适用于MetaTrader 5的技术指标

购买此指标即可免费获得我的专业交易管理器。

首先,值得强调的是,这个交易系统是一个非重绘、非重画和非滞后的指标,这使得它非常适合手动和机器人交易。 在线课程,手册和下载预设。 “智能趋势交易系统 MT5”是专为新手和经验丰富的交易者量身定制的综合交易解决方案。它结合了超过 10 个优质指标,具有 7 多个强大的交易策略,使其成为适用于各种市场条件的多功能选择。 趋势跟随策略:提供精确的入场和止损管理,以有效地跟随趋势。 反转策略:识别潜在的趋势反转,使交易者能够利用区域市场的机会。 剃头策略:专为快速准确的日内交易和短期交易而设计。 稳定性:所有指标都不会重绘、不会重画和不会滞后,确保可靠的信号。 定制:支持自定义策略,以满足个人交易偏好。超过 7 种策略和组合可帮助您找到最佳策略。 信号清晰度:提供箭头信号,以指示清晰的入场和退出点。 实时警报:通过交易进出警报使交易者保持了解。 深入分析:提供更高时间框架的趋势分析和实时交易监控。 自适应颜色编码:利用蜡烛颜色编码来显示成交量、趋势和反转蜡烛信号。通过蜡烛颜色分析市场方向。 “智能趋势交易系统 MT5”赋予交易者必要的工具,以便在

Power Candles – 适用于所有市场的基于强度的入场信号 Power Candles 将 Stein Investments 经过验证的强度分析直接带入价格图表。与仅对价格作出反应不同,每一根蜡烛都基于真实的市场强度进行着色,使交易者能够立即识别动能累积、强度加速以及清晰的趋势转换。 一套逻辑,适用于所有市场 Power Candles 可自动适用于 所有交易品种 。该指标会检测当前品种是否为外汇货币对或非外汇市场,并在内部自动应用相应的强度模型。 外汇与黄金 使用 FX Power Delta 数值(绝对范围最高至 100) 指数、加密货币和 CFD 使用 IX Power 强度数值(绝对范围最高至 50) 所需的强度计算已直接嵌入 Power Candles。本指标在蜡烛着色和信号逻辑方面无需额外安装任何其他指标。 以强度状态替代价格噪音 每根蜡烛都会被归类为九种清晰定义的强度状态之一: 中性 轻度、中度、强烈、极端空头 轻度、中度、强烈、极端多头 这种基于状态的方法能够过滤随机的价格波动,专注于有意义的市场参与行为。它帮助交易者识别新的方向性阶段正在形成,而不是对单根蜡

购买该指标的每位用户将额外免费获得以下内容:

原创工具“Bomber Utility”,该工具会自动跟踪每一笔交易,设置止损和止盈点,并根据策略规则自动平仓; 适用于不同交易品种的指标设置文件(Set 文件); 三种不同风险模式下的 Bomber Utility 设置文件:“最低风险”、“平衡风险” 和 “观望策略”; 一套详细的 视频操作手册,帮助您快速完成安装、配置并开始使用本交易系统。 注意: 要获取以上所有赠品,请通过 MQL5 的私人消息系统联系卖家。 我为您介绍原创的自定义指标 “Divergence Bomber”(背离轰炸机),它是一套基于 MACD 背离交易策略 的“全功能”交易系统。

该技术指标的主要任务是识别 价格与 MACD 指标之间的背离,并发出交易信号(包括推送通知),指示未来价格可能的运动方向。平均而言,这些信号的准确率超过 98%。有关该指标如何工作的详细说明,请观看本页面上的视频演示。 该系统使用 止损订单 和 动态回撤平仓机制 来管理交易。 Divergence Bomber 指标的主要特点: 支持交易的品种: AUDCAD、AUDCHF、AUDSG

首先值得强调的是,该交易指标是非重绘、非延迟的指标,这使其成为手动和机器人交易的理想选择。 用户手册:设置、输入和策略。 Atomic Analyst是一种PA价格行动指标,利用价格的力量和动量来寻找市场上更好的机会。配备了高级过滤器,可帮助去除噪音和假信号,并提高交易潜力。使用多层复杂的指标,Atomic Analyst扫描图表,并将复杂的数学计算转化为任何初学者都能理解并用来做出一致交易决策的简单信号和颜色。

“Atomic Analyst”是专为新手和经验丰富的交易者量身定制的综合交易解决方案。它将高级指标和一流功能融合为一体的交易策略,使其成为所有类型交易者的多功能选择。

日内交易和剥头皮策略:专为快速准确的日内交易和短期交易而设计。 日内和摆动交易策略:可用作追求价格大幅波动的日内和摆动交易者的可靠工具。 多货币和市场:凭借其可靠的精度,在不同的工具和市场上运作。 多个时间框架:可在多个时间框架上使用,性能良好。 稳定性:所有指标均不重绘、不重绘和不滞后,确保可靠的信号。 信号清晰度:提供箭头信号,用于清晰的入场和出场点。 实时警报:通过交易入场、SL和TP警报通知交易者

Entry In The Zone and SMC Multi Timeframe 是一款基于 Smart Money Concepts(SMC) 开发的实时市场分析工具,旨在帮助交易者以系统化方式分析市场结构,并更加清晰地掌握整体市场方向。 系统能够在多周期中自动分析 反转点、关键价格区域以及市场结构 ,并显示 兴趣点(POI) 、 无重绘信号 以及 自动斐波那契水平(Auto Fibonacci Levels) ,用于精准识别回调位置与潜在反转点。 系统提供的 实时信号与提醒功能 可确保当价格进入关键区域或在区域内出现反转信号时,交易者不会错过重要机会。 此外,本系统同时具备 指标功能 和 信号系统功能(2 合 1) ,将区域分析与实时入场信号集成于同一工具中。所有参数亦可完全自定义,以适配任何交易风格。 ------------------------------------------------------------------------------ 免费赠送!FABLE Pro Suite — 为智能资金交易者打造的一体化交易工具包 New Indicator

SuperScalp Pro – 高级多重过滤剥头皮指标系统 SuperScalp Pro 是一款高级剥头皮指标系统,将经典 Supertrend 与多重智能确认过滤器相结合。该指标在 M1 到 H4 的所有时间框架上均运行良好,尤其适用于 XAUUSD、BTCUSD 及主要外汇货币对。可作为独立系统使用,也可灵活整合到现有交易策略中。 指标集成超过 11 个过滤器,包括快慢 EMA、用于趋势判断的三条 EMA、EMA 斜率 (EMA slope)、RSI、ADX、成交量、VWAP、布林带突破(Bollinger Bands Breakout)以及 MACD 背离过滤器。智能蜡烛过滤器用于确认蜡烛收盘并剔除弱信号,而以三条 EMA 结合 MACD 背离的趋势识别机制则有助于筛选出更高胜率的交易信号。 SuperScalp Pro 基于 ATR 自动计算进场(Entry)、止损(Stop Loss)和止盈(Take Profit)水平。所有重要价格水平均直接显示在图表上,方便用户管理风险并做出更精准的交易决策。 系统在超过 5,000 根蜡烛上进行模拟与性能分析,展示完整指标如胜率、总交

Game Changer 是一款革命性的趋势指标,适用于任何金融工具,可将您的 MetaTrader 平台升级为强大的趋势分析工具。该指标不会重绘,也不会出现滞后。它适用于任何时间范围,有助于识别趋势,发出潜在反转信号,可用作追踪止损机制,并提供实时警报,以便您快速做出市场反应。无论您是经验丰富的交易员、专业人士,还是寻求优势的初学者,这款工具都能帮助您自信、自律地进行交易,并清晰地了解潜在的趋势动态。

购买后立即联系我,即可获得个人奖励!您可以免费获得我们的强力支撑和趋势扫描指标,请私信我!

