Apex Swing VWAP MT5

- Indicators

- German Pablo Gori

- Version: 1.0

- Activations: 12

Professional Trading Indicator with Dynamic VWAP

🎯 GENERAL DESCRIPTION

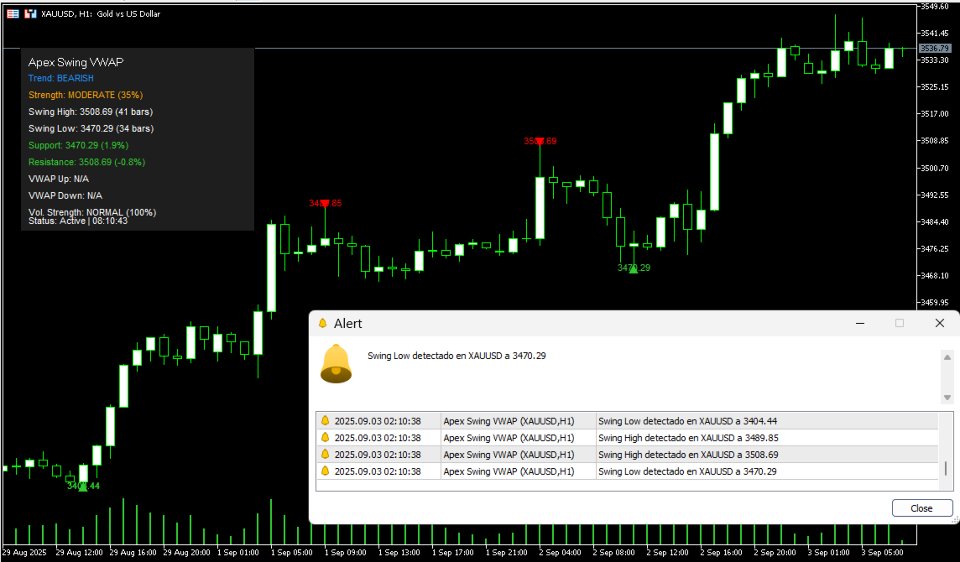

The Apex Swing VWAP is an advanced indicator that revolutionizes traditional technical analysis by combining the power of VWAP (Volume Weighted Average Price) with automatic detection of key market swing points. Unlike static VWAP indicators, this system calculates multiple dynamic VWAPs from the most significant price swings, delivering extremely precise support and resistance levels.

