Gold Scalper Pro PSAR ADX Dashboard MT5 (Version 3.92 – Enhanced Pairs)

Professional Multi-Timeframe Trading Indicator with Advanced Signal Detection

Overview

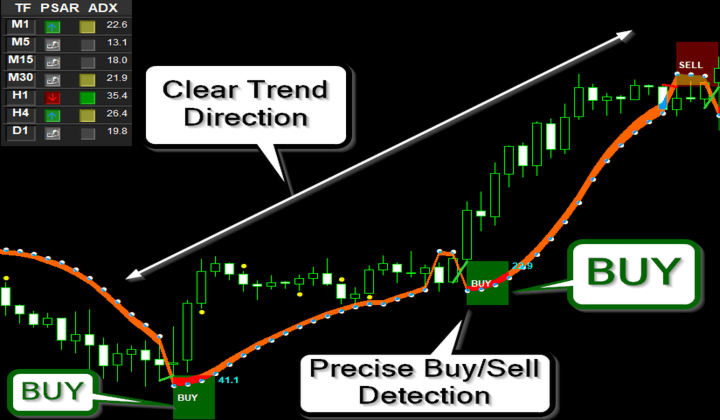

The Parabolic SAR V3 + ADX is a sophisticated technical analysis indicator that combines the trend-following capabilities of the Parabolic Stop and Reverse (PSAR) with the momentum strength measurement of the Average Directional Index (ADX). This enhanced version features pair-specific optimization, a multi-language alert system, and a comprehensive multi-timeframe dashboard for professional traders.

Key Features

Core Functionality

- Parabolic SAR Integration: Precise trend reversal detection with customizable step and maximum parameters.

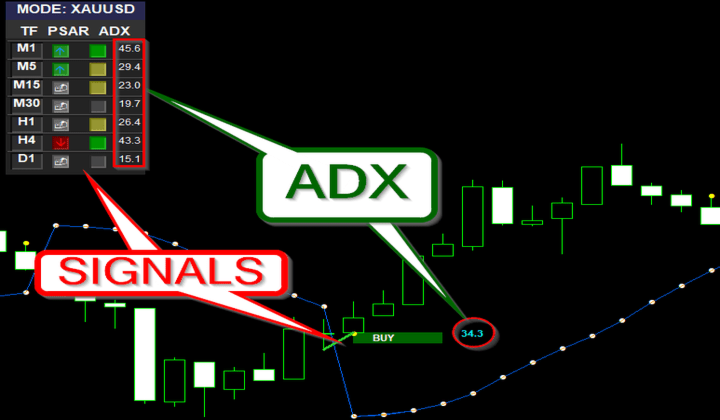

- ADX Filter System: Eliminates weak signals by filtering trades based on trend strength.

- Directional Movement Cross Detection: Additional confirmation signals through +DI/-DI crossovers.

- ADX Cloud Visualization: Visual representation of trend strength with dynamic height adjustment.

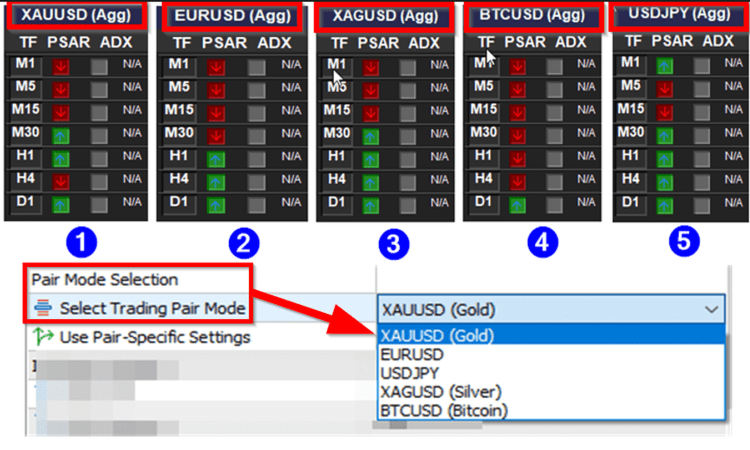

Pair-Specific Optimization

Pre-configured conservative settings for major trading instruments:

- XAUUSD (Gold): Optimized for precious metals volatility.

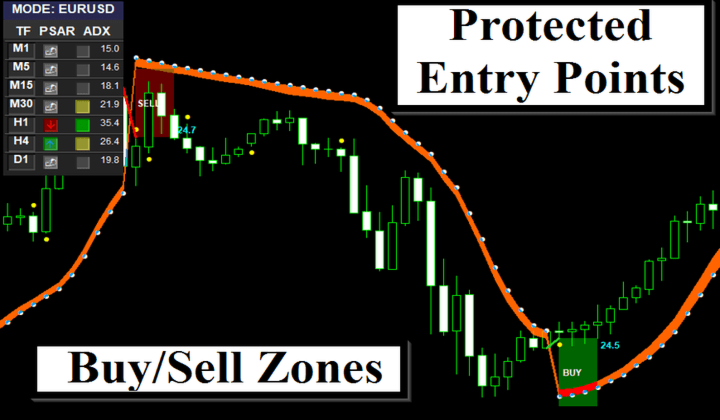

- EURUSD: Calibrated for major forex pair characteristics.

