Golden Hen EA

- Experts

- Taner Altinsoy

- Version: 2.3

- Updated: 13 December 2025

- Activations: 10

Overview

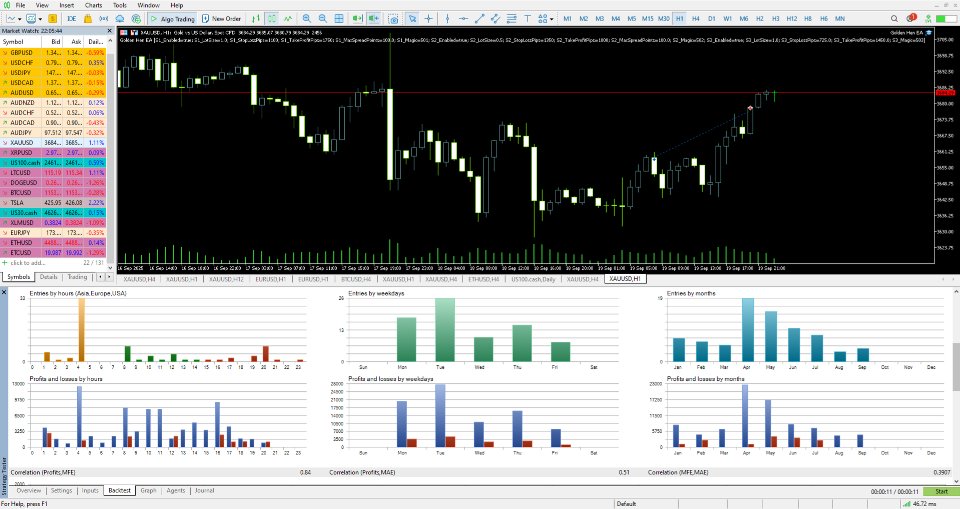

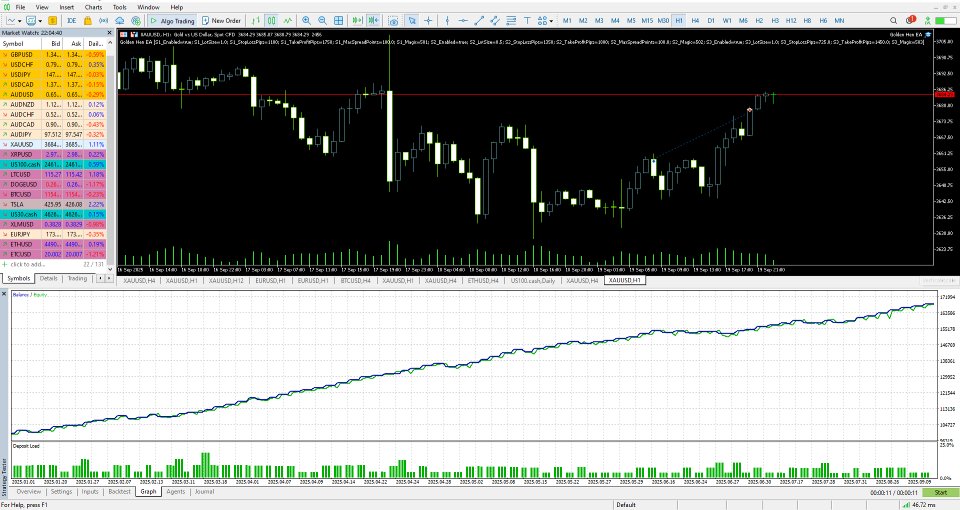

Golden Hen EA is an Expert Advisor designed specifically for XAUUSD. It operates by combining eight independent trading strategies, each triggered by different market conditions and timeframes (M5, M30, H2, H4, H6, H12).

The EA is designed to manage its entries and filters automatically. The core logic of the EA focuses on identifying specific signals. Golden Hen EA does not use grid, martingale, or averaging techniques.

All trades opened by the EA use a predefined Stop Loss and Take Profit.

Overview of the Eight Strategies

The EA analyzes the XAUUSD chart across multiple timeframes simultaneously:

-

Strategy 1 (M30): This strategy analyzes a specific sequence of recent bars to identify potential bullish reversal signals following a defined bearish pattern.

