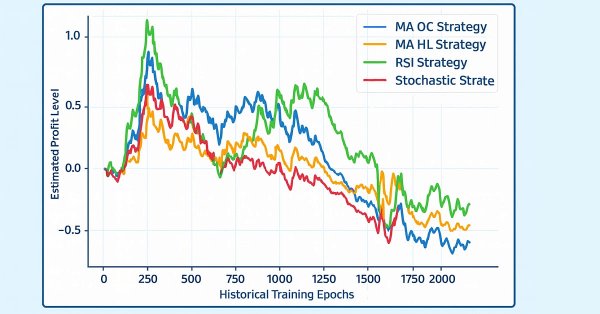

Overcoming The Limitation of Machine Learning (Part 7): Automatic Strategy Selection

This article demonstrates how to automatically identify potentially profitable trading strategies using MetaTrader 5. White-box solutions, powered by unsupervised matrix factorization, are faster to configure, more interpretable, and provide clear guidance on which strategies to retain. Black-box solutions, while more time-consuming, are better suited for complex market conditions that white-box approaches may not capture. Join us as we discuss how our trading strategies can help us carefully identify profitable strategies under any circumstance.

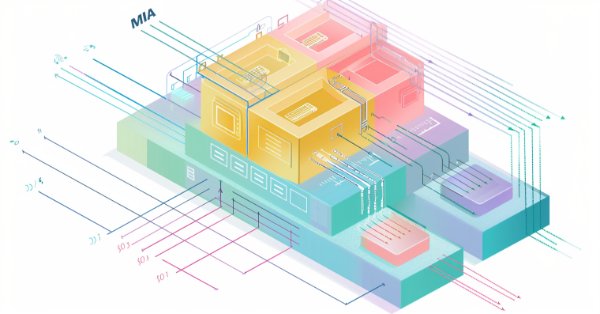

The Group Method of Data Handling: Implementing the Multilayered Iterative Algorithm in MQL5

In this article we describe the implementation of the Multilayered Iterative Algorithm of the Group Method of Data Handling in MQL5.

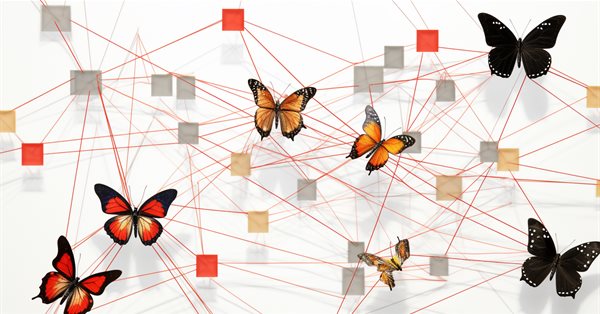

Example of Causality Network Analysis (CNA) and Vector Auto-Regression Model for Market Event Prediction

This article presents a comprehensive guide to implementing a sophisticated trading system using Causality Network Analysis (CNA) and Vector Autoregression (VAR) in MQL5. It covers the theoretical background of these methods, provides detailed explanations of key functions in the trading algorithm, and includes example code for implementation.

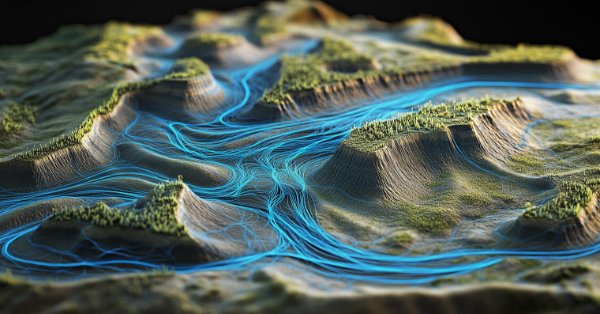

Artificial Showering Algorithm (ASHA)

The article presents the Artificial Showering Algorithm (ASHA), a new metaheuristic method developed for solving general optimization problems. Based on simulation of water flow and accumulation processes, this algorithm constructs the concept of an ideal field, in which each unit of resource (water) is called upon to find an optimal solution. We will find out how ASHA adapts flow and accumulation principles to efficiently allocate resources in a search space, and see its implementation and test results.

