Neural Networks in Trading: Point Cloud Analysis (PointNet)

Direct point cloud analysis avoids unnecessary data growth and improves the performance of models in classification and segmentation tasks. Such approaches demonstrate high performance and robustness to perturbations in the original data.

Analyzing binary code of prices on the exchange (Part II): Converting to BIP39 and writing GPT model

Continuing tries to decipher price movements... What about linguistic analysis of the "market dictionary" that we get by converting the binary price code to BIP39? In this article, we will delve into an innovative approach to exchange data analysis and consider how modern natural language processing techniques can be applied to the market language.

MQL5 Wizard Techniques you should know (Part 76): Using Patterns of Awesome Oscillator and the Envelope Channels with Supervised Learning

We follow up on our last article, where we introduced the indicator couple of the Awesome-Oscillator and the Envelope Channel, by looking at how this pairing could be enhanced with Supervised Learning. The Awesome-Oscillator and Envelope-Channel are a trend-spotting and support/resistance complimentary mix. Our supervised learning approach is a CNN that engages the Dot Product Kernel with Cross-Time-Attention to size its kernels and channels. As per usual, this is done in a custom signal class file that works with the MQL5 wizard to assemble an Expert Advisor.

Neural Networks in Trading: Transformer for the Point Cloud (Pointformer)

In this article, we will talk about algorithms for using attention methods in solving problems of detecting objects in a point cloud. Object detection in point clouds is important for many real-world applications.

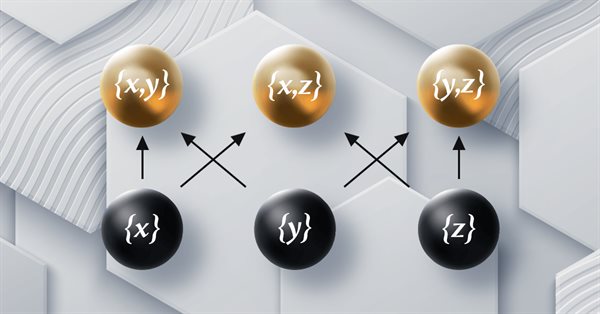

Category Theory in MQL5 (Part 17): Functors and Monoids

This article, the final in our series to tackle functors as a subject, revisits monoids as a category. Monoids which we have already introduced in these series are used here to aid in position sizing, together with multi-layer perceptrons.

Neural networks are easy (Part 59): Dichotomy of Control (DoC)

In the previous article, we got acquainted with the Decision Transformer. But the complex stochastic environment of the foreign exchange market did not allow us to fully implement the potential of the presented method. In this article, I will introduce an algorithm that is aimed at improving the performance of algorithms in stochastic environments.

Overcoming The Limitation of Machine Learning (Part 3): A Fresh Perspective on Irreducible Error

This article takes a fresh perspective on a hidden, geometric source of error that quietly shapes every prediction your models make. By rethinking how we measure and apply machine learning forecasts in trading, we reveal how this overlooked perspective can unlock sharper decisions, stronger returns, and a more intelligent way to work with models we thought we already understood.

MQL5 Wizard Techniques you should know (Part 55): SAC with Prioritized Experience Replay

Replay buffers in Reinforcement Learning are particularly important with off-policy algorithms like DQN or SAC. This then puts the spotlight on the sampling process of this memory-buffer. While default options with SAC, for instance, use random selection from this buffer, Prioritized Experience Replay buffers fine tune this by sampling from the buffer based on a TD-score. We review the importance of Reinforcement Learning, and, as always, examine just this hypothesis (not the cross-validation) in a wizard assembled Expert Advisor.

Population optimization algorithms: Boids Algorithm

The article considers Boids algorithm based on unique examples of animal flocking behavior. In turn, the Boids algorithm serves as the basis for the creation of the whole class of algorithms united under the name "Swarm Intelligence".

Forex arbitrage trading: Analyzing synthetic currencies movements and their mean reversion

In this article, we will examine the movements of synthetic currencies using Python and MQL5 and explore how feasible Forex arbitrage is today. We will also consider ready-made Python code for analyzing synthetic currencies and share more details on what synthetic currencies are in Forex.

