Watch the Market tutorial videos on YouTube

How to buy а trading robot or an indicator

Run your EA on

virtual hosting

virtual hosting

Test аn indicator/trading robot before buying

Want to earn in the Market?

How to present a product for a sell-through

Trading Robots for MetaTrader 4

AI Forex Robot - The Future of Automated Trading. AI Forex Robot is powered by a next-generation Artificial Intelligence system based on a hybrid LSTM Transformer neural network, specifically designed for analyzing XAUUSD and EURUSD price movements on the Forex market. The system analyzes complex market structures, adapts its strategy in real time and makes data-driven decisions with a high level of precision. AI Forex Robot is a modern, fully automated system powered by artificial i

Vortex - your investment in the future

The Vortex Gold EA expert Advisor made specifically for trading gold (XAU/USD) on the Metatrader platform. Built using proprietary indicators and secret author's algorithms, this EA employs a comprehensive trading strategy designed to capture profitable movements in the gold market. Key components of its strategy include classic indicators as CCI and Parabolic Indicator, which work together to accurately signal ideal entry and exit points. At the heart of V

Vortex Turbo — “Trade the storm — control the Vortex”

Vortex Turbo represents the next evolutionary stage in intelligent trading — a unique development that merges cutting-edge AI architecture, adaptive market logic, and precise risk control. Built upon proven algorithmic principles, it integrates multiple strategies into a unified high-speed ecosystem powered by a new level of predictive intelligence. Designed as a scalping expert for gold XAUUSD(GOLD), Vortex Turbo employs a controlled martin

The XG Gold Robot MT4 is specially designed for Gold. We decided to include this EA in our offering after extensive testing . XG Gold Robot and works perfectly with the XAUUSD, GOLD, XAUEUR pairs. XG Gold Robot has been created for all traders who like to Trade in Gold and includes additional a function that displays weekly Gold levels with the minimum and maximum displayed in the panel as well as on the chart, which will help you in manual trading. It’s a strategy based on Price

EA Gold Stuff is an Expert Advisor designed specifically for trading gold. The operation is based on opening orders using the Gold Stuff indicator, thus the EA works according to the "Trend Follow" strategy, which means following the trend. Real-time results can be viewed here . Contact me immediately after the purchase to get personal bonus! You can get a free copy of our Strong Support and Trend Scanner indicator, please pm. me! Settings and manual here

Please note that I do not sell my

Game Change EA is a trend following trading system powered based on the Game Changer indicator. It automatically sells whenever a red dot forms and continues in the sell direction until a yellow X appears, which signals a potential end of the trend. The same logic applies for buy trades. When a blue dot appears the EA begins buying and it will close out the buy cycle as soon as a yellow X is detected.

This EA is suitable for any currency pair and any time frame, however it performs exceptiona

Introducing Quantum Emperor EA , the groundbreaking MQL5 expert advisor that's transforming the way you trade the prestigious GBPUSD pair! Developed by a team of experienced traders with trading experience of over 13 years.

IMPORTANT! After the purchase please send me a private message to receive the installation manual and the setup instructions.

***Buy Quantum Emperor EA and you could get Quantum StarMan for free !*** Ask in private for more details Verified Signal: Click Here

MT5 Versi

Quantum King EA — Intelligent Power, Refined for Every Trader

IMPORTANT! After the purchase please send me a private message to receive the installation manual and the setup instructions.

Special Launch Price Live Signal: CLICK HERE

MT5 version : CLICK HERE

Quantum King channel: Click Here

***Buy Quantum King MT4 and you could get Quantum StarMan for free !*** Ask in private for more details!

Rule your trading with precision and discipline.

Quantum King EA brings the strengt

Quantum strategy is a combination of quantum superposition and trading signal model. EA Quantum Dark Gold determines Buy and Sell positions simultaneously for each signal and simultaneously places 2 orders Buy Stop and Sell Stop. Then the momentum determines which order position is executed and cancels the remaining pending order. This interesting idea forms the Quantum Dark Gold with a unique entry method. Open positions are then managed by Trailing, Stop Loss and position balancing strategies

Limited stock at the current price!

