Automating Trading Strategies in MQL5 (Part 45): Inverse Fair Value Gap (IFVG)

Introduction

In our previous article (Part 44), we developed a Change of Character (CHoCH) detection system in MetaQuotes Language 5 (MQL5). This system scanned bars to identify and label swing highs and lows for trend determination. It triggered trades on breaks signaling reversals. The system supported per-bar and tick modes, and visualized with icons, labels, break lines, and dynamic fonts. In Part 45, we develop an Inverse Fair Value Gap (IFVG) system.

This system identifies bullish or bearish Fair Value Gaps (FVGs) on recent bars, applying a minimum gap size filter. It tracks states as normal, mitigated, or inverted based on price interactions. Mitigation occurs on far-side breaks, retracement on re-entry, and inversion on close beyond the far side from inside. The system ignores overlaps while limiting tracked FVGs. It supports one, limited, or unlimited trades per FVG. It opens buys on bullish IFVGs or sells on bearish. Zones are visualized as colored rectangles with state/trade labels, as well as mitigation icons. We will cover the following topics:

- Understanding the Inverse Fair Value Gap (IFVG) Framework

- Implementation in MQL5

- Backtesting

- Conclusion

By the end, you’ll have a functional MQL5 strategy for detecting and trading IFVGs with state tracking, adaptive visuals, and configurable modes—let’s dive in!

Understanding the Inverse Fair Value Gap (IFVG) Framework

The Fair Value Gap (FVG) is a price action concept representing imbalances or gaps between candles where buying or selling pressure created an unfilled void, often seen as bullish FVGs (low of later candle above high of earlier) or bearish FVGs (high of later below low of earlier), acting as potential support/resistance zones that price may retrace to fill. An Inverse Fair Value Gap (IFVG) occurs when a mitigated FVG (price broke the far side) is retraced into and then inverted by price closing beyond the far side from inside, signaling a reversal: a mitigated bullish FVG inverting bearish (price closes below low after re-entry) or mitigated bearish inverting bullish (closes above high). States track progression — normal (initial gap), mitigated (far-side break), retraced (re-entry after mitigation), inverted (close beyond far from inside post-retrace) — with inversion as the key trade signal.

In a mitigated bearish FVG (original down gap), a bullish IFVG triggers when price re-enters after mitigation and closes above the high, entering buy with stop-loss below low and take-profit at fixed points. Conversely, for a mitigated bullish FVG (original up), a bearish IFVG on close below low enters sell with stop-loss above high. Have a look below at the different setups we could have.

Our plan is to detect FVGs on recent bars with minimum gap filtering, load historical FVGs on initialization, track/update states (normal/mitigated/inverted) based on price interactions, ignore overlaps, limit tracked FVGs with cleanup of expired, trade inversions with buys on bullish IFVGs (orig down inverted) or sells on bearish (orig up inverted), fixed trade levels, trade modes/counts per FVG, trailing stops, and visualize colored rectangles (normal/mitigated/inverted shades) with state/trade labels and mitigation icons. In brief, here is a visual representation of our objectives.

Implementation in MQL5

To create the program in MQL5, open the MetaEditor, go to the Navigator, locate the Experts folder, click on the "New" tab, and follow the prompts to create the file. Once it is made, in the coding environment, we will need to declare some input parameters and global variables that we will use throughout the program.

//+------------------------------------------------------------------+ //| FVG Inverse.mq5 | //| Copyright 2025, Allan Munene Mutiiria. | //| https://t.me/Forex_Algo_Trader | //+------------------------------------------------------------------+ #property copyright "Copyright 2025, Allan Munene Mutiiria." #property link "https://t.me/Forex_Algo_Trader" #property version "1.00" #include <Trade/Trade.mqh> //+------------------------------------------------------------------+ //| Global Variables | //+------------------------------------------------------------------+ CTrade obj_Trade; //--- Trade object #define FVG_Prefix "IFVG REC " //--- FVG prefix // Normal FVGs #define CLR_UP clrGreen // Green for normal up (Bullish FVG) #define CLR_DOWN clrRed // Red for normal down (Bearish FVG) // Mitigated FVGs #define CLR_MIT_UP clrPurple // Purple for mitigated up (Mitigated Bullish FVG) #define CLR_MIT_DOWN clrOrange // Orange for mitigated down (Mitigated Bearish FVG) // Inverted FVGs #define CLR_INV_UP clrRed // Red for inverted up (Bearish IFVG) #define CLR_INV_DOWN clrGreen // Green for inverted down (Bullish IFVG) //+------------------------------------------------------------------+ //| Enums | //+------------------------------------------------------------------+ enum TradeMode { // Define trade mode enum TradeOnce, // Trade Once LimitedTrades, // Limited Trades UnlimitedTrades // Unlimited Trades }; enum FVGState { // Define FVG state enum Normal, // Normal Mitigated, // Mitigated Inverted // Inverted }; enum TrailingTypeEnum { // Define enum for trailing stop types Trailing_None = 0, // None Trailing_Points = 2 // By Points }; //+------------------------------------------------------------------+ //| Input Parameters | //+------------------------------------------------------------------+ input group "EA GENERAL SETTINGS" input double inpLot = 0.01; // Lotsize input int sl_pts = 300; // Stop Loss Points input int tp_pts = 300; // Take Profit Points input int minPts = 100; // Minimum Gap Size in Points input int FVG_Rec_Ext_Bars = 30; // FVG Extension Bars input bool prt = true; // Print Statements input long magic_number = 123456789; // Magic Number input bool ignoreOverlaps = true; // Ignore new FVGs that overlap existing ones input TradeMode tradeMode = TradeOnce; // Mode for trading FVGs input int maxTradesPerFVG = 2; // Maximum trades per FVG for LimitedTrades input int maxFVGs = 50; // Maximum FVGs to track in array input TrailingTypeEnum TrailingType = Trailing_None; // Trailing Stop Type input double Trailing_Stop_Pips = 30.0; // Trailing Stop in Pips (for Points type) input double Min_Profit_To_Trail_Pips = 50.0; // Min Profit to Start Trailing in Pips

We begin the implementation by including the trade library with "#include <Trade/Trade.mqh>", which provides the CTrade class for managing orders and positions. We declare "obj_Trade" as a global instance of "CTrade" to handle all trading operations. We define a string constant "FVG_Prefix" as "IFVG REC " for naming FVG rectangle objects. We set color constants for different FVG states and directions: "CLR_UP" as green for normal bullish FVGs, "CLR_DOWN" as red for normal bearish, "CLR_MIT_UP" as purple for mitigated bullish, "CLR_MIT_DOWN" as orange for mitigated bearish, "CLR_INV_UP" as red for inverted bearish (orig up), and "CLR_INV_DOWN" as green for inverted bullish. You can change these to your desired ones; they are just arbitrary colors we used for our white background chart.

Then, we create three enumerations for configuration. The "TradeMode" enum offers "TradeOnce" to limit to one trade per FVG, "LimitedTrades" for a user-defined max per FVG, and "UnlimitedTrades" with no per-FVG limit. This is important if you want to trade multiple taps. The "FVGState" enum defines "Normal" for initial gaps, "Mitigated" after far-side breaks, and "Inverted" on inversion signals. The "TrailingTypeEnum" enum provides "Trailing_None" to disable trailing and "Trailing_Points" for points-based trailing stops.

