Automating Trading Strategies in MQL5 (Part 36): Supply and Demand Trading with Retest and Impulse Model

Introduction

In our previous article (Part 35), we developed a Breaker Block Trading System in MetaQuotes Language 5 (MQL5) that identified consolidation ranges, validated breaker blocks with swing points, and traded retests with customizable risk parameters and visual feedback. In Part 36, we develop a Supply and Demand Trading System utilizing a retest and impulse model. This model detects supply and demand zones through consolidation, validates them with impulsive moves, and executes trades on retests with trend confirmation and dynamic chart visualizations. We will cover the following topics:

By the end, you’ll have a functional MQL5 strategy for trading supply and demand zone retests, ready for customization—let’s dive in!

Understanding the Supply and Demand Strategy Framework

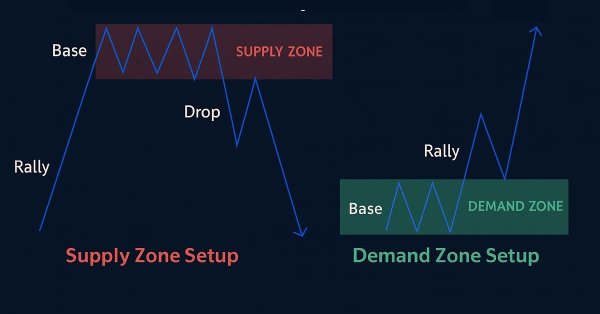

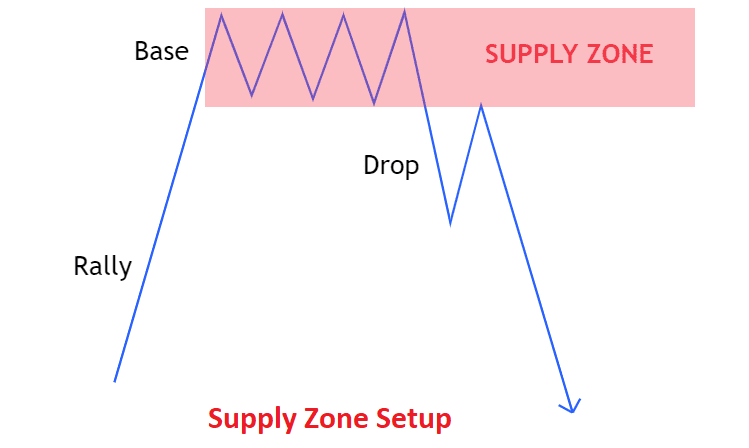

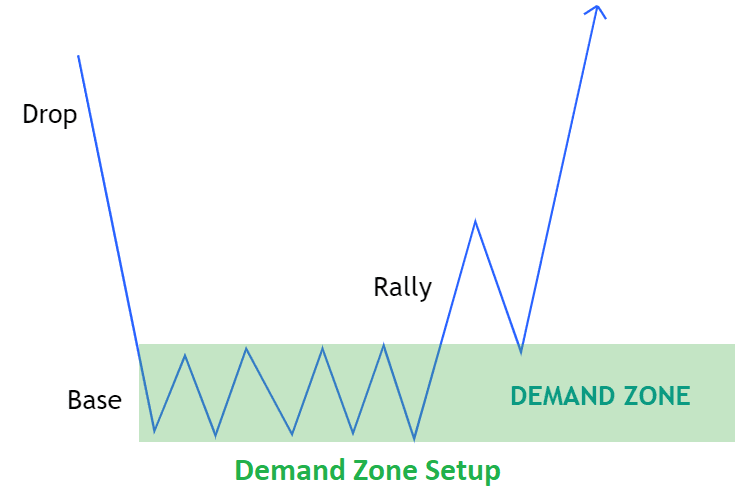

The supply and demand strategy identifies key price zones where significant buying (demand) or selling (supply) has occurred, typically after periods of consolidation. After an impulsive price move confirms a zone's validity, traders aim to trade its retest. They may enter buy trades when price revisits a demand zone in a downtrend, or initiate sell trades at a supply zone in an uptrend, expecting a bounce. By defining risk and reward levels, traders capitalize on high-probability setups. Have a look below at the different setups we could have.

Supply Zone Setup:

Demand Zone Setup:

Our plan is to detect consolidation ranges over a set number of bars, validate zones with impulsive moves using a multiplier-based threshold, and confirm trade entries with optional trend checks. We will implement logic to track zone status, execute trades on retests with customizable stop-loss and take-profit settings, and visualize zones with dynamic labels and colors, creating a system for precise supply and demand trading. In brief, here is a visual representation of our objectives.

Implementation in MQL5

To create the program in MQL5, open the MetaEditor, go to the Navigator, locate the Experts folder, click on the "New" tab, and follow the prompts to create the file. Once it is made, in the coding environment, we will need to declare some input parameters and global variables that we will use throughout the program.

//+------------------------------------------------------------------+ //| Supply and Demand EA.mq5 | //| Copyright 2025, Allan Munene Mutiiria. | //| https://t.me/Forex_Algo_Trader | //+------------------------------------------------------------------+ #property copyright "Forex Algo-Trader, Allan" #property link "https://t.me/Forex_Algo_Trader" #property version "1.00" #property strict #include <Trade/Trade.mqh> //--- Include Trade library for position management CTrade obj_Trade; //--- Instantiate trade object for order operations

We begin the implementation by including the trade library with "#include <Trade/Trade.mqh>", which provides built-in functions for managing trade operations. We then initialize the trade object "obj_Trade" using the CTrade class, allowing the Expert Advisor to execute buy and sell orders programmatically. This setup will ensure that trade execution is handled efficiently without requiring manual intervention. Then we can declare some enumerations that will enable classification of some user inputs.

//+------------------------------------------------------------------+ //| Enum for trading tested zones | //+------------------------------------------------------------------+ enum TradeTestedZonesMode { // Define modes for trading tested zones NoRetrade, // Trade zones only once LimitedRetrade, // Trade zones up to a maximum number of times UnlimitedRetrade // Trade zones as long as they are valid }; //+------------------------------------------------------------------+ //| Enum for broken zones validation | //+------------------------------------------------------------------+ enum BrokenZonesMode { // Define modes for broken zones validation AllowBroken, // Zones can be marked as broken NoBroken // Zones remain testable regardless of price break }; //+------------------------------------------------------------------+ //| Enum for zone size restriction | //+------------------------------------------------------------------+ enum ZoneSizeMode { // Define modes for zone size restrictions NoRestriction, // No restriction on zone size EnforceLimits // Enforce minimum and maximum zone points }; //+------------------------------------------------------------------+ //| Enum for trend confirmation | //+------------------------------------------------------------------+ enum TrendConfirmationMode { // Define modes for trend confirmation NoConfirmation, // No trend confirmation required ConfirmTrend // Confirm trend before trading on tap };

We forward declare some key enumerations to configure trading behavior and zone validation. First, we create the "TradeTestedZonesMode" enum with options: "NoRetrade" (trade zones once), "LimitedRetrade" (trade up to a set limit), and "UnlimitedRetrade" (trade while valid), which control how often zones can be traded. Then, we define the "BrokenZonesMode" enum with "AllowBroken" (mark zones as broken if price breaches them) and "NoBroken" (keep zones testable), determining zone validity after breakouts. Next, we implement the "ZoneSizeMode" enum with "NoRestriction" (no size limits) and "EnforceLimits" (restrict zone size within bounds), ensuring zones meet size criteria.

