Dark Mars

- Experts

- Evgeniy Scherbina

- Version: 1.1

- Updated: 23 May 2025

- Activations: 10

The Dark Mars Expert Advisor is ready for fully automated trading with various symbols.

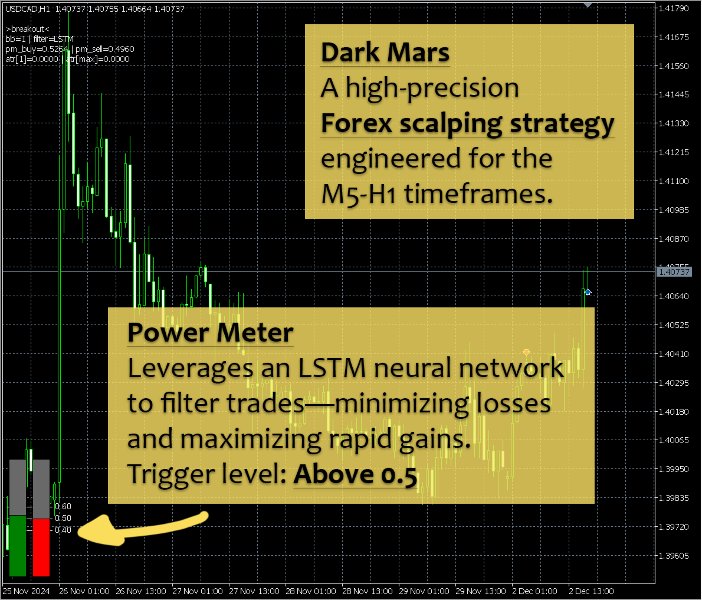

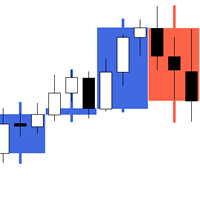

The Dark Mars EA is a scalper that I have tested on the M5, M15, M30, and H1 timeframes. The EA opens trades on breakouts or pullbacks based on the Bollinger Bands indicator.

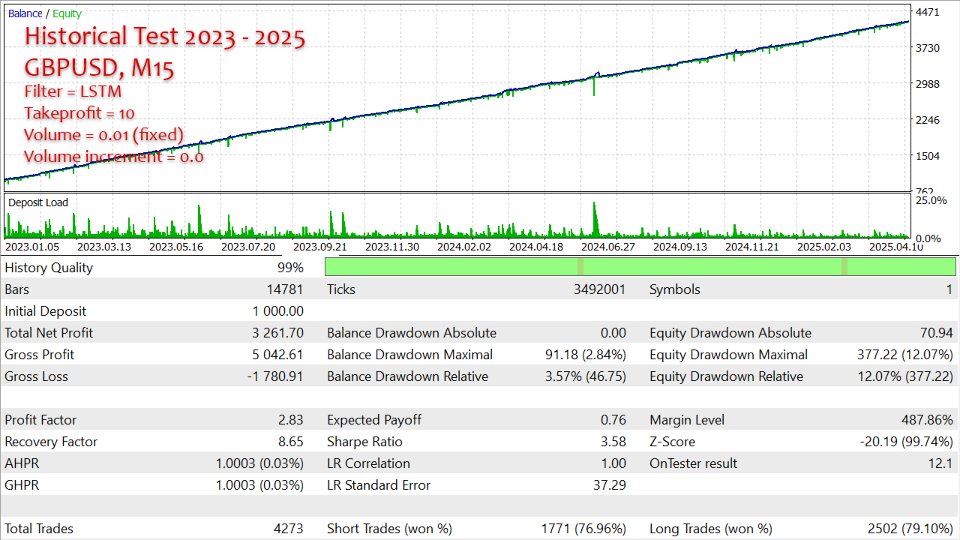

The EA is ready to trade right away with default settings — no optimization needed for GBPUSD and USDCAD.

Love this EA? Leave a positive review and get Latte as a FREE bonus!