Arithmetic Optimization Algorithm (AOA): From AOA to SOA (Simple Optimization Algorithm)

In this article, we present the Arithmetic Optimization Algorithm (AOA) based on simple arithmetic operations: addition, subtraction, multiplication and division. These basic mathematical operations serve as the foundation for finding optimal solutions to various problems.

MQL5 Wizard Techniques you should know (Part 10). The Unconventional RBM

Restrictive Boltzmann Machines are at the basic level, a two-layer neural network that is proficient at unsupervised classification through dimensionality reduction. We take its basic principles and examine if we were to re-design and train it unorthodoxly, we could get a useful signal filter.

Eigenvectors and eigenvalues: Exploratory data analysis in MetaTrader 5

In this article we explore different ways in which the eigenvectors and eigenvalues can be applied in exploratory data analysis to reveal unique relationships in data.

Integrating MQL5 with Data Processing Packages (Part 6): Merging Market Feedback with Model Adaptation

In this part, we focus on how to merge real-time market feedback—such as live trade outcomes, volatility changes, and liquidity shifts—with adaptive model learning to maintain a responsive and self-improving trading system.

MQL5 Wizard Techniques you should know (Part 81): Using Patterns of Ichimoku and the ADX-Wilder with Beta VAE Inference Learning

This piece follows up ‘Part-80’, where we examined the pairing of Ichimoku and the ADX under a Reinforcement Learning framework. We now shift focus to Inference Learning. Ichimoku and ADX are complimentary as already covered, however we are going to revisit the conclusions of the last article related to pipeline use. For our inference learning, we are using the Beta algorithm of a Variational Auto Encoder. We also stick with the implementation of a custom signal class designed for integration with the MQL5 Wizard.

Neural networks made easy (Part 77): Cross-Covariance Transformer (XCiT)

In our models, we often use various attention algorithms. And, probably, most often we use Transformers. Their main disadvantage is the resource requirement. In this article, we will consider a new algorithm that can help reduce computing costs without losing quality.

Analyzing binary code of prices on the exchange (Part I): A new look at technical analysis

This article presents an innovative approach to technical analysis based on converting price movements into binary code. The author demonstrates how various aspects of market behavior — from simple price movements to complex patterns — can be encoded in a sequence of zeros and ones.

Neural networks made easy (Part 70): Closed-Form Policy Improvement Operators (CFPI)

In this article, we will get acquainted with an algorithm that uses closed-form policy improvement operators to optimize Agent actions in offline mode.

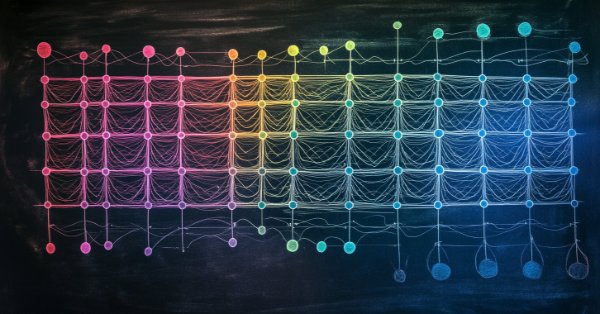

MQL5 Wizard Techniques you should know (Part 23): CNNs

Convolutional Neural Networks are another machine learning algorithm that tend to specialize in decomposing multi-dimensioned data sets into key constituent parts. We look at how this is typically achieved and explore a possible application for traders in another MQL5 wizard signal class.

A feature selection algorithm using energy based learning in pure MQL5

In this article we present the implementation of a feature selection algorithm described in an academic paper titled,"FREL: A stable feature selection algorithm", called Feature weighting as regularized energy based learning.

