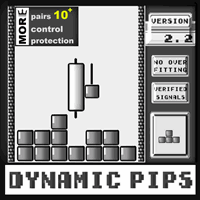

The Bitcoin Reaper

- Experts

- Profalgo Limited

- Version: 2.1

- Updated: 30 August 2025

- Activations: 10

LAUNCH PROMO:

- Only a very limited number of copies will be available at current price!

- Final Price: 999$

- NEW (from 349$) --> GET 1 EA FOR FREE (for 2 trade account numbers).

Welcome to the BITCOIN REAPER!

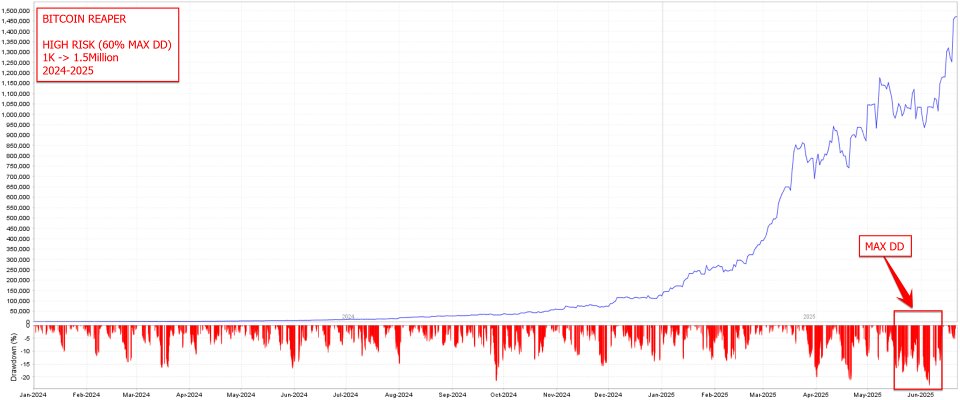

After the Tremendous success of the Gold Reaper, I decided it is time to apply the same winning principles to the Bitcoin Market, and boy, does it look promising!

I have been developing trading systems for over 2 decades now, and my speciality "by far" are the Breakout Strategies.

This simple but effective strategy has a way of staying in the top of all-time best trading strategies and can be applied to basically any market. And for a volatile market like Bitcoin, it really shines!

So how does the strategy work?

The breakout strategy will trade the breakouts of important support and resistance levels. It will use a stoploss, take-profit and various trailing stoploss functions for each trade.

For the Bitcoin Reaper, I implemented this for the H1 timeframe, which makes it trade frequently, but still very effectively.

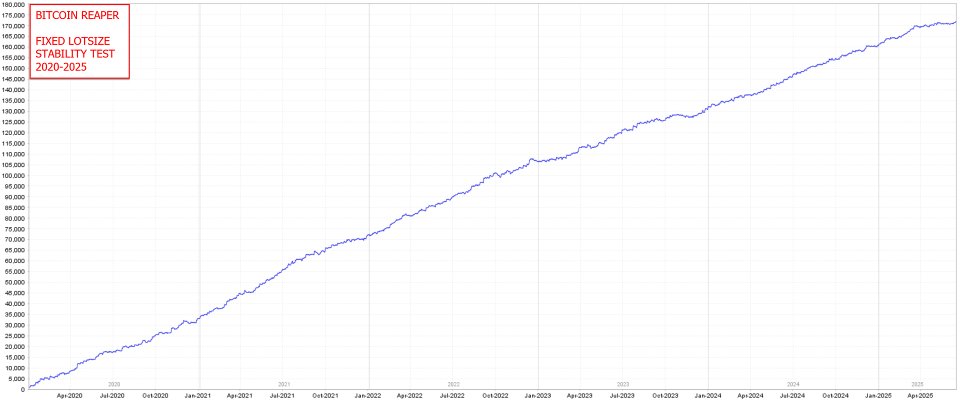

Also, I made sure that the EA will auto-adapt to future price changes in Bitcoin. So if Bitcoin is trading around 100K, or around 10K, or around 1Million,

the EA will automatically adjust all entry and exit parameters and no re-optimization will be needed!

Diversification is King!

Instead of relying on 1 strategy alone, I have implemented 10 different strategies, which are all perfectly balanced into this 1 EA.