Dark Mars and Latte are two completely different trading styles — diversify your strategy with both at no extra cost. If you are interested, write to me via the Messages to claim your bonus. Limited offer, so act fast!

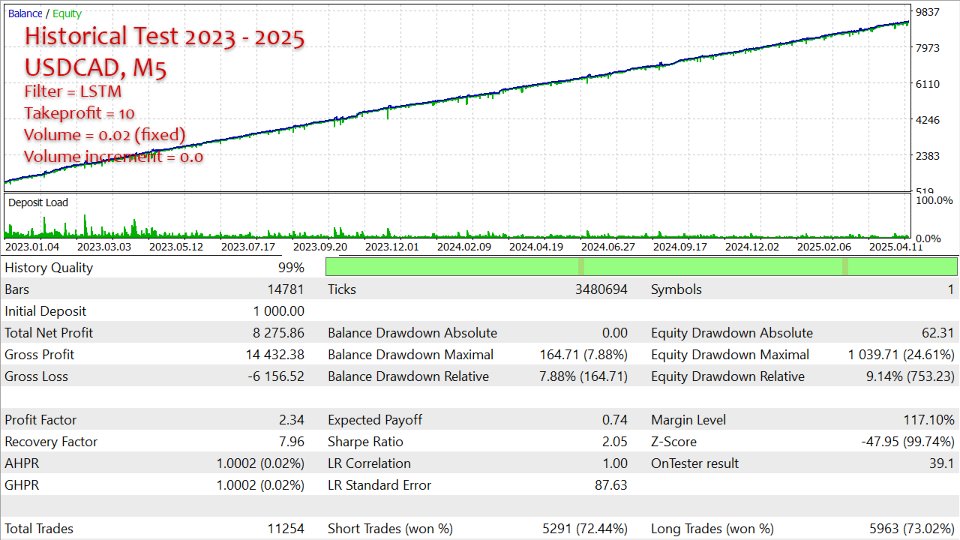

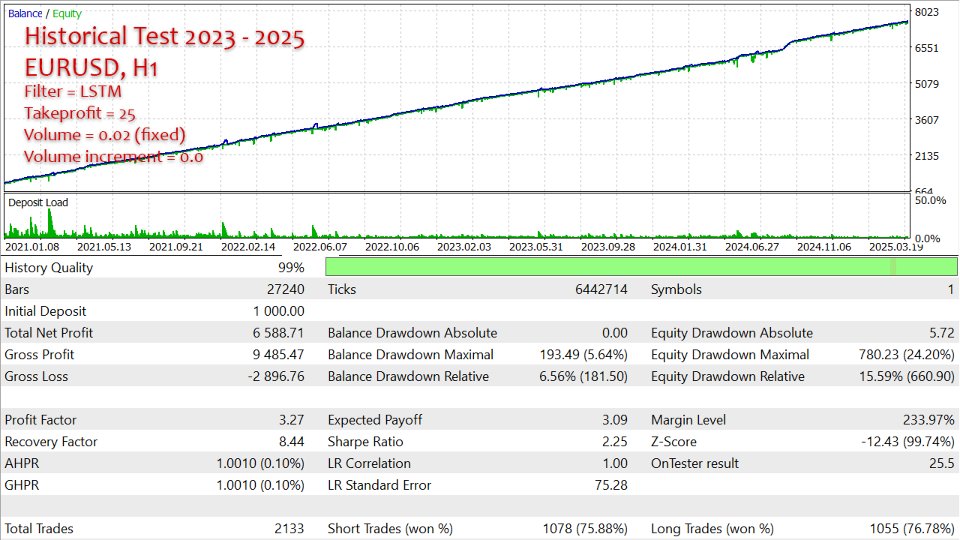

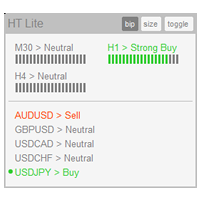

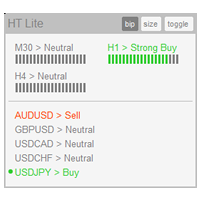

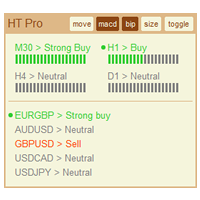

A well-known advantage of scalpers is the high number of trades executed daily. The market is in a flat range 80% of the time, and during these periods, the scalper generates profits. A known drawback of scalpers is their inability to handle trending markets. To overcome this limitation, I have added two filters: LSTM (a neural network) and ATR (a volatility indicator). The LSTM filter requires training, so it only works with the following symbols: AUDUSD, EURUSD, GBPUSD, USDCAD, USDCHF, and USDJPY. For other symbols, you can use the ATR filter or trade without a filter.

The filter's purpose is to predict trend formation. It identifies a trend and "reverses" the trade.

Trading Recommendations

- Symbols: GBPUSD M15-H1 and USDCAD M15-H1

- Deposit: $250 (preferably $1,000)

- Volume = 0.01 and Volume increment = 0.0-0.01

What to Expect from the EA?

For the two symbols (GBPUSD and USDCAD) and a $1,000 deposit, the monthly profit may range between 5-10%, with typical drawdowns of 3-5%. In rare cases where a "false trend" occurs, the drawdown may reach 20-30%.

When a "false trend" appears, the EA continues opening trades based on signals to offset floating losses. It draws a virtual take-profit level on the chart, indicating where the price needs to reach to close all trades in profit.

I do not recommend running more than two symbols with Volume = 0.01 and Volume increment = 0.01 if testing the strategy on a deposit below $1,000.

EA Properties

- Max trades per symbol >> max number of trades for a symbol. If a signal repeats, the EA keeps opening similar trades until it reaches the max number.

- Close all profit (%) >> a profit target as a percentage to allow closing all trades. Set 0 to switch off.

