The MQL5 Standard Library Explorer (Part 8) : The Hybrid Trades Journal Logging with CFile

In this article, we explore the File Operations classes of the MQL5 Standard Library to build a robust reporting module that automatically generates Excel-ready CSV files. Along the way, we clearly distinguish between manually executed trades and algorithmically executed orders, laying the groundwork for reliable, auditable trade reporting.

Using Deep Reinforcement Learning to Enhance Ilan Expert Advisor

We revisit the Ilan grid Expert Advisor and integrate Q-learning in MQL5 to build an adaptive version for MetaTrader 5. The article shows how to define state features, discretize them for a Q-table, select actions with ε-greedy, and shape rewards for averaging and exits. You will implement saving/loading the Q-table, tune learning parameters, and test on EURUSD/AUDUSD in the Strategy Tester to evaluate stability and drawdown risks.

From Novice to Expert: Developing a Liquidity Strategy

Liquidity zones are commonly traded by waiting for the price to return and retest the zone of interest, often through the placement of pending orders within these areas. In this article, we leverage MQL5 to bring this concept to life, demonstrating how such zones can be identified programmatically and how risk management can be systematically applied. Join the discussion as we explore both the logic behind liquidity-based trading and its practical implementation.

Price Action Analysis Toolkit Development (Part 58): Range Contraction Analysis and Maturity Classification Module

Building on the previous article that introduced the market state classification module, this installment focuses on implementing the core logic for identifying and evaluating compression zones. It presents a range contraction detection and maturity grading system in MQL5 that analyzes market congestion using price action alone.

Visualizing Strategies in MQL5: Laying Out Optimization Results Across Criterion Charts

In this article, we write an example of visualizing the optimization process and display the top three passes for the four optimization criteria. We will also provide an opportunity to select one of the three best passes for displaying its data in tables and on a chart.

Neuroboids Optimization Algorithm 2 (NOA2)

The new proprietary optimization algorithm NOA2 (Neuroboids Optimization Algorithm 2) combines the principles of swarm intelligence with neural control. NOA2 combines the mechanics of a neuroboid swarm with an adaptive neural system that allows agents to self-correct their behavior while searching for the optimum. The algorithm is under active development and demonstrates potential for solving complex optimization problems.

Price Action Analysis Toolkit Development (Part 57): Developing a Market State Classification Module in MQL5

This article develops a market state classification module for MQL5 that interprets price behavior using completed price data. By examining volatility contraction, expansion, and structural consistency, the tool classifies market conditions as compression, transition, expansion, or trend, providing a clear contextual framework for price action analysis.

The MQL5 Standard Library Explorer (Part 6): Optimizing a generated Expert Advisor

In this discussion, we follow up on the previously developed multi-signal Expert Advisor with the objective of exploring and applying available optimization methods. The aim is to determine whether the trading performance of the EA can be meaningfully improved through systematic optimization based on historical data.

Price Action Analysis Toolkit Development (Part 56): Reading Session Acceptance and Rejection with CPI

This article presents a session-based analytical framework that combines time-defined market sessions with the Candle Pressure Index (CPI) to classify acceptance and rejection behavior at session boundaries using closed-candle data and clearly defined rules.

Developing Market Memory Zones Indicator: Where Price Is Likely To Return

In this discussion, we will develop an indicator to identify price zones created by strong market activity, such as impulsive moves, structure shifts, and liquidity events. These zones represent areas where the market has left “memory” due to unfilled orders or rapid price displacement. By marking these regions on the chart, the indicator highlights where price is statistically more likely to revisit and react in the future.

Developing a multi-currency Expert Advisor (Part 24): Adding a new strategy (II)

In this article, we will continue to connect the new strategy to the created auto optimization system. Let's look at what changes need to be made to the optimization project creation EA, as well as the second and third stage EAs.

