Technische Indikatoren für den MetaTrader 4

Gann Made Easy ist ein professionelles und einfach zu bedienendes Forex-Handelssystem, das auf den besten Handelsprinzipien unter Verwendung der Theorie von Mr. basiert. W.D. Gann. Der Indikator liefert genaue KAUF- und VERKAUFSsignale, einschließlich Stop-Loss- und Take-Profit-Levels. Mit PUSH-Benachrichtigungen können Sie auch unterwegs handeln. BITTE KONTAKTIEREN SIE MICH NACH DEM KAUF, UM KOSTENLOS HANDELSTIPPS, BONUSSE UND DEN GANN MADE EASY EA ASSISTANT ZU ERHALTEN! Wahrscheinlich haben Si

Pulse Scalping Line - ein Indikator zur Identifizierung potenzieller Pivot-Punkte. Auf der Grundlage dieses Indikators können Sie ein effektives Martingale-System aufbauen. Unseren Statistiken zufolge gibt der Indikator maximal 4 fehlerhafte Pivot-Punkte in einer Serie an. Im Durchschnitt sind es 2 Pivot-Punkte. Das heißt, zeigt der Indikator eine Umkehrung an, ist er fehlerhaft. Das bedeutet, dass das zweite Signal des Indikators sehr genau sein wird. Auf der Grundlage dieser Informationen kön

Die ersten 25 Exemplare zu $80, danach wird der Preis auf $149 erhöht (3 Exemplare übrig)

Gold Signal Pro ist ein leistungsstarker MT4-Indikator, der Händlern helfen soll, starke Preisreaktionen auf dem Markt zu erkennen. Er konzentriert sich auf klare Dochtverwerfungen und zeigt an, wenn der Preis ein Niveau stark zurückweist und oft in dieselbe Richtung weitergeht. Gold Signal Pro wurde hauptsächlich für das Scalping von Gold (XAUUSD) entwickelt und funktioniert am besten auf niedrigeren Ze

Derzeit 20% Rabatt!

Die beste Lösung für jeden Neueinsteiger oder Expert Händler!

Dieses Dashboard arbeitet mit 28 Währungspaaren. Es basiert auf 2 unserer Hauptindikatoren (Advanced Currency Strength 28 und Advanced Currency Impulse). Es bietet einen hervorragenden Überblick über den gesamten Forex-Markt. Es zeigt die Werte der Advanced Currency Strength, die Veränderungsrate der Währungen und die Signale für 28 Devisenpaare in allen (9) Zeitrahmen. Stellen Sie sich vor, wie sich Ihr Handel

NEW YEAR 2026 SALE OFFER PRICE AT JUST 75 DOLLARS FEW COPIES ONLY AT This price From 28th Jan -31th Jan MIDNIGHT Final offer GRAB YOUR COPY ON THIS New Year EVE last offer GRAB IT! Der Preis wird nach Ablauf der Angebotsfrist auf 150 Dollar erhöht. Full Fledged EA und Alert plus für Warnungen werden auch in diesem Angebot zusammen mit dem Kauf von Indikator zur Verfügung gestellt werden. Begrenzte Kopien nur zu diesem Preis und Ea zu. Holen Sie sich Ihre Kopie bald Alert plus für Indikator mit S

Apollo SR Master ist ein Support/Resistance-Indikator mit besonderen Funktionen, der das Trading mit Support/Resistance-Zonen einfacher und zuverlässiger macht. Der Indikator berechnet Support/Resistance-Zonen in Echtzeit ohne Verzögerung, indem er lokale Kurshochs und -tiefs erkennt. Um die neu entstandene Support/Resistance-Zone zu bestätigen, zeigt der Indikator ein spezielles Signal an, das signalisiert, dass die Zone als Kauf- oder Verkaufssignal verwendet werden kann. In diesem Fall erhöht

Game Changer ist ein revolutionärer Trendindikator, der für jedes Finanzinstrument entwickelt wurde und Ihren Metatrader in einen leistungsstarken Trendanalysator verwandelt. Der Indikator zeichnet nicht neu und verzögert nicht. Er funktioniert in jedem Zeitrahmen und unterstützt die Trenderkennung, signalisiert potenzielle Umkehrungen, dient als Trailing-Stop-Mechanismus und liefert Echtzeit-Warnungen für schnelle Marktreaktionen. Egal, ob Sie erfahrener Trader, Profi oder Anfänger auf der Such

Ein exklusiver Indikator, der einen innovativen Algorithmus verwendet, um den Markttrend schnell und genau zu bestimmen. Der Indikator berechnet automatisch die Eröffnungs-, Schluss- und Gewinnniveaus und liefert detaillierte Handelsstatistiken. Mit diesen Funktionen können Sie das am besten geeignete Handelsinstrument für die aktuellen Marktbedingungen auswählen. Darüber hinaus können Sie ganz einfach Ihre eigenen Pfeilindikatoren in Scalper Inside Pro integrieren, um deren Statistiken und Rent

Volatility Trend System – ein Handelssystem, das Signale für Einstiege gibt. Das Volatilitätssystem liefert lineare und punktuelle Signale in Richtung des Trends sowie Signale zum Verlassen des Trends, ohne Neuzeichnung und Verzögerungen. Der Trendindikator überwacht die Richtung des mittelfristigen Trends, zeigt die Richtung und deren Änderung an. Der Signalindikator basiert auf Änderungen der Volatilität und zeigt Markteintritte an.

