Creating Custom Indicators in MQL5 (Part 8): Adding Volume Integration for Deeper Market Profile Analysis

In this article, we enhance the hybrid Time Price Opportunity (TPO) market profile indicator in MQL5 by integrating volume data to calculate volume-based point of control, value areas, and volume-weighted average price with customizable highlighting options. The system introduces advanced features like initial balance detection, key level extension lines, split profiles, and alternative TPO characters such as squares or circles for improved visual analysis across multiple timeframes.

MQL5 Trading Tools (Part 20): Canvas Graphing with Statistical Correlation and Regression Analysis

In this article, we create a canvas-based graphing tool in MQL5 for statistical correlation and linear regression analysis between two symbols, with draggable and resizable features. We incorporate ALGLIB for regression calculations, dynamic tick labels, data points, and a stats panel displaying slope, intercept, correlation, and R-squared. This interactive visualization aids in pair trading insights, supporting customizable themes, borders, and real-time updates on new bars

Market Simulation (Part 16): Sockets (X)

We are close to completing this challenge. However, before we begin, I want you to try to understand these two articles—this one and the previous one. That way, you will truly understand the next article, in which I will cover exclusively the part related to MQL5 programming. But I will also try to make it understandable. If you do not understand these last two articles, it will be difficult for you to understand the next one, because the material accumulates. The more things there are to do, the more you need to create and understand in order to achieve the goal.

Creating Custom Indicators in MQL5 (Part 7): Hybrid Time Price Opportunity (TPO) Market Profiles for Session Analysis

In this article, we develop a custom indicator in MQL5 for hybrid Time Price Opportunity (TPO) market profiles, supporting multiple session timeframes such as intraday, daily, weekly, monthly, and fixed periods with timezone adjustments. The indicator quantizes prices into a grid, tracks session data including highs, lows, opens, and closes, and calculates key elements like the point of control and value area based on TPO counts. It renders profiles visually on the chart with customizable colors for TPO letters, single prints, value areas, POC, and close markers, enabling detailed session analysis

Market Simulation (Part 15): Sockets (IX)

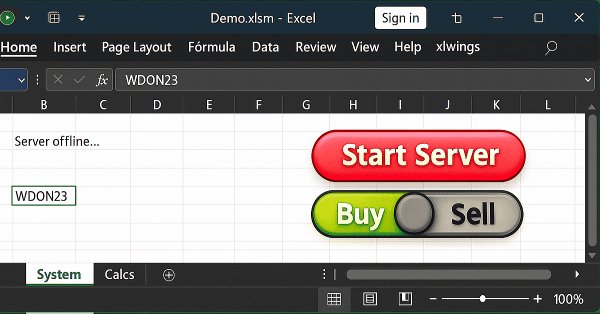

In this article, we will discuss one of the possible solutions to what we have been trying to demonstrate—namely, how to allow an Excel user to perform an action in MetaTrader 5 without sending orders or opening or closing positions. The idea is that the user employs Excel to conduct fundamental analysis of a particular symbol. And by using only Excel, they can instruct an expert advisor running in MetaTrader 5 to open or close a specific position.

Introduction to MQL5 (Part 41): Beginner Guide to File Handling in MQL5 (III)

Learn how to read a CSV file in MQL5 and organize its trading data into dynamic arrays. This article shows step by step how to count file elements, store all data in a single array, and separate each column into dedicated arrays, laying the foundation for advanced analysis and trading performance visualization.

Market Simulation (Part 13): Sockets (VII)

When we develop something in xlwings or any other package that allows reading and writing directly to Excel, we must note that all programs, functions, or procedures execute and then complete their task. They do not remain in a loop, no matter how hard we try to do things differently.

Market Simulation (Part 12): Sockets (VI)

In this article, we will look at how to solve certain problems and issues that arise when using Python code within other programs. More specifically, we will demonstrate a common issue encountered when using Excel in conjunction with MetaTrader 5, although we will be using Python to facilitate this interaction. However, this implementation has a minor drawback. It does not occur in all cases, but only in certain specific situations. When it does happen, it is necessary to understand the cause. In today’s article, we will begin explaining how to resolve this issue.