We group the input parameters under "EA GENERAL SETTINGS" for the properties dialog. These include "inpLot" for lot size, "sl_pts" and "tp_pts" for stop-loss and take-profit distances in points, "minPts" as the minimum gap size to qualify as an FVG, "FVG_Rec_Ext_Bars" for how many bars to extend FVG rectangles rightward, "prt" to toggle print logging, "magic_number" for trade identification, "ignoreOverlaps" to skip new FVGs overlapping existing ones (we thought this would be extrememly important for visual clarity, but you can ignore), "tradeMode" using the enum for trading limits, "maxTradesPerFVG" for the limit in limited mode, "maxFVGs" to cap tracked FVGs in the array, "TrailingType" with its enum, "Trailing_Stop_Pips" for trailing distance, and "Min_Profit_To_Trail_Pips" for the profit threshold before trailing starts. With the inputs in place, we will define some structure and helper functions to help in managing our setups.

//+------------------------------------------------------------------+ //| Structure for FVG zone information | //+------------------------------------------------------------------+ struct FVGZone { // Define FVG zone structure string name; //--- Zone name datetime startTime; //--- Start time datetime origEndTime; //--- Original end time datetime mitTime; //--- Mitigation time bool signal; //--- Signal flag bool inverted; //--- Inverted flag bool mit; //--- Mitigated flag bool ret; //--- Retraced flag bool origUp; //--- Original up flag int tradeCount; //--- Trade count FVGState state; //--- State bool newSignal; //--- New signal flag }; FVGZone fvgs[]; //--- FVG zones array //+------------------------------------------------------------------+ //| Get color based on state and direction | //+------------------------------------------------------------------+ color GetFVGColor(bool isUp, FVGState currentState) { if (currentState == Normal) return isUp ? CLR_UP : CLR_DOWN; //--- Return normal color if (currentState == Mitigated) return isUp ? CLR_MIT_UP : CLR_MIT_DOWN; //--- Return mitigated color if (currentState == Inverted) return isUp ? CLR_INV_UP : CLR_INV_DOWN; //--- Return inverted color return clrNONE; //--- Return none } //+------------------------------------------------------------------+ //| Print FVGs for debugging | //+------------------------------------------------------------------+ void PrintFVGs() { if (!prt) return; //--- Return if no print Print("Current FVGs count: ", ArraySize(fvgs)); //--- Print count for (int i = 0; i < ArraySize(fvgs); i++) { //--- Iterate FVGs Print("FVG ", i, ": ", fvgs[i].name, " state=", EnumToString(fvgs[i].state), " mit=", fvgs[i].mit, " ret=", fvgs[i].ret, " inverted=", fvgs[i].inverted, " tradeCount=", fvgs[i].tradeCount, " newSignal=", fvgs[i].newSignal, " endTime=", TimeToString(fvgs[i].origEndTime)); //--- Print details } }

First, we define the "FVGZone" structure to hold all relevant information for each detected fair value gap, including "name" as a string for the object identifier, "startTime" and "origEndTime" as datetimes for the gap's initial span, "mitTime" for when mitigation occurs, boolean flags like "signal" for inversion triggers, "inverted" for inversion status, "mit" for mitigation, "ret" for retracement, "origUp" to indicate if it was originally a bullish gap, "tradeCount" as an integer to track trades on this FVG, "state" using the state enum, and "newSignal" as a boolean for fresh inversion signals. We then declare a global array "fvgs[]" of type "FVGZone" to store all active FVGs, allowing us to track multiple gaps efficiently with their states.

We implement the "GetFVGColor" function to determine the appropriate color for an FVG rectangle based on its direction "isUp" and "currentState": for "Normal", we return "CLR_UP" (green) if up or "CLR_DOWN" (red) if down; for "Mitigated", "CLR_MIT_UP" (purple) or "CLR_MIT_DOWN" (orange); for "Inverted", "CLR_INV_UP" (red) or "CLR_INV_DOWN" (green); otherwise, none. We also create the "PrintFVGs" function for debugging, which returns early if "prt" is false, otherwise prints the current count from ArraySize, then loops through each entry to print details like index, name, state via EnumToString, flags for mit/ret/inverted, trade count, new signal, and end time with the TimeToString function. We can now proceed to defining the visual functions for the rectangles and labels.

//+------------------------------------------------------------------+ //| Create Rectangle | //+------------------------------------------------------------------+ void CreateRec(string objName, datetime time1, double price1, datetime time2, double price2, color clr) { ObjectCreate(0, objName, OBJ_RECTANGLE, 0, time1, price1, time2, price2); //--- Create rectangle ObjectSetInteger(0, objName, OBJPROP_FILL, true); //--- Set fill ObjectSetInteger(0, objName, OBJPROP_COLOR, clr); //--- Set color ObjectSetInteger(0, objName, OBJPROP_BACK, false); //--- Set foreground datetime midTime = time1 + (time2 - time1) / 2; //--- Calc mid time double midPrice = (price1 + price2) / 2; //--- Calc mid price CreateLabel(objName, midTime, midPrice); //--- Create label ChartRedraw(0); //--- Redraw chart } //+------------------------------------------------------------------+ //| Update Rectangle | //+------------------------------------------------------------------+ void UpdateRec(string objName, datetime time1, double price1, datetime time2, double price2, color clr) { if (ObjectFind(0, objName) >= 0) { //--- Check exists ObjectSetInteger(0, objName, OBJPROP_TIME, 0, time1); //--- Set time1 ObjectSetDouble(0, objName, OBJPROP_PRICE, 0, price1); //--- Set price1 ObjectSetInteger(0, objName, OBJPROP_TIME, 1, time2); //--- Set time2 ObjectSetDouble(0, objName, OBJPROP_PRICE, 1, price2); //--- Set price2 ObjectSetInteger(0, objName, OBJPROP_COLOR, clr); //--- Set color datetime midTime = time1 + (time2 - time1) / 2; //--- Calc mid time double midPrice = (price1 + price2) / 2; //--- Calc mid price UpdateLabel(objName, midTime, midPrice); //--- Update label ChartRedraw(0); //--- Redraw chart } } //+------------------------------------------------------------------+ //| Create label | //+------------------------------------------------------------------+ void CreateLabel(string zoneName, datetime time, double price) { string lblName = zoneName + "_Label"; //--- Label name ObjectCreate(0, lblName, OBJ_TEXT, 0, time, price); //--- Create text ObjectSetInteger(0, lblName, OBJPROP_ANCHOR, ANCHOR_CENTER); //--- Set anchor ObjectSetInteger(0, lblName, OBJPROP_COLOR, clrBlack); //--- Set color UpdateLabelText(lblName, zoneName); //--- Update text } //+------------------------------------------------------------------+ //| Update label position | //+------------------------------------------------------------------+ void UpdateLabel(string zoneName, datetime time, double price) { string lblName = zoneName + "_Label"; //--- Label name if (ObjectFind(0, lblName) >= 0) { //--- Check exists ObjectSetInteger(0, lblName, OBJPROP_TIME, 0, time); //--- Set time ObjectSetDouble(0, lblName, OBJPROP_PRICE, 0, price); //--- Set price UpdateLabelText(lblName, zoneName); //--- Update text } } //+------------------------------------------------------------------+ //| Update label text | //+------------------------------------------------------------------+ void UpdateLabelText(string lblName, string zoneName) { string text = ""; //--- Init text int tradeCnt = 0; //--- Init count FVGState state = Normal; //--- Init state bool origUp = false; //--- Init orig up for (int idx = 0; idx < ArraySize(fvgs); idx++) { //--- Iterate FVGs if (fvgs[idx].name == zoneName) { //--- Check match tradeCnt = fvgs[idx].tradeCount; //--- Get count state = fvgs[idx].state; //--- Get state origUp = fvgs[idx].origUp; //--- Get orig up break; //--- Break loop } } if (state == Normal) { //--- Check normal text = origUp ? "Bullish FVG" : "Bearish FVG"; //--- Set text } else if (state == Mitigated) { //--- Check mitigated text = origUp ? "Mitigated Bullish FVG" : "Mitigated Bearish FVG"; //--- Set text } else if (state == Inverted) { //--- Check inverted text = origUp ? "Bearish Inversed FVG" : "Bullish Inversed FVG"; //--- Set text } if (tradeCnt > 0) { //--- Check traded text += " (Traded " + IntegerToString(tradeCnt) + " times)"; //--- Add traded } ObjectSetString(0, lblName, OBJPROP_TEXT, text); //--- Set text } //+------------------------------------------------------------------+ //| Draw mitigation icon | //+------------------------------------------------------------------+ void DrawMitIcon(string fvgNAME, datetime mitTime, double fvgHigh, double fvgLow, bool isUp) { string iconName = fvgNAME + "_MitIcon"; //--- Icon name double iconPrice = isUp ? fvgLow : fvgHigh; //--- Icon price ObjectCreate(0, iconName, OBJ_ARROW, 0, mitTime, iconPrice); //--- Create arrow ObjectSetInteger(0, iconName, OBJPROP_ARROWCODE, 251); //--- Set code ObjectSetInteger(0, iconName, OBJPROP_COLOR, clrBlue); //--- Set color ObjectSetInteger(0, iconName, OBJPROP_ANCHOR, isUp ? ANCHOR_TOP : ANCHOR_BOTTOM); //--- Set anchor ChartRedraw(0); //--- Redraw chart }