- USDJPY: Adjusted for yen cross dynamics.

- XAGUSD (Silver): Fine-tuned for silver market behavior.

- BTCUSD: Configured for cryptocurrency volatility patterns.

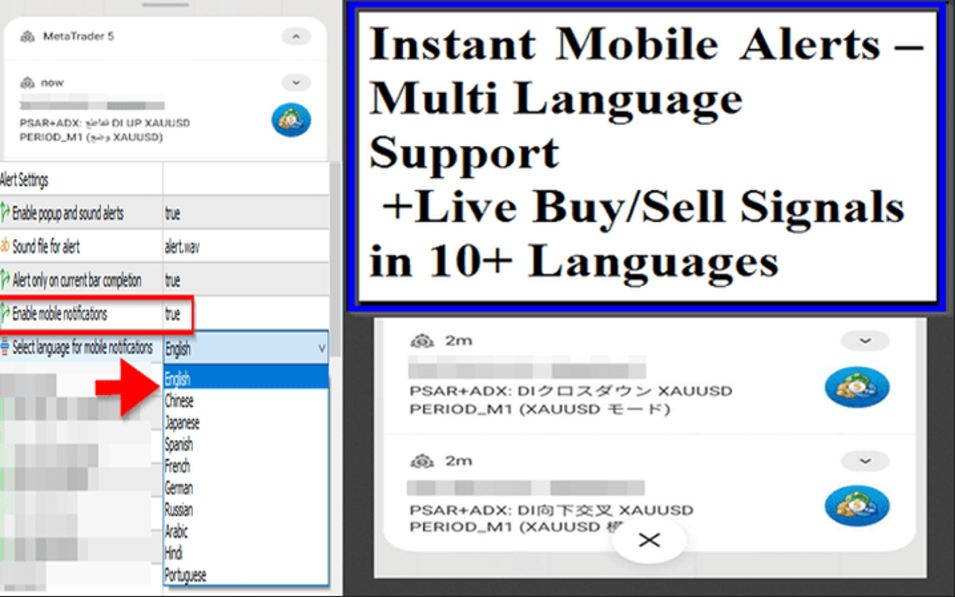

Advanced Alert System

- Multi-Language Support: Alerts available in 10 languages.

- Mobile Notifications: Push notifications to mobile devices.

- Sound Alerts: Customizable audio notifications.

- Bar Close Confirmation: Option to alert only on completed candles.

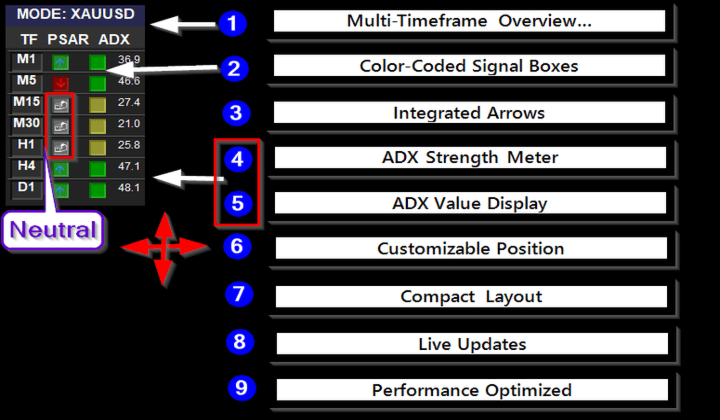

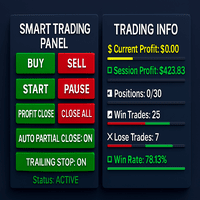

Professional Dashboard

- Multi-Timeframe Analysis: Simultaneous monitoring of 7 timeframes (M1, M5, M15, M30, H1, H4, D1).

- Color-Coded Status: Instant visual feedback on signal strength.

- ADX Meter: Real-time trend strength indication with three-tier color coding.

- Signal Box Display: Clear buy/sell signal identification with directional arrows.

Visual Enhancements

- Signal Boxes: Customizable rectangular overlays marking entry points.

- Trend Lines: Dynamic trend visualization connecting signal points.

- ADX Value Display: Real-time ADX values shown alongside signals.

- Transparency Controls: Adjustable opacity for all visual elements.

Technical Specifications

Signal Generation

- Buy Signal: PSAR flips below price + ADX above threshold + optional DI confirmation.

- Sell Signal: PSAR flips above price + ADX above threshold + optional DI confirmation.

- Weak Signal Filtering: Automatic rejection of signals when ADX falls below minimum threshold.

Customization Options

- Visual Controls: Comprehensive color and transparency settings.

- Box Dimensions: Adjustable signal box length and height parameters.

- ADX Thresholds: Configurable minimum ADX levels for signal validation.

- Cloud Settings: Dynamic ADX cloud with customizable height and colors.

Performance Features

- Optimized Calculations: Efficient buffer management for smooth operation.

