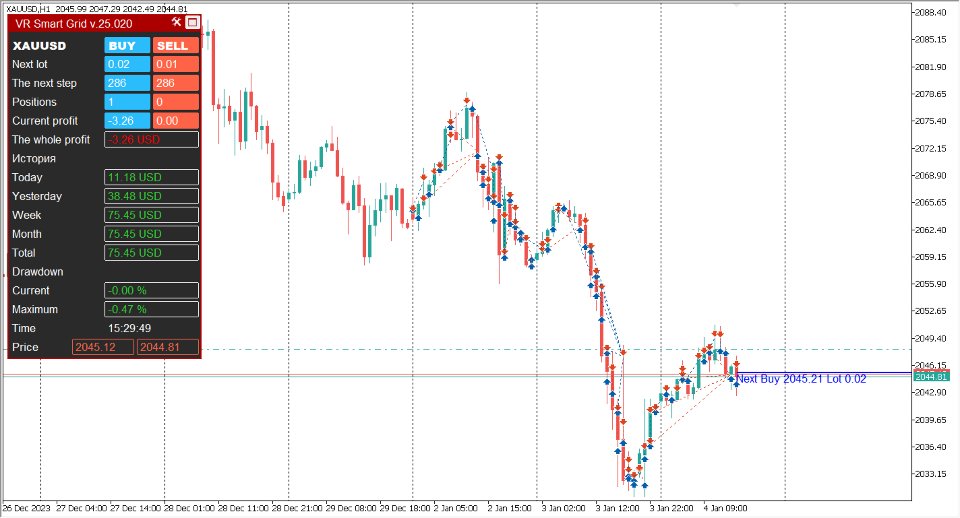

VR Smart Grid MT5

- Experts

- Vladimir Pastushak

- Version: 25.110

- Updated: 1 November 2025

- Activations: 20

VR Smart Grid - Smart Trading Robot (Advisor), which is capable of in stages to close many market positions with a profit given by the trader. The gradual closure of small parts helps to quickly and effectively reduce risks. The trading strategy algorithm includes several carefully worked out trading strategies . The fundamental strategy consists in creating a grid of positions and a partial closure of positions with a fixed profit. The trading robot (adviser) analyzes the current market situation, dividing the lots into separate parts, which allows you to calculate the optimal average price to close a certain part of the positions. This method ensures the maximum approximation of the average price to the current market price, and minor fluctuations in the market lead to automatic closure in advance of the position of positions.

Set files, demo versions of the product, instructions and bonuses are available on the [blog]

Version for [MetaTrader 4]

The Robot Trade Strategy VR Smart Grid has eight different methods for closing market positions. Depending on the selected method, the adviser can set real or virtual levels of Take Profit. The sequence of calculation of lots can be set by the trader manually or is determined automatically by one of the methods, including the principle of fibonacci . The distance between the positions can also be tuned manually for each step or calculated automatically.

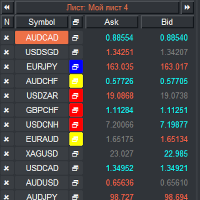

VR Smart Grid is capable of trading with financial instruments in in fully automatic mode , leaving the trader only control over the settings. Depending on the parameters, using the VR Smart Grid, you can manage and accompany the positions opened by other advisers or the trader itself. The method of opening a position - whether through a computer terminal or a mobile application - does not matter for an adviser.

The algorithm of work Trade strategy is based on the management and adjustment of market positions. For example, with an upward trend for a purchase position, the adviser uses trailing stop. As soon as the Stop Loss level is in the profit zone, the adviser will open an additional position. The purpose of this tactics is minimize the risks trade. In the conditions of a descending trend, the adviser opens up a position for averaging with the established lot and step. At the slightest rollback, the VR Smart Grid will gradually close the entire grid of positions in small parts.

Advantages of the adviser VR Smart Grid:

- The trading robot is easy to set up;

- Suitable for beginners and professionals;

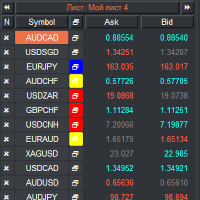

- Works with any financial instruments (Forex, Crypto, CFD, Futures, Metals);

- The adviser can trade in any time periods;

- It provides several deposits of averaging, including smart and partial averaging.