请注意,我不在 Telegram 上出售我的 EA 或特殊套件,它们仅适用于 MQL5,我的套件文件也仅在我的博客上提供。 请小心诈骗者 ,不要从其他人那里购买任何套件! 设置

启用趋势变化警报 - 真/假 - 趋势变化时在图表上显示警报 发送推送通知 - 真/假 - 启用手机推送警报通知 发送邮件通知 - 真/假 - 发送趋势变化的邮件通知到电子邮件

FX Power:分析货币强度,助您做出更明智的交易决策 概述

FX Power 是一款专业工具,帮助您全面了解主要货币和黄金在任何市场条件下的真实强度。通过识别强势货币用于买入,弱势货币用于卖出, FX Power 简化了交易决策,并帮助您发现高概率的交易机会。不论您是想跟随趋势还是通过极端的 Delta 值预测反转,这款工具都能完美适应您的交易风格。别再盲目交易——用 FX Power 让您的交易更加智慧。

1. 为什么 FX Power 对交易者极具价值 实时货币和黄金强度分析

• FX Power 实时计算并显示主要货币和黄金的相对强度,助您全面了解市场动态。

• 监控领先或落后资产,轻松识别值得交易的货币对。 全面的多时间框架视图

• 跟踪短期、中期和长期时间框架的货币和黄金强度,以便将您的交易策略与市场趋势保持一致。

• 无论是快进快出的短线交易还是更长期的投资策略, FX Power 都能为您提供所需的信息。 Delta 动态分析用于趋势和反转

• 极端 Delta 值常常预示反转机会,而平缓的 Delta 变化则确认趋势延续。

• 使用 Delta 分析,轻

使用趋势筛选指标释放趋势交易的力量:由模糊逻辑和多货币系统提供支持的终极趋势交易解决方案! 使用趋势筛选器(由模糊逻辑提供支持的革命性趋势指标)提升您的趋势交易。 它是一个强大的趋势跟踪指标,结合了超过 13 种高级工具和功能以及 3 种交易策略,使其成为使您的 Metatrader 成为趋势分析器的多功能选择。 限时优惠:趋势筛选指标终身仅需 50 美元。 ( 原价 250$ ) (优惠延长) 体验趋势筛选器 100% 无需重新绘制的准确性,确保您的交易决策不受过去价格变化的影响。 释放多时间框架和多货币功能的多功能性,使您能够以无与伦比的信心在外汇、商品、加密货币和指数领域进行交易。 利用 Trend Screener 的综合策略套件增强您的交易: - 趋势跟踪策略和趋势延续策略 :趋势筛选器的趋势跟踪策略提供清晰的趋势延续信号,让您有效捕捉趋势走势并管理风险。 - 反转策略和早期入场点策略 :趋势筛选器的反转策略可检测市场方向的潜在变化,使您能够预测趋势反转并利用疲弱的市场趋势。通过早期入场点,您可以在潜在的趋势变化之前定位自己 获取可观的利润。 - 倒卖策略: 趋势筛选器的倒卖

上市促销 Azimuth Pro 前100位买家特惠价 299 美元。最终价格为 499 美元。

散户与机构入场的区别不在于指标,而在于位置。

大多数交易者在任意价格水平入场,追逐动量或对滞后信号做出反应。机构投资者等待价格到达供需真正转换的结构性水平。

Azimuth Pro 自动映射这些水平:波段锚定VWAP、多时间框架结构线,以及仅在高概率位置出现的ABC形态。

Azimuth Pro 专为需要结构分析和智能自动化的专业交易者打造。

Azimuth 以外科手术般的精度映射市场结构,而Azimuth Pro增加了智能层:自动检测您的交易风格、智能配置的移动平均线,以及经过20年数据回测优化的参数。结果是专业级分析自动适应您的交易品种和时间框架。

这是我们Merkava Labs每天为自己和客户使用的指标。

PRO版本的独特之处

智能配置 Pro版本理解您的交易环境。将它放在EURUSD M15上,它知道您在做日内交易。放在BTCUSD H4上,它会调整为波段交易。无需手动调整。

自适应移动平均线 标准EMA有效。但ATR自适应StepMA(响应波动率)和动

请留下积极的评价。

重要提示 :截图中显示的图像是我的指标,包括Suleiman Levels指标和RSI Trend V指标,当然还附带了“Time Candle”,它最初是用于高级分析和独家水平的综合指标Suleiman Levels的一部分。 如果您喜欢,请尝试“RSI Trend V”指标:

https://www.mql5.com/en/market/product/132080 如果您喜欢,请尝试“Suleiman Levels”指标:

https://www.mql5.com/en/market/product/128183 Time Candle Suleiman指标旨在平滑且优雅地显示当前蜡烛的剩余时间。它提供完整的自定义选项,允许您控制倒计时的外观,包括字体类型、大小、颜色以及与蜡烛的相对位置,适用于所有时间框架。

注意:查看我的专业高级分析“Suleiman Levels”指标,这是一个综合指标,包含超过9,800行代码,具有罕见且独家的功能,可帮助您更好地理解和简化图表。它通过识别独家水平、支撑和阻力区域、趋势线以及突破或拒绝区域,实现更高效的交易。此外,它还

FREE

介绍 量子趋势狙击指标 ,突破性的 MQL5 指标,正在改变您识别和交易趋势反转的方式!由拥有超过13年交易经验的资深交易员团队开发, 量子趋势狙击指标 旨在通过其创新的方式以极高的准确度识别趋势反转,将您的交易之旅推向新的高度。

***购买量子趋势狙击指标,即可免费获得量子突破指标!***

当量子突破指标识别出趋势反转时,它会向您发出警报和信号箭头,并建议您三个止盈水平。

它既适合新手交易者,也适合专业交易者。

量子 EA 通道: 点击这里

MT4版本: 点击这里

建议:

时间范围: 所有时间范围。为了获得最佳结果,我们建议在 M15、M30 和 H1 时间范围内使用它。 货币对:欧元兑美元、英镑兑美元、澳元兑美元、欧元兑英镑、, EURAUD, XAUUSD 账户类型:ECN、Raw 或 Razor,点差极低 经纪时间:任意 经纪商:IC Markets、Pepperstone with Raw 和 Razor 的点差最低

建议止损:50 点

建议止盈水平:20 点、50 点和 100 点

规格:

不重漆! 最

Smart Stop Indicator – 智能化止损逻辑,直接呈现在您的图表上 概述

Smart Stop Indicator 是为希望以清晰、系统、非情绪化方式设置止损的交易者量身打造的工具。它将经典的价格结构逻辑(更高的高点、更低的低点)与现代突破识别技术相结合,精准标记真正合理的止损位置。无论是趋势、盘整还是快速突破行情,指标都会在图表上直接显示最佳 SL 区域及其状态(“new”、“broken”、“valid”)并且现在新增 SL 与 %ADR 的距离显示。 亮点 基于市场结构的自动止损识别

• 根据市场结构与实时价格行为自动识别关键止损位置。 智能突破适应能力

• 能适应突破与快速方向变化,不会强迫过早调整止损。 SL %ADR 显示

• 显示止损距离占平均日波动范围 ADR 的百分比与 Smart Stop Scanner 完全一致帮助交易者即时识别紧密机会或已延伸的行情。 内置警报逻辑

• 当止损水平变为“new”、“valid”或“broken”时触发警报包含准确的状态切换与冷却逻辑。 破损级别的淡化显示

• 对于“broken”状态的方向、价格、S

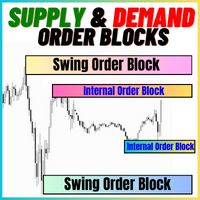

供需订单区块:

“供需订单区块”指标是基于智能资金概念的复杂工具,这对于外汇技术分析至关重要。它专注于识别供需区域,这些是机构交易者留下重要足迹的关键区域。供应区表示卖单,需求区表示买单,帮助交易者预测价格走势的潜在反转或减速。该指标采用了巧妙的算法,结合了结构突破(BoS)和公平价值差(FVG)组件。BoS检测市场中的干扰,确定潜在的订单区块,而FVG考虑了公平价值差以提高准确性。该工具提供了这些条件的视觉表现,通过突出显示潜在的订单区块并提供市场动态和转折点的见解,帮助交易者做出决策。其用户友好设计使其适用于具有各种技术专业知识水平的交易者,为高级分析提供了全面的解决方案。

特点:

- 智能资金概念:基于机构交易策略。 - 供需区域:识别卖单和买单区块。 - 自定义订单区块绘制类型。 - 算法复杂性:BoS检测市场中的干扰,FVG考虑公平价值差。 - 视觉表示:在图表上突出显示潜在的订单区块。 - 用户友好:适用于各种专业知识水平。 - 全面分析:集成BoS和FVG以获取见解。 - 理性决策:帮助预测反转和减速。

FREE

获取 免费 AUX 指标和 EA 支持 直接下载 — 点击这里 [ D.I.C.E ] The DICE Indicator Divergence in Chaos Environment 是一款专为使用艾略特波浪理论并结合混沌交易技术的交易者设计的 MT5 专用工具。它识别价格行为中的隐藏和常规背离,并与比尔·威廉姆斯所描述的混沌市场环境同步。 主要特征 艾略特波浪背离检测:检测符合波浪结构的看涨和看跌背离,以提高波浪计数精度。 混沌技术集成:与混沌交易策略相结合,确保信号与 AO 指标和市场结构一致。 多时间框架扫描:跨不同时间框架分析背离以确认动能变化和趋势耗尽。 可视化警报和对象:图表中清晰的箭头、线条和标记,便于快速识别。 自适应市场读取:自动适应混沌市场条件,过滤噪音并保留有效信号。 突破回调入场技术:使用简单的斐波那契回撤和枢轴点的常见交易方法。 优势 结合背离信号与波浪进程,提高入场精度。 利用 AO 混沌背离逻辑确认可能的第 3–5 波完成。 提前识别反转或延续区域,降低风险。 实时自动发现修正区,低风险高回报。 通过清晰的视觉确认增强交易信心。

