Multi Indicator Signal

- Experts

- Biswarup Banerjee

- Version: 17.0

- Updated: 12 August 2025

- Activations: 20

Multi Indicator Strategy EA MT4 is a sophisticated MetaTrader 4 trading tool designed to automate trade entries and exits using nine technical indicators: ADX, Bollinger Bands, CCI, MACD, Moving Average, RSI, Stochastic, Awesome Oscillator, and RVI. Offering extensive customization with multiple entry/exit strategies and AND/OR/NA combination modes, this EA provides traders with unparalleled flexibility. Extensively back-tested, it ensures precise signal generation, robust risk management, and low resource usage for seamless execution.

You can download the MT5 version here: Multi Indicator Strategy EA MT5

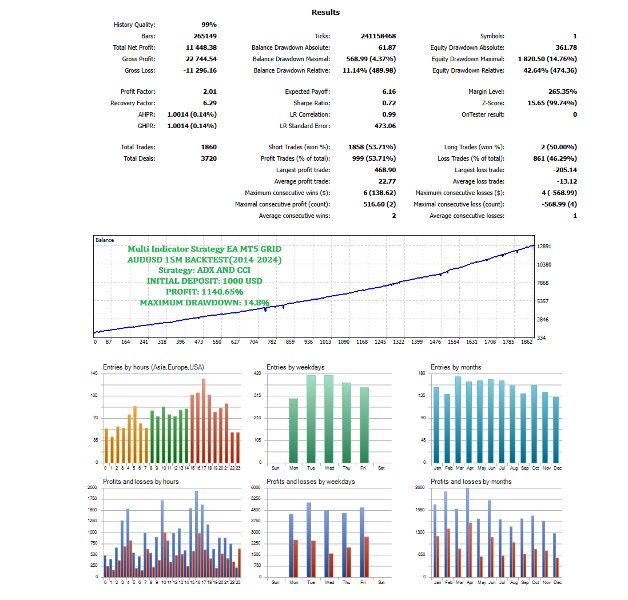

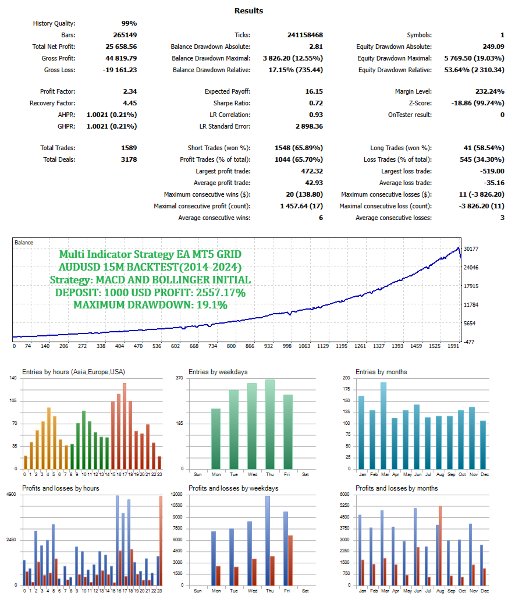

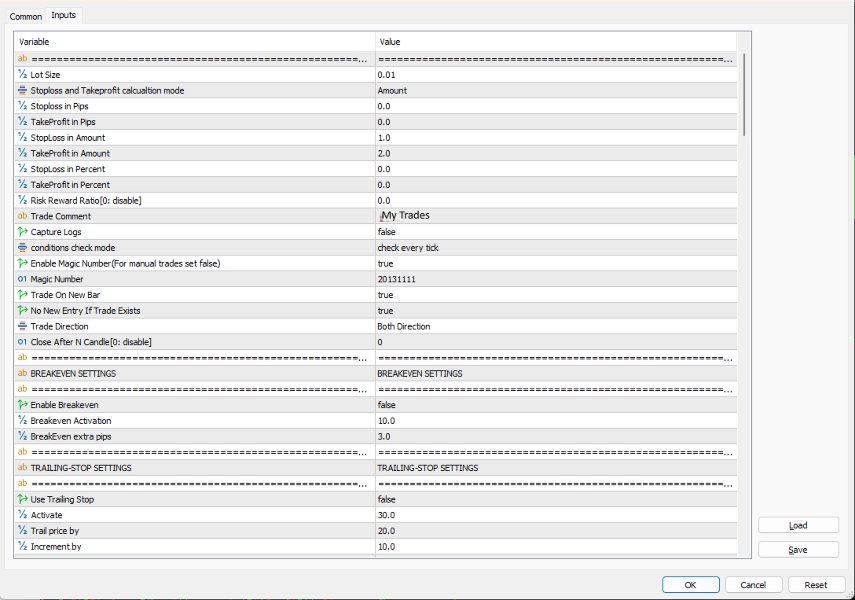

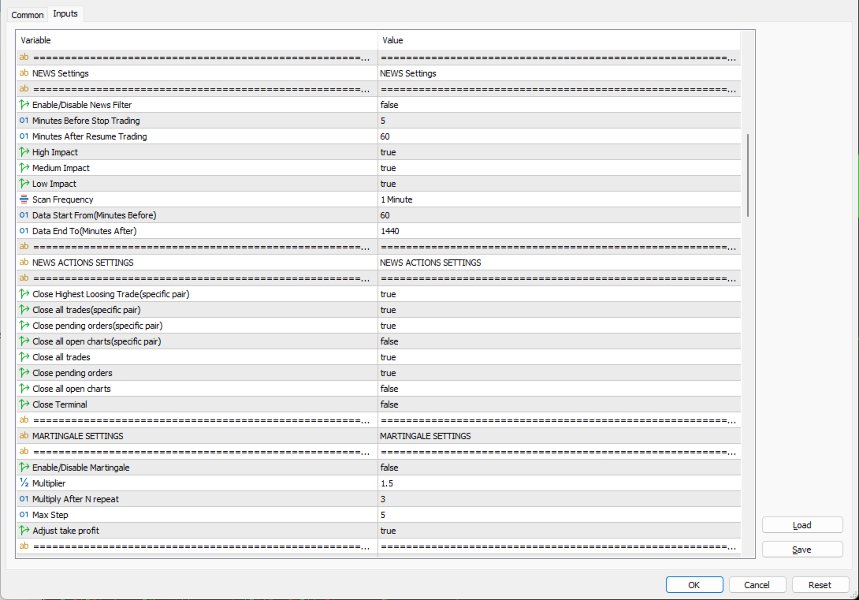

For detailed documentation: General Settings/Input Guide | Indicator Settings/Input Guide | Backtests and Set Files

Key Features Overview:

- Multi-indicator system with customizable parameters for ADX, Bollinger Bands, CCI, MACD, Moving Average, RSI, Stochastic, Awesome Oscillator, and RVI.

- Supports multiple timeframes for adaptable trading strategies.

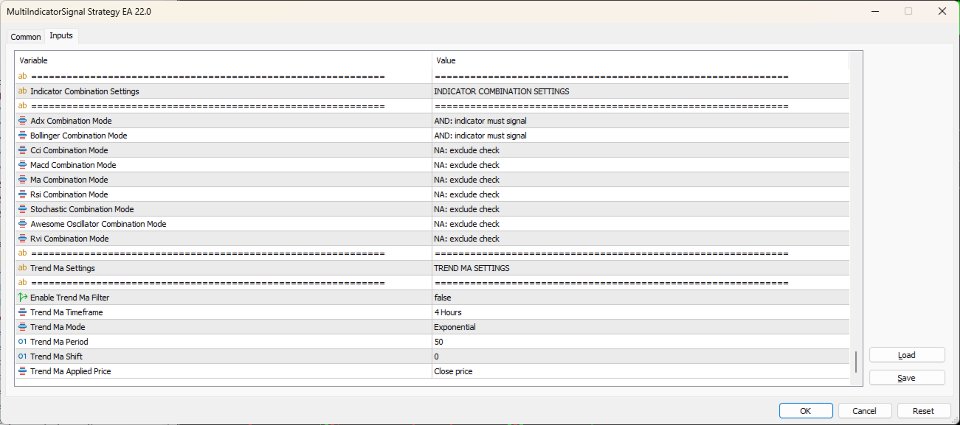

- Flexible entry/exit strategies with AND/OR/NA combination modes for tailored signal logic.