For the visualization, first, we define the "CreateRec" function to draw a new rectangle representing an FVG zone on the chart. We create the rectangle object with ObjectCreate using OBJ_RECTANGLE, spanning from time1 at price1 to time2 at price2. We enable filling with OBJPROP_FILL set to true, apply the provided color via "OBJPROP_COLOR", position it in the foreground by setting OBJPROP_BACK to false, calculate the midpoint time as time1 plus half the duration and midpoint price as the average of price1 and price2, then call "CreateLabel" to add a descriptive text at the midpoint, and finally redraw the chart using the ChartRedraw function. We implement the "UpdateRec" function to modify an existing FVG rectangle when its state or color changes. If the object exists per ObjectFind, we update its coordinates by setting "OBJPROP_TIME" and "OBJPROP_PRICE" for both anchors, apply the new color, recalculate the midpoint time and price as before, call "UpdateLabel" to reposition and refresh the text, and redraw the chart.

Next,we create the "CreateLabel" function to add a text label inside the FVG rectangle. We form the label name by appending "_Label" to the zone name, create an OBJ_TEXT object at the given time and price with "ObjectCreate", set its anchor to center via OBJPROP_ANCHOR, color to black, then call "UpdateLabelText" to set the initial descriptive text. We define the "UpdateLabel" function to move an existing label when the rectangle adjusts. If the label exists, we update its position, then call "UpdateLabelText" to refresh its content based on the current state. We then implement the "UpdateLabelText" function to build and set the label's string dynamically. We initialize an empty text, then loop through the "fvgs" array to find the matching zone by name and retrieve its trade count, state, and original up direction.

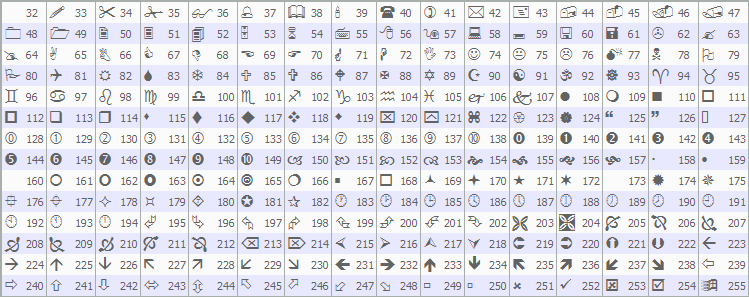

Based on the state, we set text to "Bullish FVG" or "Bearish FVG" for normal, "Mitigated Bullish FVG" or "Mitigated Bearish FVG" for mitigated, "Bearish Inversed FVG" or "Bullish Inversed FVG" for inverted; if trade count exceeds 0, we append "(Traded X times)". We apply this text to the label with ObjectSetString and OBJPROP_TEXT. Finally, we create the "DrawMitIcon" function to place a visual marker at mitigation events. We form the icon name by appending "_MitIcon" to the FVG name, create an OBJ_ARROW at the mitigation time and appropriate price (low for up gaps, high for down), set its arrow code to 251, color to blue, anchor to top for up or bottom for down based on "isUp", and redraw the chart. You can change the arrow code per your liking based on the MQL5 Wingdings font as below.

Armed with these functions, we can create the initial markup of the setups on the chart using the available bars on the chart to create that indicator styling, so we are able to see the setups on initialization of the program. We will house the logic in a function, too.