- Memory Management: Proper cleanup of visual objects on indicator removal.

- Multi-Handle Support: Simultaneous multi-timeframe data processing.

Use Cases

Professional Trading

- Swing Trading: Medium-term trend identification and entry timing.

- Scalping: Short-term signal generation with ADX strength confirmation.

- Portfolio Management: Multi-asset monitoring through pair-specific modes.

Risk Management

- Signal Filtering: ADX threshold prevents trading in choppy, trendless markets.

- Trend Confirmation: Multiple indicator convergence reduces false signals.

- Visual Clarity: Clear signal identification minimizes interpretation errors.

This professional-grade indicator combines proven technical analysis methods with modern user interface design, delivering reliable trend analysis and signal generation for traders across all market conditions and trading styles.

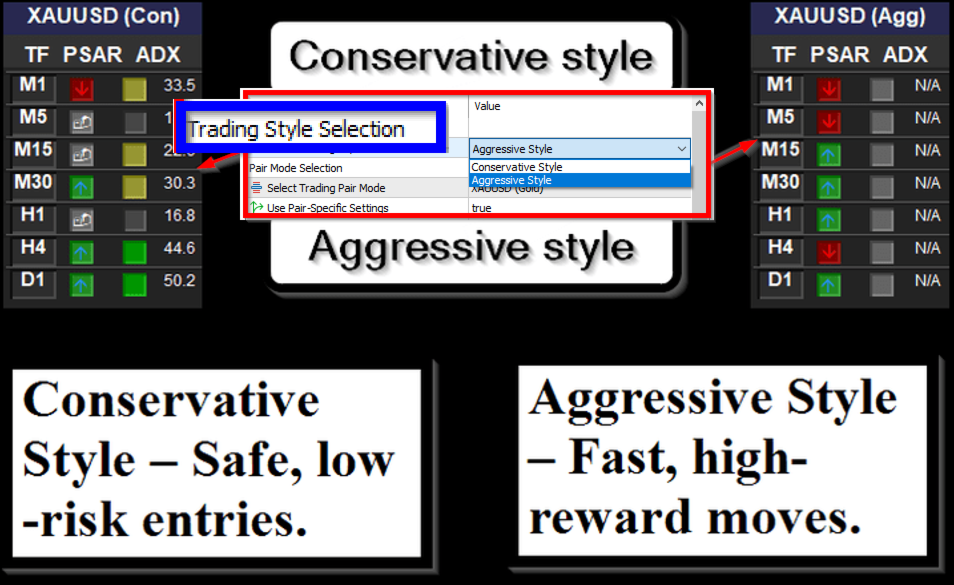

PSAR+ADX Trading Style Guide by Time Horizon

SCALPING (M1-M5, Hold: Minutes)

Aggressive Style - RECOMMENDED

Setup:

- Timeframes: M1, M5

- Pure PSAR signals (no ADX filter)

- Quick entries on PSAR flip

- Tight stops: 10-20 pips

Why Aggressive Works Better:

- Captures quick momentum shifts

- No delay from ADX confirmation

- Higher signal frequency needed for scalping

- Fast execution matches scalping requirements

Conservative Style - NOT RECOMMENDED

- ADX confirmation creates delays

- Misses quick scalping opportunities

- Too few signals for scalping frequency

- Better suited for longer timeframes

INTRADAY TRADING (M15-H1, Hold: Hours)

Aggressive Style - GOOD FIT

Setup:

- Timeframes: M15, M30

- All PSAR directional changes

- Stop loss: 20-50 pips

- Target: 30-80 pip moves

Advantages:

- More trading opportunities

- Catches intraday momentum

- Good for active session trading

- Quick profit realization

Conservative Style - ALSO GOOD FIT

Setup:

- Timeframes: M30, H1

- ADX >25 confirmation required

- Stop loss: 40-80 pips

- Target: 80-150 pip moves

Advantages:

- Higher probability setups

- Less false signals during consolidation

- Better risk-reward ratios

- Suitable for part-time traders

SWING TRADING (H1-D1, Hold: Days/Weeks)

Conservative Style - HIGHLY RECOMMENDED

Setup:

- Timeframes: H1, H4, D1

- ADX >25 + multi-timeframe alignment

- Stop loss: 100-300 pips

- Target: 200-800 pip moves

Why Conservative Excels:

- Filters out market noise

- Catches major trend moves

- Perfect for trend-following approach

- Lower maintenance trading

Aggressive Style - LESS SUITABLE

- Generates too many signals

- Increases overtrading risk

- Noise outweighs trend signals

- Better for shorter timeframes

Quick Selection Guide

SCALPING: Aggressive only (M1-M5)

INTRADAY: Both styles work (Aggressive: M15-M30, Conservative: M30-H1)

SWING: Conservative preferred (H1-D1)

Risk Management by Style

Aggressive (All Timeframes):

- Risk: 0.5-1% per trade

- Daily limit: 3% account risk

- Stop after 3 consecutive losses

Conservative (All Timeframes):

- Risk: 1-2% per trade

- Daily limit: 4% account risk

- Focus on quality over quantity