版本 15.0

2025.07.10

1. Trailing stop and breakeven added for grid and hedge

版本 14.0

2025.07.09

1. For a single trade with no sl and tp , hedge sl and tp is not considered

版本 13.0

2025.07.06

1. Avoid trailing for Grid and hedge Orders

2. Avoid breakeven for Grid and hedge Orders

版本 12.0

2025.07.02

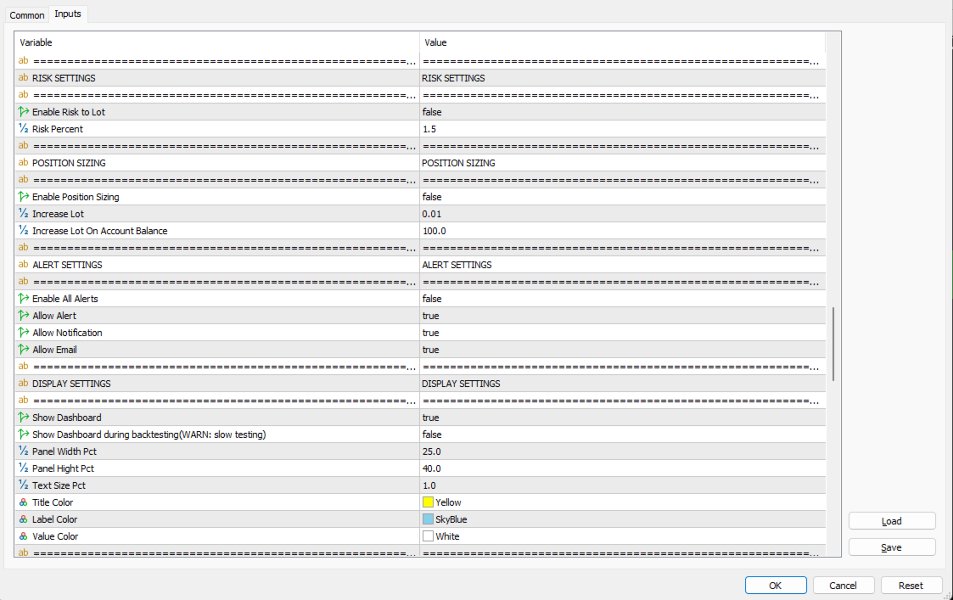

1. Dashboard look and feel updated

2. Dashboard resize issue fixed

3. Current entry and exit strategy is displayed in dashboard

4. Ontester method for custom max optimization

5. Text resize issue on dashboard fixed

6. Formatted input section for trend max

版本 11.0

2025.06.18

Fixes applied

-------------------------------------

1. New entry and exit strategies added

版本 10.0

2025.06.18

Fixes applied

-------------------------------------

1. Moved volume check logic before trade placement

2. Moved available money check logic before trade placement

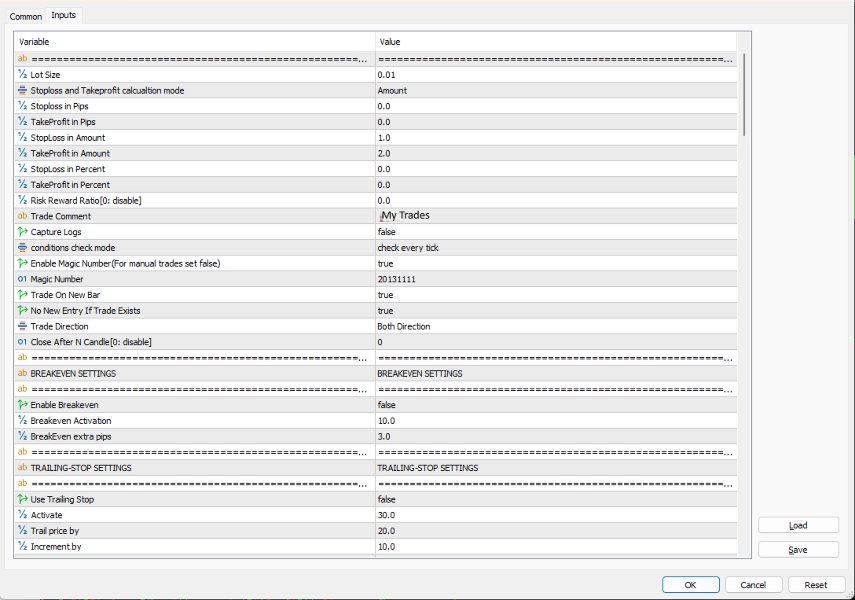

3. Default lot size can be put as 0 in case of risk percent mode

版本 9.0

2025.06.12

Fixes applied

-------------------------------------

1. Risk to Lot logic is upgraded. Now we dont need to put risk per microlot

2. It works with all stoploss modes Pips, Amount and Percent

3. Check added in validation logic, where it checks

When sltp mode is amount the stoploss amount cant be greater than risk amount

when sltp mode is percentage the stoploss percent cant be greater then risk percent