Finally, we add the "TrendConfirmationMode" enum with "NoConfirmation" (no trend check) and "ConfirmTrend" (require trend validation), enabling optional trend-based trade filtering. This will make the system have a flexible configuration for zone trading and validation rules. We can use these enumerations to create our user inputs.

//+------------------------------------------------------------------+ //| Input Parameters | //+------------------------------------------------------------------+ input double tradeLotSize = 0.01; // Trade size in lots input bool enableTrading = true; // Enable automated trading input bool enableTrailingStop = true; // Enable trailing stop input double trailingStopPoints = 30; // Trailing stop points input double minProfitToTrail = 50; // Minimum trailing points input int uniqueMagicNumber = 12345; // Magic Number input int consolidationBars = 5; // Consolidation range bars input double maxConsolidationSpread = 30; // Maximum allowed spread in points for consolidation input double stopLossDistance = 200; // Stop loss in points input double takeProfitDistance = 400; // Take profit in points input double minMoveAwayPoints = 50; // Minimum points price must move away before zone is ready input bool deleteBrokenZonesFromChart = false; // Delete broken zones from chart input bool deleteExpiredZonesFromChart = false; // Delete expired zones from chart input int zoneExtensionBars = 150; // Number of bars to extend zones to the right input bool enableImpulseValidation = true; // Enable impulse move validation input int impulseCheckBars = 3; // Number of bars to check for impulsive move input double impulseMultiplier = 1.0; // Multiplier for impulsive threshold input TradeTestedZonesMode tradeTestedMode = NoRetrade; // Mode for trading tested zones input int maxTradesPerZone = 2; // Maximum trades per zone for LimitedRetrade input BrokenZonesMode brokenZoneMode = AllowBroken; // Mode for broken zones validation input color demandZoneColor = clrBlue; // Color for untested demand zones input color supplyZoneColor = clrRed; // Color for untested supply zones input color testedDemandZoneColor = clrBlueViolet; // Color for tested demand zones input color testedSupplyZoneColor = clrOrange; // Color for tested supply zones input color brokenZoneColor = clrDarkGray; // Color for broken zones input color labelTextColor = clrBlack; // Color for text labels input ZoneSizeMode zoneSizeRestriction = NoRestriction; // Zone size restriction mode input double minZonePoints = 50; // Minimum zone size in points input double maxZonePoints = 300; // Maximum zone size in points input TrendConfirmationMode trendConfirmation = NoConfirmation; // Trend confirmation mode input int trendLookbackBars = 10; // Number of bars for trend confirmation input double minTrendPoints = 1; // Minimum points for trend confirmation

Here, we establish the configuration input parameters for our system to define its trading and visualization behavior. We have added self-explanatory comments to make everything easy and straightforward. Finally, since we will be managing several supply and demand zones, we need to declare a structure where we will store the zones' information for ease of management.

//+------------------------------------------------------------------+ //| Structure for zone information | //+------------------------------------------------------------------+ struct SDZone { //--- Define structure for supply/demand zones double high; //--- Store zone high price double low; //--- Store zone low price datetime startTime; //--- Store zone start time datetime endTime; //--- Store zone end time datetime breakoutTime; //--- Store breakout time bool isDemand; //--- Indicate demand (true) or supply (false) bool tested; //--- Track if zone was tested bool broken; //--- Track if zone was broken bool readyForTest; //--- Track if zone is ready for testing int tradeCount; //--- Track number of trades on zone string name; //--- Store zone object name }; //+------------------------------------------------------------------+ //| Global variables | //+------------------------------------------------------------------+ SDZone zones[]; //--- Store active supply/demand zones SDZone potentialZones[]; //--- Store potential zones awaiting validation int maxZones = 50; //--- Set maximum number of zones to track //+------------------------------------------------------------------+ //| Expert initialization function | //+------------------------------------------------------------------+ int OnInit() { obj_Trade.SetExpertMagicNumber(uniqueMagicNumber); //--- Set magic number for trade identification return(INIT_SUCCEEDED); //--- Return initialization success } //+------------------------------------------------------------------+ //| Expert deinitialization function | //+------------------------------------------------------------------+ void OnDeinit(const int reason) { ObjectsDeleteAll(0, "SDZone_"); //--- Remove all zone objects from chart ChartRedraw(0); //--- Redraw chart to clear objects }

First, we create the "SDZone" structure to store zone details, including high and low prices, start, end, and breakout times, flags for demand/supply type ("isDemand"), tested status ("tested"), broken status ("broken"), readiness for testing ("readyForTest"), trade count ("tradeCount"), and object name ("name"). Then, we initialize global variables: "zones" array to hold active supply and demand zones, "potentialZones" array for zones awaiting validation, and "maxZones" set to 50 to limit tracked zones. You can increase or decrease this value based on your timeframe and settings; we just chose an arbitrary standard value.

In the OnInit event handler, we call "SetExpertMagicNumber" on "obj_Trade" with "uniqueMagicNumber" to tag trades and return INIT_SUCCEEDED for successful initialization. In the OnDeinit function, we use ObjectsDeleteAll to remove all chart objects with the "SDZone_" prefix, as we will be naming all our objects with this prefix, and call ChartRedraw to refresh the chart, ensuring clean resource cleanup. We can now define some helper functions that will help us detect and manage the zones. We will start with the logic that will detect the zones, but first, let us have a helper function that will help in debugging the zones.

//+------------------------------------------------------------------+ //| Print zones for debugging | //+------------------------------------------------------------------+ void PrintZones(SDZone &arr[]) { Print("Current zones count: ", ArraySize(arr)); //--- Log total number of zones for (int i = 0; i < ArraySize(arr); i++) { //--- Iterate through zones Print("Zone ", i, ": ", arr[i].name, " endTime: ", TimeToString(arr[i].endTime)); //--- Log zone details } }

To monitor zone states, we develop the "PrintZones" function, which takes an "SDZone" array, logs the total number of zones using Print with ArraySize, and iterates through the array to log each zone’s index, name, and end time with "Print" and TimeToString for clear tracking. We can now develop the core logic to detect the zones.

