Automating Trading Strategies in MQL5 (Part 35): Creating a Breaker Block Trading System

Introduction

In our previous article (Part 34), we developed a Trendline Breakout System in MetaQuotes Language 5 (MQL5) that identified support and resistance trendlines using swing points, validated by R-squared goodness of fit, to execute breakout trades with dynamic chart visualizations. In Part 35, we create a Breaker Block Trading System that detects consolidation ranges, validates breaker blocks with swing points, and trades retests with customizable risk parameters and visual feedback. We will cover the following topics:

By the end, you’ll have a functional MQL5 strategy for trading breaker block retests, ready for customization—let’s dive in!

Understanding the Breaker Block Strategy Framework

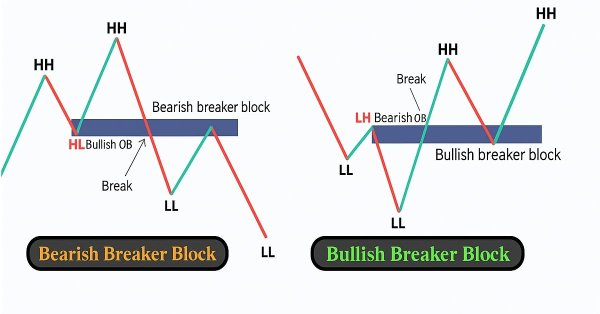

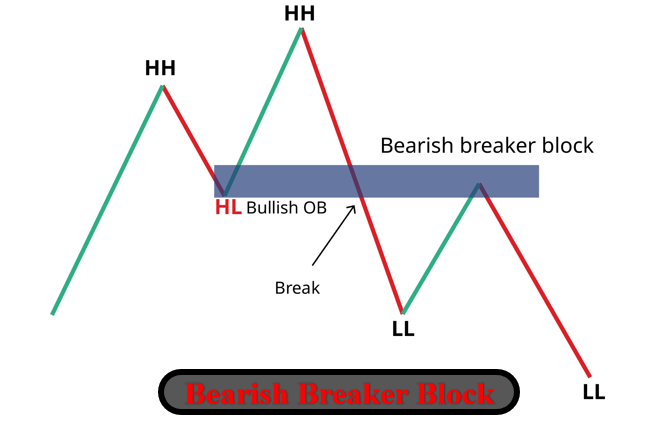

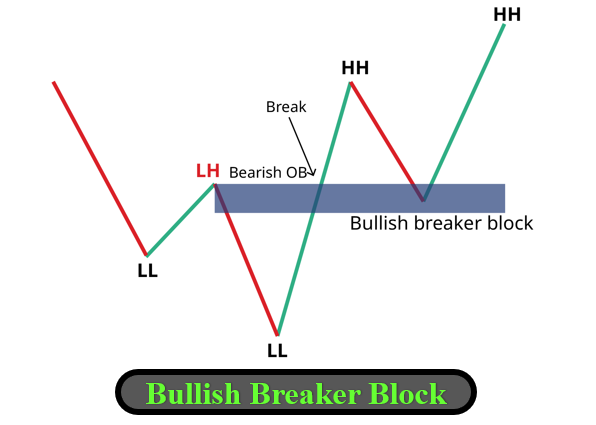

The breaker block strategy is a trading strategy that identifies consolidation ranges where price moves within a tight range, followed by a breakout and an impulsive move, forming order blocks that, when invalidated, become breaker blocks for potential retest trades. It capitalizes on price returning to these blocks after a significant move away, entering trades in the direction of the breakout with defined stop-loss and take-profit levels, enhanced by visual chart elements. Have a look at the different breaker blocks we could have below.

Bearish Breaker Block:

Bullish Breaker Block:

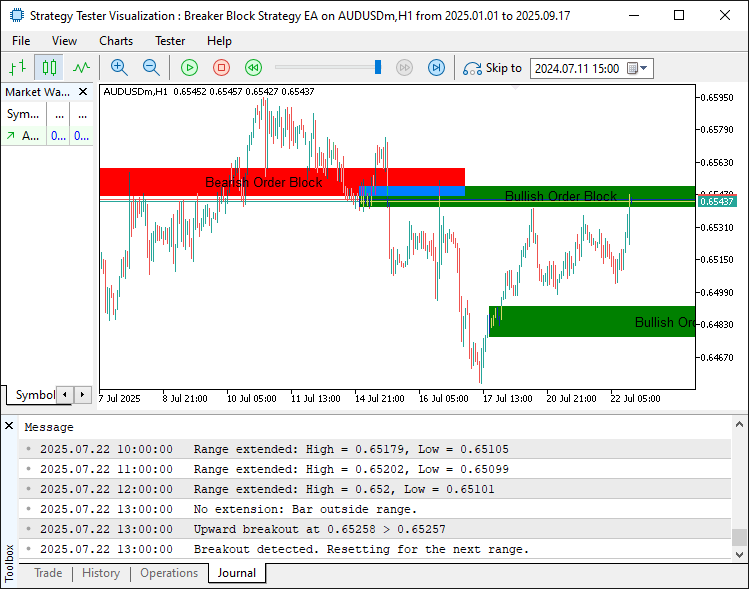

Our plan is to detect consolidation ranges by analyzing a set number of bars, identify breakouts when price exits the range, and confirm impulsive moves using a multiplier-based threshold. We will implement logic to validate breaker blocks with swing points, execute trades on retests with customizable parameters, and visualize blocks with dynamic labels and arrows, thereby creating a system for identifying and trading breaker block opportunities. In brief, here is a visual representation of our objectives.

Implementation in MQL5

To create the program in MQL5, open the MetaEditor, go to the Navigator, locate the Experts folder, click on the "New" tab, and follow the prompts to create the file. Once it is made, in the coding environment, we will need to declare some input parameters and global variables that we will use throughout the program.

//+------------------------------------------------------------------+ //| Breaker Block Strategy EA.mq5 | //| Copyright 2025, Allan Munene Mutiiria. | //| https://t.me/Forex_Algo_Trader | //+------------------------------------------------------------------+ #property copyright "Forex Algo-Trader, Allan" #property link "https://t.me/Forex_Algo_Trader" #property version "1.00" #property strict #include <Trade/Trade.mqh> //--- Include Trade library for position management CTrade obj_Trade; //--- Instantiate trade object for order operations

We begin the implementation by including the trade library with "#include <Trade/Trade.mqh>", which provides built-in functions for managing trade operations. We then initialize the trade object "obj_Trade" using the CTrade class, allowing the Expert Advisor to execute buy and sell orders programmatically. This setup will ensure that trade execution is handled efficiently without requiring manual intervention. Then we can provide some inputs so the user can change and control the behavior from the user interface (UI).

