Traditional MACD Indicator MT4

- Indicators

- Eda Kaya

- Version: 2.1

Traditional MACD Indicator for MT4

The Traditional MACD Indicator for MT4 is a fundamental component in the field of technical analysis. This MetaTrader 4 oscillator aids traders in recognizing trend momentum, directional bias, and actionable buy/sell setups.

The indicator integrates two moving averages alongside a histogram, operating as a classic version of the MACD. Trading signals arise from divergences and the interplay between the moving averages and the histogram, enhancing the accuracy of trend assessments.

«Indicator Installation & User Guide»

MT4 Indicator Installation | Traditional MACD Indicator MT5 | ALL Products By TradingFinderLab | Best MT4 Indicator: Refined Order Block Indicator for MT4 | Best MT4 Utility: Trade Assistant Expert TF MT4 | TP & SL Tool: Risk Reward Ratio Calculator RRR MT4 | Prop Firm Protector: Prop Draw Down Protector Expert Advisor MT4 | Money Management: Easy Trade Manager MT4

Specifications of the Traditional MACD Indicator

The table below summarizes the main specifications of the Traditional MACD Indicator for MT4:

| Category | Oscillator - Signal & Forecast - Currency Strength |

| Platform | MetaTrader 4 |

| Skill Level | Beginner |

| Indicator Type | Reversal - Leading |

| Time Frame | Multi-Timeframe |

| Trading Style | Scalping - Day Trading - Intraday Trading |

| Markets | Forex - Cryptocurrencies - Indices |

Overview of the Traditional MACD Indicator

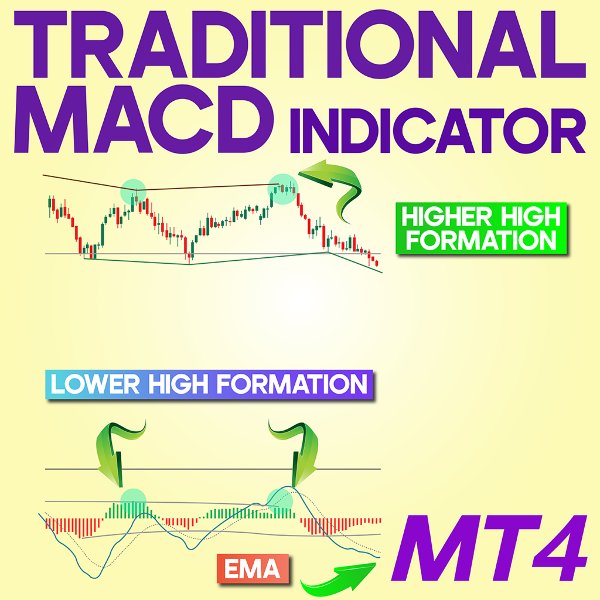

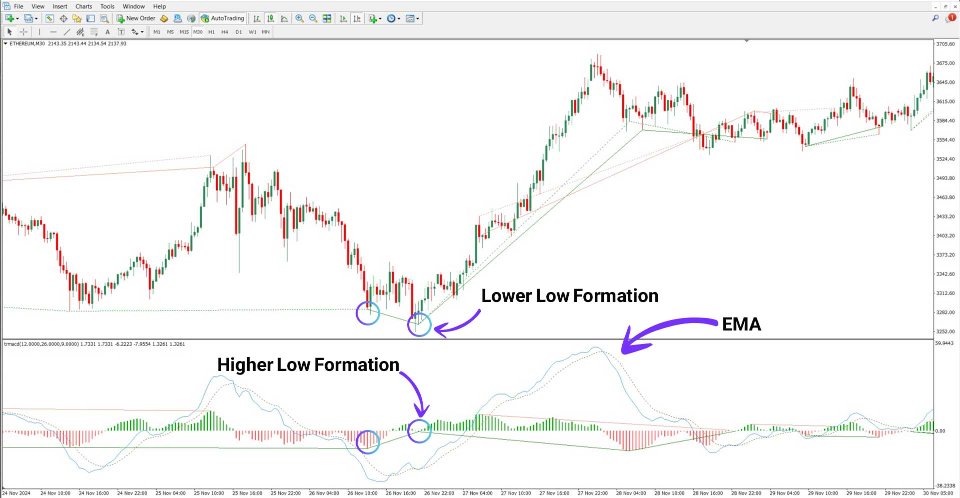

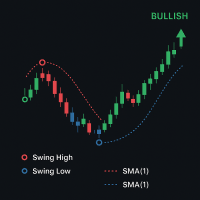

The Traditional MACD Indicator for MT4 displays a histogram that incorporates hidden divergence lines between price candles. When the moving average lines fall beneath the histogram, it suggests bearish pressure. Conversely, if the moving averages rise above the histogram, it signals potential bullish activity.

Buy Signal

The accompanying chart example illustrates divergence between candlesticks and the MACD histogram. While price action marks lower lows, the histogram depicts higher lows. Simultaneously, the moving averages cross above the histogram, remaining in the positive territory, confirming a long entry setup.

Sell Signal

On the EUR/USD one-hour timeframe, a higher high forms in price while the histogram records a lower high. The moving averages shift below the histogram at this stage. Such divergence represents a classic sell signal, guiding traders towards short opportunities.

Traditional MACD Indicator Settings

The customizable settings available within the Traditional MACD Indicator for MT4 include:

- FAST_EMA: Sets the fast-moving average calculation period.

- SLOW_EMA: Sets the slow-moving average calculation period.

- SIGNAL: Computes the signal line component.

- LOOKBACK_LIMIT: Determines the historical candlesticks count for calculations.

- DIVERGENCE_LINES: Toggles the visibility of divergence lines on the chart.

Conclusion

The Traditional MACD Indicator for MT4 is an effective tool for detecting divergences, trend shifts, and strategic trade entries. By plotting hidden divergences between candles and histogram bars, along with tracking moving average positioning, this MetaTrader 4 oscillator serves as an essential resource for traders across various market environments.