//+------------------------------------------------------------------+ //| Detect supply and demand zones | //+------------------------------------------------------------------+ void DetectZones() { int startIndex = consolidationBars + 1; //--- Set start index for consolidation check if (iBars(_Symbol, _Period) < startIndex + 1) return; //--- Exit if insufficient bars bool isConsolidated = true; //--- Assume consolidation double highPrice = iHigh(_Symbol, _Period, startIndex); //--- Initialize high price double lowPrice = iLow(_Symbol, _Period, startIndex); //--- Initialize low price for (int i = startIndex - 1; i >= 2; i--) { //--- Iterate through consolidation bars highPrice = MathMax(highPrice, iHigh(_Symbol, _Period, i)); //--- Update highest high lowPrice = MathMin(lowPrice, iLow(_Symbol, _Period, i)); //--- Update lowest low if (highPrice - lowPrice > maxConsolidationSpread * _Point) { //--- Check spread limit isConsolidated = false; //--- Mark as not consolidated break; //--- Exit loop } } if (isConsolidated) { //--- Confirm consolidation double closePrice = iClose(_Symbol, _Period, 1); //--- Get last closed bar price double breakoutLow = iLow(_Symbol, _Period, 1); //--- Get breakout bar low double breakoutHigh = iHigh(_Symbol, _Period, 1); //--- Get breakout bar high bool isDemandZone = closePrice > highPrice && breakoutLow >= lowPrice; //--- Check demand zone bool isSupplyZone = closePrice < lowPrice && breakoutHigh <= highPrice; //--- Check supply zone if (isDemandZone || isSupplyZone) { //--- Validate zone type double zoneSize = (highPrice - lowPrice) / _Point; //--- Calculate zone size if (zoneSizeRestriction == EnforceLimits && (zoneSize < minZonePoints || zoneSize > maxZonePoints)) return; //--- Check size restrictions datetime lastClosedBarTime = iTime(_Symbol, _Period, 1); //--- Get last bar time bool overlaps = false; //--- Initialize overlap flag for (int j = 0; j < ArraySize(zones); j++) { //--- Check existing zones if (lastClosedBarTime < zones[j].endTime) { //--- Check time overlap double maxLow = MathMax(lowPrice, zones[j].low); //--- Find max low double minHigh = MathMin(highPrice, zones[j].high); //--- Find min high if (maxLow <= minHigh) { //--- Check price overlap overlaps = true; //--- Mark as overlapping break; //--- Exit loop } } } bool duplicate = false; //--- Initialize duplicate flag for (int j = 0; j < ArraySize(zones); j++) { //--- Check for duplicates if (lastClosedBarTime < zones[j].endTime) { //--- Check time if (MathAbs(zones[j].high - highPrice) < _Point && MathAbs(zones[j].low - lowPrice) < _Point) { //--- Check price match duplicate = true; //--- Mark as duplicate break; //--- Exit loop } } } if (overlaps || duplicate) return; //--- Skip overlapping or duplicate zones if (enableImpulseValidation) { //--- Check impulse validation bool pot_overlaps = false; //--- Initialize potential overlap flag for (int j = 0; j < ArraySize(potentialZones); j++) { //--- Check potential zones if (lastClosedBarTime < potentialZones[j].endTime) { //--- Check time overlap double maxLow = MathMax(lowPrice, potentialZones[j].low); //--- Find max low double minHigh = MathMin(highPrice, potentialZones[j].high); //--- Find min high if (maxLow <= minHigh) { //--- Check price overlap pot_overlaps = true; //--- Mark as overlapping break; //--- Exit loop } } } bool pot_duplicate = false; //--- Initialize potential duplicate flag for (int j = 0; j < ArraySize(potentialZones); j++) { //--- Check potential duplicates if (lastClosedBarTime < potentialZones[j].endTime) { //--- Check time if (MathAbs(potentialZones[j].high - highPrice) < _Point && MathAbs(potentialZones[j].low - lowPrice) < _Point) { //--- Check price match pot_duplicate = true; //--- Mark as duplicate break; //--- Exit loop } } } if (pot_overlaps || pot_duplicate) return; //--- Skip overlapping or duplicate potential zones int potCount = ArraySize(potentialZones); //--- Get potential zones count ArrayResize(potentialZones, potCount + 1); //--- Resize potential zones array potentialZones[potCount].high = highPrice; //--- Set zone high potentialZones[potCount].low = lowPrice; //--- Set zone low potentialZones[potCount].startTime = iTime(_Symbol, _Period, startIndex); //--- Set start time potentialZones[potCount].endTime = TimeCurrent() + PeriodSeconds(_Period) * zoneExtensionBars; //--- Set end time potentialZones[potCount].breakoutTime = iTime(_Symbol, _Period, 1); //--- Set breakout time potentialZones[potCount].isDemand = isDemandZone; //--- Set zone type potentialZones[potCount].tested = false; //--- Set untested potentialZones[potCount].broken = false; //--- Set not broken potentialZones[potCount].readyForTest = false; //--- Set not ready potentialZones[potCount].tradeCount = 0; //--- Initialize trade count potentialZones[potCount].name = "PotentialZone_" + TimeToString(potentialZones[potCount].startTime, TIME_DATE|TIME_SECONDS); //--- Set zone name Print("Potential zone created: ", (isDemandZone ? "Demand" : "Supply"), " at ", lowPrice, " - ", highPrice, " endTime: ", TimeToString(potentialZones[potCount].endTime)); //--- Log potential zone } else { //--- No impulse validation int zoneCount = ArraySize(zones); //--- Get zones count if (zoneCount >= maxZones) { //--- Check max zones limit ArrayRemove(zones, 0, 1); //--- Remove oldest zone zoneCount--; //--- Decrease count } ArrayResize(zones, zoneCount + 1); //--- Resize zones array zones[zoneCount].high = highPrice; //--- Set zone high zones[zoneCount].low = lowPrice; //--- Set zone low zones[zoneCount].startTime = iTime(_Symbol, _Period, startIndex); //--- Set start time zones[zoneCount].endTime = TimeCurrent() + PeriodSeconds(_Period) * zoneExtensionBars; //--- Set end time zones[zoneCount].breakoutTime = iTime(_Symbol, _Period, 1); //--- Set breakout time zones[zoneCount].isDemand = isDemandZone; //--- Set zone type zones[zoneCount].tested = false; //--- Set untested zones[zoneCount].broken = false; //--- Set not broken zones[zoneCount].readyForTest = false; //--- Set not ready zones[zoneCount].tradeCount = 0; //--- Initialize trade count zones[zoneCount].name = "SDZone_" + TimeToString(zones[zoneCount].startTime, TIME_DATE|TIME_SECONDS); //--- Set zone name Print("Zone created: ", (isDemandZone ? "Demand" : "Supply"), " zone: ", zones[zoneCount].name, " at ", lowPrice, " - ", highPrice, " endTime: ", TimeToString(zones[zoneCount].endTime)); //--- Log zone creation PrintZones(zones); //--- Print zones for debugging } } } }

Here, we implement the zone detection logic for our system. In the "DetectZones" function, we set "startIndex" to "consolidationBars + 1", exiting if insufficient bars exist via the iBars function. We assume consolidation ("isConsolidated" true), initialize "highPrice" and "lowPrice" with iHigh and iLow at "startIndex", and iterate backward through bars, updating with MathMax and MathMin, marking "isConsolidated" false if the range exceeds "maxConsolidationSpread * Point". If consolidated, we check the last bar’s close ("iClose"), low ("iLow"), and high ("iHigh") to identify demand ("closePrice > highPrice" and "breakoutLow >= lowPrice") or supply zones ("closePrice < lowPrice" and "breakoutHigh <= highPrice").