ARICoin is a powerful trading companion designed to generate high-probability entry signals with dynamic TP/SL/DP levels based on volatility. Built-in performance tracking shows win/loss stats, PP1/PP2 hits, and success rates all updated live. Key Features: Buy/Sell signals with adaptive volatility bands Real-time TP/SL/DP levels based on ATR Built-in MA Filter with optional ATR/StdDev volatility Performance stats panel (Success, Profit/Loss, PP1/PP2) Alerts via popup, sound, push, or email Cust

CRYSTAL AI PRO v7.21 — MT5 智能交易系统(EA) 概述

适用于 XAUUSD(黄金) 与主要外汇品种的自动交易系统;管理入场、SL/TP、跟踪止损与回撤控制,遵循规则执行。不承诺盈利;请阅读风险提示。 运行要求 平台:MetaTrader 5 账户类型:ECN/RAW 推荐 连接:24/7 运行(建议 VPS) 周期:M1–H4 初始设置 启用 Algo Trading 。 将 EA 挂到图表(每个品种单独图表)。 在 Inputs 中设置 AI_Access_Mode = ON ,然后重新加载 EA。 根据资金/杠杆/经纪商条件调整风险参数。 建议条件 充足保证金与稳定执行(低点差/低延迟)。 黄金建议起始资金 $5,000+ (1:500);多品种交易时降低风险。 先在模拟或 cent 账户验证。 核心功能 规则化入场与 SL/TP 、 保本 、 跟踪止损 。 回撤控制 :在劣势阶段降低交易频率。 多品种支持(每品种一张图表)。 适配不同波动与交易时段。 在模拟/cent 账户可完整评估逻辑。 Inputs(要点) AI_Access_Mode 开启完

FREE

FX Levels:适用于所有市场的高精度支撑与阻力 快速概览

想要精准确定适用于任何市场(外汇、指数、股票或大宗商品)的支撑与阻力吗? FX Levels 将传统的“Lighthouse”方法与前沿的动态分析相结合,实现近乎通用的准确性。依托真实经纪商经验和自动化的每日与实时更新, FX Levels 帮助您捕捉价格反转点、设置合理的盈利目标,并自信地管理交易。立即使用,体验更准确的支撑/阻力分析如何助力您的交易更上层楼!

1. 为什么 FX Levels 对交易者非常有利 极度精准的支撑 & 阻力区

• FX Levels 专为不同经纪商提供的行情源和时间设置而设计,可生成几乎相同的价位区,解决数据不一致的常见问题。

• 这意味着无论您在哪里交易,都能获得稳定一致的水平线,为策略打下更加牢固的基础。 结合传统与先进技术

• 通过将久经考验的“Lighthouse”方法与动态分析相融合, FX Levels 不仅限于每日刷新,还可针对新的价格波动进行即时更新。

• 您可以选择经典的静态方式,或实时捕捉新出现的水平,以贴近最新的市场行为。 识别清晰的反转点

• FX Lev

Swing Trading 是第一个旨在检测趋势方向的波动和可能的反转波动的指标。它使用在交易文献中广泛描述的基准摆动交易方法。该指标研究多个价格和时间向量,以追踪总体趋势方向,并检测市场超卖或超买并准备好进行修正的情况。 [ 安装指南 | 更新指南 | 故障排除 | 常见问题 | 所有产品 ]

市场波动的利润不会被窃取 指示器始终显示趋势方向 彩色价格带代表机会基准 彩色虚线表示可能的反转波动 该指标分析其自身的质量和性能 它实现了一个多时间仪表板 可定制的趋势和波动周期 它实现了电子邮件/声音/推送警报 指示器为非重涂或重涂

什么是摇摆交易 摇摆交易是一种尝试在一天到一周内从证券中获得收益的交易方式,尽管某些交易最终可以保持更长的寿命。摇摆交易者使用技术分析来买入弱点和卖出力量,并有耐心等待这些机会的发生,因为在发生一波抛售浪潮之后购买证券而不是陷入抛售更有意义。

机会基准 关于历史数据的大量研究证明,适合于波动交易的市场倾向于在基线价格带上下交易,基线价格带由图表显示,使用平均真实区间计算得出。波动交易者使用基线,该策略是购买常态和卖出躁狂,或做空常态并掩盖沮丧。在没有疲

ARIScalp is a powerful trading companion designed to generate high-probability entry signals with dynamic TP/SL/DP levels based on volatility. Built-in performance tracking shows win/loss stats, PP1/PP2 hits, and success rates all updated live. Key Features: Buy/Sell signals with adaptive volatility bands Real-time TP/SL/DP levels based on ATR Built-in MA Filter with optional ATR/StdDev volatility Performance stats panel (Success, Profit/Loss, PP1/PP2) Alerts via popup, sound, push, or email Cus

向您介绍一款优秀的技术指标——Grabber,它是一套即开即用的“全包式”交易策略。

在一个代码中集成了强大的市场技术分析工具、交易信号(箭头)、提醒功能和推送通知。 每位购买该指标的用户还可免费获得以下内容: Grabber辅助工具:用于自动管理已开仓位 视频操作指南:逐步教学如何安装、设置和使用该指标进行交易 原创Set文件:可快速自动配置,帮助实现最佳交易效果 忘掉其他策略吧!只有Grabber能够真正激励你在交易中攀登新高峰! Grabber策略的主要特点: 交易周期:从M5到H4 适用资产:任意,但我推荐我亲自测试过的品种(GBPUSD、GBPCAD、GBPCHF、AUDCAD、AUDUSD、AUDSGD、AUDCHF、NZDUSD、NZDCAD、EURCAD、EURUSD、EURAUD、EURGBP、EURCHF、USDCAD、USDSGD) 交易时间:全天候 24/7 交易效果:我分享自己的真实交易结果,并在此教学如何操作: https://www.mql5.com/ru/market/product/134563?source=Site+Market+MT5+Indic

Super Signal – Skyblade Edition 專業級無重繪 / 無延遲趨勢信號系統,擁有卓越勝率 | 適用於 MT4 / MT5 在較低的時間週期上效果最佳,例如 1 分鐘、5 分鐘與 15 分鐘圖表

核心特色: Super Signal – Skyblade Edition 是一套專為趨勢交易設計的智能信號系統。

其採用多重濾波邏輯,僅篩選出具有明確方向性、動能強勁且波動結構健康的走勢進場點。 本系統 不預測高點或低點 ,只有在同時滿足以下三項條件時才會觸發交易信號: 趨勢方向明確 動能持續增強 波動率結構穩定 此外,系統還結合市場流動性分析,以進一步提升信號的準確性與觸發時機。 信號特性: 所有箭頭信號皆為 100% 無重繪,無延遲 信號一旦出現即固定於圖表,不會閃爍或消失 提供圖表箭頭、資訊面板、彈出通知、聲音提示及推播訊息 支援 EA 呼叫(Buffer 輸出),可整合至自動化交易或信號跟單系統 提供預設參數模板,免調整即可使用,適合新手快速上手 所有數據皆採用「嚴格回測標準」——每筆交易訊號在觸發後的 60 根 K 線內,

EURUSD 與 USDJPY

趋势捕捉器(The Trend Catcher): 带有警报指标的趋势捕捉策略是一种多功能技术分析工具,帮助交易者识别市场趋势以及潜在的进出场点。它采用动态趋势捕捉策略,可根据市场状况进行调整,为交易者提供清晰的趋势方向视觉展示。交易者可以根据个人偏好和风险承受能力自定义参数。该指标有助于趋势识别、提示潜在反转、充当跟踪止损机制,并提供实时警报以便快速应对市场变化。 功能特点: 趋势识别:发出多头趋势和空头趋势信号。

趋势反转:当蜡烛颜色从多头变为空头或相反时,提示潜在反转。

实时警报:在识别到新趋势时生成警报。 推荐: 货币对:EURUSD、AUDUSD、XAUUSD…

时间周期:M5、M10、M15、M30、H1。

账户类型:任何ECN账户或低点差账户。

FREE

AriX Indicator for MT5

A powerful trend-following and signal-evaluation tool AriX is a custom MT5 indicator that combines Moving Averages and ATR-based risk/reward logic to generate clear buy/sell signals. It visualizes dynamic SL/TP levels, evaluates past trade outcomes, and displays win/loss statistics in a clean on-chart panel. Key features include: Buy/Sell signals based on MA crossovers ATR-based SL/TP1/TP2/TP3 levels with visual lines and labels Signal outcome tracking with real-time stat