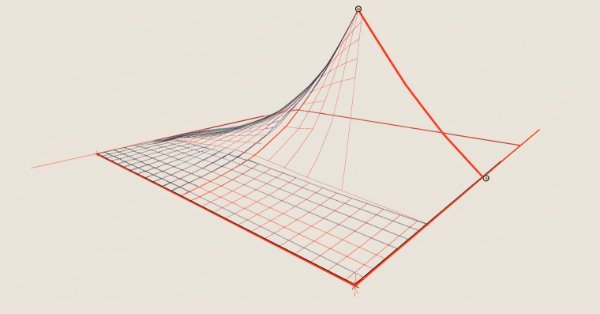

Population optimization algorithms: Spiral Dynamics Optimization (SDO) algorithm

The article presents an optimization algorithm based on the patterns of constructing spiral trajectories in nature, such as mollusk shells - the spiral dynamics optimization (SDO) algorithm. I have thoroughly revised and modified the algorithm proposed by the authors. The article will consider the necessity of these changes.

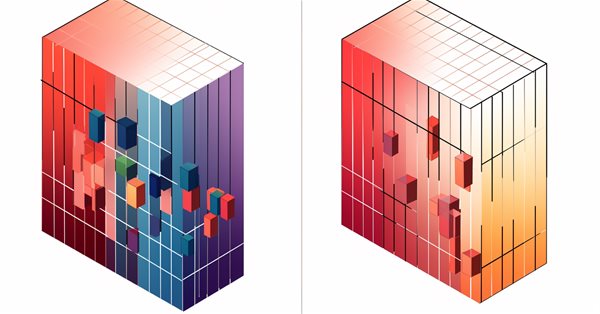

Data Science and ML (Part 36): Dealing with Biased Financial Markets

Financial markets are not perfectly balanced. Some markets are bullish, some are bearish, and some exhibit some ranging behaviors indicating uncertainty in either direction, this unbalanced information when used to train machine learning models can be misleading as the markets change frequently. In this article, we are going to discuss several ways to tackle this issue.

Most notable Artificial Cooperative Search algorithm modifications (ACSm)

Here we will consider the evolution of the ACS algorithm: three modifications aimed at improving the convergence characteristics and the algorithm efficiency. Transformation of one of the leading optimization algorithms. From matrix modifications to revolutionary approaches regarding population formation.

MQL5 Wizard Techniques you should know (Part 82): Using Patterns of TRIX and the WPR with DQN Reinforcement Learning

In the last article, we examined the pairing of Ichimoku and the ADX under an Inference Learning framework. For this piece we revisit, Reinforcement Learning when used with an indicator pairing we considered last in ‘Part 68’. The TRIX and Williams Percent Range. Our algorithm for this review will be the Quantile Regression DQN. As usual, we present this as a custom signal class designed for implementation with the MQL5 Wizard.

Tabu Search (TS)

The article discusses the Tabu Search algorithm, one of the first and most well-known metaheuristic methods. We will go through the algorithm operation in detail, starting with choosing an initial solution and exploring neighboring options, with an emphasis on using a tabu list. The article covers the key aspects of the algorithm and its features.

Neural Networks in Trading: Piecewise Linear Representation of Time Series

This article is somewhat different from my earlier publications. In this article, we will talk about an alternative representation of time series. Piecewise linear representation of time series is a method of approximating a time series using linear functions over small intervals.

Animal Migration Optimization (AMO) algorithm

The article is devoted to the AMO algorithm, which models the seasonal migration of animals in search of optimal conditions for life and reproduction. The main features of AMO include the use of topological neighborhood and a probabilistic update mechanism, which makes it easy to implement and flexible for various optimization tasks.

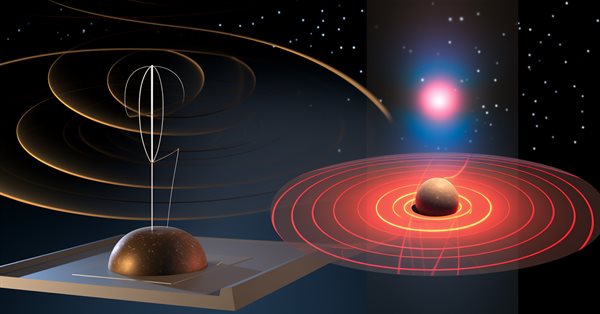

Neural Networks in Trading: Models Using Wavelet Transform and Multi-Task Attention

We invite you to explore a framework that combines wavelet transforms and a multi-task self-attention model, aimed at improving the responsiveness and accuracy of forecasting in volatile market conditions. The wavelet transform allows asset returns to be decomposed into high and low frequencies, carefully capturing long-term market trends and short-term fluctuations.

