Automated Actual Support Resistance A2SR

- Indicators

- Yohana Parmi

- Version: 9.47

- Updated: 28 April 2025

- Activations: 10

A. What is A2SR?

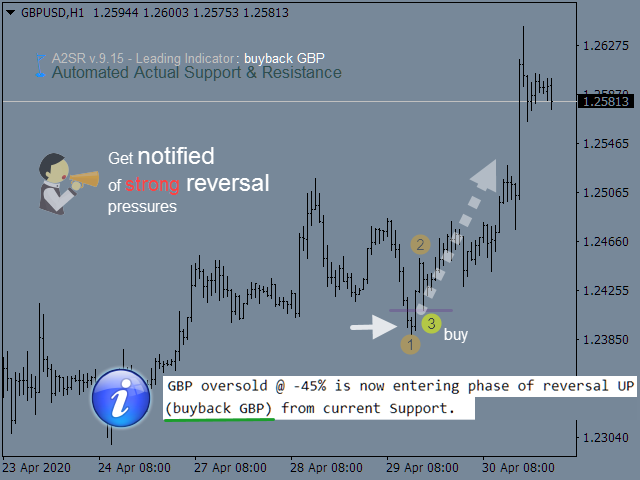

* It's a leading technical indicator (no repaint, no lagging).

-- Guidance :

-- at https://www.mql5.com/en/blogs/post/734748/page4#comment_16532516

-- and https://www.mql5.com/en/users/yohana/blog

-- Special event : 30$ for welcoming 2025 :)

-- https://c.mql5.com/1/298/A2SR_Products_2025_B.png

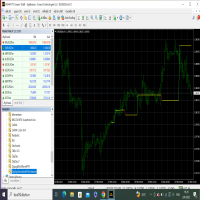

- A2SR has a special technique in determining the levels of Support (demand) and Resistance (supply).

- Unlike the ordinary way that we seen on the net, A2SR has a original concept in determining actual SR levels.

- The original technique was not taken from the internet, and it has never been published on the internet either.

- A2SR will auto select the SR level according to your trading style.

- Even though you are changing the time frame but the SR level will remain on its position.

- Because the actual SR is not obtained from the time frame you use.

A2SR has complete instruments for trading.

- Genuine concept for Actual Support (demand) & Resistance (supply).

- Market Sentiment for news event and central banks speech.

- Genuine concept for Major Currency Strength (MCS) for news event and trend.

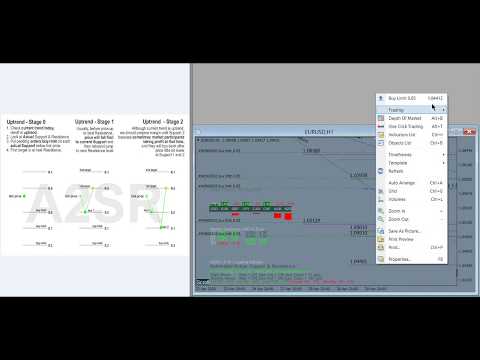

- Current Trend today, including a suggestion for placing positions.

- Auto level trend lines for SR, Breakout and Breakdown. You'll find it easier to analyze charts.

- Genuine concept for Daily price jump and fall in average and maximum range (news events).

- Overbought and Oversold, displayed at the same time for scale H1, H4, Daily, Weekly and Monthly.

B. Why we prefer to use A2SR?

- SR levels here are an actual level, and not obtained from the time frame as usual.

- It is leading indicator, the SR levels are available before price reach there, and it is not repaint and not lagging either.

- A2SR have been designed for creating trade plan for any currency pairs, metals, and stocks in the MetaTrader.

- Basics of using A2SR are also available in user's guide in .pdf file, and you will get further training from the author as necessary.

- You will no longer need in busy drawing on the chart, because A2SR help you to work automatically and all instruments are completed.

- A2SR will help you to select which SR for Short-Term and/or Swing trades.

- Finally, you will have plenty of time to review the market, including market sentiment and creating trades plan.

C. The author understands quality.

For sure A2SR has been built with an efficient concept in logic and programming,

so that the process of analysis does not overload your computer's CPU.

Processes at the same time for 28 currency pairs is actually not a small process.

(reading 30 currency pairs - including USDSEK and EURSEK)

Please do not use low-quality computers when running large processes like this leading indicator.

Minimum system requirements:

i3 / Ryzen 3 processor or equivalent, apps and data on SSD, 8GB RAM, OS Windows 7, 8, 8.1, 10 or above.

D. Input Parameters

'input parameters' are provided at:

https://www.mql5.com/en/market/product/5225#!tab=comments&page=29&comment=43980702

E. Installation/Updates

https://www.mql5.com/en/blogs/post/734748/page4#comment_16522671

Very good indicator, I'm satisfied. May the Lord bless Yohana