Volumatic VIDyA MT4

- Indicators

- Duc Hoan Nguyen

- Version: 2.11

- Updated: 27 February 2025

- Activations: 10

New tools will be $30 for the first week or the first 3 purchases!

Trading Tools Channel on MQL5: Join my MQL5 channel to update the latest news from me

Volumatic VIDYA (Variable Index Dynamic Average) is an advanced indicator designed to track trends and analyze buy-sell pressure within each phase of a trend. By utilizing the Variable Index Dynamic Average as a core dynamic smoothing technique, this tool provides critical insights into both price and volume dynamics at pivotal market structure levels.

See more MT5 version at: Volumatic VIDyA MT5

See more products at: All Products

To use iCustom for EA, please see here: Create EA (iCustom) with VOLUMATIC VIDYA

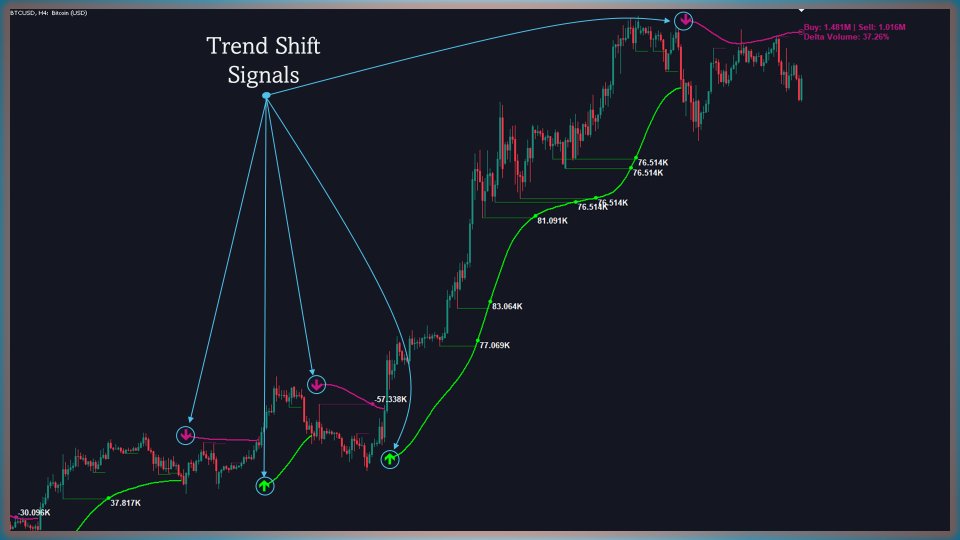

Core ConceptVolumatic VIDYA excels at identifying trends while analyzing the volume pressure driving them. The VIDYA line dynamically adapts to the strength of price movements, making it more responsive and accurate than traditional moving averages like SMA or EMA.

Beyond trend detection, Volumatic VIDYA calculates and visualizes buy-sell pressure, offering a comprehensive perspective on market participation. Horizontal lines drawn from market structure pivots, enhanced with volume data, highlight key support and resistance levels.

Additionally, alerts functionality ensures traders stay updated on critical market movements, making Volumatic VIDYA a proactive trading tool.

Key Features

1. Dynamic VIDYA Calculation

VIDYA dynamically adjusts to market momentum and volatility using the Chande Momentum Oscillator (CMO). This allows it to:

- React swiftly: Capture rapid market shifts with minimal lag.

- Filter out noise: Provide clear signals even during low volatility.

To signal trend reversals, Volumatic VIDYA uses intuitive arrows:

- Upward arrows: Indicate potential bullish reversals when the price crosses above the VIDYA line.

- Downward arrows: Signal potential bearish changes when the price drops below the VIDYA line.

These signals are enhanced with Trend Change Alerts, notifying traders in real-time when such events occur. Alerts allow timely action even when away from the screen, helping traders seize opportunities or mitigate risks.