Price Action Analysis Toolkit Development (Part 54): Filtering Trends with EMA and Smoothed Price Action

This article explores a method that combines Heikin‑Ashi smoothing with EMA20 High and Low boundaries and an EMA50 trend filter to improve trade clarity and timing. It demonstrates how these tools can help traders identify genuine momentum, filter out noise, and better navigate volatile or trending markets.

Python-MetaTrader 5 Strategy Tester (Part 02): Dealing with Bars, Ticks, and Overloading Built-in Functions in a Simulator

In this article, we introduce functions similar to those provided by the Python-MetaTrader 5 module, providing a simulator with a familiar interface and a custom way of handling bars and ticks internally.

Neuroboids Optimization Algorithm (NOA)

A new bioinspired optimization metaheuristic, NOA (Neuroboids Optimization Algorithm), combines the principles of collective intelligence and neural networks. Unlike conventional methods, the algorithm uses a population of self-learning "neuroboids", each with its own neural network that adapts its search strategy in real time. The article reveals the architecture of the algorithm, the mechanisms of self-learning of agents, and the prospects for applying this hybrid approach to complex optimization problems.

Successful Restaurateur Algorithm (SRA)

Successful Restaurateur Algorithm (SRA) is an innovative optimization method inspired by restaurant business management principles. Unlike traditional approaches, SRA does not discard weak solutions, but improves them by combining with elements of successful ones. The algorithm shows competitive results and offers a fresh perspective on balancing exploration and exploitation in optimization problems.

Billiards Optimization Algorithm (BOA)

The BOA method is inspired by the classic game of billiards and simulates the search for optimal solutions as a game with balls trying to fall into pockets representing the best results. In this article, we will consider the basics of BOA, its mathematical model, and its efficiency in solving various optimization problems.

Developing a multi-currency Expert Advisor (Part 24): Adding a new strategy (I)

In this article, we will look at how to connect a new strategy to the auto optimization system we have created. Let's see what kind of EAs we need to create and whether it will be possible to do without changing the EA library files or minimize the necessary changes.

Chaos Game Optimization (CGO)

The article presents a new metaheuristic algorithm, Chaos Game Optimization (CGO), which demonstrates a unique ability to maintain high efficiency when dealing with high-dimensional problems. Unlike most optimization algorithms, CGO not only does not lose, but sometimes even increases performance when scaling a problem, which is its key feature.

From Novice to Expert: Developing a Geographic Market Awareness with MQL5 Visualization

Trading without session awareness is like navigating without a compass—you're moving, but not with purpose. Today, we're revolutionizing how traders perceive market timing by transforming ordinary charts into dynamic geographical displays. Using MQL5's powerful visualization capabilities, we'll build a live world map that illuminates active trading sessions in real-time, turning abstract market hours into intuitive visual intelligence. This journey sharpens your trading psychology and reveals professional-grade programming techniques that bridge the gap between complex market structure and practical, actionable insight.

Developing a multi-currency Expert Advisor (Part 23): Putting in order the conveyor of automatic project optimization stages (II)

We aim to create a system for automatic periodic optimization of trading strategies used in one final EA. As the system evolves, it becomes increasingly complex, so it is necessary to look at it as a whole from time to time in order to identify bottlenecks and suboptimal solutions.

Market Simulation (Part 07): Sockets (I)

Sockets. Do you know what they are for or how to use them in MetaTrader 5? If the answer is no, let's start by studying them. In today's article, we'll cover the basics. Since there are several ways to do the same thing, and we are always interested in the result, I want to show that there is indeed a simple way to transfer data from MetaTrader 5 to other programs, such as Excel. However, the main idea is not to transfer data from MetaTrader 5 to Excel, but the opposite, that is, to transfer data from Excel or any other program to MetaTrader 5.

