Smart Breakout Channels MT4

- Indicators

- Duc Hoan Nguyen

- Version: 1.12

- Updated: 12 August 2025

- Activations: 10

New tools will be $30 for the first week or the first 3 purchases!

Trading Tools Channel on MQL5: Join my MQL5 channel to update the latest news from me

See more MT5 version at: Smart Breakout Channels MT5 Scanner

See more MT4 version at: Smart Breakout Channels MT4 Scanner

See more products at: All Products

CONCEPTS

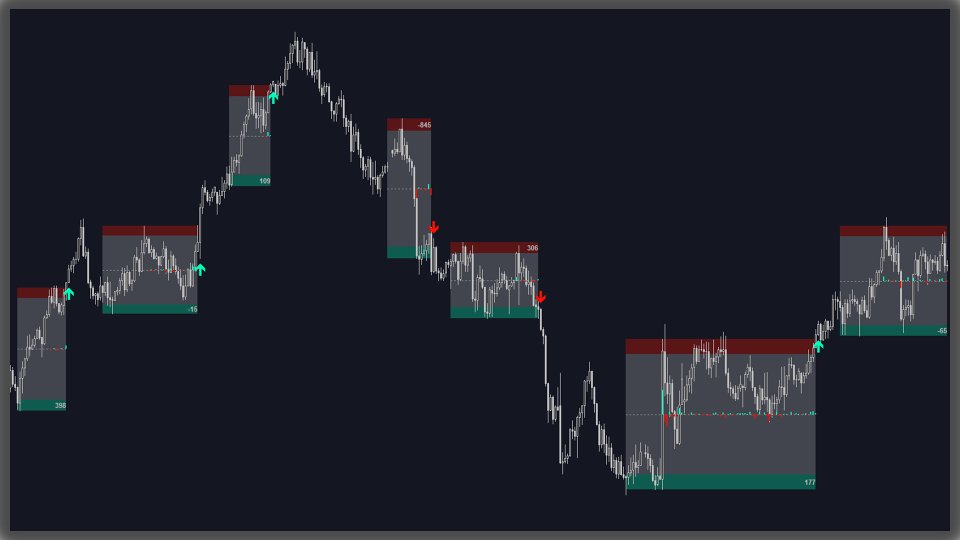

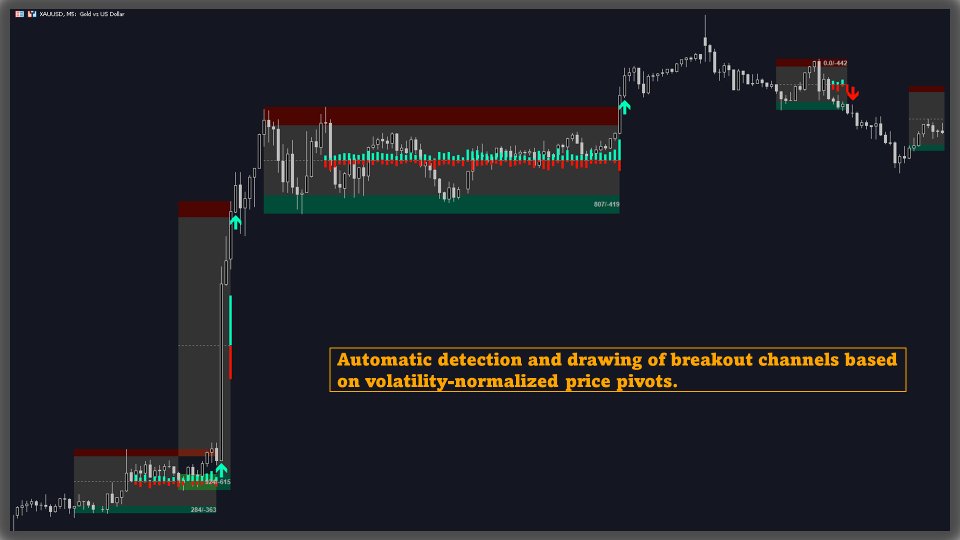

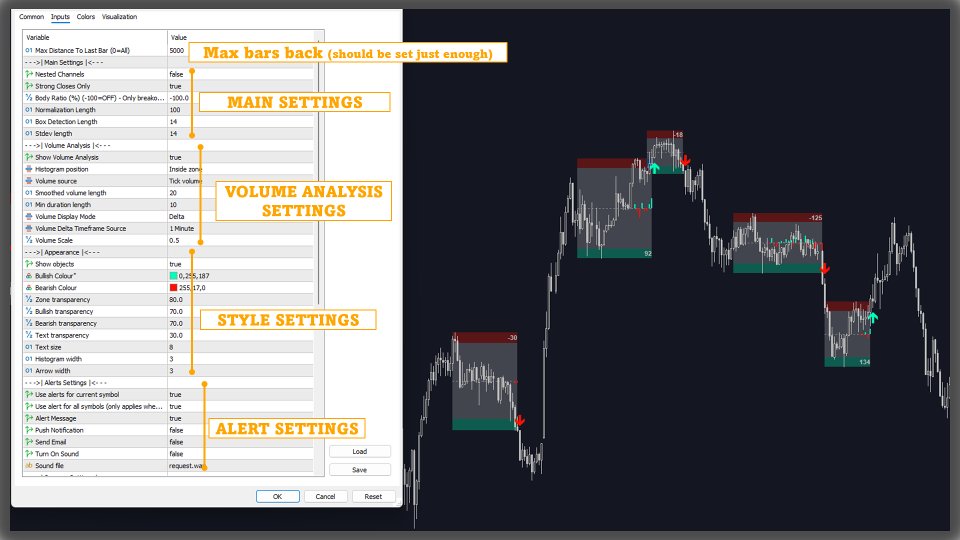

The calculation of normalized price volatility is performed by measuring the standard deviation of price and mapping it to a [0,1] scale using the highest and lowest