Final price: $1999 --> PROMO: From $299 --> The price will go up every 5 purchases, next price : $399 Golden Mirage is a robust gold trading robot designed for traders who value reliability, simplicity, and professional-grade performance. Powered by a proven combination of RSI, Moving Average, ADX, and High/Low Level indicators, Golden Mirage delivers high-quality signals and fully automated trading on the M5 timeframe for XAUUSD (GOLD) . It features a robu

CyNera: Your Trading, Our Technology Manual & set files: contact me after purchase to receive the manual and set files Price: The price increases based on the number of licenses sold Available copies: 4 Trading gold, one of the most volatile instruments in the market, demands precision, in-depth analysis, and strong risk management. CyNera Expert Advisor seamlessly integrates these elements into a sophisticated system designed for optimal gold trading. CyNera’s advanced strategies and technolog

Aura Black Edition is a fully automated EA designed to trade GOLD only. Expert showed stable results on XAUUSD in 2011-2020 period. No dangerous methods of money management used, no martingale, no grid or scalp. Suitable for any broker conditions. EA trained with a multilayer perceptron Neural Network (MLP) is a class of feedforward artificial neural network (ANN). The term MLP is used ambiguously, sometimes loosely to any feedforward ANN, sometimes strictly to refer to networks composed of mult

Goldex AI: Today's success will be tomorrow's fruits SUPER DISCOUNT FOR LIMITED TIME! LAST 2 COPIES FOR 299 USD BEFORE PRICE WILL INCREASE. Real IC Markets signal: Goldex AI High risk Manual and set files: Contact me after purchase to receive the manual and set files. Price: The starting price is $899 and will increase by $199 after every ten sales. Available copies: 2 Goldex AI - Advanced trading robot with neural networks, trend, and price action. Goldex AI is a high-performance trading robot

Bazooka EA – Trend & Momentum Expert Advisor for MT4 MT5: https://www.mql5.com/en/market/product/163078 Default settings are configured to backtest EA on GOLD M5 timeframe with Open Price method from 2024 year till today. Correct settings for other timeframes you will find in comments section. Bazooka EA is a fully automated Expert Advisor for MetaTrader 4 , designed to trade directional market moves using trend confirmation and momentum filtering .

The EA focuses on controlled entries and disc

UPDATE — DECEMBER 2025

At the end of November 2024, the Aurum expert advisor was released for sale.

Throughout this time, it traded in real market conditions without a news filter, without additional protective restrictions, and without complex limitations — while confidently remaining profitable and stable. Live Signal

This full year of real trading clearly demonstrated the reliability of the trading system.

Only after that, based on real experience and statistics, a major update was release

BB Return — an Expert Advisor for gold trading (XAUUSD). I previously used this trading idea in manual trading. The core of the strategy is a return of price to the Bollinger Bands range, but not blindly and not on every touch. For the gold market, bands alone are not enough, so the EA uses additional filters that eliminate weak and non-working market situations. Trades are opened only when the return logic is truly justified. Trading principles — the strategy does not use grid trading, martin

AI Prop Firms - Intelligent Automation Built for Prop Trading Firms . AI Prop Firms is an advanced fully automated Forex trading system powered by Artificial Intelligence , developed specifically to operate within the strict rules and evaluation models of prop trading firms. The system is designed to trade under controlled risk conditions while maintaining consistency , stability, and compliance with prop firm requirements. AI Prop Firms uses intelligent market analysis logic that continu

ICMarkets Live Signal: Click Here The EA is introduced at an early-stage price. The price will increase with every few sales and will never be reduced. Early buyers receive the best available price. What You Need to Do to Succeed with KT Gold Drift EA?

