Technische Indikatoren für den MetaTrader 4

Gann Made Easy ist ein professionelles und einfach zu bedienendes Forex-Handelssystem, das auf den besten Handelsprinzipien unter Verwendung der Theorie von Mr. basiert. W.D. Gann. Der Indikator liefert genaue KAUF- und VERKAUFSsignale, einschließlich Stop-Loss- und Take-Profit-Levels. Mit PUSH-Benachrichtigungen können Sie auch unterwegs handeln. BITTE KONTAKTIEREN SIE MICH NACH DEM KAUF, UM KOSTENLOS HANDELSTIPPS, BONUSSE UND DEN GANN MADE EASY EA ASSISTANT ZU ERHALTEN! Wahrscheinlich haben Si

Ein exklusiver Indikator, der einen innovativen Algorithmus verwendet, um den Markttrend schnell und genau zu bestimmen. Der Indikator berechnet automatisch die Eröffnungs-, Schluss- und Gewinnniveaus und liefert detaillierte Handelsstatistiken. Mit diesen Funktionen können Sie das am besten geeignete Handelsinstrument für die aktuellen Marktbedingungen auswählen. Darüber hinaus können Sie ganz einfach Ihre eigenen Pfeilindikatoren in Scalper Inside Pro integrieren, um deren Statistiken und Rent

Game Changer ist ein revolutionärer Trendindikator, der für alle Finanzinstrumente geeignet ist und Ihren MetaTrader in einen leistungsstarken Trendanalysator verwandelt. Er funktioniert in jedem Zeitrahmen und unterstützt die Trendidentifizierung, signalisiert potenzielle Trendumkehrungen, dient als Trailing-Stop-Mechanismus und bietet Echtzeit-Benachrichtigungen für schnelle Marktreaktionen. Egal, ob Sie ein erfahrener Profi oder ein Einsteiger auf der Suche nach einem Wettbewerbsvorteil sind

Dieser Indikator ist eine hervorragende Kombination aus unseren 2 Produkten Advanced Currency IMPULSE with ALERT + Currency Strength Exotics .

Es funktioniert für alle Zeitrahmen und zeigt grafisch Impulse der Stärke oder Schwäche für die 8 wichtigsten Währungen plus ein Symbol!

Dieser Indikator ist darauf spezialisiert, die Beschleunigung der Währungsstärke für beliebige Symbole wie Gold, Exotische Paare, Rohstoffe, Indizes oder Futures anzuzeigen. Als erster seiner Art kann jedes Symbol

Miraculous Indicator – 100 % Nicht-Repaint Forex- und Binary-Tool basierend auf dem Gann-Quadrat der Neun Dieses Video stellt den Miraculous Indicator vor, ein hochpräzises und leistungsstarkes Trading-Tool, das speziell für Forex- und binäre Optionen-Trader entwickelt wurde. Was diesen Indikator einzigartig macht, ist seine Grundlage auf dem legendären Gann-Quadrat der Neun und Ganns Gesetz der Vibration , was ihn zu einem der präzisesten Prognose-Tools im modernen Trading macht. Der Miraculous

Der Indikator zeigt präzise die Umkehrpunkte und Kurserholungszonen an, in denen die Die wichtigsten Akteure . Sie erkennen, wo sich neue Trends herausbilden, und treffen Entscheidungen mit maximaler Präzision, wobei Sie die Kontrolle über jeden einzelnen Handel behalten. VERSION MT5 - Sein maximales Potenzial entfaltet es in Kombination mit dem TREND LINES PRO Indikator. Was der Indikator anzeigt:

Umkehrstrukturen und Umkehrebenen mit Aktivierung zu Beginn eines neuen Trends. A

M1 SNIPER ist ein benutzerfreundliches Handelsindikatorsystem. Es handelt sich um einen Pfeilindikator, der für den M1-Zeitrahmen entwickelt wurde. Der Indikator kann als eigenständiges System für Scalping im M1-Zeitrahmen oder als Teil Ihres bestehenden Handelssystems verwendet werden. Obwohl dieses Handelssystem speziell für den M1-Zeitrahmen entwickelt wurde, kann es auch für andere Zeitrahmen verwendet werden. Ursprünglich habe ich diese Methode für den Handel mit XAUUSD und BTCUSD entwickel

Dynamic Forex28 Navigator – Das Forex-Handelstool der nächsten Generation AKTUELL 49 % RABATT. Dynamic Forex28 Navigator ist die Weiterentwicklung unserer seit langem beliebten Indikatoren und vereint die Leistung von drei in einem: Advanced Currency Strength28 Indicator (695 Bewertungen) + Advanced Currency IMPULSE mit ALERT (520 Bewertungen) + CS28 Combo Signals (Bonus) Details zum Indikator https://www.mql5.com/en/blogs/post/758844

Was bietet der Strength Indicator der nächsten Generation?

