Candlestick Patterns Analytics

- Indicators

- Denis Luchinkin

- Version: 1.1

- Updated: 30 November 2021

- Activations: 20

Candlestick Patterns Analytics is a powerful tool for analyzing candlestick patterns. Do you trade based on candlestick patterns? Then Candlestick Patterns Analytics is designed for you.

The undeniable advantage of the indicator:

- Predicts trading result when trading candlestick patterns;

- Uses statistical data based on the history of the selected symbol and timeframe.

What the indicator does

- Finds and marks on the chart 29 candlestick patterns;

- Draws arrows to indicate the classical and statistical trade direction;

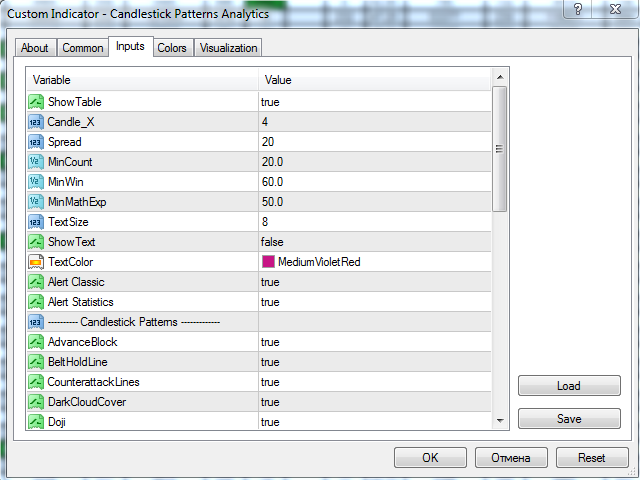

Description of Input Parameters

- ShowTable - Show/hide the table;

- Candle_X - the serial number of the candlestick after pattern formation, a detailed report for which will be displayed in the table;

- Spread - the average symbol spread in points;

- MinCount - the minimum number of candlestick patterns in history for the calculation of statistic;

- MinWin - the minimum percent of the winning direction;

- MinMathExp - the minimum mathematical expectation in points;

- TextSize - text size, determines the size of the table and text of candlestick pattern names on the chart;

- ShowText - show the text of candlestick pattern names on the chart;

- TextColor - the color of the text of candlestick pattern names on the chart;

- Alert Classic - alert for classical trading;

- Alert Statistics - alert for statistical trading;

- ---------- Candlestick Patterns ------------- - separators;

- AdvanceBlock - candlestick pattern;

- BeltHoldLine - candlestick pattern;

- CounterattackLines - candlestick pattern;

- DarkCloudCover - candlestick pattern;

- Doji - candlestick pattern;

- Engulfing - candlestick pattern;

- EveningStar - candlestick pattern;

- Gap - candlestick pattern;

- GravestoneDoji - candlestick pattern;

- Hammer - candlestick pattern;

- HangingMan - candlestick pattern;

- Harami - candlestick pattern;

- InvertedHammer - candlestick pattern;

- LongLeggedDoji - candlestick pattern;

- MatHoldPattern - candlestick pattern;

- MorningStar - candlestick pattern;

- OnNeckLine - candlestick pattern;

- Piercing - candlestick pattern;

- SeparatingLines - candlestick pattern;

- ShootingStar - candlestick pattern;

- SideBySideWhite - candlestick pattern;

- StalledPattern - candlestick pattern;

- TasukiGap - candlestick pattern;

- ThreeCrows - candlestick pattern;

- ThreeLineStrike - candlestick pattern;

- ThreeMethods - candlestick pattern;

- ThreeWhiteSoldiers - candlestick pattern;

- Tweezer - candlestick pattern;

- UpsideGapTwoCrows - candlestick pattern;

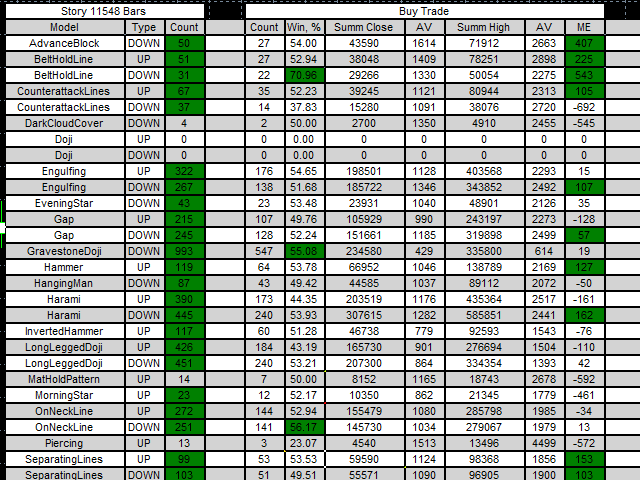

Description of the table

History block (screenshot 2):

- Model - pattern name;

- Type - classical trade direction;

- Count - the number of patterns in history.

Buy trading block (screenshot 2):

- Count - the number of winning patterns;

- Win, % - the percent of winning patterns;

- Summ Close - the amount of wins since the opening of the first candlestick after the pattern till the close of the "X"th candlestick;

- AV - average gain in points;

- Summ High - the sum of highs in the range from the opening of the first candlestick after the pattern till the close of the "X"th candlestick;

- AV - the average high in points;

- ME - mathematical expectation of profit in points.

Sell trading block (screenshot 3):

- Count - the number of winning patterns;

- Win, % - the percent of winning patterns;

- Summ Close - the amount of wins since the opening of the first candlestick after the pattern till the close of the "X"th candlestick;

- AV - average gain in points;

- Summ Low - the sum of lows in the range from the opening of the first candlestick after the pattern till the close of the "X"th candlestick;

- AV - the average high in points;

- ME - mathematical expectation of profit in points.

Candlestick analysis block (screenshot 3):

- X = 4 - the number of the candlestick after the pattern, a detailed report for which will be displayed (Block 2 and Block 3);

- 1 - 8 - candlestick after the pattern, for which a brief conclusion will be presented.

Cells Count, Win, ME are colored in green if the appropriate values are exceeded.

Cells X, 1 -8 - when exceeded simultaneously.

For example, on the attached screenshots, we can select good working patterns for the analyzed pair and timeframe: AdvanceBlock Down (Buy), BeltHoldLine Down (Buy), CounterattackLines Down (Sell).

Only a few patterns can be tested in the Strategy Tester.

It is recommended to use the Candlestick Patterns Custom indicator in Expert Advisors.