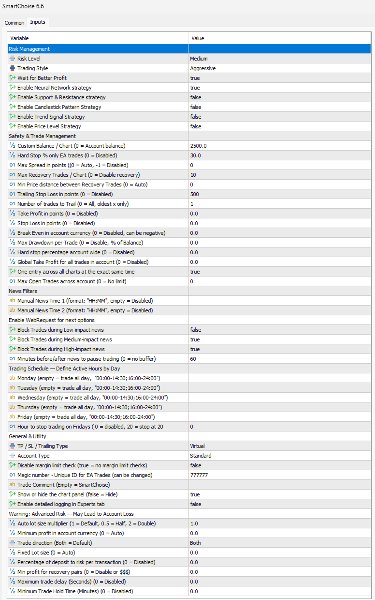

SmartChoise

- Experts

- Gabriel Costin Floricel

- Version: 7.3

- Updated: 17 August 2025

- Activations: 20

SmartChoise EA – Neural Network–Powered Trading System for XAU/USD (Gold) on M1 Timeframe

The user manual is available via the link in my profile page.

Price reduced for 24 hours

This EA is built for long-term, controlled growth—understanding and aligning it with your risk tolerance is key to its success.

Uses a neural network–based engine that continuously analyzes real-time market data to adapt trading strategies according to current market conditions. This approach helps optimize trade entries, improve risk control, and manage exposure intelligently.

Unlike systems that rely on martingale strategies, SmartChoise EA uses adaptive lot sizing and well-defined risk management rules, making it suitable for traders with different experience levels and risk appetites.

Key Features

-

Neural network–driven decision-making

-

No martingale

-

Dynamic lot sizing based on market conditions, equity, trend strength ...

-

Multiple trading modes and adjustable risk levels

-

Optional support/resistance and candlestick pattern strategies

-

Advanced recovery system for managing drawdowns

-

Built-in trailing stop and news filter options

Optional Strategies (Disabled by Default)

You can manually enable additional strategies to increase trade frequency and diversify entry logic

Important Notes

-

Smaller accounts may not be ideal for the recovery strategy, as they have less room to absorb drawdown.

-

Backtesting Limitation:

This EA was trained using historical market data, which means the backtest results may not reflect real future performance. While backtesting can demonstrate logic and behavior, it cannot guarantee live results due to the adaptive nature of the neural network. For this reason, always rely more on forward testing. -

Small accounts may not be suited for recovery-based trading due to limited drawdown capacity.

-

Using a Hard Stop Percentage and Stop Loss is recommended for smaller balances.

-

The Recovery Strategy aims to recover from drawdowns over time. This EA is designed for long-term, steady growth.

-

Disabling the recovery system or using a fixed lot size significantly changes how the EA operates and increases risk.

-

Fixed lot size disables the EA’s dynamic lot calculation based on trend strength, significantly increasing risk and making it unsuitable for recovery trading unless you carefully manage risk.

-

A small Hard Stop disables the recovery strategy, turning the EA into a simple TP/SL bot instead of a full recovery system.

Recommended Use

Small Accounts

-

Use Low or Medium risk levels

-

Focus on stable, controlled performance

Larger Accounts / Experienced Users

-

Can explore High or Extreme risk settings

-

Suitable for those seeking higher returns with more market exposure

Basic Configuration

-

Risk Level: Low, Medium, High, Extreme

-

Trading Style: Conservative (fewer trades, lower risk) or Aggressive (more trades, higher risk)

-

Hard Stop %: Limits maximum daily drawdown (e.g., 20 = 20%)

-

Max Spread: Controls entry during volatile periods, Automatically adjusts to the current market and broker conditions

- Virtual (Hidden) Trailing Stop Loss -SL levels are only managed internally by the EA. This gives better protection and avoids unwanted interference.

News Filter

-

Pause trading around scheduled news based on impact level (Low, Medium, High)

-

Customize buffer time to suspend entries before/after news events

-

Note: You must enable WebRequest for news filtering

Trade Comments Each trade includes a comment to identify the strategy used:

-

NN = Neural Network

-

SR = Support/Resistance

-

CD = Candlestick Pattern

-

R = Recovery

Example: SmartChoise_4A_CD means a trade was opened a extreme risk(4) aggressive(A) using the candlestick strategy.

Before You Trade Live

Always test the EA on a demo account first. This helps you understand how it behaves under your chosen settings and ensures your risk is in line with expectations.

To diversify risk, you can run multiple charts with different Magic Numbers.

Recommended Setup for Small Accounts:

It is strongly recommended to use a cent account to give the EA enough room to manage trades effectively.If the lot size is set too high, the EA’s recovery system may not function as intended, and drawdown could increase significantly. Always match your lot size or risk level to your account balance for optimal performance and safe recovery.

I've been using the EA since December 2024. After several configuration adjustments, performance is there with minimal drawdown.