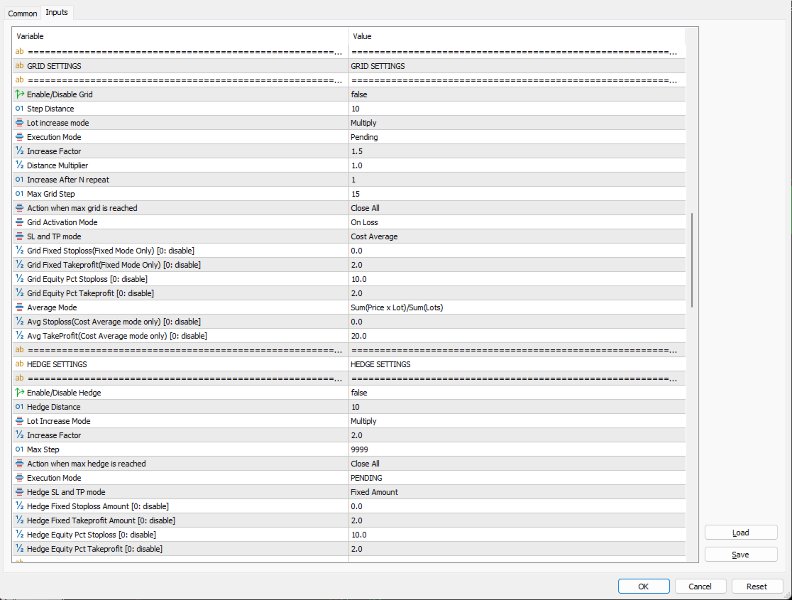

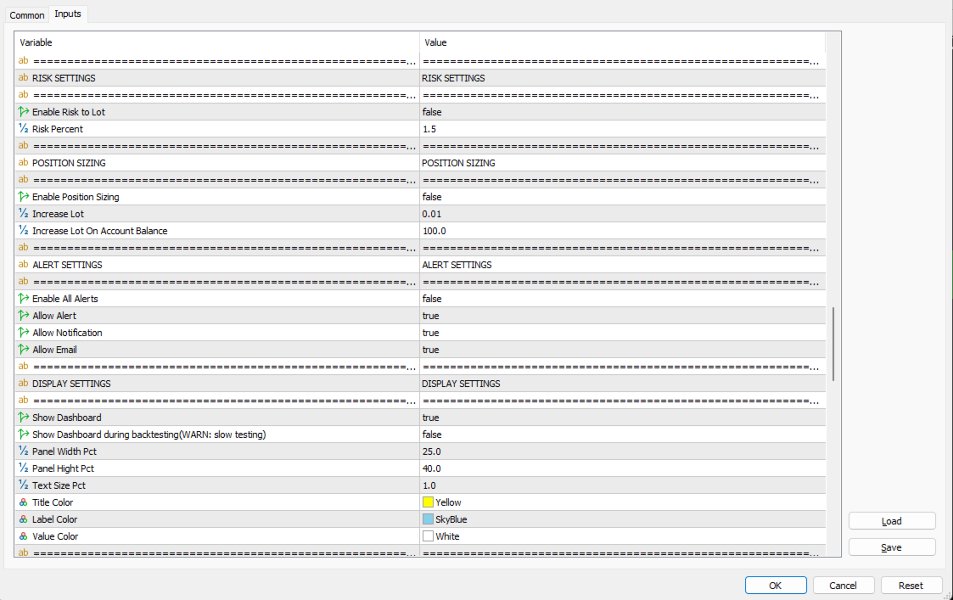

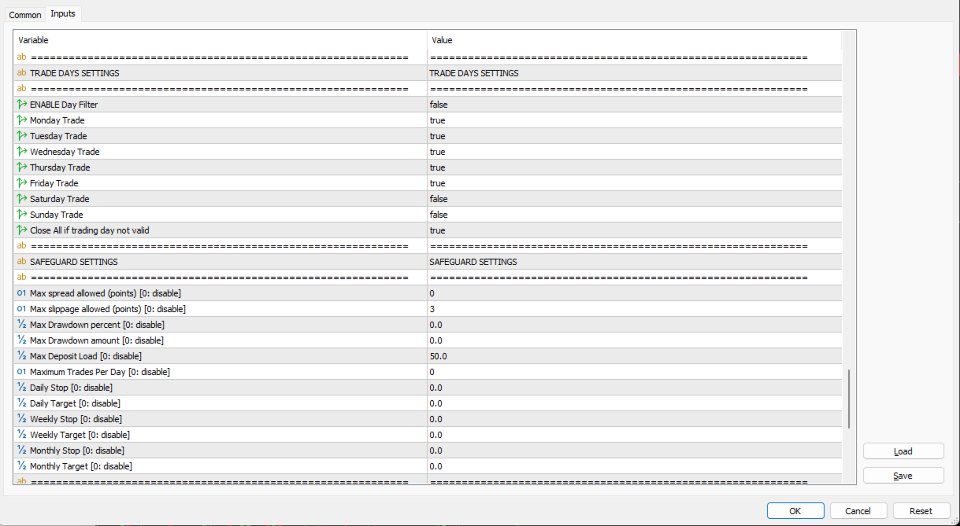

- Advanced risk management with Stop-Loss, Take-Profit, and loss recovery options (Grid, Hedge, Martingale).

- Trend filter using a higher timeframe Moving Average for enhanced trade accuracy.