//+------------------------------------------------------------------+ //| Input Parameters | //+------------------------------------------------------------------+ input double tradeLotSize = 0.01; // Trade size for each position in lots input bool enableTrading = true; // Toggle to enable or disable automated trading input bool enableTrailingStop = true; // Toggle to enable or disable trailing stop input double trailingStopPoints = 30; // Distance in points for trailing stop adjustment input double minProfitToTrail = 50; // Minimum profit in points before trailing starts input int uniqueMagicNumber = 12345; // Unique identifier for EA trades input int consolidationBars = 7; // Number of bars to check for consolidation range input double maxConsolidationSpread = 50; // Maximum allowed spread in points for consolidation input int barsToWaitAfterBreakout = 3; // Bars to wait after breakout before impulse check input double impulseMultiplier = 1.0; // Multiplier for detecting impulsive price moves input double stopLossDistance = 1500; // Stop loss distance in points from entry input double takeProfitDistance = 1500; // Take profit distance in points from entry input double moveAwayDistance = 50; // Distance in points for price to move away post-invalidation input color bullishColor = clrGreen; // Base color for bullish order/breaker blocks input color bearishColor = clrRed; // Base color for bearish order/breaker blocks input color labelTextColor = clrBlack; // Color for text labels on blocks input bool enableSwingValidation = true; // Enable validation of swing points for block invalidation input bool showSwingPoints = true; // Show swing point labels if validation enabled input color swingLabelColor = clrWhite; // Color for swing point labels input int swingFontSize = 10; // Font size for swing point labels

Here, we define input parameters to configure the program's behavior. "tradeLotSize" sets the position size, while "enableTrading" and "enableTrailingStop" control execution and trailing stops, with "trailingStopPoints" and "minProfitToTrail" refining stop logic. "uniqueMagicNumber" identifies trades, and consolidation is detected using "consolidationBars" and "maxConsolidationSpread". The rest of the inputs are self-explanatory. We have added comments to ease their understanding. Lastly, we need to define some global variables that we will use for the overall system control.

//+------------------------------------------------------------------+ //| Structure for price and index | //+------------------------------------------------------------------+ struct PriceAndIndex { //--- Define structure for price and index data double price; //--- Store price value (high or low) int index; //--- Store bar index of price }; //+------------------------------------------------------------------+ //| Global variables for market state tracking | //+------------------------------------------------------------------+ PriceAndIndex rangeHighestHigh = {0, 0}; //--- Track highest high in consolidation range PriceAndIndex rangeLowestLow = {0, 0}; //--- Track lowest low in consolidation range bool isBreakoutDetected = false; //--- Flag for breakout detection double lastImpulseLow = 0.0; //--- Store low price after breakout for impulse double lastImpulseHigh = 0.0; //--- Store high price after breakout for impulse int breakoutBarNumber = -1; //--- Store bar index of breakout datetime breakoutTimestamp = 0; //--- Store timestamp of breakout string blockNames[]; //--- Store names of block objects datetime blockEndTimes[]; //--- Store end times of blocks bool invalidatedStatus[]; //--- Track invalidation status of blocks string blockTypes[]; //--- Track block types (OB/BB, bullish/bearish) bool movedAwayStatus[]; //--- Track if price moved away after invalidation bool retestedStatus[]; //--- Track if block was retested string blockLabels[]; //--- Store label object names for blocks datetime creationTimes[]; //--- Store creation times of blocks datetime invalidationTimes[]; //--- Store invalidation times of blocks double invalidationSwings[]; //--- Store swing high/low at invalidation bool isBullishImpulse = false; //--- Flag for bullish impulsive move bool isBearishImpulse = false; //--- Flag for bearish impulsive move #define OB_Prefix "OB REC " //--- Define prefix for order block names

Here, we establish the data structures and state tracking for the system. First, we define the "PriceAndIndex" structure to hold a price value (high or low) and its corresponding bar index, enabling precise tracking of consolidation range boundaries. Then, we initialize global variables: "rangeHighestHigh" and "rangeLowestLow" as "PriceAndIndex" instances to store the highest high and lowest low of the consolidation range, "isBreakoutDetected" as false to flag breakout events, "lastImpulseLow" and "lastImpulseHigh" as 0.0 to record prices post-breakout for impulse checks, "breakoutBarNumber" as -1 and "breakoutTimestamp" as 0 to track breakout timing, and arrays "blockNames", "blockEndTimes", "invalidatedStatus", "blockTypes", "movedAwayStatus", "retestedStatus", "blockLabels", "creationTimes", "invalidationTimes", and "invalidationSwings" to manage block objects, their expiration, invalidation, types (order or breaker block, bullish or bearish), retest status, and associated swing points.

Finally, we define "OB_Prefix" as "OB REC " for consistent naming of order block objects. Let us now define some helper functions that we will need to darken the color of invalidated order blocks and handle event handlers.

//+------------------------------------------------------------------+ //| Darken color by factor | //+------------------------------------------------------------------+ color DarkenColor(color colorValue, double factor = 0.8) { int red = int((colorValue & 0xFF) * factor); //--- Extract and darken red component int green = int(((colorValue >> 8) & 0xFF) * factor); //--- Extract and darken green component int blue = int(((colorValue >> 16) & 0xFF) * factor); //--- Extract and darken blue component return (color)(red | (green << 8) | (blue << 16)); //--- Combine components into color } //+------------------------------------------------------------------+ //| Price data accessors | //+------------------------------------------------------------------+ double high(int index) { return iHigh(_Symbol, _Period, index); //--- Return high price for specified index } double low(int index) { return iLow(_Symbol, _Period, index); //--- Return low price for specified index } double close(int index) { return iClose(_Symbol, _Period, index); //--- Return close price for specified index } datetime time(int index) { return iTime(_Symbol, _Period, index); //--- Return time for specified index } //+------------------------------------------------------------------+ //| Expert initialization function | //+------------------------------------------------------------------+ int OnInit() { obj_Trade.SetExpertMagicNumber(uniqueMagicNumber); //--- Set magic number for trade identification return(INIT_SUCCEEDED); //--- Return initialization success } //+------------------------------------------------------------------+ //| Expert deinitialization function | //+------------------------------------------------------------------+ void OnDeinit(const int reason) { ObjectsDeleteAll(0, OB_Prefix); //--- Remove all objects with OB prefix ChartRedraw(0); //--- Redraw chart to clear objects }

We continue to implement utility and lifecycle management functions for our system. First, we develop the "DarkenColor" function, which takes a color value and an optional factor (default 0.8), extracts red, green, and blue components using bitwise operations ("colorValue & 0xFF", "(colorValue >> 8) & 0xFF", "(colorValue >> 16) & 0xFF"), darkens them by multiplying with the factor, and combines them with bitwise shifts ("red | (green << 8) | (blue << 16)") to return a darkened color for visual distinction of invalidated blocks.

Then, we create accessor functions "high", "low", "close", and "time", which return the high price (iHigh), low price ("iLow"), close price ("iClose"), and timestamp (iTime) for a given bar index on the current symbol and period, simplifying price data retrieval. Next, in the OnInit function, we call "SetExpertMagicNumber" on "obj_Trade" with "uniqueMagicNumber" to tag trades for identification and return INIT_SUCCEEDED for successful initialization. Finally, in the OnDeinit function, we use ObjectsDeleteAll to remove all chart objects with "OB_Prefix" and call ChartRedraw to refresh the chart, ensuring clean resource cleanup. We can now graduate to the main OnTick event handler to implement our main control logic.

