Self Optimizing Expert Advisors in MQL5 (Part 17): Ensemble Intelligence

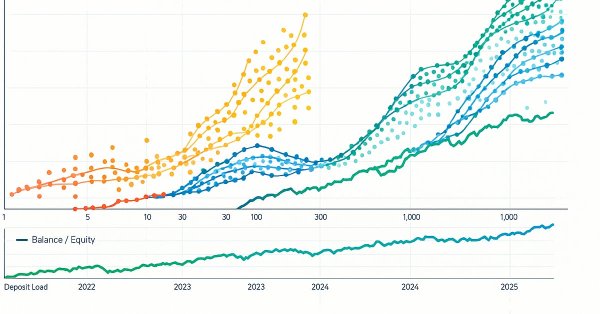

All algorithmic trading strategies are difficult to set up and maintain, regardless of complexity—a challenge shared by beginners and experts alike. This article introduces an ensemble framework where supervised models and human intuition work together to overcome their shared limitations. By aligning a moving average channel strategy with a Ridge Regression model on the same indicators, we achieve centralized control, faster self-correction, and profitability from otherwise unprofitable systems.

Integrating MQL5 with Data Processing Packages (Part 6): Merging Market Feedback with Model Adaptation

In this part, we focus on how to merge real-time market feedback—such as live trade outcomes, volatility changes, and liquidity shifts—with adaptive model learning to maintain a responsive and self-improving trading system.

Blood inheritance optimization (BIO)

I present to you my new population optimization algorithm - Blood Inheritance Optimization (BIO), inspired by the human blood group inheritance system. In this algorithm, each solution has its own "blood type" that determines the way it evolves. Just as in nature where a child's blood type is inherited according to specific rules, in BIO new solutions acquire their characteristics through a system of inheritance and mutations.

Neural Networks in Trading: Memory Augmented Context-Aware Learning for Cryptocurrency Markets (Final Part)

The MacroHFT framework for high-frequency cryptocurrency trading uses context-aware reinforcement learning and memory to adapt to dynamic market conditions. At the end of this article, we will test the implemented approaches on real historical data to assess their effectiveness.

Analyzing all price movement options on the IBM quantum computer

We will use a quantum computer from IBM to discover all price movement options. Sounds like science fiction? Welcome to the world of quantum computing for trading!

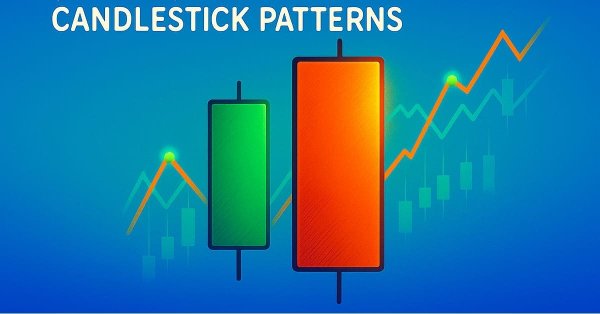

Reimagining Classic Strategies (Part 18): Searching For Candlestick Patterns

This article helps new community members search for and discover their own candlestick patterns. Describing these patterns can be daunting, as it requires manually searching and creatively identifying improvements. Here, we introduce the engulfing candlestick pattern and show how it can be enhanced for more profitable trading applications.

Neural Networks in Trading: Memory Augmented Context-Aware Learning (MacroHFT) for Cryptocurrency Markets

I invite you to explore the MacroHFT framework, which applies context-aware reinforcement learning and memory to improve high-frequency cryptocurrency trading decisions using macroeconomic data and adaptive agents.

Circle Search Algorithm (CSA)

The article presents a new metaheuristic optimization Circle Search Algorithm (CSA) based on the geometric properties of a circle. The algorithm uses the principle of moving points along tangents to find the optimal solution, combining the phases of global exploration and local exploitation.

MetaTrader 5 Machine Learning Blueprint (Part 5): Sequential Bootstrapping—Debiasing Labels, Improving Returns

Sequential bootstrapping reshapes bootstrap sampling for financial machine learning by actively avoiding temporally overlapping labels, producing more independent training samples, sharper uncertainty estimates, and more robust trading models. This practical guide explains the intuition, shows the algorithm step‑by‑step, provides optimized code patterns for large datasets, and demonstrates measurable performance gains through simulations and real backtests.

Reimagining Classic Strategies (Part 17): Modelling Technical Indicators

In this discussion, we focus on how we can break the glass ceiling imposed by classical machine learning techniques in finance. It appears that the greatest limitation to the value we can extract from statistical models does not lie in the models themselves — neither in the data nor in the complexity of the algorithms — but rather in the methodology we use to apply them. In other words, the true bottleneck may be how we employ the model, not the model’s intrinsic capability.