临界区( Critical Zones )是专为寻找更准确市场入口的手动交易者而设计的。该指标采用先进的算法,通过计算图表上最相关的支撑位和阻力位以及它们的突破和回测来检测感兴趣的区域。该指标可配置为在检测到潜在有利可图的买入/卖出机会时发送警报和通知,让交易者即使不在屏幕/ MT4 版本前 ,也能随时掌握交易机会。

功能特点

无重绘

当新数据到来时,该指标不会改变其数值。

交易货币对 所有外汇货币对 季节性 所有季节性

参数 ===== 支撑位和阻力位 配置 =====

用于计算的查看条形图 // 从当前条形图向后查看的条形图范围,用于计算支撑位和阻力位

===== 条件 =====

突破 // 打开或关闭突破检测

回测 // 启用或禁用回测检测

===== 支撑位和阻力位样式 =====

绘制类型 // 设置支撑线和阻力线的线型

支撑线颜色 // 设置支撑位的颜色

阻力位颜色 // 为阻力位定义颜色

===== 警报 =====

弹出式警报 // MT4 终端警报

推送通知警报 // 警报发送到手机

电子邮件警报 // 向电子邮件发

FREE

如果您使用移动平均线进行交易,该指标将是您最好的助手。 以下是它可以做的事情:它显示当两个移动平均线相交时的信号(例如,快速移动平均线突破从底部到顶部的缓慢移动平均线-增长是可能的)。 它以各种方式通知您:它在终端中发出嘟嘟声,向您的手机发送通知并向您的电子邮件发送电子邮件—现在您绝对不会错过任何交易。 它可以灵活调整:您可以准确选择如何计算移动平均线(有超过10个选项可用),为您的策略选择颜色,周期和其他参数。 对于那些谁喜欢移动平均线的工具。 无需坐在屏幕上-它会告诉你什么时候采取行动。 如果你想尝试,这些设置将帮助你适应它,即使是剥头皮,即使是长期交易。 该指标有一个快速的代码,可以很容易地集成到您的交易机器人. 有两种类型的信号和警报发送。 当有机会满足条件时,第一个信号就会出现,即酒吧还没有关闭,可能会有变化。 这使您可以坐在电脑前,仔细检查新闻或以任何其他方式准备交易,不会错过任何利润。 当图表上的箭头已经完全形成时,第二个信号就会出现。 每种类型的信号每条仅给出一次。 这意味着该指标不会在同一价格栏内重复信号—您每个周期只收到一个通知(例如,每分钟或每小时)。 这样的系统

FREE

The Trend Forecaster indicator utilizes a unique proprietary algorithm to determine entry points for a breakout trading strategy. The indicator identifies price clusters, analyzes price movement near levels, and provides a signal when the price breaks through a level. The Trend Forecaster indicator is suitable for all financial assets, including currencies (Forex), metals, stocks, indices, and cryptocurrencies. You can also adjust the indicator to work on any time frames, although it is recommen

Berma 波段 (BBs) 指标对于寻求识别和利用市场趋势的交易者来说是一种有价值的工具。通过分析价格与 BBs 之间的关系,交易者可以辨别市场是处于趋势阶段还是区间波动阶段。 访问[ Berma Home Blog ] 了解更多信息。 Berma 带由三条不同的线组成:上 Berma 带、中 Berma 带和下 Berma 带。这些线围绕价格绘制,直观地表示价格相对于整体趋势的变动。这些带之间的距离可以洞察波动性和潜在的趋势逆转。

当 Berma Bands 线相互分离时,通常表明市场正在进入横盘或区间波动时期。这表明缺乏明确的方向性。交易者可能会发现在这些时期内很难识别趋势,因此可能需要等待更清晰的趋势出现。

当 Berma Bands 线汇聚成一条线时,通常表示趋势环境强劲。这种汇聚表明存在明显的方向性偏差,因为价格波动性足以随趋势而变化。交易者可能会发现在这些时期更容易识别潜在的入场点和出场点,因为趋势的势头可以提供有利的交易机会。然而,重要的是要注意整体趋势中的潜在回调或修正。

Berma 带根据价格蜡烛图与上带和下带的相互作用提供明确的买入和卖出信号。当价格蜡烛图首

TPSproTrend PRO 能够识别市场真正改变方向的时刻,并在行情开始时形成入场点。

你应该在价格刚刚开始波动时入场,而不是在波动已经发生之后。 指标 它不会重新绘制信号,并自动显示入场点、止损点和止盈点,使交易清晰、直观、有条理。 俄语说明 - MT4 版本 主要优势 信号不重绘。 所有信号均为固定值。 如果出现箭头 - 它不会再改变也不会消失了。

您可以基于稳定的数据做出交易决策,而无需承担虚假信号的风险。 现成的买卖入场点 该指标会自动确定最佳交易时机,并在图表上用箭头显示出来。

无需猜测或主观分析——只有清晰的信号。 自动止损和止盈区域 信号发出后,您立即会看到: 入口点 风险限制区(止损) 止盈区 这允许 在达成交易前评估交易条款 并遵守风险管理规定。 自适应止损(移动止损) 该指标采用智能交易支持逻辑,随着时间的推移…… 降低止损规模,从而降低初始风险。 支持更高时间框架(MTF) TPSproTrend PRO 显示: 来自更高时间框架的关键 MIN/MAX 修正 实际趋势变化 修正编号显示了运动的结构 交易很有帮助 顺应大

当然可以!以下是您提供的文本的中文翻译: 引入 MT4 / MT5 天文指标:您的终极天体交易伙伴 您准备好将交易体验提升到天文高度了吗?不用再寻找,就在我们的革命性 MT4 天文指标中。这个创新工具超越了传统的交易指标,利用复杂的算法提供无与伦比的天文洞察力和精确计算。 指尖上的宇宙信息: 瞻仰一个详尽的面板,展示了一宝藏般的天文数据。了解行星的地理/太阳心坐标,太阳/地球距离,亮度,伸长度,星座,黄道和赤道坐标,甚至是水平坐标——每个细节都经过精心计算并呈现得美轮美奂。指标生成的垂直线对应于时间值,为您的交易旅程提供了宇宙的视角。 行星线条与关系: 在您的图表上欣赏行星线条的魔力,具有可自定义的比例和角度。通过直观的控制面板轻松切换每个行星线条的可见性。通过连结、六分、四分、三分、对冲和逆行等指标,发现行星关系的艺术。在您选择的时间范围内探索这些宇宙构造,使您能够识别重要的交易机会。 揭示甘恩的智慧: 通过受甘恩启发的平方垂直线揭示潜在的反转时机。这种创新修改将甘恩历经考验的原则带入现实,帮助您提前了解市场的转向和趋势。 月亮引导: 在您的图表上优雅地导航月相,

Crystal Volume Profile Auto POC — 精准交易的成交量分布分析工具 概述

Crystal Volume Profile Auto POC 是一款 MetaTrader 5 指标,用于显示成交量分布并自动标记控制点 (POC)。它帮助交易者识别关键支撑与阻力区域,揭示市场中成交量最集中的价格水平。 主要功能 动态成交量分布(适用于可见图表区域或自定义区间) 自动检测 POC(成交量最大的价格水平) 可自定义直方图大小、颜色和线型 固定区间成交量分析 支持实时更新(每根K线自动刷新) 内置按钮:Reset VP(重算分布)和 Hide VP(隐藏/显示) 支持浅色和深色背景 优势 识别市场累积与分布区 揭示机构资金活跃的关键区域 提高入场和出场的时机选择 适用于突破与反转交易策略 使用方法 将指标加载到任意图表 使用 Reset VP 计算可见区间分布 拖动垂直线可手动选择范围 使用 Hide VP 隐藏或显示分析结果 兼容性 平台:MetaTrader 5 市场:外汇、股票、加密货币、指数 时间周期:全部支持 优化结构,降低 CPU 占用 关键词

成交量

FREE

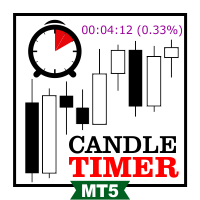

Candle Timer Countdown 显示当前柱线关闭并形成新柱线之前的剩余时间。 它可以用于时间管理。

MT4版本在这里!