Vorsichtsmaßnahmen für das Abonnieren des Indikators Dieser Indikator unterstützt nur die Computerversion von MT4 MT5, Mobiltelefone und Tablets werden nicht unterstützt. Der Indikator zeigt nur den Einstiegspfeil des Tages an. Der Pfeil der Vorgeschichte wird nicht angezeigt. (Die Live-Übertragung dient der Demonstration) Der Indikator ist eine Handelshilfe Es handelt sich nicht um einen EA für automatischen Handel Keine Copy-Trading-Funktion

Der Indikator zeigt nur die Einstiegsposition an Ke

Currency Strength Wizard ist ein sehr leistungsstarker Indikator, der Ihnen eine Komplettlösung für erfolgreichen Handel bietet. Der Indikator berechnet die Stärke dieses oder jenes Forex-Paares anhand der Daten aller Währungen in mehreren Zeitrahmen. Diese Daten werden in Form von benutzerfreundlichen Währungsindizes und Währungsstärkelinien dargestellt, anhand derer Sie die Stärke dieser oder jener Währung erkennen können. Sie müssen lediglich den Indikator an das Diagramm anhängen, mit dem Si

TREND LINES PRO Hilft dabei zu verstehen, wo der Markt tatsächlich die Richtung ändert. Der Indikator zeigt echte Trendumkehrungen und Punkte an, an denen wichtige Marktteilnehmer wieder einsteigen.

Sie sehen BOS-Linien Trendwechsel und wichtige Kursniveaus in höheren Zeitrahmen – ohne komplexe Einstellungen oder unnötiges Rauschen. Signale werden nicht neu gezeichnet und bleiben nach dem Schließen des Balkens im Chart sichtbar. VERSION MT 5 – Entfaltet ihr volles Potenzial in

Derzeit 40% Rabatt!

Die beste Lösung für jeden Neueinsteiger oder Expert Händler!

Dieses Dashboard arbeitet mit 28 Währungspaaren. Es basiert auf 2 unserer Hauptindikatoren (Advanced Currency Strength 28 und Advanced Currency Impulse). Es bietet einen hervorragenden Überblick über den gesamten Forex-Markt. Es zeigt die Werte der Advanced Currency Strength, die Veränderungsrate der Währungen und die Signale für 28 Devisenpaare in allen (9) Zeitrahmen. Stellen Sie sich vor, wie sich Ihr Handel

Volatility Trend System – ein Handelssystem, das Signale für Einstiege gibt. Das Volatilitätssystem liefert lineare und punktuelle Signale in Richtung des Trends sowie Signale zum Verlassen des Trends, ohne Neuzeichnung und Verzögerungen. Der Trendindikator überwacht die Richtung des mittelfristigen Trends, zeigt die Richtung und deren Änderung an. Der Signalindikator basiert auf Änderungen der Volatilität und zeigt Markteintritte an.

Der Indikator ist mit mehreren Arten von Warnungen ausgestat

Stärke von 8 Währungen plus EIN EXOTISCHES Paar oder Rohstoffe oder Indexe!

Jedes Produkt kann als 9. Linie hinzugefügt werden. Fügen Sie Rohstoffe, Indexes oder exotische Währungen hinzu (Gold, Silber, Öl, DAX, US30, MXN, TRY, CNH ...). Eine neue noch nie dagewesene TRADING STRATEGIE !!! Dieser Indikator ist einzigartig, weil wir eine Reihe von proprietäre Funktionen und neue Formeln eingebaut haben. Es funktioniert für alle Zeitrahmen. Basierend auf neuen zugrunde liegenden Algorithmen ist e

Gold Scalper Super ist ein einfach zu bedienendes Handelssystem. Der Indikator kann sowohl als eigenständiges Scalping-System auf dem M1-Zeitrahmen als auch als Teil Ihres bestehenden Handelssystems verwendet werden. Bonus: beim Kauf eines Indikators, Trend Arrow Super ist kostenlos zur Verfügung gestellt, schreiben Sie uns nach dem Kauf. Der Indikator 100% nicht neu malen!!! Wenn ein Signal erscheint, verschwindet es nicht! Im Gegensatz zu Indikatoren mit Redrawing, die zum Verlust einer Einla

# Smart Sweep Sniper MT4 Version ( Midnight Pro Edition , spezialisiert auf Scalping und Intraday Trading in Prop Firm, hier erhältlich ) ## The Institutional Edge - Erkennen Sie, wo intelligentes Geld agiert und steigen Sie ein, wenn es darauf ankommt If you like it, leave a positive review to support its development. If you encounter a bug, let us know before posting a review. When you complete your challenge, share your certificate in the comments. Happy trading! Smart Sweep Sniper ist ein p

Suchen Sie nach einem leistungsstarken und dennoch leichten Swing-Detektor, der Wendepunkte in der Marktstruktur genau identifiziert? Sie wollen klare, zuverlässige Kauf- und Verkaufssignale, die in jedem Zeitrahmen und für jedes Instrument funktionieren?

Buy Sell Arrow MT Swing ist genau dafür entwickelt worden - präzise Swing-Erkennung einfach und effektiv gemacht. Dieser Indikator identifiziert höhere Hochs (HH) , höhere Tiefs (HL) , niedrigere Hochs (LH) und niedrigere Tiefs (LL) mit bemerke

FX Volume: Erleben Sie den echten Marktüberblick aus der Sicht eines Brokers Kurzüberblick

Möchten Sie Ihre Handelsstrategie auf das nächste Level bringen? FX Volume liefert Ihnen Echtzeit-Einblicke in die Positionierung von Retail-Tradern und Brokern — lange bevor verzögerte Berichte wie der COT verfügbar sind. Ob Sie nach beständigen Gewinnen streben oder einfach einen tieferen Vorteil am Markt suchen, FX Volume hilft Ihnen, große Ungleichgewichte zu erkennen, Breakouts zu bestätigen und Ihr

Einzigartiger Gann-Indikator für XAUUSD

IQ Gold Gann Levels ist ein Präzisionsinstrument, das ausschließlich für den Intraday-Handel mit XAUUSD/Gold entwickelt wurde und nicht nachgemalt wird. Es verwendet die Quadratwurzelmethode von W.D. Gann, um Unterstützungs- und Widerstandsniveaus in Echtzeit darzustellen, und hilft Händlern, hochwahrscheinliche Einstiegsmöglichkeiten mit Vertrauen und Klarheit zu erkennen. William Delbert Gann (W.D. Gann) war ein außergewöhnlicher Marktanalyst, dessen Han

PRO Renko System ist ein hochpräzises Handelssystem, das speziell für den Handel mit RENKO-Charts entwickelt wurde.

