MACD Divergece Reversal PRO

- Indicators

- German Pablo Gori

- Version: 1.0

- Activations: 12

The MACD Divergence Reversal PRO is an advanced indicator designed to identify investment opportunities through the analysis of MACD divergences combined with innovative technical filters. It is an essential tool for traders looking to anticipate trend changes in volatile, ranging, or at the end of prolonged trends.

Main Features:

-

Detection of MACD Divergences:

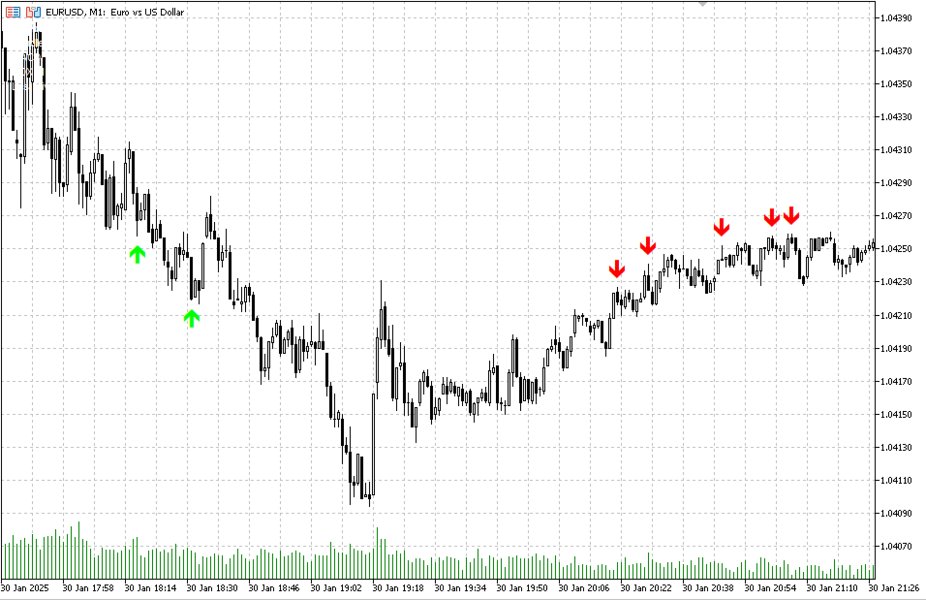

- Regular Bullish Divergence: When the price forms a lower low but the MACD shows a higher low (bearish weakness).

- Regular Bearish Divergence: When the price reaches a higher high but the MACD forms a lower high (bullish weakness).

- Hidden Divergences: For continuation strategies (optional).

-

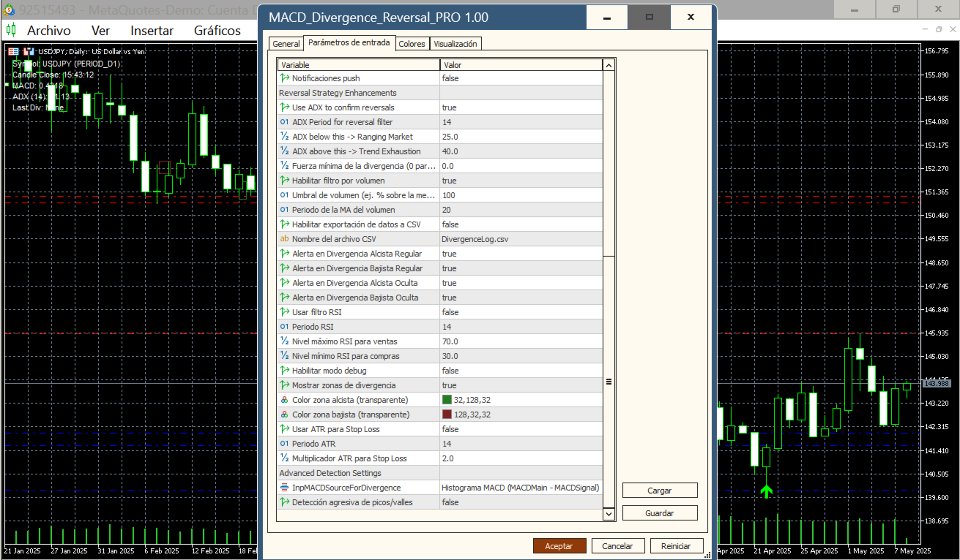

Advanced Filters for Signal Confirmation:

- ADX Filter: Integrates the Average Directional Index (ADX) to validate the strength of reversal:

- ADX < 25 → Sideways market (range).