4. in amount and percent mode tp is calculated based on the calculated lot size

example

symbol -EURUSD

Account balance -1000

risk percent -1

stoploss amount - 1

takeprofit amount - 2

Lot size -0.1

if stoploss hit loss would be - 10

if tp hit profit would be - (risk amount(10)/stoploss amount (1))* takeprofit amount (2) which is = 20

now for percent mode

symbol -EURUSD

Account balance -1000

risk percent -1

stoploss percent - 0.5

takeprofit percent - 1.5

Lot size -0.02

if stoploss hit loss would be - 10

if tp hit profit would be - (risk percent(1.5)/stoploss amount (0.5))* takeprofit amount (15) which is = 30

版本 8.0

2025.06.09

Fixes applied

-------------------------------------

Total close order check before trade placement

other minor fixes

版本 7.0

2025.05.30

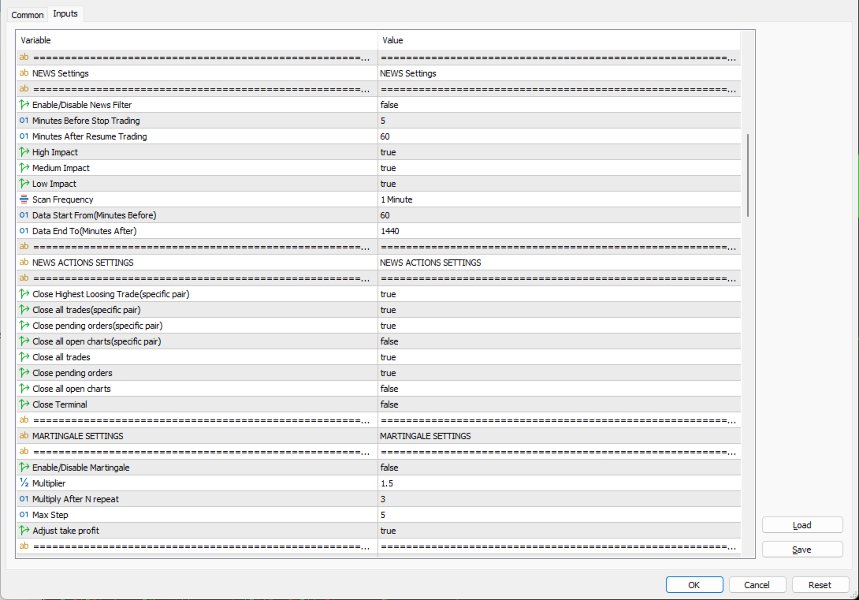

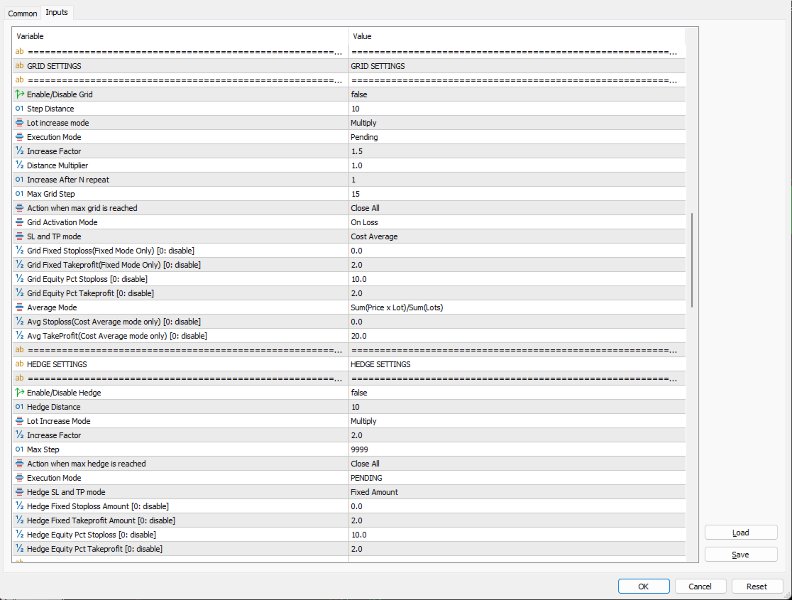

1. Fixed max hedge logic.

2. Added two inputs

MAX_GRID_ACTION(Action when max grid is reached)