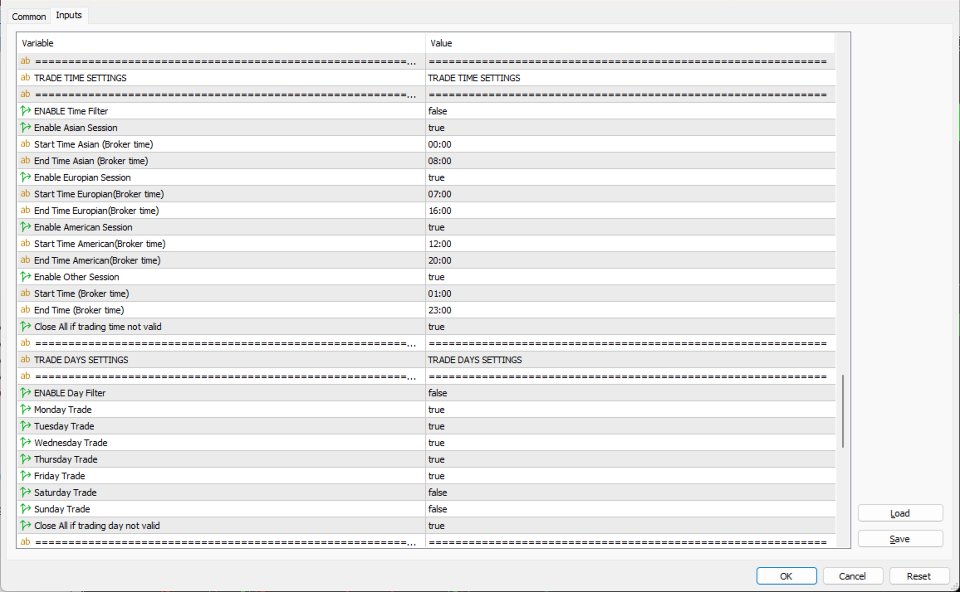

- Day/time filters for session-specific trading to optimize performance.

- Real-time dashboard displaying trade details, account metrics, and system status.

- Pop-up, email, and push notifications for timely updates.

- MQL5 VPS compatible for reliable 24/7 operation.