For valid zones, we verify size restrictions with "zoneSizeRestriction" and "minZonePoints"/"maxZonePoints", check for overlaps or duplicates in "zones" and "potentialZones" using "MathMax" and "MathMin", and, if "enableImpulseValidation" is true, add to "potentialZones" with ArrayResize, setting fields like "high", "low", "startTime" (iTime), "endTime" ("TimeCurrent + zoneExtensionBars"), and "name" ("PotentialZone"), logging with "Print"; otherwise, we add directly to "zones", removing the oldest if "maxZones" is reached, and log with "Print" and "PrintZones" for debugging so we keep track of our zones, hence creating the core logic for detecting and storing supply and demand zones. We can run this in the OnInit event handler to detect the zones.

//+------------------------------------------------------------------+ //| Expert tick function | //+------------------------------------------------------------------+ void OnTick() { static datetime lastBarTime = 0; //--- Store last processed bar time datetime currentBarTime = iTime(_Symbol, _Period, 0); //--- Get current bar time bool isNewBar = (currentBarTime != lastBarTime); //--- Check for new bar if (isNewBar) { //--- Process new bar lastBarTime = currentBarTime; //--- Update last bar time DetectZones(); //--- Detect new zones } }

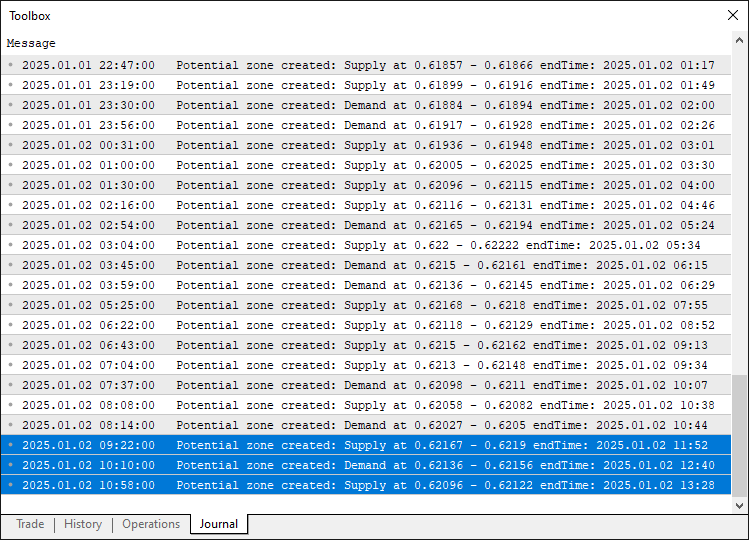

In the OnTick event handler, we track new bars by comparing the current bar’s time from iTime (for the symbol and period at shift 0) with a static "lastBarTime", setting "isNewBar" to true, and updating "lastBarTime" if different. If a new bar is detected, we call our function, "DetectZones", to identify new supply and demand zones based on consolidation patterns. We are now able to detect the zones as below.

Now that we can detect potential supply and demand zones, we just have to validate them via the rally up or down movements, which we will refer to as impulse movements. For modularization, we can have the entire logic in a function.

//+------------------------------------------------------------------+ //| Validate potential zones based on impulsive move | //+------------------------------------------------------------------+ void ValidatePotentialZones() { datetime lastClosedBarTime = iTime(_Symbol, _Period, 1); //--- Get last closed bar time for (int p = ArraySize(potentialZones) - 1; p >= 0; p--) { //--- Iterate potential zones backward if (lastClosedBarTime >= potentialZones[p].endTime) { //--- Check for expired zone Print("Potential zone expired and removed from array: ", potentialZones[p].name, " endTime: ", TimeToString(potentialZones[p].endTime)); //--- Log expiration ArrayRemove(potentialZones, p, 1); //--- Remove expired zone continue; //--- Skip to next } if (TimeCurrent() > potentialZones[p].breakoutTime + impulseCheckBars * PeriodSeconds(_Period)) { //--- Check impulse window bool isImpulsive = false; //--- Initialize impulsive flag int breakoutShift = iBarShift(_Symbol, _Period, potentialZones[p].breakoutTime, false); //--- Get breakout bar shift double range = potentialZones[p].high - potentialZones[p].low; //--- Calculate zone range double threshold = range * impulseMultiplier; //--- Calculate impulse threshold for (int shift = 1; shift <= impulseCheckBars; shift++) { //--- Check bars after breakout if (shift + breakoutShift >= iBars(_Symbol, _Period)) continue; //--- Skip out-of-bounds double cl = iClose(_Symbol, _Period, shift); //--- Get close price if (potentialZones[p].isDemand) { //--- Check demand zone if (cl >= potentialZones[p].high + threshold) { //--- Check bullish impulse isImpulsive = true; //--- Set impulsive flag break; //--- Exit loop } } else { //--- Check supply zone if (cl <= potentialZones[p].low - threshold) { //--- Check bearish impulse isImpulsive = true; //--- Set impulsive flag break; //--- Exit loop } } } if (isImpulsive) { //--- Process impulsive zone double zoneSize = (potentialZones[p].high - potentialZones[p].low) / _Point; //--- Calculate zone size if (zoneSizeRestriction == EnforceLimits && (zoneSize < minZonePoints || zoneSize > maxZonePoints)) { //--- Check size limits ArrayRemove(potentialZones, p, 1); //--- Remove invalid zone continue; //--- Skip to next } bool overlaps = false; //--- Initialize overlap flag for (int j = 0; j < ArraySize(zones); j++) { //--- Check existing zones if (lastClosedBarTime < zones[j].endTime) { //--- Check time overlap double maxLow = MathMax(potentialZones[p].low, zones[j].low); //--- Find max low double minHigh = MathMin(potentialZones[p].high, zones[j].high); //--- Find min high if (maxLow <= minHigh) { //--- Check price overlap overlaps = true; //--- Mark as overlapping break; //--- Exit loop } } } bool duplicate = false; //--- Initialize duplicate flag for (int j = 0; j < ArraySize(zones); j++) { //--- Check for duplicates if (lastClosedBarTime < zones[j].endTime) { //--- Check time if (MathAbs(zones[j].high - potentialZones[p].high) < _Point && MathAbs(zones[j].low - potentialZones[p].low) < _Point) { //--- Check price match duplicate = true; //--- Mark as duplicate break; //--- Exit loop } } } if (overlaps || duplicate) { //--- Check overlap or duplicate Print("Validated zone overlaps or duplicates, discarded: ", potentialZones[p].low, " - ", potentialZones[p].high); //--- Log discard ArrayRemove(potentialZones, p, 1); //--- Remove zone continue; //--- Skip to next } int zoneCount = ArraySize(zones); //--- Get zones count if (zoneCount >= maxZones) { //--- Check max zones limit ArrayRemove(zones, 0, 1); //--- Remove oldest zone zoneCount--; //--- Decrease count } ArrayResize(zones, zoneCount + 1); //--- Resize zones array zones[zoneCount] = potentialZones[p]; //--- Copy potential zone zones[zoneCount].name = "SDZone_" + TimeToString(zones[zoneCount].startTime, TIME_DATE|TIME_SECONDS); //--- Set zone name zones[zoneCount].endTime = TimeCurrent() + PeriodSeconds(_Period) * zoneExtensionBars; //--- Update end time Print("Zone validated: ", (zones[zoneCount].isDemand ? "Demand" : "Supply"), " zone: ", zones[zoneCount].name, " at ", zones[zoneCount].low, " - ", zones[zoneCount].high, " endTime: ", TimeToString(zones[zoneCount].endTime)); //--- Log validation ArrayRemove(potentialZones, p, 1); //--- Remove validated zone PrintZones(zones); //--- Print zones for debugging } else { //--- Zone not impulsive Print("Potential zone not impulsive, discarded: ", potentialZones[p].low, " - ", potentialZones[p].high); //--- Log discard ArrayRemove(potentialZones, p, 1); //--- Remove non-impulsive zone } } } }