prices over a defined lookback period. When normalized volatility reaches a local low and then begins to rise, a boxed channel is drawn between the highest and lowest prices in that zone. These boxes remain until price moves beyond them, either with a candle close (configurable) or by touching the boundary. Volume information is displayed as delta bars inside the box, showing volume distribution during the channel. A real-time visual gauge indicates the position of volume delta within the channel range.

FEATURES

-

Detection and drawing of breakout channels based on volatility-normalized price pivots.

-

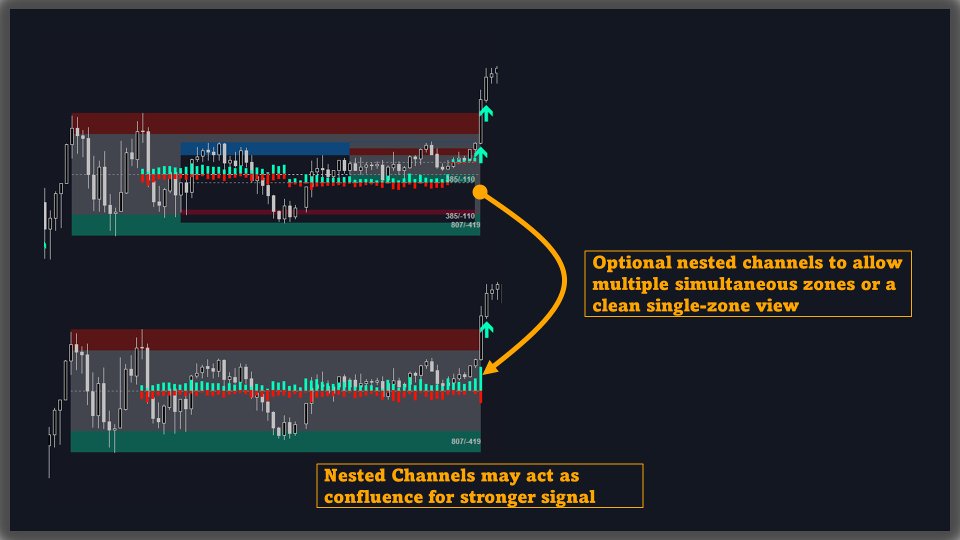

Optional nested channels to allow multiple simultaneous zones or a single-zone view.