Dies ist ein universelles System, das auf verschiedene Handelsinstrumente angewendet werden kann. Das System neutralisiert effektiv so genannte Marktgeräusche, die Ihnen Zugang zu genauen Umkehrsignalen geben.

Der Indikator ist sehr einfach zu bedienen und hat nur einen Parameter, der für die Signalerzeugung verantwortlich ist. Sie können das Tool einfach an jedes Handelsinstrum

Zunächst einmal ist es erwähnenswert, dass dieser Handelsindikator nicht neu malt, nicht neu zeichnet und keine Verzögerung aufweist, was ihn sowohl für manuellen als auch für Roboterhandel ideal macht. Benutzerhandbuch: Einstellungen, Eingaben und Strategie. Der Atom-Analyst ist ein PA-Preisaktionsindikator, der die Stärke und das Momentum des Preises nutzt, um einen besseren Vorteil auf dem Markt zu finden. Ausgestattet mit fortschrittlichen Filtern, die helfen, Rauschen und falsche Signale z

Der Indikator "MR BEAST LIQUIDITY ALERTS" ist ein fortschrittliches Tool, das auf der Grundlage einer Reihe von technischen Indikatoren und Trendanalysen Signale und Warnungen zur Marktliquidität liefert. Dieser Indikator ist ideal für Händler, die auf der Suche nach Handelsmöglichkeiten auf der Grundlage von Preisdynamik und Volatilitätsniveaus sind. Er bietet eine klare und detaillierte Anzeige im MetaTrader-Chartfenster. Hauptmerkmale: Adaptiver ATR-Kanal: Berechnet einen dynamischen Kanal au

Der Pips Stalker ist ein Long-Short-Pfeil-ähnlicher Indikator, der Trader aller Niveaus hilft, bessere Entscheidungen beim Markthandel zu treffen. Der Indikator übermalt nie neu und verwendet RSI als Hauptsignallogik; sobald ein Pfeil gegeben ist, wird er nie neu lackiert oder zurückgestrichen und die Pfeile sind nicht verzögert.

MERKMALE DES PIPS STALKER-PFEILS :

STATISTIK-PANEL ein einzigartiges Info-Dashboard, das die Gesamtgewinnquote und nützliche Statistiken wie maximale Siege und verlo

IQ FX Gann Levels ist ein Präzisionshandelsindikator, der auf den Quadratwurzelmethoden von W.D. Gann basiert. Er zeichnet Unterstützungs- und Widerstandsniveaus in Echtzeit, die nicht übermalt werden, um Händlern zu helfen, Intraday- und Scalping-Gelegenheiten mit hoher Genauigkeit zu erkennen . William Delbert Gann (W.D. Gann) war ein außergewöhnlicher Marktanalyst, dessen Handelstechnik auf einer komplexen Mischung aus Mathematik, Geometrie, Astrologie und antiker Mathematik basierte, die sic

FX Power: Analysieren Sie die Stärke von Währungen für intelligentere Handelsentscheidungen Übersicht

FX Power ist Ihr unverzichtbares Werkzeug, um die tatsächliche Stärke von Währungen und Gold unter allen Marktbedingungen zu verstehen. Indem Sie starke Währungen kaufen und schwache verkaufen, vereinfacht FX Power Ihre Handelsentscheidungen und deckt Chancen mit hoher Wahrscheinlichkeit auf. Ob Sie Trends folgen oder extreme Delta-Werte nutzen, um Umkehrungen zu prognostizieren, dieses Tool p

Betreten Sie die Welt des Devisenhandels mit Zuversicht, Klarheit und Präzision mit Gold Indicator , einem Tool der nächsten Generation, das Ihre Handelsleistung auf die nächste Stufe hebt. Ganz gleich, ob Sie ein erfahrener Profi sind oder gerade erst Ihre Reise auf den Devisenmärkten beginnen, Gold Indicator liefert Ihnen leistungsstarke Erkenntnisse und hilft Ihnen, intelligenter zu handeln, nicht härter. Der Gold Indicator basiert auf der bewährten Synergie dreier fortschrittlicher Indikato

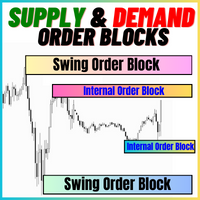

Derzeit 40% Rabatt! Die beste Lösung für jeden Anfänger oder erfahrenen Händler! Dieser Indikator ist ein einzigartiges, qualitativ hochwertiges und erschwingliches Trading-Tool, da wir eine Reihe von proprietären Funktionen und eine neue Formel integriert haben. Mit diesem Update werden Sie in der Lage sein, doppelte Zeitrahmenzonen anzuzeigen. Sie können nicht nur einen höheren TF (Zeitrahmen) anzeigen, sondern sowohl den Chart-TF als auch den höheren TF: SHOWING NESTED ZONES. Alle Supply Dema