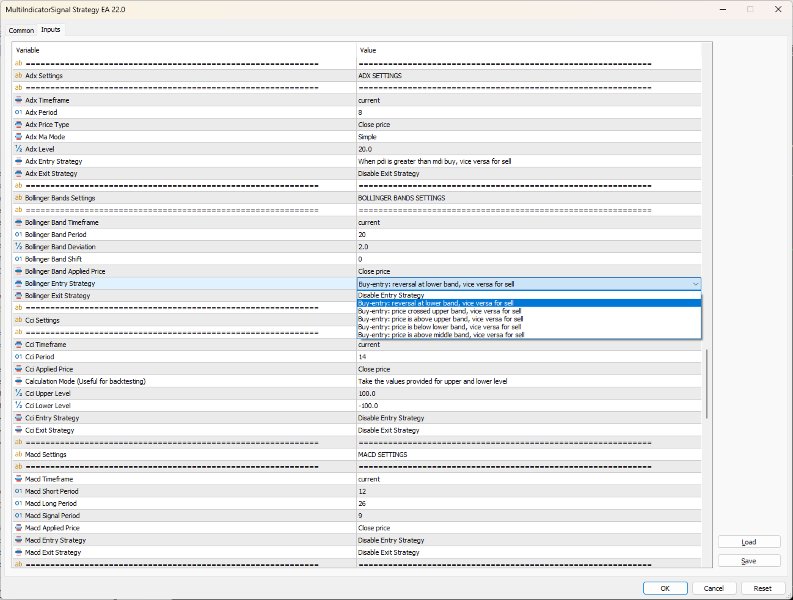

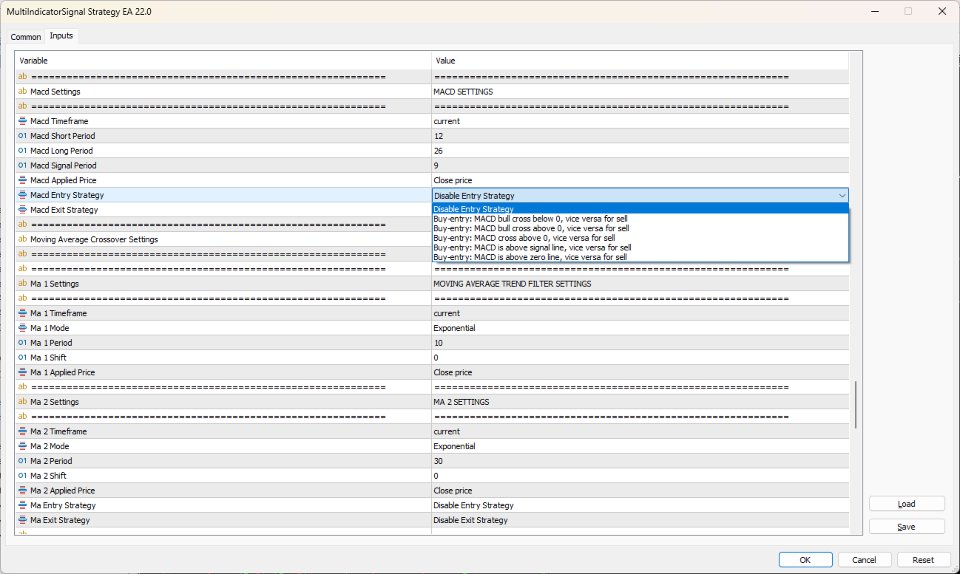

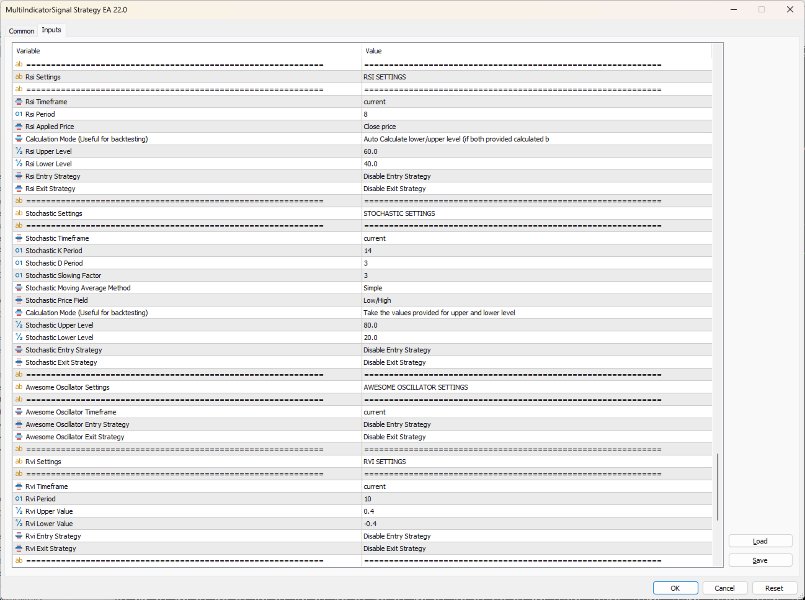

Indicator Strategies Overview:

Each indicator supports multiple configurable entry and exit strategies. Key examples include:

- ADX: Buy when +DI exceeds -DI (PDI > MDI); sell when below. Buy when ADX crosses above a threshold; sell when below.

- Bollinger Bands: Buy on reversal at lower band; sell at upper band. Buy when price exceeds middle band; sell when below.

- CCI: Buy when CCI enters oversold; sell when overbought. Buy when CCI crosses above zero; sell when below.

- MACD: Buy on bullish cross below zero; sell on bearish cross above. Buy when MACD exceeds signal line; sell when below.

- Moving Average: Buy on fast MA crossing above slow MA; sell when below. Buy when price is above fast MA; sell when below.

- RSI: Buy when RSI crosses above 50; sell when below. Buy when RSI is below lower level; sell when above upper level.

- Stochastic: Buy when %K crosses above 50; sell when below. Buy on %K/%D crossover below oversold; sell above overbought.

- Awesome Oscillator: Buy when AO crosses above zero; sell when below. Buy on bullish saucer pattern; sell on bearish.

- RVI: Buy when main line crosses above signal; sell when below. Buy when main exceeds upper level; sell when below lower level.

- Exit Strategies: Mirror entry strategies with reversal logic (e.g., RSI buy-exit on cross below 50).

Note: Multi Indicator Strategy EA MT4 is a professional trading tool that enhances decision-making through multi-indicator signals. It requires careful configuration of indicator parameters, entry/exit strategies, and risk management settings to align with your trading goals and risk tolerance. Thorough testing in a demo environment is essential to optimize performance and mitigate risks associated with automated trading and loss recovery strategies.

Important Advice:

This is a professional trading tool, not a guaranteed profit system. The complexity of multi-indicator signals and loss recovery strategies (Grid, Hedge, Martingale) can lead to significant risks if not properly managed, particularly in volatile markets. To ensure effective use:

- Test thoroughly on a demo account before deploying on a live account to understand signal behavior and risk exposure.

- Regularly review and adjust settings based on market conditions. Check the MQL5 Blog links above for the latest recommendations, backtests, and configuration guidelines.

Check all my products: https://www.mql5.com/en/users/biswait50/seller

Contact me for support: https://www.mql5.com/en/users/biswait50

Interested in a free 7-day trial? Feel free to reach out to me via my profile section.

This is the second EA I have bought from this developer and I have found both the product and the developer himself to be very helpful on both occasions. I chose the Multi Indicator Strategy EA because I wanted one that only opened trades when there is a strong chance they won't go in the wrong direction as I am trying to grow a very small account. Because you can set a confluence of many different indicators using this EA you can reduce the probability of it opening bad trades very effectively. Also, as with all this developer's other EAs, there are a multitude of risk reduction and money management settings built in which, if you know how to use them well, can limit your risks of loss even further. Once I started back testing I had a few questions and the developer was very quick to respond, and very open to making slight tweaks where they might be needed. Because this EA is so comprehensive with both Money/Risk management and with the checks and balances it makes before entry, I find it to be very good indeed for handling the growth of a small account, and of course this could be amplified with larger accounts too.