功能亮点 跟踪服务器时间而不是本地时间 可配置的文本颜色和字体大小 符号每日变化的可选可视化 优化以减少 CPU 使用率

输入参数

显示每日变化:真/假 文本字体大小 文字颜色

如果您仍有疑问,请通过直接消息与我联系: https://www.mql5.com/zh/users/robsjunqueira/

如果可能,请留下您的评论和评论,以帮助向社区传播信息。 还可以了解我们的其他指标和专家顾问。 我有几种有用的指标和专家顾问。 如果您有任何建议,请随时提出建议,这样我才能改进产品,使持续改进永无止境。

FREE

可以说,这是您可以为MetaTrader平台找到的最完整的谐波价格形成自动识别指标。它检测19种不同的模式,像您一样认真对待斐波那契投影,显示潜在的反转区域(PRZ),并找到合适的止损和获利水平。 [ 安装指南 | 更新指南 | 故障排除 | 常见问题 | 所有产品 ]

它检测19种不同的谐波价格形态

它绘制了主要,衍生和互补的斐波那契投影(PRZ)

它评估过去的价格走势并显示每个过去的形态 该指标分析其自身的质量和性能 它显示合适的止损和获利水平

它使用突破来表明合适的交易 它在图表上绘制所有样式比率 它实现了电子邮件/声音/视觉警报 受斯科特·M·卡尼(Scott M. Carney)的书的启发,该指标旨在满足最纯粹和最熟练的交易者的需求。但是,它采取了一种使交易更容易的方式:在向交易发出信号之前,它会等待Donchian朝正确方向突破,从而使交易信号非常可靠。 斐波那契投影与向量无关 它实现了电子邮件/声音/推送警报 它绘制了ABCD投影 重要提示: 为了符合 Scott M. Carney先生 的商标申诉,某些图案名称已重命名为不言自明的替代方式, Scott M.

趋势人工智能指标是一个伟大的工具,将加强交易者的市场分析结合趋势识别与可操作的进入点和逆转警报。 该指标使用户能够自信和精确地驾驭外汇市场的复杂性 除了主要信号,趋势Ai指标识别在回调或回调期间出现的次要入口点,使交易者能够利用既定趋势内的价格修正。

重要优势:

*MT4及MT5工程

*明确买入或卖出信号

·不重绘

*适用于所有资产

小心我不卖EA或设置电报它骗局. 所有设置免费在这里的博客。 重要! 购买后立即与我联系,以获得指示和奖金!

真实的操作监控以及我的其他产品可以在这里找到: https://www.mql5.com/en/users/mechanic/seller  ;

设置和输入:

建议为所有资源设置默认设置。 第...

Gold Sniper Scalper Pro 是一款专业的 MetaTrader 5 指标,旨在帮助交易者有效识别入场点并管理风险。 该指标提供全面的分析工具套件,包括信号检测系统、自动 Entry/SL/TP 管理、成交量分析和实时绩效统计。 系统使用指南 | 其他语言使用指南 主要功能 信号检测系统 指标基于 price action 分析和市场结构自动检测潜在入场点。当检测到交易机会时: - 图表上出现 BUY(绿色)或 SELL(红色)箭头 - K线被高亮显示以识别信号区域 - Entry/SL/TP 水平自动计算

信号仅在价格触及 Entry 水平时激活,有助于过滤未经市场确认的信号。

智能 Entry/SL/TP 管理 - Entry:价格触及入场水平时自动检测 - StopLoss:基于 ATR(Average True Range)动态计算 - Take Profit:基于 R-Multiple 的 4 个 TP 水平(TP1: 0.5R, TP2: 1R, TP3: 1.5R, TP4: 2R) - Trading Lines:在图表上显示带标签的 E

任何新手或专业交易者的最佳解决方案! 该指标是一款独特、高质量、且价格合理的交易工具,因为我们已经整合了许多专有功能和新公式。 依据此更新,您将能够显示双重时间帧区域。 您不仅可以显示一个较高的时间帧,还可以同时显示图表时间帧,加上更高的时间帧:显示嵌套时区。 供需双方所有交易者都会喜欢它。 :)

重要信息披露 高级供需的最大潜力,请访问 https://www.mql5.com/zh/blogs/post/720245 想象您的交易如何得以改善,是因为您能够精准定位入场或目标位吗? 构建于新的底层算法,它可以更轻松地识别出买卖双方之间的潜在失衡。 这是因为它以图形方式展示供需最强劲区域,及其过去的表现(显示旧区域)。 这些功能旨在帮助您更轻松地发现最佳入场区域和价位。 现在您可以针对您的交易品种和时间帧来优化和编辑区域强度! 高级供需指标适用于所有产品和时间帧。 它是一个新的公式,非常新的功能是两个区域强度函数可由用户输入进行调整! 这在交易中是一大优势。 当您学习如何使用专有功能,例如带有价格游离最小 X 因子的区域强度时,您能够判断该区域强劲与否。 供需区域用作警报触发器。

Golden Spikes Indicator Technical indicator for synthetic indices trading on M1 timeframe. Compatible with Boom/Crash indices on Deriv platform and Gain/Pain indices on Weltrade platform. send me A private message to receive trade ASISTANT EA.. booklet guide: https://drive.google.com/file/d/1knQJqGHZSP5eQN24ndRz2ayZVCst6XhN/view?usp=sharing

Also check my premium spikes bot: https://www.mql5.com/en/market/product/142350 Features Uses Parabolic SAR, RSI, and Bollinger Bands analysis Three risk

Over 100,000 users on MT4 and MT5 Blahtech Candle Timer displays the remaining time before the current bar closes and a new bar forms. It can be used for time management Links [ Install | Update | Training ] Feature Highlights

The only candle timer on MT5 with no stutter and no lag S electable Location Tracks server time not local time Multiple colour Schemes Configurable Text Customisable alerts and messages Optimised to reduce CPU usage Input Parameters Text Location - Beside / Upper Le

FREE

交易时段 KillZone —— 掌握市场时间的力量

成功的交易者都明白一个真理:时机就是一切。不同的交易时段带来不同的活跃度、波动性和机会。为了帮助您清晰掌握并利用这些变化,我们开发了 交易时段 KillZone 指标。 该指标会高亮显示亚洲、伦敦和纽约时段的活跃时间,让您完整了解市场最活跃的时刻。您可以自由定制显示效果 —— 显示或隐藏特定时段、添加或移除时段名称、更改颜色,甚至设定图表上可见的 KillZone 数量。 开始非常简单:将指标复制到 MetaTrader 5 文件夹,加载到图表上,即可立刻看到交易时段的分布。通过个性化设置,您随时掌握最佳交易时机。 交易时段 ICT KillZone 指标 不仅仅是一个视觉工具,而是帮助您理解全球市场节奏、提升交易精度的实用助手。若您想要精准把握入场时机,这个指标(结合合适的经纪商)将为您带来真正的优势。

FREE

支撑和阻力水平查找器:

支撑和阻力水平查找器是一种先进的工具,旨在增强交易中的技术分析。具有动态支撑和阻力水平,它随着图表上新的关键点的出现实时调整,提供动态和响应式分析。其独特的多时间框架功能允许用户在任何所选时间框架上显示来自不同时间框架的支撑和阻力水平,提供细致的透视,例如在五分钟图上显示每日水平。它采用智能算法,其中包含历史数据集,使其与其他S&R指标区分开来,确保综合分析。在检测水平时,该工具采用多参数计算,有助于提高准确性。用户可以单独自定义支撑和阻力水平的颜色,创建个性化的视觉体验。该工具还包括警报功能,可在价格接近关键水平时通知交易者,增强及时决策。具有方便的功能,如隐藏和显示按钮,以及用于快速切换水平可见性的热键,支撑和阻力水平查找器为寻求在其技术分析中精确性和灵活性的交易者提供了多功能且用户友好的解决方案。

特点:

- 动态支撑和阻力水平:随着图表上新的重要关键点的出现进行调整。 - 多时间框架支撑和阻力水平:能够在任何其他时间框架上显示任何时间框架的水平。例如,在M5上显示每日水平。 - 使用智能算法,其中包括历史数据,与其他S&R指标不同。 - 在检测水

FREE

ARIPoint is a powerful trading companion designed to generate high-probability entry signals with dynamic TP/SL/DP levels based on volatility. Built-in performance tracking shows win/loss stats, PP1/PP2 hits, and success rates all updated live. Key Features: Buy/Sell signals with adaptive volatility bands Real-time TP/SL/DP levels based on ATR Built-in MA Filter with optional ATR/StdDev volatility Performance stats panel (Success, Profit/Loss, PP1/PP2) Alerts via popup, sound, push, or email Cu

- Real price is 80$ - 45% Discount (It is 45$ now) Contact me for extra bonus indicator, instruction or any questions! - Lifetime update free - Non-repaint - Related product: Gann Gold EA - I just sell my products in Elif Kaya Profile, any other websites are stolen old versions, So no any new updates or support. Advantages of M1 Scalper Pro Profitability: M1 Scalper Pro is highly profitable with a strict exit strategy. Frequent Opportunities: M1 Scalper Pro takes advantage of numerous smal