-

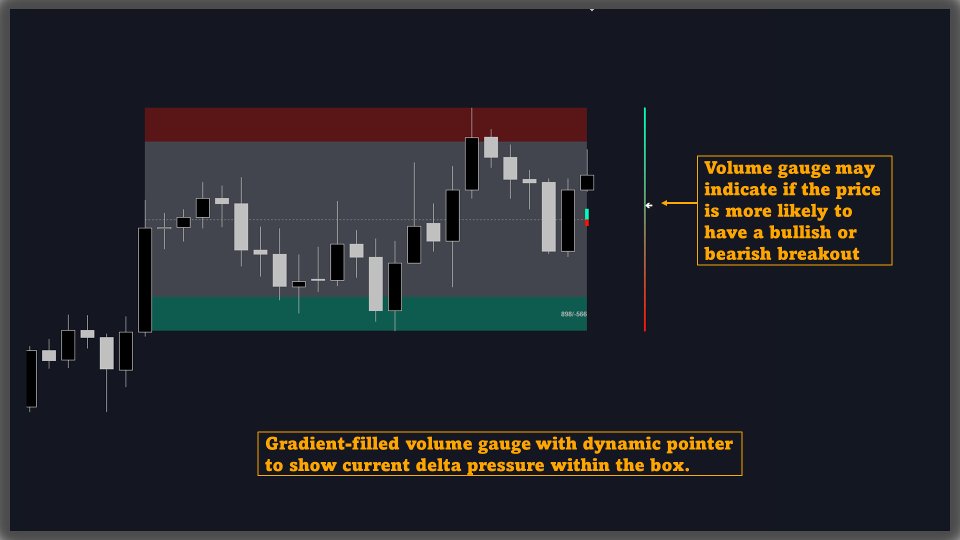

Gradient-filled volume gauge with dynamic pointer to display current delta position within the box.

-

Three volume display modes: raw volume, comparative up/down volume, and delta.

-

Alerts for new channel formation and breakout events.