//+------------------------------------------------------------------+ //| Process historical mitigation, retracement, signal for an FVG | //+------------------------------------------------------------------+ void ProcessHistoricalState(int idx) { string fvgNAME = fvgs[idx].name; //--- Get name datetime timeSTART = fvgs[idx].startTime; //--- Get start time datetime endTime = fvgs[idx].origEndTime; //--- Get end time double fvgLow = MathMin(ObjectGetDouble(0, fvgNAME, OBJPROP_PRICE, 0), ObjectGetDouble(0, fvgNAME, OBJPROP_PRICE, 1)); //--- Calc low double fvgHigh = MathMax(ObjectGetDouble(0, fvgNAME, OBJPROP_PRICE, 0), ObjectGetDouble(0, fvgNAME, OBJPROP_PRICE, 1)); //--- Calc high int fvgBar = iBarShift(_Symbol, _Period, timeSTART); //--- Get bar if (fvgBar < 0) return; //--- Return invalid bool isMit = false, isRet = false, isSig = false; //--- Init flags datetime mitTime = 0; //--- Init mit time int mitK = -1, sigK = -1; //--- Init indices for (int k = fvgBar - 1; k >= 0; k--) { //--- Iterate bars double barLow = iLow(_Symbol, _Period, k); //--- Get bar low double barHigh = iHigh(_Symbol, _Period, k); //--- Get bar high double barClose = iClose(_Symbol, _Period, k); //--- Get bar close if (!isMit) { //--- Check not mit bool breakFar = (fvgs[idx].origUp && barLow < fvgLow) || (!fvgs[idx].origUp && barHigh > fvgHigh); //--- Check break far if (breakFar) { //--- Break far isMit = true; //--- Set mit mitK = k; //--- Set mit k mitTime = iTime(_Symbol, _Period, k); //--- Set mit time if (prt) Print("Historical Mitigated: ", fvgNAME, " at bar ", k, " time=", TimeToString(mitTime)); //--- Log mitigated } } if (isMit && !isRet) { //--- Check mit and not ret bool inside = (barHigh > fvgLow && barLow < fvgHigh); //--- Check inside if (inside) { //--- Inside isRet = true; //--- Set ret if (prt) Print("Historical Retraced: ", fvgNAME, " at bar ", k); //--- Log retraced } } if (isMit && isRet && !isSig) { //--- Check mit ret not sig bool signal = (fvgs[idx].origUp && barClose < fvgLow) || (!fvgs[idx].origUp && barClose > fvgHigh); //--- Check signal if (signal) { //--- Signal if (k + 1 < iBars(_Symbol, _Period)) { //--- Check prev bar double prevClose = iClose(_Symbol, _Period, k + 1); //--- Get prev close bool prevInside = (prevClose > fvgLow && prevClose < fvgHigh); //--- Check prev inside if (prevInside) { //--- Prev inside isSig = true; //--- Set sig sigK = k; //--- Set sig k if (prt) Print("Historical Signal/Inverted: ", fvgNAME, " at bar ", k, " time=", TimeToString(iTime(_Symbol, _Period, k))); //--- Log signal } } } } } fvgs[idx].mit = isMit; //--- Set mit fvgs[idx].ret = isRet; //--- Set ret fvgs[idx].inverted = isSig; //--- Set inverted fvgs[idx].signal = isSig; //--- Set signal fvgs[idx].mitTime = mitTime; //--- Set mit time fvgs[idx].state = isSig ? Inverted : (isMit ? Mitigated : Normal); //--- Set state fvgs[idx].newSignal = false; //--- Set no new signal color currentClr = GetFVGColor(fvgs[idx].origUp, fvgs[idx].state); //--- Get color UpdateRec(fvgs[idx].name, fvgs[idx].startTime, fvgLow, fvgs[idx].origEndTime, fvgHigh, currentClr); //--- Update rec if (mitTime > 0) DrawMitIcon(fvgs[idx].name, mitTime, fvgHigh, fvgLow, fvgs[idx].origUp); //--- Draw mit icon }

Here, we define the "ProcessHistoricalState" function to analyze and update the state of a specific FVG in the array during initialization, checking for mitigation, retracement, and inversion based on historical bars after the gap's start. We start by retrieving the FVG's name, start time, and original end time from the structure at the given index, then calculate its low and high prices using MathMin and MathMax on the rectangle object's prices via ObjectGetDouble with OBJPROP_PRICE. We find the bar index of the start time with iBarShift and return early if invalid. We initialize flags for mitigation, retracement, and signal to false, along with a mitigation time and bar indices to -1. We then loop backward from the bar before the FVG to bar 0: for each bar, we get its low, high, and close with the iLow, iHigh, and iClose functions. If not yet mitigated, we check for a far-side break — for original up gaps (bullish FVG), if bar low drops below FVG low; for down gaps, if bar high exceeds FVG high — setting the mitigation flag, bar index, time via iTime, and logging if "prt" is true.

If mitigated but not retraced, we check if the bar overlaps the FVG (high above low and low below high), setting the retracement flag and logging. If both mitigated and retraced but no signal, we detect inversion: for up gaps, if bar close is below FVG low; for down gaps, above FVG high — then verify the previous bar's close was inside the FVG (above low and below high) to confirm from-inside exit, setting the signal flag, bar index, and logging.

We update the structure fields: mitigation, retracement, inverted, and signal to the flag values, mitigation time, state as "Inverted" if signal, "Mitigated" if mitigated, or "Normal", and reset the new signal to false. We get the current color with "GetFVGColor" based on original direction and state, update the rectangle via "UpdateRec" with possibly adjusted coordinates and new color, and if mitigated, draw the mitigation icon with "DrawMitIcon" at the mitigation time and appropriate edge price (low for up gaps, high for down). We can now use this function in the initialization function to draw our first setups.

//+------------------------------------------------------------------+ //| Expert initialization function | //+------------------------------------------------------------------+ int OnInit() { obj_Trade.SetExpertMagicNumber(magic_number); //--- Set magic number ObjectsDeleteAll(0, FVG_Prefix); //--- Delete FVG objects ArrayResize(fvgs, 0); //--- Reset array if (prt) Print("Initializing: Deleted all existing FVG objects and reset array."); //--- Log init int visibleBars = (int)ChartGetInteger(0, CHART_VISIBLE_BARS); //--- Get visible bars if (prt) Print("Total Visible Bars On Chart = ", visibleBars); //--- Log visible bars // Detect historical FVGs from older to newer for (int i = visibleBars - 3; i >= 0; i--) { //--- Iterate bars double low0 = iLow(_Symbol, _Period, i); //--- Get low0 double high2 = iHigh(_Symbol, _Period, i + 2); //--- Get high2 double gap_L0_H2 = NormalizeDouble((low0 - high2) / _Point, _Digits); //--- Calc gap L0 H2 double high0 = iHigh(_Symbol, _Period, i); //--- Get high0 double low2 = iLow(_Symbol, _Period, i + 2); //--- Get low2 double gap_H0_L2 = NormalizeDouble((low2 - high0) / _Point, _Digits); //--- Calc gap H0 L2 bool FVG_UP = low0 > high2 && gap_L0_H2 > minPts; //--- Check up FVG bool FVG_DOWN = low2 > high0 && gap_H0_L2 > minPts; //--- Check down FVG if (FVG_UP || FVG_DOWN) { //--- Check FVG datetime time1 = iTime(_Symbol, _Period, i + 1); //--- Get time1 double price1 = FVG_UP ? high2 : high0; //--- Set price1 double price2 = FVG_UP ? low0 : low2; //--- Set price2 double newLow = MathMin(price1, price2); //--- Calc new low double newHigh = MathMax(price1, price2); //--- Calc new high bool overlaps = false; //--- Init overlaps if (ignoreOverlaps) { //--- Check ignore overlaps for (int ex = 0; ex < ArraySize(fvgs); ex++) { //--- Iterate existing double exLow = ObjectGetDouble(0, fvgs[ex].name, OBJPROP_PRICE, 0); //--- Get ex low double exHigh = ObjectGetDouble(0, fvgs[ex].name, OBJPROP_PRICE, 1); //--- Get ex high exLow = MathMin(exLow, exHigh); //--- Min ex low exHigh = MathMax(exLow, exHigh); //--- Max ex high if (MathMax(newLow, exLow) < MathMin(newHigh, exHigh)) { //--- Check overlap overlaps = true; //--- Set overlaps if (prt) Print("Historical: Skipping overlapping FVG at ", TimeToString(time1)); //--- Log skip break; //--- Break loop } } } if (overlaps) continue; //--- Continue if overlaps string fvgNAME = FVG_Prefix + "(" + TimeToString(time1) + ")"; //--- FVG name color fvgClr = FVG_UP ? CLR_UP : CLR_DOWN; //--- Set color CreateRec(fvgNAME, time1, price1, time1 + PeriodSeconds(_Period) * FVG_Rec_Ext_Bars, price2, fvgClr); //--- Create rec int size = ArraySize(fvgs); //--- Get size if (size >= maxFVGs) { //--- Check max if (prt) Print("Historical: Max FVGs reached, removing oldest."); //--- Log max ArrayRemove(fvgs, 0, 1); //--- Remove oldest PrintFVGs(); //--- Print FVGs } ArrayResize(fvgs, size + 1); //--- Resize array fvgs[size].name = fvgNAME; //--- Set name fvgs[size].startTime = time1; //--- Set start time fvgs[size].origEndTime = time1 + PeriodSeconds(_Period) * FVG_Rec_Ext_Bars; //--- Set end time fvgs[size].mitTime = 0; //--- Set mit time fvgs[size].signal = false; //--- Set signal fvgs[size].inverted = false; //--- Set inverted fvgs[size].mit = false; //--- Set mit fvgs[size].ret = false; //--- Set ret fvgs[size].origUp = FVG_UP; //--- Set orig up fvgs[size].tradeCount = 0; //--- Set trade count fvgs[size].state = Normal; //--- Set state fvgs[size].newSignal = false; //--- Set new signal if (prt) Print("Historical FVG created: ", fvgNAME, " origUp=", FVG_UP, " endTime=", TimeToString(fvgs[size].origEndTime)); //--- Log created PrintFVGs(); //--- Print FVGs } } // Process historical states for (int j = 0; j < ArraySize(fvgs); j++) { //--- Iterate FVGs ProcessHistoricalState(j); //--- Process state } PrintFVGs(); //--- Print FVGs return(INIT_SUCCEEDED); //--- Return success } //+------------------------------------------------------------------+ //| Expert deinitialization function | //+------------------------------------------------------------------+ void OnDeinit(const int reason) { for (int i = 0; i < ArraySize(fvgs); i++) { //--- Iterate FVGs ObjectDelete(0, fvgs[i].name); //--- Delete name ObjectDelete(0, fvgs[i].name + "_Label"); //--- Delete label ObjectDelete(0, fvgs[i].name + "_MitIcon"); //--- Delete mit icon } ArrayResize(fvgs, 0); //--- Reset array ChartRedraw(0); //--- Redraw chart if (prt) Print("Deinit: Deleted all FVG objects and reset array."); //--- Log deinit }