Einführung Harmonische Muster eignen sich am besten zur Vorhersage potenzieller Wendepunkte. Traditionell wurden Harmonic Patterns manuell identifiziert, indem man Spitzen- und Tiefpunkte im Chart miteinander verband. Die manuelle Erkennung harmonischer Muster ist mühsam und nicht für jedermann geeignet. Bei der manuellen Erkennung von Mustern ist man oft subjektiven Einschätzungen ausgesetzt. Um diese Einschränkungen zu vermeiden, wurde Harmonic Pattern Plus entwickelt, um den Prozess der Erke

CRT Multi-Timeframe Market Structure & Liquidity Sweep Indicator

Nicht-überholende | Multi-Asset | MT5 Version verfügbar

MT5-Version: https: //www.mql5.com/en/market/product/162075 Vollständiges Benutzerhandbuch - erklärt, was jede Funktion tut und warum: https: //www.mql5.com/en/blogs/post/767525 Schnellstart-Benutzerhandbuch - erklärt, wie und in welcher Reihenfolge zu konfigurieren ist: https: //www.mql5.com/en/blogs/post/767540

Übersicht der Indikatoren

CRT Ghost Candle HTF Fractal ist ein

Trend Ai Indicator ist ein großartiges Tool, das die Marktanalyse eines Händlers verbessert, indem Trendidentifikation mit umsetzbaren Einstiegspunkten und Umkehrwarnungen kombiniert wird. Dieser Indikator ermöglicht es Benutzern, die Komplexität des Forex-Marktes mit Zuversicht und Präzision zu navigieren Über die primären Signale hinaus identifiziert der Trend Ai-Indikator sekundäre Einstiegspunkte, die bei Pullbacks oder Retracements auftreten, sodass Händler von Preiskorrekturen innerhalb d

Tool der Market Maker. Meravith wird: Alle Zeitrahmen analysieren und den aktuell gültigen Trend anzeigen.

Liquiditätszonen (Volumen-Gleichgewicht) hervorheben, in denen bullisches und bearisches Volumen gleich sind.

Alle Liquiditätsniveaus aus verschiedenen Zeitrahmen direkt im Chart anzeigen.

Eine textbasierte Marktanalyse generieren und zur Orientierung bereitstellen.

Ziele, Unterstützungsniveaus und Stop-Loss-Punkte basierend auf dem aktuellen Trend berechnen.

Das Risiko-/Chance-Verhältnis I

MT5-Version | FAQ Der Owl Smart Levels Indikator ist ein komplettes Handelssystem innerhalb eines Indikators, der so beliebte Marktanalysetools wie die fortschrittlichen Fraktale von Bill Williams , Valable ZigZag, das die richtige Wellenstruktur des Marktes aufbaut, und Fibonacci-Levels , die die genauen Einstiegslevels markieren, enthält in den Markt und Orte, um Gewinne mitzunehmen. Detaillierte Strategiebeschreibung Anleitung zur Verwendung des Indikators Berater-Assistent im

Apollo Secret Trend ist ein professioneller Trendindikator, der verwendet werden kann, um Trends für jedes Paar und jeden Zeitrahmen zu finden. Der Indikator kann leicht zu Ihrem primären Handelsindikator werden, mit dem Sie Markttrends erkennen können, unabhängig davon, welches Paar oder welchen Zeitrahmen Sie bevorzugen. Durch die Verwendung eines speziellen Parameters im Indikator können Sie die Signale an Ihren persönlichen Handelsstil anpassen. Der Indikator bietet alle Arten von Warnungen,

Apollo SR Master ist ein Support/Resistance-Indikator mit besonderen Funktionen, der das Trading mit Support/Resistance-Zonen einfacher und zuverlässiger macht. Der Indikator berechnet Support/Resistance-Zonen in Echtzeit ohne Verzögerung, indem er lokale Kurshochs und -tiefs erkennt. Um die neu entstandene Support/Resistance-Zone zu bestätigen, zeigt der Indikator ein spezielles Signal an, das signalisiert, dass die Zone als Kauf- oder Verkaufssignal verwendet werden kann. In diesem Fall erhöht

No Repaint Bext ist ein vollständiges Handelssystem. Es zeigt an, wann eine Position geöffnet oder geschlossen werden soll und in welche Richtung gehandelt werden muss. Jedes Mal, wenn ein grüner Pfeil erscheint, sollte eine Kaufposition eröffnet werden. Alle Kaufpositionen werden geschlossen, sobald ein roter Pfeil erscheint. Umgekehrt wird bei einem roten Pfeil eine Verkaufsposition eröffnet, die geschlossen wird, sobald ein grüner Pfeil erscheint. Der Handel erfolgt auf dem M5-Zeitrahmen und

Der Indikator „ Dynamic Scalper System “ ist für Scalping-Handel innerhalb von Trendwellen konzipiert.

Getestet an wichtigen Währungspaaren und Gold, Kompatibilität mit anderen Handelsinstrumenten ist gegeben.

Liefert Signale für die kurzfristige Eröffnung von Positionen entlang des Trends mit zusätzlicher Unterstützung von Kursbewegungen.

Das Prinzip des Indikators:

Große Pfeile bestimmen die Trendrichtung.

Ein Algorithmus zur Generierung von Scalping-Signalen in Form kleiner Pfeile arbeitet

- Real Preis ist 200$ - 50% Rabatt (Es ist 99$ jetzt) - Es ist für 3 Käufe aktiviert. Kontaktieren Sie mich für zusätzliche Bonus (Gann Trend Indikator ), Anleitung oder Fragen! - Nicht nachgemalt, keine Verzögerung - Ich verkaufe nur meine Produkte in Elif Kaya Profil, alle anderen Websites sind gestohlenen alten Versionen, also keine neuen Updates oder Unterstützung. - Lifetime Update kostenlos Gann Gold EA MT5 Einführung Die Theorien von W.D. Gann zur technischen Analyse faszinieren Trader s

DERZEIT 40% RABATT

Die beste Lösung für jeden Newbie oder Expert Trader!