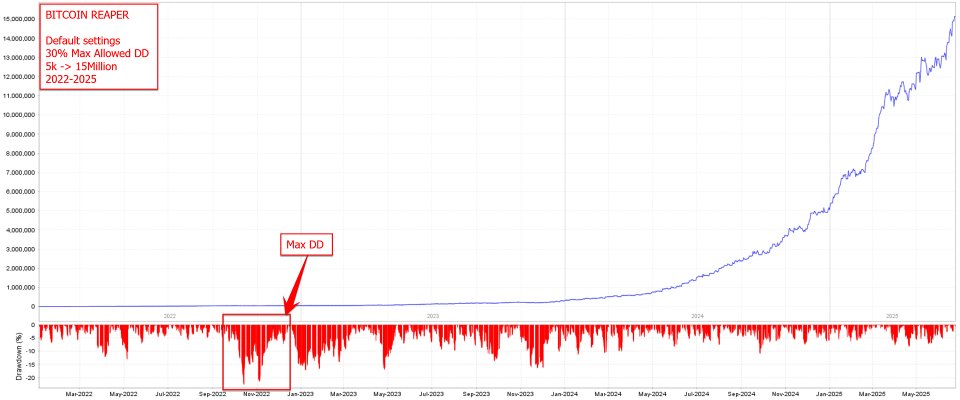

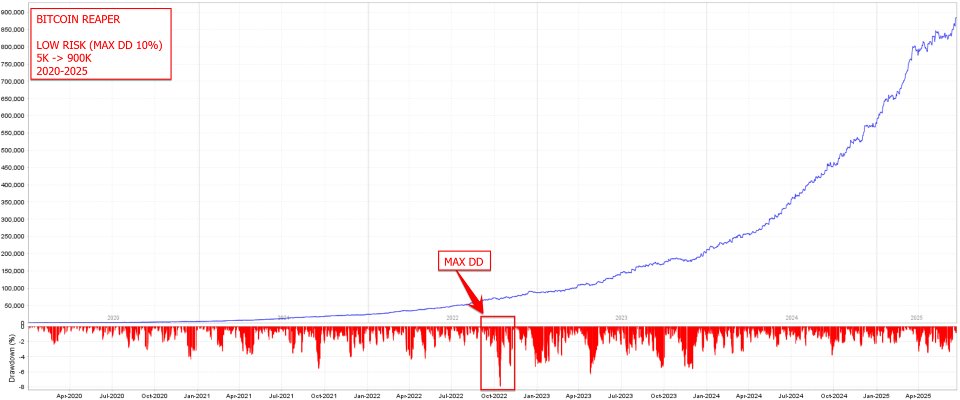

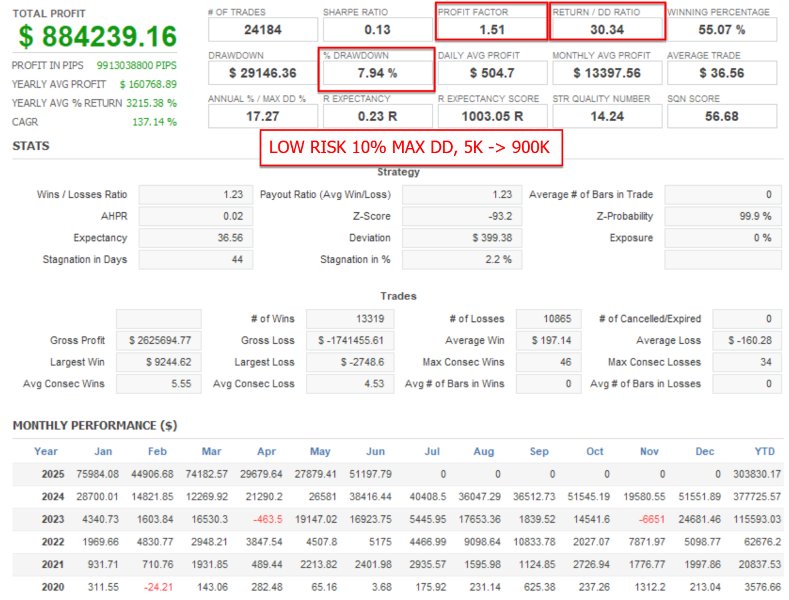

Also, I made it extremely easy to set it up: you simply choose your desired “max allowed total drawdown” value,

and the EA will do everything automatically -> from selecting which strategies to run, to perfectly setting the risk for each individual strategy.

And good news for Prop firm traders: it’s 100% compatible!

Key features:

- 10 different strategies to spread the risk and create the most stable performance

- Each trade protected with a safe stoploss

- Trailing Stoploss and Trailing Takeprofit algorithms will limit risk and increase potential profits

- Super Easy setup: simply choose your desired maximum drawdown level.

- 1 chart only: all 10 different strategies are run from 1 single H1 chart

- EA will automatically adjust to Bitcoin price -> so all stoploss, Takeprofit, TrailingSL, etc, but also entry criteria, are all variable and automatically adjusted over time, based on the actual price of Bitcoin

- PROP FIRM READY

- 2 decades of experience in creating robust trading systems is poured into this

HOW TO SET UP:

Simply run on Bitcoin H1 Chart, and set your risk, using the "max allowed total drawdown" parameter.