In the OnInit event handler, which runs when the program starts, we first assign the input "magic_number" to "obj_Trade" with "SetExpertMagicNumber" for trade identification. We then clear any existing FVG rectangles by calling ObjectsDeleteAll with the current chart and "FVG_Prefix", reset the "fvgs" array size to 0 using ArrayResize, and log the initialization if "prt" is true. We retrieve the number of visible bars on the chart with ChartGetInteger using CHART_VISIBLE_BARS into "visibleBars", logging it if "prt".

To detect historical FVGs from oldest to newest, we loop from "visibleBars - 3" down to 0: for each bar i, we calculate potential gaps by comparing low of i to high of i+2 (normalized gap in points into "gap_L0_H2") and high of i to low of i+2 ("gap_H0_L2"), setting "FVG_UP" if low0 > high2 and gap > "minPts" (bullish gap) or "FVG_DOWN" if low2 > high0 and gap > "minPts" (bearish gap). We need at least 3 complete bars to detect a gap. It is extra important that you understand this once and for all. We visualized it for you for clarity as below.

Continuing, if either type is found, we get the time of bar i+1 into "time1", set prices accordingly, calculate the gap's low and high with the MathMin and MathMax functions. If "ignoreOverlaps" is true, we check against all existing in "fvgs" by fetching their prices with ObjectGetDouble and comparing ranges — if overlapping (max of lows < min of highs), we set "overlaps" true and log skip if "prt", continuing to next. If no overlap, we form the name as "FVG_Prefix + (TimeToString(time1))", choose color based on up or down, call "CreateRec" to draw the rectangle extended by "FVG_Rec_Ext_Bars" periods. We check if the array size reaches "maxFVGs", removing the oldest with ArrayRemove and logging if "prt", then resize "fvgs" up by one, populate the new entry with name, times, flags all false except "origUp" as "FVG_UP", trade count 0, state "Normal", new signal false, log creation if "prt", and call "PrintFVGs". See how the overlaps could impact the visual appeal, but have no issue with the trading activity.

You can see that the overlapping instances are not visually appealing. Then, after detecting all historical FVGs, we loop through "fvgs" and call "ProcessHistoricalState" on each index to set initial states based on past price action, then call "PrintFVGs" again, and return INIT_SUCCEEDED. Finally, in the OnDeinit function, we loop through "fvgs", deleting each rectangle, label (suffixed "_Label"), and mitigation icon ("_MitIcon") with ObjectDelete, resize "fvgs" to 0, redraw the chart, and log the deinit if "prt". When we compile, we get the following outcome.

From the visualization, we can see that we scan, map, and update all the FVGs on loadup. What we now need to do is continue the detection and setup updates on new bars. Let us start with the detection logic.

//+------------------------------------------------------------------+ //| Detect new FVGs on recent bars | //+------------------------------------------------------------------+ void DetectFVGs() { for (int i = 3; i >= 1; i--) { //--- Iterate recent bars double low0 = iLow(_Symbol, _Period, i); //--- Get low0 double high2 = iHigh(_Symbol, _Period, i + 2); //--- Get high2 double gap_L0_H2 = NormalizeDouble((low0 - high2) / _Point, _Digits); //--- Calc gap L0 H2 double high0 = iHigh(_Symbol, _Period, i); //--- Get high0 double low2 = iLow(_Symbol, _Period, i + 2); //--- Get low2 double gap_H0_L2 = NormalizeDouble((low2 - high0) / _Point, _Digits); //--- Calc gap H0 L2 bool FVG_UP = low0 > high2 && gap_L0_H2 > minPts; //--- Check up FVG bool FVG_DOWN = low2 > high0 && gap_H0_L2 > minPts; //--- Check down FVG if (FVG_UP || FVG_DOWN) { //--- Check FVG datetime time1 = iTime(_Symbol, _Period, i + 1); //--- Get time1 double price1 = FVG_UP ? high2 : high0; //--- Set price1 double price2 = FVG_UP ? low0 : low2; //--- Set price2 double newLow = MathMin(price1, price2); //--- Calc new low double newHigh = MathMax(price1, price2); //--- Calc new high bool overlaps = false; //--- Init overlaps if (ignoreOverlaps) { //--- Check ignore overlaps for (int ex = 0; ex < ArraySize(fvgs); ex++) { //--- Iterate existing double exLow = MathMin(ObjectGetDouble(0, fvgs[ex].name, OBJPROP_PRICE, 0), ObjectGetDouble(0, fvgs[ex].name, OBJPROP_PRICE, 1)); //--- Calc ex low double exHigh = MathMax(ObjectGetDouble(0, fvgs[ex].name, OBJPROP_PRICE, 0), ObjectGetDouble(0, fvgs[ex].name, OBJPROP_PRICE, 1)); //--- Calc ex high if (MathMax(newLow, exLow) < MathMin(newHigh, exHigh)) { //--- Check overlap overlaps = true; //--- Set overlaps if (prt) Print("Detect: Skipping overlapping FVG at ", TimeToString(time1)); //--- Log skip break; //--- Break loop } } } if (overlaps) continue; //--- Continue if overlaps string fvgNAME = FVG_Prefix + "(" + TimeToString(time1) + ")"; //--- FVG name if (ObjectFind(0, fvgNAME) >= 0) continue; //--- Skip duplicate color fvgClr = FVG_UP ? CLR_UP : CLR_DOWN; //--- Set color datetime endTime = time1 + PeriodSeconds(_Period) * FVG_Rec_Ext_Bars; //--- Calc end time CreateRec(fvgNAME, time1, price1, endTime, price2, fvgClr); //--- Create rec int size = ArraySize(fvgs); //--- Get size if (size >= maxFVGs) { //--- Check max if (prt) Print("Detect: Max FVGs reached, removing oldest."); //--- Log max ArrayRemove(fvgs, 0, 1); //--- Remove oldest PrintFVGs(); //--- Print FVGs } ArrayResize(fvgs, size + 1); //--- Resize array fvgs[size].name = fvgNAME; //--- Set name fvgs[size].startTime = time1; //--- Set start time fvgs[size].origEndTime = endTime; //--- Set end time fvgs[size].mitTime = 0; //--- Set mit time fvgs[size].signal = false; //--- Set signal fvgs[size].inverted = false; //--- Set inverted fvgs[size].mit = false; //--- Set mit fvgs[size].ret = false; //--- Set ret fvgs[size].origUp = FVG_UP; //--- Set orig up fvgs[size].tradeCount = 0; //--- Set trade count fvgs[size].state = Normal; //--- Set state fvgs[size].newSignal = false; //--- Set new signal if (prt) Print("New FVG added to storage: ", fvgNAME, " origUp=", FVG_UP, " endTime=", TimeToString(endTime)); //--- Log added PrintFVGs(); //--- Print FVGs } } }