MQL5 Wizard Techniques you should know (Part 45): Reinforcement Learning with Monte-Carlo

Monte-Carlo is the fourth different algorithm in reinforcement learning that we are considering with the aim of exploring its implementation in wizard assembled Expert Advisors. Though anchored in random sampling, it does present vast ways of simulation which we can look to exploit.

Neural networks made easy (Part 82): Ordinary Differential Equation models (NeuralODE)

In this article, we will discuss another type of models that are aimed at studying the dynamics of the environmental state.

Economic forecasts: Exploring the Python potential

How to use World Bank economic data for forecasts? What happens when you combine AI models and economics?

Mastering Model Interpretation: Gaining Deeper Insight From Your Machine Learning Models

Machine Learning is a complex and rewarding field for anyone of any experience. In this article we dive deep into the inner mechanisms powering the models you build, we explore the intricate world of features,predictions and impactful decisions unravelling the complexities and gaining a firm grasp of model interpretation. Learn the art of navigating tradeoffs , enhancing predictions, ranking feature importance all while ensuring robust decision making. This essential read helps you clock more performance from your machine learning models and extract more value for employing machine learning methodologies.

Forecasting exchange rates using classic machine learning methods: Logit and Probit models

In the article, an attempt is made to build a trading EA for predicting exchange rate quotes. The algorithm is based on classical classification models - logistic and probit regression. The likelihood ratio criterion is used as a filter for trading signals.

Ensemble methods to enhance numerical predictions in MQL5

In this article, we present the implementation of several ensemble learning methods in MQL5 and examine their effectiveness across different scenarios.

Neural Networks in Trading: A Hybrid Trading Framework with Predictive Coding (Final Part)

We continue our examination of the StockFormer hybrid trading system, which combines predictive coding and reinforcement learning algorithms for financial time series analysis. The system is based on three Transformer branches with a Diversified Multi-Head Attention (DMH-Attn) mechanism that enables the capturing of complex patterns and interdependencies between assets. Previously, we got acquainted with the theoretical aspects of the framework and implemented the DMH-Attn mechanisms. Today, we will talk about the model architecture and training.

Spurious Regressions in Python

Spurious regressions occur when two time series exhibit a high degree of correlation purely by chance, leading to misleading results in regression analysis. In such cases, even though variables may appear to be related, the correlation is coincidental and the model may be unreliable.

Chemical reaction optimization (CRO) algorithm (Part I): Process chemistry in optimization

In the first part of this article, we will dive into the world of chemical reactions and discover a new approach to optimization! Chemical reaction optimization (CRO) uses principles derived from the laws of thermodynamics to achieve efficient results. We will reveal the secrets of decomposition, synthesis and other chemical processes that became the basis of this innovative method.

Anarchic Society Optimization (ASO) algorithm

In this article, we will get acquainted with the Anarchic Society Optimization (ASO) algorithm and discuss how an algorithm based on the irrational and adventurous behavior of participants in an anarchic society (an anomalous system of social interaction free from centralized power and various kinds of hierarchies) is able to explore the solution space and avoid the traps of local optimum. The article presents a unified ASO structure applicable to both continuous and discrete problems.

Neural Networks in Trading: Generalized 3D Referring Expression Segmentation

While analyzing the market situation, we divide it into separate segments, identifying key trends. However, traditional analysis methods often focus on one aspect and thus limit the proper perception. In this article, we will learn about a method that enables the selection of multiple objects to ensure a more comprehensive and multi-layered understanding of the situation.

Self Optimizing Expert Advisor With MQL5 And Python (Part VI): Taking Advantage of Deep Double Descent

Traditional machine learning teaches practitioners to be vigilant not to overfit their models. However, this ideology is being challenged by new insights published by diligent researches from Harvard, who have discovered that what appears to be overfitting may in some circumstances be the results of terminating your training procedures prematurely. We will demonstrate how we can use the ideas published in the research paper, to improve our use of AI in forecasting market returns.