Markets Positioning Codex in MQL5 (Part 2): Bitwise Learning, with Multi-Patterns for Nvidia

We continue our new series on Market-Positioning, where we study particular assets, with specific trade directions over manageable test windows. We started this by considering Nvidia Corp stock in the last article, where we covered 5 signal patterns from the complimentary pairing of the RSI and DeMarker oscillators. For this article, we cover the remaining 5 patterns and also delve into multi-pattern options that not only feature untethered combinations of all ten, but also specialized combinations of just a pair.

Market Simulation (Part 06): Transferring Information from MetaTrader 5 to Excel

Many people, especially non=programmers, find it very difficult to transfer information between MetaTrader 5 and other programs. One such program is Excel. Many use Excel as a way to manage and maintain their risk control. It is an excellent program and easy to learn, even for those who are not VBA programmers. Here we will look at how to establish a connection between MetaTrader 5 and Excel (a very simple method).

Markets Positioning Codex in MQL5 (Part 1): Bitwise Learning for Nvidia

We commence a new article series that builds upon our earlier efforts laid out in the MQL5 Wizard series, by taking them further as we step up our approach to systematic trading and strategy testing. Within these new series, we’ll concentrate our focus on Expert Advisors that are coded to hold only a single type of position - primarily longs. Focusing on just one market trend can simplify analysis, lessen strategy complexity and expose some key insights, especially when dealing in assets beyond forex. Our series, therefore, will investigate if this is effective in equities and other non-forex assets, where long only systems usually correlate well with smart money or institution strategies.

Blood inheritance optimization (BIO)

I present to you my new population optimization algorithm - Blood Inheritance Optimization (BIO), inspired by the human blood group inheritance system. In this algorithm, each solution has its own "blood type" that determines the way it evolves. Just as in nature where a child's blood type is inherited according to specific rules, in BIO new solutions acquire their characteristics through a system of inheritance and mutations.

Developing a multi-currency Expert Advisor (Part 22): Starting the transition to hot swapping of settings

If we are going to automate periodic optimization, we need to think about auto updates of the settings of the EAs already running on the trading account. This should also allow us to run the EA in the strategy tester and change its settings within a single run.

Circle Search Algorithm (CSA)

The article presents a new metaheuristic optimization Circle Search Algorithm (CSA) based on the geometric properties of a circle. The algorithm uses the principle of moving points along tangents to find the optimal solution, combining the phases of global exploration and local exploitation.

Market Simulation (Part 05): Creating the C_Orders Class (II)

In this article, I will explain how Chart Trade, together with the Expert Advisor, will process a request to close all of the users' open positions. This may sound simple, but there are a few complications that you need to know how to manage.

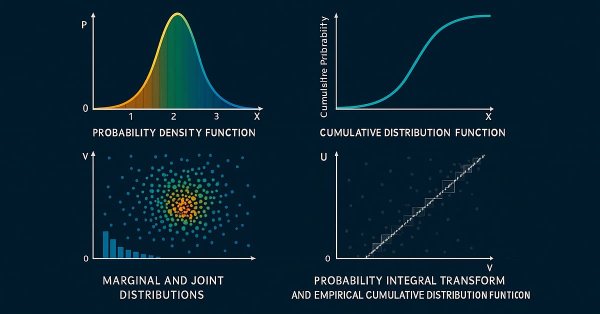

Bivariate Copulae in MQL5 (Part 1): Implementing Gaussian and Student's t-Copulae for Dependency Modeling

This is the first part of an article series presenting the implementation of bivariate copulae in MQL5. This article presents code implementing Gaussian and Student's t-copulae. It also delves into the fundamentals of statistical copulae and related topics. The code is based on the Arbitragelab Python package by Hudson and Thames.

Market Simulation (Part 03): A Matter of Performance

Often we have to take a step back and then move forward. In this article, we will show all the changes necessary to ensure that the Mouse and Chart Trade indicators do not break. As a bonus, we'll also cover other changes that have occurred in other header files that will be widely used in the future.

Market Simulation (Part 02): Cross Orders (II)

Unlike what was done in the previous article, here we will test the selection option using an Expert Advisor. Although this is not a final solution yet, it will be enough for now. With the help of this article, you will be able to understand how to implement one of the possible solutions.