Introduction to MQL5 (Part 40): Beginner Guide to File Handling in MQL5 (II)

Create a CSV trading journal in MQL5 by reading account history over a defined period and writing structured records to file. The article explains deal counting, ticket retrieval, symbol and order type decoding, and capturing entry (lot, time, price, SL/TP) and exit (time, price, profit, result) data with dynamic arrays. The result is an organized, persistent log suitable for analysis and reporting.

ARIMA Forecasting Indicator in MQL5

In this article we are implementing ARIMA forecasting indicator in MQL5. It examines how the ARIMA model generates forecasts, its applicability to the Forex market and the stock market in general. It also explains what AR autoregression is, how autoregressive models are used for forecasting, and how the autoregression mechanism works.

Quantitative Analysis of Trends: Collecting Statistics in Python

What is quantitative trend analysis in the Forex market? We collect statistics on trends, their magnitude and distribution across the EURUSD currency pair. How quantitative trend analysis can help you create a profitable trading expert advisor.

Market Simulation: (Part 11): Sockets (V)

We are beginning to implement the connection between Excel and MetaTrader 5, but first we need to understand some key points. This way, you won't have to rack your brains trying to figure out why something works or doesn't. And before you frown at the prospect of integrating Python and Excel, let's see how we can (to some extent) control MetaTrader 5 through Excel using xlwings. What we demonstrate here will primarily focus on educational objectives. However, don't think that we can only do what will be covered here.

Bivariate Copulae in MQL5: (Part 3): Implementation and Tuning of Mixed Copula Models in MQL5

The article extends our copula toolkit with mixed copulas implemented natively in MQL5. We construct Clayton–Frank–Gumbel and Clayton–Student–t–Gumbel mixtures, estimate them via EM, and enable sparsity control through SCAD with cross‑validation. Provided scripts tune hyperparameters, compare mixtures using information criteria, and save trained models. Practitioners can apply these components to capture asymmetric tail dependence and embed the selected model in indicators or Expert Advisors.

MQL5 Trading Tools (Part 16): Improved Super-Sampling Anti-Aliasing (SSAA) and High-Resolution Rendering

We add supersampling‑driven anti‑aliasing and high‑resolution rendering to the MQL5 canvas dashboard, then downsample to the target size. The article implements rounded rectangle fills and borders, rounded triangle arrows, and a custom scrollbar with theming for the stats and text panels. These tools help you build smoother, more legible UI components in MetaTrader 5.

Integrating MQL5 with Data Processing Packages (Part 7): Building Multi-Agent Environments for Cross-Symbol Collaboration

The article presents a complete Python–MQL5 integration for multi‑agent trading: MT5 data ingestion, indicator computation, per‑agent decisions, and a weighted consensus that outputs a single action. Signals are stored to JSON, served by Flask, and consumed by an MQL5 Expert Advisor for execution with position sizing and ATR‑derived SL/TP. Flask routes provide safe lifecycle control and status monitoring.

Introduction to MQL5 (Part 39): Beginner Guide to File Handling in MQL5 (I)

This article introduces file handling in MQL5 using a practical, project-based workflow. You will use FileSelectDialog to choose or create a CSV file, open it with FileOpen, and write structured account headers such as account name, balance, login, date range, and last update. The result is a clear foundation for a reusable trading journal and safe file operations in MetaTrader 5.

Algorithmic Trading Strategies: AI and Its Road to Golden Pinnacles

This article demonstrates an approach to creating trading strategies for gold using machine learning. Considering the proposed approach to the analysis and forecasting of time series from different angles, it is possible to determine its advantages and disadvantages in comparison with other ways of creating trading systems which are based solely on the analysis and forecasting of financial time series.

Angular Analysis of Price Movements: A Hybrid Model for Predicting Financial Markets

What is angular analysis of financial markets? How to use price action angles and machine learning to make accurate forecasts with 67% accuracy? How to combine a regression and classification model with angular features and obtain a working algorithm? What does Gann have to do with it? Why are price movement angles a good indicator for machine learning?

Overcoming Accessibility Problems in MQL5 Trading Tools (I)

This article explores an accessibility-focused enhancement that goes beyond default terminal alerts by leveraging MQL5 resource management to deliver contextual voice feedback. Instead of generic tones, the indicator communicates what has occurred and why, allowing traders to understand market events without relying solely on visual observation. This approach is especially valuable for visually impaired traders, but it also benefits busy or multitasking users who prefer hands-free interaction.