Patience. Discipline. Time. KT Gold Drift EA is based on a real-world trading approach used by professional traders and private fund managers. Its strength is not in short-term excitement, but in long-term consistency. This EA is designed to be t

Last copy at 499$ -> next price 599$ Dark Nova is a fully automatic Expert Advisor for Scalping Trading on AUDCAD, AUDNZD and NZDCAD . This Expert Advisor is based on a sophisticated multi-indicator algorithm combining Bollinger Bands , Moving Averages , ADX , RSI and Extreme Points detection. It is highly customizable to suit your trading needs. If you Buy this Expert Advisor you can write a feedback at market and get a second EA for Free , for More info contact me The basic strategy of this EA

Javier Gold Scalper: Our Technology by Your Side!

Manual and configuration files: contact me after purchase to receive the manual and configuration files Price: The price increases according to the number of licenses sold Available copies: 5 Trading gold, one of the most volatile assets in the financial market, requires high precision, thorough analysis, and extremely effective risk management. The Javier Gold Scalper was developed specifically to integrate these pillars into a robust and sophi

XAU FLUX - Professional Gold Scalping Expert Advisor >>>User Guide <<< XAU FLUX is a professional trading robot designed for fast and disciplined trading in the gold market. It is developed for traders aiming to achieve consistent profits from small daily price movements. Key Features:

XAU FLUX uses an advanced scalping system that operates on the M1 & M5 timeframe to evaluate micro opportunities in the market. The EA continuously analyzes market conditions to identify suitable entry points and

WINTER SALE — LIMITED TIME!

Get GOLD Scalper PRO with a huge –60% discount AND receive News Scope EA PRO as a FREE BONUS ! Special Winter Sale Price: $177

(Regular Price: $447 — You Save $270!) FREE BONUS: News Scope EA PRO

A powerful multi-symbol strategy packed with advanced features, supporting 5 trading pairs — real value: $397! After completing your purchase, simply contact me and I will send you your BONUS EA immediately. Don’t miss this once-a-year opportunity! Live Results: https:/

Trend Ai EA is designed to work with the Trend Ai indicator which will do its own market analysis by combining trend identification with actionable entry points and reversal alerts and will take over all the signals of the indicator in full auto! The EA contains a number of external parameters that are fully adjustable and allows the trader to customize the expert according to his choice. Be careful i not sell EA or sets at telegram it scam. All settings free here at blog . IMPORTANT! Con

esko EA – Low-Risk Trading System Jesko is a special Expert Advisor built on a proven strategy that has been tested and optimized for years.

It has been live-tested on real accounts and has consistently shown profitable and low-risk performance . Now we decided to make it available to the public. Signal live Four months of a live account Easy to install

Works on any broker (ECN recommended)

Minimum deposit: $100 24/7 support 5 min or 1 min: Gold For backtesting: Make sure INCORRECT does not

ADVANCED MULTI SCALPING EA - is fully automatic multi-pair trading system - very safe with steady growth . This profitable scalping EA is really one of the most stable system on the market at the present time - it takes around 70-100 trades per month. Download EA Set_files for testing and trading: USDCHF Set_file GBPCHF Set_file GBPCAD Set_file GBPAUD Set_file EURCHF Set_file EURCAD Set_file EURAUD Set_file AUDCAD Set_file Features of EA: Additional spread settings. Adjustable Volatility

WINTER SALE — LIMITED TIME!

Get Forex GOLD Investor with a huge –60% discount AND receive News Scope EA PRO as a FREE BONUS ! Special Winter Price: $217

(Regular Price: $547 — You Save $330!) FREE BONUS: News Scope EA PRO

A powerful multi-symbol strategy packed with advanced features, supporting 5 trading pairs — real value: $397! After completing your purchase, simply contact me and I will send you your BONUS EA immediately. Don’t miss this once-a-year opportunity! Live Results: https://w

Capybara EA is an advanced automated trend following system based on the Hama indicator. If the market turns bearish and the indicator turns red the EA will sell, if the market turns bullish and the indicator turns blue the EA will buy. The EA can accurately detect the beginning of uptrends and downtrends and will control open trades in a martingale/grid style until it hits TP. Recommended pairs: All major pairs like eurusd; audusd; gbpusd; nzdusd and also minor pairs like audcad; nzdcad;

WINTER SALE — LIMITED TIME!