Category Theory in MQL5 (Part 12): Orders

This article which is part of a series that follows Category Theory implementation of Graphs in MQL5, delves in Orders. We examine how concepts of Order-Theory can support monoid sets in informing trade decisions by considering two major ordering types.

Neural Networks Made Easy (Part 90): Frequency Interpolation of Time Series (FITS)

By studying the FEDformer method, we opened the door to the frequency domain of time series representation. In this new article, we will continue the topic we started. We will consider a method with which we can not only conduct an analysis, but also predict subsequent states in a particular area.

Hybridization of population algorithms. Sequential and parallel structures

Here we will dive into the world of hybridization of optimization algorithms by looking at three key types: strategy mixing, sequential and parallel hybridization. We will conduct a series of experiments combining and testing relevant optimization algorithms.

MQL5 Wizard Techniques You Should Know (Part 15): Support Vector Machines with Newton's Polynomial

Support Vector Machines classify data based on predefined classes by exploring the effects of increasing its dimensionality. It is a supervised learning method that is fairly complex given its potential to deal with multi-dimensioned data. For this article we consider how it’s very basic implementation of 2-dimensioned data can be done more efficiently with Newton’s Polynomial when classifying price-action.

An introduction to Receiver Operating Characteristic curves

ROC curves are graphical representations used to evaluate the performance of classifiers. Despite ROC graphs being relatively straightforward, there exist common misconceptions and pitfalls when using them in practice. This article aims to provide an introduction to ROC graphs as a tool for practitioners seeking to understand classifier performance evaluation.

MQL5 Wizard Techniques you should know (Part 70): Using Patterns of SAR and the RVI with a Exponential Kernel Network

We follow up our last article, where we introduced the indicator pair of the SAR and the RVI, by considering how this indicator pairing could be extended with Machine Learning. SAR and RVI are a trend and momentum complimentary pairing. Our machine learning approach uses a convolution neural network that engages the Exponential kernel in sizing its kernels and channels, when fine-tuning the forecasts of this indicator pairing. As always, this is done in a custom signal class file that works with the MQL5 wizard to assemble an Expert Advisor.

Ordinal Encoding for Nominal Variables

In this article, we discuss and demonstrate how to convert nominal predictors into numerical formats that are suitable for machine learning algorithms, using both Python and MQL5.

Neural Networks in Trading: Hierarchical Dual-Tower Transformer (Hidformer)

We invite you to get acquainted with the Hierarchical Double-Tower Transformer (Hidformer) framework, which was developed for time series forecasting and data analysis. The framework authors proposed several improvements to the Transformer architecture, which resulted in increased forecast accuracy and reduced computational resource consumption.

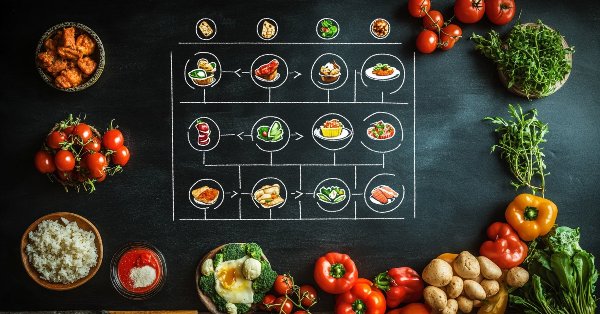

Successful Restaurateur Algorithm (SRA)

Successful Restaurateur Algorithm (SRA) is an innovative optimization method inspired by restaurant business management principles. Unlike traditional approaches, SRA does not discard weak solutions, but improves them by combining with elements of successful ones. The algorithm shows competitive results and offers a fresh perspective on balancing exploration and exploitation in optimization problems.

Neural Network in Practice: Least Squares

In this article, we'll look at a few ideas, including how mathematical formulas are more complex in appearance than when implemented in code. In addition, we will consider how to set up a chart quadrant, as well as one interesting problem that may arise in your MQL5 code. Although, to be honest, I still don't quite understand how to explain it. Anyway, I'll show you how to fix it in code.