MultiFrame Momentum

- Indicators

- Andres Felipe Carvajal Rodriguez

- Version: 1.1

- Updated: 11 August 2025

- Activations: 20

MultiFrame Momentum Indicator

The MultiFrame Momentum is an advanced indicator that analyzes momentum strength and direction across multiple timeframes. It combines price patterns with dynamic volatility to generate more precise signals. It uses an intelligent weighting system that automatically adjusts the influence of each timeframe based on its recent activity (ATR-based), making it ideal for trading in markets with changing volatility, such as Forex, indices, or cryptocurrencies.

How to Use It

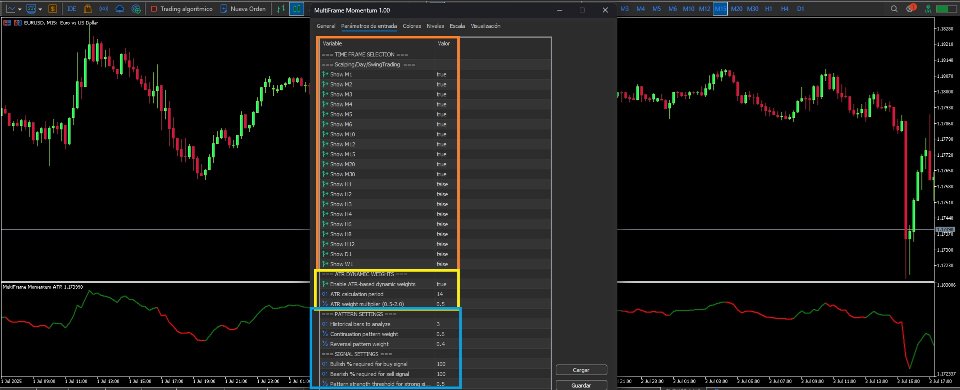

1. Initial Configuration

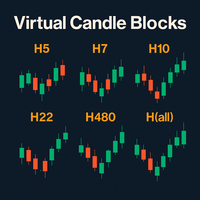

Timeframe Selection: Activate/deactivate timeframes according to your strategy:

-

Scalping: M1-M30

-

Day Trading: M15-H4

-

Swing Trading: H1-W1

Dynamic Weights (ATR):

-

UseDynamicWeights: Activates/deactivates automatic weight adjustment (recommended: ON).

-

ATR_Period: Period for calculating volatility (e.g., 14 for balance, 7 for higher sensitivity).

-

ATR_Multiplier: Intensity of the ATR effect (0.3 = gentle, 1.0 = aggressive).

Pattern Adjustments:

-

ContinuationWeight: Weight given to continuation patterns (e.g., consecutive candles in the same direction).

-

ReversalWeight: Weight given to reversal patterns (e.g., candles that reverse direction).

Signal Thresholds:

-

BuyThreshold: Minimum bullish probability percentage for a buy (e.g., 100).

-

SellThreshold: Minimum bearish probability percentage for a sell.

-

StrongSignalThreshold: Minimum pattern strength for reliable signals (e.g., 0.5).

2. Signal Interpretation

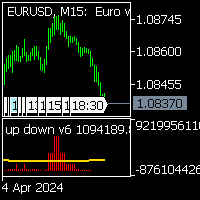

Green Line:

-

Condition: Bullish probability > BuyThreshold + pattern strength > StrongSignalThreshold .

-

Action: High-confidence buy signal.

Red Line:

-

Condition: Bearish probability > SellThreshold + pattern strength < -StrongSignalThreshold .

-

Action: High-confidence sell signal.

3. Additional Filters

Analyzed History ( HistoryBars ):

-

Number of previous candles evaluated in each timeframe (e.g., 3 = analyzes the last 3 candles).

Adaptive Volatility:

-

Timeframes with higher ATR (volatility) are automatically weighted more heavily, filtering out sideways markets.

Recommended Strategies

For Scalpers (M1-M15)

Quick Signals:

-

Buy when the line is green and the price closes above the upper Bollinger band (20,2).

-

Sell when the line is red and the price closes below the lower band.

Risk Management:

-

Use dynamic stops based on the ATR of the traded timeframe (e.g., 1.5 x current ATR).

For Swing Traders (H1-D1)

Volume Confirmation:

-

Filter signals where volume is > 30% of the average of the last 50 candles.

Divergences:

-

If the line is green but the price makes lower lows, wait for a close above the previous high.

For Cryptocurrencies

Recommended Settings:

-

ATR_Period = 10 (higher sensitivity to sudden changes).

-

ATR_Multiplier = 0.7 (balance between reactivity and stability).

-

Avoid trading on timeframes < M5 during significant news events.

Key Advantages

-

More Precise Signals: Combines real-time price patterns and volatility.

-

Adaptability: Works equally well in trending or sideways markets.

-

Customization: Adjustable to any trading style (scalping, swing, position).

Note: For intraday operations, it's recommended to trade during the London and New York sessions.