Get Infinity Trader EA with a huge –60% discount AND receive News Scope EA PRO as a FREE BONUS ! Special Christmas Price: $217

(Regular Price: $547 — You Save $330!) FREE BONUS: News Scope EA PRO

A powerful multi-symbol strategy packed with advanced features, supporting 5 trading pairs — real value: $397! After completing your purchase, simply contact me and I will send you your BONUS EA immediately. Don’t miss this once-a-year opportunity! Infinity Trader EA Live

Two Sided Scalp allows you to select 2 pairs to trade, then both pairs are scalped at the same time on 1 chart.

Recommended Pairs Examples (GBPUSD and USDCHF, EURUSD and USDCHF, AUDUSD and GBPUSD)

Two Sided Scalp live signal available! Current price will be increased. Limited time price 75 USD

No grid, no martingale Recommended Chart: Trades 2 symbols on 1 chart (single-chart setup)

Timeframe: H1

Inputs Lot Size Calculation Method - Select auto lot or fixed lot

Fixed Lot Size - Fixed lot size

ICMarkets Live Signal: Click Here What You Need to Do to Succeed with KT Gold Nexus EA?

Patience. Discipline. Time. KT Gold Nexus EA is based on a real-world trading approach used by professional traders and private fund managers. Its strength is not in short-term excitement, but in long-term consistency. This EA is designed to be traded over time. It is recommended to stay invested for at least one year to experience its real potential. Just like professional trading, there can be losing weeks

Golden Scalper PRO: Our Technology by Your Side!

Manual and configuration files: Contact me after purchase to receive the manual and configuration files. Price: The price increases according to the number of licenses sold. Available copies: 3 Trading gold, one of the most volatile assets in the financial market, requires high precision, thorough analysis, and extremely effective risk management. Golden Scalper PRO was developed precisely to integrate these pillars into a robust and sophisticate

Recovery Manager Pro is a system for recovering drawdowns from other advisors or from manually opened orders. RM Pro has the ability to automatically dynamically adjust. The trader needs to select the risk level and the advisor will work in fully automatic mode. Can work in drawdown recovery mode and standby mode! If another advisor generates a drawdown, RM Pro will disable it, lock the position and start the process of restoring the deposit using partial closures. In its trading, the advisor u

Gold Mining EA is a sophisticated automated trading system that combines momentum-based technical analysis with intelligent grid management. Designed primarily for trending markets like Gold (XAUUSD), this EA uses a unique combination of Aroon Oscillator and RSI indicators to identify high-probability entry points while managing risk through multiple protective mechanisms. Trading Style: Grid Trading with Trend Following

Best Instruments: XAUUSD (Gold)

Recommended Timeframe: M15(15-minute)

Mini

Live signal (more than 600% Profit in 7 Weeks - DrawDown<9) - Final real price is 999$ - Discount and price is 199$ (Next price is 300$) , Price will be increased after 24 hours. Welcome, Gold GANN Expert opens automatically trade with Highly profit, Fixed small Stop loss. After purchase, You will receive one more EA for Free! Contact me for this BONUS! (BUY 1, GET 1 FREE) - Lifetime update free No Martingale, No Grid, No Scam I am focused on help my clients, not just earn.