Python-MetaTrader 5 Strategy Tester (Part 05): Multi-Symbols and Timeframes Strategy Tester

This article presents a MetaTrader 5–compatible backtesting workflow that scales across symbols and timeframes. We use HistoryManager to parallelize data collection, synchronize bars and ticks from all timeframes, and run symbol‑isolated OnTick handlers in threads. You will learn how modelling modes affect speed/accuracy, when to rely on terminal data, how to reduce I/O with event‑driven updates, and how to assemble a complete multicurrency trading robot.

Analyzing Overbought and Oversold Trends Via Chaos Theory Approaches

We determine the overbought and oversold condition of the market according to chaos theory: integrating the principles of chaos theory, fractal geometry and neural networks to forecast financial markets. The study demonstrates the use of the Lyapunov exponent as a measure of market randomness and the dynamic adaptation of trading signals. The methodology includes an algorithm for generating fractal noise, hyperbolic tangent activation, and moment optimization.

Integrating Computer Vision into Trading in MQL5 (Part 1): Creating Basic Functions

The EURUSD forecasting system with the use of computer vision and deep learning. Learn how convolutional neural networks can recognize complex price patterns in the foreign exchange market and predict exchange rate movements with up to 54% accuracy. The article shares the methodology for creating an algorithm that uses artificial intelligence technologies for visual analysis of charts instead of traditional technical indicators. The author demonstrates the process of transforming price data into "images", their processing by a neural network, and a unique opportunity to peer into the "consciousness" of AI through activation maps and attention heatmaps. Practical Python code using the MetaTrader 5 library allows readers to reproduce the system and apply it in their own trading.

Exploring Machine Learning in Unidirectional Trend Trading Using Gold as a Case Study

This article discusses an approach to trading only in the chosen direction (buy or sell). For this purpose, the technique of causal inference and machine learning are used.

Employing Game Theory Approaches in Trading Algorithms

We are creating an adaptive self-learning trading expert advisor based on DQN machine learning, with multidimensional causal inference. The EA will successfully trade simultaneously on 7 currency pairs. And agents of different pairs will exchange information with each other.

Swap Arbitrage in Forex: Building a Synthetic Portfolio and Generating a Consistent Swap Flow

Do you want to know how to benefit from the difference in interest rates? This article considers how to use swap arbitrage in Forex to earn stable profit every night, creating a portfolio that is resistant to market fluctuations.

From Novice to Expert: Statistical Validation of Supply and Demand Zones

Today, we uncover the often overlooked statistical foundation behind supply and demand trading strategies. By combining MQL5 with Python through a Jupyter Notebook workflow, we conduct a structured, data-driven investigation aimed at transforming visual market assumptions into measurable insights. This article covers the complete research process, including data collection, Python-based statistical analysis, algorithm design, testing, and final conclusions. To explore the methodology and findings in detail, read the full article.

Market Simulation (Part 10): Sockets (IV)

In this article, we'll look at what you need to do to start using Excel to manage MetaTrader 5, but in a very interesting way. To do this, we will use an Excel add-in to avoid using built-in VBA. If you don't know what add-in is meant, read this article and learn how to program in Python directly in Excel.

Neuroboids Optimization Algorithm 2 (NOA2)

The new proprietary optimization algorithm NOA2 (Neuroboids Optimization Algorithm 2) combines the principles of swarm intelligence with neural control. NOA2 combines the mechanics of a neuroboid swarm with an adaptive neural system that allows agents to self-correct their behavior while searching for the optimum. The algorithm is under active development and demonstrates potential for solving complex optimization problems.

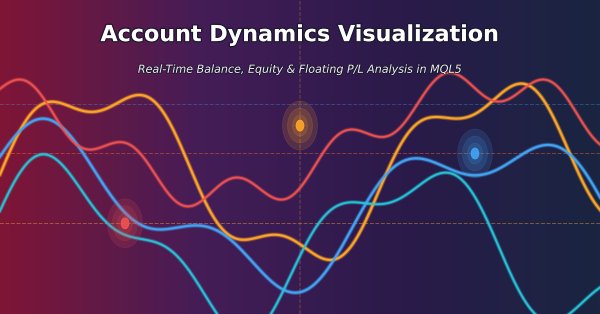

Tracking Account Dynamics: Balance, Equity, and Floating P/L Visualization in MQL5

Create a custom MT5 indicator that processes the entire deal history and plots starting balance, balance, equity, and floating P/L as continuous curves. It updates per bar, aggregates positions across symbols, and avoids external dependencies through local caching. Use it to inspect equity–balance divergence, realized vs. unrealized results, and the timing of risk deployment.