- Filter to detect a trend >> filter for trend detection. If a trend is identified, the filter "reverses" the trade. The LSTM filter currently works only on six major symbols: AUDUSD, EURUSD, GBPUSD, USDCAD, USDCHF, and USDJPY. For other symbols, you can use the ATR volatility filter or no filter. The ATR filter can also be used on the six major symbols.

- Max spread >> the EA won't open or close trades if the spread is higher than this.

- Show power meter >> shows a panel of the signal power for the chart's symbol. If the signal strength exceeds the target value, the market is entering a trending phase.

- Timeframe for trading decisions >> the timeframe used to calculate the Bollinger Bands indicator and make trading decisions.

- Timeframe for ATR filter >> the timeframe for calculating the ATR volatility indicator. I recommend using a higher timeframe than the trading timeframe.

- Comment

- Magic

- Takeprofit

- Stoploss >> the EA manages trades internally based on its calculations. The stoploss serves more as a nominal safeguard.

- Volume >> volume per trade.

- Volume increment >> Volume increase (by adding to the last trade’s volume) for each subsequent trade.

Been running this EA for about a month now on a $10,000 account,1:1000 Leverage in ICMARKET, only trading GBPUSD and USDCAD with the default 0.05 lot settings. Honestly, I’m pretty happy with it so far. Profit: Around 6–7% growth Drawdown: Most of the time it stayed around 30–50%. Had one “false trend” week where it went down close to 70%, but it recovered over the next few days as the EA kept adding trades and managing the basket. Features I liked: The virtual TP line is super handy – lets you see exactly where the market needs to go to close everything in profit. The power meter also gives a nice heads-up when a trend might be forming. Filters: Tried both ATR and LSTM filters – ATR felt more reliable when things got volatile, but LSTM is great for major pairs. Pros: Consistent profits (if you keep it to 1 pair). Easy setup, clear explanation of settings. Cons: Recovery can take a while in trending markets! Not for overloading with too many pairs on a small account. Final thoughts: If you’re looking for crazy fast profits, this isn’t it. But if you want steady growth and can ride out the occasional drawdown, this EA does the job. Just stick to the recommended setup and don’t overtrade.