Dieser Indikator ist ein einzigartiges, qualitativ hochwertiges und erschwingliches Trading-Tool, da wir eine Reihe von proprietären Funktionen und eine neue Formel integriert haben. Mit nur EINEM Chart können Sie die Währungsstärke für 28 Forex-Paare ablesen! Stellen Sie sich vor, wie sich Ihr Handel verbessern wird, weil Sie in der Lage sind, den genauen Auslösungspunkt eines neuen Trends oder einer Scalping-Gelegenhei

Der Market Structure Break Out (MSB) ist ein fortschrittliches Tool, das für MT4 und MT5 entwickelt wurde. Es hilft Tradern, Marktbewegungen als strukturierte Abfolgen zu betrachten und bietet durch Pfeile und Alarme zuverlässige Handelssignale – sowohl in Trendrichtung als auch in Gegenrichtung. Eine weitere wichtige Funktion dieses Produkts ist das Zeichnen von stabilen Angebots- und Nachfragezonen , die nicht verschwinden. Zudem ermöglicht die Live-Backtest-Funktion , die vergangene Performa

DERZEIT 40% RABATT!

Die beste Lösung für jeden Newbie oder Expert Trader!

Dieser Indikator ist ein einzigartiges, qualitativ hochwertiges und erschwingliches Handelsinstrument, da wir eine Reihe von proprietären Funktionen und eine geheime Formel eingebaut haben. Mit nur EINEM Chart liefert er Alerts für alle 28 Währungspaare. Stellen Sie sich vor, wie sich Ihr Handel verbessern wird, weil Sie in der Lage sind, den genauen Auslösepunkt eines neuen Trends oder einer Scalping-Gelegenheit zu erk

Sind Sie auf der Suche nach einem einfachen und zuverlässigen Indikator, der Ihnen helfen kann, Marktschwungpunkte leicht zu erkennen? Möchten Sie klare Kauf- und Verkaufssignale, die auf jedem Zeitrahmen und jedem Handelsinstrument funktionieren? Buy Sell Signal Pro wurde entwickelt, um genau das zu tun. Er hilft Händlern, wichtige Wendepunkte des Marktes zu erkennen und die aktuelle Marktstruktur auf klare und einfache Weise zu verstehen. Dieser Indikator erkennt höhere Hochs (HH), höhere Tie

Neuro Athena ist ein völlig neuer Weg, um präzise Ein- und Ausstiegssignale zu erhalten. Es verwendet die Fibonacci-Sequenz als Grundlage für die Berechnung seiner Levels. Mit Neuro Athena wissen Sie immer, wann Sie Ihre Trades öffnen und schließen müssen. Senden Sie mir eine Nachricht und erhalten Sie Neuro Athena Assistant als Geschenk, um Ihren Handelsprozess zu automatisieren! Warum sollten Sie Neuro Athena wählen? 1. Zuverlässiger Algorithmus. Die Fibonacci-Sequenz ist kein Marketing-Müll,

FREE

Trendindikator, bahnbrechende, einzigartige Lösung für Trendhandel und -filterung mit allen wichtigen Trendfunktionen in einem Tool! Es handelt sich um einen 100 % nicht neu zu malenden Multi-Timeframe- und Multi-Währungs-Indikator, der für alle Symbole/Instrumente verwendet werden kann: Forex, Rohstoffe, Kryptowährungen, Indizes und Aktien. ZEITLICH BEGRENZTES ANGEBOT: Der Support- und Resistance-Screener-Indikator ist für nur 50 $ und lebenslang verfügbar. (Ursprünglicher Preis 250 $) (Angebot

Super Signal – Skyblade Edition

Professionelles No-Repaint / No-Lag Trend-Signalsystem mit außergewöhnlicher Gewinnrate | Für MT4 / MT5 Es funktioniert am besten auf niedrigeren Zeitrahmen, wie 1 Minute, 5 Minuten und 15 Minuten.

Hauptmerkmale: Super Signal – Skyblade Edition ist ein intelligentes Signalsystem, das speziell für den Trendhandel entwickelt wurde.

Es nutzt eine mehrstufige Filterlogik, um ausschließlich starke, richtungsbestimmte Bewegungen mit echtem Momentum zu identifizieren.

Scalper Vault ist ein professionelles Scalping-System, das Ihnen alles bietet, was Sie für erfolgreiches Scalping benötigen. Dieser Indikator ist ein komplettes Handelssystem, das von Forex- und Binäroptionshändlern verwendet werden kann. Der empfohlene Zeitrahmen ist M5. Das System liefert Ihnen genaue Pfeilsignale in Richtung des Trends. Es liefert Ihnen auch Top- und Bottom-Signale und Gann-Marktniveaus. Die Indikatoren bieten alle Arten von Warnungen, einschließlich PUSH-Benachrichtigungen.

