Pivot Points Signals

- Indicators

- Oeyvind Borgsoe

- Version: 1.1

Pivot Points Indicator – a fast, reliable, and fully customizable pivot detection for MetaTrader 5.

This indicator uses MetaTrader’s native iHighest and iLowest functions to identify pivot highs and lows by scanning for the highest and lowest prices within a user-defined window of bars. A pivot is confirmed only when the current bar is the absolute maximum or minimum within the selected range, ensuring accurate and timely signals based on robust built-in logic.

Key Features

- No Repainting: Once a pivot is detected, it remains fixed—previous signals are never changed or repainted. This guarantees stable and trustworthy pivot levels for real-time trading.

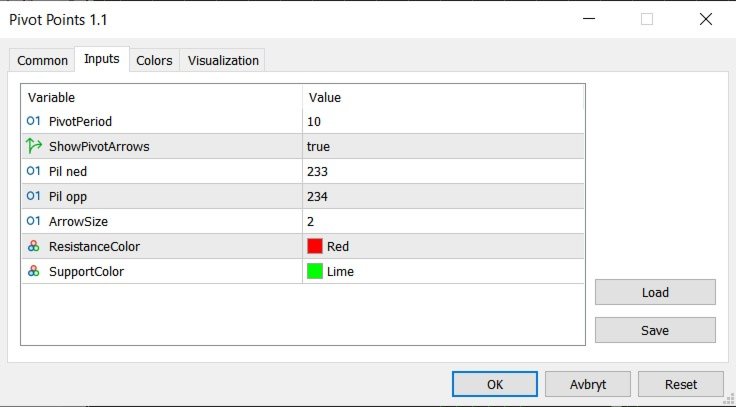

- Clear Visual Markers: Pivot highs and lows are displayed directly on the chart with distinct symbols (arrows by default). You can easily customize the symbol using the ArrowCode input—choose any Unicode character supported by MetaTrader 5, such as those from the Wingdings character set.

- Intuitive Tooltips: Hover over any pivot symbol to instantly see the corresponding price.

- Adjustable Sensitivity: Fine-tune the pivot period to match your trading style. A longer period smooths the indicator for fewer, more significant pivots, while a shorter period increases responsiveness.

- Ideal for Trending Markets: Range-based pivot detection is especially effective in trending conditions, providing actionable signals where they matter most.

- Lightweight and Efficient: Optimized for performance, the indicator processes only new bars and avoids unnecessary recalculations, ensuring smooth operation even on large datasets.

The Built-in Functions Pivot Points Indicator helps you spot key market turning points without lag or risk of signal repainting. While pivot points are a powerful tool for identifying potential support and resistance levels, they are most effective when used in conjunction with other technical indicators such as moving averages, RSI, or MACD to confirm signals and improve trade accuracy. As with any indicator, it is recommended not to rely solely on pivot points for trading decisions—combine them with broader market analysis and risk management strategies for best results