ENEA mt5

- Experts

- Vitalii Tkachenko

- Version: 1.0

- Activations: 15

| Price: 404$ -> 550$ | Signal: ENEA | How To: Manual |

|---|

Main features:

-

Real-time regime detection: Trend, Range, Volatility & Flat phase

-

Dynamic strategy switching depending on the market regime

-

AI model GPT5 (HMM) learns unsupervised from historical data

-

Activation of automated TP, SL adjustment

-

Supports the M30 time frame and is based on XAUUSD

How does the Hidden Markov Model (HMM) work?

A Hidden Markov Model (HMM) is a statistical model that assumes that a system – such as the financial market – moves through invisible (hidden) states.

These states (e.g., uptrend, downtrend) are not directly observable, but they influence measurable quantities such as prices, volume, or volatility.

The HMM uses probabilities to determine which sequence of hidden states best matches the observed data.

This makes it possible to recognize patterns and assess the current state of the market much better.

HMM Components:

A Hidden Markov Model (HMM) consists of several core components that are specifically used in ENEA mt5 for regime detection.Hidden states (regimes) represent different market phases such as trend, range, or high volatility.

Transition matrix determines the probabilities with which the market moves from one regime to another.

Emission distribution describes the statistical characteristics with which each regime manifests itself in the observed market data.

The model is trained on historical price and volatility data and subsequently detects live which regime the market is currently in – entirely without manual labeling.

Regime-switching refers to the dynamic adjustment of a trading strategy to different structural states of the market, so-called market regimes.

These regimes can manifest as clear trend phases (rising or falling markets), sideways movements (range markets),

high-volatility zones (e.g., after news, gaps, or strong impulses) or phases of low volatility.

Many conventional trading approaches fail because they are rigidly applied equally to all market phases. This is exactly where the ENEA mt5 Expert Advisor comes in:

It detects the current market state in real time and dynamically adjusts its trading strategy to the respective market situation to achieve optimal performance in every regime.

In live operation, ENEA mt5 continuously analyzes the market and identifies the current regime.

Once the market state is detected, the EA automatically selects the appropriate trading strategy to respond optimally to market conditions.

If the market is in a trend phase, ENEA activates a breakout system with integrated trend filters to efficiently take advantage of movements in the trend direction.

In sideways phases (range), the EA uses a mean-reversion strategy, where entries and exits are dynamically adjusted to key support and resistance zones.

If a high-volatility market phase is detected, ENEA automatically reduces position size and selects wider stop-loss levels to control risk and avoid false trades.

Example application (XAU/USD) An HMM was trained on daily log returns and distinguishes 3 regimes:

State | Description | Market behavior |

1 | Trend phase | Strong directional movement, high momentum |

2 | Sideways / Range | Low volatility, unclear course |

3 | Shock / Volatility | Gaps, news, rapid directional changes |

ENEA detects these states live and adjusts the trade frequency and strategy selection accordingly.

A central unique selling point of ENEA mt5 is the integration of the latest model ChatGPT-5 into the decision logic of the Expert Advisor.

While the Hidden Markov Model (HMM) handles statistical regime detection, ChatGPT-5 is used as a semantic and adaptive decision layer.

This means specifically:

-

Interpretation of complex market data:

ChatGPT-5 evaluates in real time the market regimes detected by the Hidden Markov Model (HMM) and extends this analysis by intelligently incorporating additional context layers – from current market sentiment and recurring seasonal patterns to exceptional price movements due to macroeconomic news or sudden volatility spikes. This creates a highly precise, situation-specific decision-making basis that enables ENEA mt5 to select the optimal trading strategy even in complex and rapidly changing market phases. -

Self-learning approach:

The powerful GPT-5 core is specialized in identifying and evaluating deep patterns and subtle anomalies from a variety of historical trades. Based on this, particularly profitable setups are specifically reinforced and refined, while inefficient or high-risk configurations are automatically discarded – a continuous optimization process that ensures ENEA mt5 continuously adapts its trading strategies and operates permanently at the highest performance level. - Context sensitivity:

GPT-5 has the ability to seamlessly integrate even unstructured and often hard-to-measure information – such as sudden market reactions to news events, volatility spikes after important economic data, or unusual price movements in response to geopolitical events – into the decision-making process. This gives ENEA mt5 a decisive information advantage over purely statistical models, which often do not or insufficiently account for such dynamic influencing factors, and allows it to make precise and profit-oriented decisions even in unexpected market situations.