🚀 KEY FEATURES

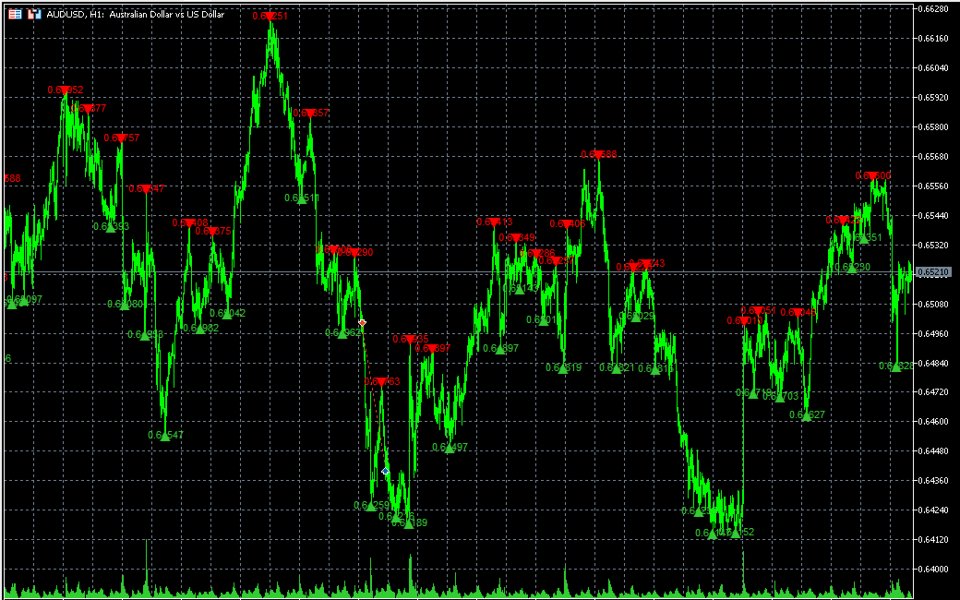

Smart Swing Detection System

- Automatic detection of swing highs and swing lows with configurable length

- Customizable visual markers at swing points

- Analysis of up to 3 historical VWAPs simultaneously

- Real-time tracking of each swing’s evolution

Dual Dynamic VWAP

- Bullish VWAP: Calculated from the latest swing low (lime green color)

- Bearish VWAP: Calculated from the latest swing high (dodger blue color)