Here, we create a function to implement the validation logic for potential supply and demand zones. In the "ValidatePotentialZones" function, we iterate backward through "potentialZones", checking if the last closed bar’s time (iTime at shift 1) exceeds a zone’s "endTime", removing expired zones with ArrayRemove, and logging the action. For zones within the impulse window ("TimeCurrent > breakoutTime + impulseCheckBars * PeriodSeconds"), we calculate the zone range ("high - low") and impulse threshold ("range * impulseMultiplier"), then check bars after the breakout (iBarShift) for a close price (iClose) exceeding the high plus threshold for demand zones or below the low minus threshold for supply zones, setting "isImpulsive" if met.

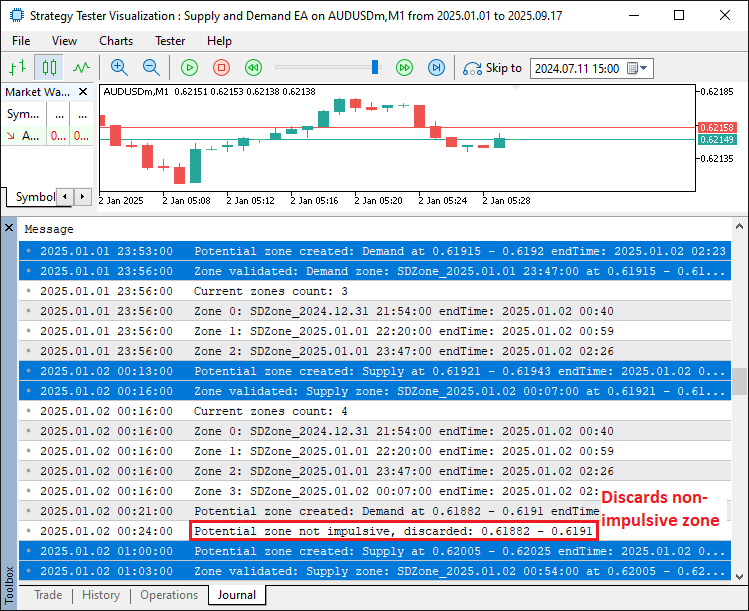

If impulsive, we verify zone size against "minZonePoints" and "maxZonePoints" if "zoneSizeRestriction" is "EnforceLimits", check for overlaps or duplicates in "zones" using MathMax and MathMin, and, if valid, move the zone to "zones" with ArrayResize, updating its name to "SDZone_" and end time, logging with the "Print" and "PrintZones" functions, then remove it from "potentialZones"; non-impulsive zones are discarded with ArrayRemove and logged, creating a system for validating zones based on impulsive moves and ensuring unique, valid zones. When you call the function in the tick event handler, you should get something that depicts the following.

Now that we can validate the zones, let us manage and visualize the zones on the chart for easier tracking.

//+------------------------------------------------------------------+ //| Update and draw zones | //+------------------------------------------------------------------+ void UpdateZones() { datetime lastClosedBarTime = iTime(_Symbol, _Period, 1); //--- Get last closed bar time for (int i = ArraySize(zones) - 1; i >= 0; i--) { //--- Iterate zones backward if (lastClosedBarTime >= zones[i].endTime) { //--- Check for expired zone Print("Zone expired and removed from array: ", zones[i].name, " endTime: ", TimeToString(zones[i].endTime)); //--- Log expiration if (deleteExpiredZonesFromChart) { //--- Check if deleting expired ObjectDelete(0, zones[i].name); //--- Delete zone rectangle ObjectDelete(0, zones[i].name + "Label"); //--- Delete zone label } ArrayRemove(zones, i, 1); //--- Remove expired zone continue; //--- Skip to next } bool wasReady = zones[i].readyForTest; //--- Store previous ready status if (!zones[i].readyForTest) { //--- Check if not ready double currentClose = iClose(_Symbol, _Period, 1); //--- Get current close double zoneLevel = zones[i].isDemand ? zones[i].high : zones[i].low; //--- Get zone level double distance = zones[i].isDemand ? (currentClose - zoneLevel) : (zoneLevel - currentClose); //--- Calculate distance if (distance > minMoveAwayPoints * _Point) { //--- Check move away distance zones[i].readyForTest = true; //--- Set ready for test } } if (!wasReady && zones[i].readyForTest) { //--- Check if newly ready Print("Zone ready for test: ", zones[i].name); //--- Log ready status } if (brokenZoneMode == AllowBroken && !zones[i].tested) { //--- Check if breakable double currentClose = iClose(_Symbol, _Period, 1); //--- Get current close bool wasBroken = zones[i].broken; //--- Store previous broken status if (zones[i].isDemand) { //--- Check demand zone if (currentClose < zones[i].low) { //--- Check if broken zones[i].broken = true; //--- Mark as broken } } else { //--- Check supply zone if (currentClose > zones[i].high) { //--- Check if broken zones[i].broken = true; //--- Mark as broken } } if (!wasBroken && zones[i].broken) { //--- Check if newly broken Print("Zone broken in UpdateZones: ", zones[i].name); //--- Log broken zone ObjectSetInteger(0, zones[i].name, OBJPROP_COLOR, brokenZoneColor); //--- Update zone color string labelName = zones[i].name + "Label"; //--- Get label name string labelText = zones[i].isDemand ? "Demand Zone (Broken)" : "Supply Zone (Broken)"; //--- Set broken label ObjectSetString(0, labelName, OBJPROP_TEXT, labelText); //--- Update label text if (deleteBrokenZonesFromChart) { //--- Check if deleting broken ObjectDelete(0, zones[i].name); //--- Delete zone rectangle ObjectDelete(0, labelName); //--- Delete zone label } } } if (ObjectFind(0, zones[i].name) >= 0 || (!zones[i].broken || !deleteBrokenZonesFromChart)) { //--- Check if drawable color zoneColor; //--- Initialize zone color if (zones[i].tested) { //--- Check if tested zoneColor = zones[i].isDemand ? testedDemandZoneColor : testedSupplyZoneColor; //--- Set tested color } else if (zones[i].broken) { //--- Check if broken zoneColor = brokenZoneColor; //--- Set broken color } else { //--- Untested zone zoneColor = zones[i].isDemand ? demandZoneColor : supplyZoneColor; //--- Set untested color } ObjectCreate(0, zones[i].name, OBJ_RECTANGLE, 0, zones[i].startTime, zones[i].high, zones[i].endTime, zones[i].low); //--- Create zone rectangle ObjectSetInteger(0, zones[i].name, OBJPROP_COLOR, zoneColor); //--- Set zone color ObjectSetInteger(0, zones[i].name, OBJPROP_FILL, true); //--- Enable fill ObjectSetInteger(0, zones[i].name, OBJPROP_BACK, true); //--- Set to background string labelName = zones[i].name + "Label"; //--- Generate label name string labelText = zones[i].isDemand ? "Demand Zone" : "Supply Zone"; //--- Set base label if (zones[i].tested) labelText += " (Tested)"; //--- Append tested status else if (zones[i].broken) labelText += " (Broken)"; //--- Append broken status datetime labelTime = zones[i].startTime + (zones[i].endTime - zones[i].startTime) / 2; //--- Calculate label time double labelPrice = (zones[i].high + zones[i].low) / 2; //--- Calculate label price ObjectCreate(0, labelName, OBJ_TEXT, 0, labelTime, labelPrice); //--- Create label ObjectSetString(0, labelName, OBJPROP_TEXT, labelText); //--- Set label text ObjectSetInteger(0, labelName, OBJPROP_COLOR, labelTextColor); //--- Set label color ObjectSetInteger(0, labelName, OBJPROP_ANCHOR, ANCHOR_CENTER); //--- Set label anchor } } ChartRedraw(0); //--- Redraw chart }