ANGEBOT ANGEBOT! Der Preis des Indikators ist auf 75 Dollar nur vom 20. Februar bis 28. Februar gehalten. Full Fledged EA und Alert plus für Alarme werden auch in diesem Angebot zusammen mit dem Kauf von Indikator zur Verfügung gestellt werden. Begrenzte Kopien nur zu diesem Preis und Ea zu. Holen Sie sich Ihre Kopie bald Alert plus für Indikator mit Set-Datei ist im Kommentarbereich mit dem Bild gehalten SMC Blast Signal mit FVG, BOS und Trendausbruch Das SMC Blast Signal ist ein präzises Hande

Produktname: GM Arrows Pro - Signale & Warnungen Kurze Beschreibung:

GM Arrows Pro ist ein sauberer, zuverlässiger MT4-Indikator, der KAUFEN/VERKAUFEN-Pfeile auf dem Chart anzeigt, mit einzigartigen Alarmen im Moment des Erscheinens des Signals. Vollständige Beschreibung:

GM Arrows Pro ist ein professioneller MT4-Indikator für Trader, die klare, umsetzbare Signale wünschen: BUY- und SELL-Pfeile, die auf dem gesamten Chartverlauf sichtbar sind Eindeutige Warnungen, wenn ein neues Signal erschei

- Real Preis ist 80$ - 40% Rabatt (Es ist 49$ jetzt) Kontaktieren Sie mich für Anleitung, Gruppe hinzufügen und alle Fragen! - Nicht neu malen - Ich verkaufe nur meine Produkte in Elif Kaya Profil, alle anderen Websites sind gestohlenen alten Versionen, also keine neuen Updates oder Unterstützung. - Lifetime Update kostenlos Verwandtes Produkt: Bitcoin Expert

Einführung Die Breakout- und Retest-Strategie wird an Unterstützungs- und Widerstandsniveaus gehandelt. Sie beinhaltet, dass der Preis e

Eine Intraday-Strategie, die auf zwei Grundprinzipien des Marktes basiert. Der Algorithmus basiert auf der Analyse von Volumina und Preiswellen mit zusätzlichen Filtern. Der intelligente Algorithmus des Indikators gibt nur dann ein Signal, wenn sich zwei Marktfaktoren zu einem vereinen. Der Indikator berechnet Wellen eines bestimmten Bereichs auf dem M1-Diagramm unter Verwendung der Daten des höheren Zeitrahmens. Und um die Welle zu bestätigen, verwendet der Indikator eine Volumenanalyse. Dieser

Der Indikator zeigt das horizontale Volumenprofil im angegebenen Bereich (BOX) und das maximale Volumen (POC) an.

Produktmerkmale. 1. Sie können Ticks oder nur den Preis verwenden. 2. Adaptiver Rasterabstand (M1-MN). 3. Adaptiver Suchschritt für hohes Volumen (Median) abhängig von der Boxgröße. 4. Automatische Chamäleonfarbe für Rahmenlinien und Schaltflächen. 5. Mehrere Boxen, einfach zu erstellen und zu löschen. 6. 70 % Volumenbereich (in den Einstellungen aktivieren). 7. Es gibt eine Warnung

GoldRush Trend Arrow Signal

Der GoldRush Trend Arrow Signal Indikator bietet präzise Echtzeit-Trendanalysen, die speziell auf schnelle, kurzfristige Scalper im XAU/USD zugeschnitten sind.

Dieses Tool wurde speziell für den 1-Minuten-Zeitrahmen entwickelt und zeigt Richtungspfeile für klare Einstiegspunkte an, sodass Scalper sich sicher in volatilen Marktbedingungen bewegen können.

Der Indikator besteht aus PRIMÄREN und SEKUNDÄREN Warnpfeilen. Die PRIMÄREN Signale sind weiße und schwarze Rich

Version 1.05 - Option zum Setzen des Daten-Offsets (Anker) mit der Maus hinzugefügt. Halten Sie einfach die SHIFT-Taste gedrückt, doppelklicken Sie auf eine beliebige Stelle im Chart und lassen Sie dann die SHIFT-Taste los. Der Anker wird auf den Balken gesetzt, der dem Doppelklick am nächsten liegt.

Version 1.04 - Korrektur für den Demomodus (d.h. den Betrieb im Strategietester) hinzugefügt. Verwenden Sie nur offene Kurse und aktivieren Sie Datum verwenden (wählen Sie einen Datumsbereich)

Der M

Hydra Trend Rider ist ein nicht nachzeichnender Trendindikator für mehrere Zeitrahmen, der präzise Kauf-/Verkaufssignale und Echtzeitwarnungen für Handels-Setups mit hoher Wahrscheinlichkeit liefert. Mit seiner farbkodierten Trendlinie, dem anpassbaren Dashboard und den mobilen Benachrichtigungen ist er perfekt für Händler, die Klarheit, Vertrauen und Konsistenz im Trendhandel suchen. Einrichtung & Anleitung: MT5-Version hier herunterladen . Um zu lernen, wie man den Indikator benutzt: Indikator

Das Ein-Minuten-Gold ist ein volumen-, preis- und trendbasierter Einstiegssignal-Indikator mit Pfeilen, der Tradern hilft, die richtige Marktseite zu wählen und Chancen zu generieren. Warum Ein-Minuten-Gold wählen? TP-SL. Eingebaute Take-Profit- und Stop-Loss-Objekte erscheinen im Chart bei jedem Signal. Zwei Methoden: ATR TP-SL und feste Punkte TP-SL. Statistik-Panel. Zeigt Gewinn-/Verluststatistik über gewählte Historienkerzen, aktuelle Gewinnrate %, Gewinn-/Verlustserien und Nettoprofit. Hoc

FREE

Volumen gibt der Preisaktion Tiefe! Volume Critical kann die günstigsten Bereiche für die Platzierung von Trades genau lokalisieren. Steigen Sie so früh wie möglich in Umkehrbewegungen ein, um die besten Risiko-Ertrags-Setups zu erhalten!