//+------------------------------------------------------------------+ //| Expert tick function | //+------------------------------------------------------------------+ void OnTick() { static bool isNewBar = false; //--- Track new bar status int currentBarCount = iBars(_Symbol, _Period); //--- Get current bar count static int previousBarCount = currentBarCount; //--- Store previous bar count if (previousBarCount == currentBarCount) { //--- Check if no new bar isNewBar = false; //--- Set no new bar } else { //--- New bar detected isNewBar = true; //--- Set new bar flag previousBarCount = currentBarCount; //--- Update previous bar count } if (!isNewBar) return; //--- Exit if not new bar int startBarIndex = 1; //--- Set start index for analysis int chartScale = (int)ChartGetInteger(0, CHART_SCALE); //--- Get chart zoom scale int dynamicFontSize = 8 + (chartScale * 2); //--- Calculate dynamic font size if (!isBreakoutDetected) { //--- Check if no breakout detected if (rangeHighestHigh.price == 0 && rangeLowestLow.price == 0) { //--- Check if range not set bool isConsolidated = true; //--- Assume consolidation for (int i = startBarIndex; i < startBarIndex + consolidationBars - 1; i++) { //--- Iterate consolidation bars if (MathAbs(high(i) - high(i + 1)) > maxConsolidationSpread * Point() || MathAbs(low(i) - low(i + 1)) > maxConsolidationSpread * Point()) { //--- Check spread isConsolidated = false; //--- Mark as not consolidated break; //--- Exit loop } } if (isConsolidated) { //--- Confirm consolidation rangeHighestHigh.price = high(startBarIndex); //--- Set initial high rangeHighestHigh.index = startBarIndex; //--- Set high index for (int i = startBarIndex + 1; i < startBarIndex + consolidationBars; i++) { //--- Find highest high if (high(i) > rangeHighestHigh.price) { //--- Check higher high rangeHighestHigh.price = high(i); //--- Update highest high rangeHighestHigh.index = i; //--- Update high index } } rangeLowestLow.price = low(startBarIndex); //--- Set initial low rangeLowestLow.index = startBarIndex; //--- Set low index for (int i = startBarIndex + 1; i < startBarIndex + consolidationBars; i++) { //--- Find lowest low if (low(i) < rangeLowestLow.price) { //--- Check lower low rangeLowestLow.price = low(i); //--- Update lowest low rangeLowestLow.index = i; //--- Update low index } } Print("Consolidation range established: Highest High = ", rangeHighestHigh.price, " at index ", rangeHighestHigh.index, " and Lowest Low = ", rangeLowestLow.price, " at index ", rangeLowestLow.index); //--- Log range } } else { //--- Range already set double currentHigh = high(1); //--- Get current high double currentLow = low(1); //--- Get current low if (currentHigh <= rangeHighestHigh.price && currentLow >= rangeLowestLow.price) { //--- Check within range Print("Range extended: High = ", currentHigh, ", Low = ", currentLow); //--- Log range extension } else { //--- Outside range Print("No extension: Bar outside range."); //--- Log no extension } } } }

We begin by defining a logic to first detect the consolidation ranges. In the OnTick function, we track new bars by comparing the current bar count from iBars with a static "previousBarCount", setting "isNewBar" to true and updating "previousBarCount" if a new bar is detected, or false to exit if not. We then retrieve the chart’s zoom scale with ChartGetInteger using CHART_SCALE and calculate a "dynamicFontSize" as 8 plus twice the scale for adaptive label sizing. If no breakout is detected ("isBreakoutDetected" is false) and no range is set ("rangeHighestHigh.price" and "rangeLowestLow.price" are 0), we check for consolidation by iterating through "consolidationBars" starting at "startBarIndex" 1, ensuring adjacent bars’ highs and lows differ by less than "maxConsolidationSpread * Point()" using MathAbs, setting "isConsolidated" to false if exceeded.

If consolidated, we set "rangeHighestHigh.price" and "rangeLowestLow.price" to the high and low of "startBarIndex" using "high" and "low", then iterate through "consolidationBars" to update them to the highest high and lowest low with their indices, logging the range with the Print function. If a range exists, we check if the current bar’s high and low ("high(1)", "low(1)") are within "rangeHighestHigh.price" and "rangeLowestLow.price", logging the extension if true, or no extension if outside. We can now use the prices to detect, visualize, and manage the order blocks before we use them for further analysis, because we need to invalidate them first before they become breaker blocks.