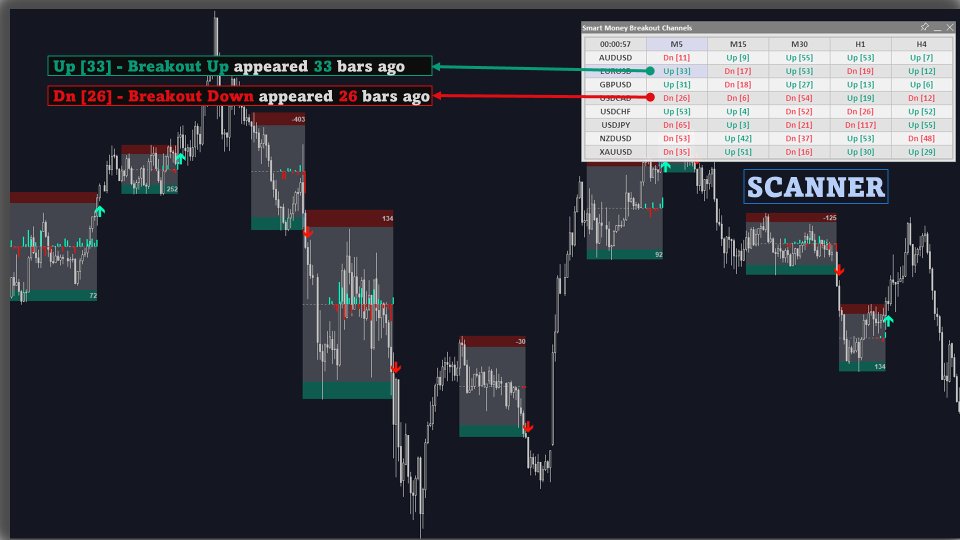

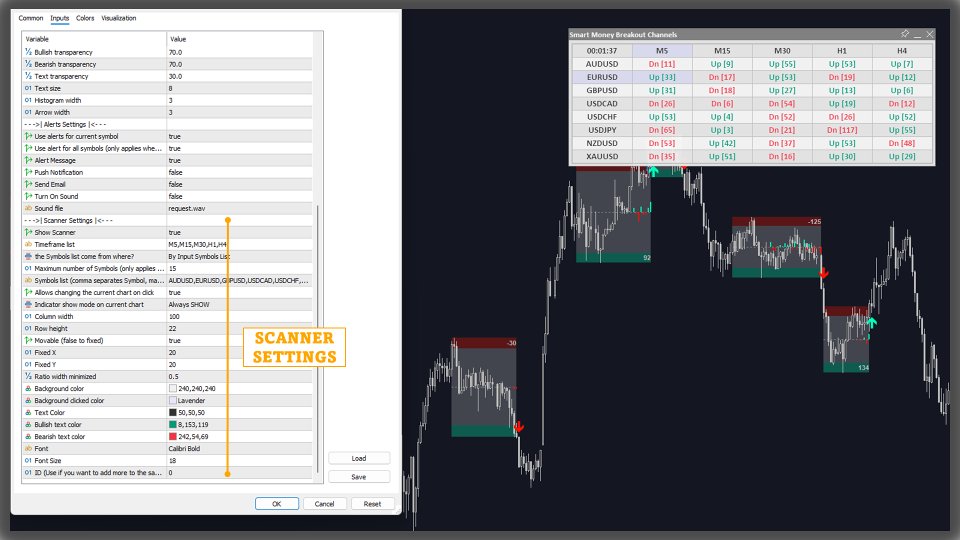

SCANNER AND ALERTS

Users can turn on/off the scanner to monitor other charts quickly.USAGE

The indicator has signal alerts when Buy/Sell appear, Breakout arrows appear, users can easily grasp market information with these alerts (especially when using Scanner)

Apply the indicator to any chart. A breakout box appears when volatility changes and a stable range forms. Monitor price in relation to box boundaries. A move above the upper boundary may indicate upward continuation, and a move below the lower boundary may indicate downward continuation. The “Strong Closes Only” option can be used to filter signals.

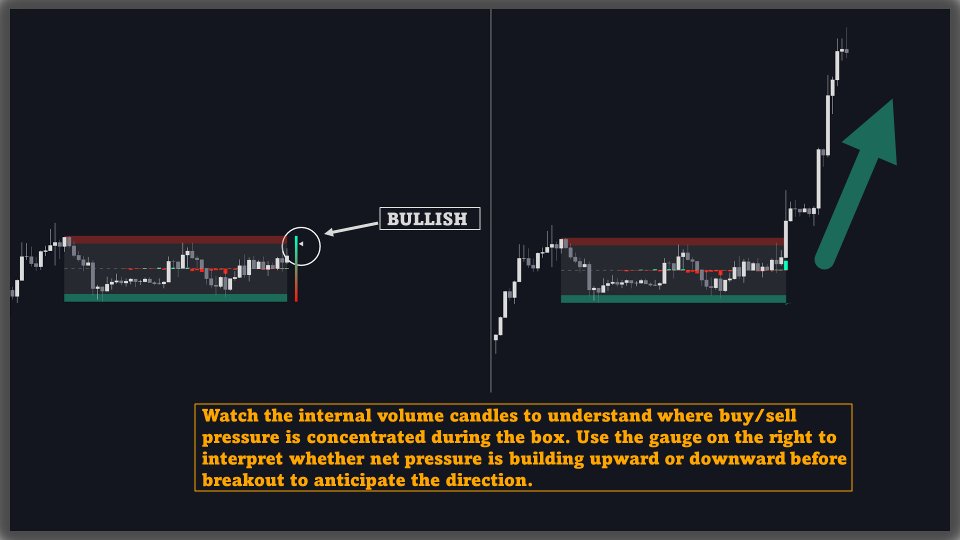

Observe internal volume candles to assess the concentration of buy/sell activity within the box. The gauge on the right can be used to interpret whether net pressure is leaning upward or downward before a breakout.

Alerts can be used to receive notifications of breakout events without constant chart monitoring.