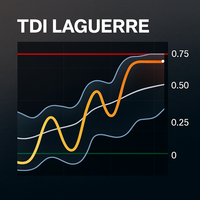

Laguerre RSI Classic

- Indicators

- Andres Felipe Carvajal Rodriguez

- Version: 1.1

- Updated: 8 August 2025

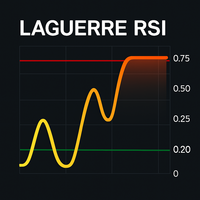

Laguerre RSI: An Advanced Oscillator for Market Analysis

The Laguerre RSI is an advanced oscillator based on digital filters, developed by John Ehlers. This indicator smooths price fluctuations using a technique called the Laguerre filter, allowing for more precise detection of overbought and oversold zones while reducing market noise.

The Laguerre RSI oscillates between 0 and 1, with standard levels set as follows:

- Overbought: above 0.75

- Oversold: below 0.25

This indicator is ideal for detecting market turns, precise entries, and signal confirmations.

Optional Features

The Laguerre RSI includes optional functionalities such as:

- Sound, email, or push alerts

- Visual filling between critical zones

- Flexible smoothing parameter (gamma)

User Manual

Configurable Parameters:

1. Main Configuration

- gamma (0.1 to 0.9):

- Controls the degree of smoothing.

- Lower values → more sensitivity, more signals.

- Higher values → greater smoothness, less noise.

- overbought / oversold:

- Levels for marking extreme zones.

- Default:

- overbought = 0.75

- oversold = 0.25

2. Visual Appearance

- mainLineColor: Color of the main Laguerre RSI line.

- lineWidth: Thickness of the line.

- overboughtColor / oversoldColor: Colors of guide lines for key levels.

- fillBackground: Activates or deactivates filling between levels.

- fillColor: Color of the background zone (neutral).

3. Alerts

- alertsEnabled: Activates sound alerts when entering critical zones.

- emailAlerts / pushAlerts: Sends alerts via email or mobile notifications.

- alertPrefix: Custom text at the beginning of the alert message.

Suggested Strategies

Strategy 1: Confluence with MACD (D1 + H1)

Objective: To trade only in favor of the larger trend, using the Laguerre RSI as a trigger on lower timeframes.

Step-by-step:

- Open the chart in the daily timeframe (D1).

- Apply the standard MACD (12, 26, 9).

- If the MACD is below 0 → only look for SELLS.

- If the MACD is above 0 → only look for BUYS.

- Switch to the H1 timeframe.

- Apply the Laguerre RSI.

Combined Strategy with MACD and Laguerre RSI

When the MACD on the daily timeframe (D1) is below 0, the overall trend is bearish.

- In that case, switch to H1 and wait for the Laguerre RSI to cross downwards from the 0.75 level. This indicates a selling opportunity.

When the MACD on D1 is above 0, the trend is bullish.

- Then, switch to H1 and wait for the Laguerre RSI to cross upwards from the 0.25 level. This signals a good buying opportunity.

Advantages:

- Superior trend filter + entry precision.

- Reduces false signals.

- Increases success probability.

Strategy 2: Extreme Reversals

Wait for the Laguerre RSI to reach extremes (≈ 0 or ≈ 1) and then return to the middle range (0.5) to consider a reversal.

Strategy 3: With Support/Resistance

Combine the Laguerre RSI with key horizontal price levels. Enter when the price touches support/resistance and the RSI is in the opposite zone (buy at support + RSI < 0.25).

Final Recommendation

Use the Laguerre RSI as a complement to your analysis, not as a sole signal. It can be especially powerful when combined with:

- MACD

- Market structure

- Price action

User didn't leave any comment to the rating