We proceed to implement the zone management and visualization logic for the system. In the "UpdateZones" function, we iterate backward through "zones", checking if the last closed bar’s time (iTime at shift 1) exceeds a zone’s "endTime", removing expired zones with ArrayRemove, deleting their chart objects (OBJ_RECTANGLE and "Label") if "deleteExpiredZonesFromChart" is true, and logging, ensuring that if a zone is expired, it is no longer our concern. For non-ready zones, we calculate the distance from the current close (iClose) to the zone’s high (demand) or low (supply), marking "readyForTest" true if it exceeds "minMoveAwayPoints * _Point", logging if newly ready.

If "brokenZoneMode" is "AllowBroken" and the zone is untested, we mark it broken if the close falls below the low (demand) or above the high (supply), updating the color to "brokenZoneColor" with ObjectSetInteger and label to "Demand/Supply Zone (Broken)" with ObjectSetString, deleting objects if "deleteBrokenZonesFromChart" is true, and logging the instance. For drawable zones (existing or not broken with "deleteBrokenZonesFromChart" false), we set colors ("demandZoneColor", "supplyZoneColor", "testedDemandZoneColor", "testedSupplyZoneColor", or "brokenZoneColor") based on status, draw rectangles with ObjectCreate ("OBJ_RECTANGLE") using "startTime", "high", "endTime", and "low", and add centered labels with "ObjectCreate" (OBJ_TEXT) using "labelTextColor", then redraw the chart with the ChartRedraw function, thus updating zone states and rendering them dynamically. We can now call this function in the tick event handler, and when we do, we get the following outcome.

Now that we can manage the zones and visualize them on the chart, we just need to track them and trade based on fulfilled trading conditions. We will create a function that will loop through the valid zones and check the trading conditions.

//+------------------------------------------------------------------+ //| Trade on zones | //+------------------------------------------------------------------+ void TradeOnZones(bool isNewBar) { static datetime lastTradeCheck = 0; //--- Store last trade check time datetime currentBarTime = iTime(_Symbol, _Period, 0); //--- Get current bar time if (!isNewBar || lastTradeCheck == currentBarTime) return; //--- Exit if not new bar or checked lastTradeCheck = currentBarTime; //--- Update last trade check double currentBid = NormalizeDouble(SymbolInfoDouble(_Symbol, SYMBOL_BID), _Digits); //--- Get current bid double currentAsk = NormalizeDouble(SymbolInfoDouble(_Symbol, SYMBOL_ASK), _Digits); //--- Get current ask for (int i = 0; i < ArraySize(zones); i++) { //--- Iterate through zones if (zones[i].broken) continue; //--- Skip broken zones if (tradeTestedMode == NoRetrade && zones[i].tested) continue; //--- Skip tested zones if (tradeTestedMode == LimitedRetrade && zones[i].tested && zones[i].tradeCount >= maxTradesPerZone) continue; //--- Skip max trades if (!zones[i].readyForTest) continue; //--- Skip not ready zones double prevHigh = iHigh(_Symbol, _Period, 1); //--- Get previous high double prevLow = iLow(_Symbol, _Period, 1); //--- Get previous low double prevClose = iClose(_Symbol, _Period, 1); //--- Get previous close bool tapped = false; //--- Initialize tap flag bool overlap = (prevLow <= zones[i].high && prevHigh >= zones[i].low); //--- Check candle overlap if (zones[i].isDemand) { //--- Check demand zone if (overlap && prevClose > zones[i].high) { //--- Confirm demand tap tapped = true; //--- Set tapped flag } } else { //--- Check supply zone if (overlap && prevClose < zones[i].low) { //--- Confirm supply tap tapped = true; //--- Set tapped flag } } if (tapped) { //--- Process tapped zone bool trendConfirmed = (trendConfirmation == NoConfirmation); //--- Assume no trend confirmation if (trendConfirmation == ConfirmTrend) { //--- Check trend confirmation int oldShift = 2 + trendLookbackBars - 1; //--- Calculate lookback shift if (oldShift >= iBars(_Symbol, _Period)) continue; //--- Skip if insufficient bars double oldClose = iClose(_Symbol, _Period, oldShift); //--- Get old close double recentClose = iClose(_Symbol, _Period, 2); //--- Get recent close double minChange = minTrendPoints * _Point; //--- Calculate min trend change if (zones[i].isDemand) { //--- Check demand trend trendConfirmed = (oldClose > recentClose + minChange); //--- Confirm downtrend } else { //--- Check supply trend trendConfirmed = (oldClose < recentClose - minChange); //--- Confirm uptrend } } if (!trendConfirmed) continue; //--- Skip if trend not confirmed bool wasTested = zones[i].tested; //--- Store previous tested status if (zones[i].isDemand) { //--- Handle demand trade double entryPrice = currentAsk; //--- Set entry at ask double stopLossPrice = NormalizeDouble(zones[i].low - stopLossDistance * _Point, _Digits); //--- Set stop loss double takeProfitPrice = NormalizeDouble(entryPrice + takeProfitDistance * _Point, _Digits); //--- Set take profit obj_Trade.Buy(tradeLotSize, _Symbol, entryPrice, stopLossPrice, takeProfitPrice, "Buy at Demand Zone"); //--- Execute buy trade Print("Buy trade entered at Demand Zone: ", zones[i].name); //--- Log buy trade } else { //--- Handle supply trade double entryPrice = currentBid; //--- Set entry at bid double stopLossPrice = NormalizeDouble(zones[i].high + stopLossDistance * _Point, _Digits); //--- Set stop loss double takeProfitPrice = NormalizeDouble(entryPrice - takeProfitDistance * _Point, _Digits); //--- Set take profit obj_Trade.Sell(tradeLotSize, _Symbol, entryPrice, stopLossPrice, takeProfitPrice, "Sell at Supply Zone"); //--- Execute sell trade Print("Sell trade entered at Supply Zone: ", zones[i].name); //--- Log sell trade } zones[i].tested = true; //--- Mark zone as tested zones[i].tradeCount++; //--- Increment trade count if (!wasTested && zones[i].tested) { //--- Check if newly tested Print("Zone tested: ", zones[i].name, ", Trade count: ", zones[i].tradeCount); //--- Log tested zone } color zoneColor = zones[i].isDemand ? testedDemandZoneColor : testedSupplyZoneColor; //--- Set tested color ObjectSetInteger(0, zones[i].name, OBJPROP_COLOR, zoneColor); //--- Update zone color string labelName = zones[i].name + "Label"; //--- Get label name string labelText = zones[i].isDemand ? "Demand Zone (Tested)" : "Supply Zone (Tested)"; //--- Set tested label ObjectSetString(0, labelName, OBJPROP_TEXT, labelText); //--- Update label text } } ChartRedraw(0); //--- Redraw chart }