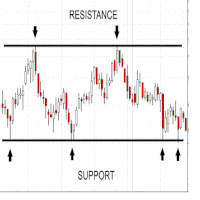

3. Market Structure Pivot Lines with Volume LabelsSupport and resistance levels are defined by horizontal lines drawn from market structure pivots:

- Horizontal liquidity lines: Drawn from price highs and lows, extended until breached.

- Volume labels: Display the average volume over the last six bars at these levels for clarity on market strength.

Extend Liquidity Line Alerts notify traders when these critical levels are broken. This feature is especially useful for:

- Identifying potential breakouts or breakdowns.

- Anticipating price movements near significant levels of interest.

- Adjusting stop-loss or take-profit levels dynamically.

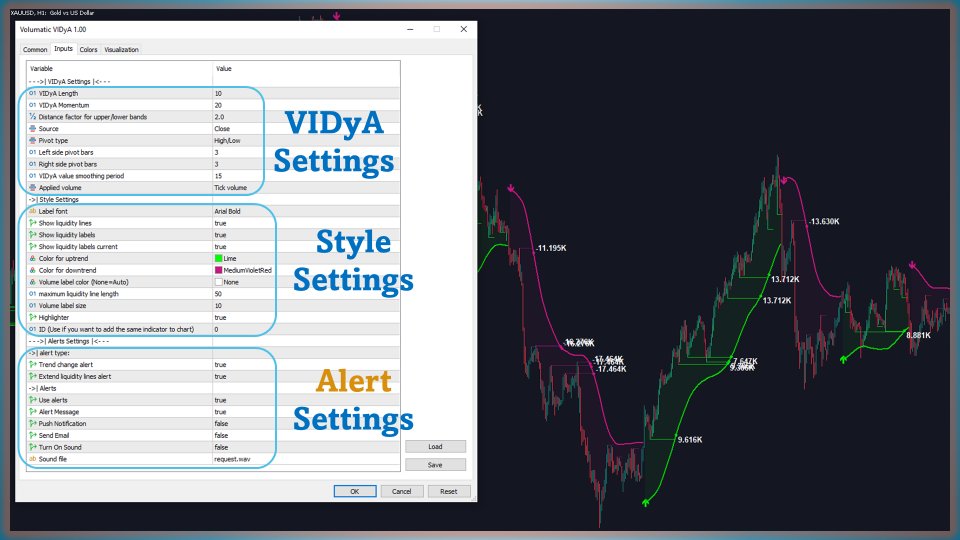

Volumatic VIDYA integrates a robust alerts system to enhance trading efficiency:

- Trend Change Alerts: Triggered when the price crosses the VIDYA line, marking potential bullish or bearish reversals.

- Extended Liquidity Line Alerts: Notify traders when price breaks above or below key pivot levels, signaling possible breakout or breakdown scenarios.

These alerts are customizable, allowing notifications via email, push, or sound, ensuring you stay informed without constant chart monitoring.

Customization OptionsVolumatic VIDYA is highly flexible, with options to suit diverse trading styles:

- VIDYA settings: Adjust length and momentum for personalized trend responsiveness.

- Pivot detection sensitivity: Define the number of bars used to calculate pivot points.

- Alert preferences: Tailor notifications to focus on specific market events, reducing unnecessary distractions.

- Monitor trends: Use the VIDYA line to track the market direction and align your strategy.

- Analyze volume pressure: Leverage delta volume to confirm trend strength or spot reversals.

- Plan around liquidity lines: Use pivot levels and associated alerts to identify breakout or support areas.

- Enable alerts: Automate monitoring to save time while staying informed about key changes.

By combining dynamic trend tracking, volume analysis, and proactive alerts, Volumatic VIDYA stands out as a comprehensive trading tool. Whether you're scalping, swing trading, or holding long-term positions, this indicator delivers:

- Dynamic adaptability: Captures trends effectively in volatile markets.

- Volume insights: Adds context to price movements for better decision-making.

- Real-time alerts: Keeps you informed of key events without constant chart monitoring.

Stay ahead in the market with Volumatic VIDYA—your ultimate partner for mastering trends, volume, and proactive trading!

Solid indicator. Developer is very open suggestions and has great customer service!