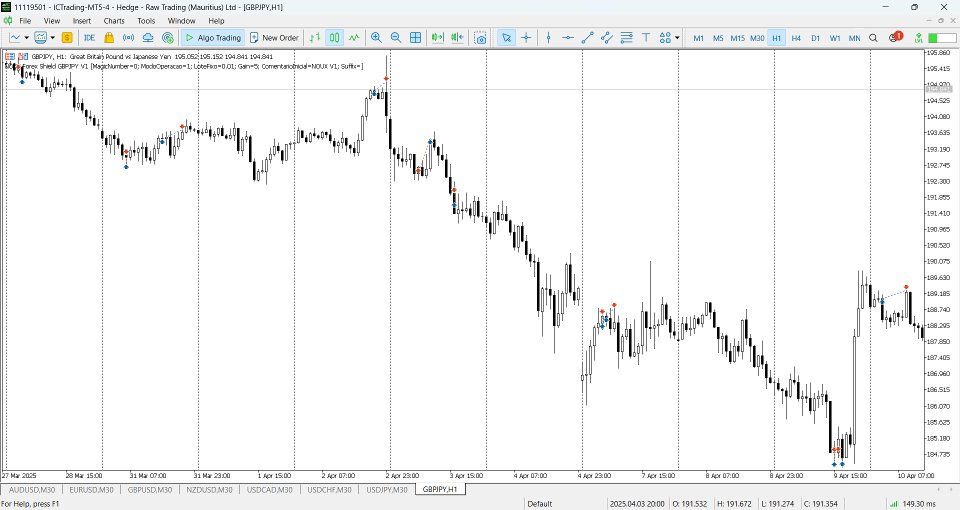

NOUX Forex Shield gbpjpy mt5 ict fgv

- Experts

- Damiem Marchand De Campos

- Version: 2.0

- Updated: 17 July 2025

- Activations: 10

EXPERT for YOUR OWN ACCOUNT - This Expert Advisor has been designed, developed and optimized especially for your own use.

This is a powerful Expert Advisor (EA) for taking advantage of the best and biggest opportunities in the GBPJPY symbol, in all phases of the trend, from start to finish, on the H1 timeframe and on the MT5 platform.