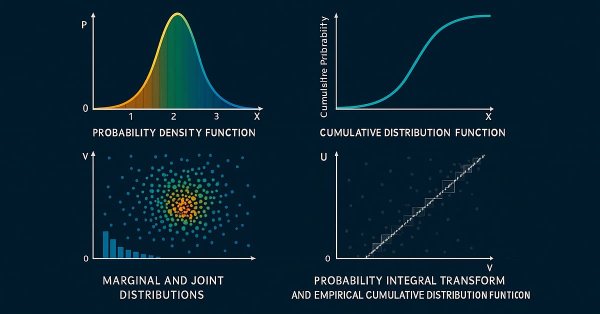

Bivariate Copulae in MQL5 (Part 1): Implementing Gaussian and Student's t-Copulae for Dependency Modeling

This is the first part of an article series presenting the implementation of bivariate copulae in MQL5. This article presents code implementing Gaussian and Student's t-copulae. It also delves into the fundamentals of statistical copulae and related topics. The code is based on the Arbitragelab Python package by Hudson and Thames.

Atmosphere Clouds Model Optimization (ACMO): Theory

The article is devoted to the metaheuristic Atmosphere Clouds Model Optimization (ACMO) algorithm, which simulates the behavior of clouds to solve optimization problems. The algorithm uses the principles of cloud generation, movement and propagation, adapting to the "weather conditions" in the solution space. The article reveals how the algorithm's meteorological simulation finds optimal solutions in a complex possibility space and describes in detail the stages of ACMO operation, including "sky" preparation, cloud birth, cloud movement, and rain concentration.

Neural Networks in Trading: Multi-Task Learning Based on the ResNeXt Model (Final Part)

We continue exploring a multi-task learning framework based on ResNeXt, which is characterized by modularity, high computational efficiency, and the ability to identify stable patterns in data. Using a single encoder and specialized "heads" reduces the risk of model overfitting and improves the quality of forecasts.

Adaptive Social Behavior Optimization (ASBO): Two-phase evolution

We continue dwelling on the topic of social behavior of living organisms and its impact on the development of a new mathematical model - ASBO (Adaptive Social Behavior Optimization). We will dive into the two-phase evolution, test the algorithm and draw conclusions. Just as in nature a group of living organisms join their efforts to survive, ASBO uses principles of collective behavior to solve complex optimization problems.

The case for using Hospital-Performance Data with Perceptrons, this Q4, in weighing SPDR XLV's next Performance

XLV is SPDR healthcare ETF and in an age where it is common to be bombarded by a wide array of traditional news items plus social media feeds, it can be pressing to select a data set for use with a model. We try to tackle this problem for this ETF by sizing up some of its critical data sets in MQL5.

Neural networks made easy (Part 69): Density-based support constraint for the behavioral policy (SPOT)

In offline learning, we use a fixed dataset, which limits the coverage of environmental diversity. During the learning process, our Agent can generate actions beyond this dataset. If there is no feedback from the environment, how can we be sure that the assessments of such actions are correct? Maintaining the Agent's policy within the training dataset becomes an important aspect to ensure the reliability of training. This is what we will talk about in this article.

Neuroboids Optimization Algorithm (NOA)

A new bioinspired optimization metaheuristic, NOA (Neuroboids Optimization Algorithm), combines the principles of collective intelligence and neural networks. Unlike conventional methods, the algorithm uses a population of self-learning "neuroboids", each with its own neural network that adapts its search strategy in real time. The article reveals the architecture of the algorithm, the mechanisms of self-learning of agents, and the prospects for applying this hybrid approach to complex optimization problems.

Central Force Optimization (CFO) algorithm

The article presents the Central Force Optimization (CFO) algorithm inspired by the laws of gravity. It explores how principles of physical attraction can solve optimization problems where "heavier" solutions attract less successful counterparts.

Neural Networks in Trading: Hyperbolic Latent Diffusion Model (HypDiff)

The article considers methods of encoding initial data in hyperbolic latent space through anisotropic diffusion processes. This helps to more accurately preserve the topological characteristics of the current market situation and improves the quality of its analysis.

Atmosphere Clouds Model Optimization (ACMO): Practice

In this article, we will continue diving into the implementation of the ACMO (Atmospheric Cloud Model Optimization) algorithm. In particular, we will discuss two key aspects: the movement of clouds into low-pressure regions and the rain simulation, including the initialization of droplets and their distribution among clouds. We will also look at other methods that play an important role in managing the state of clouds and ensuring their interaction with the environment.

