Revert Edge

- Experts

- Levi Dane Benjamin

- Version: 3.0

- Updated: 21 September 2025

- Activations: 15

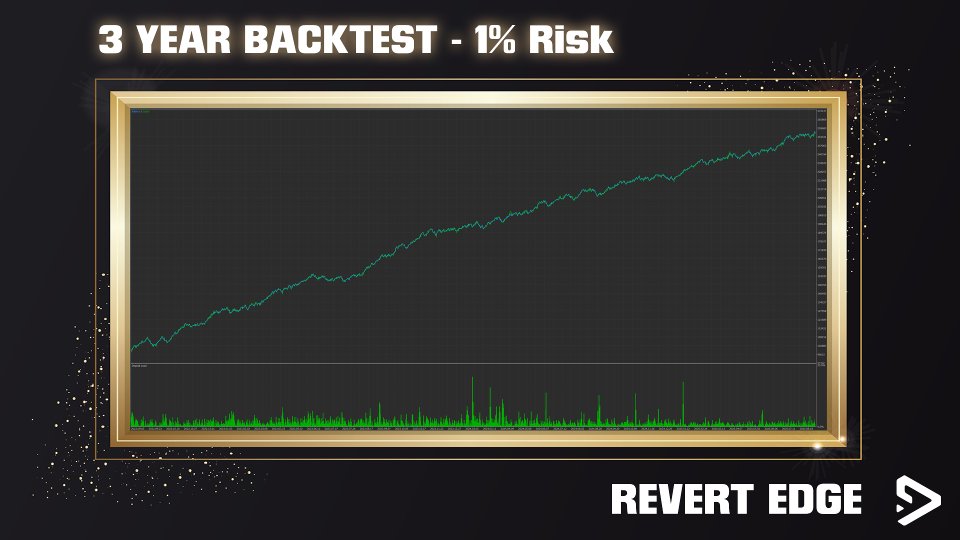

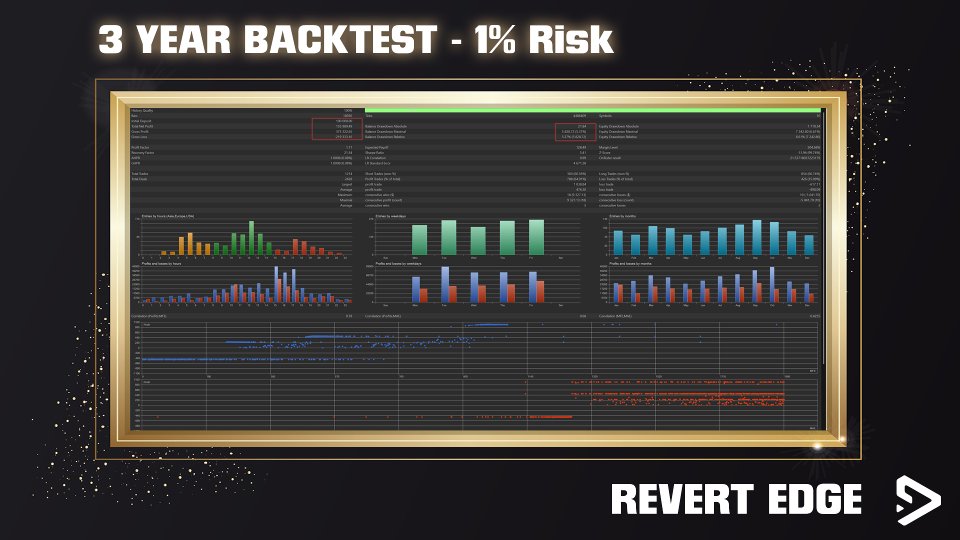

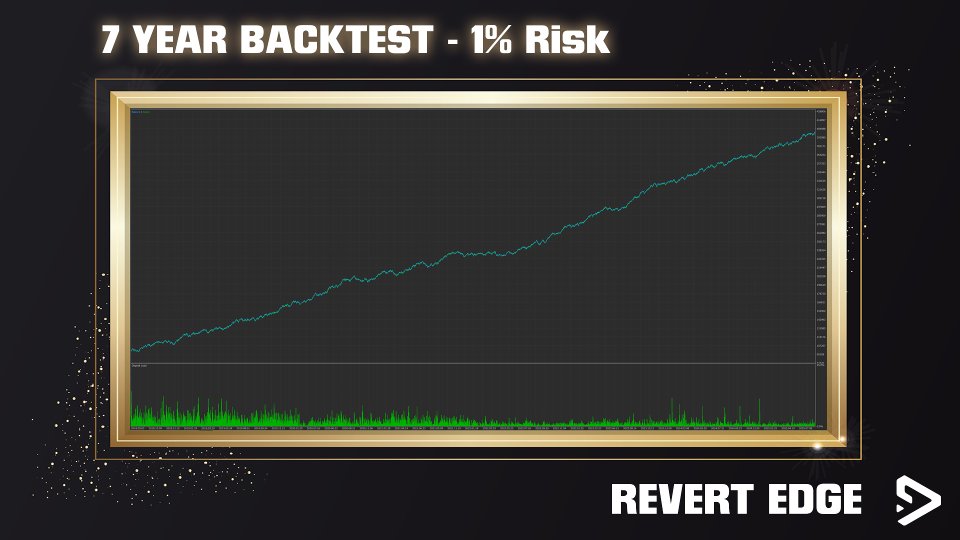

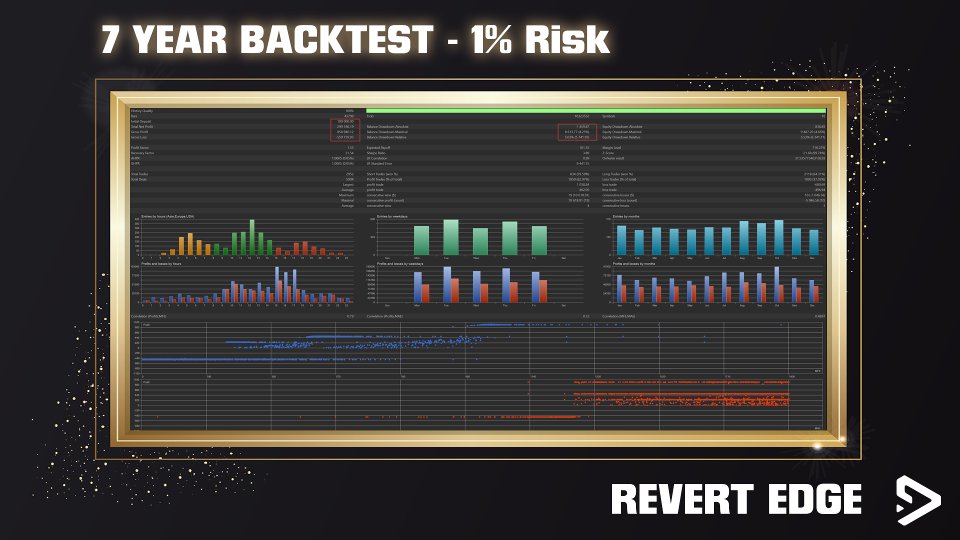

Revert Edge is a carefully crafted algorithm built on 8+ years of live trading experience. Its core focus is slow, steady account growth with an emphasis on long-term performance and not unsustainable, quick, short-term gains.

The EA is developed to trade multiple currencies such as AUDCAD, AUDUSD, EURGBP, EURUSD, NZDCAD, USDJPY, XAUUSD, GER40, US500 and more!

It uses a mean reversion strategy and takes advantage of price levels that are sensitive to some sort of reaction which the EA takes advantage of.

I have designed the EA to work straight away with minimal setup.

Why Revert Edge

Unlike many EA's promising to turn $250 into $1,000,000 or leveraging buzzwords like AI, Neural Networks, or Machine Learning, Revert Edge relies on proven quantitative methods and real-world results.

I do not rely on clearly manipulated back tests showing a perfectly straight or curved equity curve claiming to perform miracles.

The EA may not place trades everyday as it can go multiple days taking no trades. It is not a scalping system.

This EA will appeal to those who appreciate steady and respectable progress from a trading system.