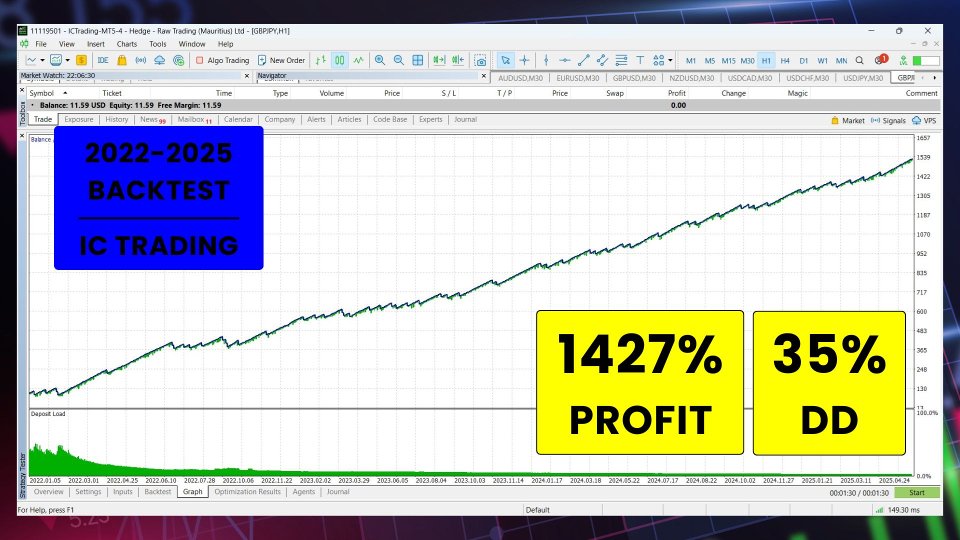

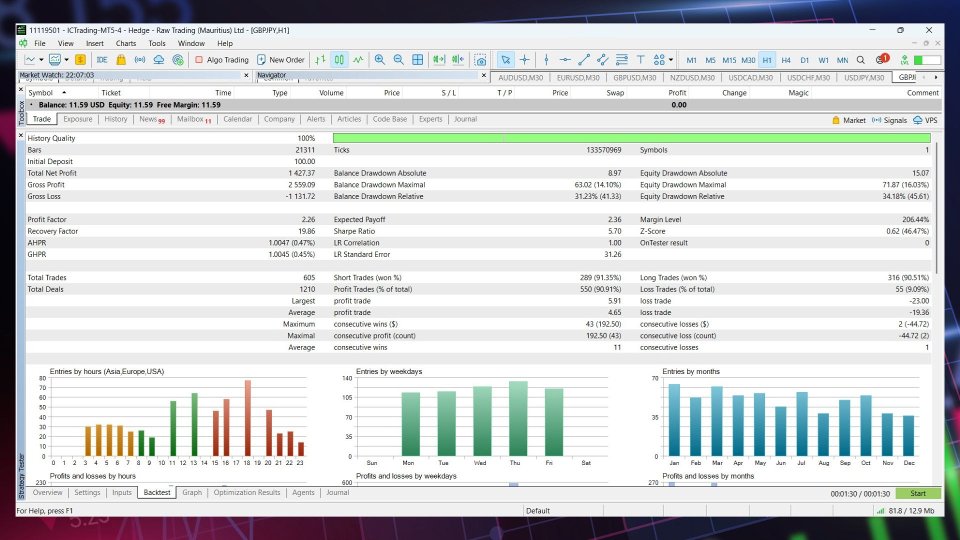

Impressive accuracy, performance and consistency in backtests over the last 3 years.

The EA works like a hunter, a sniper, analyzing the price movement, its strength and trend, patiently waiting for the best opportunities to do its job with extreme precision.

The EA is based on the ICT FVG FAIR VALUE GAP strategies and uses many native and proprietary indicators as well.

Key features:

This EA continuously analyzes the price movement and when it identifies the best opportunities, it sends a single limited order, thus opening a position.

Every position has a fixed Target and a fixed Stop Loss set from the beginning.

The lot is also calculated and determined automatically from the inputs.

Security Always: This EA is very SAFE, it does NOT use Grid, Martingale or Hedge strategies. All trades have only one entry per trade and are protected by a hard stop loss.

This EA is its very strong RESILIENT to high-impact NEWS (FOMC, FED, Payroll, ECB, BOE, SNB, BOC, BOJ, RBA or RBNZ) or any other abrupt price movements. You don't need to do anything, the EA protects itself.

Three Operation Modes:

Fixed Lot: You can enter the fixed lot you want in the inputs.

Fixed Profit: You can enter the profit amount in USD you want in the inputs. This amount will be fixed and the lot will be calculated automatically.

AutoLot: You can enter the percentage of the balance that will be used as Target Profit in the inputs.

How to install:

- Download this EA,

- Make sure that all pairs (GBPJPY) are in the Market Watch (Ctrl+M),

- Have the (GBPJPY) chart on the H1 timeframe,

- Place this EA on the (GBPJPY) chart,

- Check and adjust the parameters as shown below,

- Click OK to activate,

- Done!

INPUTS for YOUR OWN ACCOUNT - If you want to customize, there are these parameters:

- [#01] Magic Number,

- [#02] Operation Mode (Fixed Lot or Fixed Profit or AutoLot),

- --- If [#02] is Fixed Lot,

- --- If [#02] is Fixed Profit (USD),

- --- If [#02] is AutoLot,

- [#06] Comment,

- [#07] Suffix.

I am committed to continuously optimize and improve all my EAs to give you and me the best possible trading experience. You will receive all UPDATES for FREE and I will also add new features to the EA based on customer suggestions.