Neural Networks in Trading: A Multi-Agent System with Conceptual Reinforcement (Final Part)

We continue to implement the approaches proposed by the authors of the FinCon framework. FinCon is a multi-agent system based on Large Language Models (LLMs). Today, we will implement the necessary modules and conduct comprehensive testing of the model on real historical data.

Self Optimizing Expert Advisors in MQL5 (Part 16): Supervised Linear System Identification

Linear system identifcation may be coupled to learn to correct the error in a supervised learning algorithm. This allows us to build applications that depend on statistical modelling techniques without necessarily inheriting the fragility of the model's restrictive assumptions. Classical supervised learning algorithms have many needs that may be supplemented by pairing these models with a feedback controller that can correct the model to keep up with current market conditions.

Neural Networks in Trading: A Multi-Agent System with Conceptual Reinforcement (FinCon)

We invite you to explore the FinCon framework, which is a a Large Language Model (LLM)-based multi-agent system. The framework uses conceptual verbal reinforcement to improve decision making and risk management, enabling effective performance on a variety of financial tasks.

Machine Learning Blueprint (Part 4): The Hidden Flaw in Your Financial ML Pipeline — Label Concurrency

Discover how to fix a critical flaw in financial machine learning that causes overfit models and poor live performance—label concurrency. When using the triple-barrier method, your training labels overlap in time, violating the core IID assumption of most ML algorithms. This article provides a hands-on solution through sample weighting. You will learn how to quantify temporal overlap between trading signals, calculate sample weights that reflect each observation's unique information, and implement these weights in scikit-learn to build more robust classifiers. Learning these essential techniques will make your trading models more robust, reliable and profitable.

Overcoming The Limitation of Machine Learning (Part 6): Effective Memory Cross Validation

In this discussion, we contrast the classical approach to time series cross-validation with modern alternatives that challenge its core assumptions. We expose key blind spots in the traditional method—especially its failure to account for evolving market conditions. To address these gaps, we introduce Effective Memory Cross-Validation (EMCV), a domain-aware approach that questions the long-held belief that more historical data always improves performance.

Neural Networks in Trading: A Multimodal, Tool-Augmented Agent for Financial Markets (Final Part)

We continue to develop the algorithms for FinAgent, a multimodal financial trading agent designed to analyze multimodal market dynamics data and historical trading patterns.

Neural Networks in Trading: A Multimodal, Tool-Augmented Agent for Financial Markets (FinAgent)

We invite you to explore FinAgent, a multimodal financial trading agent framework designed to analyze various types of data reflecting market dynamics and historical trading patterns.

Royal Flush Optimization (RFO)

The original Royal Flush Optimization algorithm offers a new approach to solving optimization problems, replacing the classic binary coding of genetic algorithms with a sector-based approach inspired by poker principles. RFO demonstrates how simplifying basic principles can lead to an efficient and practical optimization method. The article presents a detailed analysis of the algorithm and test results.

MQL5 Wizard Techniques you should know (Part 85): Using Patterns of Stochastic-Oscillator and the FrAMA with Beta VAE Inference Learning

This piece follows up ‘Part-84’, where we introduced the pairing of Stochastic and the Fractal Adaptive Moving Average. We now shift focus to Inference Learning, where we look to see if laggard patterns in the last article could have their fortunes turned around. The Stochastic and FrAMA are a momentum-trend complimentary pairing. For our inference learning, we are revisiting the Beta algorithm of a Variational Auto Encoder. We also, as always, do the implementation of a custom signal class designed for integration with the MQL5 Wizard.

Neural Networks in Trading: An Agent with Layered Memory (Final Part)

We continue our work on creating the FinMem framework, which uses layered memory approaches that mimic human cognitive processes. This allows the model not only to effectively process complex financial data but also to adapt to new signals, significantly improving the accuracy and effectiveness of investment decisions in dynamically changing markets.

Dialectic Search (DA)

The article introduces the dialectical algorithm (DA), a new global optimization method inspired by the philosophical concept of dialectics. The algorithm exploits a unique division of the population into speculative and practical thinkers. Testing shows impressive performance of up to 98% on low-dimensional problems and overall efficiency of 57.95%. The article explains these metrics and presents a detailed description of the algorithm and the results of experiments on different types of functions.

Biological neuron for forecasting financial time series

We will build a biologically correct system of neurons for time series forecasting. The introduction of a plasma-like environment into the neural network architecture creates a kind of "collective intelligence," where each neuron influences the system's operation not only through direct connections, but also through long-range electromagnetic interactions. Let's see how the neural brain modeling system will perform in the market.

