Momentum Horizon

- Experts

- Paul Geirnaerdt

- Version: 1.0

- Activations: 10

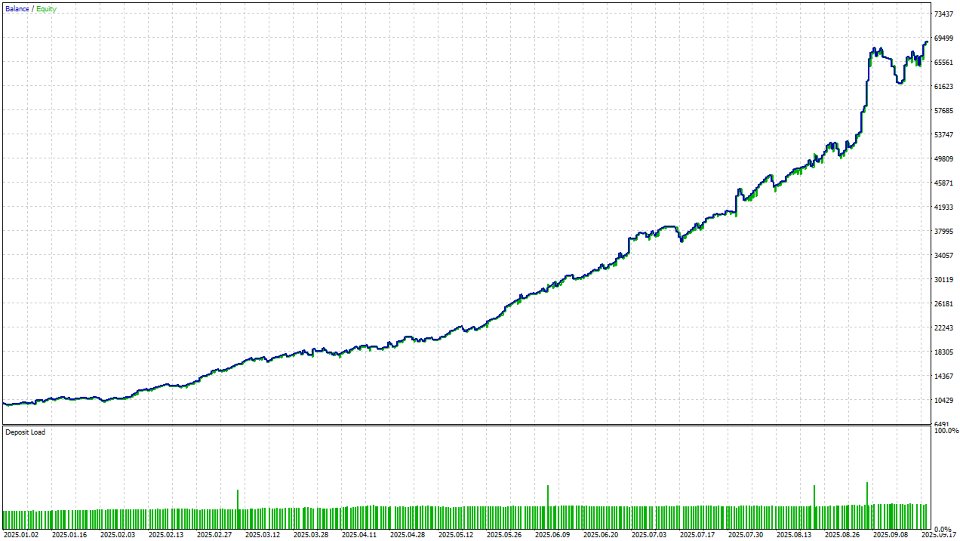

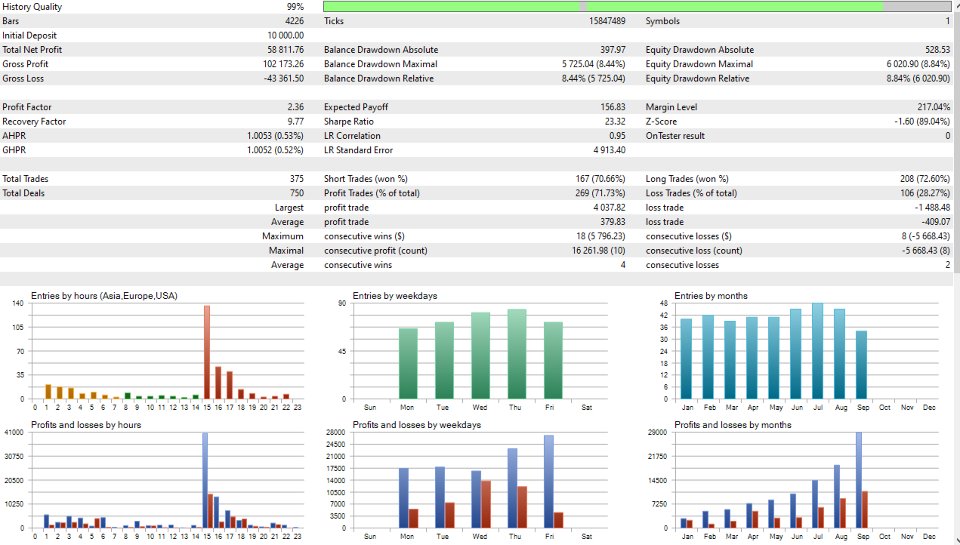

Momentum Horizon is a fully automated trading system built for MetaTrader 5, designed to capture high-probability breakout moves in the Gold market. It focuses on two of the most time-tested price action patterns: the daily breakout of yesterday’s high/low, and the powerful 'London session' breakout, where volatility often surges as global markets overlap. By combining these setups, the system seeks to position itself right where momentum is most likely to accelerate.

The EA can operate with precision pending stop orders or react instantly with market entries, depending on your preference. Risk management is fully integrated — lot sizing can be automatically calculated based on your account equity and stop distance, while smart trailing stops lock in profits as trades move in your favor. Optional ATR-based stop loss and trailing logic allow the system to adapt dynamically to changing market volatility, giving your strategy the flexibility to perform across a variety of conditions.

Momentum Horizon was built with professional standards in mind: it monitors spreads to avoid costly entries, suspends signals when market conditions aren’t right, and automatically expires outdated levels to keep your trading clean and disciplined. Whether you’re looking to complement your manual trading or deploy a robust hands-free breakout system, Momentum Horizon is designed to help you harness market momentum with confidence.

Settings

- Trade Magic – Unique ID number for this EA’s trades (prevents interference with other EAs).

- Trade Comment – Text label added to each order for easy identification.

- Trade Volume – Fixed lot size to use if risk-based sizing is disabled.

- Trade Risk (%) – Percent of account equity to risk per trade; overrides fixed lot size if greater than zero.

- Market or Stop – Choose between placing pending stop orders in advance, or waiting to enter at market orders when a breakout level is crossed.

- Breakout Points – Extra buffer (in points) added beyond the breakout level to avoid false triggers.

- Auto SL and Trailing – If enabled, stop loss and trailing levels are based on ATR (market volatility) instead of fixed points.

- Auto Correction Factor – Fine-tunes ATR-based stop distances (higher = wider stops).

- Max Spread Points – Maximum allowed spread; blocks new trades if exceeded.

- Suspension Seconds – How long a signal is suspended after a high-spread event before being re-enabled.

- Stoploss Points – Fixed stop loss distance in points (used if 'Auto' is off).

- Takeprofit Points – Fixed take profit distance in points.

- Trailing Trigger – Profit distance (in points) at which the trailing stop activates.

- Trailing Points – Distance (in points) the stop loss trails behind price once trailing is active.