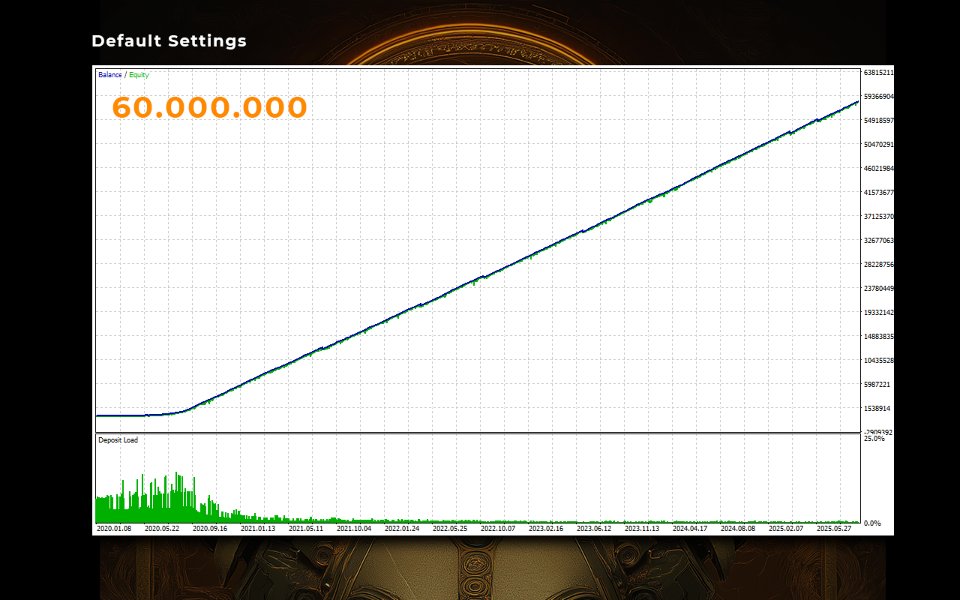

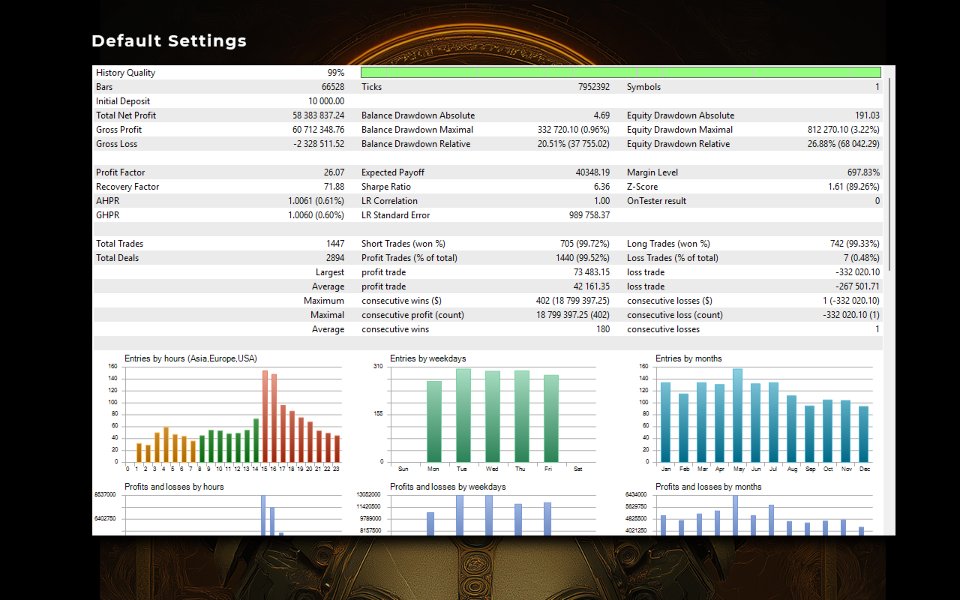

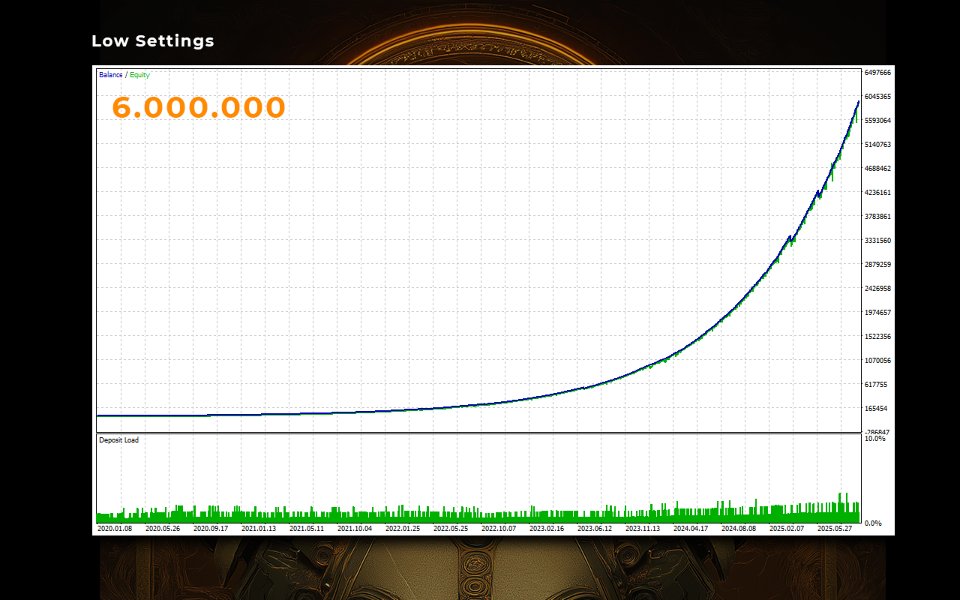

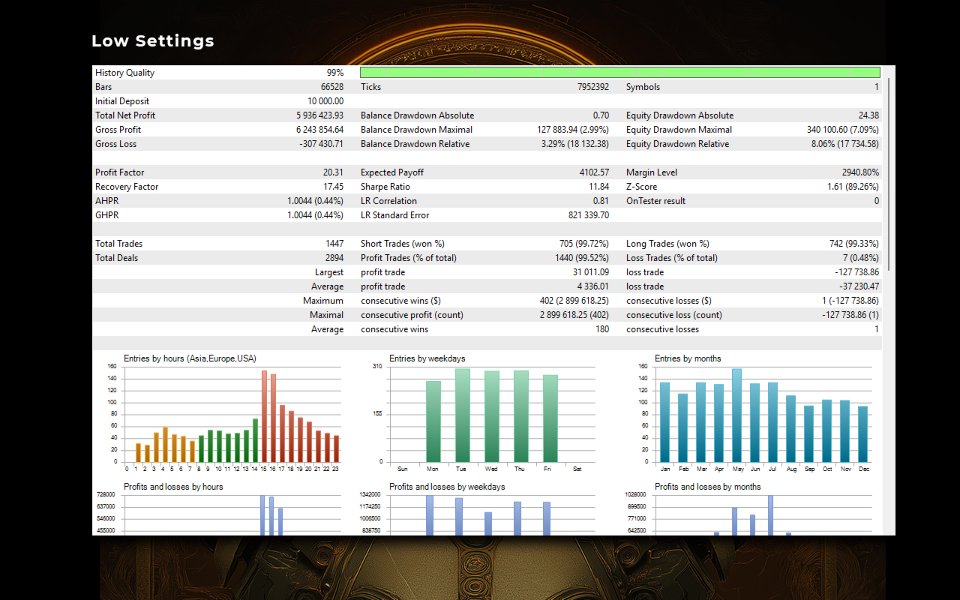

How good is it?

The combination of HMM (precise regime classification) and ChatGPT-5 (adaptive, context-based strategy adjustment) creates a trading algorithm that not only reacts to current market conditions but proactively prepares optimal trading decisions. This dual-engine structure shows its particular strength especially in transition phases between different market regimes – a typical weakness of many EAs – and ensures significantly more stable results. While the HMM handles the clear structural analysis, GPT-5 brings the “market intelligence” to specifically exploit opportunities even in complex and unpredictable market situations.