Creating volatility forecast indicator using Python

In this article, we will forecast future extreme volatility using binary classification. Besides, we will develop an extreme volatility forecast indicator using machine learning.

Neural Networks in Trading: An Agent with Layered Memory

Layered memory approaches that mimic human cognitive processes enable the processing of complex financial data and adaptation to new signals, thereby improving the effectiveness of investment decisions in dynamic markets.

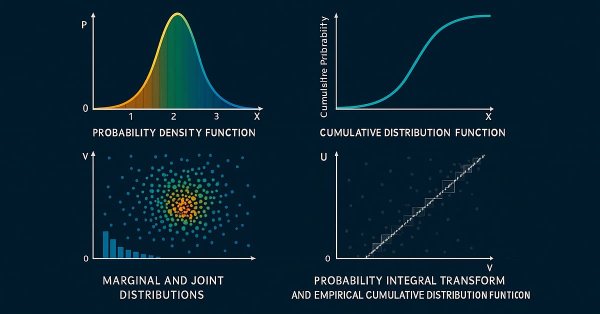

Bivariate Copulae in MQL5 (Part 1): Implementing Gaussian and Student's t-Copulae for Dependency Modeling

This is the first part of an article series presenting the implementation of bivariate copulae in MQL5. This article presents code implementing Gaussian and Student's t-copulae. It also delves into the fundamentals of statistical copulae and related topics. The code is based on the Arbitragelab Python package by Hudson and Thames.

Time Evolution Travel Algorithm (TETA)

This is my own algorithm. The article presents the Time Evolution Travel Algorithm (TETA) inspired by the concept of parallel universes and time streams. The basic idea of the algorithm is that, although time travel in the conventional sense is impossible, we can choose a sequence of events that lead to different realities.

Neural Networks in Trading: Models Using Wavelet Transform and Multi-Task Attention (Final Part)

In the previous article, we explored the theoretical foundations and began implementing the approaches of the Multitask-Stockformer framework, which combines the wavelet transform and the Self-Attention multitask model. We continue to implement the algorithms of this framework and evaluate their effectiveness on real historical data.

MQL5 Wizard Techniques you should know (Part 82): Using Patterns of TRIX and the WPR with DQN Reinforcement Learning

In the last article, we examined the pairing of Ichimoku and the ADX under an Inference Learning framework. For this piece we revisit, Reinforcement Learning when used with an indicator pairing we considered last in ‘Part 68’. The TRIX and Williams Percent Range. Our algorithm for this review will be the Quantile Regression DQN. As usual, we present this as a custom signal class designed for implementation with the MQL5 Wizard.

Evolutionary trading algorithm with reinforcement learning and extinction of feeble individuals (ETARE)

In this article, I introduce an innovative trading algorithm that combines evolutionary algorithms with deep reinforcement learning for Forex trading. The algorithm uses the mechanism of extinction of inefficient individuals to optimize the trading strategy.

Neural Networks in Trading: Models Using Wavelet Transform and Multi-Task Attention

We invite you to explore a framework that combines wavelet transforms and a multi-task self-attention model, aimed at improving the responsiveness and accuracy of forecasting in volatile market conditions. The wavelet transform allows asset returns to be decomposed into high and low frequencies, carefully capturing long-term market trends and short-term fluctuations.

MetaTrader 5 Machine Learning Blueprint (Part 3): Trend-Scanning Labeling Method

We have built a robust feature engineering pipeline using proper tick-based bars to eliminate data leakage and solved the critical problem of labeling with meta-labeled triple-barrier signals. This installment covers the advanced labeling technique, trend-scanning, for adaptive horizons. After covering the theory, an example shows how trend-scanning labels can be used with meta-labeling to improve on the classic moving average crossover strategy.

MQL5 Wizard Techniques you should know (Part 81): Using Patterns of Ichimoku and the ADX-Wilder with Beta VAE Inference Learning

This piece follows up ‘Part-80’, where we examined the pairing of Ichimoku and the ADX under a Reinforcement Learning framework. We now shift focus to Inference Learning. Ichimoku and ADX are complimentary as already covered, however we are going to revisit the conclusions of the last article related to pipeline use. For our inference learning, we are using the Beta algorithm of a Variational Auto Encoder. We also stick with the implementation of a custom signal class designed for integration with the MQL5 Wizard.