To implement the trading logic for zone retests or taps, we create the "TradeOnZones" function. First, we track new bars with a static "lastTradeCheck" and exit if not new or already checked, updating "lastTradeCheck" with iTime if true, and retrieve bid and ask prices normalized with the SymbolInfoDouble and NormalizeDouble functions. We iterate through "zones", skipping broken, over-tested (based on "tradeTestedMode" and "maxTradesPerZone"), or unready zones, then check the previous bar’s high (iHigh), low ("iLow"), and close (iClose) for overlap with the zone; for demand zones ("isDemand"), we confirm a tap if "overlap" is true and "prevClose > high", for supply if "overlap" and "prevClose < low", setting "tapped" accordingly.

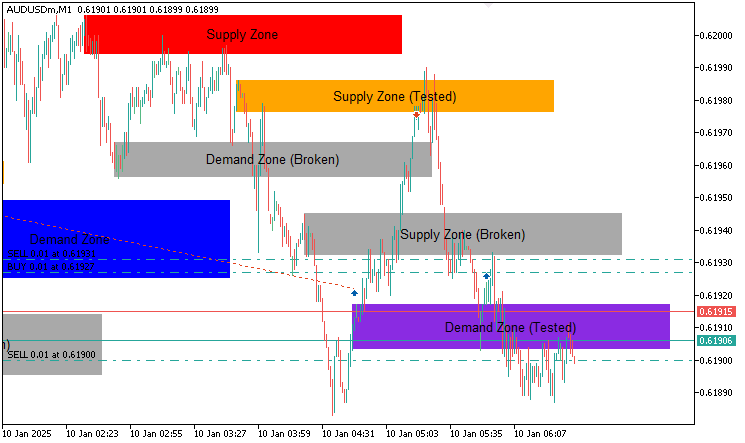

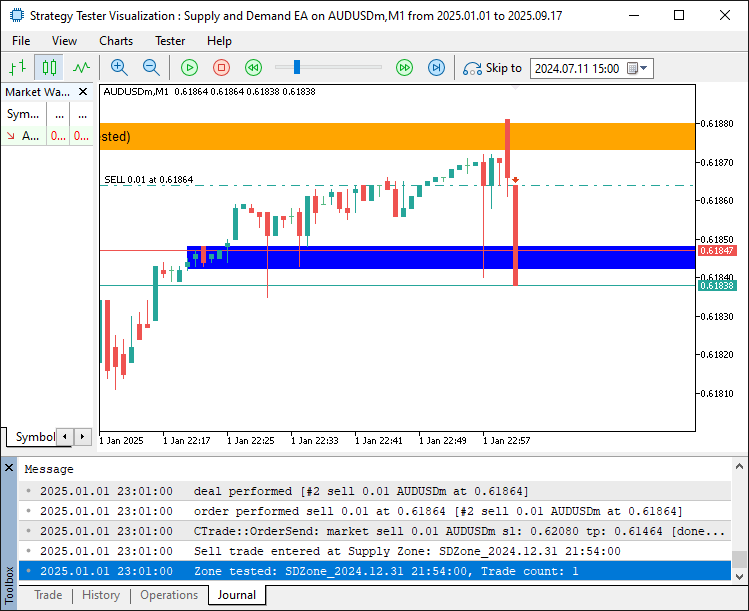

If tapped, we confirm trend if "trendConfirmation" is "ConfirmTrend" by comparing old and recent closes ("iClose") over "trendLookbackBars" against "minTrendPoints * _Point", skipping if not confirmed. For valid taps, we execute trades: for demand, buy at ask with stop loss below "low" by "stopLossDistance * _Point" and take profit above entry by "takeProfitDistance * _Point" using "obj_Trade.Buy", logging with Print; for supply, sell at bid with stop loss above "high" and take profit below entry, using "obj_Trade.Sell". We mark the zone as "tested", increment "tradeCount", log if newly tested, update the zone color to "testedDemandZoneColor" or "testedSupplyZoneColor" with ObjectSetInteger, and refresh the label text to "Demand/Supply Zone (Tested)" with the ObjectSetString function. Finally, we redraw the chart. When we call the function, we get the following outcome.

From the image, we can see that we detect the zone tapping and store the number of trades or taps essentially for that zone, so that we can trade it on some other taps if needed. What now remains is adding a trailing stop to maximize the gains. We will have it in a function as well.

//+------------------------------------------------------------------+ //| Apply trailing stop to open positions | //+------------------------------------------------------------------+ void ApplyTrailingStop() { double point = _Point; //--- Get point value for (int i = PositionsTotal() - 1; i >= 0; i--) { //--- Iterate through positions if (PositionGetTicket(i) > 0) { //--- Check valid ticket if (PositionGetString(POSITION_SYMBOL) == _Symbol && PositionGetInteger(POSITION_MAGIC) == uniqueMagicNumber) { //--- Verify symbol and magic double sl = PositionGetDouble(POSITION_SL); //--- Get current stop loss double tp = PositionGetDouble(POSITION_TP); //--- Get current take profit double openPrice = PositionGetDouble(POSITION_PRICE_OPEN); //--- Get open price if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_BUY) { //--- Check buy position double newSL = NormalizeDouble(SymbolInfoDouble(_Symbol, SYMBOL_BID) - trailingStopPoints * point, _Digits); //--- Calculate new stop loss if (newSL > sl && SymbolInfoDouble(_Symbol, SYMBOL_BID) - openPrice > minProfitToTrail * point) { //--- Check trailing condition obj_Trade.PositionModify(PositionGetInteger(POSITION_TICKET), newSL, tp); //--- Update stop loss } } else if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_SELL) { //--- Check sell position double newSL = NormalizeDouble(SymbolInfoDouble(_Symbol, SYMBOL_ASK) + trailingStopPoints * point, _Digits); //--- Calculate new stop loss if (newSL < sl && openPrice - SymbolInfoDouble(_Symbol, SYMBOL_ASK) > minProfitToTrail * point) { //--- Check trailing condition obj_Trade.PositionModify(PositionGetInteger(POSITION_TICKET), newSL, tp); //--- Update stop loss } } } } } }

Here, we implement the trailing stop logic to manage open positions dynamically. In the "ApplyTrailingStop" function, we retrieve the point value with _Point and iterate backward through open positions using PositionsTotal, verifying each position’s ticket with PositionGetTicket, symbol with PositionGetString, and magic number with PositionGetInteger against the magic number.