Der Indikator ist mit mehreren Arten von Warnungen ausgestat

M1 SNIPER ist ein benutzerfreundliches Handelsindikatorsystem. Es handelt sich um einen Pfeilindikator, der für den M1-Zeitrahmen entwickelt wurde. Der Indikator kann als eigenständiges System für Scalping im M1-Zeitrahmen oder als Teil Ihres bestehenden Handelssystems verwendet werden. Obwohl dieses Handelssystem speziell für den M1-Zeitrahmen entwickelt wurde, kann es auch für andere Zeitrahmen verwendet werden. Ursprünglich habe ich diese Methode für den Handel mit XAUUSD und BTCUSD entwickel

Trend Ai Indicator ist ein großartiges Tool, das die Marktanalyse eines Händlers verbessert, indem Trendidentifikation mit umsetzbaren Einstiegspunkten und Umkehrwarnungen kombiniert wird. Dieser Indikator ermöglicht es Benutzern, die Komplexität des Forex-Marktes mit Zuversicht und Präzision zu navigieren Über die primären Signale hinaus identifiziert der Trend Ai-Indikator sekundäre Einstiegspunkte, die bei Pullbacks oder Retracements auftreten, sodass Händler von Preiskorrekturen innerhalb d

Zunächst einmal ist es erwähnenswert, dass dieser Handelsindikator nicht neu malt, nicht neu zeichnet und keine Verzögerung aufweist, was ihn sowohl für manuellen als auch für Roboterhandel ideal macht. Benutzerhandbuch: Einstellungen, Eingaben und Strategie. Der Atom-Analyst ist ein PA-Preisaktionsindikator, der die Stärke und das Momentum des Preises nutzt, um einen besseren Vorteil auf dem Markt zu finden. Ausgestattet mit fortschrittlichen Filtern, die helfen, Rauschen und falsche Signale z

Wenn Sie diesen Indikator kaufen, erhalten Sie meinen professionellen Trade Manager + EA KOSTENLOS dazu.

Zunächst einmal ist es wichtig zu betonen, dass dieses Handelssystem ein Nicht-Repainting-, Nicht-Redrawing- und Nicht-Verzögerungsindikator ist, was es sowohl für manuelles als auch für automatisches Trading ideal macht. Online-Kurs, Handbuch und Vorlagen herunterladen. Das "Smart Trend Trading System MT5" ist eine umfassende Handelslösung, die für neue und erfahrene Trader maßgeschneide

Dieser Indikator ist eine hervorragende Kombination aus unseren 2 Produkten Advanced Currency IMPULSE with ALERT + Currency Strength Exotics .

Es funktioniert für alle Zeitrahmen und zeigt grafisch Impulse der Stärke oder Schwäche für die 8 wichtigsten Währungen plus ein Symbol!

Dieser Indikator ist darauf spezialisiert, die Beschleunigung der Währungsstärke für beliebige Symbole wie Gold, Exotische Paare, Rohstoffe, Indizes oder Futures anzuzeigen. Als erster seiner Art kann jedes Symbol

Trendindikator, bahnbrechende, einzigartige Lösung für Trendhandel und -filterung mit allen wichtigen Trendfunktionen in einem Tool! Es handelt sich um einen 100 % nicht neu zu malenden Multi-Timeframe- und Multi-Währungs-Indikator, der für alle Symbole/Instrumente verwendet werden kann: Forex, Rohstoffe, Kryptowährungen, Indizes und Aktien. ZEITLICH BEGRENZTES ANGEBOT: Der Support- und Resistance-Screener-Indikator ist für nur 50 $ und lebenslang verfügbar. (Ursprünglicher Preis 250 $) (Angebot

Zunächst einmal ist es wichtig zu betonen, dass dieses Handelstool ein Nicht-Repaint-, Nicht-Redraw- und Nicht-Verzögerungsindikator ist, was es ideal für professionelles Trading macht. Online-Kurs, Benutzerhandbuch und Demo. Der Smart Price Action Concepts Indikator ist ein sehr leistungsstarkes Werkzeug sowohl für neue als auch erfahrene Händler. Er vereint mehr als 20 nützliche Indikatoren in einem und kombiniert fortgeschrittene Handelsideen wie die Analyse des Inner Circle Traders und Stra

Currency Strength Wizard ist ein sehr leistungsstarker Indikator, der Ihnen eine Komplettlösung für erfolgreichen Handel bietet. Der Indikator berechnet die Stärke dieses oder jenes Forex-Paares anhand der Daten aller Währungen in mehreren Zeitrahmen. Diese Daten werden in Form von benutzerfreundlichen Währungsindizes und Währungsstärkelinien dargestellt, anhand derer Sie die Stärke dieser oder jener Währung erkennen können. Sie müssen lediglich den Indikator an das Diagramm anhängen, mit dem Si

Miraculous Indicator – 100 % Nicht-Repaint Forex- und Binary-Tool basierend auf dem Gann-Quadrat der Neun Dieses Video stellt den Miraculous Indicator vor, ein hochpräzises und leistungsstarkes Trading-Tool, das speziell für Forex- und binäre Optionen-Trader entwickelt wurde. Was diesen Indikator einzigartig macht, ist seine Grundlage auf dem legendären Gann-Quadrat der Neun und Ganns Gesetz der Vibration , was ihn zu einem der präzisesten Prognose-Tools im modernen Trading macht. Der Miraculous

Stärke von 8 Währungen plus EIN EXOTISCHES Paar oder Rohstoffe oder Indexe!

