Apex WilliamsR MT4

- Indicators

- German Pablo Gori

- Version: 1.0

- Activations: 12

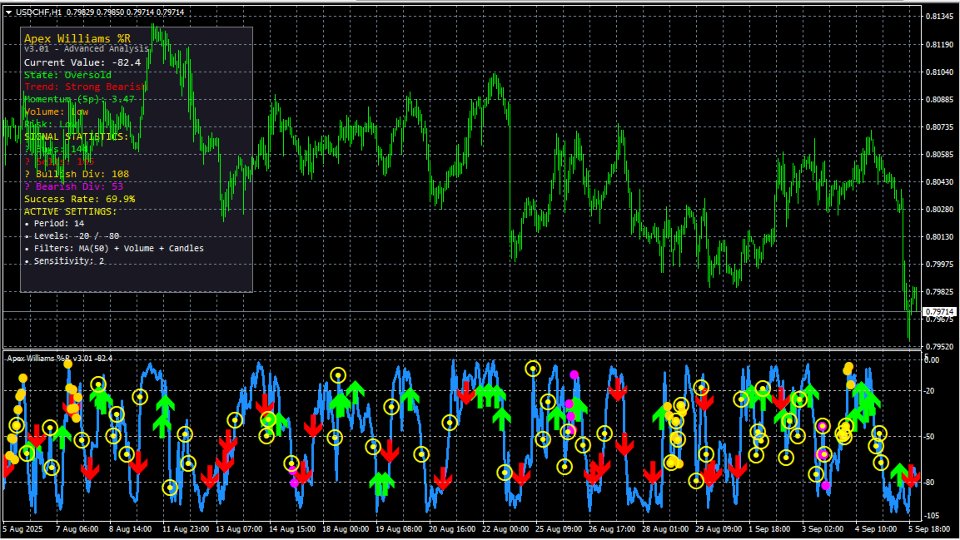

🎯 Apex Williams %R Advanced Trading Indicator

Overview

The Apex Williams %R is an advanced technical indicator based on the classic Williams %R, completely redesigned with professional trading functionalities. This tool combines momentum analysis, divergence detection, multiple confirmations, and a comprehensive visual dashboard to maximize the accuracy of trading signals.

🚀 Key Features

Intelligent Signal System

Reversal Signals: Detects exits from overbought/oversold zones with automatic confirmation

Trend Pullbacks: Identifies entry opportunities within established trends

Momentum Crossovers: Signals based on crossing the central line (-50)

Automatic Divergences: Real-time detection of bullish and bearish divergences

Multiple Confirmations

Volume Analysis: Confirms signals using relative volume analysis

Candlestick Patterns: Recognition of Hammer and Shooting Star patterns

Trend Filter: Configurable moving average to confirm market direction

Risk Analysis: Automatic assessment of market volatility

Advanced Visual Dashboard

Real-Time Statistics: Signal count and estimated success rate

Market Status: Comprehensive analysis of current market conditions

Active Settings: Visualization of all applied filters

Momentum Analysis: Market strength indicators

Professional Alert System

Sound Alerts: Immediate notifications for trading signals

Push Notifications: Delivery to mobile devices (optional)

Intelligent Cooldown: Prevents repetitive alert spam

Multiple Alert Types: Different identifiable signal categories

📊 Recommended Trading Styles

Swing Trading ⭐⭐⭐⭐⭐

Ideal for: 1-7 day trades

Advantage: Divergences and reversal signals perform excellently in swing setups

Timeframes: H1, H4, D1

Day Trading ⭐⭐⭐⭐

Ideal for: Intraday operations with multiple entries

Advantage: Pullbacks and momentum crossovers offer multiple opportunities

Timeframes: M15, M30, H1

Scalping ⭐⭐⭐

Ideal for: Short-duration trades with volume confirmation

Advantage: Fast momentum signals work well in liquid markets

Timeframes: M1, M5, M15

Position Trading ⭐⭐⭐⭐

Ideal for: Medium to long-term investments

Advantage: Major divergences indicate significant trend changes

Timeframes: H4, D1, W1

⏰ Recommended Timeframes

Primary Timeframes (Maximum Effectiveness)

H1 (1 Hour): Perfect balance between signals and market noise

H4 (4 Hours): Ideal for swing trading and trend analysis

D1 (Daily): High-quality signals for position trading

Secondary Timeframes (Good Effectiveness)

M30 (30 Minutes): For active day trading with good liquidity

M15 (15 Minutes): Intraday trading with volume confirmation

W1 (Weekly): Long-term trend analysis

Specialized Timeframes (For Experienced Users)

M5 (5 Minutes): Scalping in high-liquidity markets

M1 (1 Minute): Only for professional scalpers with experience

💱 Ideal Symbols

Major Forex Pairs ⭐⭐⭐⭐⭐

EURUSD, GBPUSD, USDJPY, USDCHF: Maximum liquidity and low spreads

AUDUSD, USDCAD, NZDUSD: Excellent for reversal signals

Advantage: High liquidity, reliable technical patterns

Stock Indices ⭐⭐⭐⭐⭐

US30, NAS100, SPX500, UK100: Clear trends and strong momentum

GER30, FRA40, AUS200: Good response to technical analysis

Advantage: Clear directional movements, effective divergences

Commodities ⭐⭐⭐⭐

XAUUSD (Gold), XAGUSD (Silver): Excellent for divergences

USOIL, UKOIL: Strong momentum movements

Advantage: Predictable volatility, sustained trends

Minor Forex Pairs ⭐⭐⭐⭐

EURJPY, GBPJPY, EURGBP: Good volatility

AUDCAD, NZDCAD: Clear technical patterns

Advantage: Less algorithmic competition

Cryptocurrencies ⭐⭐⭐

BTCUSD, ETHUSD: Only on H1 or higher timeframes

Caution: High volatility—use strict risk management

🎛️ Recommended Settings

For Beginners

Williams Period: 14

Sensitivity: 2

Trend Filter: Enabled (MA 50)

Volume Confirmation: Enabled

Candlestick Patterns: Disabled

Alerts: Enabled

For Experienced Traders

Williams Period: 10-21 (depending on volatility)

Sensitivity: 1-3 (depending on aggressiveness)

All Confirmations: Enabled

Divergence Analysis: Enabled

Risk Analysis: Enabled

For Day Trading

Williams Period: 14

MA Period: 21

Sensitivity: 3

Focus: Pullbacks + Center Cross

For Swing Trading

Williams Period: 14

MA Period: 50-200

Sensitivity: 1-2

Focus: Reversals + Divergences

⚠️ Important Considerations

Risk Management

Never risk more than 2% per trade

Always use stop-loss orders

Consider the dashboard’s risk analysis

Combine with fundamental analysis during major news events

Market Conditions

Best performance: Trending or range-bound markets

Caution: During high-impact news releases

Avoid: Extremely volatile markets without confirmation

Optimization

Recommended Backtesting: Test configurations on historical data

Paper Trading: Practice before using real money

Progressive Adjustment: Fine-tune parameters based on results

📈 Competitive Advantages

Multiple Confirmations: Significantly reduces false positives

Complete Dashboard: Real-time comprehensive information

Adaptability: Works across multiple timeframes and symbols

Advanced Analysis: Includes divergences and risk analysis

User-Friendly: Intuitive interface with automatic alerts

🎯 Target Audience

Traders of all levels: From beginners to professionals

Swing Traders: Specialists in medium-term operations

Day Traders: Intraday operators seeking multiple opportunities

Fund Managers: Professionals requiring advanced technical analysis

Educational Traders: Institutions and trading mentors