For buy positions (POSITION_TYPE_BUY), we calculate a new stop loss as the bid price (SymbolInfoDouble with SYMBOL_BID) minus "trailingStopPoints * point", normalized with NormalizeDouble, and update it with "obj_Trade.PositionModify" if higher than the current stop loss ("PositionGetDouble(POSITION_SL)") and the profit exceeds "minProfitToTrail * point". For sell positions, we calculate the new stop loss as the ask price ("SYMBOL_ASK") plus "trailingStopPoints * point", updating if lower than the current stop loss and profit exceeds the threshold, thus adjusting stop losses to lock in profits during favorable price movements. We can just call it on every tick now to do the management as follows.

//+------------------------------------------------------------------+ //| Expert tick function | //+------------------------------------------------------------------+ void OnTick() { if (enableTrailingStop) { //--- Check if trailing stop enabled ApplyTrailingStop(); //--- Apply trailing stop to positions } static datetime lastBarTime = 0; //--- Store last processed bar time datetime currentBarTime = iTime(_Symbol, _Period, 0); //--- Get current bar time bool isNewBar = (currentBarTime != lastBarTime); //--- Check for new bar if (isNewBar) { //--- Process new bar lastBarTime = currentBarTime; //--- Update last bar time DetectZones(); //--- Detect new zones ValidatePotentialZones(); //--- Validate potential zones UpdateZones(); //--- Update existing zones } if (enableTrading) { //--- Check if trading enabled TradeOnZones(isNewBar); //--- Execute trades on zones } }

When we run the program, we get the following outcome.

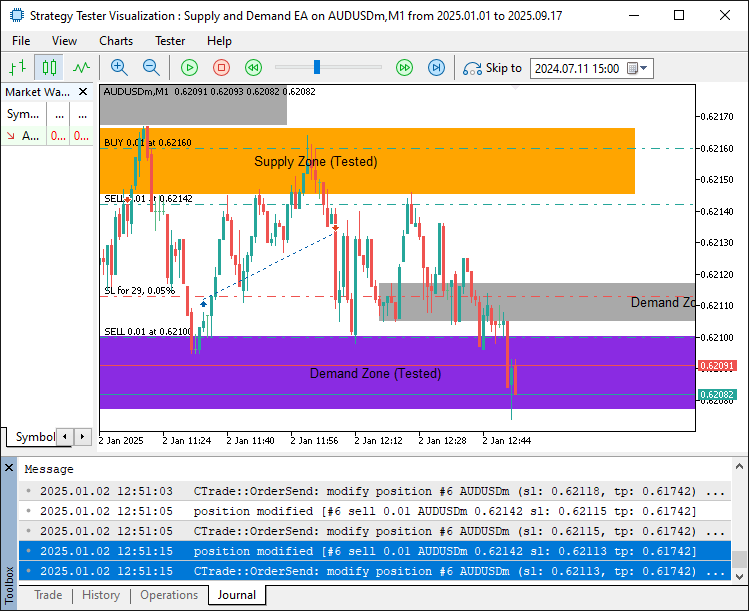

From the image, we can see that the trailing stop is fully enabled when the price goes in our favour. Here is a unified test for both zones in the previous month.

From the visualization, we can see that the program identifies and verifies all the entry conditions, and if validated, opens the respective position with the respective entry parameters, hence achieving our objective. The thing that remains is backtesting the program, and that is handled in the next section.

Backtesting

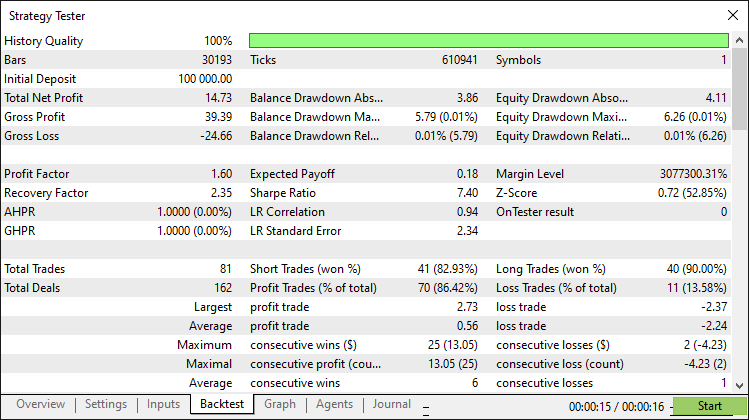

After thorough backtesting, we have the following results.

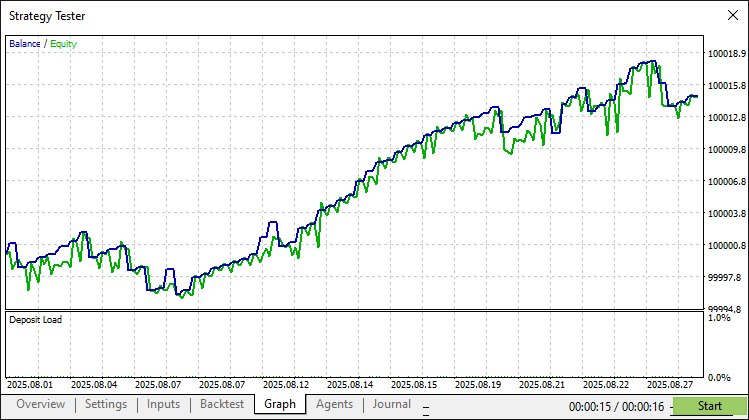

Backtest graph:

Backtest report:

Conclusion

In conclusion, we’ve created a supply and demand trading system in MQL5 for detecting supply and demand zones through consolidation, validating them with impulsive moves, and trading retests with trend confirmation and customizable risk settings. The system visualizes zones with dynamic labels and colors, incorporating trailing stops for effective risk management.

Disclaimer: This article is for educational purposes only. Trading carries significant financial risks, and market volatility may result in losses. Thorough backtesting and careful risk management are crucial before deploying this program in live markets.

With this supply and demand strategy, you’re equipped to trade retest opportunities, ready for further optimization in your trading journey. Happy trading!

Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

This article was written by a user of the site and reflects their personal views. MetaQuotes Ltd is not responsible for the accuracy of the information presented, nor for any consequences resulting from the use of the solutions, strategies or recommendations described.

Neural Networks in Trading: A Hybrid Trading Framework with Predictive Coding (Final Part)

Neural Networks in Trading: A Hybrid Trading Framework with Predictive Coding (Final Part)

Developing Advanced ICT Trading Systems: Implementing Signals in the Order Blocks Indicator

Developing Advanced ICT Trading Systems: Implementing Signals in the Order Blocks Indicator

MQL5 Wizard Techniques you should know (Part 81): Using Patterns of Ichimoku and the ADX-Wilder with Beta VAE Inference Learning

MQL5 Wizard Techniques you should know (Part 81): Using Patterns of Ichimoku and the ADX-Wilder with Beta VAE Inference Learning

Price Action Analysis Toolkit Development (Part 43): Candlestick Probability and Breakouts

Price Action Analysis Toolkit Development (Part 43): Candlestick Probability and Breakouts

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

i compiled it withou any errors.Unfortunately, you can't see anything in the backtest or on the chart. Neither supply & demand zones are plotted, nor are signals recognized or trades executed. The debug and journal are also empty. Has anyone gotten it to work? Can the auto check if the code is complete and up to date?

Worked on 1m time frame