if (rangeHighestHigh.price > 0 && rangeLowestLow.price > 0) { //--- Check if range defined double currentClosePrice = close(1); //--- Get current close price if (currentClosePrice > rangeHighestHigh.price) { //--- Check upward breakout Print("Upward breakout at ", currentClosePrice, " > ", rangeHighestHigh.price); //--- Log breakout isBreakoutDetected = true; //--- Set breakout flag } else if (currentClosePrice < rangeLowestLow.price) { //--- Check downward breakout Print("Downward breakout at ", currentClosePrice, " < ", rangeLowestLow.price); //--- Log breakout isBreakoutDetected = true; //--- Set breakout flag } } if (isBreakoutDetected) { //--- Process breakout Print("Breakout detected. Resetting for the next range."); //--- Log reset breakoutBarNumber = 1; //--- Set breakout bar index breakoutTimestamp = TimeCurrent(); //--- Set breakout timestamp lastImpulseHigh = rangeHighestHigh.price; //--- Store high for impulse check lastImpulseLow = rangeLowestLow.price; //--- Store low for impulse check isBreakoutDetected = false; //--- Reset breakout flag rangeHighestHigh.price = 0; //--- Clear highest high rangeHighestHigh.index = 0; //--- Clear high index rangeLowestLow.price = 0; //--- Clear lowest low rangeLowestLow.index = 0; //--- Clear low index } if (breakoutBarNumber >= 0 && TimeCurrent() > breakoutTimestamp + barsToWaitAfterBreakout * PeriodSeconds()) { //--- Check impulse window double impulseRange = lastImpulseHigh - lastImpulseLow; //--- Calculate impulse range double impulseThresholdPrice = impulseRange * impulseMultiplier; //--- Calculate impulse threshold isBullishImpulse = false; //--- Reset bullish impulse flag isBearishImpulse = false; //--- Reset bearish impulse flag for (int i = 1; i <= barsToWaitAfterBreakout; i++) { //--- Check bars for impulse double closePrice = close(i); //--- Get close price if (closePrice >= lastImpulseHigh + impulseThresholdPrice) { //--- Check bullish impulse isBullishImpulse = true; //--- Set bullish impulse flag Print("Impulsive upward move: ", closePrice, " >= ", lastImpulseHigh + impulseThresholdPrice); //--- Log bullish impulse break; //--- Exit loop } else if (closePrice <= lastImpulseLow - impulseThresholdPrice) { //--- Check bearish impulse isBearishImpulse = true; //--- Set bearish impulse flag Print("Impulsive downward move: ", closePrice, " <= ", lastImpulseLow - impulseThresholdPrice); //--- Log bearish impulse break; //--- Exit loop } } if (!isBullishImpulse && !isBearishImpulse) { //--- Check no impulse Print("No impulsive movement detected."); //--- Log no impulse } bool isOrderBlockValid = isBearishImpulse || isBullishImpulse; //--- Validate order block if (isOrderBlockValid) { //--- Process valid order block datetime blockStartTime = iTime(_Symbol, _Period, consolidationBars + barsToWaitAfterBreakout + 1); //--- Set block start time double blockTopPrice = lastImpulseHigh; //--- Set block top price int visibleBarsOnChart = (int)ChartGetInteger(0, CHART_VISIBLE_BARS); //--- Get visible bars datetime blockEndTime = blockStartTime + (visibleBarsOnChart / 1) * PeriodSeconds(); //--- Set block end time double blockBottomPrice = lastImpulseLow; //--- Set block bottom price string blockName = OB_Prefix + "(" + TimeToString(blockStartTime) + ")"; //--- Generate block name color blockColor = isBullishImpulse ? bullishColor : bearishColor; //--- Set block color string blockLabel = isBullishImpulse ? "Bullish Order Block" : "Bearish Order Block"; //--- Set block label string blockType = isBullishImpulse ? "OB-bullish" : "OB-bearish"; //--- Set block type if (ObjectFind(0, blockName) < 0) { //--- Check if block exists ObjectCreate(0, blockName, OBJ_RECTANGLE, 0, blockStartTime, blockTopPrice, blockEndTime, blockBottomPrice); //--- Create block rectangle ObjectSetInteger(0, blockName, OBJPROP_TIME, 0, blockStartTime); //--- Set start time ObjectSetDouble(0, blockName, OBJPROP_PRICE, 0, blockTopPrice); //--- Set top price ObjectSetInteger(0, blockName, OBJPROP_TIME, 1, blockEndTime); //--- Set end time ObjectSetDouble(0, blockName, OBJPROP_PRICE, 1, blockBottomPrice); //--- Set bottom price ObjectSetInteger(0, blockName, OBJPROP_FILL, true); //--- Enable fill ObjectSetInteger(0, blockName, OBJPROP_COLOR, blockColor); //--- Set block color ObjectSetInteger(0, blockName, OBJPROP_BACK, false); //--- Set to foreground datetime labelTime = blockStartTime + (blockEndTime - blockStartTime) / 2; //--- Calculate label time double labelPrice = (blockTopPrice + blockBottomPrice) / 2; //--- Calculate label price string labelObjectName = blockName + " Label"; //--- Generate label name ObjectCreate(0, labelObjectName, OBJ_TEXT, 0, labelTime, labelPrice); //--- Create label ObjectSetString(0, labelObjectName, OBJPROP_TEXT, blockLabel); //--- Set label text ObjectSetInteger(0, labelObjectName, OBJPROP_COLOR, labelTextColor); //--- Set label color ObjectSetInteger(0, labelObjectName, OBJPROP_FONTSIZE, dynamicFontSize); //--- Set label font size ObjectSetInteger(0, labelObjectName, OBJPROP_ANCHOR, ANCHOR_CENTER); //--- Set label anchor ChartRedraw(0); //--- Redraw chart ArrayResize(blockNames, ArraySize(blockNames) + 1); //--- Resize block names array blockNames[ArraySize(blockNames) - 1] = blockName; //--- Add block name ArrayResize(blockEndTimes, ArraySize(blockEndTimes) + 1); //--- Resize end times array blockEndTimes[ArraySize(blockEndTimes) - 1] = blockEndTime; //--- Add end time ArrayResize(invalidatedStatus, ArraySize(invalidatedStatus) + 1); //--- Resize invalidated status invalidatedStatus[ArraySize(invalidatedStatus) - 1] = false; //--- Set invalidated status ArrayResize(blockTypes, ArraySize(blockTypes) + 1); //--- Resize block types array blockTypes[ArraySize(blockTypes) - 1] = blockType; //--- Add block type ArrayResize(movedAwayStatus, ArraySize(movedAwayStatus) + 1); //--- Resize moved away status movedAwayStatus[ArraySize(movedAwayStatus) - 1] = false; //--- Set moved away status ArrayResize(retestedStatus, ArraySize(retestedStatus) + 1); //--- Resize retested status retestedStatus[ArraySize(retestedStatus) - 1] = false; //--- Set retested status ArrayResize(blockLabels, ArraySize(blockLabels) + 1); //--- Resize block labels array blockLabels[ArraySize(blockLabels) - 1] = labelObjectName; //--- Add label name ArrayResize(creationTimes, ArraySize(creationTimes) + 1); //--- Resize creation times creationTimes[ArraySize(creationTimes) - 1] = time(1); //--- Set creation time ArrayResize(invalidationTimes, ArraySize(invalidationTimes) + 1); //--- Resize invalidation times invalidationTimes[ArraySize(invalidationTimes) - 1] = 0; //--- Set invalidation time ArrayResize(invalidationSwings, ArraySize(invalidationSwings) + 1); //--- Resize invalidation swings invalidationSwings[ArraySize(invalidationSwings) - 1] = 0.0; //--- Set invalidation swing Print("Order Block created: ", blockName); //--- Log block creation } } breakoutBarNumber = -1; //--- Reset breakout bar breakoutTimestamp = 0; //--- Reset breakout timestamp lastImpulseHigh = 0; //--- Reset impulse high lastImpulseLow = 0; //--- Reset impulse low isBullishImpulse = false; //--- Reset bullish impulse isBearishImpulse = false; //--- Reset bearish impulse }

Here, we implement the breakout detection and order block creation logic. First, we check if a consolidation range is defined ("rangeHighestHigh.price" and "rangeLowestLow.price" > 0), retrieving the current bar’s close price with "close(1)"; if it exceeds "rangeHighestHigh.price", we log an upward breakout and set "isBreakoutDetected" to true, or if below "rangeLowestLow.price", we log a downward breakout and set the flag. Then, if "isBreakoutDetected" is true, we log the breakout, set "breakoutBarNumber" to 1 and "breakoutTimestamp" to TimeCurrent, store "lastImpulseHigh" and "lastImpulseLow", and reset range variables and the breakout flag.

Next, if "breakoutBarNumber" is non-negative and the current time exceeds "breakoutTimestamp + barsToWaitAfterBreakout * PeriodSeconds", we calculate the "impulseRange" ("lastImpulseHigh - lastImpulseLow") and threshold ("impulseRange * impulseMultiplier"), checking bars within "barsToWaitAfterBreakout" for a close price exceeding "lastImpulseHigh + impulseThresholdPrice" (setting "isBullishImpulse") or below "lastImpulseLow - impulseThresholdPrice" (setting "isBearishImpulse").

If no impulse is detected, we log it; if valid ("isBearishImpulse" or "isBullishImpulse"), we create an order block using ObjectCreate (OBJ_RECTANGLE) with "blockStartTime" from iTime, top/bottom prices from "lastImpulseHigh"/"lastImpulseLow", and end time based on "ChartGetInteger(CHART_VISIBLE_BARS)", setting properties like "OBJPROP_FILL" and "OBJPROP_COLOR" ("bullishColor" or "bearishColor"), adding a centered label with "blockLabel" via "OBJ_TEXT", and updating arrays "blockNames", "blockEndTimes", "invalidatedStatus", "blockTypes", "movedAwayStatus", "retestedStatus", "blockLabels", "creationTimes", and "invalidationSwings". Finally, we reset breakout variables. This creates a system for detecting breakouts and visualizing order blocks. Upon compilation, we get the following outcome.