Merkmale Aggressiver Algorithmus, der Umkehrungen vorhersagt Volumen-Klassifizierungen Graue Histogramme - Normales Volumen, durchschnittliche Marktaktivität Orange Histogramme - Trending Volume, erhöhte Marktaktivität Rosa Histogramme - Überkauftes Volumen, w

PairMaster Kauf-Verkauf-Pfeil-Indikator für MT4 Handeln Sie Umkehrungen wie ein Profi - fangen Sie jeden Swing-Punkt mit Präzision ab Der PairMaster Buy Sell Arrow Indicator ist ein leistungsfähiges MetaTrader 4-Tool, mit dem sich hochwahrscheinliche Swing-Trading-Gelegenheiten identifizieren lassen. PairMaster wurde für Trader entwickelt, die Wert auf Genauigkeit, Klarheit und Einfachheit legen. Er erkennt wichtige Wendepunkte im Markt und zeichnet intuitive Kauf- und Verkaufspfeile direkt auf

Werden Sie Breaker Trader und profitieren Sie von Änderungen der Marktstruktur, wenn sich der Preis umkehrt.

Der Order Block Breaker Indikator zeigt an, wann sich eine Trend- oder Preisbewegung der Erschöpfung nähert und bereit ist, sich umzukehren. Es weist Sie auf Änderungen in der Marktstruktur hin, die normalerweise auftreten, wenn eine Umkehrung oder ein größerer Rückzug bevorsteht.

Der Indikator verwendet eine proprietäre Berechnung, die Ausbrüche und Preisdynamik identifiziert. Jedes M

Scalping Lines System - ist ein Scalping-Handelssystem, das speziell für den Handel mit Gold (XAUUSD) auf den Zeitrahmen M1 und H1 entwickelt wurde.

Es kombiniert Indikatoren für Trend-, Volatilitäts- und Überkauft-/Überverkauft-Analysen in einem einzigen Oszillator zur Identifizierung kurzfristiger Signale. Die wichtigsten internen Parameter für die Signallinien sind vorkonfiguriert. Einige Parameter können manuell angepasst werden: „Trendwellendauer“ reguliert die Dauer einer Signalfolge in

ICT, SMC, Smart Money Concept, Support and Resistance, Trend Analysis, Price Action, Market Structure, Order Blocks, Breaker Blocks, Momentum Shift, Strong Imbalance, HH/LL/HL/LH, Fair Value Gap, FVG, Premium & Discount Zones, Fibonacci Retracement, OTE, Buyside Liquidity, Sellside Liquidity, Liquidity Voids, Market Sessions, NDOG, NWOG,Silver Bullet,ict template

Auf dem Finanzmarkt ist eine genaue Marktanalyse für Investoren von entscheidender Bedeutung. Um Investoren dabei zu helfen, Markttren

Wenn Sie diesen Indikator kaufen, erhalten Sie meinen professionellen Trade Manager + EA KOSTENLOS dazu.

Zunächst einmal ist es wichtig zu betonen, dass dieses Handelssystem ein Nicht-Repainting-, Nicht-Redrawing- und Nicht-Verzögerungsindikator ist, was es sowohl für manuelles als auch für automatisches Trading ideal macht. Online-Kurs, Handbuch und Vorlagen herunterladen. Das "Smart Trend Trading System MT5" ist eine umfassende Handelslösung, die für neue und erfahrene Trader maßgeschneide

Der Indikator berechnet die Stärke von acht Hauptwährungen und kann auch die Stärke jeder anderen Währung, Metall oder CFD berechnen. Sie müssen nicht viele Diagramme durchsehen, um die starken und schwachen Währungen sowie ihre aktuelle Dynamik zu bestimmen. Das Bild des gesamten Devisenmarktes für jeden Zeitraum kann in einem einzigen Indikatorfenster angezeigt werden. Integrierte Tools zur Überwachung und Kontrolle der Situation helfen Ihnen, Gewinne nicht zu verpassen.

Hauptmerkmale Es ist

Die Supply and Demand Order Blocks:

Der Indikator "Supply and Demand Order Blocks" ist ein anspruchsvolles Tool, das auf den Konzepten des Smart Money basiert und für die technische Analyse im Devisenhandel unerlässlich ist. Er konzentriert sich darauf, Angebot und Nachfrage Zonen zu identifizieren, entscheidende Bereiche, in denen institutionelle Händler deutliche Spuren hinterlassen. Die Angebotszone, die Verkaufsaufträge anzeigt, und die Nachfragezone, die Kaufaufträge anzeigt, helfen Händl

FREE

Der Gann Box Indikator ist ein leistungsstarkes und vielseitiges Werkzeug, das dazu entwickelt wurde, Händlern zu helfen, die Schlüsselniveaus des Marktes zu identifizieren und zu nutzen. Dieser Indikator ermöglicht es, ein Rechteck im Diagramm zu zeichnen, das automatisch in mehrere Zonen mit strategischen Niveaus 0, 0.25, 0.50, 0.75, 1 unterteilt wird. Wenn der Preis eines dieser Niveaus erreicht, werden Warnungen ausgelöst, was eine wertvolle Hilfe bei Handelsentscheidungen bietet. Sie wissen

Die ersten 25 Exemplare zu $80, danach wird der Preis auf $149 erhöht (3 Exemplare übrig)