- Has several trend trading modes, against the trend;

- Can accompany and control the positions of other trading algorithms;

- Automatically takes into account the commissions and swap;

- Works with optimization in a strategic tester;

- Free updates.

- Free technical support.

- Settings sets, contact the author.

Main recommendations:

- Control the work of the trading robot and change the settings in a timely manner.

- Carry out testing on demo accounts in conditions as close as possible to real ones.

- Use the VPS server.

- Do not allow big risks.

- Configure the Metatrader terminal to send push messages to receive messages to the smartphone.

- Contact the author of the program for additional information, settings and bonuses.

- Carefully study the program settings on the blog.

Dear colleagues and friends-traders,

Like many of you, I strive to earn money in financial markets. Work on VR Smart Grid adviser began in 2009. Since then, I have tried thousands of variations of algorithms and logical schemes. Each new version took place thorough testing on training and demo accounts, since simulators cannot convey all the complexity of real conditions. Only observing the behavior of the adviser in living trade, I made improvements, step by step, improving the algorithm to the optimal configuration.

VR Smart Grid stands out among similar solutions not only by the presence of eight deprivation methods, but also with the flexibility of settings that allow you to accurately configure an automatic trading strategy for your needs.

Settings of a trading robot and their description

The trend is considered when the price is above the upper position for the purchase, it is considered against the trend when the price is below the upper position for the purchase. For sales with accuracy for circulation.

4/5 - the settings are marked with the number of signs after the comma by the broker.

Description of the settings and default settings are made for 3-5 significant brokers. For 2-4 significant configuration brokers, the marked 4/5 sign should be indicated 10 times less.

< = Lot calculation settings = >

- The type of lot calculation - Setting allows you to choose the type of automatic calculation of the lot.

- Fixed lot (Example: 0.01) - The mode in which a standard fixed lot is used.

- Percentage lot (Example: 3) - The mode in which the new lot is calculated as a percent of the deposit.

- The balance for the minimum lot (Example: 300 for the minimum lot) - The mode in which the lot is calculated from the amount of the deposit for the minimum lot. For example, the trader set the deposit 500. In this case, the sum of the general deposit will be divided by 500 and multiplied by the minimum acceptance of the broker lot. If the deposit is 2000 dollars and the trader indicated $ 500, 2000 /500 = 4, 4 * by 0.01, the starting lot will be 0.04.

- Value (Lot, Percentage, Balance) - Value for the specified type of calculation of the lot.

- Manual sequence of lots, through ; (Example: 0.01;0.05;0.02;0.04) - Setting allows you to set any sequence of lots manually. The setting has the highest priority and disables the work of the above settings.

- Type of automatic lot calculation - Setting allows you to choose an automatic method for calculating lots for new positions that open against the trend.

- The starting lot (Calculation example: 1,1,1,1,1) - The lot remains unchanged and is always equal to the calculated lot in the setting Value (Lot, Percentage, Balance).

- Martingale lot (Calculation example: 1,2,4,8,16) - The lot is calculated by the formula: the lot of the previous position is multiplied by 2.

- Fibo lot (Calculation example: 1,1,2,3,5,8) - The lot is calculated according to the principle of Fibonacci numbers, each new lot is equal to the sum of the previous two lots.

- The sum of the maximum and starting lot (Calculation example: 1,2,3,4,5) - The lot is calculated on the principle of adding a lot calculated in the setting of Value (Lot, Percentage, Balance) and the lot of the last open position.

- The sum of lots of extreme positions (Calculation example: 3+,4,7,10) - The lot is calculated on the principle of adding lots of the first and last positions.

- Additional lot multiplier (0 - Disabled) - Setting allows you to increase the calculated lot or reduce it. Example: Fibo Calculation without Additional Lot Multiplier: 1.1,2,3,5,8. Calculation using Additional Lot Multiplier is 2: 1*2 = 2, 1+2 = 3*2, 3+6 = 9*2. This setting can not only aggressively increase the lots, but also reduce them if the setting value is less than 0. For example, 1 * 0.5 = 0.5, 1 + 0.5 = 1.5 * 0.5 = 0.75.