Th

The Expert Advisor is a system designed to recover unprofitable positions. The author's algorithm locks a losing position, splits it into many separate parts, and closes each of them separately. Easy setup, delayed launch in case of drawdown, locking, disabling other Expert Advisors, averaging with trend filtering and partial closing of a losing position are built into one tool. It is the use of closing losses in parts that allows you to reduce losses with a lower deposit load, which ensures saf

Expert Advisor Infinity Gold Code is a fully automated trading system developed specifically for the Gold market (XAUUSD). It combines momentum analysis with volatility-based modeling, alongside advanced scalping logic and intelligent position management, to optimize performance while maintaining disciplined risk control. The system incorporates an optional Moving Average (MA) trend filter, allowing trades to align with the prevailing market direction and thereby improving signal reliability du

EA Black Dragon runs on the trend indicator. The EA opens a deal by indicator color, then there is the opportunity to increase the network of orders or work with stop loss. Be careful i not sell EA or sets at telegram it scam. All settings free here at blog . IMPORTANT! Contact me immediately after the purchase to get instructions and a bonus! Real operation monitoring as well as my other products can be found here: https://www.mql5.com/en/users/mechanic/seller

Inputs Value

·

SouthEast is an expert advisor developed from my experience in manual trading that has been automated. SouthEast is specifically designed to generate maximum profits with small deposits by prioritizing the security of your funds. Why SouthEast?

SouthEast does not require complicated settings and is easy to use because user only need to upload a set file that is already available. Currently there are set files for 20 fx pairs. The best GRID EA with the ability to control risks. I will share my

ORIX System — a trading robot developed specifically for the GBPUSD currency pair on the M5 timeframe. The Expert Advisor is based on price behavior analysis and market structure elements and does not use standard technical indicators. The EA does not use martingale, trading grids, averaging against the market, hedging, opening trades without a stop-loss, or high-frequency or chaotic trading.

Main requirements and recommendations Currency pair: GBPUSD

Timeframe: M5

Minimum deposit: from 100 USD

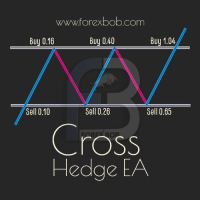

Cross Hedge EA Cross Hedge EA is a hedging EA which helps you recover the losing trade in a very tricky way based on "Zone Recovery Algorithm". It Hedge with an increased lot size based on multiplier factor in the market direction and if market reverse its direction again then it open a incremental lot in the current market direction. Doing this way it ends with a profit no matter in what direction the market will move.

Use Cent account with $300 deposits atleast for gold and Standard account w

XGen Scalper MT4 - Professional Automated Trading System

XGen Scalper is a state-of-the-art Expert Advisor that combines advanced algorithmic structure with proven technical analysis to deliver consistent results across all markets. This powerful trading system operates seamlessly on forex pairs, precious metals such as gold and silver, cryptocurrencies, and commodity indices.

Advanced Algorithmic Technology

The proprietary wave scanning algorithm processes market data in real time, identify

The Best Oil Trading Robot in the World. Crude Oil Robot is the undisputed, top-tier trading robot designed for the XTIUSD or any crude instrument offered by your broker. This is not a generic algorithm, but it's a highly specialized system built exclusively for the crude oil market, utilizing unique technologies not available in any other trading bot. Crude Oil Robot is equipped with exclusive features tailored specifically for the OIL market , such as: Volatility Anomaly Fil

The Golden Way The Golden Wayis an automated trading software applied to the MT4 platform. The Golden Way adopts a comprehensive hybrid strategy, and through the coordinated operation of multiple strategies, it can accurately capture long and short opportunities in the Gold (XAUUSD) market, helping you timely grasp trading opportunities under different market conditions. Relying on mature trading logic, it helps you conduct professional and efficient trading operations in the Gold market. S

EA Aurum Trader combines a breakout and a trend-following strategy with a maximum of two trades per day. Real-time results can be viewed here . Contact me immediately after the purchase to get personal bonus! You can get a free copy of our Strong Support and Trend Scanner indicator, please pm. me! Settings and manual here