Neural Networks in Trading: A Hybrid Trading Framework with Predictive Coding (Final Part)

We continue our examination of the StockFormer hybrid trading system, which combines predictive coding and reinforcement learning algorithms for financial time series analysis. The system is based on three Transformer branches with a Diversified Multi-Head Attention (DMH-Attn) mechanism that enables the capturing of complex patterns and interdependencies between assets. Previously, we got acquainted with the theoretical aspects of the framework and implemented the DMH-Attn mechanisms. Today, we will talk about the model architecture and training.

Price movement discretization methods in Python

We will look at price discretization methods using Python + MQL5. In this article, I will share my practical experience developing a Python library that implements a wide range of approaches to bar formation — from classic Volume and Range bars to more exotic methods like Renko and Kagi. We will consider three-line breakout candles and range bars analyzing their statistics and trying to define how else the prices can be represented discretely.

Reimagining Classic Strategies (Part 16): Double Bollinger Band Breakouts

This article walks the reader through a reimagined version of the classical Bollinger Band breakout strategy. It identifies key weaknesses in the original approach, such as its well-known susceptibility to false breakouts. The article aims to introduce a possible solution: the Double Bollinger Band trading strategy. This relatively lesser known approach supplements the weaknesses of the classical version and offers a more dynamic perspective on financial markets. It helps us overcome the old limitations defined by the original rules, providing traders with a stronger and more adaptive framework.

Cyclic Parthenogenesis Algorithm (CPA)

The article considers a new population optimization algorithm - Cyclic Parthenogenesis Algorithm (CPA), inspired by the unique reproductive strategy of aphids. The algorithm combines two reproduction mechanisms — parthenogenesis and sexual reproduction — and also utilizes the colonial structure of the population with the possibility of migration between colonies. The key features of the algorithm are adaptive switching between different reproductive strategies and a system of information exchange between colonies through the flight mechanism.

MQL5 Wizard Techniques you should know (Part 80): Using Patterns of Ichimoku and the ADX-Wilder with TD3 Reinforcement Learning

This article follows up ‘Part-74’, where we examined the pairing of Ichimoku and the ADX under a Supervised Learning framework, by moving our focus to Reinforcement Learning. Ichimoku and ADX form a complementary combination of support/resistance mapping and trend strength spotting. In this installment, we indulge in how the Twin Delayed Deep Deterministic Policy Gradient (TD3) algorithm can be used with this indicator set. As with earlier parts of the series, the implementation is carried out in a custom signal class designed for integration with the MQL5 Wizard, which facilitates seamless Expert Advisor assembly.

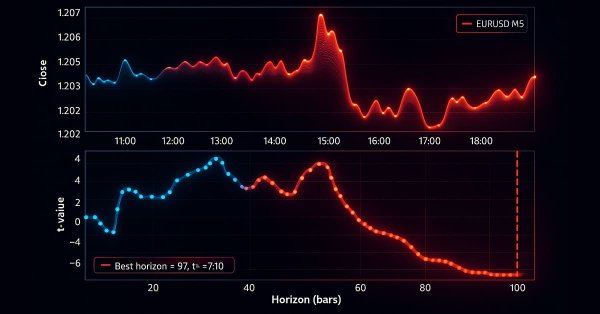

Overcoming The Limitation of Machine Learning (Part 4): Overcoming Irreducible Error Using Multiple Forecast Horizons

Machine learning is often viewed through statistical or linear algebraic lenses, but this article emphasizes a geometric perspective of model predictions. It demonstrates that models do not truly approximate the target but rather map it onto a new coordinate system, creating an inherent misalignment that results in irreducible error. The article proposes that multi-step predictions, comparing the model’s forecasts across different horizons, offer a more effective approach than direct comparisons with the target. By applying this method to a trading model, the article demonstrates significant improvements in profitability and accuracy without changing the underlying model.

Neuro-symbolic systems in algorithmic trading: Combining symbolic rules and neural networks

The article describes the experience of developing a hybrid trading system that combines classical technical analysis with neural networks. The author provides a detailed analysis of the system architecture from basic pattern analysis and neural network structure to the mechanisms behind trading decisions, and shares real code and practical observations.

Functions for activating neurons during training: The key to fast convergence?

This article presents a study of the interaction of different activation functions with optimization algorithms in the context of neural network training. Particular attention is paid to the comparison of the classical ADAM and its population version when working with a wide range of activation functions, including the oscillating ACON and Snake functions. Using a minimalistic MLP (1-1-1) architecture and a single training example, the influence of activation functions on the optimization is isolated from other factors. The article proposes an approach to manage network weights through the boundaries of activation functions and a weight reflection mechanism, which allows avoiding problems with saturation and stagnation in training.