NTRon 2OOO

- Experts

- Konstantin Freize

- Version: 2.10

- Activations: 14

Hybrid Trading Strategy for XAUUSD – Combination of News Sentiment & Order Book Imbalance

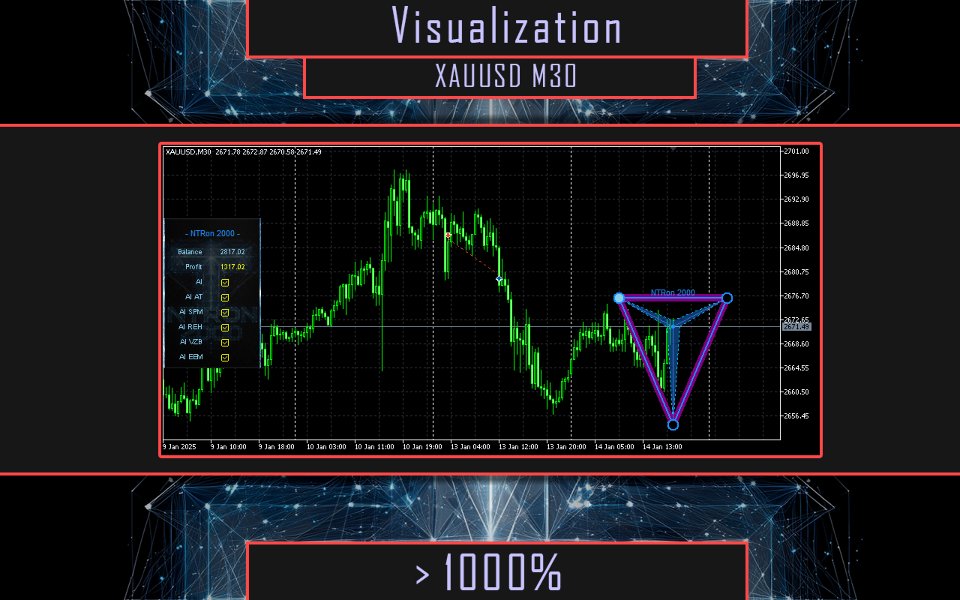

This strategy combines two rarely used but highly effective trading approaches into a hybrid system developed exclusively for trading XAUUSD (Gold) on the 30-minute chart.

While conventional Expert Advisors often rely on predefined indicators or basic chart patterns, this system is based on an intelligent market access model

that integrates real-time data and context-based analysis into its decision-making process.

-

Real-time sentiment analysis of economic news (powered by GPT-5)

-

Simulation of order book imbalances (DOM) using tick data

The combination of these two components provides a robust foundation for precise entries and exits by incorporating both fundamental and microstructural market data.