Jedes Produkt kann als 9. Linie hinzugefügt werden. Fügen Sie Rohstoffe, Indexes oder exotische Währungen hinzu (Gold, Silber, Öl, DAX, US30, MXN, TRY, CNH ...). Eine neue noch nie dagewesene TRADING STRATEGIE !!! Dieser Indikator ist einzigartig, weil wir eine Reihe von proprietäre Funktionen und neue Formeln eingebaut haben. Es funktioniert für alle Zeitrahmen. Basierend auf neuen zugrunde liegenden Algorithmen ist e

Indikator im Voraus Bestimmt Marktumkehrpunkte und -zonen und ermöglicht es Ihnen, abzuwarten, bis der Preis zu diesem Niveau zurückkehrt, um am Anfang eines neuen Trends einzusteigen, anstatt an dessen Ende.

Er zeigt Umkehrniveaus wenn der Markt eine Richtungsänderung bestätigt und weitere Bewegungen ausbildet.

Der Indikator funktioniert ohne Nachzeichnen, ist für alle Instrumente optimiert und entfaltet sein volles Potenzial in Kombination mit dem TREND LINES PRO

Gold Scalper Super ist ein einfach zu bedienendes Handelssystem. Der Indikator kann sowohl als eigenständiges Scalping-System auf dem M1-Zeitrahmen als auch als Teil Ihres bestehenden Handelssystems verwendet werden. Bonus: beim Kauf eines Indikators, Trend Arrow Super ist kostenlos zur Verfügung gestellt, schreiben Sie uns nach dem Kauf. Der Indikator 100% nicht neu malen!!! Wenn ein Signal erscheint, verschwindet es nicht! Im Gegensatz zu Indikatoren mit Redrawing, die zum Verlust einer Einla

Einzigartiger Gann-Indikator für XAUUSD

IQ Gold Gann Levels ist ein Präzisionsinstrument, das ausschließlich für den Intraday-Handel mit XAUUSD/Gold entwickelt wurde und nicht nachgemalt wird. Es verwendet die Quadratwurzelmethode von W.D. Gann, um Unterstützungs- und Widerstandsniveaus in Echtzeit darzustellen, und hilft Händlern, hochwahrscheinliche Einstiegsmöglichkeiten mit Vertrauen und Klarheit zu erkennen. William Delbert Gann (W.D. Gann) war ein außergewöhnlicher Marktanalyst, dessen Han

Dieses Dashboard zeigt die neuesten verfügbaren harmonischen Muster für die ausgewählten Symbole, so dass Sie Zeit sparen und effizienter sein werden / MT5-Version .

Kostenloser Indikator: Basic Harmonic Pattern

Spalten des Indikators Symbol: die ausgewählten Symbole werden angezeigt Trend: bullish oder bearish Pattern : Art des Musters (Gartley, Schmetterling, Fledermaus, Krabbe, Hai, Cypher oder ABCD) Entry : Einstiegskurs SL: Stop-Loss-Kurs TP1: 1. Take-Profit-Kurs TP2: 2. Gewinnmitnahme-

Hören Sie auf, mit Zufallssignalen zu handeln. Fangen Sie an, mit echter Confluence zu handeln Haben Sie genug von Indikatoren, die sich wiederholen, widersprüchliche Signale geben und Sie mehr verwirren als überzeugen? Der Quantum Regime Indicator ist ein professionelles, eigenständiges Trading-Tool, das für ernsthafte Trader entwickelt wurde, die einen systematischen Vorteil suchen. Er löst das größte Problem der technischen Analyse - falsche Signale - durch den Einsatz eines leistungsstarken

Matrix Arrow Indicator MT4 ist ein einzigartiger 10-in-1-Trend, der zu 100 % nicht neu gezeichnet werden kann. Multi-Timeframe-Indikator, der für alle Symbole/Instrumente verwendet werden kann: Forex, Rohstoffe, Kryptowährungen, Indizes, Aktien. Der Matrix Arrow Indicator MT4 wird den aktuellen Trend in seinen frühen Stadien bestimmen und Informationen und Daten von bis zu 10 Standardindikatoren sammeln, die sind: Durchschnittlicher Richtungsbewegungsindex (ADX) Rohstoffkanalindex (CCI) Klassis

Wir stellen Ihnen den F-16 Plane Indicator vor, ein hochmodernes MT4-Tool, das Ihr Trading-Erlebnis revolutionieren wird. Inspiriert von der unvergleichlichen Geschwindigkeit und Präzision des F-16-Kampfflugzeugs kombiniert dieser Indikator fortschrittliche Algorithmen und modernste Technologie, um eine beispiellose Leistung auf den Finanzmärkten zu bieten. Mit dem F-16 Plane Indicator schweben Sie über der Konkurrenz, da er Echtzeit-Analysen liefert und äußerst präzise Trading-Signale generiert

ANLEITUNG RUS / ANLEITUNG ENG / Version MT5 Hauptfunktionen: Zeigt aktive Zonen von Verkäufern und Käufern an! Der Indikator zeigt alle korrekten ersten Impulsniveaus/-zonen für Käufe und Verkäufe an. Wenn diese Niveaus/Zonen aktiviert werden, wo die Suche nach Einstiegspunkten beginnt, ändern die Niveaus ihre Farbe und werden mit bestimmten Farben gefüllt. Außerdem erscheinen Pfeile für eine intuitivere Wahrnehmung der Situation. LOGIC AI - Anzeige von Zonen (Kreisen) zur Suche von Einst

FX Volume: Erleben Sie den echten Marktüberblick aus der Sicht eines Brokers Kurzüberblick

Möchten Sie Ihre Handelsstrategie auf das nächste Level bringen? FX Volume liefert Ihnen Echtzeit-Einblicke in die Positionierung von Retail-Tradern und Brokern — lange bevor verzögerte Berichte wie der COT verfügbar sind. Ob Sie nach beständigen Gewinnen streben oder einfach einen tieferen Vorteil am Markt suchen, FX Volume hilft Ihnen, große Ungleichgewichte zu erkennen, Breakouts zu bestätigen und Ihr

PRO Renko System ist ein hochpräzises Handelssystem, das speziell für den Handel mit RENKO-Charts entwickelt wurde.

