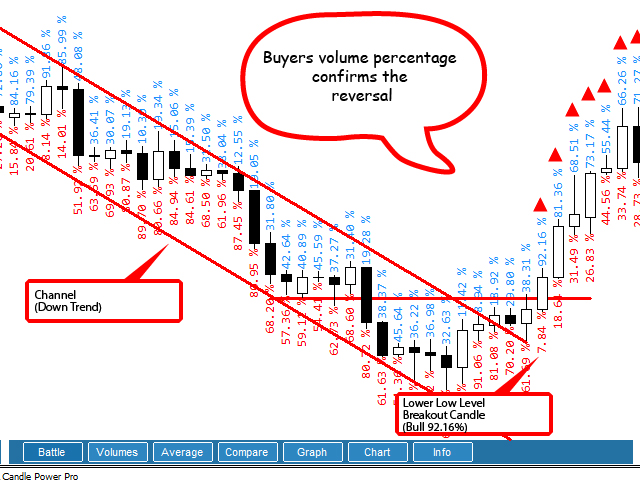

3. Reversal Trading (Mean Reversion)

-

Divergence Signals: Spot reversals when price makes higher highs but bull ticks decrease (bearish divergence).

-

Liquidity Grabs: Identify stop hunts near swing highs/lows with extreme bear/bull ticks before reversal.

-

Volume Climax: Look for spikes in opposing volume (e.g., strong bull ticks after a downtrend) as reversal clues.

4. Institutional (Smart Money) Strategies

-

Liquidity Pools: Detect institutional order blocks where high volume clusters form.

-

Fair Value Gaps (FVGs): Confirm FVG fills with volume drop-off, indicating completion.

-

Session Based Plays: Align with London/New York Killzones volume surges at opens validate breakouts.

5. Scalping & Intraday Trading

-

Micro Breakouts: Use 1-5 min charts with volume confirmation for quick momentum trades.

-

Liquidity Zones: Target high volume nodes for quick entries/exits.

-

News Events: Filter volatility spikes by checking if volume supports the price move.

Risk Management Across Strategies

-

Volume Based Stops: Exit if volume ticks oppose the trade direction (e.g., long trade with rising bear ticks).

-

Min Ratio Filter: Ignore weak signals by setting a threshold (e.g., only >75% bull ticks count).

-

Multi-Timeframe Checks: Confirm higher timeframe volume trends before entering.

This indicator adapts to any trading style, providing volume backed confirmation while keeping flexibility for discretionary traders. Whether you trade breakouts, reversals, or trends, real tick data helps separate noise from high probability setups.

Key Features

-

Real Volume Tick Analysis: Measures bull/bear transaction percentages per candle.

-

Multi-Symbol Comparison: Benchmarks volume trends across 19 Forex pairs or instruments.

-

Divergence Detection: Flags price volume mismatches for early reversal warnings.

-

Customizable Alerts: Mobile/popup notifications for volume spikes, divergences, or trend shifts.

Who Should Use This Indicator?

-

ICT/SMC Traders: Aligns with liquidity grabs, breaker blocks, and market structure shifts.

-

Volume Profile Analysts: Enhances order flow strategies with tick level data.

-

Breakout & Session Traders: Confirms London/New York volatility moves with volume backing.

-

Swing Traders: Identifies trend exhaustion or reversals via volume divergences.

Final Notes – A Professional Volume Analysis Tool

The Candle Power Pro does not guarantee profits but provides a data driven framework to interpret market maker behavior, liquidity pools, and volume based price action. By combining tick data analytics with Smart Money principles, it helps traders avoid fakeouts, spot institutional footprints, and refine entries/exits.

For optimal results, pair with price action analysis, session timing, and risk management rules. The indicator is compatible with MetaTrader 4 and designed for traders seeking depth beyond conventional volume indicators.

The best indicator I’ve found, and the only reason I still use MT4.