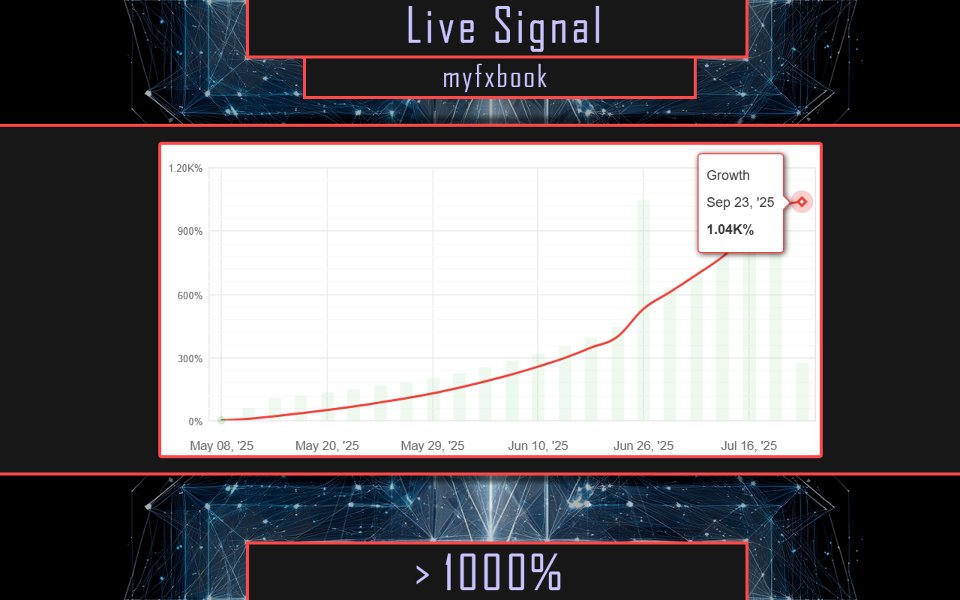

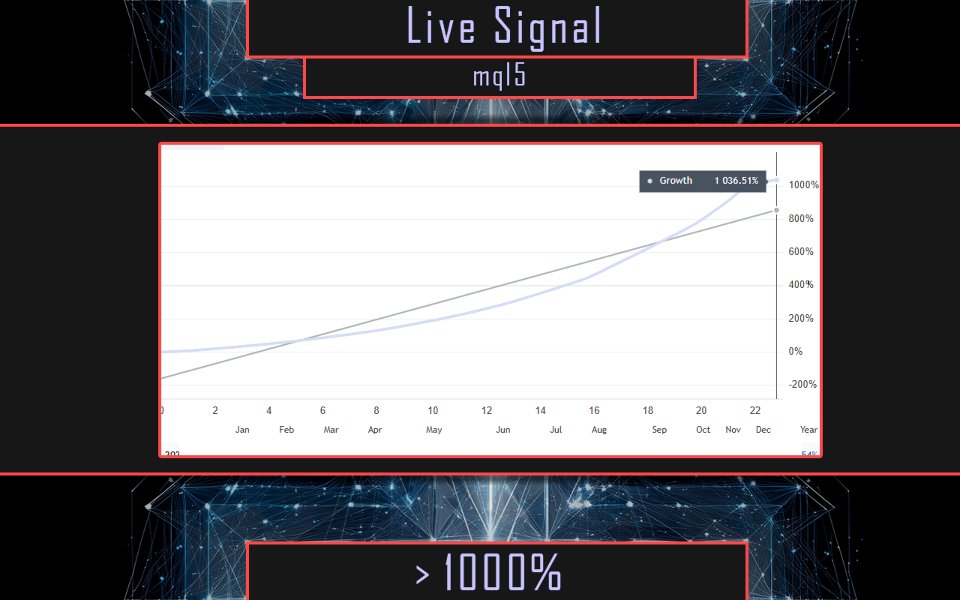

Transparency is important to me, which is why you can track all results through the linked signal: Signal

Please contact me directly after purchase to receive the set file and the manual.

[Features & Recommendation]

-

Trading Instrument: XAUUSD (Gold)

-

Timeframe: 30 minutes (optimal balance between reaction speed and signal quality)

-

Leverage: minimum 1:50 (to make efficient use of movements without overexposing risk)

-

Initial Capital: from 230 USD (already allows for small lot sizes with conservative risk management)

[Sentiment Analysis of News Headlines]

Gold reacts strongly to macroeconomic data such as inflation reports, employment figures, and U.S. interest rate decisions.

Instead of avoiding these periods like many systems do, this strategy actively uses the sentiment derived from original headlines as a decision-making factor:

-

Positive sentiment for USD (hawkish Fed comments, strong economic data) → tendency short on XAUUSD

-

Negative sentiment for USD (weak data, dovish rhetoric) → tendency long on XAUUSD

GPT-5 acts as a semantic filter, interpreting headlines not only literally but also contextually.

For example, it can determine whether a phrase like "Fed cautious on inflation" should be classified as restrictive (bullish for USD, bearish for Gold) or neutral.

This prevents the system from being misled by superficial keywords and enables a well-founded, high-quality sentiment assessment.

[Order Book Imbalance / DOM Simulation]

Since MT4/MT5 provides only limited order book data, a DOM simulation is implemented using tick data. This process includes:

-

Identification of volume clusters and price levels

-

Detection of noticeable accumulations of buy or sell interest

-

Recognition of potential liquidity walls (price levels with high concentrations of supply or demand)

The challenge lies in distinguishing real liquidity barriers from artificial ones (fake walls). This is where GPT-5 once again plays a crucial role: the AI detects patterns in the tick flow and filters out anomalies to eliminate false signals.