We define the "DetectFVGs" function to scan the most recent bars for new fair value gaps on every new bar, adding them to our tracking system if they meet criteria. We loop from shift 3 down to 1 to check the last few completed bars (this is not new now): for each i, we fetch low of i with iLow into "low0", high of i+2 into "high2", and calculate the normalized gap in points into "gap_L0_H2"; similarly for high of i into "high0", low of i+2 into "low2", and "gap_H0_L2". We set "FVG_UP" true if "low0 > high2" and gap exceeds "minPts" (bullish gap), or "FVG_DOWN" if "low2 > high0" and gap > "minPts" (bearish gap).

If either is detected, we get the time of i+1 into "time1", set "price1" to "high2" for up or "high0" for down, "price2" to "low0" or "low2", and calculate the gap's low and high. If "ignoreOverlaps" is true, we check against all existing in "fvgs" by fetching their prices with ObjectGetDouble and using MathMin/MathMax to get ranges — if a new gap overlaps any (max lows < min highs), we set "overlaps" true, log skip if "prt", and continue. If no overlap and no duplicate object per ObjectFind, we form the name as "FVG_Prefix + (TimeToString(time1))", choose color based on up (green) or down (red), calculate "endTime" as "time1 + PeriodSeconds(_Period) * FVG_Rec_Ext_Bars", and call "CreateRec" to draw the rectangle. We then manage the "fvgs" array: if size reaches "maxFVGs", remove the oldest with ArrayRemove and log if "prt", then resize up by one with ArrayResize, populate the new entry with name, times, mitigation time 0, all flags false except "origUp" as "FVG_UP", trade count 0, state "Normal", new signal false, log addition if "prt", and call "PrintFVGs". This detects and stores only valid, non-overlapping new FVGs extending rightward for visibility. We can call this function in the tick event handler to do the heavy lifting as below.

//+------------------------------------------------------------------+ //| Expert tick function | //+------------------------------------------------------------------+ void OnTick() { static datetime lastBarTime = 0; //--- Last bar time datetime curBarTime = iTime(_Symbol, _Period, 0); //--- Current bar time bool newBar = (curBarTime != lastBarTime); //--- Check new bar if (!newBar) return; //--- Return if not new lastBarTime = curBarTime; //--- Update last time DetectFVGs(); //--- Detect FVGs }

In the OnTick event handler, which executes on every price tick to handle real-time updates, we use a static "lastBarTime" to track the previous bar's open time, fetch the current bar's time with iTime at shift 0 into "curBarTime", and set "newBar" to true if they differ, indicating a new bar has formed. If not a new bar, we return early to avoid redundant processing. Otherwise, we update "lastBarTime" to "curBarTime" and call "DetectFVGs" to scan for new gaps on recent bars. We get the following outcome.

With the initial detection handled, we can proceed to updating the setups. We use the following logic.

//+------------------------------------------------------------------+ //| Update states for all FVGs | //+------------------------------------------------------------------+ void UpdateFVGs() { double prevClose = iClose(_Symbol, _Period, 1); //--- Get prev close double prevLow = iLow(_Symbol, _Period, 1); //--- Get prev low double prevHigh = iHigh(_Symbol, _Period, 1); //--- Get prev high double bar2Close = iClose(_Symbol, _Period, 2); //--- Get bar2 close datetime curBarTime = iTime(_Symbol, _Period, 1); //--- Get prev bar time bool removed = false; //--- Init removed for (int j = ArraySize(fvgs) - 1; j >= 0; j--) { //--- Iterate reverse if (ObjectFind(0, fvgs[j].name) < 0) { //--- Check no object if (prt) Print("Update: Removed non-existent FVG from storage: ", fvgs[j].name); //--- Log removed ArrayRemove(fvgs, j, 1); //--- Remove from array removed = true; //--- Set removed continue; //--- Continue } double fvgLow = MathMin(ObjectGetDouble(0, fvgs[j].name, OBJPROP_PRICE, 0), ObjectGetDouble(0, fvgs[j].name, OBJPROP_PRICE, 1)); //--- Calc low double fvgHigh = MathMax(ObjectGetDouble(0, fvgs[j].name, OBJPROP_PRICE, 0), ObjectGetDouble(0, fvgs[j].name, OBJPROP_PRICE, 1)); //--- Calc high if (!fvgs[j].mit) { //--- Check not mit bool breakFar = (fvgs[j].origUp && prevLow < fvgLow) || (!fvgs[j].origUp && prevHigh > fvgHigh); //--- Check break far if (breakFar) { //--- Break far fvgs[j].mit = true; //--- Set mit fvgs[j].mitTime = curBarTime; //--- Set mit time fvgs[j].state = Mitigated; //--- Set state if (prt) Print("Mitigated FVG: ", fvgs[j].name, " at time=", TimeToString(curBarTime)); //--- Log mitigated color mitClr = GetFVGColor(fvgs[j].origUp, fvgs[j].state); //--- Get color UpdateRec(fvgs[j].name, fvgs[j].startTime, fvgLow, fvgs[j].origEndTime, fvgHigh, mitClr); //--- Update rec DrawMitIcon(fvgs[j].name, curBarTime, fvgHigh, fvgLow, fvgs[j].origUp); //--- Draw icon } } if (fvgs[j].mit && !fvgs[j].ret) { //--- Check mit not ret bool inside = (prevHigh > fvgLow && prevLow < fvgHigh); //--- Check inside if (inside) { //--- Inside fvgs[j].ret = true; //--- Set ret if (prt) Print("Retraced into FVG: ", fvgs[j].name); //--- Log retraced } } if (fvgs[j].mit && fvgs[j].ret) { //--- Check mit ret bool signal = (fvgs[j].origUp && prevClose < fvgLow) || (!fvgs[j].origUp && prevClose > fvgHigh); //--- Check signal bool prevInside = (bar2Close > fvgLow && bar2Close < fvgHigh); //--- Check prev inside if (signal && curBarTime != fvgs[j].mitTime && prevInside) { //--- Check signal conditions fvgs[j].newSignal = true; //--- Set new signal if (!fvgs[j].inverted) { //--- Check not inverted fvgs[j].inverted = true; //--- Set inverted fvgs[j].state = Inverted; //--- Set state if (prt) Print("Signal/Inverted FVG: ", fvgs[j].name, " at time=", TimeToString(curBarTime)); //--- Log signal color sigClr = GetFVGColor(fvgs[j].origUp, fvgs[j].state); //--- Get color UpdateRec(fvgs[j].name, fvgs[j].startTime, fvgLow, fvgs[j].origEndTime, fvgHigh, sigClr); //--- Update rec } } } } if (removed) PrintFVGs(); //--- Print if removed }