- Maximum Buy lot - The setting limits the maximum lot for purchases, if as a result of the calculations of the Lotten Management strategy, the lot will be more than indicated in the setting, the trading robot will open the position not exceeding the value of the specified in the setting.

- Maximum Sell lot - The setting limits the maximum lot for sales, if as a result of the calculations of the lot of lots of lots, the lot will be more than indicated in the setting, the trading robot will open the position not exceeding the value of the specified in the setting.

< = Position Pitch Settings = >

- Type of distance calculation - Type of distance calculation for new positions against the trend.

- Points (Example: 100) - The distance is calculated in points.

- ATR modified (Example: 50) - The distance is calculated according to the modified ATR indicator formula. In this algorithm, the distance for sale may differ from the purchase distance.

- Percentages (Example: 1.5) - The distance is calculated as a percentage of growth or falling of the current price from the last position against the trend.

- Bollinger Bands difference line (Example: 12) - The distance is calculated as the difference between the upper and lower line of the Bollinger Bands indicator.

- Donchian difference line (Example: 22) - The distance is calculated as the difference between the upper and lower line of the Donchian indicator.

- The average value of the bars (Example: 30) - The distance is calculated as the average value of the bars for the specified period.

- 4/5 Value (Points, Percentage, Indicator Period) - Value for the specified type of distance.

- 4/5 Step increase between positions (0 - Disabled) - The setting allows you to increase the distance depending on the number of positions by the type of trend.

- Manual distance sequence, through ; (Example: 50;100;80;30) - Setting allows you to set any sequence of distances manually. The setting has the highest priority and disables the work of the above settings.

< = Working time settings = >

- Trading on a new bar - The setting allows you to set to limit the opening of trading positions by the appearance of a new bar. Depending on the selected period and other calculated conditions, the trading robot will open positions only taking into account the appearance of a new bar, the specified period. This setting does not affect the algorithms for calculating indicators. All indicator calculations are made relative to the period on which the trading robot works.

- Enable time-based work - The setting turns on or disconnects the work of the trading robot in time.

- Trading end Time - The time when the trading robot should complete the work.

- Trading start time - The time when the trading robot should resume work.

< = Trading Settings = >

- 4/5 Maximum Spread (0 - Disabled) - Setting stops the work of the trading robot in case of the spread more than the trial set.

- Type of trading Operations - Setting allows you to set the type of trading positions for trading.

- Buy and Sell Together - A trading robot can simultaneously buy and sell.

- Buy only - A trading robot can make transactions only for a purchase.

- Sell only - A trading robot can only make transactions for a purchase.

- Buy - Smooth Stop - A trading robot smoothly stops working with purchases. The principle of operation of this algorithm: the trading robot makes transactions for the purchase until the entire purchase network is completely closed. After closing all the purchases, new positions on the purchase will not open.

- Sell - Smooth Stop - A trading robot smoothly stops working with purchases. The principle of operation of this algorithm: the trading robot makes transactions for the purchase until the entire purchase network is completely closed. After the closure of all sales, new positions for sale will not open.

- Buy and Sell is a smooth Stop - A trading robot smoothly stops trading. The principle of operation of this algorithm: a trading robot makes transactions for the purchase and sale until the entire network is completely closed. After the closure of all positions, the new ones will not open.

- Control of Manual Positions (Magic Number = 0) - Setting allows the trading algorithm to take control of certain trading positions opened by the trader in a manual or other trading robot. When using this setting, the Magic Number parameter should be indicated as 0 for manual positions or Magic Number of another trading robot. Avoid the work of several trading robots with one Magic Number! Before turning on this settings, in order to avoid conflicts of trading robots, other robots should be turned off! This setting allows you to resolve the difficult situations created by other trading robots or a manual trader.

- Maximum Number of Purchase Positions (0 - Disabled) - The setting limits the maximum number of purchases against the trend.

- Maximum Number of Positions for Sale (0 - Disabled) - Setting limits the maximum number of sales against the trend.

< = Balance Management Settings = >

- Close All Positions with Profit or Loss (Example: 50 OR -30) - Setting allows you to set the amount of profit or loss at which a trading robot should close all positions on the purchase and sale.

