PZ Turtle Trading EA MT5

- Experts

- PZ TRADING SLU

- Version: 4.4

- Updated: 14 January 2023

- Activations: 20

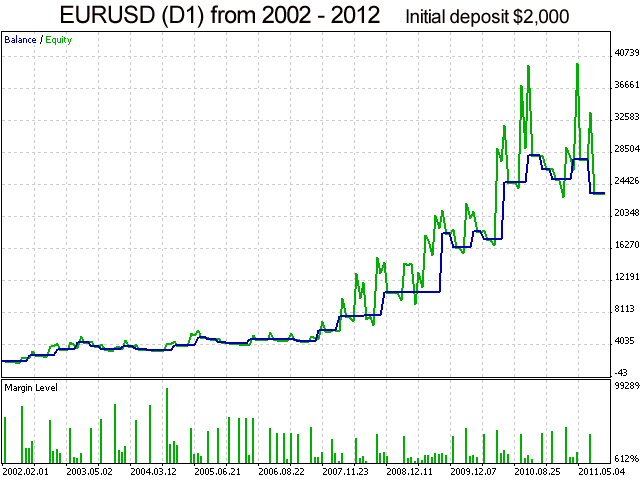

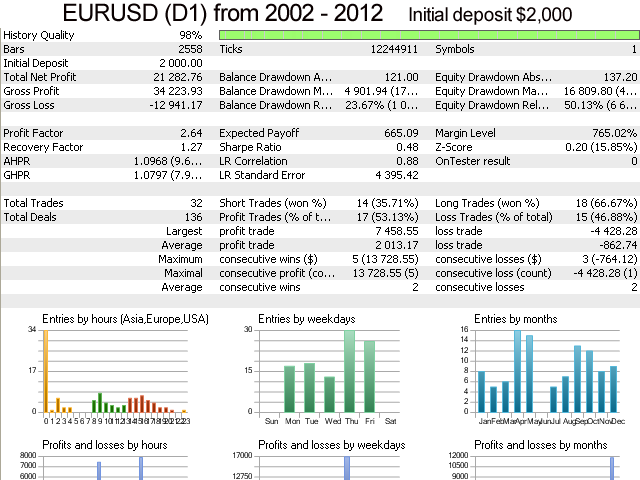

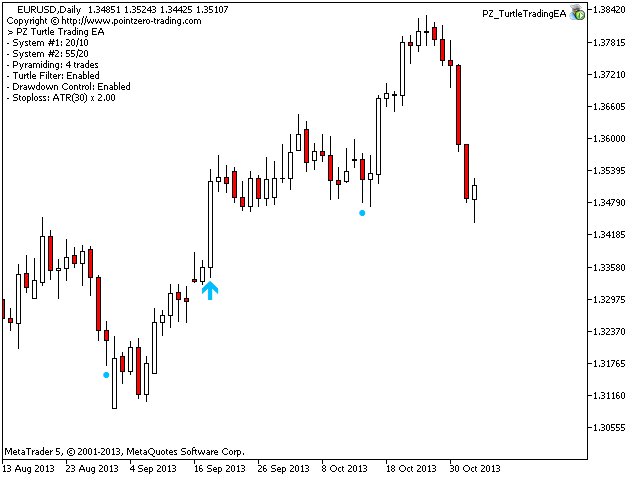

This expert advisor implements the original Dennis and Eckhardt trading system, commonly known as The Turtle Trader. It trades exactly like the original turtles did, and can be used by experienced traders to capture trends in up or down markets. [ Installation Guide | Update Guide | Troubleshooting | FAQ | All Products ]

- Easy to use and supervise

- Fully configurable strategy settings

- Fully configurable trading settings

- Works for ECN/Non-ECN brokers and 2-3-4-5 digit symbols

- Works for CFDs and forex instruments

The strategy trades two complementary systems, a main and a failsafe system:

- System one trades 20-day breakouts and closes deals at 10-day breakouts

- System two trades 55-day breakouts and closes deals at 20-day breakouts

The basic principles of the strategy are the following:

- Trades are filtered based on the outcome of the last signal

- Trades are pyramided up to 4 trades, at intervals of ATR(30)/2

- The trailing-stop is applied for all trades using Ask/Bid +/- ATR(30)*2

- The risk per trade decreases 10% for every 20% drawdown in the account

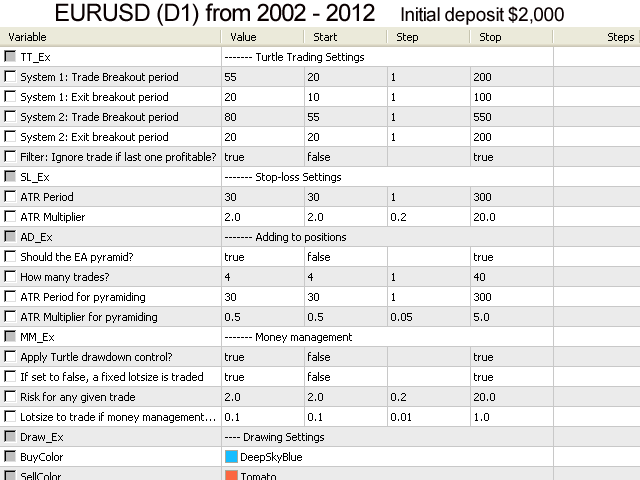

Settings

When loading the expert advisor to any chart, you will be presented with a set of options as input parameters. Don't despair if you think they are

too many, because parameters are grouped into self-explanatory blocks. This is what each block of parameters does.

- Turtle Trading Settings

This group of parameters allows you to customize the period of trading systems S1 and S2 and use of the filters. - Adding to positions

Once a trade was taken, the original turtles would pile up three more positions on top on the first one, by adding an additional trade every time the market moved in their favor 50% of the ATR. This group of parameters allows you to disable or customise this behavior.

- Stop-loss Settings

The initial stop-loss for all trades is, by default, two times the Average True Range. You can set your own stop-loss using this group of parameters. - Money Management

For every 10 percent in drawdown in their account, the turtles cut their trading unit risk by 20 percent. In this group of parameters you can disable this behavior, and customize the common money management parameters.

Fully functional