This allows the EA to recognize whether the market is truly ready to break through a level—or if it's simply a manipulation attempt by large players to mislead retail traders.

[Synergy Effect – Why This Combination is Unique]

The true strength of this system lies in the intelligent combination of two complementary analytical approaches.

Sentiment analysis provides clear macroeconomic orientation—based on fundamental data, it defines a long or short bias.

In parallel, the DOM simulation analyzes market behavior at the micro level and identifies institutional intent through tick clustering.

Example: If the news indicates USD weakness—which is generally bullish for gold—and the DOM simulation shows strong buying activity at lower price levels, this creates a highly probable long scenario.

Conversely, a seemingly bullish setup is ignored if the news suggests a long bias, but the order book clearly indicates that smart money is positioned in the opposite direction.

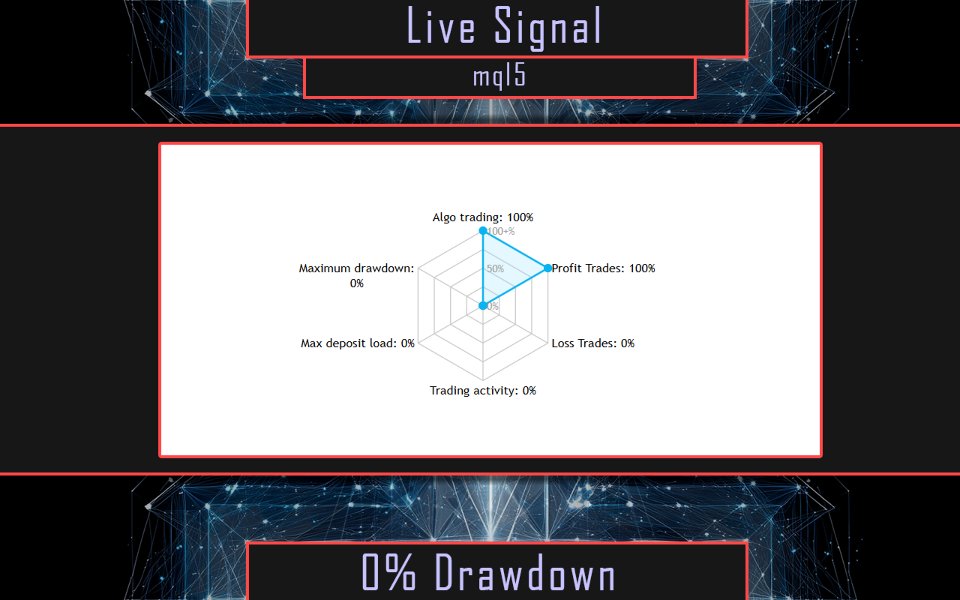

This combination results in a dual-layered filtering mechanism that significantly reduces false trades, increases accuracy, and maintains drawdown stability.

[Market Potential & Uniqueness]

This strategy clearly stands out from conventional approaches and is extremely rare in this form on the market.While most systems rely solely on technical indicators or static news filters, this Expert Advisor combines two powerful components:

A GPT-powered news sentiment analysis and a DOM simulation based on tick data (order book imbalance).

This innovative approach merges both fundamental and microstructural market information into a single system, opening up new possibilities for precise and well-founded trading decisions.

Especially in trading XAUUSD, an asset highly sensitive to news and driven by liquidity dynamics, this hybrid model proves to be

not only extremely stable but also clearly focused on sustainable success in a dynamic market environment.

Conclusion:

This trading strategy combines the best of both worlds: macroeconomic intelligence + microstructural precision.

GPT-5 is used not just as a signal generator, but as an intelligent filter against false signals—a combination rarely applied, yet with enormous potential.

I purchased NTRon 2OOO. The author, Konstantin Freize, was very kind. I made my first trade using it, and it was profitable. I've purchased and tested various EAs, but this one feels truly excellent. I plan to document the results after running it for a while. I feel the author is trustworth