Please note that I do not sell my EA's or special sets on telegram, it is only available on Mql5 and my set files are only available on my blog here . Be careful of

Gold Medalist is an intelligent system focused on volatile trading on the XAUUSD market. It aims to identify and effectively exploit short-term price impulses, providing traders with new profit opportunities. Special offer for the first 10 buyers! Next price: $1,495

The full list is available for your convenience at https://www.mql5.com/ru/users/pants-dmi/seller

The Gold Medalist's key advantage lies in its unique price action analysis system. By accurately measuring price movement, it can id

Gold Emperor EA MT4 Expert Advisor the full list for your convenience is available https://www.mql5.com/ru/users/pants-dmi/seller

Gold Emperor EA is an automated trading advisor (expert) designed specifically for gold trading (XAU/USD) on the MetaTrader 4 (MT4) platform. It is designed to maximize profits and minimize risks when trading this volatile asset.

Key Features:

Gold Specialization: The EA is designed to take into account the specific characteristics of gold price movement,

Be sure to contact me after purchase by writing a private message! Also, if you have any questions before purchasing, feel free to ask them. Only a few copies left at $129. Next price is $399 Live signal

Monitoring MT5 version

Meet your trusted crypto market assistant — Bitcoin Scalper Pro. This is the perfect solution for those who want to trade Bitcoin professionally and efficiently! This unique trading advisor is designed specifically for Bitcoin trading and uses a powerful price level br

The EA consists of 100 virtual Prototype-4 EAs with different settings. The outcome of calculations is the resulting lot. The idea behind the virtual strategies is that in case any of the virtual strategies is "wiped", the entire deposit is not, it is only decreased by 1/100, i.e. 1% (when using Risk=5000, VirtualBalance=5000). It is possible to set the lot size to start opening positions, the step and the maximum number of opened lots and positions using the settings of the EA. The Expert Advis

GaMBLeRs – Smart Trading Machine for Exponential Account Growth [ Quantum Trading Machine] PROMO LAUNCH — 5 star Reviewers Wanted! Lifetime 3-Month Price . Limited Quota . Act Fast! Is trading gambling??? Yes, if you realize that forex and capital market trading almost entirely resembles gambling. Within seconds, you can become wealthier—or lose everything just as quickly. This undeniable fact sparks endless debates. Some argue trading is just normal commerce with profit and loss, but statistics

Cheat Engine is a midrange gold scalping system that can make decisions based on global forex sentiment via web-based API.

Cheat Engine live signal coming soon! Current price will be increased. Limited time price 80 USD

Single shot trading only. No grid or martingale ever.

Intelligent trailing stop exits that adapts to daily volatility The global forex sentiment is a measurement of hundreds of thousands of traders' positions totaling over 1 billion USD in account value. Cheat Engine is able to

Turn any trading strategy into a position trading strategy or trade the proven RSI & ADR based position trading strategies, including automated drawdown control system for positions that move against you. This EA is an evolution and a simplification of the MRA EA that has been used for position trading strategies taught on the Market Structure Trader website for many years. See my profile for a link to the website, free position trading course and other products. The EA will automatically scale

SwiftCap Master EA is a fully automated trading system designed to operate across several high-volatility markets including forex, metals, indices and crypto. The EA identifies key market highs and lows, places pending stop orders at major breakout zones, and manages open positions with smart trailing-stop logic. It follows a disciplined trend-trading approach with a strong emphasis on risk control and steady, consistent growth. Download All Set Files || MT5 Version

This robot uses its own built-in oscillator and other tools to measure market movements (volatility, speed, power, and direction). At an appropriate time, it places an invisible pending order on the market, which it continues to work with according to the set TradingMode. It is recommended to use a fast broker with low fees, accurate quotes and no limitation of stop loss size. You can use any timeframe.