Now that we can detect the initial order blocks, let us define some logic so that when there is a respective price breakout, we mark them as invalidated, and confirm the invalidation via price action swing points. We will darken their color for distinction.

for (int j = ArraySize(blockNames) - 1; j >= 0; j--) { //--- Iterate through blocks string currentBlockName = blockNames[j]; //--- Get current block name bool doesBlockExist = false; //--- Initialize block existence flag double blockHigh = ObjectGetDouble(0, currentBlockName, OBJPROP_PRICE, 0); //--- Get block high double blockLow = ObjectGetDouble(0, currentBlockName, OBJPROP_PRICE, 1); //--- Get block low datetime blockStartTime = (datetime)ObjectGetInteger(0, currentBlockName, OBJPROP_TIME, 0); //--- Get block start datetime blockEndTime = (datetime)ObjectGetInteger(0, currentBlockName, OBJPROP_TIME, 1); //--- Get block end color blockCurrentColor = (color)ObjectGetInteger(0, currentBlockName, OBJPROP_COLOR); //--- Get block color if (time(1) < blockEndTime) { //--- Check if block still valid doesBlockExist = true; //--- Set block exists } if (StringFind(blockTypes[j], "OB-") == 0 && !invalidatedStatus[j]) { //--- Check valid order block bool invalidated = false; //--- Initialize invalidation flag string newBlockType = ""; //--- Initialize new block type color invalidatedColor = clrNONE; //--- Initialize invalidated color string newLabel = ""; //--- Initialize new label bool isForBullishBB = false; //--- Initialize bullish breaker block flag double breakPrice = 0.0; //--- Initialize break price int arrowCode = 0; //--- Initialize arrow code int anchor = 0; //--- Initialize anchor if (blockTypes[j] == "OB-bearish" && close(1) > blockHigh) { //--- Check bearish block invalidation isForBullishBB = true; //--- Set bullish breaker block breakPrice = blockHigh; //--- Set break price arrowCode = 233; //--- Set upward arrow anchor = ANCHOR_BOTTOM; //--- Set bottom anchor newBlockType = "Invalidated-bearish"; //--- Set invalidated type invalidatedColor = DarkenColor(bearishColor); //--- Darken bearish color newLabel = "Invalidated Bearish Order Block"; //--- Set invalidated label } else if (blockTypes[j] == "OB-bullish" && close(1) < blockLow) { //--- Check bullish block invalidation isForBullishBB = false; //--- Set bearish breaker block breakPrice = blockLow; //--- Set break price arrowCode = 234; //--- Set downward arrow anchor = ANCHOR_TOP; //--- Set top anchor newBlockType = "Invalidated-bullish"; //--- Set invalidated type invalidatedColor = DarkenColor(bullishColor); //--- Darken bullish color newLabel = "Invalidated Bullish Order Block"; //--- Set invalidated label } else { //--- No invalidation continue; //--- Skip to next block } bool validSwingForInvalidation = true; //--- Assume valid swing int swingShift = -1; //--- Initialize swing shift double swingPrice = 0.0; //--- Initialize swing price if (enableSwingValidation) { //--- Check swing validation int creationShift = iBarShift(_Symbol, _Period, creationTimes[j], false); //--- Get creation bar shift if (creationShift > 1) { //--- Ensure enough bars double extreme = isForBullishBB ? blockLow : blockHigh; //--- Set extreme price bool isBearishOB = isForBullishBB; //--- Set bearish OB flag if (isBearishOB) { //--- Handle bearish OB double minLow = extreme; //--- Initialize minimum low for (int k = creationShift - 1; k > 1; k--) { //--- Find lower low if (low(k) < minLow) { //--- Check lower low minLow = low(k); //--- Update minimum low swingShift = k; //--- Update swing shift } } validSwingForInvalidation = minLow < extreme; //--- Validate swing swingPrice = minLow; //--- Set swing price } else { //--- Handle bullish OB double maxHigh = extreme; //--- Initialize maximum high for (int k = creationShift - 1; k > 1; k--) { //--- Find higher high if (high(k) > maxHigh) { //--- Check higher high maxHigh = high(k); //--- Update maximum high swingShift = k; //--- Update swing shift } } validSwingForInvalidation = maxHigh > extreme; //--- Validate swing swingPrice = maxHigh; //--- Set swing price } } else { //--- Insufficient bars validSwingForInvalidation = false; //--- Invalidate swing } } if (validSwingForInvalidation) { //--- Confirm swing validation invalidated = true; //--- Set invalidated flag } if (invalidated) { //--- Process invalidation ObjectSetInteger(0, currentBlockName, OBJPROP_COLOR, invalidatedColor); //--- Update block color ObjectDelete(0, blockLabels[j]); //--- Delete old label datetime labelTime = blockStartTime + (blockEndTime - blockStartTime) / 2; //--- Calculate new label time double labelPrice = (blockHigh + blockLow) / 2; //--- Calculate new label price string newLabelObjectName = currentBlockName + " Label"; //--- Generate new label name ObjectCreate(0, newLabelObjectName, OBJ_TEXT, 0, labelTime, labelPrice); //--- Create new label ObjectSetString(0, newLabelObjectName, OBJPROP_TEXT, newLabel); //--- Set label text ObjectSetInteger(0, newLabelObjectName, OBJPROP_COLOR, labelTextColor); //--- Set label color ObjectSetInteger(0, newLabelObjectName, OBJPROP_FONTSIZE, dynamicFontSize); //--- Set label font size ObjectSetInteger(0, newLabelObjectName, OBJPROP_ANCHOR, ANCHOR_CENTER); //--- Set label anchor string arrowName = currentBlockName + "_break_arrow"; //--- Generate arrow name if (ObjectFind(0, arrowName) < 0) { //--- Check if arrow exists ObjectCreate(0, arrowName, OBJ_ARROW, 0, time(1), breakPrice); //--- Create break arrow ObjectSetInteger(0, arrowName, OBJPROP_ARROWCODE, arrowCode); //--- Set arrow code ObjectSetInteger(0, arrowName, OBJPROP_ANCHOR, anchor); //--- Set arrow anchor ObjectSetInteger(0, arrowName, OBJPROP_COLOR, invalidatedColor); //--- Set arrow color } if (enableSwingValidation && showSwingPoints && swingShift > 0) { //--- Check swing point display string swingLabelName = currentBlockName + "_invalid_swing"; //--- Generate swing label name if (ObjectFind(0, swingLabelName) < 0) { //--- Check if swing label exists datetime swingTime = time(swingShift); //--- Get swing time ObjectCreate(0, swingLabelName, OBJ_TEXT, 0, swingTime, swingPrice); //--- Create swing label string swingText = isForBullishBB ? "LL" : "HH"; //--- Set swing text ObjectSetString(0, swingLabelName, OBJPROP_TEXT, swingText); //--- Set swing label text ObjectSetInteger(0, swingLabelName, OBJPROP_COLOR, swingLabelColor); //--- Set swing label color ObjectSetInteger(0, swingLabelName, OBJPROP_FONTSIZE, swingFontSize); //--- Set swing label font size ObjectSetInteger(0, swingLabelName, OBJPROP_ANCHOR, isForBullishBB ? ANCHOR_LEFT_UPPER : ANCHOR_LEFT_LOWER); //--- Set swing label anchor } } ChartRedraw(0); //--- Redraw chart invalidatedStatus[j] = true; //--- Set invalidated status blockTypes[j] = newBlockType; //--- Update block type movedAwayStatus[j] = false; //--- Reset moved away status retestedStatus[j] = false; //--- Reset retested status blockLabels[j] = newLabelObjectName; //--- Update label name invalidationTimes[j] = time(1); //--- Set invalidation time invalidationSwings[j] = isForBullishBB ? high(1) : low(1); //--- Set invalidation swing Print("Order Block invalidated: ", currentBlockName); //--- Log invalidation } } if (!doesBlockExist) { //--- Check if block expired ArrayRemove(blockNames, j, 1); //--- Remove block name ArrayRemove(blockEndTimes, j, 1); //--- Remove end time ArrayRemove(invalidatedStatus, j, 1); //--- Remove invalidated status ArrayRemove(blockTypes, j, 1); //--- Remove block type ArrayRemove(movedAwayStatus, j, 1); //--- Remove moved away status ArrayRemove(retestedStatus, j, 1); //--- Remove retested status ArrayRemove(blockLabels, j, 1); //--- Remove label name ArrayRemove(creationTimes, j, 1); //--- Remove creation time ArrayRemove(invalidationTimes, j, 1); //--- Remove invalidation time ArrayRemove(invalidationSwings, j, 1); //--- Remove invalidation swing Print("Removed expired block at index ", j); //--- Log block removal } }