Dies ist ein universelles System, das auf verschiedene Handelsinstrumente angewendet werden kann. Das System neutralisiert effektiv so genannte Marktgeräusche, die Ihnen Zugang zu genauen Umkehrsignalen geben.

Der Indikator ist sehr einfach zu bedienen und hat nur einen Parameter, der für die Signalerzeugung verantwortlich ist. Sie können das Tool einfach an jedes Handelsinstrum

Special offer : ALL TOOLS , just $35 each! New tools will be $30 for the first week or the first 3 purchases ! Trading Tools Channel on MQL5 : Join my MQL5 channel to update the latest news from me Der Volumetrische Orderblock Multi Timeframe Indikator ist ein leistungsstarkes Werkzeug für Trader, die tiefere Einblicke in das Marktverhalten suchen, indem sie Schlüsselpreisbereiche identifizieren, in denen bedeutende Marktteilnehmer Aufträge ansammeln. Diese Bereiche, bekannt als vo

FX Power: Analysieren Sie die Stärke von Währungen für intelligentere Handelsentscheidungen Übersicht

FX Power ist Ihr unverzichtbares Werkzeug, um die tatsächliche Stärke von Währungen und Gold unter allen Marktbedingungen zu verstehen. Indem Sie starke Währungen kaufen und schwache verkaufen, vereinfacht FX Power Ihre Handelsentscheidungen und deckt Chancen mit hoher Wahrscheinlichkeit auf. Ob Sie Trends folgen oder extreme Delta-Werte nutzen, um Umkehrungen zu prognostizieren, dieses Tool p

Reversal Zones Pro ist ein Indikator, der speziell für die genaue Identifizierung wichtiger Trendumkehrzonen entwickelt wurde. Er berechnet die durchschnittliche tatsächliche Spanne der Kursbewegung von der unteren bis zur oberen Grenze und zeigt potenzielle Zonen direkt auf dem Chart an, was Händlern hilft, wichtige Trendumkehrpunkte effektiv zu identifizieren. Hauptmerkmale: Identifizierung von Umkehrzonen: Der Indikator zeigt potenzielle Umkehrzonen visuell direkt auf dem Chart an. Dies hilf

Day Trader Master ist ein komplettes Handelssystem für Daytrader. Das System besteht aus zwei Indikatoren. Ein Indikator ist ein Pfeilsignal zum Kaufen und Verkaufen. Es ist die Pfeilanzeige, die Sie erhalten. Den zweiten Indikator stelle ich Ihnen kostenlos zur Verfügung. Der zweite Indikator ist ein Trendindikator, der speziell für die Verwendung in Verbindung mit diesen Pfeilen entwickelt wurde. INDIKATOREN WIEDERHOLEN SICH NICHT UND NICHT ZU SPÄT! Die Verwendung dieses Systems ist sehr einfa

Der Seismograph MarketQuake Detector. Description in English :

https://www.mql5.com/en/market/product/113869?source=Site+Market+Product+Page#description How to use the Seismograph :

https://www.mql5.com/en/market/product/113869#!tab=comments&page=2&comment=52806941

Create an EA :

https://www.mql5.com/en/market/product/113869#!tab=comments&page=3&comment=52816509

Unabhängig davon, wie Sie handeln, möchten Sie auf jeden Fall den Eintritt in den Markt mit geringer Liquidität vermeiden.- Der

Dynamic Forex28 Navigator – Das Forex-Handelstool der nächsten Generation AKTUELL 49 % RABATT. Dynamic Forex28 Navigator ist die Weiterentwicklung unserer seit langem beliebten Indikatoren und vereint die Leistung von drei in einem: Advanced Currency Strength28 Indicator (695 Bewertungen) + Advanced Currency IMPULSE mit ALERT (520 Bewertungen) + CS28 Combo Signals (Bonus) Details zum Indikator https://www.mql5.com/en/blogs/post/758844

Was bietet der Strength Indicator der nächsten Generation?

DERZEIT 31% RABATT!

Die beste Lösung für jeden Newbie oder Expert Trader!

Dieser Indikator ist ein einzigartiges, qualitativ hochwertiges und erschwingliches Handelsinstrument, da wir eine Reihe von proprietären Funktionen und eine geheime Formel eingebaut haben. Mit nur EINEM Chart liefert er Alerts für alle 28 Währungspaare. Stellen Sie sich vor, wie sich Ihr Handel verbessern wird, weil Sie in der Lage sind, den genauen Auslösepunkt eines neuen Trends oder einer Scalping-Gelegenheit zu erk

Intelligentes Handelssystem. Alle Zeitrahmen, Währungen, Kryptowährungen, Metalle … Alle MT4 und alle Bildschirme und Vorlagen werden automatisch konfiguriert. Ein Anfänger handelt einfach auf der Grundlage eines Signals. Die Parameter eines einzigartigen flexiblen Algorithmus sind in den Einstellungen offen.