- Historical VWAPs shown with dotted lines for reference

- Real-time price labels

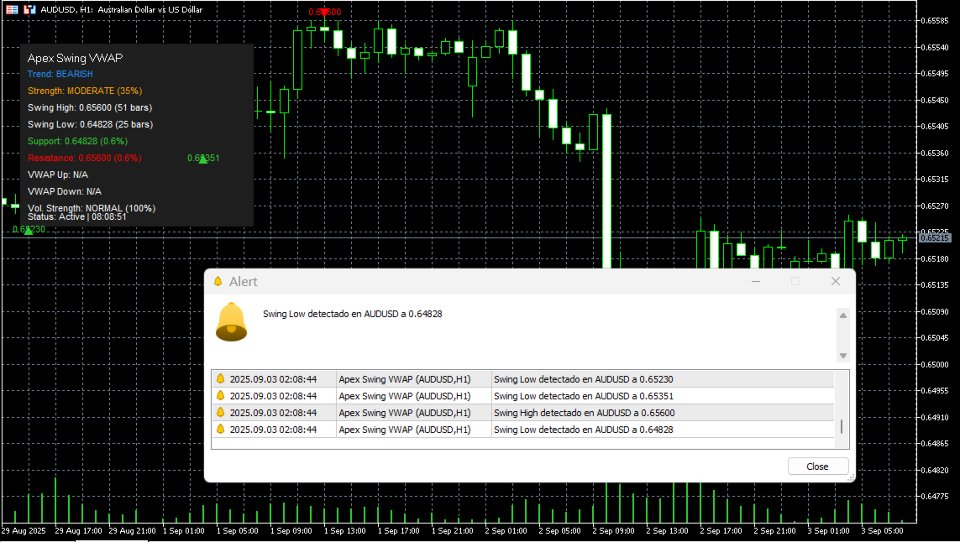

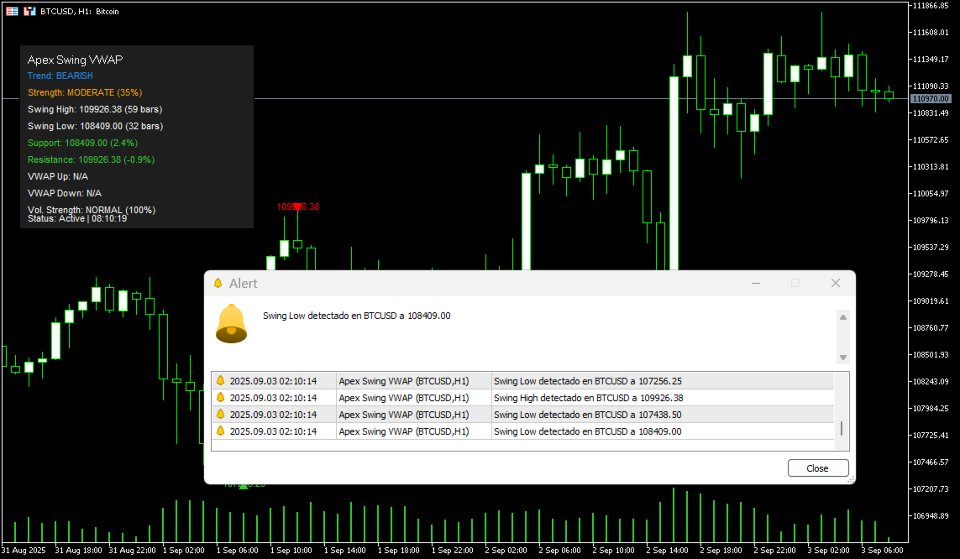

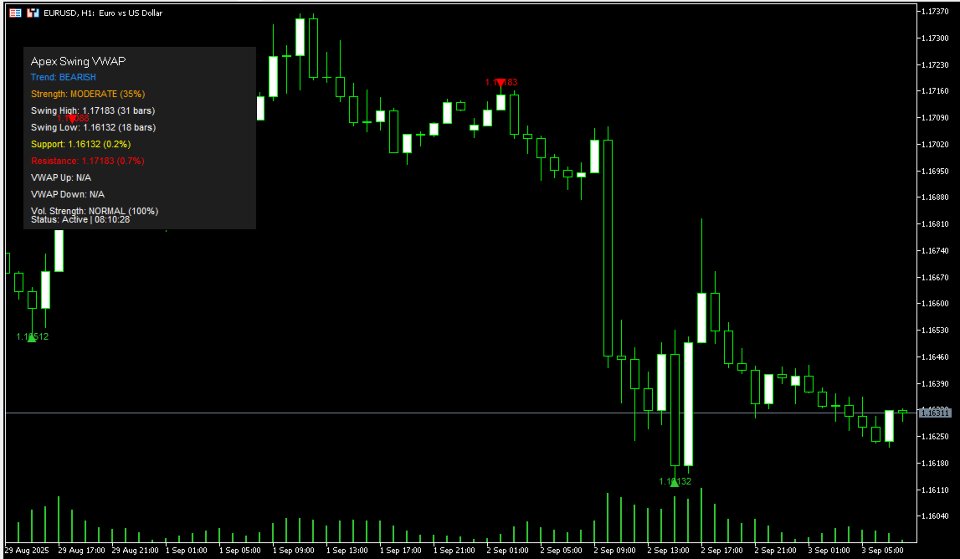

Complete Analytical Dashboard

- Information panel with real-time key metrics

- Trend analysis with strength classification (Weak / Moderate / Strong / Very Strong)

- Dynamic support and resistance levels

- Comparative volume analysis (strength vs. average)

- Percentage distance to key levels

- Activity status and timestamp

Advanced Alert System

- Configurable alerts on detection of new swings

- Notifications when price breaks VWAP levels

- Alerts when approaching support/resistance

📊 INTEGRATED TECHNICAL ANALYSIS

Multi-Factor Trend Strength

The indicator calculates trend strength based on:

- Swing Consistency (25 points)

- Relative Volume (25 points)

- Time in Trend (25 points)

- Position vs. VWAP (25 points)

Dynamic Levels

- Automatic calculation of support/resistance

- Integration with historical swings

- Percentage proximity analysis

- Color-coded by relevance

💼 RECOMMENDED TRADING STYLES

Swing Trading ⭐⭐⭐⭐⭐

Ideal for: 1–5 day trades

- VWAPs from swings provide ideal entry and exit levels

- Dashboard shows trend strength for optimal timing

Day Trading ⭐⭐⭐⭐

Excellent for: Scalping and intraday trading

- VWAP levels act as price magnets

- Alerts enable quick reactions to market changes

Position Trading ⭐⭐⭐

Suitable for: Long-term trades

- Historical VWAPs highlight major macro levels

- Trend analysis helps maintain positions

Breakout Trading ⭐⭐⭐⭐⭐

Perfect for: Range and pattern breakouts

- Automatic detection when price breaks key VWAPs

- Confirmed with integrated volume analysis

🎲 RECOMMENDED SYMBOLS

Forex (Highest Effectiveness)