- Acter Closing All Positions - Setting sets the robot further actions after closing all positions.

- Close All Positions and Stop Trading - completely stop the robot trading.

- Close All Positions and Continue Trading - Continue Trade.

< = Averaging Settings = >

- Type of averaging - Setting allows you to choose the type of calculation of the average price. Partial closure is possible only when using virtual levels.

- All positions, real TakeProfit - It works only with real levels, the type of averaging at which all positions on the purchase or all positions for sale are calculated.

- Two extreme positions, a real TakeProfit - It works only with real levels, the type of averaging at which two extreme positions for the purchase or two extreme positions for sale are calculated.

- The last two positions, the real TakeProfit - It works only with real levels, the type of averaging at which the last two positions with large lots for the purchase or the last two positions with large lots for sale are calculated.

- Smart choice, Real TakeProfit - It works only with real levels, the type of averaging at which the trading robot analyzes all the prices of averages and chooses the best.

- All positions, virtual TakeProfit - It works only with virtual levels, the type of averaging at which all positions on the purchase or all positions on sale are calculated.

- Two extreme positions, virtual TakeProfit - It works only with virtual levels, the type of averaging at which all positions on the purchase or all positions on sale are calculated.

- Last two positions, virtual TakeProfit - It works only with virtual levels, the type of averaging at which the last two positions with large lots for the purchase or the last two positions with large lots for sale are calculated.

- Smart choice, virtual TakeProfit - It works only with virtual levels, the type of averaging at which the trading robot analyzes all the prices of averaging and chooses the best.

- Do not use averaging - Settings turn off the automatic calculation of average prices. Positions are controlled using other functions or in a manual trader.

- Closing the percentage portion of the Virtual mode (Example: 25) - It works only with virtual deprivation regimes. The setting sets the percentage of closing lots of positions.

- 4/5 Minimum profit for closing positions (Example: 25) - The setting sets the number of points of additional profit, when closing a series of positions.

< = Trailing trend stop = >

- Type of trend-based trailing - Settings set the type of trailing stop for trend:

- Classic - Classic trailing of the stop in which the stop loss moves around the price on a given number of points.

- Dynamic - The dynamic trailing of the stop at which the distance for the stop Loss is calculated on the percentage ratio. This trailing of the stop requires indicate the size of the potential trend in points. (Average trend size for the Eurusd 8000 - 11,000 points)

- Manual - The mode in which the trader itself controls the movement of Stop Loss.

- 4/5 Potential trend size (Points) (Example: 4000) - The value for the specified type of calculation of trailing foot.

- Maximum percentage for a trailing stop (Dynamic) - The setting limits the dynamic trailing of the stop if the trend is more than the trader indicated in the 4/5 Potential Trend Size setting.

< = Trailing stop against the trend = >

- Type of anti -Trend Trailing - Setting sets the type of trailing foot for positions against the trend:

- Classic - Classic trailing of the stop at which the stop loss moves around the price on a given number of points.

- Dynamic - Dynamic trailing of the stop in which the distance for the stop Loss is calculated on the percentage ratio. This trailing of the stop requires indicate the size of the potential trend in points. (Average trend size for the Eurusd 8000 - 11,000 points)

- Manual - The mode in which the trader itself controls the movement of Stop Loss.

- 4/5 Potential Trend Size (Points) (Example: 4000) - Value for the specified type of calculation of trailing foot.

- Maximum percentage for a traveling stop (Dynamic) - Settings limits the dynamic trailing of the stop if the trend indicated the 4/5 Potential Trend Size settings.

< = Setting up strategies = >

- The type of signals for the strategy - The setting sets the type of signal to open positions.

- do not use indicator signals - the signal is not used, the trading robot checks the availability of positions and if they start trading.

- CCI Indicator Signal - Cigal from the CCI indicator. Cinal for purchase is considered when the current indication of the CCI indicator on the current bar is more readings on the previous bar and the indicator value is less than -100. For sales, a return signal.

- The Signal of the Donchian Channel Indicator - a signal from the Donchian indicator. A signal for the purchase is considered to break through the upper boundary of the channel. For sales, a return signal.