To make it even more easy, I made some set files for low -> high risk, and for prop firms. you can download the here

IMPORTANT:

- For AUTO_GMT TO WORK -> you must add the URL "https : // www . worldtimeserver.com/" (remove spaces!!) to the "allowed URL's" in your MT4/MT5 terminal (tools -> options -> expert advisors)

- You might need to remove the "volume limit" and "maximum volume" limit for bitcoin in the strategy tester to see the real potential. I explain how to do in this post

Requirements:

- A broker with a low spread in highly recommended! (contact me for my personal recommendations)

- Minimum balance: 150$

- Leverage: 1:100 or more is recommended

Parameter Overview:

- ShowInfoPanel -> display the information panel on the chart

- Adjustment for Infopanel size -> in case of 4K display, set value to "2"

- update infopanel during testing -> disabled for faster backtesting

SETTINGS

- Allow Buy Trades / Allow Sell Trades -> here you can enable/disable buy trades and sell trades

- Maximum allowed spread: maximum spread for pending orders to be allowed

- SetSL_TP_After_Entry -> enable only if your broker doesn't allow pending orders with SL and TP

- Use Virtual Expiration -> enable only if your broker doesn't allow pending order with expiration date

- BaseMagicNumber -> the base magicnumber that will be used for all strategies

- Comment for trades -> the comment to be used for the trades

- RemoveCommentSuffix -> Remove the strategy name from the comment

TRADE FREQUENCY SETUP

- Trade Frequency -> here you can set the trade frequency, which will basically select which strategies to run. I recommend using “auto” if you are not sure which one is best for you.

GMT SETTINGS

- AutoGMT -> let the EA calculate the correct GMT offset for your broker, so that the time of NFP will be correct

- GMT_OFFSET_Winter -> for setting the GMT Offset manually in the wintertime (when AutoGMT is off, or during backtesting!)

- GMT_OFFSET_Summer -> for setting the GMT Offset manually in the summertime (when AutoGMT is off, or during backtesting!)

NFP FILTER

- EnableNFP_Filter -> turn the NFP filter on or off

- NFP_CloseOpenTrades -> force the EA to close all open trades when NFP starts (X minutes before NFP)

- NFP_ClosePendingOrders -> force the EA to delete all pending orders when NFP starts (X minutes before NFP)

- NFP_MinutesBefore -> how many minutes before the NFP event, to close trades and pending orders

- NFP_MinutesAfter -> how many minutes after the NFP event, before the EA resumes trading again

- Propfirm unique settings -> here you can adjust various entry and exit parameters to make the EA trade differently from other users

- CPI/IR FILTER -> these parameters are comparable with the NFP parameters explained above

PROP FIRM UNIQUE TRADES SETTINGS

- Randomization -> this will randomize the entries, exits and TrailingSL values a bit, so that multiple users on the same broker, will have a bit different trades. Also good for prop firms. Good value is "50"

- AdjustEntry/AdjustSL/etc -> here you can enter an offset (in pips) to the entry and/or exit parameters that are used internally

RISK SETTINGS

- Set Balance To Use Manually: here you can set a fixed balance value that you want the EA to use for risk calculations.

- Max Allowed Total DD: The prefered maximum allowed total drawdown (in %). The EA will then determine lotsize and trade frequency (when that is set to “auto”) based on the historical max DD of the EA. It will NOT prevent the EA from trading further once that max drawdown would be reached.

- Set Max Daily Drawdown -> Here you can set a maximum allowed daily drawdown (in %). If it is reached, the EA would close all trades and pending orders, and wait for the next day. This is usefull for prop firms

- Lotsize OnlyUp -> this will prevent lotsize to decrease after losses or if balance decreases

- Check Margin -> Use when the EA has problems setting trades on your broker because of low margin, while there is sufficient margin

- Use Equity instead of Balance -> use Equity of the account to calculate all lotsize values

TRADING HOURS

- Use Trading Timezone -> this will enable/disable the use of the trading hours filter

- KillPending -> when enabled, the pending orders will be removed when outside of trading hours

- KillOpen -> when enabled, the open trades will be closed once the time goes outside of the trading hours

- Time_Source -> here you can select which “clock” to use for the trading hours

- Monday -> Sunday time settings à here you can set the start and stop time for all days

For those that don’t know me yet: all my EA’s go through a rigorous process of testing, stress-testing, robust optimization to make sure that the EA will not simply be some nice backtest-EA.

I don't use any 'neural network/machine learning AI/ChatGPT/Quantum computer/perfect straight line backtests' sales talk, but instead, I offer a real, honest trading system,

based on proven methodology for development and live execution.

As a developer, I have +15 years of experience in creating automated trading systems. I know what has the potential to work and what has not.

I create honest systems, with the highest probability of live trading matching the backtests, without cheating.

Also, there is a very enthousiastic group of existing clients, ready to share their experiences about my EA's: join the public group here

This is my third product from Wim. There have been ups and downs—especially during BTC's prolonged sideways movement, which impacted my decision to keep running the EA. However, Wim listens to feedback from the group and has recently added features like an aggressive SL, which I really appreciate. I'm satisfied and feel lucky to have invested in this EA—it’s been worth it so far. We'll see how things play out, but for those seeking a long-term EA, TBR is definitely one to consider. I can recommend it!

Update: 3/09/2025 I legit love this ea day by day. Aggressive SL has been my fav feature. Keep it up Wim!