Cyclic Parthenogenesis Algorithm (CPA)

The article considers a new population optimization algorithm - Cyclic Parthenogenesis Algorithm (CPA), inspired by the unique reproductive strategy of aphids. The algorithm combines two reproduction mechanisms — parthenogenesis and sexual reproduction — and also utilizes the colonial structure of the population with the possibility of migration between colonies. The key features of the algorithm are adaptive switching between different reproductive strategies and a system of information exchange between colonies through the flight mechanism.

Developing A Custom Account Performace Matrix Indicator

This indicator acts as a discipline enforcer by tracking account equity, profit/loss, and drawdown in real-time while displaying a performance dashboard. It can help traders stay consistent, avoid overtrading, and comply with prop-firm challenge rules.

Developing a multi-currency Expert Advisor (Part 21): Preparing for an important experiment and optimizing the code

For further progress it would be good to see if we can improve the results by periodically re-running the automatic optimization and generating a new EA. The stumbling block in many debates about the use of parameter optimization is the question of how long the obtained parameters can be used for trading in the future period while maintaining the profitability and drawdown at the specified levels. And is it even possible to do this?

Developing a Custom Market Sentiment Indicator

In this article we are developing a custom market sentiment indicator to classify conditions into bullish, bearish, risk-on, risk-off, or neutral. Using multi-timeframe, the indicator can provide traders with a clearer perspective of overall market bias and short-term confirmations.

Market Simulation (Part 01): Cross Orders (I)

Today we will begin the second stage, where we will look at the market replay/simulation system. First, we will show a possible solution for cross orders. I will show you the solution, but it is not final yet. It will be a possible solution to a problem that we will need to solve in the near future.

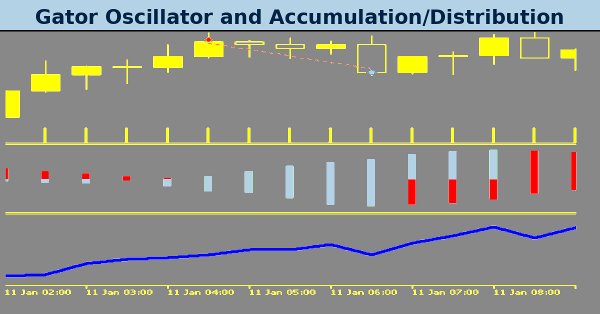

MQL5 Wizard Techniques you should know (Part 77): Using Gator Oscillator and the Accumulation/Distribution Oscillator

The Gator Oscillator by Bill Williams and the Accumulation/Distribution Oscillator are another indicator pairing that could be used harmoniously within an MQL5 Expert Advisor. We use the Gator Oscillator for its ability to affirm trends, while the A/D is used to provide confirmation of the trends via checks on volume. In exploring this indicator pairing, as always, we use the MQL5 wizard to build and test out their potential.

Implementing Practical Modules from Other Languages in MQL5 (Part 03): Schedule Module from Python, the OnTimer Event on Steroids

The schedule module in Python offers a simple way to schedule repeated tasks. While MQL5 lacks a built-in equivalent, in this article we’ll implement a similar library to make it easier to set up timed events in MetaTrader 5.

From Novice to Expert: Animated News Headline Using MQL5 (VII) — Post Impact Strategy for News Trading

The risk of whipsaw is extremely high during the first minute following a high-impact economic news release. In that brief window, price movements can be erratic and volatile, often triggering both sides of pending orders. Shortly after the release—typically within a minute—the market tends to stabilize, resuming or correcting the prevailing trend with more typical volatility. In this section, we’ll explore an alternative approach to news trading, aiming to assess its effectiveness as a valuable addition to a trader’s toolkit. Continue reading for more insights and details in this discussion.

Cycles and trading

This article is about using cycles in trading. We will consider building a trading strategy based on cyclical models.