MQL5 Trading Tools (Part 14): Pixel-Perfect Scrollable Text Canvas with Antialiasing and Rounded Scrollbar

In this article, we enhance the canvas-based price dashboard in MQL5 by adding a pixel-perfect scrollable text panel for usage guides, overcoming native scrolling limitations through custom antialiasing and a rounded scrollbar design with hover-expand functionality. The text panel supports themed backgrounds with opacity, dynamic line wrapping for content like instructions and contacts, and interactive navigation via up/down buttons, slider dragging, and mouse wheel scrolling within the body area.

Creating Custom Indicators in MQL5 (Part 6): Evolving RSI Calculations with Smoothing, Hue Shifts, and Multi-Timeframe Support

In this article, we build a versatile RSI indicator in MQL5 supporting multiple variants, data sources, and smoothing methods for improved analysis. We add hue shifts for color visuals, dynamic boundaries for overbought/oversold zones, and notifications for trend alerts. It includes multi-timeframe support with interpolation, offering us a customizable RSI tool for diverse strategies.

MQL5 Trading Tools (Part 13): Creating a Canvas-Based Price Dashboard with Graph and Stats Panels

In this article, we develop a canvas-based price dashboard in MQL5 using the CCanvas class to create interactive panels for visualizing recent price graphs and account statistics, with support for background images, fog effects, and gradient fills. The system includes draggable and resizable features via mouse event handling, theme toggling between dark and light modes with dynamic color adjustments, and minimize/maximize controls for efficient chart space management.

Larry Williams Market Secrets (Part 7): An Empirical Study of the Trade Day of the Week Concept

An empirical study of Larry Williams’ Trade Day of the Week concept, showing how time-based market bias can be measured, tested, and applied using MQL5. This article presents a practical framework for analyzing win rates and performance across trading days to improve short-term trading systems.

Developing Trend Trading Strategies Using Machine Learning

This study introduces a novel methodology for the development of trend-following trading strategies. This section describes the process of annotating training data and using it to train classifiers. This process yields fully operational trading systems designed to run on MetaTrader 5.

Statistical Arbitrage Through Cointegrated Stocks (Part 10): Detecting Structural Breaks

This article presents the Chow test for detecting structural breaks in pair relationships and the application of the Cumulative Sum of Squares - CUSUM - for structural breaks monitoring and early detection. The article uses the Nvidia/Intel partnership announcement and the US Gov foreign trade tariff announcement as examples of slope inversion and intercept shift, respectively. Python scripts for all the tests are provided.

Python-MetaTrader 5 Strategy Tester (Part 04): Tester 101

In this fascinating article, we build our very first trading robot in the simulator and run a strategy testing action that resembles how the MetaTrader 5 strategy tester works, then compare the outcome produced in a custom simulation against our favorite terminal.

Forex Arbitrage Trading: Relationship Assessment Panel

This article presents the development of an arbitrage analysis panel in MQL5. How to get fair exchange rates on Forex in different ways? Create an indicator to obtain deviations of market prices from fair exchange rates, as well as to assess the benefits of arbitrage ways of exchanging one currency for another (as in triangular arbitrage).

Central Force Optimization (CFO) algorithm

The article presents the Central Force Optimization (CFO) algorithm inspired by the laws of gravity. It explores how principles of physical attraction can solve optimization problems where "heavier" solutions attract less successful counterparts.

MQL5 Trading Tools (Part 12): Enhancing the Correlation Matrix Dashboard with Interactivity

In this article, we enhance the correlation matrix dashboard in MQL5 with interactive features like panel dragging, minimizing/maximizing, hover effects on buttons and timeframes, and mouse event handling for improved user experience. We add sorting of symbols by average correlation strength in ascending/descending modes, toggle between correlation and p-value views, and incorporate light/dark theme switching with dynamic color updates.

Build a Remote Forex Risk Management System in Python

We are making a remote professional risk manager for Forex in Python, deploying it on the server step by step. In the course of the article, we will understand how to programmatically manage Forex risks, and how not to waste a Forex deposit any more.