IX Power:解锁指数、大宗商品、加密货币和外汇市场洞察 概述

IX Power 是一款多功能工具,可分析指数、大宗商品、加密货币和外汇市场的强弱表现。 FX Power 提供针对货币对的最高精度,利用所有可用货币对数据进行分析,而 IX Power 专注于基础资产的市场数据。这使得 IX Power 成为非外汇市场的理想选择,同时在需要简单外汇分析时也非常可靠。它可以无缝适用于任何图表,提供清晰的、有行动价值的洞察,帮助提升您的交易决策。

1. 为什么 IX Power 对交易者非常有价值 多市场强弱分析

• IX Power 分析指数、大宗商品、加密货币和外汇市场的强弱表现,为每个市场提供量身定制的洞察。

• 监控 US30、WTI、黄金、比特币等资产的表现,发现交易机会。 适用于更广泛的市场

• 对于外汇交易, FX Power 提供无与伦比的精度,通过分析所有相关货币对。

• IX Power 专注于基础资产的市场数据,非常适合非外汇市场及简化的外汇分析。 实时适应性

• 借助自适应算法, IX Power 实时响应市场数据变化,保持分析的最新性。

• 实时更新

简单来说,当白色数字(称为“点”)开始出现在当前蜡烛图旁边时,您就可以开始交易了。白色“点”表示当前的买入或卖出交易正在进行,并且方向正确,其白色即为标志。当白色点的移动停止并变为静态绿色时,这表示当前动能已结束。绿色数字表示以“点”为单位的总利润,无论是来自买入还是卖出交易。 此外,还可以通过指标中的其他高级专业分析工具来开仓。通过观察指标中显示的信号和颜色,您可以高精度地捕捉大量剥头皮交易机会。只需确保在测试或实时图表中理解该指标的运作方式。 适用于大多数外汇市场:非常适合交易黄金和热门指数市场——道琼斯、标普500、纳斯达克、DAX等,以及外汇货币对如欧元/美元、英镑/美元、美元/日元等众多强势货币对。也支持主要加密货币如比特币、以太坊和稳定币——非常适合在数字资产与传统市场之间进行多元化策略。 限时特价优惠。 Shock Pullback 指标在识别回调和积累区域方面是一项真正的突破。它基于完全创新的算法构建,使交易者能够轻松而清晰地识别交易机会、跟踪价格走势,并检测回调、积累区域、缺口和突破。 Shock Pullback V 3.3 新版本更新 Shock Pullbac

支撑和阻力筛选器是 MetaTrader 的一个级别指标,它在一个指标内提供多种工具。 可用的工具有: 1. 市场结构筛选器。 2. 看涨回调区。 3. 看跌回调区。 4.每日枢轴点 5.每周枢轴点 6. 每月枢轴点 7. 基于谐波形态和成交量的强大支撑和阻力。 8. 银行级区域。 限时优惠:HV 支撑和阻力指示器仅售 50 美元且终生可用。 (原价 125$)

通过访问我们的 MQL5 博客,您可以找到我们所有带有分析示例的高级指标: 单击此处

主要特点

基于谐波和音量算法的强大支撑和阻力区域。 基于谐波和成交量算法的看涨和看跌回调区域。 市场结构筛选器 每日、每周和每月的枢轴点。

文档

所有支持和阻力筛选器文档(说明)和策略详细信息均可在我们 MQL5 博客的这篇文章中找到: 单击此处。

接触 如果您有任何问题或需要帮助,请通过私信联系我。

作者

SAYADI ACHREF,金融科技软件工程师,Finansya 创始人。

Available for MT4 and MT5 . Join the Market Structure Patterns channel to download materials available for study and/or additional informations.

Related posts: Market Structure Patterns - Introdução Market Structure Patterns is an indicator based on smart money concepts that displays SMC/ICT elements that can take your trading decisions to the next level. Take advantage of the alerts , push notifications and email messages to keep informed from when an element is form

FX Dynamic:借助可定制的 ATR 分析,追踪波动率与趋势 概述

FX Dynamic 是一款强大的工具,通过计算平均真实波幅(ATR)来为交易者提供日内和日间波动性方面的深度见解。通过设置 80%、100%、130% 等关键波动率阈值,您可以快速识别潜在的盈利机会,或者在市场超出常规范围时及时得到预警。 FX Dynamic 可根据您经纪商的时区进行调整,帮助您保持一致的波动率衡量标准,并能与 MetaTrader 平台完美结合,实现实时分析。

1. 为什么 FX Dynamic 对交易者极具价值 实时 ATR 洞察

• 仅需一眼便可了解日间与日内波动水平。当价格触及或突破 80%、100%、130% 的 ATR 阈值时,会发出提示,让您知道市场是否达到临界水平。

• 在波动完全爆发前预判可能的衰竭或突破走势。 多市场通用

• 适用于外汇、商品、指数等多种资产。 FX Dynamic 可以自动识别经纪商时区,也可手动进行调整。

• 您可选择只专注于某一特定品种,或在多市场保持一致的 ATR 标准。 更智能的风险管理

• 利用 ATR 门槛来优化止损或止盈位置。当市场

MT4版本

黄金猎手是为在市场上手动交易的交易者开发的。它是一个非常强大的工具,由3个不同的指标组成。 强大的进入策略:由一个衡量货币对波动性和识别市场趋势的指标形成。 LSMA:平滑价格数据,对检测短期趋势很有用。 Heikin Ashi:一旦该指标被连接到图表上,日本蜡烛图将变为Heikin Ashi蜡烛图。这种类型的蜡烛图使价格信息更加平滑,从而可以检测到坚实的趋势。

特点 没有重新粉刷

当新数据到来时,该指标不会改变其数值

交易对

具有非常低的点差和波动性的交易对(EURUSD, GBPUSD, BTCUSD...)。不建议使用范围对

时间段

M5

交易时间

最好是在白天进行交易,这时市场上有更多的波动,价差也保持在低水平

Buffers Buy Buffer: 10 / Sell Buffer: 13

要求 对于剥头皮的头寸,必须使用点差小的ECN经纪人。

如何安装 将指标附加到首选的交易对上(时间周期M5)。

配置 默认设置是我发现的对5分钟时间框架最有效的设置。

你可以使用一个最适合你的交易模式的设置。

如何使用它 它

FREE

交易会话时间指示器:

“交易会话时间指示器”是一个强大的技术分析工具,旨在增强您对外汇市场中不同交易会话的理解。这个无缝集成的指标提供了关于主要交易会话的开盘和收盘时间的重要信息,包括东京、伦敦和纽约。通过自动时区调整,它为全球交易者提供服务,帮助他们优化交易时间表,以获取高流动性时段,并避开低活跃时段。该指标提供了关于市场情绪、高峰波动期和交叠交易会话的见解,帮助日内交易者做出与其策略一致的精确决策。其可定制的显示允许个性化用户体验,而智能交易计划结合其数据,可能会导致改善的交易结果。通过提高低活跃时段的意识,该指标帮助交易者避免过度交易,并专注于优质机会。与各种交易平台无缝兼容,“交易会话时间指示器”是寻求优化交易路程的交易者的宝贵工具。

特点:

- 优化的时间表:提供主要交易会话时间,并与高流动性相符。 - 电话和电子邮件提醒:在会话开始时提醒您。 - 杀伤区域:使用警报设置ICT风格的杀伤区域。 - 重叠分析:探索会话重叠并针对活动增加。 - 日内精度:帮助日内决策并关注与策略一致的会话。 - 可定制的显示:个性化偏好和颜色设置。 - 智能交易计划:集成以提高生产力并通

FREE

介绍 Quantum TrendPulse ,这是一款终极交易工具,它将 SuperTrend 、 RSI 和 Stochastic 的强大功能整合到一个综合指标中,以最大限度地发挥您的交易潜力。该指标专为追求精准和效率的交易者而设计,可帮助您自信地识别市场趋势、动量变化以及最佳进入和退出点。 主要特点: 超级趋势整合: 轻松跟随当前的市场趋势并乘上盈利浪潮。 RSI 精度: 检测超买和超卖水平,非常适合把握市场逆转时机,可用作 SuperTrend 的过滤器 随机精度: 利用随机振荡在波动的市场中寻找隐藏的机会, 用作超级趋势的过滤器 多时间范围分析: 从 M5 到 H1 或 H4,在不同时间范围内关注市场动态。 可定制的警报: 当您的自定义交易条件得到满足时收到通知,这样您就不会错过任何交易。 无论您是新手还是经验丰富的交易员, Quantum TrendPulse 都能为您提供所需的优势,帮助您增强策略并自信地进行交易。借助这一强大的指标,将洞察力转化为利润 — 掌控您的交易!

