Quarterly Theory ICT 03 Precision Swing Points MT5

- Indicators

- Eda Kaya

- Version: 1.5

Quarterly Theory ICT 03 Precision Swing Points MT5

The Quarterly Theory ICT 03 Precision Swing Points MT5 indicator is a specialized analytical solution built on the ICT methodology for Metatrader 5.

It applies the concept of Precision Swing Points to identify potential market shifts with accuracy. By monitoring divergence and convergence patterns in candle closings between two or more correlated instruments, the indicator highlights signals using color-coded arrows directly on the chart.

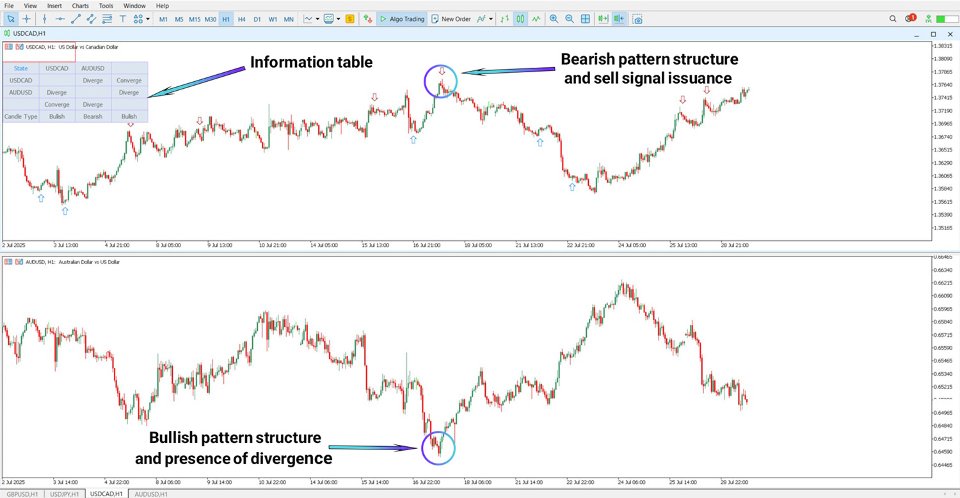

A key feature of this tool is its integrated live dashboard, which provides traders with ongoing updates regarding correlation strength and divergence status across multiple assets.

«Indicator Installation & User Guide»

Specifications of Quarterly Theory ICT 03 Precision Swing Points Indicator

| Category | ICT – Forecast Signals – Pivot/Fractal Zones |

| Platform | Metatrader 5 |

| Skill Level | Advanced |

| Indicator Type | Reversal |

| Time Frame | Multi-timeframe |

| Trading Style | Scalping – Intraday – Swing |

| Market | All Tradable Markets |

Quarterly Theory ICT 03 Indicator in Action

The Precision Swing Points structure is based on a sequence of three candles, with the central bar carrying the highest analytical weight.

- When the middle candle shows bearish behavior on the base symbol but bullish on a correlated symbol, a positive divergence forms, prompting a buy signal.

- Conversely, if the central bar appears bullish on the base asset but bearish on the correlated one, this is marked as a negative divergence, triggering a sell signal.

Buy Example

For instance, when analyzing USD/CAD as the primary instrument and AUD/USD as the correlated symbol, a bullish pattern emerges on the base chart, while the correlated chart shows bearish pressure. This mismatch creates divergence, prompting the indicator to signal a buy entry on USD/CAD.

Sell Example

In another case, comparing EUR/USD as the base symbol with USD/CHF as the correlated one, a bearish swing pattern is identified on EUR/USD, while USD/CHF shows a bullish setup. This divergence condition produces a sell signal.

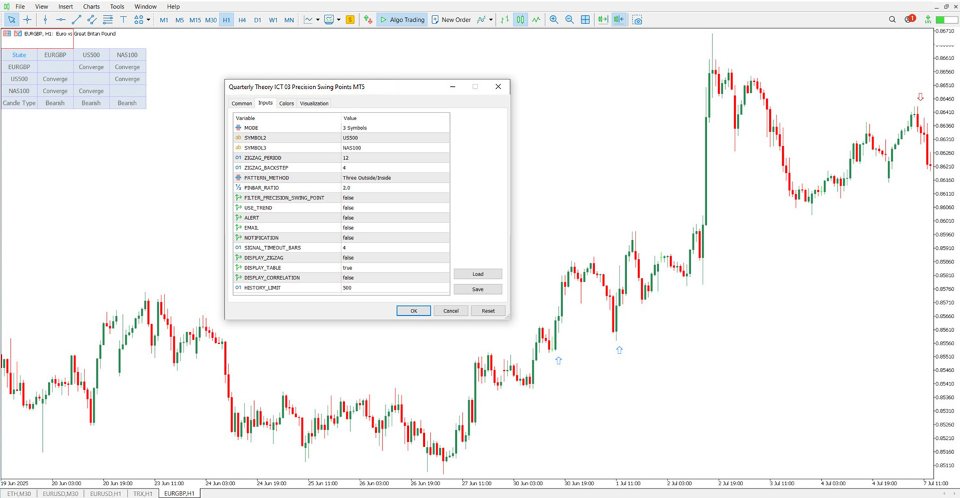

Quarterly Theory ICT 03 Precision Swing Points MT5 – Settings

- MODE – Choose comparison mode (two or three instruments)

- SYMBOL2 / SYMBOL3 – Select additional correlated assets

- ZIGZAG_PERIOD – Defines period for ZigZag calculations

- ZIGZAG_BACKSTEP – Minimum spacing between ZigZag points

- PATTERN_METHOD – Determines pattern recognition style

- PINBAR_RATIO – Validation threshold for pin bar structures

- FILTER_PRECISION_SWING_POINT – Show only highly accurate swing points

- USE_TREND – Apply trend filter to confirm signals with the broader market direction

- ALERT / EMAIL / NOTIFICATION – Multiple options for alerts and trade updates

- SIGNAL_TIMEOUT_BARS – Duration signals remain on screen

- DISPLAY_ZIGZAG – Toggle ZigZag lines on chart

- DISPLAY_TABLE – Enable/disable real-time divergence table

- DISPLAY_CORRELATION – Show asset correlation data in the dashboard

- HISTORY_LIMIT – Number of past candles to analyze

Conclusion

The Quarterly Theory ICT 03 Precision Swing Points MT5 indicator is a professional-grade tool that helps traders capture potential reversal zones through divergence analysis between two or three correlated assets.

By applying the three-candle swing point structure, the indicator generates actionable bullish or bearish trade signals on the next bar after confirmation. Alongside this, the live data panel enhances decision-making by presenting up-to-date information on divergence patterns and candlestick behavior.