Features spread protection slippage protection no grid no martingale a small SL for every tr

////// THEHRANTO V3 /////// **** Important ****** This robot is equipped with a professional News Filter. During backtests, all important economic events are detected and trades are filtered before and after high-impact news. While backtests show reduced risk during news releases, the best way to verify real performance is through live signals

https://www.nxfx.ca/

ScalpingMaster XAU EA for MetaTrader 4 (XAUUSD) Overview ScalpingMaster XAU is an Expert Advisor (EA) for MetaTrader 4 (MT4) designed for XAUUSD (Gold). It uses trend-based entries and an optional grid-style position management. The EA also provides basket risk controls, including closing all open positions when a basket profit or basket loss level (in account currency) is reached. Trading involves risk and results depend on market conditions, broker execution, and settings. Main functions Tren

Aura Neuron is a distinctive Expert Advisor that continues the Aura series of trading systems. By leveraging advanced Neural Networks and cutting-edge classic trading strategies, Aura Neuron offers an innovative approach with excellent potential performance. Fully automated, this Expert Advisor is designed to trade currency pair XAUUSD (GOLD). It has demonstrated consistent stability across these pairs from 1999 to 2023. The system avoids dangerous money management techniques, such as martingale

Introduction EA Omega Code is a core strategy that has been distilled over many years of research and optimization for the Forex and Gold markets. The strategy combines Scalper and Trailing to optimize performance and reduce risk. Trading orders have Stop Loss, Trailing for customization, and provide many other parameters to optimize the system to suit each user's trading plan. Promotion: with the purchase of Omega Code, users can access the source-code. If you are really interested in the sour

PROP FIRM READY! ( download SETFILE ) LAUNCH PROMO: Only a few copies left at current price! Final price: 990$ Get 1 EA for free (for 3 trade accounts) -> contact me after purchase Ultimate Combo Deal -> click here JOIN PUBLIC GROUP: Click here Live Signal

Welcome to the Gold Reaper! Build on the very succesfull Goldtrade Pro, this EA has been designed to run on multiple timeframes at the same time, and has the option to set the trade frequency from very conservative to extreme volatile

Contact me for discount before purchasing! AI-Driven Technology with ChatGPT Turbo Infinity EA is an advanced trading Expert Advisor designed for GBPUSD and XAUUSD. It focuses on safety, consistent returns, and infinite profitability. Unlike many other EAs, which rely on high-risk strategies such as martingale or grid trading. Infinity EA employs a disciplined, profitable scalping strategy based on neural network embedded over machine learning, data analytics AI based technology provided by lat

MT4 Version : https://www.mql5.com/en/market/product/90950 MT5 Version : https://www.mql5.com/en/market/product/93706

Rebate Hunter – Multi-Pair Hedging Grid EA (Dynamic Adaptive)

Rebate Hunter is a multi-pair hedging grid Expert Advisor designed to generate consistent trading volume while targeting controlled basket profit. The EA opens Buy & Sell simultaneously (hedged entry), then manages positions using an dynamic-adaptive grid distance and an automated basket close system.

This approach

MT4 Version : https://www.mql5.com/en/market/product/102622 MT5 Version : https://www.mql5.com/en/market/product/102624

Introducing the "Gold Buster" EA: Next-Generation Dynamic Support-Resistance and Risk Management System The "Gold Buster" EA represents the cutting-edge of automated trading systems, leveraging the latest advancements in open position management and risk analysis technology to redefine how support and resistance levels are identified and utilized in the financial markets. Th

Gold is Cold EA is based on the author’s personal trend indicator. The EA will accurately detect the beginning of uptrends with blue arrow and downtrends with red arrow, and will control open trades in a martingale/grid style until it hits TP. Recommended pairs: All major pairs like xauusd; eurusd; audusd; gbpusd; nzdusd and also minor pairs like audcad; nzdcad; eurnzd and eurcad on m15 or higher time frames.