- ADX > 40 → Trend exhaustion.

- RSI Filter: Customizes overbought (70) and oversold (30) levels to filter unreliable signals.

- Volume Filter: Activates alerts only when volume exceeds the moving average (configurable).

- ADX Filter: Integrates the Average Directional Index (ADX) to validate the strength of reversal:

-

Integrated Risk Management:

- ATR-Based Stop-Loss: Automatically calculates protection levels by multiplying the ATR (Average True Range) by an adjustable factor.

-

Clear and Accessible Visualization:

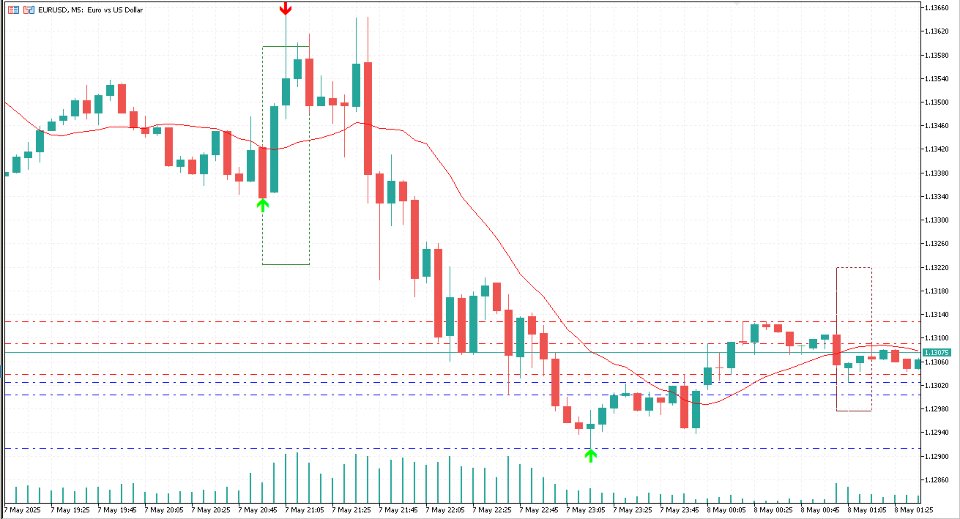

- Colored Arrows: Visual signals on the chart (green for bullish, red for bearish).

- Divergence Zones: Shades areas between peaks/troughs for better interpretation.

- Information Panel: Displays real-time data:

- Current values of MACD, RSI, and ADX.

- Last detected divergence and its time.

- Candle expiration timer.

-

Customizable Alerts:

- Push notifications, audible alerts, and email notifications.

- Flexible configuration to enable alerts by type of divergence (regular/hidden).

-

Historical Data Export:

- Saves all signals in a CSV file for later analysis (date, type of divergence, price, strength, volume conditions, etc.).

-

Dynamic Support and Resistance Levels:

- Automatically identifies key levels based on local lows/highs (configurable).

MACD Divergence Reversal Strategy This indicator is optimized for trend-reversal strategies, ideal in the following scenarios:

- Sideways Markets: In congestion zones, divergences anticipate breakouts.

- Trend Exhaustion: At the end of prolonged bullish or bearish movements, detects hidden weakness.

- Daily/Weekly Charts: Perfect for position traders or swing trading.

Example of Use:

- Bullish Divergence on Daily Chart: If the price falls to a new low but the MACD forms a higher low, the indicator marks the zone with a green arrow, suggesting a potential buy.

- ADX Filter: If ADX > 40, the signal is considered exhaustion, reinforcing the idea of reversal.

Competitive Advantages:

- Full Customization: Adjust MACD periods, volume thresholds, colors, and styles.

- Integration with Other Indicators: Compatibility with RSI, ADX, and ATR for multi-timeframe strategies.

- Debug Mode and Export: Enables rigorous backtesting and parameter optimization.