Correlation Nexus

- Indicators

- Andres Felipe Carvajal Rodriguez

- Version: 1.0

- Activations: 20

Correlation Nexus

Correlation Nexus: Master the Direct or Inverse Relationship Between Pairs

Correlation Nexus is an advanced technical indicator for MetaTrader 5 that detects trading opportunities based on the statistical correlation between two financial instruments. This system allows traders to profit from both positive (direct) correlations and negative (inverse) correlations, adapting dynamically to different currency pairs, indices, or commodities.

Unlike conventional tools, this indicator doesn't operate in isolation. Its logic combines real statistical correlation, confirmatory technical analysis, and a visually clear signal system with a control panel that lets you act with greater precision and confidence.

How It Works

-

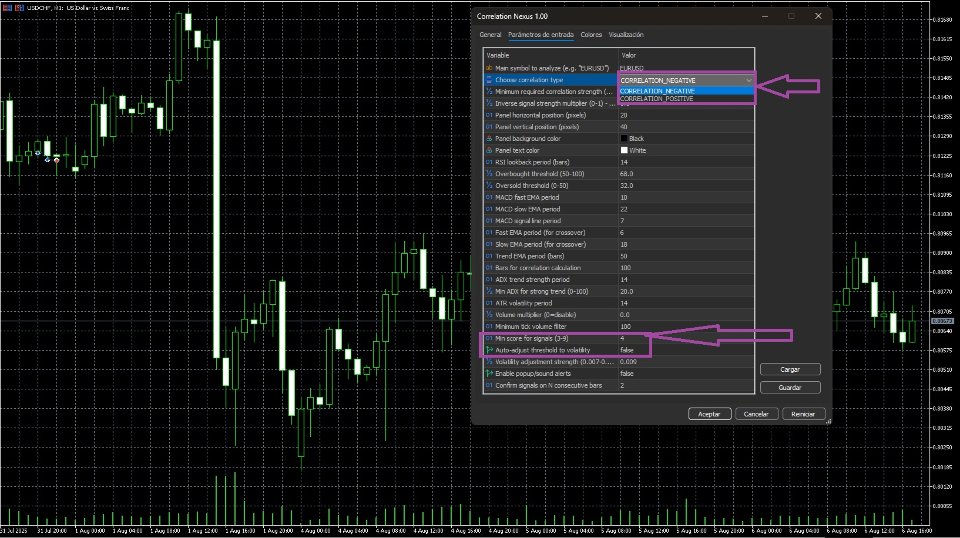

Choose a primary pair ( symbol_to_analyze ) and enter it in the indicator's settings.

-

Open a chart for the secondary pair (where you'll apply the indicator).

-

Select the type of correlation you want to trade:

-

Negative (Inverse) Correlation: Opposite signals between the pairs.

-

Positive (Direct) Correlation: Synchronized signals between the pairs.

-

-

The indicator continuously evaluates the relationship between the two assets. A signal will only be generated when the technical analysis of the primary pair is strong enough and the selected correlation threshold is met.

Types of Correlation and Examples

| Correlation Type | Recommended Pairs | Signal Logic | Example |

| Negative (Inverse) | EUR/USD ↔ USD/CHF </> XAU/USD ↔ DXY | BUY on primary → SELL on secondary | BUY on EUR/USD → SELL on USD/CHF |

| Positive (Direct) | AUD/USD ↔ NZD/USD </> EUR/USD ↔ GBP/USD | BUY on primary → BUY on secondary | BUY on AUD/USD → BUY on NZD/USD |

Double Threshold System

To ensure the highest quality signals, Correlation Nexus uses a double-validation system with separate, user-configurable thresholds.

-

Correlation Threshold ( min_correlation_strength )

-

Defines the strength of the relationship between the pairs.

-

Default Value: 0.8 . This means signals will only be activated if the correlation is ≥ +0.8 (for positive) or ≤ -0.8 (for negative).

-

Customizable Threshold: Users can adjust this value according to their strategy, for example, to 0.6 for more signals or 0.9 for higher precision.

-

-

Score Threshold ( score_threshold )

-

Defines the strength of the technical analysis signal.

-

The indicator assigns a score to each buy or sell signal based on multiple indicators (RSI, MACD, EMAs, etc.).

-

Fixed Threshold: Users can manually define a minimum score to validate signals, with a recommended range between 3 and 9.

-

Default Value: 4 (recommended).

-

4 : more flexibility, more signals.

-

6 : a more conservative approach, fewer signals.

-

This option is ideal for those who prefer to maintain control over the system's sensitivity.

-

-

Dynamic Threshold:

-

When this option is enabled, the threshold automatically adjusts based on market volatility, measured by the ATR (Average True Range).

-

Adjustment Range: between 4 and 9 , with an average value between 5 and 6 .

-

Under normal conditions, it rarely drops to 4 or rises to 7, and almost never reaches 8 or 9.

-

High values: more restrictive, fewer signals, higher precision.

-

Low values: more signals, greater flexibility, but less filtering.

-

This option is useful in changing environments where the system needs to adapt automatically.

-

-

Key Features

-

Dual Mode: Operates with inverse or direct logic based on the type of correlation.

-

Integrated Technical Analysis: Validates signals with tools like RSI, MACD, EMAs, and ADX.

-

Interactive Panel: Displays signal strength, correlation type, and score in real time.

-

Double Quality Threshold: Combines a correlation threshold and a score threshold to filter signals.

-

Risk Management: Advanced filters for volume (tick) and volatility (ATR) to trade only under optimal conditions.

-

Compatible with multiple symbols and timeframes.

-

Supports visual, sound, and notification alerts.

Strategic Advantages

-

Avoids false signals: by requiring real statistical correlation plus technical confirmation.

-

Allows trading of less volatile pairs based on the logic of major pairs (e.g., using EUR/USD to trade USD/CHF).

-

Ideal for statistical arbitrage or cross-trading between indices, currencies, and metals.

-

Flexible for multiple strategies: day trading, swing trading, or partial automation.

Final Recommendation

If you're looking for a reliable, visual, and powerful tool that combines statistical and technical analysis, Correlation Nexus gives you a real competitive advantage by allowing you to trade the relationship between assets and not just their individual price.

You're no longer limited to trading a single pair: you can see the market as an interconnected system and make decisions based on how assets move relative to each other.