To implement the logic for managing and invalidating order blocks, we iterate backward through "blockNames" to process each block, retrieving its high and low prices with ObjectGetDouble and start/end times with ObjectGetInteger, marking it as existing if the current bar’s time ("time(1)") is before its end time. For valid order blocks (type starting with "OB-" and not invalidated), we check invalidation: if "OB-bearish" and the close price ("close(1)") exceeds the block’s high, we set up a bullish breaker block with an upward arrow (code 233) using "ObjectCreate" (OBJ_ARROW) and a darkened color from "DarkenColor"; if "OB-bullish" and the close is below the block’s low, we set a bearish breaker block with a downward arrow (code 234). MQL5 offers a vast list of Wingdings codes as below, so you can use them to your liking.

If "enableSwingValidation" is true, we validate the block by checking for a lower low (for bearish) or higher high (for bullish) since creation using iBarShift and "low"/"high", updating the block’s color and label with ObjectSetInteger and ObjectCreate (OBJ_TEXT) if valid. If "showSwingPoints" is enabled, we add a swing label ("LL" or "HH") with "ObjectCreate" at the swing’s time and price. If invalidated, we update block states with "invalidatedStatus", "blockTypes", and "invalidationTimes", log the invalidation, and reset retest status. If a block doesn’t exist, we use ArrayRemove to remove its states, like "invalidatedStatus", from storage arrays and log the removal, then redraw the chart with the ChartRedraw function. Upon compilation, you should get something as follows.

Now that we have the second step for invalidation being complete, we can graduate to the next step, where we keep track and wait for the price to retest our invalidated order blocks and mark them as breaker blocks.

for (int j = ArraySize(blockNames) - 1; j >= 0; j--) { //--- Iterate invalidated blocks if (StringFind(blockTypes[j], "Invalidated-") != 0) continue; //--- Skip non-invalidated string currentBlockName = blockNames[j]; //--- Get current block name double blockHigh = ObjectGetDouble(0, currentBlockName, OBJPROP_PRICE, 0); //--- Get block high double blockLow = ObjectGetDouble(0, currentBlockName, OBJPROP_PRICE, 1); //--- Get block low datetime blockStartTime = (datetime)ObjectGetInteger(0, currentBlockName, OBJPROP_TIME, 0); //--- Get block start datetime blockEndTime = (datetime)ObjectGetInteger(0, currentBlockName, OBJPROP_TIME, 1); //--- Get block end bool isForBullishBB = (blockTypes[j] == "Invalidated-bearish"); //--- Check for bullish breaker block datetime currentBarTime = time(1); //--- Get current bar time if (currentBarTime <= invalidationTimes[j]) continue; //--- Skip if same or earlier bar if (!movedAwayStatus[j]) { //--- Check if not moved away if (isForBullishBB && close(1) > blockHigh + moveAwayDistance * _Point) { //--- Check bullish move away movedAwayStatus[j] = true; //--- Set moved away Print("Moved away for bullish BB setup: ", currentBlockName); //--- Log move away } else if (!isForBullishBB && close(1) < blockLow - moveAwayDistance * _Point) { //--- Check bearish move away movedAwayStatus[j] = true; //--- Set moved away Print("Moved away for bearish BB setup: ", currentBlockName); //--- Log move away } } if (movedAwayStatus[j] && !retestedStatus[j]) { //--- Check for retest bool retestCondition = false; //--- Initialize retest condition if (isForBullishBB && low(1) <= blockHigh && close(1) > blockHigh) { //--- Check bullish retest retestCondition = true; //--- Set retest condition } else if (!isForBullishBB && high(1) >= blockLow && close(1) < blockLow) { //--- Check bearish retest retestCondition = true; //--- Set retest condition } bool validSwingForRetest = true; //--- Assume valid swing int swingShift = -1; //--- Initialize swing shift double swingPrice = 0.0; //--- Initialize swing price if (enableSwingValidation && retestCondition) { //--- Check swing validation int invalidShift = iBarShift(_Symbol, _Period, invalidationTimes[j], false); //--- Get invalidation shift if (invalidShift > 1) { //--- Ensure enough bars double extreme = invalidationSwings[j]; //--- Get invalidation swing if (isForBullishBB) { //--- Handle bullish breaker block double maxHigh = extreme; //--- Initialize maximum high for (int k = invalidShift - 1; k > 1; k--) { //--- Find higher high if (high(k) > maxHigh) { //--- Check higher high maxHigh = high(k); //--- Update maximum high swingShift = k; //--- Update swing shift } } validSwingForRetest = maxHigh > extreme; //--- Validate swing swingPrice = maxHigh; //--- Set swing price } else { //--- Handle bearish breaker block double minLow = extreme; //--- Initialize minimum low for (int k = invalidShift - 1; k > 1; k--) { //--- Find lower low if (low(k) < minLow) { //--- Check lower low minLow = low(k); //--- Update minimum low swingShift = k; //--- Update swing shift } } validSwingForRetest = minLow < extreme; //--- Validate swing swingPrice = minLow; //--- Set swing price } } else { //--- Insufficient bars validSwingForRetest = false; //--- Invalidate swing } } } }

To implement the retest detection logic for invalidated breaker blocks, we iterate backward through "blockNames" for blocks with "Invalidated-" in "blockTypes", retrieving high and low prices with ObjectGetDouble and start/end times with ObjectGetInteger, checking if the block is a bullish breaker block ("Invalidated-bearish"). If the current bar’s time ("time(1)") is not after "invalidationTimes", we skip to the next block. For blocks not yet moved away ("movedAwayStatus" false), we check if the close price ("close(1)") exceeds "blockHigh + moveAwayDistance * _Point" for bullish or falls below "blockLow - moveAwayDistance * _Point" for bearish, setting "movedAwayStatus" to true.