- Intersection of the 2X Moving Average - a signal from the intersection of two sliding medium -sized Moving Average. The signal for the purchase is the intersection of a fast sliding medium slow from the bottom up. For sales, a return signal.

- The Signal of the User Indicator - A user signal from the user indicator or other application. The trading robot has the possibility of receiving signals from third -party applications. The signal transmission principle is very simple. Your application should transmit a signal through global variable terminals according to the principle: 1 make a purchase, -1 make a sale. The principle of forming the name of the global variable: _symbol + "-vrsg-" + Imagicnumber;

- _ symbol - the name of the financial instrument according to the terminal nomenclature.

- "-vrsg-" -distinctive prefix.

- Magicnumber - the robot to which the signal is transmitted.

- Period of Indicators: Donchian, CCI, Moving Average 1 (Example: 25) - The period of the period for the specified first indicator.

- Indicator Period: Moving Average 2 (Example: 33) - the period of the period for the specified second indicator.

< = Other settings = >

- Display The Information Panel - The setting turns on or disables the information panel on the graphics. In the strategies and optimizer strategies, the information panel does not work in the strategies and the optimizer. For the strategies tester, a change in testing balance is displayed taking into account the arrival of the new bar.

- The size of the Information Panel - Setting up the size of the information panel.

- Smartphone Notifications - Setting allows you to receive a notification of changes in the robot trade in Metatrader to a mobile device.

- Notifications in the Terminal - Setting allows you to receive a standard notification in the terminal (ALERT).

- Email notifications - Setting allows you to receive a notification of changes in the robot trading to the email address.

- Telegram notifications - Setting allows you to receive a notification of changes in the robot trade in a telegram channel.

- Telegram Channel Name - The name of the Channel Telegram.

- Secret Telegram Bot Token - Secret Token Telegram Bota working in the channel.

- Serial Number of items (Magicnumber) - a unique position number.

- 4/5 Slippage (Points) - slippage.

- Comment on the Positions - commentary on positions or their mask. The mask allows you to create comments automatically. The maximum number of tags for the mask 3. Example :: Eaname :: Magic: - Comment will be VR Smart Grid v.25.020 Mn 227

- Tags of masks

- : Eaname: - Writes the name of the trading robot and its version in the comment.

- : Magic: - Write down in the commentary of Magicnumber of the Trade Robot.

- : Balance: - writes in the commentary the balance of a trading account at the time of opening a position.

- : Equity: - will record a floating profit or loss at the time of opening a position.

- : Typpos: - Wash the type of position.

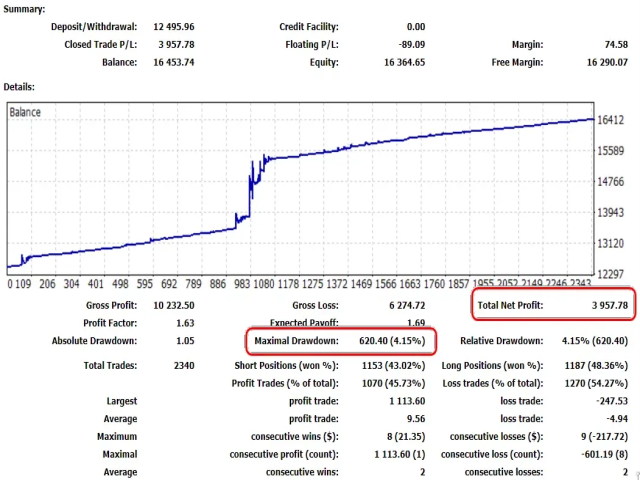

Important! When testing the program in the strategy tester, please keep the following points in mind:

- The best testing is to use the program under real conditions. To evaluate the real effectiveness of the application, please buy the program for a short time and use it on demo accounts or micro-accounts.

- The strategy tester built into MetaTrader does not take into account the following: financial instrument, trading period, spread, leverage, commission, ping, requotes, real tick receipt rate, tick quality and other conditions.

- The profitability and loss results obtained with the strategy tester should not be taken into account!

Sir , Please send for me. set file update smart grid versi Version: 25.20