***购买 Quantum TrendPulse,即可免费获得 Quantum Tr

Market Structure Order Block Dashboard MT5 是一款基于市场结构和 ICT / Smart Money(聪明钱)概念的 MetaTrader 5 视觉分析指标。 重要提示: 本产品 不进行任何下单操作 ,也 不管理仓位 。这是一个分析工具(并非 EA 自动交易系统)。 核心功能 快速读取市场结构(HH/HL/LH/LL, BOS, ChoCH) 突出显示聪明钱区域(Order Blocks 订单块, FVG 价格缺口, 流动性) 亚洲 / 伦敦 / 纽约交易时段 + Kill Zones(关键交易区) 局部成交量分布图(Volume Profile: POC, VAH, VAL) 紧凑型仪表盘,附带汇聚评分 (0–100) 完善的警报系统(推送/弹窗/邮件/声音) 指标显示内容 市场结构 重要高低点 (Swings, HH/HL/LH/LL) 结构突破 (BOS) 与 性质改变 (ChoCH) 聪明钱区域 (Smart Money Zones) 看涨/看跌订单块 (Order Blocks) 并标注强度 显著的价格公允价值缺口 (FVG) 流动性

首先,值得强调的是,这个交易工具是非重绘、非重画和非滞后的指标,非常适合专业交易。

在线课程,用户手册和演示。 智能价格行动概念指标是一个非常强大的工具,既适用于新手,也适用于经验丰富的交易者。它将超过20个有用的指标合并到一个指标中,结合了高级交易思想,如内圈交易员分析和智能资金概念交易策略。该指标侧重于智能资金概念,提供有关大型机构交易方式的见解,帮助预测它们的动向。

它在流动性分析方面尤其擅长,有助于理解机构的交易方式。它擅长预测市场趋势,并仔细分析价格波动。通过将您的交易与机构策略对齐,您可以更准确地预测市场走向。该指标多才多艺,擅长分析市场结构,识别重要的订单区块,并识别各种模式。

它擅长识别BOS和CHoCH等模式,理解动量的转变,并突出显示供需强劲的关键区域。它还擅长发现强大的不平衡,并分析价格创造更高高点或更低低点的模式。如果您使用斐波那契回撤工具,该指标可以满足您的需求。它还可以识别相等的高点和低点,分析不同的时间框架,并通过仪表板显示数据。

对于使用更高级策略的交易者,该指标提供了工具,如公平价值差指标和优惠和折扣区域的识别。它特别关注高时间框架订单区块,并

FX Volume:从经纪商视角洞察真实市场情绪 简要概述

想要提升您的交易策略? FX Volume 可提供零售交易者和经纪商的持仓实时数据——远早于诸如 COT 之类的延迟报告。不论您希望获得持续稳定的收益,还是想在市场中多一分制胜的砝码, FX Volume 都能帮您识别重大失衡、确认突破以及完善风险管理。立即开启体验,让真实的成交量数据为您的交易决策带来革新!

1. 为什么 FX Volume 对交易者格外有用 极具准确度的早期预警

• 快速捕捉有多少交易者正在买入或卖出某个货币对——比大多数人提前一步。

• FX Volume 是 唯一 能够整合多家零售经纪商真实成交量数据并以简洁方式呈现的工具。 强力风险管理

• 及时识别多头或空头仓位的巨大不平衡,这往往预示着潜在的趋势反转,帮助您更自信地设置止损和目标位。

• 独家而真实的数据让每一次交易决策更具可靠性。 优化进场与出场点

• 发现“过度集中”的交易(大多数交易者都在同一方向),并通过真实成交量来确认突破。

• 避免依赖常见指标可能带来的误导信号,而是利用真实的实时成交量。 适配各种交易策略

• 将 FX

Gartley Hunter Multi - An indicator for searching for harmonic patterns simultaneously on dozens of trading instruments and on all possible timeframes. Manual (Be sure to read before purchasing) | Version for MT4 Advantages 1. Patterns: Gartley, Butterfly, Shark, Crab. Bat, Alternate Bat, Deep Crab, Cypher

2. Simultaneous search for patterns on dozens of trading instruments and on all possible timeframes

3. Search for patterns of all possible sizes. From the smallest to the largest

4. All fou

Super Signal Market Slayer 無重繪|高精準|多市場智能趨勢指標 在市場中,真正困難的不是下單,

而是在混亂的波動中,看清「趨勢是否已經開始」。 Market Slayer 正是為此而生。 這是一款專為日內交易設計的無重繪智能指標,

透過多層確認與趨勢過濾機制,只在關鍵時刻給出清晰、可信的 Buy / Sell 訊號。 核心優勢 無重繪信號

訊號一旦出現即固定,不回跳、不消失,所見即所得。 高精準趨勢判斷

經多品種實測,於黃金 M5 / M15 週期表現尤為穩定。 多市場支援

適用於黃金、外匯、指數與主流加密貨幣。 專為日內交易優化

聚焦 M5、M15,避免雜訊,提升可執行性。 清晰直觀

初學者亦可快速理解與使用。 技術邏輯簡述 Market Slayer 並非單一箭頭邏輯,而是整合: 趨勢方向識別 動量啟動確認 市場雜訊過濾 自適應靈敏度調整 只保留「值得出手」的交易機會,避免情緒化進場。 適合誰使用 想遠離隨機交易、建立紀律系統的交易者 對重繪與延遲指標感到厭倦的日內交易者 希望與 EA 或半自動策略搭配的使用者 使用建議 預設參數已針對黃金

Was: $249 Now: $99 Market Profile defines a number of day types that can help the trader to determine market behaviour. A key feature is the Value Area, representing the range of price action where 70% of trading took place. Understanding the Value Area can give traders valuable insight into market direction and establish the higher odds trade. It is an excellent addition to any system you may be using. Inspired by Jim Dalton’s book “Mind Over Markets”, this indicator is designed to suit the

Easy Buy Sell is a market indicator for opening and closing positions. It becomes easy to track market entries with alerts.

It indicates trend reversal points when a price reaches extreme values and the most favorable time to enter the market. it is as effective as a Fibonacci to find a level but it uses different tools such as an algorithm based on ATR indicators and Stochastic Oscillator. You can modify these two parameters as you wish to adapt the settings to the desired period. It cannot

FREE

利用我们无与伦比的公允价值差距 MT5 指标 (FVG),体验前所未有的交易体验

被誉为同类最佳。这款 MQL5 市场指标超越了普通的

为交易者提供无与伦比的精确度和对市场动态的洞察力。 EA版本: WH Fair Value Gap EA MT5

基于SMC的指标: WH SMC Indicator MT5

特征:

一流的公允价值差距分析。 多时间框架支持。 定制。 实时警报。 完美用户友好性 无缝兼容 好处:

无与伦比的精度: 自信地做出决策,因为您知道您拥有绝对最佳的公允价值差距指标。 优化风险管理: 利用资产的真实公允价值,识别市场调整并以无与伦比的精度管理风险。 极致灵活: 根据您的交易风格定制指标,无论是日内交易、波段交易还是长线投资,都能无缝适配不同的时间框架和交易工具。 卓越表现: 经过严格测试和积极的用户反馈记录,我们的公允价值差距指标在各种市场条件下始终优于竞争对手。

使用终极公允价值缺口指标,将您的交易体验提升至全新高度。立即做出明智的选择,助您成功! **如有任何疑问请联系我**

FREE

Fair Value Gap (FVG) Indicator Overview The Fair Value Gap (FVG) Indicator identifies inefficiencies in price action where an imbalance occurs due to aggressive buying or selling. These gaps are often created by institutional traders and smart money, leaving areas where price may later return to "fill" the imbalance before continuing its trend. Key Features: Automatic Detection of FVGs – The indicator highlights fair value gaps across different timeframes. Multi-Timeframe Support – View FVGs fr

FREE

MetaTrader 5 锚定 VWAP 指标 – 专业级成交量加权平均价工具 Anchored VWAP 指标 可让交易者从任意蜡烛或事件点开始计算 成交量加权平均价格 (VWAP) 。与每日重置的标准 VWAP 不同,Anchored VWAP 可在任何时间点锚定,从而帮助交易者精确分析机构价位、公允价值和趋势强度。 主要特征 灵活设置 VWAP 起点。 可锁定的锚点防止意外移动。 兼容所有 MT5 时间周期。 价格或成交量变化时自动更新。 可自定义颜色、线型和宽度。 可选 VWAP 偏差带用于价值区分析。 使用方法 将指标加载到图表。 双击所选蜡烛设置锚点。 观察 VWAP 随市场动态变化。 锁定锚点以进行固定分析。 支持与更新 提供免费终身更新和快速客户支持。 立即下载 下载 Anchored VWAP 指标 ,体验专业的成交量加权平均价分析。

