Version 2.9

2023.03.30

*** Please always make a backup of the existing indicator (the .ex4 file) before you make the update ***

Change log:

- added an option to write the signals as global variables instead of to a file

- added a possibility to use the indicator in single chart mode (checking only the current chart symbol and time frame). This option is in some ways limited though. More information in the product's blog

- added the possibility to set the colors in the panel

- added the possibility to set a custom alert text

- added the possibility to set a custom panel title

Version 2.8

2020.11.02

*** Please always make a backup of the existing indicator (the .ex4 file) before you make an update ***

- bug fix in the pinbar filter

- added the possibility to enable the MA trend filter separately for regular and hidden divergences

Version 2.7

2020.09.13

*** Please always make a backup of the existing indicator (the .ex4 file) before you make an update ***

- I have changed the logic of detecting divergences so that more divergences will be detected. The new logic will allow divergences even if there are additional indicator extremums (top/bottoms) between the 2 already existing extremum points.

Version 2.6

2020.06.04

- upon request I have added the possibility to scan for "early" divergences. This means that the alert will come directly upon candle open instead of waiting for the slope in the indicator to change direction (candle shift 1 or 2). Candle shift must be set to 0 for this to work. Please be aware though that this will lead to more false signals.

Version 2.5

2019.11.11

- added the possibility to write the signals in the panel to a file. Could for instance be used by an Expert Advisor for automatical trading. For instance this product: https://www.mql5.com/en/market/product/43512

Version 2.4

2019.10.29

- added support for a second (fast) MA when using the MA trend filter

- added the possibility to use the RSI filter on first, second or both extremums

- added Bollinger bands filter as an alternative to the RSI filter

- added MFI, Momentum, Composite Index and MACD histogram (main line) divergences

Version 2.3

2019.09.11

- added scanning for OBV, ADX and ATR divergences

- added ADX filter

- added the possibility to select a specific time frame for the RSI filter

- added the option to use the RSI filter also on all lower time frames

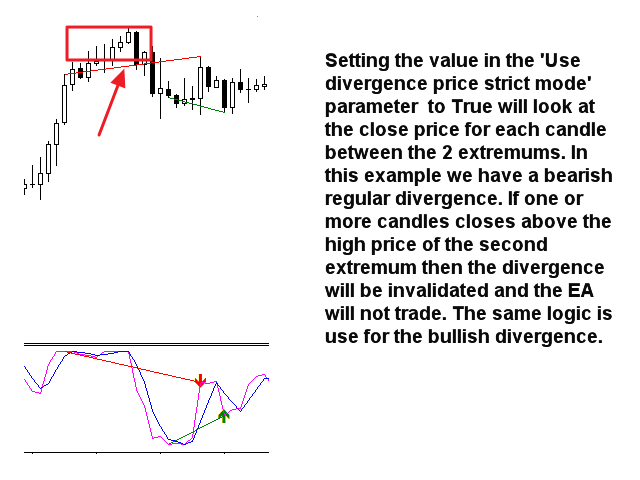

- added an option to use divergence strict mode for close price levels. Please see the first screenshot under the product description

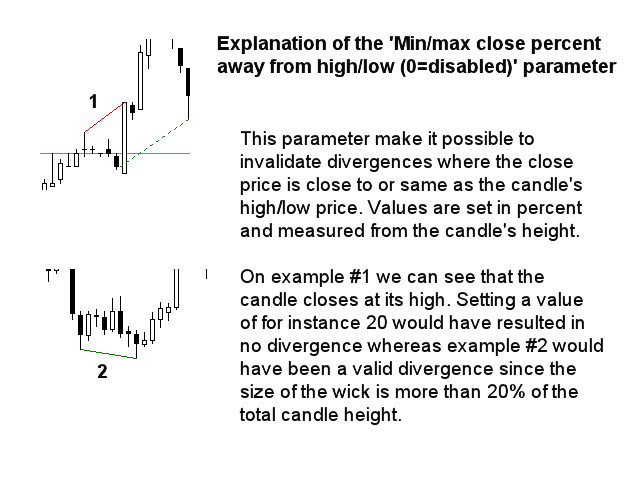

- added a filter option for setting a minimum price close level for the last extremum (divergence) candle. Please see the second screenshot under the product description.