EUR/USD, GBP/USD, USD/JPY, USD/CHF

AUD/USD, NZD/USD, USD/CAD

Higher liquidity = more accurate and reliable VWAPs

Stock Indices

S&P 500, NASDAQ, DAX, FTSE 100

Nikkei 225, ASX 200

Institutional volume makes VWAP highly relevant

Commodities

Gold, Silver, WTI/Brent Oil

Copper, Natural Gas

Wide swings generate durable VWAP levels

Cryptocurrencies (With Caution)

BTC/USD, ETH/USD (major pairs only)

Higher volatility requires parameter adjustments

⏰ OPTIMAL TIMEFRAMES

H4 (4 Hours) ⭐⭐⭐⭐⭐

- IDEAL timeframe for the indicator

- Perfect balance between signals and noise

- Significant swings with durable VWAPs

H1 (1 Hour) ⭐⭐⭐⭐

- Excellent for active day trading

- Sufficient volume data for accurate calculations

- Good signal frequency

D1 (Daily) ⭐⭐⭐⭐

- Great for swing trading

- High-quality, highly significant VWAPs

- Lower frequency but higher reliability

M30 (30 Minutes) ⭐⭐⭐

- Acceptable for advanced scalping

- Requires experience in interpretation

- More signals, some false positives

M15/M5 ⭐⭐

- Only for highly experienced traders

- High noise level, requires additional filtering

- Use only in high-liquidity markets

🛠 CONFIGURATION & CUSTOMIZATION

Main Parameters

- SwingLength: Length for swing detection (Recommended: 8–15)

- MaxHistoricalVWAPs: Number of historical VWAPs (Recommended: 2–5)

- Customizable colors for bullish/bearish trends

- Fully configurable dashboard

Flexible Alerts

- Independent activation/deactivation

- Configuration of alert types

- Customizable messages

📈 SUGGESTED TRADING STRATEGIES

Strategy 1: VWAP Bounce

- Wait for price near a relevant VWAP

- Confirm with volume analysis (>120% of average)

- Enter in the direction of the main trend

- Stop loss: Behind the opposite swing

- Target: Next swing level

Strategy 2: VWAP Breakout

- Identify VWAP acting as resistance/support

- Wait for breakout with high volume

- Confirm with trend change on dashboard

- Enter after retest of broken VWAP

- Target: Next historical VWAP

Strategy 3: Level Confluence

- Look for alignment between VWAP and support/resistance

- Confirm with trend strength >50%

- Enter only with confluence of at least 2 factors

- Risk management: 1:2 or 1:3 risk/reward

🎯 COMPETITIVE ADVANTAGES

vs. Traditional VWAP

✅ Multiple simultaneous VWAPs

✅ Calculated from relevant points (swings)

✅ Dashboard with advanced metrics

✅ Integrated trend analysis

vs. Swing Indicators

✅ Includes volume analysis

✅ Quantified price levels

✅ Complete alert system

✅ Multi-factor strength analysis

Unique Features

🏆 First indicator to combine Swing Detection + Dynamic VWAP

🏆 Most complete VWAP analysis dashboard on the market

🏆 Intelligent multi-factor alert system

🏆 Real-time comparative volume analysis

💡 SPECIFIC USE CASES

For Beginner Traders

- Dashboard simplifies interpretation

- Clear trend signals

- Easy-to-follow visual levels

For Advanced Traders

- Multiple VWAPs for complex analysis

- Strength metrics for precise timing

- Advanced settings for full customization

For Algorithmic Trading

- Exportable numerical values

- Clear signal logic

- Integrable with Expert Advisors

🛡 RISK MANAGEMENT

Dynamic Stops

- Use opposing swings as natural stop levels

- Adjust based on market volatility

- Consider VWAP distance for position sizing

Multiple Confirmation

- Never trade solely on VWAP break

- Confirm with volume and trend direction

- Use dashboard for comprehensive analysis

📊 EXPECTED PERFORMANCE

Trending Markets

- Effectiveness: 75–85%

- Risk/Reward: 1:2 to 1:4

- Frequency: 3–8 signals/week (H4)

Sideways (Range-bound) Markets

- Effectiveness: 60–70%

- Risk/Reward: 1:1 to 1:2

- Frequency: 5–12 signals/week (H4)