VR Atr Pro MT5

- Indicators

- Vladimir Pastushak

- Version: 23.15

- Updated: 6 February 2023

- Activations: 20

VR ATR Pro is a powerful professional tool for determination of target levels on a financial instrument.

The indicator's effectiveness has been proved by thousands tests on real and demo accounts.

VR ATR Pro is the indicator that works on real data using live true statistics.

Statistics is stubborn, the usage of real statistical data in mathematical calculations allows you to calculate the exact target levels for a financial instrument.

Advantages

The indicator has a number of advantages, here are just some of them:

- High accuracy of the indicator.

- You can exclude paranormal bar from calculations.

- Simple display of target levels directly on the business chart.

- Works with any financial instruments (Forex, Metals, CFD, Futures, Crypto).

- Does not redraw, constantly saves its readings.

- Effective for determination of Stop Loss and Take Profit levels.

- Smartphone notifications, e-mail and MetaTrader alert.

- The versions for MetaTrader 4 and MetaTrader 5 are exactly the same.

- Easy to set up and install.

- Good for beginners and experienced traders.

- Works on all periods and time frames.

Recommendations

- The period for calculating the indicator must be less than the Timeframe of the indicator.

- Use the calculation of the settings readings accuracy for new financial instruments.

- Use the indicator to calculate the levels on daily periods or periods longer than daily.

- Use the indicator along with your trading system.

- Place Take Profit inside the levels, and Stop Loss outside the levels.

- Use a calculation period greater than 10 to get the most accurate results.

- It is recommended to avoid trading if the price has reached the level calculated by the indicator.

Algorithm of work

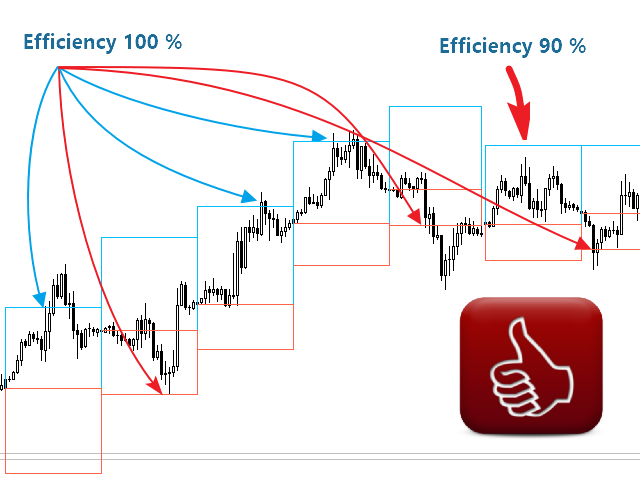

The algorithm of the indicator is based on the mathematical calculation of the average price behaviour for a specified period of time.

The period indicator “detects” and memorizes the number of points passed for the period. Then the indicator, on the base of the mathematical formula of the average price, calculates the levels for forecasting price growth and for forecasting price falling.

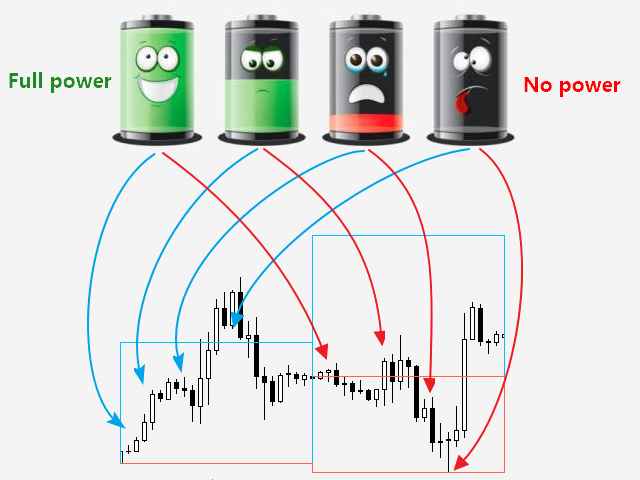

Thanks to such use of the real data, the indicator does not redraw and shows high accuracy. The indicator can be compared to the current charge in the battery of your phone.

You know that on average, your phone loses its charge after 12-16 hours of use. Likewise, VR ATR Pro calculates the level, if the day before yesterday the price passed 50 points, yesterday the price passed 60 points, today 55, then tomorrow the probability that the price will pass 55 points on average is almost 99%.

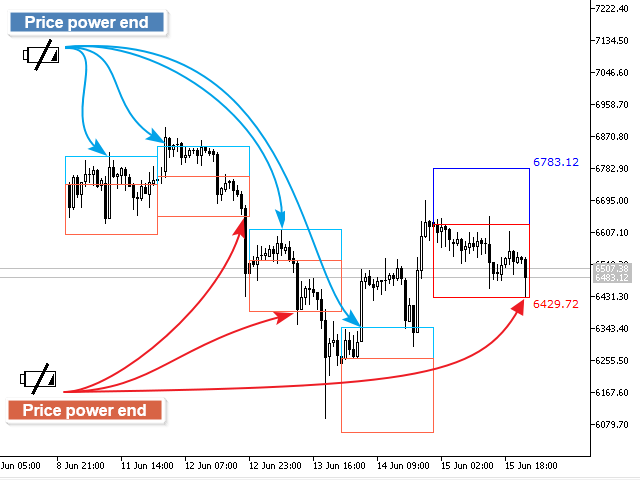

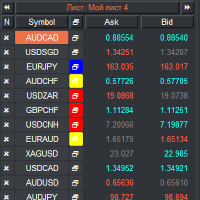

Program displays two levels on the business chart:

- The upper level is the predicted level of the price increase

- The lower level is the predicted level of the price decrease

Levels can be displayed as areas with deviations from the exact level. This allows to calculate the prices within the range of statistical deviation.

Accuracy of the readings

The program does not show the signals for buying or selling a financial instrument. VR ATR Pro calculates the target levels to which the price strives, the levels for which the price has enough strength and energy to reach.

These levels can be used to set Stop Loss and Take Profit values. To calculate the accuracy of the indicator, it is recommended to make a calculation according to the principle of how many times in history the price reached the levels calculated by the indicator.

In this way we will find out the accuracy of the indicator.

Conditions for calculating the accuracy of VR ATR Pro

- 5 signs after the decimal point

- 100 periods for calculation

- The period for calculating levels - 10

- Timeframe for calculating - One day

- Calculation dates 10/18/2019 - 03/09/2020

- Timeframe of indicator display - 1 hour

- EUR / USD Reading accuracy 88%

- GBP / USD Reading Accuracy 78%

- BTC / USD Reading Accuracy 75%

Version for: MetaTrader 4

Your feedback, the best thanks to us! Leave a review.

More information in blog.

Just a perfect tool thanks you Vladimir!