PZ Candlestick Patterns

- Indicators

- PZ TRADING SLU

- Version: 5.2

- Updated: 20 October 2020

- Activations: 20

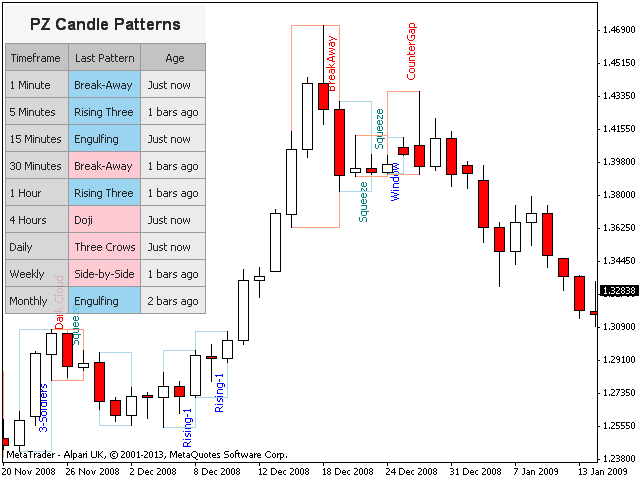

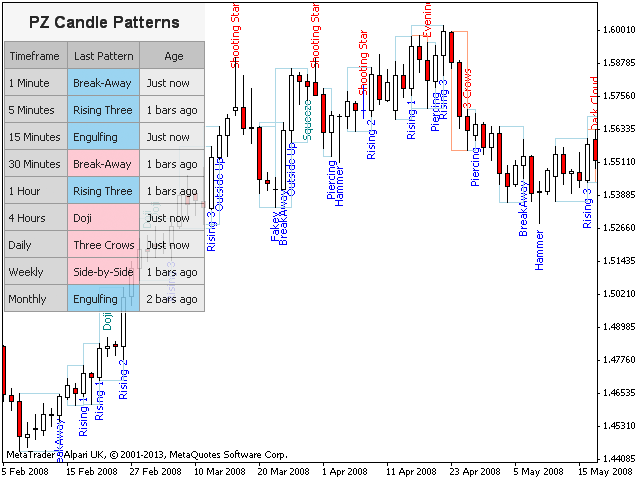

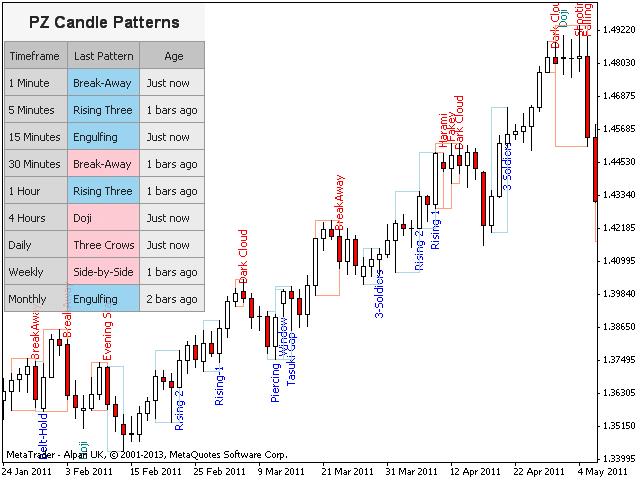

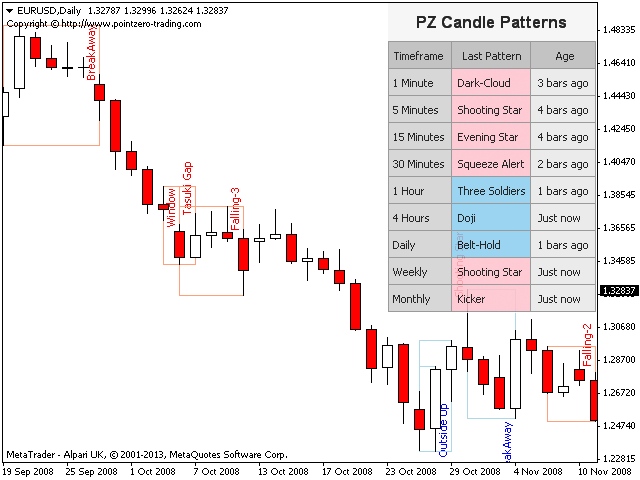

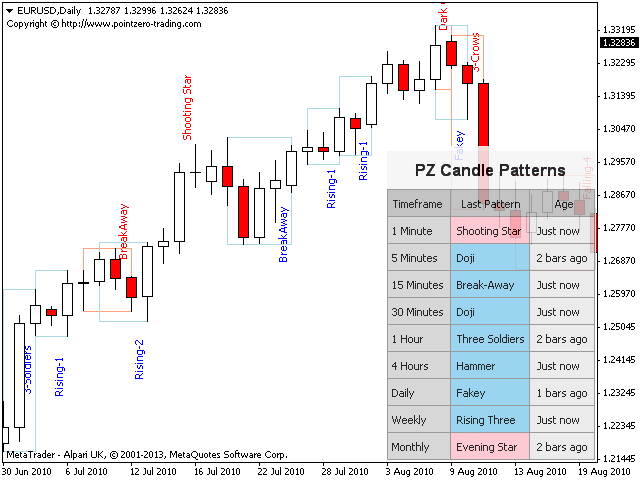

This indicator recognizes over 30 Japanese Candlestick Patterns and highlights them beautifully on the chart. It is simply one of those indicators price action traders can't live without.

- Boost your technical analysis overnight

- Detect japanese candlestick patterns easily

- Trade reliable and universal reversal patterns

- Hop onto established trends safely using continuation patterns

- The indicator is non-repainting and implements alerts

- The indicator implements a multi-timeframe dashboard

It detects so many patterns that the chart might look really cluttered, making it difficult to read. The trader might need to disable undesired patterns from the indicator inputs to make the chart more readable.

- It detects 1-bar, 2-bar, 3-bar and multi-bar patterns

- It detects reversal, continuation and weakness patterns

- Patterns can be enabled or disabled

List of Candlestick Patterns Detected

- Break-Away (a.k.a Line Strikes) from 1 to 5 bars

- Fakey (a.k.a Hikkake)

- Counter Gap

- Three Soldiers / Three Crows

- Hammers / Shooting Star / Hanging Man

- Engulfing

- Outside Up / Outside Down

- Harami

- Inside Up / Inside Down

- Morning Star / Evening Star

- Kicker

- Piercing / Dark Cloud

- Belt Hold

- Rising Three / Falling Three from 1 to 5 bars

- Tasuki Gap

- Side by Side Gap

- Windows

- Advance Block / Descend Block

- Deliberation

- Marubozu

- Squeeze Alert (a.k.a Master Candle)

- Dojis

Settings

- PaintBars

Switch on/off the highlighting of patterns using the color of the bars. - DisplayLabels

Show or hide text labels displaying the name of the recognized patterns.

- BullLabel / BearLabel

Choose the color of the text labels for bullish and bearish patterns.

- DisplayRectangles

Show or hide boxes surrounding the recognized patterns.

- BullRectangle / BearRectangle