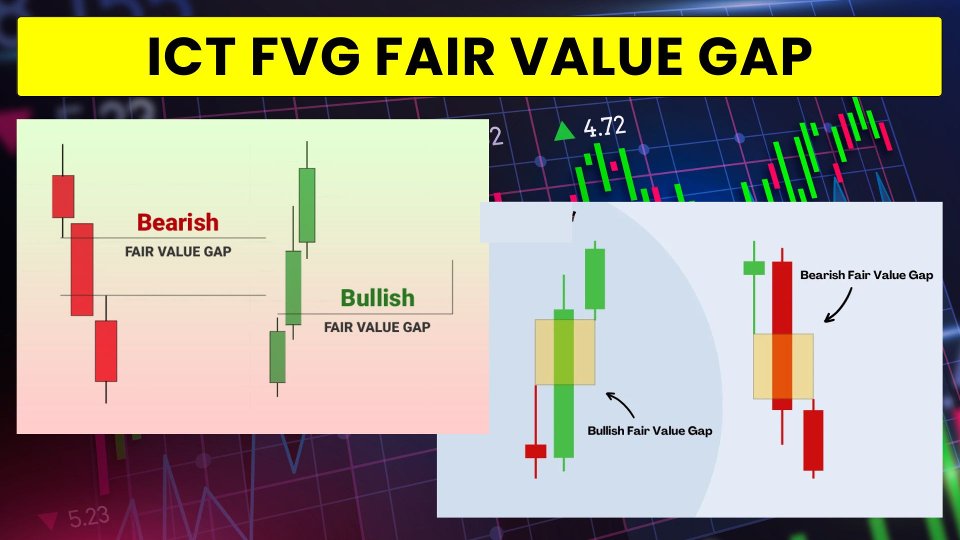

The main strategy of this expert is - ICT FVG FAIR VALUE GAP - by Michael J. Huddleston

The ICT FVG (Fair Value Gap) technique, developed within the Inner Circle Trader (ICT) methodology, is a widely used approach in technical analysis to identify entry opportunities based on liquidity imbalances in financial markets. The concept of the Fair Value Gap refers to areas on the chart where there is a dislocation between buyers and sellers, typically following sharp price movements, revealing potential zones of institutional interest and possible trend reversals or continuations.

IDENTIFYING THE FAIR VALUE GAP

The FVG is identified when, in a sequence of three consecutive candles, there is a "gap" between the high of one candle and the low of the next, with no overlap. This gap indicates a liquidity imbalance where price moved quickly without sufficient exchanges between buyers and sellers. These areas are seen as zones where large players, such as financial institutions, may return to seek liquidity, making them critical for analysis and strategic entries.

INSTITUTIONAL ROLE AND PRICE REVERSALS

One of the core principles of the ICT technique is the idea that the market is driven by institutions that target specific liquidity areas, such as Fair Value Gaps. After a strong move, price often retraces back to these gaps before continuing its path. This happens because institutional orders may not have been fully executed during the initial move. The return to the FVG represents an attempt to "fill" those orders, which can offer reversal or continuation opportunities depending on the market context.

CONFLUENCE WITH OTHER ICT ANALYSIS ELEMENTS

To increase the precision of entries based on FVGs, the technique is often used in confluence with other ICT concepts such as Liquidity, Breaker Blocks, Order Blocks, and Market Structure. The presence of an FVG within a liquidity zone or near an Order Block significantly enhances the likelihood of a meaningful price reaction. Additionally, multi-timeframe analysis (top-down) is essential to validate the significance of the gap, ensuring the entry aligns with the prevailing trend and institutional zones of interest.

This expert also uses a basket of indicators as a basis, the main one being a unique and exclusive indicator, created and optimized by the developer.

Damian is an excellent developer who provides fast and efficient support. He is always willing to help and answer all your questions. I have added his EAs to my portfolio and will be testing them on a live account over the coming months. So far, no issues at all. In backtests, the results are excellent with a relatively low drawdown.