For blocks that have moved away but not retested ("retestedStatus" false), we set a bullish retest if "low(1)" reaches "blockHigh" and "close(1)" is above, or a bearish retest if "high(1)" reaches "blockLow" and "close(1)" is below. If "enableSwingValidation" and a retest condition are met, we validate swings using iBarShift to get the invalidation bar, checking for a higher high ("high") for bullish or lower low ("low") for bearish since invalidation, setting "validSwingForRetest" and "swingPrice" accordingly, creating a system for identifying valid retest opportunities after price movement. We can track the retests, mark the blocks as breaker blocks, change their color for distinction, and open positions. Here is the logic we use to achieve that.

if (retestCondition && validSwingForRetest) { //--- Confirm retest and swing if (enableTrading) { //--- Check trading enabled double entryPrice = 0.0; //--- Initialize entry price double stopLossPrice = 0.0; //--- Initialize stop loss double takeProfitPrice = 0.0; //--- Initialize take profit if (isForBullishBB) { //--- Handle bullish trade entryPrice = NormalizeDouble(SymbolInfoDouble(_Symbol, SYMBOL_ASK), _Digits); //--- Set entry at ask stopLossPrice = entryPrice - stopLossDistance * _Point; //--- Set stop loss takeProfitPrice = entryPrice + takeProfitDistance * _Point; //--- Set take profit obj_Trade.Buy(tradeLotSize, _Symbol, entryPrice, stopLossPrice, takeProfitPrice); //--- Execute buy trade Print("Buy trade on bullish BB retest: ", currentBlockName); //--- Log buy trade } else { //--- Handle bearish trade entryPrice = NormalizeDouble(SymbolInfoDouble(_Symbol, SYMBOL_BID), _Digits); //--- Set entry at bid stopLossPrice = entryPrice + stopLossDistance * _Point; //--- Set stop loss takeProfitPrice = entryPrice - takeProfitDistance * _Point; //--- Set take profit obj_Trade.Sell(tradeLotSize, _Symbol, entryPrice, stopLossPrice, takeProfitPrice); //--- Execute sell trade Print("Sell trade on bearish BB retest: ", currentBlockName); //--- Log sell trade } } color bbColor = isForBullishBB ? clrBlueViolet : clrOrange; //--- Set breaker block color ObjectSetInteger(0, currentBlockName, OBJPROP_COLOR, bbColor); //--- Update block color ObjectDelete(0, blockLabels[j]); //--- Delete old label string newLabel = isForBullishBB ? "Bullish Breaker Block" : "Bearish Breaker Block"; //--- Set new label datetime labelTime = blockStartTime + (blockEndTime - blockStartTime) / 2; //--- Calculate label time double labelPrice = (blockHigh + blockLow) / 2; //--- Calculate label price string newLabelObjectName = currentBlockName + " Label"; //--- Generate new label name ObjectCreate(0, newLabelObjectName, OBJ_TEXT, 0, labelTime, labelPrice); //--- Create new label ObjectSetString(0, newLabelObjectName, OBJPROP_TEXT, newLabel); //--- Set label text ObjectSetInteger(0, newLabelObjectName, OBJPROP_COLOR, labelTextColor); //--- Set label color ObjectSetInteger(0, newLabelObjectName, OBJPROP_FONTSIZE, dynamicFontSize); //--- Set label font size ObjectSetInteger(0, newLabelObjectName, OBJPROP_ANCHOR, ANCHOR_CENTER); //--- Set label anchor if (enableSwingValidation && showSwingPoints && swingShift > 0) { //--- Check swing point display string swingLabelName = currentBlockName + "_retest_swing"; //--- Generate swing label name if (ObjectFind(0, swingLabelName) < 0) { //--- Check if swing label exists datetime swingTime = time(swingShift); //--- Get swing time ObjectCreate(0, swingLabelName, OBJ_TEXT, 0, swingTime, swingPrice); //--- Create swing label string swingText = isForBullishBB ? "HH" : "LL"; //--- Set swing text ObjectSetString(0, swingLabelName, OBJPROP_TEXT, swingText); //--- Set swing label text ObjectSetInteger(0, swingLabelName, OBJPROP_COLOR, swingLabelColor); //--- Set swing label color ObjectSetInteger(0, swingLabelName, OBJPROP_FONTSIZE, swingFontSize); //--- Set swing label font size ObjectSetInteger(0, swingLabelName, OBJPROP_ANCHOR, isForBullishBB ? ANCHOR_LEFT_LOWER : ANCHOR_LEFT_UPPER); //--- Set swing label anchor } } ChartRedraw(0); //--- Redraw chart blockTypes[j] = isForBullishBB ? "BB-bullish" : "BB-bearish"; //--- Update block type retestedStatus[j] = true; //--- Set retested status blockLabels[j] = newLabelObjectName; //--- Update label name Print("Converted to ", newLabel, ": ", currentBlockName); //--- Log conversion }

Finally, we implement the trading and visualization logic for retested breaker blocks. If a retest is confirmed ("retestCondition" and "validSwingForRetest" are true) and trading is enabled ("enableTrading"), we execute trades: for a bullish breaker block ("isForBullishBB"), we set the entry at the ask price using SymbolInfoDouble, calculate stop loss ("stopLossDistance * _Point" below entry) and take profit ("takeProfitDistance * _Point" above entry), and execute a buy with "obj_Trade.Buy"; for bearish, we use the bid price, set stop loss above and take profit below, and execute a sell with "obj_Trade.Sell", logging accordingly.

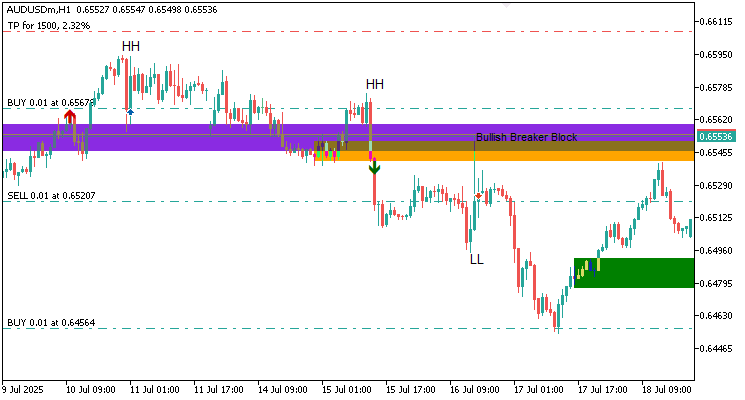

Then, we update the block’s appearance by setting its color to clrBlueViolet for bullish or "clrOrange" for bearish with ObjectSetInteger, delete the old label with ObjectDelete, and create a new OBJ_TEXT label ("Bullish Breaker Block" or "Bearish Breaker Block") at the block’s midpoint using "ObjectCreate" with "labelTextColor" and "dynamicFontSize". If "enableSwingValidation" and "showSwingPoints" are true with a valid "swingShift", we add a swing label ("HH" for bullish, "LL" for bearish) at the swing’s time and price using ObjectCreate with "swingLabelColor" and "swingFontSize". Finally, we update "blockTypes" to "BB-bullish" or "BB-bearish", set "retestedStatus" to true, update "blockLabels", log the conversion, and redraw the chart. Upon compilation, we have the following outcome.

From the image, we can see that we can detect, visualize, and trade the breaker blocks accordingly. What we now need to do is add a trailing stop logic to maximize profits, and all will be done. We define a function for that to modularize the code.