Here, we define the "UpdateFVGs" function to refresh the states of all tracked fair value gaps on each new bar, using the previous bar's data to detect mitigation, retracement, and inversion in real time. We start by fetching the previous bar's close with iClose at shift 1 into "prevClose", its low with iLow into "prevLow", high with iHigh into "prevHigh", the bar before that's close into "bar2Close" at shift 2, and the previous bar's time with "iTime" at shift 1 into "curBarTime". We initialize a "removed" flag to false, then loop backward through the "fvgs" array to safely remove entries if needed. For each FVG at index j, if the rectangle object is missing per "ObjectFind" returning negative, we log the removal if "prt" is true, delete the entry with ArrayRemove, set "removed" true, and continue to the next. Otherwise, we calculate the current low and high from the object's prices using "MathMin" and "MathMax" on ObjectGetDouble with OBJPROP_PRICE for anchors 0 and 1.

If not yet mitigated, we check for a far-side break: for original up gaps, if "prevLow" drops below FVG low; for down gaps, if "prevHigh" exceeds FVG high — setting the mitigation flag true, "mitTime" to "curBarTime", state to "Mitigated", logging if "prt", getting the new color with "GetFVGColor", updating the rectangle via "UpdateRec" with adjusted coordinates and color, and drawing the mitigation icon with "DrawMitIcon" at "curBarTime" and the far edge (high for down gaps, low for up). If mitigated but not retraced, we verify if the previous bar overlaps the FVG (high above low and low below high), setting the retracement flag true and logging.

If both mitigated and retraced, we detect inversion: for up gaps, if "prevClose" is below FVG low; for down gaps, above FVG high — also ensuring it's not the mitigation bar itself and that "bar2Close" was inside the FVG (above low and below high) to confirm from-inside exit. We set "newSignal" true, and if not already inverted, set inverted true, state to "Inverted", log, get inversion color, and update the rectangle. Finally, if any removals occurred, we call "PrintFVGs" for debugging. This keeps all FVGs' states current, enabling accurate inversion signals for trading while handling orphaned objects gracefully. We get the following outcome when we call the function.

We can see that we update the setups when prices interact with them. What now remains is trading the inversion setups, and that will be all. Here is the logic we implemented to achieve that in a function to maintain modularization.

//+------------------------------------------------------------------+ //| Trade on FVGs with signals | //+------------------------------------------------------------------+ void TradeOnFVGs() { double Ask = NormalizeDouble(SymbolInfoDouble(_Symbol, SYMBOL_ASK), _Digits); //--- Get ask double Bid = NormalizeDouble(SymbolInfoDouble(_Symbol, SYMBOL_BID), _Digits); //--- Get bid for (int j = 0; j < ArraySize(fvgs); j++) { //--- Iterate FVGs if (!fvgs[j].newSignal || fvgs[j].mitTime == 0) continue; //--- Skip no signal or no mit if (tradeMode == TradeOnce && fvgs[j].tradeCount >= 1) { //--- Check once and traded fvgs[j].newSignal = false; //--- Reset signal continue; //--- Continue } if (tradeMode == LimitedTrades && fvgs[j].tradeCount >= maxTradesPerFVG) { //--- Check limited and max fvgs[j].newSignal = false; //--- Reset signal continue; //--- Continue } double fvgLow = MathMin(ObjectGetDouble(0, fvgs[j].name, OBJPROP_PRICE, 0), ObjectGetDouble(0, fvgs[j].name, OBJPROP_PRICE, 1)); //--- Calc low double fvgHigh = MathMax(ObjectGetDouble(0, fvgs[j].name, OBJPROP_PRICE, 0), ObjectGetDouble(0, fvgs[j].name, OBJPROP_PRICE, 1)); //--- Calc high if (!fvgs[j].origUp) { //--- Check orig down: Bullish IFVG, Buy if (prt) Print("BULLISH IFVG TRADE SIGNAL For ", fvgs[j].name, " at ", Bid); //--- Log buy signal double SL_Buy = NormalizeDouble(fvgLow - sl_pts * _Point, _Digits); //--- Calc buy SL double TP_Buy = NormalizeDouble(Ask + tp_pts * _Point, _Digits); //--- Calc buy TP obj_Trade.Buy(inpLot, _Symbol, Ask, SL_Buy, TP_Buy, "IFVG Buy"); //--- Open buy } else { //--- Orig up: Bearish IFVG, Sell if (prt) Print("BEARISH IFVG TRADE SIGNAL For ", fvgs[j].name, " at ", Ask); //--- Log sell signal double SL_Sell = NormalizeDouble(fvgHigh + sl_pts * _Point, _Digits); //--- Calc sell SL double TP_Sell = NormalizeDouble(Bid - tp_pts * _Point, _Digits); //--- Calc sell TP obj_Trade.Sell(inpLot, _Symbol, Bid, SL_Sell, TP_Sell, "IFVG Sell"); //--- Open sell } fvgs[j].tradeCount++; //--- Increment count fvgs[j].newSignal = false; //--- Reset signal fvgs[j].ret = false; //--- Reset ret if (prt) Print("Trade executed on ", fvgs[j].name, ", tradeCount now=", fvgs[j].tradeCount); //--- Log executed double midPrice = (fvgLow + fvgHigh) / 2; //--- Calc mid price datetime midTime = fvgs[j].startTime + (fvgs[j].origEndTime - fvgs[j].startTime) / 2; //--- Calc mid time UpdateLabel(fvgs[j].name, midTime, midPrice); //--- Update label } } //+------------------------------------------------------------------+ //| Cleanup expired FVGs from array (keep on chart) | //+------------------------------------------------------------------+ void CleanupExpiredFVGs(datetime curBarTime) { bool removed = false; //--- Init removed for (int j = ArraySize(fvgs) - 1; j >= 0; j--) { //--- Iterate reverse if (curBarTime > fvgs[j].origEndTime) { //--- Check expired if (prt) Print("Expired FVG removed from storage (kept on chart): ", fvgs[j].name, " endTime=", TimeToString(fvgs[j].origEndTime)); //--- Log expired ArrayRemove(fvgs, j, 1); //--- Remove from array removed = true; //--- Set removed } } if (removed) PrintFVGs(); //--- Print if removed }

First, we define the "TradeOnFVGs" function to execute trades on fresh inversion signals from the FVGs, respecting the configured trade modes and limits. We first retrieve the current ask price with SymbolInfoDouble using SYMBOL_ASK and normalize it to digits into "Ask", doing the same for bid with SYMBOL_BID into "Bid". We then loop through the "fvgs" array: for each entry, we skip if no new signal or mitigation time is zero. We check trade modes — for "TradeOnce", if trade count is 1 or more, or for "LimitedTrades", if at or above "maxTradesPerFVG", we reset the new signal flag and continue.