Choose the color of the rectangles for bullish and bearish patterns.

- 1-Bar Patterns

Switch on/off recognition of 1-bar patterns one by one.

- 2-Bar Patterns

Switch on/off recognition of 2-bar patterns one by one.

- 3-bar Patterns

Switch on/off recognition of 3-bar patterns and beyond.

- DonchianFilter

This option only applies to reversal patterns. Since reversal patterns are only valid at the end of a trend, some kind of condition must be placed to display or ignore certain patterns. A Donchian Filter allows us to filter any reversal pattern using the highest/lowest of the desired last number of bars. The default behavior is to ignore bearish reversal patterns below the highest of the last four bars, and ignore bullish reversal patterns above the lowest of the last four bars. This parameter allows you to switch on/off this filter.

- ReversalDonchian

The desired number of bars to evaluate in order to display or ignore reversal patterns. (Only applies if the above option is enabled)

- RedundantReversals

Reversal patterns often take place one after another as the market turns its direction, signaling the reversal more than once as the price evolves. For example, it is frequent to see reversals very similar to the following. A Bullish Hammer (Bar 1), followed by an Engulfing Pattern (Bar 2), an Outside Up Pattern (Day 3) and Three Soldiers (Day 4), being all of them redundant reversal patterns after the first hammer took place. If disabled, the RedundantReversals parameter eliminates this redundancy and hides future reversal patterns in the same direction after the first valid one. This feature is very useful if you are visually backtesting charts but not so much for live trading, since you want to receive as many signals as possible -or perhaps didn't trade the first hammer-. Make sure to enable this option for live trading, in order to see all opportunities and receive alerts.

- Alerts

Enable alerts, email alerts and/or sound alerts for the patterns enabled above.

Author

Arturo López Pérez, private investor and speculator, software engineer and founder of Point Zero Trading Solutions.

Probably the most complete candle patterns indicator, very simple and easy to use.