//+------------------------------------------------------------------+ //| Apply trailing stop to open positions | //+------------------------------------------------------------------+ void applyTrailingStop(double trailingPoints, CTrade &trade_object, int magicNo = 0) { double buyStopLoss = NormalizeDouble(SymbolInfoDouble(_Symbol, SYMBOL_BID) - trailingPoints * _Point, _Digits); //--- Calculate buy stop loss double sellStopLoss = NormalizeDouble(SymbolInfoDouble(_Symbol, SYMBOL_ASK) + trailingPoints * _Point, _Digits); //--- Calculate sell stop loss for (int i = PositionsTotal() - 1; i >= 0; i--) { //--- Iterate through open positions ulong ticket = PositionGetTicket(i); //--- Get position ticket if (ticket > 0 && PositionGetString(POSITION_SYMBOL) == _Symbol && (magicNo == 0 || PositionGetInteger(POSITION_MAGIC) == magicNo)) { //--- Verify position if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_BUY && buyStopLoss > PositionGetDouble(POSITION_PRICE_OPEN) && (buyStopLoss > PositionGetDouble(POSITION_SL) || PositionGetDouble(POSITION_SL) == 0)) { //--- Check buy trailing trade_object.PositionModify(ticket, buyStopLoss, PositionGetDouble(POSITION_TP)); //--- Update buy stop loss } else if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_SELL && sellStopLoss < PositionGetDouble(POSITION_PRICE_OPEN) && (sellStopLoss < PositionGetDouble(POSITION_SL) || PositionGetDouble(POSITION_SL) == 0)) { //--- Check sell trailing trade_object.PositionModify(ticket, sellStopLoss, PositionGetDouble(POSITION_TP)); //--- Update sell stop loss } } } } //--- Call the function on every tick //+------------------------------------------------------------------+ //| Expert tick function | //+------------------------------------------------------------------+ void OnTick() { if (enableTrailingStop) { //--- Check if trailing stop enabled applyTrailingStop(trailingStopPoints, obj_Trade, uniqueMagicNumber); //--- Apply trailing stop } //--- }

Here, we implement the trailing stop functionality and integrate it into the event-driven logic. First, we develop the "applyTrailingStop" function, which calculates a buy stop loss as the current bid price (SymbolInfoDouble with SYMBOL_BID) minus "trailingPoints * _Point" and a sell stop loss as the ask price ("SYMBOL_ASK") plus "trailingPoints * _Point", both normalized with NormalizeDouble to the symbol’s digits. We iterate backward through open positions using PositionsTotal, retrieving each position’s ticket with PositionGetTicket" and verifying it matches the symbol and "magicNo" (if non-zero) with the PositionGetString and "PositionGetInteger" functions.

For buy positions (POSITION_TYPE_BUY), we check if "buyStopLoss" is above the open price ("PositionGetDouble(POSITION_PRICE_OPEN)") and higher than the current stop loss or unset, updating it with "trade_object.PositionModify"; for sell positions, we ensure "sellStopLoss" is below the open price and lower than the current stop loss or unset, updating similarly. Then, in the OnTick function, we check if "enableTrailingStop" is true and call "applyTrailingStop" with "trailingStopPoints", "obj_Trade", and "uniqueMagicNumber" to manage open positions on every tick. Upon compilation, we get the following outcome.

From the image, we can see that the trailing stop is fully enabled when the price goes in our favour. Here is a unified test for both bearish and bullish breaker blocks.

From the visualization, we can see that the program identifies and verifies all the entry conditions, and if validated, opens the respective position with the respective entry parameters, hence achieving our objective. The thing that remains is backtesting the program, and that is handled in the next section.

Backtesting

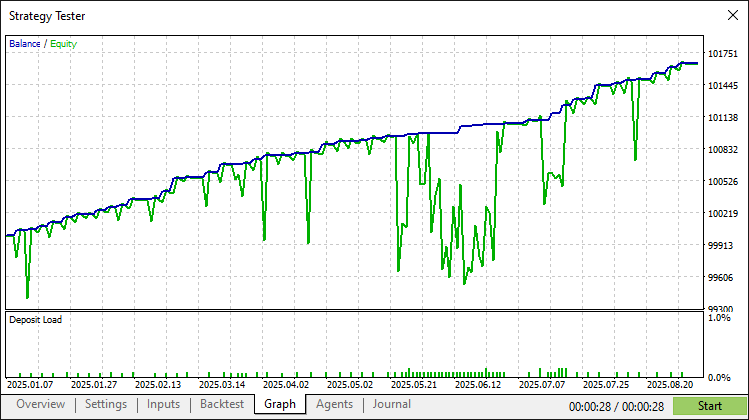

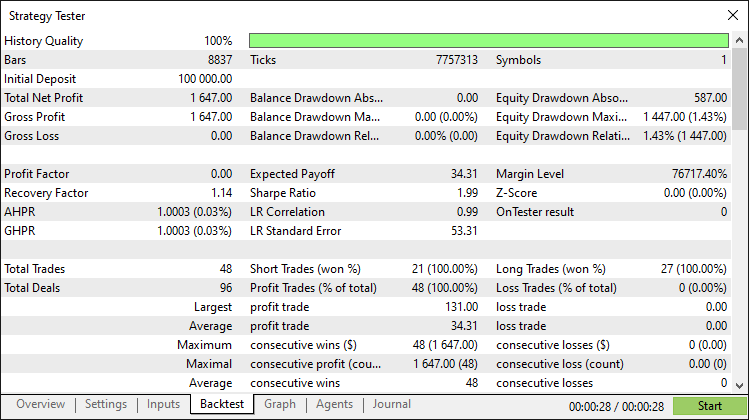

After thorough backtesting, we have the following results.

Backtest graph:

Backtest report:

Conclusion

In conclusion, we’ve created a breaker blocks trading system in MQL5 for identifying consolidation ranges, validating breaker blocks with swing points, and executing retest trades with customizable risk parameters and trailing stops. The system visualizes order and breaker blocks with dynamic labels and arrows, enhancing trade decision clarity.

Disclaimer: This article is for educational purposes only. Trading carries significant financial risks, and market volatility may result in losses. Thorough backtesting and careful risk management are crucial before deploying this program in live markets.

With this breaker block strategy, you’re equipped to capture price retest opportunities, ready for further refinement in your trading journey. Happy trading!

Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

This article was written by a user of the site and reflects their personal views. MetaQuotes Ltd is not responsible for the accuracy of the information presented, nor for any consequences resulting from the use of the solutions, strategies or recommendations described.

Visual assessment and adjustment of trading in MetaTrader 5

Visual assessment and adjustment of trading in MetaTrader 5

From Novice to Expert: Backend Operations Monitor using MQL5

From Novice to Expert: Backend Operations Monitor using MQL5

Reimagining Classic Strategies (Part 16): Double Bollinger Band Breakouts

Reimagining Classic Strategies (Part 16): Double Bollinger Band Breakouts

MQL5 Trading Tools (Part 9): Developing a First Run User Setup Wizard for Expert Advisors with Scrollable Guide

MQL5 Trading Tools (Part 9): Developing a First Run User Setup Wizard for Expert Advisors with Scrollable Guide

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

I tried adding the shared file but it is not drawing or I can say nothing is happening on chart or no trades are taken. Kindly help with execution flow.

Thanks in advance