Population optimization algorithms: Bacterial Foraging Optimization - Genetic Algorithm (BFO-GA)

The article presents a new approach to solving optimization problems by combining ideas from bacterial foraging optimization (BFO) algorithms and techniques used in the genetic algorithm (GA) into a hybrid BFO-GA algorithm. It uses bacterial swarming to globally search for an optimal solution and genetic operators to refine local optima. Unlike the original BFO, bacteria can now mutate and inherit genes.

Neural Networks in Trading: Two-Dimensional Connection Space Models (Chimera)

In this article, we will explore the innovative Chimera framework: a two-dimensional state-space model that uses neural networks to analyze multivariate time series. This method offers high accuracy with low computational cost, outperforming traditional approaches and Transformer architectures.

Feature selection and dimensionality reduction using principal components

The article delves into the implementation of a modified Forward Selection Component Analysis algorithm, drawing inspiration from the research presented in “Forward Selection Component Analysis: Algorithms and Applications” by Luca Puggini and Sean McLoone.

Building Volatility models in MQL5 (Part I): The Initial Implementation

In this article, we present an MQL5 library for modeling volatility, designed to function similarly to Python's arch package. The library currently supports the specification of common conditional mean (HAR, AR, Constant Mean, Zero Mean) and conditional volatility (Constant Variance, ARCH, GARCH) models.

Overcoming The Limitation of Machine Learning (Part 8): Nonparametric Strategy Selection

This article shows how to configure a black-box model to automatically uncover strong trading strategies using a data-driven approach. By using Mutual Information to prioritize the most learnable signals, we can build smarter and more adaptive models that outperform conventional methods. Readers will also learn to avoid common pitfalls like overreliance on surface-level metrics, and instead develop strategies rooted in meaningful statistical insight.

Stepwise feature selection in MQL5

In this article, we introduce a modified version of stepwise feature selection, implemented in MQL5. This approach is based on the techniques outlined in Modern Data Mining Algorithms in C++ and CUDA C by Timothy Masters.

MQL5 Wizard Techniques you should know (Part 29): Continuation on Learning Rates with MLPs

We wrap up our look at learning rate sensitivity to the performance of Expert Advisors by primarily examining the Adaptive Learning Rates. These learning rates aim to be customized for each parameter in a layer during the training process and so we assess potential benefits vs the expected performance toll.

Neuroboids Optimization Algorithm 2 (NOA2)

The new proprietary optimization algorithm NOA2 (Neuroboids Optimization Algorithm 2) combines the principles of swarm intelligence with neural control. NOA2 combines the mechanics of a neuroboid swarm with an adaptive neural system that allows agents to self-correct their behavior while searching for the optimum. The algorithm is under active development and demonstrates potential for solving complex optimization problems.

MQL5 Wizard Techniques you should know (Part 30): Spotlight on Batch-Normalization in Machine Learning

Batch normalization is the pre-processing of data before it is fed into a machine learning algorithm, like a neural network. This is always done while being mindful of the type of Activation to be used by the algorithm. We therefore explore the different approaches that one can take in reaping the benefits of this, with the help of a wizard assembled Expert Advisor.

Swap Arbitrage in Forex: Building a Synthetic Portfolio and Generating a Consistent Swap Flow

Do you want to know how to benefit from the difference in interest rates? This article considers how to use swap arbitrage in Forex to earn stable profit every night, creating a portfolio that is resistant to market fluctuations.

Data Science and ML (Part 48): Are Transformers a Big Deal for Trading?

From ChatGPT to Gemini and many model AI tools for text, image, and video generation. Transformers have rocked the AI-world. But, are they applicable in the financial (trading) space? Let's find out.

Employing Game Theory Approaches in Trading Algorithms

We are creating an adaptive self-learning trading expert advisor based on DQN machine learning, with multidimensional causal inference. The EA will successfully trade simultaneously on 7 currency pairs. And agents of different pairs will exchange information with each other.