For valid signals, we calculate the FVG's low and high from the rectangle's prices using MathMin and MathMax on the ObjectGetDouble function. If not original up (bearish FVG, inverting bullish), we log the buy signal if "prt" is true, set stop-loss below low minus "sl_pts * _Point" normalized, take-profit above ask plus "tp_pts * _Point" normalized, and open a buy with "obj_Trade.Buy" using "inpLot", symbol, "Ask", calculated levels, and comment "IFVG Buy". Same logic for a bearish one. We increment the trade count, reset new signal and retracement flags, log the execution with current count if "prt", calculate midpoint price and time, and call "UpdateLabel" to refresh the label position.

Finally, we implement the "CleanupExpiredFVGs" function to remove outdated FVGs from the array while keeping their visuals on the chart, called with the previous bar's time. We initialize a removed flag to false, then loop backward through "fvgs": if the provided time exceeds the original end time, we log the expiration, remove the entry with ArrayRemove, and set removed to true. If any removals happened, we call "PrintFVGs" for debugging. This is very important to make sure that we track only setups that matter to us. When we call these and run, we get the following outcome.

Since we can act on the signals generated and open positions, we just need to manage the trades by applying a trailing stop. Here is the logic we use to achieve that.

//+------------------------------------------------------------------+ //| Apply Points Trailing Stop | //+------------------------------------------------------------------+ void ApplyPointsTrailing() { double point = _Point; //--- Get point value for (int i = PositionsTotal() - 1; i >= 0; i--) { //--- Iterate positions reverse if (PositionGetTicket(i) > 0) { //--- Check valid ticket if (PositionGetString(POSITION_SYMBOL) == _Symbol && PositionGetInteger(POSITION_MAGIC) == magic_number) { //--- Check symbol and magic double sl = PositionGetDouble(POSITION_SL); //--- Get SL double tp = PositionGetDouble(POSITION_TP); //--- Get TP double openPrice = PositionGetDouble(POSITION_PRICE_OPEN); //--- Get open price ulong ticket = PositionGetInteger(POSITION_TICKET); //--- Get ticket if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_BUY) { //--- Check buy double newSL = NormalizeDouble(SymbolInfoDouble(_Symbol, SYMBOL_BID) - Trailing_Stop_Pips * point, _Digits); //--- Calc new SL if (newSL > sl && SymbolInfoDouble(_Symbol, SYMBOL_BID) - openPrice > Min_Profit_To_Trail_Pips * point) { //--- Check conditions obj_Trade.PositionModify(ticket, newSL, tp); //--- Modify position } } else if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_SELL) { //--- Check sell double newSL = NormalizeDouble(SymbolInfoDouble(_Symbol, SYMBOL_ASK) + Trailing_Stop_Pips * point, _Digits); //--- Calc new SL if (newSL < sl && openPrice - SymbolInfoDouble(_Symbol, SYMBOL_ASK) > Min_Profit_To_Trail_Pips * point) { //--- Check conditions obj_Trade.PositionModify(ticket, newSL, tp); //--- Modify position } } } } } } //--- Call the function in the tick event handler per tick if (TrailingType == Trailing_Points && PositionsTotal() > 0) { //--- Check trailing ApplyPointsTrailing(); //--- Apply trailing }

Here, we define the "ApplyPointsTrailing" function to implement points-based trailing stops when selected, adjusting stop-loss levels in real time as price moves profitably. We start by assigning the symbol's point value to "point" using _Point. We then loop backward through all open positions with PositionsTotal to avoid index issues during modifications, checking each ticket's validity via the PositionGetTicket function. For positions matching our symbol and "magic_number", we retrieve stop-loss with PositionGetDouble and POSITION_SL, take-profit with "POSITION_TP", open price via "POSITION_PRICE_OPEN", and ticket with "POSITION_TICKET". For buy positions (POSITION_TYPE_BUY), we calculate a new stop-loss as the current bid minus "Trailing_Stop_Pips * point", normalized to digits — if this is tighter than the existing stop-loss and unrealized profit exceeds "Min_Profit_To_Trail_Pips * point", we update the position using "obj_Trade.PositionModify" while keeping take-profit unchanged. We apply similar logic for sell positions: new stop-loss as ask plus trailing distance, modified only if it tightens and profit meets the threshold.

Within "OnTick", if "TrailingType" is "Trailing_Points" and positions exist per "PositionsTotal", we call "ApplyPointsTrailing" on every tick to ensure timely adjustments. Upon compilation, we get the following outcome.

From the visualization, we can see that we detect, trade, and manage the inverse fair value gap setups, hence achieving our objectives. The thing that remains is backtesting the program, and that is handled in the next section.

Backtesting

After thorough backtesting, we have the following results.

Backtest graph:

Backtest report:

Conclusion

In conclusion, we’ve developed an Inverse Fair Value Gap (IFVG) system in MQL5 that detects bullish/bearish Fair Value Gaps (FVGs) on recent bars with minimum gap filtering, tracks states as normal/mitigated/inverted based on price interactions, ignores overlaps while limiting tracked FVGs, and loads historical FVGs on initialization with real-time updates and expired cleanup. The system supports once/limited/unlimited trades per setup, opens buys on bullish IFVGs or sells on bearish with fixed trade levels, position limits, trailing stops, and visualizes colored rectangles with state/trade labels and mitigation icons.

Disclaimer: This article is for educational purposes only. Trading carries significant financial risks, and market volatility may result in losses. Thorough backtesting and careful risk management are crucial before deploying this program in live markets.

With this Inverse Fair Value Gap strategy offering state tracking and inversion signals, you’re equipped to trade gap imbalances, ready for further optimization in your trading journey. Happy trading!

Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

This article was written by a user of the site and reflects their personal views. MetaQuotes Ltd is not responsible for the accuracy of the information presented, nor for any consequences resulting from the use of the solutions, strategies or recommendations described.

The View and Controller components for tables in the MQL5 MVC paradigm: Containers

The View and Controller components for tables in the MQL5 MVC paradigm: Containers

Chaos Game Optimization (CGO)

Chaos Game Optimization (CGO)

Fortified Profit Architecture: Multi-Layered Account Protection

Fortified Profit Architecture: Multi-Layered Account Protection

From Novice to Expert: Developing a Geographic Market Awareness with MQL5 Visualization

From Novice to Expert: Developing a Geographic Market Awareness with MQL5 Visualization

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use