Version 2.2

2019.02.17

- added an option to use symbols from the Market Watch window instead of the symbols written in the Symbols parameter

- added the possbility to use separate RSI filter values for hidden divergences

Version 2.1

2019.02.08

- added a possibility to use stochastics overbought/oversold filter for stochastics divergences

- added the possibility to set which stochastics price field to use (Low/High or Close/Close)

Version 2.0

2018.11.26

- added the possibility to set the divergence depth used for scanning

- it will now be possible to set the candle shift where to search for the last extremum

- improved support for the strategy tester

- overall performance improvements

Version 1.9

2018.05.18

- correted an issue with absence of alerts on the D1 time frame under some circumstances

Version 1.8

2018.05.14

- added support for strategy testing

- added possibility to set the width of the panel

Version 1.7

2018.04.19

- corrected the RSI logic for regular divergences

- added the possibility to use a custom sound file for alerts

Version 1.6

2018.04.06

- corrected the alert time in the panel

- added possibility to use a custom chart template when opening a chart from the panel

Version 1.5

2018.02.16

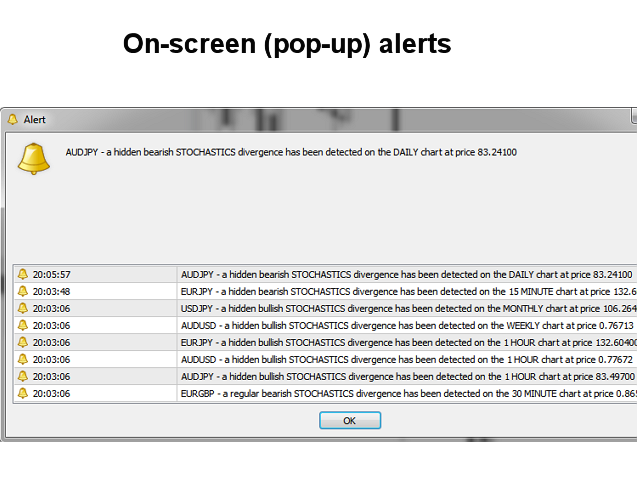

- added price level to the on-screen, push and mail alerts

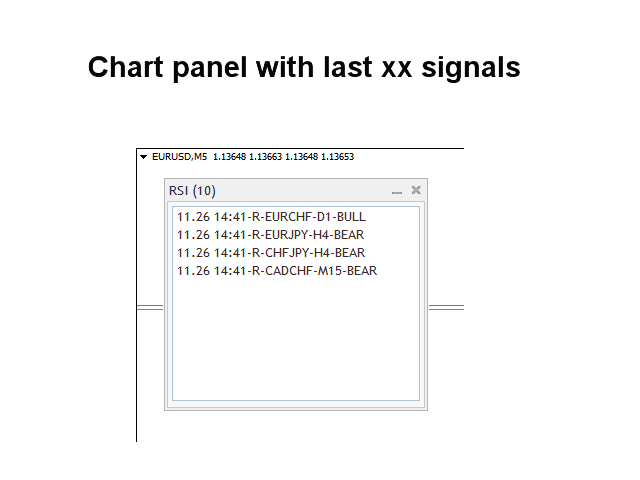

- added time of divergence alert to the panel

Version 1.4

2018.01.12

- bug fix in the Awesome oscillator

Version 1.3

2017.12.29

- added MA filter option

Version 1.2

2017.12.22

- Added the Awesome oscillator

- Possibility to disable scanning for regular divergences

- Possibility to disable the panel

Version 1.1

2017.09.19

- added pinbar/engulfing filters

Excellent product, works as described, very good contact with a friendly creator, thank you Jan. Imho one of the best developers here.