Idee 1: Zusätzlich zu „KAUFEN/VERKAUFEN“ wird an Extrempunkten das Signal „GET PROFIT“ gegeben. Diese Taktik erhöht das Ergebnis – Sie haben maximale Gewinne und mehr Transaktionen. Wenn

Dieser Indikator platziert nur qualitativ hochwertige Trades, wenn der Markt wirklich zu Ihren Gunsten ist, mit einem klaren Break und Retest. Geduld ist der Schlüssel zu dieser Preisaktionsstrategie!

Wenn Sie mehr Alarmsignale pro Tag wünschen, erhöhen Sie die Zahl neben dem Parameter namens: Empfindlichkeit der Unterstützung und des Widerstands. Nach vielen Monaten harter Arbeit und Hingabe sind wir sehr stolz darauf, Ihnen unseren von Grund auf neu entwickelten Break-and-Retest-Preisaktionsin

Ein Top- und Bottom-Indikator, der intuitiv den Trend des Bandes erkennen kann. Er ist die beste Wahl für den manuellen Handel, ohne Redrawing oder Drifting. Wie Sie diesen Indikator kostenlos erhalten: Mehr erfahren Preiserhöhung von $20 alle 3 Tage, Preiserhöhungsprozess: 79--> 99--> 119...... Bis zu einem Zielpreis von $1000. Für alle Anfänger und Programmierung Trading-Freund, können Sie das Signal in den EA zu spielen frei zu schreiben. Array 3 und Array 4, zum Beispiel, 3>4 wird grün, 3<4

MT5 Version hier verfügbar:

https://www.mql5.com/en/market/product/50048 Telegram Kanal & Gruppe:

https://t.me/bluedigitsfx V.I.P Gruppen-Zugang:

Sende Zahlungsnachweis für eines unserer kostenpflichtigen Produkte an unseren Posteingang Empfohlener Broker:

https://bit.ly/BlueDigitsFxStarTrader BlueDigitsFx Easy 123 System — Leistungsstarke Umkehr- und Ausbruchserkennung für MT4 Ein All-in-One Non-Repaint Indikator, der dir hilft, Marktstrukturveränderungen, Ausbrüche und Trendwenden einfach

Nach dem Kauf können Sie mich gerne kontaktieren, um weitere Details zu erfahren, wie Sie einen Bonusindikator namens VFI erhalten, der sich perfekt mit Easy Breakout kombinieren lässt, um die Konfluenz zu verbessern !

Easy Breakout ist ein leistungsfähiges Price Action Trading System, das auf einer der beliebtesten und vertrauenswürdigsten Strategien unter Tradern basiert: der Breakout-Strategie ! Dieser Indikator liefert kristallklare Kauf- und Verkaufssignale, die auf Ausbrüchen aus wichtige

TPSproTrend PRO - Dies ist ein Trendindikator, der den Markt automatisch analysiert und Informationen über den Trend und seine Veränderungen liefert sowie Einstiegspunkte für Trades anzeigt. ohne neu zu zeichnen!

ИНСТРУКЦИЯ RUS – ANLEITUNG ENG – VERSION MT5 Hauptfunktionen: Genaue Eingangssignale OHNE NEU ANSTRICH! Sobald ein Signal erscheint, bleibt es gültig! Dies unterscheidet es deutlich von Indikatoren, die nachträglich Signale generieren und diese dann verändern, w

Apollo BuySell Predictor ist ein professionelles Handelssystem, das mehrere Handelsmodule umfasst. Es bietet einem Trader einzigartige Breakout-Zonen, Fibonacci-basierte Unterstützungs- und Widerstandsniveaus, Pivot-Trendlinie, Pullback-Volumensignale und andere hilfreiche Funktionen, die jeder Trader täglich benötigt. Das System funktioniert mit jedem Paar. Empfohlene Zeitrahmen sind M30, H1, H4. Der Indikator kann jedoch auch mit anderen Zeitrahmen arbeiten, mit Ausnahme der Zeitrahmen höher a

Hören Sie auf zu raten. Beginnen Sie mit einem statistischen Vorteil zu handeln. Aktienindizes werden nicht wie Forex gehandelt. Sie haben definierte Sitzungen, Overnight-Gaps und folgen vorhersehbaren statistischen Mustern. Dieser Indikator liefert Ihnen die Wahrscheinlichkeitsdaten, die Sie benötigen, um Indizes wie den DAX, S&P 500 und Dow Jones mit Zuversicht zu handeln. Was ihn anders macht Die meisten Indikatoren zeigen Ihnen, was passiert ist. Dieser zeigt Ihnen, was wahrscheinlich als nä

Der Pips Stalker ist ein Long-Short-Pfeil-ähnlicher Indikator, der Trader aller Niveaus hilft, bessere Entscheidungen beim Markthandel zu treffen. Der Indikator übermalt nie neu und verwendet RSI als Hauptsignallogik; sobald ein Pfeil gegeben ist, wird er nie neu lackiert oder zurückgestrichen und die Pfeile sind nicht verzögert.