Settings: Start Hour – Starting hour of EA Start Minute – Starting minute of EA

BITCOIN BOT

Btc Bot uses the Stochastic tape Indicator and is specifically designed for trading bitcoin, however, you can trade other currency pairs also if you want. When the tape crosses from red to green, the EA will start to buy and when it crosses from green to red the EA will start to sell. Trades will be controlled in a martingale/grid style until it hits take profit. The EA has a build in news filter which will stop the entering of new positions at a certain time before the news a

Mon Scalper - Dual-Trendline Breakout Scalping Expert

Mon Scalper is a specialized Expert Advisor designed exclusively for gold (XAUUSD) trading. It utilizes a unique dual-trendline strategy to identify strong trends and breakout points, executing trades automatically based on market conditions. Join My MQL5 Channel for the Latest Updates!

Real-Time Signal : https://www.mql5.com/en/signals/2281529 Pricing : Launch Price : $199 Incremental Price Increase : The price will increase by $100 after

Only 1/5 copies left at this price ---> Next price 250$ // MT5 Version Gold King AI was created using TensorTrade, an open-source Python framework designed specifically for building, training, evaluating, and deploying robust trading algorithms using reinforcement learning. The algorithm operates during the New York trading session. After analysing the market for a couple of hours to identify areas of interest, it places pending orders that are executed when the price reaches them. This quickl

Default Settings for Gold M15 test from 2024 year. Kaufman Smart Regime EA: Adaptive Market Intelligence SPECIAL INTRODUCTORY OFFER: The power of the Smart Regime EA is being released at a fraction of its true value. Secure your license now for $50 , before the price begins its phased, step-by-step increase toward the final valuation of $500 . This is an investment in unparalleled market logic. Unlock the power of adaptive algorithmic trading. The Kaufman Smart Regime EA is not just a strategy;

$39 SPECIAL OFFER !!! ( Normal Price: $299) The Strategy Axis Trend Grid Strategy is a fully automated Expert Advisor (EA) designed for high-precision trend-following on volatile instruments like XAUUSD (Gold) and NAS100 (Nasdaq) . The system uses a unique "Ladder Entry" mechanism that capitalizes on market momentum by placing pending orders at calculated price levels only when a primary trend is confirmed. It does not simply deploy grids blindly like many other grid EAs out there. The EA id

EA Quantum Scalper GBPUSD is an automated trading system designed for the GBPUSD currency pair. Employing a scalping strategy and sophisticated position management, it aims to deliver high returns while minimizing risk. The EA analyzes tick patterns, price movements, and momentum, using unique entry points to identify potential trading opportunities. To safeguard profits and enhance efficiency, each trade is equipped with maximum Stop Loss levels and a Trailing Stop feature. Bonus: get free E

Matrix Arrow EA MT4 is a unique expert advisor that can trade the Matrix Arrow Indicator's MT4 signals with a trade panel on the chart, manually or 100% automatically. Matrix Arrow Indicator MT4 will determine the current trend at its early stages, gathering information and data from up to 10 standard indicators, which are: Average Directional Movement Index (ADX), Commodity Channel Index (CCI), Classic Heiken Ashi candles, Moving Average, Moving Average Convergence Divergence (MACD), Relative

The Ichimoku at a glance has great appeal to me and most traders. The Gold on Ichimoku EA exploits the trend filter of the Ichimoku system, combines price recalculation and signal pattern calculation to create an optimally efficient automated trading system with low risk. The trades are also executed using the Scalper method to quickly exit the market. The trades always have Stop Loss available, along with Trailing settings and closing positions when the trend changes to control risk. EA is opt

The MetaTrader Market is the only store where you can download a free demo trading robot for testing and optimization using historical data.

Read the application overview and reviews from other customers, download it right to your terminal and test a trading robot before you buy. Only on the MetaTrader Market you can test an application absolutely free of charge.

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

If you do not have an account, please register

Allow the use of cookies to log in to the MQL5.com website.

Please enable the necessary setting in your browser, otherwise you will not be able to log in.