Gold Signal Pro ist ein leistungsstarker MT4-Indikator, der Händlern helfen soll, starke Preisreaktionen auf dem Markt zu erkennen. Er konzentriert sich auf klare Dochtverwerfungen und zeigt an, wenn der Preis ein Niveau stark zurückweist und oft in dieselbe Richtung weitergeht. Gold Signal Pro wurde hauptsächlich für das Scalping von Gold (XAUUSD) entwickelt und funktioniert am besten auf niedrigeren Ze

Malaysian SNR ist ein Unterstützungs- und Widerstandssystem, das von Tradern aus Malaysia verwendet wird. Es ist eine schnelle Methode für Scalper und Daytrader, Unterstützungs- und Widerstandsniveaus zu finden. Dieser Indikator bietet folgende Funktionen: Bedienfeld zum Anzeigen / Ausblenden von Unterstützungs- und Widerstandsniveaus Aktivierbarer Wick-Rejection-Filter, um nur bestätigte SNR-Level anzuzeigen Anzeigen / Ausblenden der Preise auf den Levels Funktioniert nur im sichtbaren Bereich

Auto Order Block mit Strukturbruch basierend auf ICT und Smart Money Concepts (SMC )

Futures Strukturbruch ( BoS )

Auftragsblock ( OB )

Höherer Zeitrahmen Orderblock / Point of Interest ( POI ) auf dem aktuellen Chart angezeigt

Marktwertlücke ( FVG ) / Ungleichgewicht - MTF ( Multi Time Frame )

HH/LL/HL/LH - MTF ( Multi Time Frame )

Choch MTF ( Mehrzeitrahmen )

Volumen Ungleichgewicht , MTF vIMB

Gap's Potenz von 3

Gleiche Hochs/Tiefs , MTF EQH/EQL

Liquiditä t

Höchst-/Tiefstkurs des akt

Ein technischer Indikator, der Diagramme strukturiert und zyklische Preisbewegungen identifiziert.

Kann mit allen Diagrammen funktionieren.

Mehrere Arten von Benachrichtigungen.

Auf dem Diagramm selbst befinden sich zusätzliche Pfeile.

Ohne erneutes Zeichnen der Historie wird beim Schließen der Kerze gearbeitet.

Empfohlener TF ab M5.

Einfach zu verwenden und Parameter zu konfigurieren.

Wenn Sie 2 Indikatoren mit unterschiedlichen Parametern verwenden, können Sie diese ohne andere Indikatoren ve

Dieser Indikator analysiert parallel Kurs-Charts für mehrere Währungspaare auf allen Zeitskalen und benachrichtigt Sie, sobald ein Double Tops oder Double Bottoms Muster identifiziert wurde.

Definition Double Top / Double Bottom Muster Double Top ist ein Trendumkehrmuster, das aus zwei aufeinanderfolgenden Spitzenwerten besteht, die mehr oder weniger gleich sind, mit einem dazwischen liegenden Tiefpunkt. Dieses Muster ist eine klare Illustration eines Kampfes zwischen Käufern und Verkäufern. Di

SuperScalp Pro - Supertrend-basierter Multi-Filter Scalping-Indikator (MT4)

SuperScalp Pro ist ein professioneller Scalping-Indikator für MetaTrader 4, der auf dem Supertrend basiert und mit einem mehrschichtigen technischen Filtersystem ausgestattet ist. Er wurde entwickelt, um Händlern dabei zu helfen, qualitativ hochwertige KAUF-/VERKAUFssignale mit klarer visueller Anleitung und reduzierten Fehleinstiegen zu identifizieren, insbesondere auf niedrigeren Zeitrahmen.

MT5 Version verfügbar : E

Der Volatilitätsanalysator ist ein Momentum-Indikator, der von der Tendenz profitiert, dass der Preis nach der Konsolidierung in einer engen Handelsspanne stark ausbricht. Der Indikator verwendet auch einen Momentum-Oszillator, um die erwartete Richtung der Bewegung anzuzeigen, wenn der Squeeze ausgelöst wird. Dieses Histogramm oszilliert um die Nulllinie, ein steigendes Momentum über der Nulllinie zeigt eine Gelegenheit zum Long-Kauf an, während ein Momentum, das unter die Nulllinie fällt, ein

123456789101112131415161718192021222324252627282930313233343536373839404142434445464748495051525354555657585960616263646566676869707172737475767778798081828384858687888990919293949596979899100101102103104105106107108109110111112113114115116117118119120121122123124125126127128129130131132133134135136137138139140141142143144145146147148149150151152153154155156157158159160161

MetaTrader Market bietet jedem Entwickler eine einfache und bequeme Plattform für den Verkauf von Programmen.

Wir unterstützen Sie bei der Veröffentlichung des Produkts und beraten Sie gerne, wie man eine Beschreibung für den Market vorbereitet. Alle Produkte, die im Market verkauft werden, sind durch eine zusätzliche Verschlüsselung geschützt und können nur auf dem Rechner des Kunden gestartet werden. Illegales Kopieren ist ausgeschlossen.

Sie verpassen Handelsmöglichkeiten:

- Freie Handelsapplikationen

- Über 8.000 Signale zum Kopieren

- Wirtschaftsnachrichten für die Lage an den Finanzmärkte

Registrierung

Einloggen

Wenn Sie kein Benutzerkonto haben, registrieren Sie sich

Erlauben Sie die Verwendung von Cookies, um sich auf der Website MQL5.com anzumelden.

Bitte aktivieren Sie die notwendige Einstellung in Ihrem Browser, da Sie sich sonst nicht einloggen können.