MERKMALE DES PIPS STALKER-PFEILS :

STATISTIK-PANEL ein einzigartiges Info-Dashboard, das die Gesamtgewinnquote und nützliche Statistiken wie maximale Siege und verlo

Goldziele sind der beste Trendindikator. Der einzigartige Algorithmus des Indikators analysiert die Bewegung des Vermögenspreises unter Berücksichtigung von Faktoren der technischen und mathematischen Analyse, ermittelt die profitabelsten Einstiegspunkte, gibt ein Signal in Form eines Pfeils und des Preisniveaus (KAUF-Einstieg / VERKAUF-Einstieg) aus eine Bestellung eröffnen. Der Indikator zeigt außerdem sofort das Preisniveau für Stop Loss und fünf Preisniveaus für Take Profit an.

ACHTUNG: De

Gold Venamax – das ist der beste technische Indikator für Aktien. Der Indikatoralgorithmus analysiert die Preisbewegung eines Vermögenswerts und spiegelt die Volatilität und potenzielle Einstiegszonen wider. Indikatorfunktionen: Dies ist ein Super-Indikator mit Magic und zwei Blöcken von Trendpfeilen für komfortables und profitables Trading. Auf dem Diagramm wird eine rote Schaltfläche zum Wechseln von Blöcken angezeigt. Magic ist in den Indikatoreinstellungen eingestellt, sodass Sie den Indi

Signale zum Ein- und Ausstieg aus Trades für Währungen, Gold, Öl, Krypto – alles in MT4 ohne Neuzeichnen und mit Trendprognose. Sogar ein Anfänger kann problemlos in jedem Zeitrahmen handeln. Flexibler und genauer Algorithmus zur automatischen Abstimmung von Signalen, die auf dem Bildschirm angezeigt, auf Englisch gehört und auf einem Smartphone empfangen werden können.

Der Indikator verfügt über ein System von Hinweisen zur Schulung des Benutzers. Bewegen Sie den Mauszeiger über ein beliebi

Special offer : ALL TOOLS , just $35 each! New tools will be $30 for the first week or the first 3 purchases ! Trading Tools Channel on MQL5 : Join my MQL5 channel to update the latest news from me Volumatic VIDYA (Variable Index Dynamic Average) ist ein fortschrittlicher Indikator, der entwickelt wurde, um Trends zu verfolgen und den Kauf- und Verkaufsdruck in jeder Phase eines Trends zu analysieren. Durch die Verwendung des Variablen Index-Durchschnitts (Variable Index Dynamic Av

Eine Intraday-Strategie, die auf zwei Grundprinzipien des Marktes basiert. Der Algorithmus basiert auf der Analyse von Volumina und Preiswellen mit zusätzlichen Filtern. Der intelligente Algorithmus des Indikators gibt nur dann ein Signal, wenn sich zwei Marktfaktoren zu einem vereinen. Der Indikator berechnet Wellen eines bestimmten Bereichs auf dem M1-Diagramm unter Verwendung der Daten des höheren Zeitrahmens. Und um die Welle zu bestätigen, verwendet der Indikator eine Volumenanalyse. Dieser

Das Ein-Minuten-Gold ist ein volumen-, preis- und trendbasierter Einstiegssignal-Indikator mit Pfeilen, der Tradern hilft, die richtige Marktseite zu wählen und Chancen zu generieren. Warum Ein-Minuten-Gold wählen? TP-SL. Eingebaute Take-Profit- und Stop-Loss-Objekte erscheinen im Chart bei jedem Signal. Zwei Methoden: ATR TP-SL und feste Punkte TP-SL. Statistik-Panel. Zeigt Gewinn-/Verluststatistik über gewählte Historienkerzen, aktuelle Gewinnrate %, Gewinn-/Verlustserien und Nettoprofit. Hoc

FREE

Derzeit 33% Rabatt! Die beste Lösung für jeden Anfänger oder erfahrenen Händler! Dieser Indikator ist ein einzigartiges, qualitativ hochwertiges und erschwingliches Trading-Tool, da wir eine Reihe von proprietären Funktionen und eine neue Formel integriert haben. Mit diesem Update werden Sie in der Lage sein, doppelte Zeitrahmenzonen anzuzeigen. Sie können nicht nur einen höheren TF (Zeitrahmen) anzeigen, sondern sowohl den Chart-TF als auch den höheren TF: SHOWING NESTED ZONES. Alle Supply Dema

Das Forex Breath System ist ein trendbasiertes Handelssystem, das auf jedem Markt eingesetzt werden kann. Sie können dieses System mit Währungen, Metallen, Rohstoffen, Indizes, Krypto und sogar Aktien verwenden. Es kann auch mit jedem Zeitrahmen verwendet werden. Das System ist universell. Es zeigt den Trend an und liefert Pfeilsignale mit dem Trend. Der Indikator kann Ihnen auch eine spezielle Art von Warnungen liefern, wenn die Signale in Trendrichtung erscheinen, was den Trendhandel zu einer

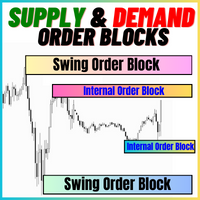

Die Supply and Demand Order Blocks:

Der Indikator "Supply and Demand Order Blocks" ist ein anspruchsvolles Tool, das auf den Konzepten des Smart Money basiert und für die technische Analyse im Devisenhandel unerlässlich ist. Er konzentriert sich darauf, Angebot und Nachfrage Zonen zu identifizieren, entscheidende Bereiche, in denen institutionelle Händler deutliche Spuren hinterlassen. Die Angebotszone, die Verkaufsaufträge anzeigt, und die Nachfragezone, die Kaufaufträge anzeigt, helfen Händl