This EA will experience periods of drawdown this is normal. Real trading includes losses and drawdown

Key Features

- Risk-Averse Strategy: No Martingale, Grid, Hedging, or other high-risk methods to artificially avoid losses.

- Precision Exits: Each position includes an emergency Stop Loss, though smarter, dynamic exit strategies are used to optimize performance.

- Multi-Symbol Trading: Diversified trades across multiple assets smooth the equity curve and reduce risk.

- One Chart Setup: Trade multiple currencies from one chart

- Fully Automated: Let the strategy work for you 24/5 with minimal intervention.

- Built-in Risk Management: Customizable drawdown limits allow you to tailor risk to your comfort level.

Strategy Details

Entry

- Runs on a 1HR Chart

- Enters a Buy after sweeping the previous days low

- Enters a Sell after sweeping the previous days high

- Has unique filters to select only the best trading setups and ignore poor signals (Not every sweep is valid)

Take Profit

- Each setup will open 2 positions with 2 Take Profits (TP1 and TP2)

- TP1 is either 0.5RR or 1RR.

- TP2 is either 1RR or 2RR

Stop Loss

- Every position will have a SL

Risk / Trade Management

- Risk % will be split across both positions. Using 1% risk, each TP will be 0.5% risk each

- If trailing is set to enable (default), once TP1 is closed, SL will be moved to Breakeven for TP2 and then be trailed after every candle close

Additional Information

- Occasionally trades will be held overnight

- Occasionally trades will be held over the weekend

- Only 1 Setup per symbol at one time can be held (No hedging, grid, or scaling in)

- Trades will be held until either TP or SL is hit

- Optimisation of all available pairs on the list is recommended before use to see which symbols to use together (Default is auto)

| Symbol | Run On Any It Trades. Trades Multi Symbol |

| Timeframe | 1HR |

| Capital | Minimum $250 |

| Broker | ICMarkets preferred. Any other Broker |

| Account Type | Any. EA does not hedge and is not spread sensitive |

| VPS | Preferred |

| Backtesting Mode | Any |

Risk Disclaimer

This EA will have losing trades and if you cannot handle some losses here and there then this EA is not for you. If you always expect the EA to be In a trade every day then this EA isn't for you. Trade frequency is around 3-5 per week

No one can promise guaranteed results. Every action has been taken to minimise the risk but the buyer should be aware that their capital is at risk and you run the EA at your own discretion.

Past performance does not guarantee future results

I feel like now is a good time to tell others my experience thus far. I've purchased this January 11th and have used this consistently even before his latest major update. Before I even loaded this onto a live account, I did many backtests. I focused on backtesting all of the available pairs individually to see which were the best of the best (most consistent and least drawdown since 2012). Since my broker has bad spreads for a handful of the pairs, I knew I had to utilize his manual ability. I ended up focusing on about 5 pairs and I only was profitable. I didn't make a crazy amount but it consistently did well. I feel like Levi should have only traded the very best pairs from the beginning especially when he first started and advised others the same. Instead, everyone traded all the pairs and many underperformed and dragged the EA down which lead to very unhappy clients. Since then, this major update, he tweaked the pairs and now only the best of best pairs are traded so now anyone can load it on auto mode and do well with it. At the time of writing this, you can see since he switched to the new update with only best of best pairs and other modifications, he is now up 5% and the account stopped losing money. I see another review made by Torsten saying Levi gives no insight to the logic. He clearly explains it in his youtube video and how it waits for an overextension for a reversion. He even explains how it manages the trade to avoid risk. Torsten says it risks way too much, but not really. The EA will, if in drawdown, get out at a pullback around breakeven for a minimal lose. It is very intelligent and rather safe. I think the system is still worth $1600. It's a shame things went the way they did initially and he really should have stuck with the 5 best pairs. I don't think he deserves the 2 out of 5 stars. Levi is a great guy and listened to a couple requests I made and quickly rolled out an update for it. He does care about this EA and his customers. Anyway, always make sure you do thorough backtests for any EA and start small and then risk "house" money. After months of using this and already making my money back, I highly recommend this for anyone's portfolio. Thank you Levi! I hope others see the value in this EA like I have.