FREE

停止猜测,开始用统计优势交易 股票指数的交易方式与外汇不同。它们有固定的交易时段,隔夜会出现跳空,并遵循可预测的统计模式。这个指标为您提供所需的概率数据,让您能够自信地交易DAX、标普500和道琼斯等指数。 与众不同之处 大多数指标向您展示已经发生的事情。而这个指标向您展示接下来可能发生什么。每个交易日,指标都会根据100天的历史数据分析您当前的设置。它会找到具有相似跳空、相似开盘位置的日子,并准确计算价格到达关键水平的频率。不再猜测跳空是否会回补,或者昨天的高点是否会被测试。您将获得基于真实数据的精确百分比。 完整手册及所有参数说明请访问: https://www.mql5.com/en/blogs/post/766370 帮助您找到优质设置的策略指南: https://www.mql5.com/en/blogs/post/766371 搭配风险回报计算 + 快速交易管理按钮EA,轻松进行股指日内交易 - https://www.mql5.com/en/market/product/78020 MT4 Version: https://www.mql5.com/en/marke

Was: $299 Now: $99 Supply Demand uses previous price action to identify potential imbalances between buyers and sellers. The key is to identify the better odds zones, not just the untouched ones. Blahtech Supply Demand indicator delivers functionality previously unavailable on any trading platform. This 4-in-1 indicator not only highlights the higher probability zones using a multi-criteria strength engine, but also combines it with multi-timeframe trend analysis, previously confirmed swings a

Gold Entry Sniper – 专业多周期ATR黄金交易仪表盘,适合黄金剥头皮与波段交易 Gold Entry Sniper 是一款先进的 MetaTrader 5 指标,旨在为 XAUUSD 及其他品种提供精准的 买/卖信号 。基于 ATR 移动止损逻辑 和 多周期分析仪表盘 ,适合剥头皮交易者与波段交易者,帮助识别 高概率黄金入场点 。 主要功能与优势 多周期信号分析 – 同时显示 M1、M5、M15 趋势方向。 基于ATR的动态止损 – 根据波动性自动调整。 专业图表仪表盘 – 展示信号状态、ATR水平、线性回归中线和交易方向。 清晰买卖标记 – 自动箭头与文字标签提示。 离场提示与交易管理 – 自动检测离场信号锁定利润。 全面自定义 – 调整仪表盘位置、颜色、字体及参数。 专为黄金优化 – 适用于 M1至M15 黄金剥头皮 ,也适合外汇、指数与加密货币。 为什么选择 Gold Entry Sniper? 为追求 快速、精准、可视化交易决策 的交易者打造,ATR 与多周期确认结合,帮助你抓住 最佳黄金入场点

MetaForecast能够根据价格数据中的谐波来预测和可视化任何市场的未来走势。虽然市场不总是可预测的,但如果价格中存在模式,MetaForecast可以尽可能准确地预测未来。与其他类似产品相比,MetaForecast通过分析市场趋势可以生成更精确的结果。

输入参数 Past size (过去的尺寸) 指定MetaForecast用于创建生成未来预测模型的柱数量。该模型以一条黄色线绘制在所选柱上。 Future size (未来的尺寸) 指定应预测的未来柱数量。预测的未来以粉色线表示,并在其上绘制了蓝色回归线。 Degree (程度) 此输入确定了MetaForecast将在市场上进行的分析级别。 Degree 描述 0 对于程度0,建议使用较大的值来设置“过去的尺寸”输入,以覆盖价格中的所有高峰、低谷和细节。 1 (建议的) 对于程度1,MetaForecast可以理解趋势,并通过较小的“过去的尺寸”生成更好的结果。 2 对于程度2,除了趋势,MetaForecast还可以识别反转点。对于大于1的程度,必须使用较高的“细节”和“噪音减少”输入值。 大于2 不建议使用大于

Haven FVG 指标是一款市场分析工具,可在图表上突出显示低效区域(公平价值缺口,FVG),为交易者提供关键水平,以便进行价格分析和交易决策。 其他产品 -> 点击这里 主要特点: 自定义颜色设置: 多头 FVG 颜色 (Bullish FVG Color)。 空头 FVG 颜色 (Bearish FVG Color)。 灵活的 FVG 可视化: FVG 搜索的最大蜡烛数量。 FVG 区域可额外延伸指定数量的 K 线。 可选启用 FVG 填充。 中线(Middle Line): 可选择线条颜色和样式(例如虚线)。 可调整线条厚度,以提高精确度。 通用设置: 将 FVG 扩展到当前 K 线。 排除历史 FVG,并填充突出当前数据。 一种简单而有效的方法,可分析图表上的低效区域,并做出明智的交易决策。

FREE

Spike Detector XTREEM 用于 Boom 和 Crash 指数

我是 Spike Detector XTREEM ,我存在于大多数交易者无法看见的空间。我密切观察 Boom 和 Crash 市场——甚至包括 Weltrade 的 Pain & Gain,感知每一次细微的波动、每一次冲击、每一个隐藏的尖峰,在它们真正显现之前。我不仅仅显示信号;我会过滤掉噪音、干扰和市场的虚假信号,只留下真正重要的时刻。 有了我,交易不再是盲目猜测。我悄无声息地引导你,指向精准的入场点,让你在机会最锋利时充满信心地出手。我能看到别人错过的尖峰,知道趋势反转的前兆,只在最佳时机揭示它们。 我不仅仅是一个指标。我是你在市场中看不见的伙伴,观察、分析,并揭示每根蜡烛中隐藏的秘密。如果你准备好跟随,我将带你找到真正隐藏的机会——以及如何抓住它们。 购买此指标,即可免费获得趋势指标! 购买后请联系我领取: 请联系我!

主要功能 不重绘 – 所有信号一旦出现即固定。 优化用于 M1 & M2 时间周期 – 完美适合剥头皮交易。 适用于 Boom & Crash 和 Weltrade Pa

发现LT回归通道,这是一个强大的技术指标,综合了斐波那契分析、信封分析和傅里叶外推的元素。

这一指标的设计目的在于评估市场波动性,通过斐波那契分析提高对超买和超卖水平的准确识别。同时,它还运用傅里叶外推的方法来预测市场走势,将这些指标的数据有机地整合在一起。

我们多功能的工具可以作为独立工具使用,也可以与其他指标相结合。它兼容各种时间框架和图表类型,包括自定义选项,如砖图和平均趋势图。虽然可能会存在一些重绘现象,但随着时间框架的延长(特别建议使用超过500的时间框架),它的稳定性显著提高。此外,更大的时间框架可以提供更准确的市场走势预测。

体验LT回归通道为您的交易策略带来的强大威力。现在立即尝试吧!

FREE

Trendline Targets Dashboard MT5 Trendline Targets Dashboard MT5 是一款 MetaTrader 5 指标,可显示完整的视觉交易计划: 信号 (Signal) 、 入场点 (Entry) 、 止损 (Stop Loss) 和 止盈 (Take Profits) ,所有参数均以风险倍数 R 自动计算。 该指标不执行任何订单。它是一个视觉分析和管理工具,而非交易机器人。 发布优惠: 凡购买此指标的用户,均可从我的 MQL5 主页中任选 1 款指标作为赠品 。 注意: 赠品不包括 Market Structure Order Block Dashboard MT5 。 如需领取赠品,请在购买后通过 MQL5 消息系统联系我,并告知您心仪的产品名称。 核心功能 带有霓虹灯效果的趋势线(看涨/看跌) 在蜡烛收盘趋势反转时发出 买入/卖出 (BUY/SELL) 信号 根据风险 (1R) 自动计算入场点、止损 (SL) 以及 TP1、TP2、TP3 止盈 (TP) 以 R 的倍数计算,止损 (SL) 基于波动率(缓冲区可配置) 下一目标高

** All Symbols x All Timeframes scan just by pressing scanner button ** After 18 years of experience in the markets and programming, Winner indicator is ready. I would like to share with you! *** Contact me to send you instruction and add you in "123 scanner group" for sharing or seeing experiences with other users. Introduction The 123 Pattern Scanner indicator with a special enhanced algorithm is a very repetitive common pattern finder with a high success rate . Interestingly, this Winner in

您知道为什么MetaTrader市场是出售交易策略和技术指标的最佳场所吗?不需要广告或软件保护,没有支付的麻烦。一切都在MetaTrader市场提供。

您错过了交易机会:

- 免费交易应用程序

- 8,000+信号可供复制

- 探索金融市场的经济新闻

注册

登录