FREE

The official release price is $65 only for the first 10 copies, ( only 2 copies left ). Nächster Preis: $125 Gold Scalper System ist ein multifunktionales Handelssystem, das eine Ausbruchsstrategie für wichtige Liquiditätsniveaus mit Bestätigung und einem eingebauten Smart DOM Pro Modul für die Markttiefenanalyse kombiniert . Das System identifiziert Zonen für die Akkumulation von Limit-Orders, verfolgt die Aktivität auf Unterstützungs- und W

Crystal Volume Profile Auto POC (MT4) — Volumenprofil mit automatischer POC-Erkennung Überblick

Crystal Volume Profile Auto POC ist ein leichtgewichtiger, optimierter Indikator für MetaTrader 4. Er zeigt die Volumenverteilung auf verschiedenen Preisniveaus an und hebt automatisch den Point of Control (POC) hervor — das Niveau mit dem größten Handelsvolumen. Damit lassen sich verdeckte Unterstützungs-/Widerstandsbereiche, Akkumulations- und Distributionszonen sowie institutionelle Handelsaktivi

FREE

Crypto_Forex Indikator SCALPING SNIPER PRO für MT4, Handelssystem ohne Repainting. Scalping Sniper Pro – ein fortschrittliches System (Indikator) zur präzisen Anzeige des Kursmomentums!

– Verbessern Sie Ihre Handelsmethoden mit dem professionellen Scalping Sniper Pro Indikator für MT4. PC and Mobile alerts. – Dieses System liefert sehr präzise, aber seltene Signale mit einer Gewinnrate von bis zu 90 %. – Das System sucht nach Signalen mithilfe vieler Paare, um eine geringe Anzahl von Signal

Dieser Indikator warnt den Nutzer, wenn der ATR einen benutzerdefinierten Wert überschreitet oder prozentuale Schwankungen aufweist, und erkennt so Volatilitätsspitzen. Besonders geeignet für: Volatilitätsbasierte Handelssysteme, Recovery Zone oder Grid Hedge Systeme. Da Volatilität für diese Systeme entscheidend ist, zeichnet der Indikator direkt auf dem Chart:

Einstiegszonen

Nachkaufpunkte

Take-Profit-Levels

Schnelles Backtesting und Parameteroptimierung werden so ermöglicht. Hauptvorteile

Vol

Der Crypto_Forex-Indikator „Auto FIBO Pro“ ist ein großartiges Hilfsmittel beim Handel!

- Der Indikator berechnet automatisch Fibo-Level und lokale Trendlinien (rote Farbe) und platziert sie im Diagramm. - Fibonacci-Level zeigen Schlüsselbereiche an, in denen der Preis umkehren kann. - Die wichtigsten Level sind 23,6 %, 38,2 %, 50 % und 61,8 %. - Sie können ihn für Reversal Scalping oder für Zone Grid Trading verwenden. - Es gibt auch viele Möglichkeiten, Ihr aktuelles System mit dem Auto FIBO

Hallo Freunde, ich hatte lange keine neuen Produkte, die ich Ihnen mit Zuversicht anbieten konnte, aber jetzt ist die Zeit gekommen. Dies ist mein neues Produkt, das auf meinem ersten Indikator basiert – eine Weiterentwicklung ohne unnötige Einstellungen, optimiert für Gold. Ich wurde oft gebeten, etwas Bequemes für den Handel zu entwickeln, aber es gelang mir nicht; es ist nicht einfach, Tests und Debugging nehmen sehr viel Zeit in Anspruch. Wie sein Vorgänger hat auch dieser Indikator seine Ei

Ultimate MTF Support & Resistance - 5-Sterne-Bestseller Neujahrsangebot - Sparen Sie $20 (Normalpreis $79) Ob Anfänger oder Profi, unser meistverkaufter Multi-Timeframe Pivot Prof wird Ihren Handel verbessern und Ihnen großartige Handelsmöglichkeiten mit den Unterstützungs- und Widerstandsniveaus bieten, die auch Profis nutzen. Der Pivot-Handel ist eine einfache und effektive Methode für den Einstieg in den Markt und den Ausstieg aus dem Markt auf Schlüsselebenen und wird von Profis seit Jahrzeh

TREND LINES PRO Hilft dabei zu verstehen, wo der Markt tatsächlich die Richtung ändert. Der Indikator zeigt echte Trendumkehrungen und Punkte an, an denen wichtige Marktteilnehmer wieder einsteigen.

Sie sehen BOS-Linien Trendwechsel und wichtige Kursniveaus in höheren Zeitrahmen – ohne komplexe Einstellungen oder unnötiges Rauschen. Signale werden nicht neu gezeichnet und bleiben nach dem Schließen des Balkens im Chart sichtbar. Was der Indikator anzeigt:

Reale Veränderungen Trend (B

SHOGUN Trade - Die Auswirkungen von 16 Jahren ohne Anpassung. Strategische Marktstruktur und die Kunst des Gewinnens und Verlierens. Klicken Sie hier für die MT5-Version https://www.mql5.com/ja/market/product/160183 Die Wahrheit über "16 Jahre", über die sogar die Entwickler entsetzt waren. Bitte sehen Sie sich zunächst das beigefügte Bild an (Backtest-Ergebnisse). Dies ist das Ergebnis der Überprüfung des USDJPY H1 für "16 ganze Jahre "** vom 1. Januar 2010 bis zum 1. Januar 2026. Dies ist kei