GRID_DO_NOTHING=1, // Do Nothing ( keep the main and grid position open)

GRID_CLOSE_ALL=2 // Close All (Close all when one more grid level is reached than the max allowed grid step)

MAX_HEDGE_ACTION(Action when max hedge is reached)

HEDGE_DO_NOTHING=1, // Do Nothing ( keep the main and hedge position open)

HEDGE_CLOSE_ALL=2 // Close All (Close all when one more hedge level is reached than the max allowed hedge step)

版本 6.0

2025.05.29

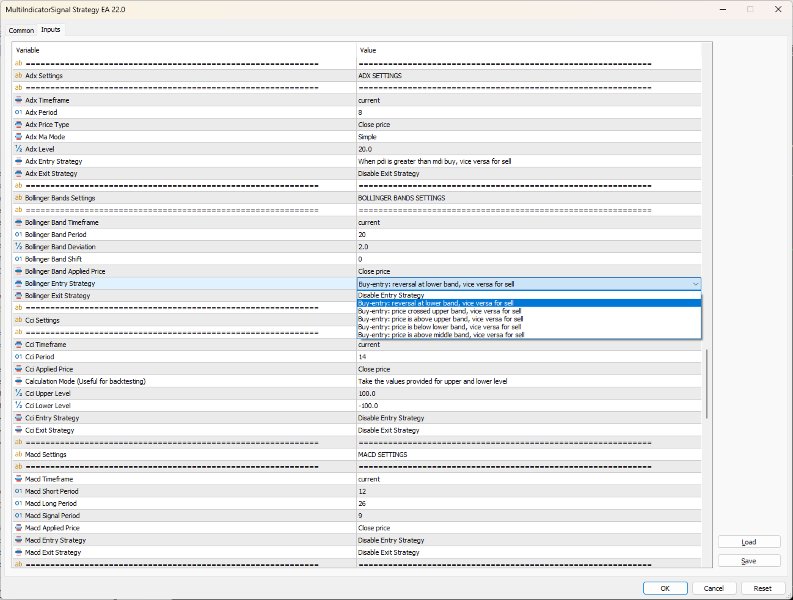

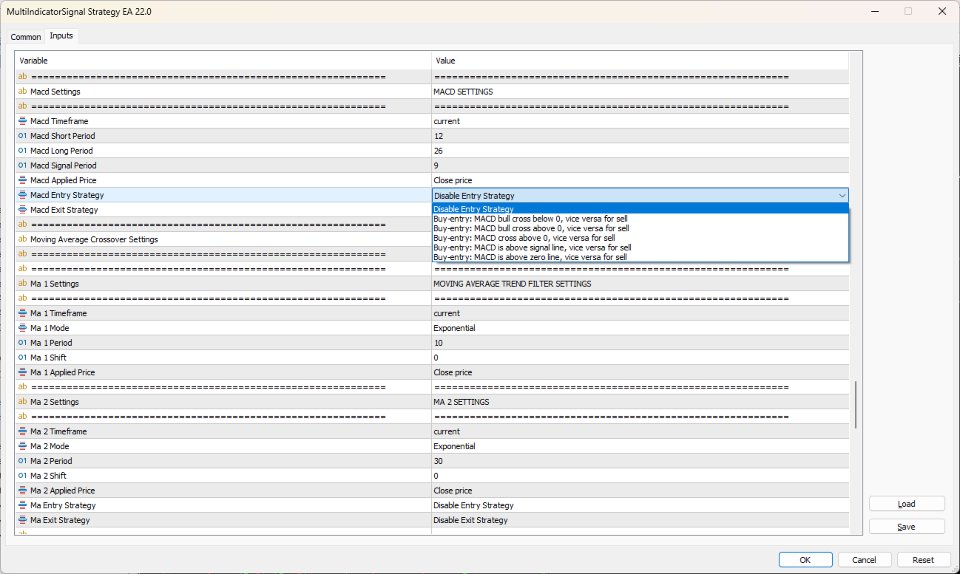

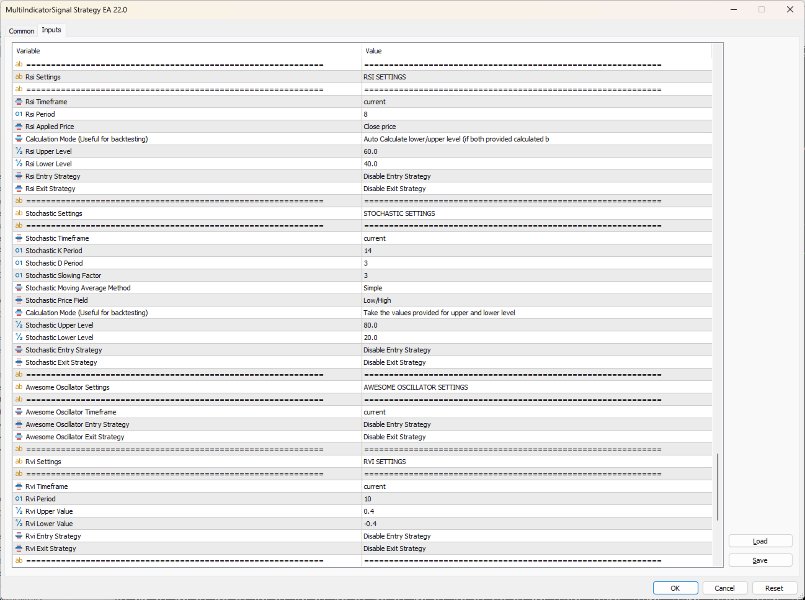

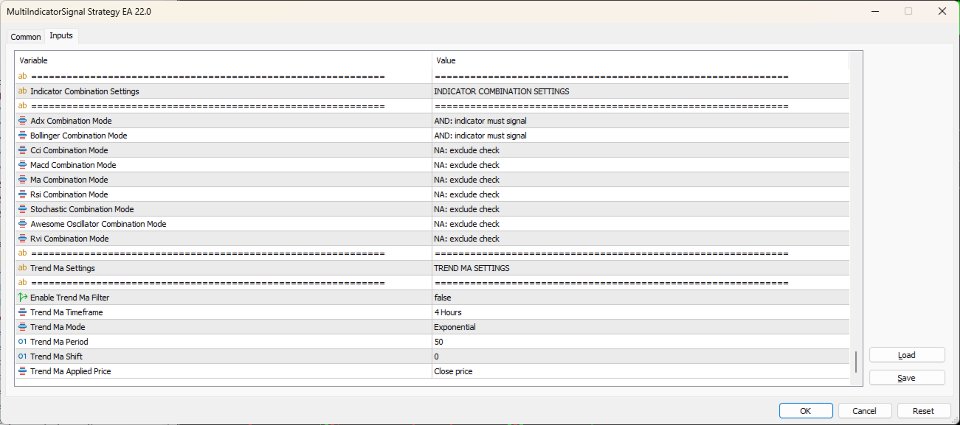

I updated your MQL5 trading system to incorporate exit signals for all indicators (ADX, Bollinger Bands, CCI, MACD, Moving Average, RSI, Stochastic, Awesome Oscillator, RVI). The GetCombinedExitSignals function mirrors GetCombinedEntrySignals, generating buyExitSignal and sellExitSignal using AND/OR combination modes. Added ENUM_AO_EXIT_STRATEGY and ENUM_RVI_EXIT_STRATEGY with inputs aoExitStrategy and rviExitStrategy, matching their entry strategies (e.g., AO: cross below zero, RVI: main below signal). Exit conditions were derived from entry signals, reversing logic for buy exits (e.g., RSI STRATEGY5: cross below 50) and using buy-entry conditions for sell exits. The combination mode section includes a heading and inputs for all indicators. The code uses Get<Indicator>Values() for data, with early returns on failure. All indicators retain original and new strategies, ensuring consistency with your provided conditions and "vice versa" logic, integrated with AND/OR aggregation for flexible signal combination.

版本 4.0

2024.11.17

lots of performance improvement and bug fixes

版本 3.0

2023.12.18

rvi 0 check is added

版本 2.0

2023.12.18

lots of improvement is done

new indicators

bug fixes

dashboard

版本 1.20

2022.12.18

Fixed martingale volume

some cosmetic text changes

This is the second EA I have bought from this developer and I have found both the product and the developer himself to be very helpful on both occasions. I chose the Multi Indicator Strategy EA because I wanted one that only opened trades when there is a strong chance they won't go in the wrong direction as I am trying to grow a very small account. Because you can set a confluence of many different indicators using this EA you can reduce the probability of it opening bad trades very effectively. Also, as with all this developer's other EAs, there are a multitude of risk reduction and money management settings built in which, if you know how to use them well, can limit your risks of loss even further. Once I started back testing I had a few questions and the developer was very quick to respond, and very open to making slight tweaks where they might be needed. Because this EA is so comprehensive with both Money/Risk management and with the checks and balances it makes before entry, I find it to be very good indeed for handling the growth of a small account, and of course this could be amplified with larger accounts too.