-

Strategy 2 (H4): This strategy identifies strong bullish momentum after a sustained downward trend. It uses the low of the previous H4 bar as a reference point for its analysis.

-

Strategy 3 (M30): This is a session-based strategy. It monitors price action relative to the low of an earlier trading session to identify potential entry points.

-

Strategy 4 (H2/H6): This is a trend-following strategy. It uses a trend indicator on a higher timeframe as a primary filter and seeks entry signals on a lower timeframe.

-

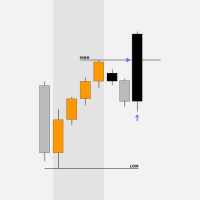

Strategy 5 (M5): This is a session breakout strategy. It identifies the high and low range of the Tokyo session and monitors for price breakouts relative to these levels during the London session.

-

Strategy 6 (H12/H4): This strategy is designed to identify major trend bottoms by monitoring extreme oversold conditions on a high timeframe. It waits for the market to show signs of being severely overextended, then looks for a specific bullish confirmation pattern to enter a BUY. This strategy is structured with a wide Take Profit target, aiming for an approximate 1:6 risk/reward ratio.

-

Strategy 7 (H2/H3): This is a 'bottom-fishing' reversal strategy. It specifically monitors price action for consolidation patterns at potential market lows, aiming to catch the early stages of a new upward trend. The strategy is structured to target a high 1:4 risk/reward ratio, maximizing potential returns relative to the risk.

- Strategy 8 (H2/H6): This is a trend-continuation strategy designed to capitalize on market momentum. It identifies a significant trend breakout and patiently waits for a corrective pullback (retracement) to validate the move before entering, ensuring a more optimal entry point.

All eight strategies are included in the EA and operate together. You can enable or disable each strategy individually via the input parameters.

Discounted price . The price will increase by $100 with every 10 purchases.

Recommended Settings:

Symbol: XAUUSD

Timeframe: Any

Leverage: Minimum 1:30

Deposit: Minimum $200

Recommended Brokers: IC Markets, Puprime, Eightcap, Pepperstone, FP Markets, FXOpen, Tickmill, Fxpro

VPS and Continuous Operation (Important)

For optimal performance, the EA requires uninterrupted 24/7 operation. Some strategies (like Strategy 4) track market conditions step-by-step. Restarting MT5 or the EA resets this internal memory, which can cause the EA to skip valid signals. Therefore, running the EA on a reliable VPS is strongly recommended.

Warning: For proper operation, please use the recommended settings. Always adjust the lot size according to your personal risk tolerance.

-

$201 - $500 Balance: 0.01 lots

-

$501 - $1,000 Balance: 0.01 - 0.02 lots

-

$1,000+ Balance: 0.01 - 0.02 lots for every $1,000 in your account

Key Features

- 8 Strategies in One EA – Short, medium, and long-term reversal signals, all working independently.

- Advanced Price Action Filters – Identifies strong market reversals with minimal false signals.

- Operates using fixed Stop Loss and Take Profit levels for better risk control.

- Fully Automated – No manual intervention required.

- XAUUSD Optimized – Developed and optimized specifically for Gold.

- Broker Friendly – Works with 4 or 5-digit brokers, ECN accounts, and supports FIFO compliance.

Risk Management

Built-in margin, lot size, and stop level validation.

Balance Protection Filter: Automatically disables all new trades if the account balance falls below a user-defined minimum monetary value, protecting your capital.

Adjustable Take Profit, lot size, and optional SL buffer for more control.

Dynamic Volatility Filter to automatically pause trading during high-risk periods, providing an essential layer of safety.

Initially, I rented this EA just to test it, and the performance was excellent, exactly the same as the backtest results. At that time, it came with 6 very good strategies, and now the author has already added 2 more (8 in total), which has made the product even better. The EA does not use grid or any kind of lot-doubling/martingale to recover losses. It is very safe, because take profit and stop loss are always placed in the market, and some of the strategies work with a risk–reward ratio around 5:1 and 4:1. The developer is very attentive and responds quickly. It is clear that he loves what he does — delivering 8 profitable and safe strategies in a single EA, with an extremely simple setup to use, without any unnecessary complications.