Impulse Zone Hunter – Präzisions-Trading-Tool Impulse Zone Hunter ist ein leistungsstarker MT4-Indikator , der Tradern einen klaren visuellen Vorteil bei der Erkennung hochwahrscheinlicher Marktbewegungen verschafft. Der Fokus liegt auf Angebots- und Nachfragezonen , Orderblöcken sowie ChoCH (Change of Character) und liefert klare Signale direkt im Chart . Hauptfunktionen: Dual-Modus-Trading Anzeige wahlweise von Supply- & Demand-Zonen oder Orderblöcken mit ChoCH-Linien . Einfaches Umschalten de

Der vorgestellte Indikator analysiert die Richtung des kurzfristigen und langfristigen Trends für bestimmte Zeiträume, wobei die Volatilität des Marktes berücksichtigt wird. Dieser Ansatz ermöglicht es, eine hohe Empfindlichkeit des Indikators mit einer hohen Wahrscheinlichkeit der Ausführung seiner Signale zu kombinieren. Das Prinzip der Anwendung ist sehr einfach: das Histogramm des Indikators ist größer als 0 - ein Kaufsignal / das Histogramm des Indikators ist kleiner als 0 - ein Verkaufssig

Werden Sie Breaker Trader und profitieren Sie von Änderungen der Marktstruktur, wenn sich der Preis umkehrt.

Der Order Block Breaker Indikator zeigt an, wann sich eine Trend- oder Preisbewegung der Erschöpfung nähert und bereit ist, sich umzukehren. Es weist Sie auf Änderungen in der Marktstruktur hin, die normalerweise auftreten, wenn eine Umkehrung oder ein größerer Rückzug bevorsteht.

Der Indikator verwendet eine proprietäre Berechnung, die Ausbrüche und Preisdynamik identifiziert. Jedes M

KATANA Skalierer für MT4 Produktübersicht Klicken Sie hier für die einfache Version https://www.mql5.com/ja/market/product/161751 KATANA Scalper für MT4 ist ein fortschrittlicher Indikator für die technische Analyse, der für die Plattform MetaTrader 4 optimiert wurde. Das Produkt wurde entwickelt, um gleichzeitig die schwierigsten Probleme im kurzfristigen Handel (Scalping und Daytrading) zu lösen: Preisrauschen und verzögerte Reaktion. Ein einzigartiger Signalverarbeitungsalgorithmus elimini

Crystal Heikin Ashi – Erweiterte Visualisierung Heikin Ashi (MT4 Version) Übersicht Crystal Heikin Ashi für MetaTrader 4 ist ein professioneller Heikin Ashi Indikator, der die Chartvisualisierung verbessert und Preisaktionstradern, Scalpern und Analysten klare Signale bietet.

Diese MT4 Version konzentriert sich auf reine Heikin Ashi Kerzen mit smartem Design, während das System leicht und leistungsoptimiert bleibt. Hinweis: Trendbasierte Färbung und erweiterte Momentum-Erkennung sind in der MT5

FREE

SMC Easy Signal wurde entwickelt, um die Verwirrung um das Smart-Money-Konzept zu beseitigen, indem es strukturelle Verschiebungen wie BOS (Break of Structure) und CHoCH (Change of Character) in einfache Kauf- und Verkaufssignale umwandelt. Es vereinfacht den Handel mit Marktstrukturen, indem es Ausbrüche und Umkehrungen automatisch identifiziert, sobald sie auftreten, so dass sich Händler auf die Ausführung statt auf die Analyse konzentrieren können. Unabhängig davon, ob der Markt seinen Trend

Multi Anchor VWAP Pro MT4 - Rein verankerter VWAP | Adaptive σ-Bänder | Smart Alerts Präzise VWAP-Verankerung, speziell für MetaTrader 4 entwickelt. Ein-Klick-Anker, dynamische σ-Bänder oder %-Bänder und sofortige Multi-Channel-Warnungen - ideal für Scalper, Intraday- und Swing-Trader, die ein institutionelles Fair-Value-Mapping benötigen. Öffentlicher Kanal: HIER KLICKEN

Vollständiges Benutzerhandbuch - Brauchen Sie MT5? Klicken Sie hier WARUM SICH PROFESSIONELLE HÄNDLER FÜR MULTI ANCHOR VWAP

123456789101112131415161718192021222324252627282930313233343536373839404142434445464748495051525354555657585960616263646566676869707172737475767778798081828384858687888990919293949596979899100101102103104105106107108109110111112113114115116117118119120121122123124125126127128129130131132133134135136137138139140141142143144145146147148149150151152153154155156157158159160

MetaTrader Market - Handelsroboter und technische Indikatoren stehen Ihnen direkt im Kundenterminal zur Verfügung.

Das MQL5.community Zahlungssystem wurde für die Services der MetaTrader Plattform entwickelt und steht allen registrierten Nutzern der MQL5.com Webseite zur Verfügung. Man kann Geldmittel durch WebMoney, PayPal und Bankkarten einzahlen und sich auszahlen lassen.

Sie verpassen Handelsmöglichkeiten:

- Freie Handelsapplikationen

- Über 8.000 Signale zum Kopieren

- Wirtschaftsnachrichten für die Lage an den Finanzmärkte

Registrierung

Einloggen

Wenn Sie kein Benutzerkonto haben, registrieren Sie sich

Erlauben Sie die Verwendung von Cookies, um sich auf der Website MQL5.com anzumelden.

Bitte aktivieren Sie die notwendige Einstellung in Ihrem Browser, da Sie sich sonst nicht einloggen können.